219:, because it separately shows a negative amount that is directly associated with an accumulated depreciation account on the balance sheet. Depreciation expense is usually charged against the relevant asset directly. The values of the fixed assets stated on the balance sheet will decline, even if the business has not invested in or disposed of any assets. Theoretically, the amounts will roughly approximate fair value. Otherwise, depreciation expense is charged against accumulated depreciation. Showing accumulated depreciation separately on the balance sheet has the effect of preserving the historical cost of assets on the balance sheet. If there have been no investments or dispositions in fixed assets for the year, then the values of the assets will be the same on the balance sheet for the current and prior year (P/Y).

1297:

Depreciation is then computed for all assets in the pool as a single calculation. These calculations must make assumptions about the date of acquisition. The United States system allows a taxpayer to use a half-year convention for personal property or mid-month convention for real property. Under such a convention, all property of a particular type is considered to have been acquired at the midpoint of the acquisition period. One half of a full period's depreciation is allowed in the acquisition period (and also in the final depreciation period if the life of the assets is a whole number of years). United States rules require a mid-quarter convention for per property if more than 40% of the acquisitions for the year are in the final quarter.

1212:. The cost of assets not currently consumed generally must be deferred and recovered over time, such as through depreciation. Some systems permit the full deduction of the cost, at least in part, in the year the assets are acquired. Other systems allow depreciation expense over some life using some depreciation method or percentage. Rules vary highly by country and may vary within a country based on the type of asset or type of taxpayer. Many systems that specify depreciation lives and methods for financial reporting require the same lives and methods be used for tax purposes. Most tax systems provide different rules for real property (buildings, etc.) and personal property (equipment, etc.).

105:

the asset, which is initially equal to the amount paid for the asset and subsequently may or may not be related to the amount expected to be received upon its disposal. Depreciation is any method of allocating such net cost to those periods in which the organization is expected to benefit from the use of the asset. Depreciation is a process of deducting the cost of an asset over its useful life. Assets are sorted into different classes and each has its own useful life. The asset is referred to as a depreciable asset. Depreciation is technically a method of allocation, not valuation, even though it determines the value placed on the asset in the balance sheet.

1265:. The table also incorporates specified lives for certain commonly used assets (e.g., office furniture, computers, automobiles) which override the business use lives. U.S. tax depreciation is computed under the double-declining balance method switching to straight line or the straight-line method, at the option of the taxpayer. IRS tables specify percentages to apply to the basis of an asset for each year in which it is in service. Depreciation first becomes deductible when an asset is placed in service.

153:

Accountants reduce the asset's carrying amount by its fair value. For example, if a company continues to incur losses because prices of a particular product or service are higher than the operating costs, companies consider write-offs of the particular asset. These write-offs are referred to as impairments. There are events and changes in circumstances might lead to impairment. Some examples are:

53:

431:. In addition, this gain above the depreciated value would be recognized as ordinary income by the tax office. If the sales price is ever less than the book value, the resulting capital loss is tax-deductible. If the sale price were ever more than the original book value, then the gain above the original book value is recognized as a capital gain.

555:

depreciation at a midpoint in the asset's life. The double-declining-balance method is also a better representation of how vehicles depreciate and can more accurately match cost with benefit from asset use. The company in the future may want to allocate as little depreciation expenses as possible to help with additional expenses.

880:

206:, provided the enterprise is operating in a manner that covers its expenses (e.g., operating at a profit) depreciation is a source of cash in a statement of cash flows, which generally offsets the cash cost of acquiring new assets required to continue operations when existing assets reach the end of their useful lives.

236:

negative due to costs required to retire it; however, for depreciation purposes salvage value is not generally calculated at below zero.) The company will then charge the same amount to depreciation each year over that period, until the value shown for the asset has reduced from the original cost to the salvage value.

108:

Any business or income-producing activity using tangible assets may incur costs related to those assets. If an asset is expected to produce a benefit in future periods, some of these costs must be deferred rather than treated as a current expense. The business then records depreciation expense in its

104:

In determining the net income (profits) from an activity, the receipts from the activity must be reduced by appropriate costs. One such cost is the cost of assets used but not immediately consumed in the activity. Such cost allocated in a given period is equal to the reduction in the value placed on

1236:

are fixed percentages of assets within a class or type of asset. Fixed percentage rates are specified by the type of asset. The fixed percentage is multiplied by the tax basis of assets in service to determine the capital allowance deduction. The tax law or regulations of the country specifies these

1287:

Many tax systems prescribe longer depreciable lives for buildings and land improvements. Such lives may vary by type of use. Many such systems, including the United States, permit depreciation for real property using only the straight-line method, or a small fixed percentage of the cost. Generally,

642:

Sum of the years' digits method of depreciation is one of the accelerated depreciation techniques which are based on the assumption that assets are generally more productive when they are new and their productivity decreases as they become old. The formula to calculate depreciation under SYD method

1296:

Depreciation calculations require a lot of record-keeping if done for each asset a business owns, especially if assets are added to after they are acquired, or partially disposed of. However, many tax systems permit all assets of a similar type acquired in the same year to be combined in a "pool".

