4099:

20:

5424:

2053:(or a mortality table) is a mathematical construction that shows the number of people alive (based on the assumptions used to build the table) at a given age. In addition to the number of lives remaining at each age, a mortality table typically provides various probabilities associated with the development of these values.

1319:

The rate of discount equals the amount of interest earned during a one-year period, divided by the balance of money at the end of that period. By contrast, an annual effective rate of interest is calculated by dividing the amount of interest earned during a one-year period by the balance of money at

398:

Various proposals have been made to adopt a linear system, where all the notation would be on a single line without the use of superscripts or subscripts. Such a method would be useful for computing where representation of the halo system can be extremely difficult. However, a standard linear system

4141:

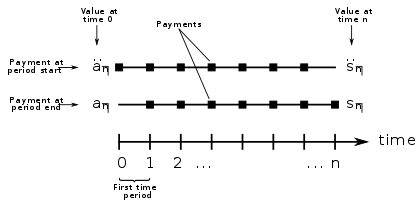

Notation directly above the basic symbol indicates when payments are made. Two dots indicates an annuity whose payments are made at the beginning of each year (an "annuity-due"); a horizontal line above the symbol indicates an annuity payable continuously (a "continuous annuity"); no mark above the

3902:

A life table generally shows the number of people alive at integral ages. If we need information regarding a fraction of a year, we must make assumptions with respect to the table, if not already implied by a mathematical formula underlying the table. A common assumption is that of a

Uniform

6022:

Notation directly above the basic symbol indicates the "type" of life insurance, whether payable at the end of the period or immediately. A horizontal line indicates life insurance payable immediately, whilst no mark above the symbol indicates payment is to be made at the end of the period

5942:

In the interest of simplicity the notation is limited and does not, for example, show whether the annuity is payable to a man or a woman (a fact that would typically be determined from the context, including whether the life table is based on male or female mortality rates).

1912:

6474:

5496:

When using these symbols, the rate of interest is not necessarily constant throughout the lifetime of the annuities. However, when the rate varies, the above formulas will no longer be valid; particular formulas can be developed for particular movements of the

1074:

This present value factor, or discount factor, is used to determine the amount of money that must be invested now in order to have a given amount of money in the future. For example, if you need 1 in one year, then the amount of money you should invest now is:

5218:

2039:

4575:

4348:

4992:

5207:

3406:

4887:

964:, interest to a debtor), more frequently than do effective rates. The result is more frequent compounding of interest income to the investor, (or interest expense to the debtor), when nominal rates are used.

951:

6613:

281:

3897:

4135:

Notation to the top-right indicates the frequency of payment (i.e., the number of annuity payments that will be made during each year). A lack of such notation means that payments are made annually.

1742:

1661:

5983:

Notation to the top-right indicates the timing of the payment of a death benefit. A lack of notation means payments are made at the end of the year of death. A figure in parentheses (for example

5045:

6297:

5429:

To understand the relationships shown above, consider that cash flows paid at a later time have a smaller present value than cash flows of the same total amount that are paid at earlier times.

1224:

1069:

356:

4698:

4426:

813:." It merely represents the number of interest conversions, or compounding times, per year. Semi-annual compounding, (or converting interest every six months), is frequently used in valuing

5857:

5101:

4088:

3610:

5946:

The

Actuarial Present Value of life contingent payments can be treated as the mathematical expectation of a present value random variable, or calculated through the current payment form.

2865:

3765:

5636:

5419:{\displaystyle a_{{\overline {n|}}i}<a_{{\overline {n|}}i}^{(m)}<{\overline {a}}_{{\overline {n|}}i}<{\ddot {a}}_{{\overline {n|}}i}^{(m)}<{\ddot {a}}_{{\overline {n|}}i}}

4645:

1317:

6133:

5713:

4202:

3172:

2404:

5587:

3031:

2641:

685:

733:

894:

5791:

1134:

773:

5506:

A life annuity is an annuity whose payments are contingent on the continuing life of the annuitant. The age of the annuitant is an important consideration in calculating the

3271:

2240:

6096:

5753:

2812:

1423:

1381:

956:

Effective and nominal rates of interest are not the same because interest paid in earlier measurement periods "earns" interest in later measurement periods; this is called

1923:

70:

Bar implies continuous – or paid at the moment of death; double dot implies paid at the beginning of the year; no mark implies paid at the end of the year;

3647:

3489:

2165:

of the table. Some mortality tables begin at an age greater than 0, in which case the radix is the number of people assumed to be alive at the youngest age in the table.

1100:

645:

5671:

4001:

3935:

2778:

1713:

1578:

1535:

1480:

807:

603:

501:

6014:

5546:

854:

465:

6055:

5491:

3967:

3802:

3061:

2926:

2888:

2738:

2704:

2344:

2270:

2213:

2185:

2159:

2131:

2081:

6229:

6187:

4728:

2581:

2517:

2484:

2456:

6208:

6166:

5977:

4129:

3693:

3535:

3452:

3221:

3107:

2972:

2670:

2316:

1734:

1692:

1501:

1444:

1339:

1248:

1157:

986:

430:

140:

5937:

5917:

5897:

5877:

5471:

5451:

5121:

4788:

4768:

4748:

4598:

4450:

4371:

4230:

3822:

3667:

3509:

3426:

3195:

3081:

2946:

2553:

2428:

2290:

2101:

1602:

1555:

569:

549:

529:

183:

160:

111:

91:

65:

45:

4462:

3824:. This is the expected number of complete years remaining to live (you may think of it as the expected number of birthdays that the person will celebrate).

4242:

4892:

4147:

5133:

3281:

5715:

indicates an annuity of 1 unit per year until the later death of member or death of spouse, to someone currently age 65 and spouse age 64.