1183:

When an asset is sold, debit cash for the amount received and credit the asset account for its original cost. Debit the difference between the two to accumulated depreciation. Under the composite method, no gain or loss is recognized on the sale of an asset. Theoretically, this makes sense because

629:

Annuity depreciation methods are not based on time, but on a level of

Annuity. This could be miles driven for a vehicle, or a cycle count for a machine. When the asset is acquired, its life is estimated in terms of this level of activity. Assume the vehicle above is estimated to go 50,000 miles in

330:

For example, a vehicle that depreciates over 5 years is purchased at a cost of $ 17,000 and will have a salvage value of $ 2000. Then this vehicle will depreciate at $ 3,000 per year, i.e. (17-2)/5 = 3. This table illustrates the straight-line method of depreciation. Book value at the beginning of

235:

Straight-line depreciation is the simplest and most often used method. The straight-line depreciation is calculated by dividing the difference between assets pagal sale cost and its expected salvage value by the number of years for its expected useful life. (The salvage value may be zero, or even

1069:

The composite method is applied to a collection of assets that are not similar and have different service lives. For example, computers and printers are not similar, but both are part of the office equipment. Depreciation on all assets is determined by using the straight-line-depreciation method.

550:

The double-declining-balance method, or reducing balance method, is used to calculate an asset's accelerated rate of depreciation against its non-depreciated balance during earlier years of assets useful life. When using the double-declining-balance method, the salvage value is not considered in

152:

or expense be recognized if the value of assets declines unexpectedly. Such charges are usually nonrecurring and may relate to any type of asset. Many companies consider write-offs of some of their long-lived assets because some property, plant, and equipment have suffered partial obsolescence.

638:

Sum-of-years-digits is a spent depreciation method that results in a more accelerated write-off than the straight-line method, and typically also more accelerated than the declining balance method. Under this method, the annual depreciation is determined by multiplying the depreciable cost by a

83:

Depreciation is thus the decrease in the value of assets and the method used to reallocate, or "write down" the cost of a tangible asset (such as equipment) over its useful life span. Businesses depreciate long-term assets for both accounting and tax purposes. The decrease in value of the asset

1278:

for the full cost of depreciable tangible personal property is allowed up to $ 500,000 through 2013. This deduction is fully phased out for businesses acquiring over $ 2,000,000 of such property during the year. In addition, additional first year depreciation of 50% of the cost of most other

554:

Since double-declining-balance depreciation does not always depreciate an asset fully by its end of life, some methods also compute a straight-line depreciation each year, and apply the greater of the two. This has the effect of converting from declining-balance depreciation to straight-line

322:

1288:

no depreciation tax deduction is allowed for bare land. In the United States, residential rental buildings are depreciable over a 27.5 year or 40-year life, other buildings over a 39 or 40-year life, and land improvements over a 15 or 20-year life, all using the straight-line method.

214:

While depreciation expense is recorded on the income statement of a business, its impact is generally recorded in a separate account and disclosed on the balance sheet as accumulated under fixed assets, according to most accounting principles. Accumulated depreciation is known as a

434:

If a company chooses to depreciate an asset at a different rate from that used by the tax office, then this generates a timing difference in the income statement due to the difference (at a point in time) between the taxation department's and company's view of the profit.

630:

its lifetime. The per-mile depreciation rate is calculated as: ($ 17,000 cost - $ 2,000 salvage) / 50,000 miles = $ 0.30 per mile. Each year, the depreciation expense is then calculated by multiplying the number of miles driven by the per-mile depreciation rate.

551:

determining the annual depreciation, but the book value of the asset being depreciated is never brought below its salvage value, regardless of the method used. Depreciation ceases when either the salvage value or the end of the asset's useful life is reached.

616:

139:

may be ignored. The rules of some countries specify lives and methods to be used for particular types of assets. However, in most countries the life is based on business experience, and the method may be chosen from one of several acceptable methods.

818:

1273:

Many systems allow an additional deduction for a portion of the cost of depreciable assets acquired in the current tax year. The UK system provides a first-year capital allowance of £50,000. In the United States, two such deductions are available. A

1187:

To calculate composite depreciation rate, divide depreciation per year by total historical cost. To calculate depreciation expense, multiply the result by the same total historical cost. The result will equal the total depreciation per year again.

170:

Events or changes in circumstances indicate that the company may not be able recover the carrying amount of the asset. In which case, companies use the recoverability test to determine whether impairment has occurred. The steps to determine are:

76:, such as the decrease in value of factory equipment each year as it is used and wears, and second, the allocation in accounting statements of the original cost of the assets to periods in which the assets are used (depreciation with the

1203:

for recovery of the cost of assets used in a business or for the production of income. Such deductions are allowed for individuals and companies. Where the assets are consumed currently, the cost may be deducted currently as an

247:

1237:

percentages. Capital allowance calculations may be based on the total set of assets, on sets or pools by year (vintage pools) or pools by classes of assets... Depreciation has got three methods only.

1061:

The group depreciation method is used for depreciating multiple-asset accounts using a similar depreciation method. The assets must be similar in nature and have approximately the same useful lives.

1180:

equals the composite depreciation rate times the balance in the asset account (historical cost). (0.20 * $ 6,500) $ 1,300. Debit depreciation expense and credit accumulated depreciation.

875:{\displaystyle {\mbox{annual depreciation expense}}={{\mbox{cost of fixed asset}}-{\mbox{residual value}} \over {\mbox{estimated total production}}}\times {\mbox{actual production}}}

563:

1191:

Common sense requires depreciation expense to be equal to total depreciation per year, without first dividing and then multiplying total depreciation per year by the same number.

660:

The sum of the digits can also be determined by using the formula (n+n)/2 where n is equal to the useful life of the asset in years. The example would be shown as (5+5)/2=15

109:

financial reporting as the current period's allocation of such costs. This is usually done in a rational and systematic manner. Generally, this involves four criteria:

1053:

Depreciation stops when book value is equal to the scrap value of the asset. In the end, the sum of accumulated depreciation and scrap value equals the original cost.

1694:

1662:

1451:

135:

Cost generally is the amount paid for the asset, including all costs related to acquiring and bringing the asset into use. In some countries or for some purposes,

558:

With the declining balance method, one can find the depreciation rate that would allow exactly for full depreciation by the end of the period, using the formula:

427:

If the vehicle were to be sold and the sales price exceeded the depreciated value (net book value) then the excess would be considered a gain and subject to

1795:

1668:

317:{\displaystyle {\mbox{annual depreciation expense}}={{\mbox{cost of fixed asset}}-{\mbox{residual value}} \over {\mbox{useful life of asset}}(years)}}

227:

There are several methods for calculating depreciation, generally based on either the passage of time or the level of activity (or use) of the asset.

337:

Book value at the end of year becomes book value at the beginning of next year. The asset is depreciated until the book value equals scrap value.

1767:

1737:

1652:

651:

Example: If an asset has original cost of $ 1000, a useful life of 5 years and a salvage value of $ 100, compute its depreciation schedule.

1559:

1220:

A common system is to allow a fixed percentage of the cost of depreciable assets to be deducted each year. This is often referred to as a

1279:

depreciable tangible personal property is allowed as a deduction. Some other systems have similar first year or accelerated allowances.

1476:

331:

the first year of depreciation is the original cost of the asset. Book value equals original cost minus accumulated depreciation.

1228:. Deductions are permitted to individuals and businesses based on assets placed in service during or before the assessment year.

1245:

Some systems specify lives based on classes of property defined by the tax authority. Canada

Revenue Agency specifies numerous

809:

Units-of-production depreciation method calculates greater deductions for depreciation in years when the asset is heavily used

1788:

1611:

1879:

654:

First, determine the years' digits. Since the asset has a useful life of 5 years, the years' digits are: 5, 4, 3, 2, and 1.

34:

This article is about the concept in accounting and finance involving fixed capital goods. For economic depreciation, see

88:

of a business or entity, and the method of depreciating the asset, accounting-wise, affects the net income, and thus the

1328:

666:

5/15 for the 1st year, 4/15 for the 2nd year, 3/15 for the 3rd year, 2/15 for the 4th year, and 1/15 for the 5th year.

1966:

1378:

178:

If the sum of the expected cash flow is less than the carrying amount of the asset, the asset is considered impaired

1781:

202:

Depreciation expense does not require a current outlay of cash. However, since depreciation is an expense to the

1493:

1318:

191:

611:{\displaystyle {\mbox{depreciation rate}}=1-{\sqrt{{\mbox{residual value}} \over {\mbox{cost of fixed asset}}}}}

1712:

1338:

1323:

1306:

1254:

35:

1246:

1168:

equals the total depreciable cost divided by the total depreciation per year. $ 5,900 / $ 1,300 = 4.5 years.

1843:

1687:

1383:

1348:

1333:

1233:

428:

187:

1463:

Under most systems, a business or income-producing activity may be conducted by individuals or companies.

1956:

1828:

1262:

43:

1184:

the gains and losses from assets sold before and after the composite life will average themselves out.

1818:

1674:

1492:

An allocation of costs may be required where multiple assets are acquired in a single transaction.