5673:

indicates an annuity of 1 unit per year until the earlier death of member or death of spouse, to someone currently age 65 and spouse age 64

4796:

6016:) means the benefit is payable at the end of the period indicated (12 for monthly; 4 for quarterly; 2 for semi-annually; 365 for daily).

899:

6504:

tends to zero, so does this probability in the continuous case. The approximate force of mortality is this probability divided by Δ

191:

6493:

4138:

Notation to the bottom-right indicates the age of the person when the annuity starts and the period for which an annuity is paid.

1667:

6530:

3276:

These symbols may also be extended to multiple years, by inserting the number of years at the bottom left of the basic symbol.

1907:{\displaystyle \,(1+i)=\left(1+{\frac {i^{(m)}}{m}}\right)^{m}=e^{\delta }=\left(1-{\frac {d^{(m)}}{m}}\right)^{-m}=(1-d)^{-1}}

5755:

indicates an annuity of 1 unit per year payable 12 times a year (1/12 unit per month) until death to someone currently age 65

3830:

6679:

1160:

6469:{\displaystyle P_{\Delta x}(x)=P(x<X<x+\Delta \;x\mid \;X>x)={\frac {F_{X}(x+\Delta \;x)-F_{X}(x)}{(1-F_{X}(x))}}}

1610:

4999:

6674:

1169:

998:

286:

4650:

4378:

6684:

5801:

5050:

4009:

3543:

5793:

indicates an annuity of 1 unit per year payable at the start of each year until death to someone currently age 65

822:

2818:

5548:

indicates an annuity of 1 unit per year payable at the end of each year until death to someone currently age 65

605:

is the nominal rate of interest convertible semiannually. If the effective annual rate of interest is 12%, then

6651:

4107:

3701:

5594:

5589:

indicates an annuity of 1 unit per year payable for 10 years with payments being made at the end of each year

4730:

is added to the top-right corner, it represents the present value of an annuity whose payments occur each one

5638:

indicates an annuity of 1 unit per year for 10 years, or until death if earlier, to someone currently age 65

4605:

6624:

6272:

5507:

1253:

818:

433:

6103:

5678:

4163:

4142:

basic symbol indicates an annuity whose payments are made at the end of each year (an "annuity-immediate").

3115:

2349:

6639:

6634:

6251:

and is construed as an instantaneous rate of mortality at a certain age measured on an annualized basis.

5553:

2980:

2587:

650:

690:

508:

859:

5760:

1105:

738:

3938:

3229:

2218:

2034:{\displaystyle \,i>i^{(2)}>i^{(3)}>\cdots >\delta >\cdots >d^{(3)}>d^{(2)}>d}

6062:

6689:

5720:

2784:

1386:

1344:

4208:) represents the present value of an annuity-immediate, which is a series of unit payments at the

5124:

4146:

If the payments to be made under an annuity are independent of any life event, it is known as an

3617:

3459:

1078:

608:

384:

5643:

4098:

3972:

3906:

2757:

1697:

1562:

1506:

1451:

960:. That is, nominal rates of interest credit interest to an investor, (alternatively charge, or

778:

574:

472:

6629:

6144:

5986:

5523:

5514:

The age of the annuitant is placed at the bottom right of the symbol, without an "angle" mark.

1581:

957:

832:

443:

6032:

5476:

3944:

3779:

3038:

2903:

2873:

2710:

2676:

2321:

2247:

2190:

2170:

2136:

2108:

2058:

6213:

6171:

6019:

Notation to the bottom-right indicates the age of the person when the life insurance begins.

4706:

2559:

2495:

2462:

2434:

395:

before or after the main letter. Example notation using the halo system can be seen below.

6659:

6497:

4428:

represents the present value of an annuity-due, which is a series of unit payments at the

3771:

1320:

the beginning of the year. The present value (today) of a payment of 1 that is to be made

6192:

6150:

5961:

4113:

3672:

3514:

3431:

3200:

3086:

2951:

2649:

2295:

1718:

1676:

1485:

1428:

1323:

1232:

1141:

970:

414:

119:

6135:

indicates a life insurance benefit of 1 payable at the (mathematical) instant of death.

4570:{\displaystyle {\ddot {a}}_{{\overline {n|}}i}=1+v+\cdots +v^{n-1}={\frac {1-v^{n}}{d}}}

5955:

5922:

5902:

5882:

5862:

5456:

5436:

5106:

4773:

4753:

4733:

4583:

4435:

4356:

4215:

3807:

3652:

3494:

3411:

3180:

3066:

2931:

2538:

2413:

2275:

2086:

1587:

1540:

814:

554:

534:

514:

168:

145:

96:

76:

50:

30:

16:

Shorthand method to record math formulas that deal with interest rates and life tables

6668:

989:

4102:

Illustration of the payment streams represented by actuarial notation for annuities.

4155:

6098:

indicates a life insurance benefit of 1 payable at the end of the month of death.

4343:{\displaystyle \,a_{{\overline {n|}}i}=v+v^{2}+\cdots +v^{n}={\frac {1-v^{n}}{i}}}

19:

6057:

indicates a life insurance benefit of 1 payable at the end of the year of death.

6248:

4987:{\displaystyle {\ddot {a}}_{{\overline {n|}}i}^{(m)}={\frac {1-v^{n}}{d^{(m)}}}}

4151:

388:

377:

6244:

5202:{\displaystyle {\overline {a}}_{{\overline {n|}}i}={\frac {1-v^{n}}{\delta }}}

2050:

3223:) are living and dying, the relationship between these two probabilities is:

829:

frequently convert interest monthly. Following the above example again where

6254:

In a life table, we consider the probability of a person dying between age (

826:

392:

1102:. If you need 25 in 5 years the amount of money you should invest now is:

3903:

Distribution of Deaths (UDD) at each year of age. Under this assumption,

3401:{\displaystyle \,_{n}d_{x}=d_{x}+d_{x+1}+\cdots +d_{x+n-1}=l_{x}-l_{x+n}}

810:

373:

369:

4882:{\displaystyle a_{{\overline {n|}}i}^{(m)}={\frac {1-v^{n}}{i^{(m)}}}}

2083:

is the number of people alive, relative to an original cohort, at age

5493:, and is often omitted if the rate is clearly known from the context.