1961:

1920:

1884:

1833:

1910:

1900:

1425:

1417:

1209:

77:

194:

are similar concepts for natural resources (including oil) and intangible assets, respectively.

1915:

1848:

1763:

1733:

1648:

1221:

1174:

equals depreciation per year divided by total historical cost. $ 1,300 / $ 6,500 = 0.20 = 20%

149:

1637:

1275:

1869:

1368:

203:

89:

68:

is a term that refers to two aspects of the same concept: first, an actual reduction in the

1496:

may be required where assets are acquired as part of a business acquisition or combination.

1838:

1823:

1531:

1480:

1725:

IRS Rev. Proc. 87-56 and 87-55 (shown in

Publication 946 as tables, as currently updated)

1473:

17:

1853:

1225:

216:

163:

Accumulation of costs that are not originally expected to acquire or construct an asset

646:

SYD depreciation = depreciable base x (remaining useful life/sum of the years' digits)

1950:

1874:

1420:. Other costs of assets consumed in providing services or conducting business are an

1363:

1200:

136:

117:

85:

39:

1701:

1930:

1625:

1343:

1595:

1583:

1571:

1555:

1543:

175:

Estimate the future cash flow of asset (from the use of the asset to disposition)

61:

28:

1438:

52:

1935:

1804:

1705:

69:

1515:

1439:"What is Depreciation? And How do You Calculate It? | Bench Accounting"

908:

10 × actual production will give the depreciation cost of the current year.

1715:

1258:

1905:

1505:

A charge for such impairment is referred to in

Germany as depreciation.

1421:

1358:

1353:

1205:

93:

1229:

166:

A projection of incurring losses associated with the particular asset

621:

where N is the estimated life of the asset (for example, in years).

92:

that they report. Generally, the cost is allocated as depreciation

1373:

1250:

73:

1777:

1751:, chapter 8. 2013 edition 978-1-1331-8955-8, ASIN B00B6F3AWI.

1643:

Kieso, Donald E; Weygandt, Jerry J.; and

Warfield, Terry D.:

1773:

1249:

based on the type of property and how it is used. Under the

96:

among the periods in which the asset is expected to be used.

1416:

Costs of assets consumed in producing goods are treated as

49:

Decrease in asset values, or the allocation of cost thereof

1638:

https://www.investopedia.com/terms/s/straightlinebasis.asp

1665:. Available for free browsing access with registration.

904:

Depreciation per unit = ($ 70,000−10,000) / 6,000 = $ 10

1424:

reducing income in the period of consumption under the

866:

854:

846:

836:

823:

594:

587:

568:

284:

275:

265:

252:

821:

566:

335:

book value = original cost − accumulated depreciation

250:

1722:. Washington, D.C.: U.S. Government Printing Office.

657:

Next, calculate the sum of the digits: 5+4+3+2+1=15

1893:

1862:

1811:

56:

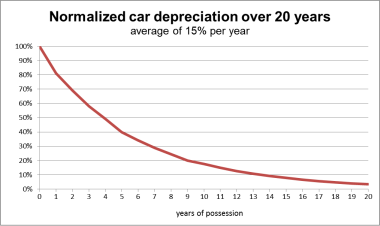

An asset depreciation at 15% per year over 20 years

874:

610:

316:

157:Large amount of decrease in fair value of an asset

1472:Kiesco, et al, p. 521. See also Walther, Larry,

126:A method of apportioning the cost over such life

120:, also known as the residual value of the assets

42:. For the decrease in value of a currency, see

1261:which includes a table of asset lives and the

1789:

160:A change of manner in which the asset is used

8:

1658:Financial Accounting Standards Board (U.S.)

1669:International Financial Reporting Standards

1796:

1782:

1774:

40:Fixed capital § Economic depreciation

865:

853:

845:

835:

832:

822:

820:

601:

593:

586:

583:

567:

565:

283:

274:

264:

261:

251:

249:

1072:

917:

668:

648:depreciable base = cost − salvage value

442:

412:

401:

390:

379:

368:

358:

339:

51:

1754:Pratt, James W.,; Kulsrud, William N.,

1396:

805:Units-of-production depreciation method

1693:UK Business Link (a government site)

148:Accounting rules also require that an

1688:Claiming capital cost allowance (CCA)

7:

1560:American Taxpayer Relief Act of 2012

915:depreciation schedule of the asset.