5212:

The present values of these annuities may be compared as follows:

4097:

961:

5899:

is the number of years of payments (or until death if earlier),

4232:

years (in other words: the value one period before the first of

946:{\displaystyle \,\left(1+{\frac {0.1139}{12}}\right)^{12}=1.12}

647:

represents the effective interest rate every six months. Since

5123:

increases without bound. The underlying annuity is known as a

4452:

years (in other words: the value at the time of the first of

3804:

is the curtate expectation of life for a person alive at age

1584:, is the limiting value of the nominal rate of interest when

3770:

Another statistic that can be obtained from a life table is

2161:: the number of people alive at age 0. This is known as the

276:{\displaystyle E(Z^{2})=E{\big (}(v^{k_{x}+1})^{2}{\big )},}

47:

is an assurance paying 1 on the insured event; lower-case

6608:{\displaystyle \mu \,(x)={\frac {F'_{X}(x)}{1-F_{X}(x)}}}

5453:

which represents the rate of interest may be replaced by

2103:. As age increases the number of people alive decreases.

1250:

can also be calculated from the following relationships:

188:

No fixed meaning, implies the second moment to calculate

67:

is an annuity paying 1 per annum at the appropriate time.

3892:{\displaystyle \,e_{x}=\sum _{t=1}^{\infty }\ _{t}p_{x}}

1446:

years in the future of an amount of 1 invested today.

6533:

6300:

6271:. In the continuous case, we could also consider the

6216:

6195:

6174:

6153:

6106:

6065:

6035:

5989:

5964:

5925:

5905:

5885:

5865:

5804:

5763:

5723:

5681:

5646:

5597:

5556:

5526:

5479:

5459:

5439:

5221:

5136:

5109:

5053:

5002:

4895:

4799:

4776:

4756:

4736:

4709:

4653:

4608:

4586:

4465:

4438:

4381:

4359:

4245:

4218:

4166:

4116:

4012:

3975:

3947:

3909:

3833:

3810:

3782:

3704:

3675:

3655:

3620:

3546:

3517:

3497:

3462:

3434:

3414:

3284:

3232:

3203:

3183:

3118:

3089:

3069:

3041:

2983:

2954:

2934:

2906:

2876:

2821:

2787:

2760:

2713:

2679:

2652:

2590:

2562:

2541:

2498:

2465:

2437:

2416:

2352:

2324:

2298:

2278:

2250:

2221:

2193:

2173:

2139:

2111:

2089:

2061:

1926:

1745:

1721:

1700:

1679:

1656:{\displaystyle \,\delta =\lim _{m\to \infty }i^{(m)}}

1613:

1590:

1565:

1543:

1509:

1488:

1454:

1431:

1389:

1347:

1326:

1256:

1235:

1172:

1144:

1108:

1081:

1001:

973:

902:

862:

835:

781:

741:

693:

653:

611:

577:

557:

537:

517:

475:

446:

417:

289:

194:

171:

148:

122:

99:

79:

53:

33:

4150:. Otherwise, in particular if payments end upon the

5040:{\displaystyle {\overline {a}}_{{\overline {n|}}i}}

3177:

Since the only possible alternatives from one age (

6607:

6468:

6223:

6202:

6181:

6160:

6127:

6090:

6049:

6008:

5971:

5931:

5911:

5891:

5871:

5851:

5785:

5747:

5707:

5665:

5630:

5581:

5540:

5485:

5465:

5445:

5418:

5201:

5115:

5095:

5039:

4986:

4881:

4782:

4762:

4742:

4722:

4692:

4639:

4592:

4569:

4444:

4420:

4373:in the denominator matches with 'i' in immediate)

4365:

4342:

4224:

4196:

4123:

4082:

3995:

3961:

3929:

3891:

3816:

3796:

3759:

3687:

3661:

3641:

3604:

3529:

3503:

3483:

3446:

3420:

3400:

3265:

3215:

3189:

3166:

3101:

3075:

3055:

3025:

2966:

2940:

2920:

2882:

2859:

2806:

2772:

2732:

2698:

2664:

2635:

2575:

2547:

2511:

2478:

2450:

2422:

2398:

2338:

2310:

2284:

2264:

2234:

2207:

2179:

2153:

2125:

2095:

2075:

2033:

1917:Their numerical value can be compared as follows:

1906:

1728:

1707:

1686:

1655:

1596:

1572:

1549:

1529:

1495:

1474:

1438:

1417:

1375:

1333:

1311:

1242:

1218:

1151:

1128:

1094:

1063:

980:

945:

888:

848:

801:

767:

727:

679:

639:

597:

563:

543:

523:

495:

459:

424:

350:

275:

177:

154:

134:

105:

85:

59:

39:

1219:{\displaystyle d={\frac {i}{1+i}}\approx i-i^{2}}

1064:{\displaystyle \,v={(1+i)}^{-1}\approx 1-i+i^{2}}

3491:is the probability of death between the ages of

2928:is the probability of death between the ages of

1622:

351:{\displaystyle v^{k_{x}+1}=e^{\delta (k_{x}+1)}}

4693:{\displaystyle {\ddot {s}}_{{\overline {n|}}i}}

4421:{\displaystyle {\ddot {a}}_{{\overline {n|}}i}}

3408:shows the number of people who die between age

440:. Thus if the annual interest rate is 12% then

372:to record mathematical formulas that deal with

4647:is the value at the time of the last payment,

551:times the effective rate of interest over one

5852:{\displaystyle a_{x:{\overline {n|}}i}^{(m)}}

5096:{\displaystyle \,a_{{\overline {n|}}i}^{(m)}}

4106:The basic symbol for the present value of an

4083:{\displaystyle \,l_{x+t}=(1-t)l_{x}+tl_{x+1}}

3605:{\displaystyle \,_{n}q_{x}={}_{n}d_{x}/l_{x}}

2187:is the limiting age of the mortality tables.

265:

222:

8:

6210:generally refers to net premiums per annum,

5979:. The following notation can then be added:

4600:in the denominator matches with 'd' in due)

4131:. The following notation can then be added:

2272:is the number of people who die between age

436:, which is the "true" rate of interest over

6262: + 1; this probability is called

2860:{\displaystyle d_{\omega -1}=l_{\omega -1}}

1482:, the nominal rate of discount convertible

6401:

6360:

6353:

6231:to special premiums, as a unique premium.

531:times a year, and is numerically equal to

6587:

6557:

6550:

6537:

6532:

6445:

6415:

6383:

6376:

6305:

6299:

6217:

6215:

6196:

6194:

6175:

6173:

6154:

6152:

6119:

6109:

6107:

6105:

6076:

6071:

6066:

6064:

6041:

6036:

6034:

5994:

5988:

5965:

5963:

5924:

5904:

5884:

5864:

5837:

5822:

5816:

5809:

5803:

5777:

5766:

5765:

5762:

5733:

5728:

5722:

5686:

5680:

5651:

5645:

5615:

5609:

5602:

5596:

5567:

5561:

5555:

5532:

5527:

5525:

5478:

5458:

5438:

5400:

5394:

5393:

5382:

5381:

5365:

5350:

5344:

5343:

5332:

5331:

5311:

5305:

5304:

5294:

5278:

5263:

5257:

5256:

5233:

5227:

5226:

5220:

5187:

5174:

5155:

5149:

5148:

5138:

5135:

5108:

5081:

5066:

5060:

5059:

5054:

5052:

5021:

5015:

5014:

5004:

5001:

4970:

4959:

4946:

4931:

4916:

4910:

4909:

4898:

4897:

4894:

4865:

4854:

4841:

4826:

4811:

4805:

4804:

4798:

4775:

4755:

4735:

4710:

4708:

4674:

4668:

4667:

4656:

4655:

4652:

4621:

4615:

4614:

4609:

4607:

4585:

4555:

4542:

4527:

4486:

4480:

4479:

4468:

4467:

4464:

4437:

4402:

4396:

4395:

4384:

4383:

4380:

4358:

4328:

4315:

4306:

4287:

4258:

4252:

4251:

4246:

4244:

4217:

4178:

4172:

4171:

4165:

4117:

4115:

4068:

4052:

4018:

4013:

4011:

3981:

3976:

3974:

3953:

3948:

3946:

3915:

3910:

3908:

3883:

3873:

3863:

3852:

3839:

3834:

3832:

3809:

3788:

3783:

3781:

3760:{\displaystyle \,_{n}p_{x}=l_{x+n}/l_{x}}

3751:

3742:

3730:

3717:

3707:

3706:

3703:

3674:

3654:

3633:

3623:

3622:

3619:

3596:

3587:

3581:

3571:

3569:

3559:

3549:

3548:

3545:

3516:

3496:

3475:

3465:

3464:

3461:

3433:

3413:

3386:

3373:

3348:

3323:

3310:

3297:

3287:

3286:

3283:

3251:

3238:

3233:

3231:

3202:

3182:

3158:

3149:

3137:

3124:

3119:

3117:

3088:

3068:

3047:

3042:

3040:

3017:

3008:

3002:

2989:

2984:

2982:

2953:

2933:

2912:

2907:

2905:

2875:

2845:

2826:

2820:

2792:

2786:

2759:

2718:

2712:

2684:

2678:

2651:

2621:

2608:

2595:

2589:

2567:

2561:

2540:

2503:

2497:

2470:

2464:

2442:

2436:

2415:

2384:

2371:

2358:

2353:

2351:

2330:

2325:

2323:

2297:

2277:

2256:

2251:

2249:

2222:

2220:

2199:

2194:

2192:

2172:

2145:

2140:

2138:

2117:

2112:

2110:

2088:

2067:

2062:

2060:

2013:

1994:

1957:

1938:

1927:

1925:

1895:

1867:

1845:

1839:

1818:

1805:

1783:

1777:

1746:

1744:

1722:

1720:

1701:

1699:

1680:

1678:

1641:

1625:

1614:

1612:

1589:

1566:

1564:

1542:

1515:

1510:

1508:

1489:

1487:

1460:

1455:

1453:

1432:

1430:

1409:

1392:

1390:

1388:

1367:

1350:

1348:

1346:

1327:

1325:

1300:

1283:

1257:

1255:

1236:

1234:

1210:

1179:

1171:

1145:

1143:

1120:

1109:

1107:

1082:

1080:

1055:

1027:

1010:

1002:

1000:

974:

972:

931:

916:

903:

901:

868:

863:

861:

836:

834:

787:

782:

780:

747:

742:

740:

711:

699:

694:

692:

665:

654:

652:

629:

617:

612:

610:

583:

578:

576:

556:

536:

516:

481:

476:

474:

447:

445:

418:

416:

331:

320:

299:

294:

288:

264:

263:

257:

239:

234:

221:

220:

205:

193:

170:

147:

121:

98:

78:

52:

32:

5919:is the number of payments per year, and

5631:{\displaystyle a_{65:{\overline {10|}}}}

4456:payments). This value is obtained from:

4236:payments). This value is obtained from:

2407:

18:

4640:{\displaystyle \,s_{{\overline {n|}}i}}

6660:International Actuarial Notation suite

6512:tend to zero, we get the function for

1425:for the future (or accumulated) value

1312:{\displaystyle \,(1-d)=v={(1+i)}^{-1}}

6654:Journal of the Institute of Actuaries

6247:and other social scientists call the

6128:{\displaystyle \,{\overline {A}}_{x}}

5708:{\displaystyle a_{\overline {65:64}}}

4197:{\displaystyle a_{{\overline {n|}}i}}

3167:{\displaystyle \,p_{x}=l_{x+1}/l_{x}}

2399:{\displaystyle \,d_{x}=l_{x}-l_{x+1}}

7:

6275:that a person who has attained age (

2346:may be calculated using the formula

5582:{\displaystyle a_{\overline {10|}}}

3649:is the probability that a life age

3063:is the probability that a life age

3026:{\displaystyle \,q_{x}=d_{x}/l_{x}}

2636:{\displaystyle d_{x}=l_{x}-l_{x+1}}

1383:. This is analogous to the formula

992:of 1 to be paid one year from now:

680:{\displaystyle \,(1.0583)^{2}=1.12}

6398:

6350:

6306:

3864:

1632:

728:{\displaystyle \,i^{(2)}/2=0.0583}

358:implying double force of interest.

14:

1673:The general relationship between

889:{\displaystyle \,i^{(12)}=0.1139}

6494:cumulative distribution function

5786:{\displaystyle {\ddot {a}}_{65}}

1129:{\displaystyle \,25\times v^{5}}

768:{\displaystyle \,i^{(2)}=0.1166}

6496:of the continuous age-at-death

4770:years, and each payment is one

3266:{\displaystyle \,p_{x}+q_{x}=1}

2235:{\displaystyle \,n\geq \omega }

775:. The appearing in the symbol

368:is a shorthand method to allow

6599:

6593:

6572:

6566:

6544:

6538:

6460:

6457:

6451:

6432:

6427:

6421:

6405:

6389:

6370:

6329:

6320:

6314:

6091:{\displaystyle \,A_{x}^{(12)}}

6083:

6077:

6001:

5995:

5844:

5838:

5823:

5740:

5734:

5616:

5568:

5401:

5372:

5366:

5351:

5312:

5285:

5279:

5264:

5234:

5156:

5088:

5082:

5067:

5022:

4977:

4971:

4938:

4932:

4917:

4872:

4866:

4833:

4827:

4812:

4717:

4711:

4675:

4622:

4487:

4403:

4259:

4179:

4045:

4033:

2020:

2014:

2001:

1995:

1964:

1958:

1945:

1939:

1892:

1879:

1852:

1846:

1790:

1784:

1759:

1747:

1648:

1642:

1629:

1537:. Discount is converted on an

1522:

1516:

1503:times a year, is analogous to

1467:

1461:

1405:

1393:

1363:

1351:

1296:

1284:

1270:

1258:

1161:annual effective discount rate

1023:

1011:

875:

869:

794:

788:

754:

748:

706:

700:

662:

655:

624:

618:

590:

584:

488:

482:

387:, where symbols are placed as

343:

324:

254:

227:

211:

198:

129:

123:

1:

5879:is the age of the annuitant,

5748:{\displaystyle a_{65}^{(12)}}

4750:th of a year for a period of

2807:{\displaystyle l_{\omega -1}}

1418:{\displaystyle \,{(1+i)}^{n}}

1376:{\displaystyle \,{(1-d)}^{n}}

23:Example of actuarial symbol.

6114:

5828:

5699:

5621:

5573:

5406:

5356:

5317:

5299:

5269:

5239:

5161:

5143:

5072:

5027:

5009:

4922:

4817:

4700:the value one period later.

4680:

4627:

4492:

4408:

4264:

4184:

823:monetary financial liability

383:Traditional notation uses a

3642:{\displaystyle \,_{n}p_{x}}

3484:{\displaystyle \,_{n}q_{x}}

1095:{\displaystyle \,1\times v}

640:{\displaystyle \,i^{(2)}/2}

6706:

2133:is the starting point for

1666:In this case, interest is

825:instruments, whereas home

5666:{\displaystyle a_{65:64}}

5047:is the limiting value of

4154:'s death, it is called a

3996:{\displaystyle \,l_{x+1}}

3930:{\displaystyle \,l_{x+t}}

2773:{\displaystyle \omega -1}

1708:{\displaystyle \,\delta }

1604:increases without bound:

1573:{\displaystyle \,\delta }

1530:{\displaystyle \,i^{(m)}}

1475:{\displaystyle \,d^{(m)}}

802:{\displaystyle \,i^{(m)}}

598:{\displaystyle \,i^{(2)}}

496:{\displaystyle \,i^{(m)}}

6652:1949 description in the

6279:) will die between age (

6009:{\displaystyle A^{(12)}}

5541:{\displaystyle \,a_{65}}

1668:convertible continuously

849:{\displaystyle \,i=0.12}

571:of a year. For example,

460:{\displaystyle \,i=0.12}

6625:Actuarial present value

6273:conditional probability

6050:{\displaystyle \,A_{x}}

5954:The basic symbol for a

5508:actuarial present value

5486:{\displaystyle \delta }

3962:{\displaystyle \,l_{x}}

3797:{\displaystyle \,e_{x}}

3056:{\displaystyle \,p_{x}}

2921:{\displaystyle \,q_{x}}

2883:{\displaystyle \omega }

2733:{\displaystyle d_{x+1}}

2699:{\displaystyle l_{x+1}}

2339:{\displaystyle \,d_{x}}

2265:{\displaystyle \,d_{x}}

2208:{\displaystyle \,l_{n}}

2180:{\displaystyle \omega }

2154:{\displaystyle \,l_{x}}

2126:{\displaystyle \,l_{0}}

2076:{\displaystyle \,l_{x}}

1341:years in the future is

819:fixed income securities

434:effective interest rate

6640:Mathematics of finance

6635:Annual percentage rate

6609:

6470:

6225:

6224:{\displaystyle \,\pi }

6204:

6183:

6182:{\displaystyle \,\pi }

6162:

6129:

6092:

6051:

6010:

5973:

5939:is the interest rate.