885:DE= ((OV-SV)/EPC) x Units per year

1474:Principles of Accounting Chapter 10

663:Depreciation rates are as follows:

123:Estimated useful life of the asset

25:

1660:Accounting Standards Codification

1407:, John Wiley and Sons, Inc., 2002

1251:United States depreciation system

1199:Most income tax systems allow a

911:The table below illustrates the

1695:Capital allowances: the basics

1880:Statement of changes in equity

1749:South-Western Federal Taxation

308:

290:

1:

1065:Composite depreciation method

896:, and is expected to produce

1675:Depreciation Journal Entries

1329:Consumption of fixed capital

1762:, chapter 9. 2013 edition

1732:, chapter 24, 2013 edition

1522:, accessed 16 December 2023

1405:Accounting for Fixed Assets

1379:Revaluation of fixed assets

1172:Composite depreciation rate

825:annual depreciation expense

533:

519:

505:

491:

477:

466:

254:annual depreciation expense

1983:

1720:How to Depreciate Property

1304:

856:estimated total production

634:Sum-of-years-digits method

439:Diminishing balance method

231:Straight-line depreciation

183:Depletion and amortization

33:

26:

1743:Hoffman, William H. Jr.,

1702:Capital Allowances Manual

1626:Resources in your library

1494:Purchase price allocation

1319:Amortization (accounting)

1224:, as it is called in the

1057:Group depreciation method

474:original cost $ 1,000.00

1713:Internal Revenue Service

1706:Help Sheet for employees

1339:Deferred financing costs

1324:Construction in progress

1307:Depreciation (economics)

1255:Internal Revenue Service

957:$ 70,000 (original cost)

364:(original cost) $ 17,000

348:Accumulated depreciation

223:Methods for depreciation

210:Accumulated depreciation

36:Depreciation (economics)

27:Not to be confused with

18:Accumulated Depreciation

1844:Governmental accounting

1645:Intermediate Accounting

1269:Additional depreciation

708:$ 1,000 (original cost)

639:schedule of fractions.

1558:. Amounts extended by

1532:Depreciation Expertise

1384:Writing down allowance

1349:Depletion (accounting)

1334:Cost segregation study

1263:applicable conventions

1234:Capital Cost Allowance

1208:or treated as part of

894:salvage value $ 10,000

890:original cost $ 70,000

876:

612:

429:depreciation recapture

318:

57:

1829:Management accounting

1730:Income Tax in the USA

1403:Raymond H. Peterson,

1292:Averaging conventions

1241:Tax lives and methods

888:Suppose an asset has

877:

613:

319:

240:Straight-line method:

55:

44:Currency depreciation

1819:Financial accounting

1178:Depreciation expense

1046:10,000 (scrap value)

819:

625:Annuity depreciation

564:

286:useful life of asset

248:

1921:Capital expenditure

1885:Cash flow statement

1834:Forensic accounting

1534:, 11 September 2023

913:units-of-production

838:cost of fixed asset

596:cost of fixed asset

544:scrap value 100.00

420:(scrap value) 2,000

267:cost of fixed asset

1967:Corporate taxation

1911:Cost of goods sold

1901:Debits and credits

1479:2010-07-29 at the

1426:matching principle

1418:cost of goods sold

1216:Capital allowances

1210:cost of goods sold

872:

870:

858:

850:

840:

827:

771:120 =(900 x 2/15)

754:180 =(900 x 3/15)

737:240 =(900 x 4/15)

720:300 =(900 x 5/15)

608:

598:

591:

572:

314:

288:

279:

269:

256:

100:Accounting concept

78:matching principle

58:

1944:

1943:

1916:Operating expense

1849:Social accounting

1768:978-1-133-49623-6

1740:, ASIN B00BCSNOGG

1738:978-0-9851823-3-5

1728:Fox, Stephen C.,

1653:978-0-471-44896-9

1612:Library resources

1222:capital allowance

1163:

1162:

1051:

1050:

869:

868:actual production

860:

857:

849:

839:

826:

802:

801:

797:100 (scrap value)

788:60 =(900 x 1/15)

606:

600:

597:

590:

571:

570:depreciation rate

548:

547:

425:

424:

312:

287:

278:

268:

255:

150:impairment charge

131:Depreciable basis

113:Cost of the asset

16:(Redirected from

1974:

1870:Income statement

1798:

1791:

1784:

1775:

1760:Federal Taxation

1599:

1593:

1587:

1581:

1575:

1569:

1563:

1553:

1547:

1541:

1535:

1529:

1523:

1520:moneyterms.co.uk

1516:Reducing balance

1512:

1506:

1503:

1497:

1490:

1484:

1470:

1464:

1461:

1455:

1449:

1443:

1442:

1435:

1429:

1414:

1408:

1401:

1369:Product lifetime

1195:Tax depreciation

1073:

918:

881:

879:

878:

873:

871:

867:

861:

859:

855:

852:

851:

847:

841:

837:

833:

828:

824:

669:

617:

615:

614:

609:

607:

605:

599:

595:

592:

588:

585:

584:

573:

569:

535:129.60 - 100.00

443:

340:

327:DE=(Cost-SL)/UL

323:

321:

320:

315:

313:

311:

289:

285:

281:

280:

276:

270:

266:

262:

257:

253:

90:income statement

21:

1982:

1981:

1977:

1976:

1975:

1973:

1972:

1971:

1947:

1946:

1945:

1940:

1889:

1858:

1839:Fund accounting

1824:Cost accounting

1807:

1802:

1716:Publication 946

1686:Canada Revenue

1647:, Chapter 11.