5933:

5913:

5893:

5873:

5853:

5787:

5749:

5709:

5667:

5632:

5583:

5542:

5487:

5467:

5447:

5420:

5203:

5117:

5097:

5041:

4988:

4883:

4784:

4764:

4744:

4724:

4694:

4641:

4594:

4571:

4446:

4422:

4367:

4344:

4226:

4198:

4125:

4103:

4084:

3997:

3963:

3931:

3893:

3868:

3818:

3798:

3761:

3689:

3663:

3643:

3606:

3531:

3505:

3485:

3448:

3422:

3402:

3267:

3217:

3191:

3168:

3103:

3077:

3057:

3027:

2968:

2942:

2922:

2884:

2861:

2808:

2774:

2734:

2700:

2666:

2637:

2577:

2549:

2513:

2480:

2452:

2424:

2400:

2340:

2312:

2286:

2266:

2236:

2209:

2181:

2155:

2127:

2097:

2077:

2035:

1908:

1730:

1709:

1688:

1657:

1598:

1574:

1551:

1531:

1497:

1476:

1440:

1419:

1377:

1335:

1313:

1244:

1220:

1153:

1130:

1096:

1065:

982:

947:

890:

850:

803:

769:

729:

681:

641:

599:

565:

545:

525:

497:

461:

426:

362:

352:

277:

179:

156:

136:

107:

93:-year-old person, for

87:

61:

41:

6680:Mathematical notation

6610:

6471:

6226:

6205:

6184:

6163:

6143:The basic symbol for

6130:

6093:

6052:

6011:

5974:

5934:

5914:

5894:

5874:

5854:

5788:

5750:

5710:

5668:

5633:

5584:

5543:

5488:

5468:

5448:

5421:

5204:

5118:

5098:

5042:

4989:

4884:

4785:

4765:

4745:

4725:

4723:{\displaystyle \,(m)}

4695:

4642:

4595:

4572:

4447:

4423:

4368:

4345:

4227:

4199:

4126:

4101:

4085:

3998:

3964:

3932:

3894:

3848:

3819:

3799:

3762:

3690:

3664:

3644:

3607:

3532:

3506:

3486:

3449:

3423:

3403:

3268:

3218:

3192:

3169:

3104:

3078:

3058:

3028:

2969:

2943:

2923:

2885:

2862:

2809:

2775:

2735:

2701:

2667:

2638:

2578:

2576:{\displaystyle l_{x}}

2550:

2514:

2512:{\displaystyle l_{0}}

2481:

2479:{\displaystyle d_{x}}

2453:

2451:{\displaystyle l_{x}}

2425:

2401:

2341:

2313:

2287:

2267:

2237:

2210:

2182:

2156:

2128:

2098:

2078:

2036:

1909:

1731:

1710:

1689:

1658:

1599:

1575:

1552:

1532:

1498:

1477:

1441:

1420:

1378:

1336:

1314:

1245:

1221:

1154:

1131:

1097:

1066:

983:

948:

891:

851:

804:

770:

730:

682:

642:

600:

566:

546:

526:

509:nominal interest rate

498:

462:

427:

353:

278:

180:

157:

137:

108:

88:

62:

42:

22:

6531:

6298:

6214:

6193:

6172:

6151:

6104:

6063:

6033:

5987:

5962:

5923:

5903:

5883:

5863:

5802:

5761:

5721:

5679:

5644:

5595:

5554:

5524:

5477:

5457:

5437:

5219:

5134:

5107:

5051:

5000:

4893:

4797:

4774:

4754:

4734:

4707:

4651:

4606:

4584:

4463:

4436:

4379:

4357:

4243:

4216:

4164:

4114:

4010:

3973:

3945:

3939:linear interpolation

3907:

3831:

3808:

3780:

3702:

3673:

3669:will survive to age

3653:

3618:

3544:

3515:

3495:

3460:

3432:

3412:

3282:

3230:

3201:

3181:

3116:

3087:

3083:will survive to age

3067:

3039:

2981:

2952:

2932:

2904:

2874:

2819:

2785:

2758:

2711:

2677:

2650:

2588:

2560:

2539:

2496:

2463:

2435:

2414:

2350:

2322:

2296:

2276:

2248:

2219:

2191:

2171:

2137:

2109:

2087:

2059:

1924:

1743:

1719:

1698:

1677:

1611:

1588:

1563:

1541:

1507:

1486:

1452:

1429:

1387:

1345:

1324:

1254:

1233:

1170:

1142:

1106:

1079:

999:

971:

900:

860:

833:

779:

739:

691:

651:

609:

575:

555:

535:

515:

473:

444:

415:

287:

192:

169:

146:

120:

97:

77:

51:

31:

6675:Applied mathematics

6565:

6203:{\displaystyle \,P}

6161:{\displaystyle \,P}

6087:

5972:{\displaystyle \,A}

5848:

5744:

5376:

5289:

5092:

4942:

4837:

4124:{\displaystyle \,a}

3688:{\displaystyle x+n}

3530:{\displaystyle x+n}

3447:{\displaystyle x+n}

3216:{\displaystyle x+1}

3102:{\displaystyle x+1}

2967:{\displaystyle x+1}

2665:{\displaystyle x+1}

2311:{\displaystyle x+1}

1729:{\displaystyle \,d}

1687:{\displaystyle \,i}

1496:{\displaystyle \,m}

1439:{\displaystyle \,n}

1334:{\displaystyle \,n}

1243:{\displaystyle \,d}

1152:{\displaystyle \,d}

981:{\displaystyle \,v}

425:{\displaystyle \,i}

399:has yet to emerge.