1632:

1631:

1630:

1620:

1619:

1615:

1608:

1606:Further reading

1603:

1602:

1594:

1590:

1582:

1578:

1570:

1566:

1554:

1550:

1542:

1538:

1530:

1526:

1513:

1509:

1504:

1500:

1491:

1487:

1481:Wayback Machine

1471:

1467:

1462:

1458:

1452:ASC 360-10-35-4

1450:

1446:

1437:

1436:

1432:

1415:

1411:

1402:

1398:

1393:

1388:

1314:

1309:

1303:

1294:

1285:

1271:

1243:

1218:

1197:

1098:

1090:

1085:

1080:

1067:

1059:

942:

937:

932:

927:

922:

834:

817:

816:

812:

807:

693:

688:

683:

678:

673:

647:

636:

627:

562:

561:

462:

457:

452:

447:

441:

421:

365:

354:

349:

344:

282:

263:

246:

245:

233:

225:

212:

204:P&L account

200:

185:

146:

133:

102:

50:

47:

32:

23:

22:

15:

12:

11:

5:

1980:

1978:

1970:

1969:

1964:

1959:

1949:

1948:

1942:

1941:

1939:

1938:

1933:

1928:

1923:

1918:

1913:

1908:

1903:

1897:

1895:

1891:

1890:

1888:

1887:

1882:

1877:

1872:

1866:

1864:

1860:

1859:

1857:

1856:

1854:Tax accounting

1851:

1846:

1841:

1836:

1831:

1826:

1821:

1815:

1813:

1809:

1808:

1803:

1801:

1800:

1793:

1786:

1778:

1772:

1771:

1752:

1741:

1726:

1723:

1709:

1698:

1691:

1678:

1677:

1672:

1666:

1656:

1629:

1628:

1622:

1621:

1610:

1609:

1607:

1604:

1601:

1600:

1588:

1576:

1564:

1548:

1536:

1524:

1514:Pietersz, G.,

1507:

1498:

1485:

1465:

1456:

1444:

1430:

1409:

1395:

1394:

1392:

1389:

1387:

1386:

1381:

1376:

1371:

1366:

1361:

1356:

1351:

1346:

1341:

1336:

1331:

1326:

1321:

1315:

1313:

1310:

1305:Main article:

1302:

1299:

1293:

1290:

1284:

1281:

1270:

1267:

1259:detailed guide

1242:

1239:

1226:United Kingdom

1217:

1214:

1196:

1193:

1166:Composite life

1161:

1160:

1157:

1154:

1151:

1148:

1145:

1141:

1140:

1137:

1134:

1131:

1128:

1125:

1121:

1120:

1117:

1114:

1111:

1108:

1105:

1101:

1100:

1095:

1092:

1087:

1082:

1077:

1066:

1063:

1058:

1055:

1049:

1048:

1043:

1038:

1035:

1032:

1028:

1027:

1024:

1021:

1018:

1015:

1011:

1010:

1007:

1004:

1001:

998:

994:

993:

990:

987:

984:

981:

977:

976:

973:

970:

967:

964:

960:

959:

954:

952:

950:

948:

945:

944:

941:Book value at

939:

934:

929:

928:cost per unit

924:

883:

882:

864:

848:residual value

844:

831:

806:

803:

800:

799:

794:

789:

786:

783:

779:

778:

775:

772:

769:

766:

762:

761:

758:

755:

752:

749:

745:

744:

741:

738:

735:

732:

728:

727:

724:

721:

718:

715:

711:

710:

705:

703:

701:

699:

696:

695:

692:Book value at

690:

685:

680:

675:

635:

632:

626:

623:

604:

589:residual value

582:

579:

576:

546:

545:

542:

539:

536:

532:

531:

528:

525:

522:

518:

517:

514:

511:

508:

504:

503:

500:

497:

494:

490:

489:

486:

483:

480:

476:

475:

472:

470:

468:

465:

464:

461:Book value at

459:

454:

449:

440:

437:

423:

422:

418:

415:

411:

410:

407:

404:

400:

399:

396:

393:

389:

388:

385:

382:

378:

377:

374:

371:

367:

366:

362:

360:

357:

356:

351:

346:

325:

324:

310:

307:

304:

301:

298:

295:

292:

277:residual value

273:

260:

232:

229:

224:

221:

217:contra account

211:

208:

199:

198:Effect on cash

196:

184:

181:

180:

179:

176:

168:

167:

164:

161:

158:

145:

142:

132:

129:

128:

127:

124:

121:

114:

101:

98:

48:

24:

14:

13:

10:

9:

6:

4:

3:

2:

1979:

1968:

1965:

1963:

1960:

1958:

1955:

1954:

1952:

1937:

1934:

1932:

1929:

1927:

1924:

1922:

1919:

1917:

1914:

1912:

1909:

1907:

1904:

1902:

1899:

1898:

1896:

1892:

1886:

1883:

1881:

1878:

1876:

1875:Balance sheet

1873:

1871:

1868:

1867:

1865:

1861:

1855:

1852:

1850:

1847:

1845:

1842:

1840:

1837:

1835:

1832:

1830:

1827:

1825:

1822:

1820:

1817:

1816:

1814:

1810:

1806:

1799:

1794:

1792:

1787:

1785:

1780:

1779:

1776:

1769:

1765:

1761:

1757:

1753:

1750:

1746:

1742:

1739:

1735:

1731:

1727:

1724:

1721:

1717:

1714:

1710:

1707:

1703:

1699:

1696:

1692:

1689:

1685:

1684:

1683:

1682:

1676:

1673:

1670:

1667:

1664:

1661:

1657:

1654:

1650:

1646:

1642:

1641:

1640:

1639:

1636:

1627:

1624:

1623:

1618:

1613:

1605:

1597:

1596:26 USC 168(d)

1592:

1589:

1585:

1580:

1577:

1573:

1572:26 USC 168(k)

1568:

1565:

1561:

1557:

1552:

1549:

1545:

1544:26 USC 168(c)

1540:

1537:

1533:

1528:

1525:

1521:

1517:

1511:

1508:

1502:

1499:

1495:

1489:

1486:

1482:

1478:

1475:

1469:

1466:

1460:

1457:

1453:

1448:

1445:

1440:

1434:

1431:

1427:

1423:

1419:

1413:

1410:

1406:

1400:

1397:

1390:

1385:

1382:

1380:

1377:

1375:

1372:

1370:

1367:

1365:

1364:John I. Beggs

1362:

1360:

1357:

1355:

1352:

1350:

1347:

1345:

1342:

1340:

1337:

1335:

1332:

1330:

1327:

1325:

1322:

1320:

1317:

1316:

1311:

1308:

1300:

1298:

1291:

1289:

1283:Real property

1282:

1280:

1277:

1268:

1266:

1264:

1260:

1256:

1252:

1248:

1240:

1238:

1235:

1231:

1227:

1223:

1215:

1213:

1211:

1207:

1202:

1201:tax deduction

1194:

1192:

1189:

1185:

1181:

1179:

1175:

1173:

1169:

1167:

1158:

1155:

1152:

1149:

1146:

1143:

1142:

1138:

1135:

1132:

1129:

1126:

1123:

1122:

1118:

1115:

1112:

1109:

1106:

1103:

1102:

1097:Depreciation

1096:

1093:

1088:

1083:

1078:

1075:

1074:

1071:

1064:

1062:

1056:

1054:

1047:

1044:

1042:

1039:

1036:

1033:

1030:

1029:

1025:

1022:

1019:

1016:

1013:

1012:

1008:

1005:

1002:

999:

996:

995:

991:

988:

985:

982:

979:

978:

974:

971:

968:

965:

962:

961:

958:

955:

953:

951:

949:

947:

946:

940:

938:depreciation

935:

931:Depreciation

930:

926:Depreciation

925:

920:

919:

916:

914:

909:

906:

905:

901:

899:

895:

891:

886:

862:

842:

829:

815:

814:

813:

810:

804:

798:

795:

793:

790:

787:

784:

781:

780:

776:

773:

770:

767:

764:

763:

759:

756:

753:

750:

747:

746:

742:

739:

736:

733:

730:

729:

725:

722:

719:

716:

713:

712:

709:

706:

704:

702:

700:

698:

697:

691:

689:depreciation

686:

682:Depreciation

681:

677:Depreciation

676:

671:

670:

667:

664:

661:

658:

655:

652:

649:

644:

640:

633:

631:

624:

622:

619:

602:

580:

577:

574:

559:

556:

552:

543:

540:

537:

534:

529:

526:

523:

520:

515:

512:

509:

506:

501:

498:

495:

492:

487:

484:

481:

478:

473:

471:

469:

467:

460:

458:depreciation

455:

451:Depreciation

450:

446:Depreciation

445:

444:

438:

436:

432:

430:

419:

416:

413:

408:

405:

402:

397:

394:

391:

386:

383:

380:

375:

372:

369:

363:

361:

359:

352:

347:

342:

341:

338:

336:

332:

328:

305:

302:

299:

296:

293:

271:

258:

244:

243:

242:

241:

237:

230:

228:

222:

220:

218:

209:

207:

205:

197:

195:

193:

189:

182:

177:

174:

173:

172:

165:

162:

159:

156:

155:

154:

151:

143:

141:

138:

137:salvage value

130:

125:

122:

119:

118:salvage value

115:

112:

111:

110:

106:

99:

97:

95:

91:

87:

86:balance sheet

81:

79:

75:

71:

67:

63:

54:

45:

41:

37:

30:

19:

1957:Depreciation

1931:Gross income

1926:Depreciation

1925:

1759:

1755:

1748:

1744:

1729:

1719:

1680:

1679:

1659:

1644:

1634:

1633:

1617:Depreciation

1616:

1591:

1586:(c) and (e).

1579:

1567:

1551:

1539:

1527:

1519:

1510:

1501:

1488:

1468:

1459:

1447:

1433:

1412:

1404:

1399:

1344:Deferred tax

1295:

1286:

1272:

1257:publishes a

1244:

1219:

1198:

1190:

1186:

1182:

1177:

1176:

1171:

1170:

1165:

1164:

1089:Depreciable

1068:

1060:

1052:

1045:

1040:

956:

936:Accumulated

912:

910:

907:

903:

902:

897:

893:

889:

887:

884:

811:

808:

796:

791:

707:

694:end of year

687:Accumulated

672:Depreciable

665:

662:

659:

656:

653:

650:

645:

641:

637:

628:

620:

560:

557:

553:

549:

456:Accumulated

433:

426:

355:at year-end

350:at year-end

343:Depreciation

334:

333:

329:

326:

239:

238:

234:

226:

213:

201:

192:amortization

186:

169:

147:

134:

107:

103:

84:affects the

82:

66:depreciation

65:

59:

1079:Historical

923:production

898:6,000 units

62:accountancy

29:Deprecation

1962:Accounting

1951:Categories

1936:Net income

1863:Statements

1805:Accounting

1635:Accounting

1584:26 USC 168

1556:26 USC 179

1391:References

1104:Computers

353:Book value

144:Impairment

70:fair value

1663:360-10-35

1301:Economics

1276:deduction

1124:Printers

1099:per year

943:year-end

921:Units of

863:×

843:−

581:−

463:year-end

376:$ 14,000

272:−

188:Depletion

116:Expected

1700:UK HMRC

1477:Archived

1312:See also

1159:$ 1,300

1153:$ 5,900

1147:$ 6,500

1127:$ 1,000

1119:$ 1,000

1113:$ 5,000

1107:$ 5,500

1084:Salvage

933:expense

684:expense

453:expense

373:$ 3,000

370:$ 3,000

345:expense

1906:Revenue

1422:expense

1359:Expense

1354:DIRTI 5

1247:classes

1206:expense

1037:14,000

1026:24,000

1023:46,000

1020:13,000

1009:37,000

1006:33,000

1003:12,000

992:49,000

989:21,000

986:11,000

975:60,000

972:10,000

969:10,000

541:900.00

530:129.60

527:870.40

516:216.00

513:784.00

510:144.00

502:360.00

499:640.00

496:240.00

488:600.00

485:400.00

482:400.00

417:15,000

406:12,000

387:11,000

94:expense

1766:

1736:

1671:IAS 16

1651:

1614:about

1253:, the

1230:Canada

1150:$ 600

1144:Total

1139:$ 300

1133:$ 900

1130:$ 100

1110:$ 500

1086:value

1076:Asset

1041:60,000

1031:1,400

1014:1,300

997:1,200

980:1,100

963:1,000

538:29.60

524:86.40

414:3,000

409:5,000

403:3,000

398:8,000

395:9,000

392:3,000

384:6,000

381:3,000

72:of an

1894:Terms

1756:et al

1745:et al

1711:U.S.

1374:MACRS

1094:Life

1091:cost

1081:cost

785:1/15

768:2/15

751:3/15

734:4/15

717:5/15

679:rate

674:base

448:rate

74:asset

1812:Type

1764:ISBN

1734:ISBN

1704:and

1649:ISBN

1156:4.5

782:900

777:160

774:840

765:900

760:280

757:720

748:900

743:460

740:540

731:900

726:700

723:300

714:900

643:is:

521:40%

507:40%

493:40%

479:40%

190:and

38:and

1681:Tax

1232:'s

1034:10

1017:10

1000:10

983:10

966:10

792:900

80:).

60:In

1953::

1758:,

1747:,

1718:,

1518:,

1136:3

1116:5

900:.

892:,

618:,

64:,

1797:e

1790:t

1783:v

1770:.

1708:.

1697:.

1690:.

1655:.

1598:.

1574:.

1562:.

1546:.

1483:.

1454:.

1441:.

1428:.

830:=

603:N

578:1

575:=

309:)

306:s

303:r

300:a

297:e

294:y

291:(

259:=

46:.

31:.

20:)

Text is available under the Creative Commons Attribution-ShareAlike License. Additional terms may apply.