135:{\displaystyle (x)}

6605:

6553:

6514:force of mortality

6466:

6241:force of mortality

6235:Force of mortality

6221:

6200:

6179:

6158:

6125:

6088:

6067:

6047:

6006:

5969:

5929:

5909:

5889:

5869:

5849:

5805:

5783:

5745:

5724:

5705:

5663:

5628:

5579:

5538:

5483:

5463:

5443:

5416:

5330:

5252:

5199:

5125:continuous annuity

5113:

5093:

5055:

5037:

4984:

4896:

4879:

4800:

4780:

4760:

4740:

4720:

4690:

4637:

4590:

4567:

4442:

4418:

4363:

4340:

4222:

4194:

4121:

4104:

4080:

3993:

3959:

3927:

3889:

3814:

3794:

3757:

3685:

3659:

3639:

3602:

3527:

3501:

3481:

3444:

3418:

3398:

3263:

3213:

3187:

3164:

3099:

3073:

3053:

3023:

2964:

2938:

2918:

2880:

2857:

2804:

2770:

2730:

2696:

2662:

2633:

2573:

2545:

2509:

2476:

2448:

2420:

2396:

2336:

2308:

2282:

2262:

2232:

2205:

2177:

2151:

2123:

2093:

2073:

2031:

1904:

1726:

1705:

1684:

1653:

1636:

1594:

1570:

1547:

1527:

1493:

1472:

1436:

1415:

1373:

1331:

1309:

1240:

1216:

1149:

1126:

1092:

1061:

978:

943:

886:

846:

799:

765:

725:

677:

637:

595:

561:

541:

521:

493:

457:

422:

366:Actuarial notation

363:

348:

273:

175:

152:

132:

103:

83:

57:

37:

6685:Actuarial science

6630:Actuarial science

6603:

6464:

6239:Among actuaries,

6117:

5932:{\displaystyle i}

5912:{\displaystyle m}

5892:{\displaystyle n}

5872:{\displaystyle x}

5831:

5774:

5702:

5624:

5576:

5466:{\displaystyle d}

5446:{\displaystyle i}

5409:

5390:

5359:

5340:

5320:

5302:

5272:

5242:

5197:

5164:

5146:

5116:{\displaystyle m}

5075:

5030:

5012:

4982:

4925:

4906:

4877:

4820:

4783:{\displaystyle m}

4763:{\displaystyle n}

4743:{\displaystyle m}

4683:

4664:

4630:

4593:{\displaystyle d}

4565:

4495:

4476:

4445:{\displaystyle n}

4432:of each year for

4411:

4392:

4366:{\displaystyle i}

4338:

4267:

4225:{\displaystyle n}

4212:of each year for

4187:

3872:

3817:{\displaystyle x}

3662:{\displaystyle x}

3504:{\displaystyle x}

3421:{\displaystyle x}

3190:{\displaystyle x}

3076:{\displaystyle x}

2941:{\displaystyle x}

2899:

2898:

2548:{\displaystyle x}

2423:{\displaystyle x}

2285:{\displaystyle x}

2096:{\displaystyle x}

1860:

1798:

1621:

1597:{\displaystyle m}

1582:force of interest

1550:{\displaystyle m}

1195:

958:compound interest

924:

564:{\displaystyle m}

544:{\displaystyle m}

524:{\displaystyle m}

178:{\displaystyle m}

155:{\displaystyle n}

106:{\displaystyle n}

86:{\displaystyle x}

60:{\displaystyle a}

40:{\displaystyle A}

6697:

6614:

6612:

6611:

6606:

6604:

6602:

6592:

6591:

6575:

6561:

6551:

6475:

6473:

6472:

6467:

6465:

6463:

6450:

6449:

6430:

6420:

6419:

6388:

6387:

6377:

6313:

6312:

6230:

6228:

6227:

6222:

6209:

6207:

6206:

6201:

6188:

6186:

6185:

6180:

6167:

6165:

6164:

6159:

6134:

6132:

6131:

6126:

6124:

6123:

6118:

6110:

6097:

6095:

6094:

6089:

6086:

6075:

6056:

6054:

6053:

6048:

6046:

6045:

6015:

6013:

6012:

6007:

6005:

6004:

5978:

5976:

5975:

5970:

5938:

5936:

5935:

5930:

5918:

5916:

5915:

5910:

5898:

5896:

5895:

5890:

5878:

5876:

5875:

5870:

5858:

5856:

5855:

5850:

5847:

5836:

5832:

5827:

5826:

5817:

5792:

5790:

5789:

5784:

5782:

5781:

5776:

5775:

5767:

5754:

5752:

5751:

5746:

5743:

5732:

5714:

5712:

5711:

5706:

5704:

5703:

5698:

5687:

5672:

5670:

5669:

5664:

5662:

5661:

5637:

5635:

5634:

5629:

5627:

5626:

5625:

5620:

5619:

5610:

5588:

5586:

5585:

5580:

5578:

5577:

5572:

5571:

5562:

5547:

5545:

5544:

5539:

5537:

5536:

5492:

5490:

5489:

5484:

5472:

5470:

5469:

5464:

5452:

5450:

5449:

5444:

5425:

5423:

5422:

5417:

5415:

5414:

5410:

5405:

5404:

5395:

5392:

5391:

5383:

5375:

5364:

5360:

5355:

5354:

5345:

5342:

5341:

5333:

5326:

5325:

5321:

5316:

5315:

5306:

5303:

5295:

5288:

5277:

5273:

5268:

5267:

5258:

5248:

5247:

5243:

5238:

5237:

5228:

5208:

5206:

5205:

5200:

5198:

5193:

5192:

5191:

5175:

5170:

5169:

5165:

5160:

5159:

5150:

5147:

5139:

5122:

5120:

5119:

5114:

5102:

5100:

5099:

5094:

5091:

5080:

5076:

5071:

5070:

5061:

5046:

5044:

5043:

5038:

5036:

5035:

5031:

5026:

5025:

5016:

5013:

5005:

4993:

4991:

4990:

4985:

4983:

4981:

4980:

4965:

4964:

4963:

4947:

4941:

4930:

4926:

4921:

4920:

4911:

4908:

4907:

4899:

4888:

4886:

4885:

4880:

4878:

4876:

4875:

4860:

4859:

4858:

4842:

4836:

4825:

4821:

4816:

4815:

4806:

4789:

4787:

4786:

4781:

4769:

4767:

4766:

4761:

4749:

4747:

4746:

4741:

4729:

4727:

4726:

4721:

4699:

4697:

4696:

4691:

4689:

4688:

4684:

4679:

4678:

4669:

4666:

4665:

4657:

4646:

4644:

4643:

4638:

4636:

4635:

4631:

4626:

4625:

4616:

4599:

4597:

4596:

4591:

4576:

4574:

4573:

4568:

4566:

4561:

4560:

4559:

4543:

4538:

4537:

4501:

4500:

4496:

4491:

4490:

4481:

4478:

4477:

4469:

4451:

4449:

4448:

4443:

4427:

4425:

4424:

4419:

4417:

4416:

4412:

4407:

4406:

4397:

4394:

4393:

4385:

4372:

4370:

4369:

4364:

4349:

4347:

4346:

4341:

4339:

4334:

4333:

4332:

4316:

4311:

4310:

4292:

4291:

4273:

4272:

4268:

4263:

4262:

4253:

4231:

4229:

4228:

4223:

4203:

4201:

4200:

4195:

4193:

4192:

4188:

4183:

4182:

4173:

4130:

4128:

4127:

4122:

4089:

4087:

4086:

4081:

4079:

4078:

4057:

4056:

4029:

4028:

4002:

4000:

3999:

3994:

3992:

3991:

3968:

3966:

3965:

3960:

3958:

3957:

3936:

3934:

3933:

3928:

3926:

3925:

3898:

3896:

3895:

3890:

3888:

3887:

3878:

3877:

3870:

3867:

3862:

3844:

3843:

3823:

3821:

3820:

3815:

3803:

3801:

3800:

3795:

3793:

3792:

3766:

3764:

3763:

3758:

3756:

3755:

3746:

3741:

3740:

3722:

3721:

3712:

3711:

3694:

3692:

3691:

3686:

3668:

3666:

3665:

3660:

3648:

3646:

3645:

3640:

3638:

3637:

3628:

3627:

3611:

3609:

3608:

3603:

3601:

3600:

3591:

3586:

3585:

3576:

3575:

3570:

3564:

3563:

3554:

3553:

3536:

3534:

3533:

3528:

3510:

3508:

3507:

3502:

3490:

3488:

3487:

3482:

3480:

3479:

3470:

3469:

3453:

3451:

3450:

3445:

3427:

3425:

3424:

3419:

3407:

3405:

3404:

3399:

3397:

3396:

3378:

3377:

3365:

3364:

3334:

3333:

3315:

3314:

3302:

3301:

3292:

3291:

3272:

3270:

3269:

3264:

3256:

3255:

3243:

3242:

3222:

3220:

3219:

3214:

3196:

3194:

3193:

3188:

3173:

3171:

3170:

3165:

3163:

3162:

3153:

3148:

3147:

3129:

3128:

3108:

3106:

3105:

3100:

3082:

3080:

3079:

3074:

3062:

3060:

3059:

3054:

3052:

3051:

3032:

3030:

3029:

3024:

3022:

3021:

3012:

3007:

3006:

2994:

2993:

2973:

2971:

2970:

2965:

2947:

2945:

2944:

2939:

2927:

2925:

2924:

2919:

2917:

2916:

2889:

2887:

2886:

2881:

2866:

2864:

2863:

2858:

2856:

2855:

2837:

2836:

2813:

2811:

2810:

2805:

2803:

2802:

2779:

2777:

2776:

2771:

2739:

2737:

2736:

2731:

2729:

2728:

2705:

2703:

2702:

2697:

2695:

2694:

2671:

2669:

2668:

2663:

2642:

2640:

2639:

2634:

2632:

2631:

2613:

2612:

2600:

2599:

2582:

2580:

2579:

2574:

2572:

2571:

2554:

2552:

2551:

2546:

2518:

2516:

2515:

2510:

2508:

2507:

2485:

2483:

2482:

2477:

2475:

2474:

2457:

2455:

2454:

2449:

2447:

2446:

2429:

2427:

2426:

2421:

2408:

2405:

2403:

2402:

2397:

2395:

2394:

2376:

2375:

2363:

2362:

2345:

2343:

2342:

2337:

2335:

2334:

2317:

2315:

2314:

2309:

2291:

2289:

2288:

2283:

2271:

2269:

2268:

2263:

2261:

2260:

2241:

2239:

2238:

2233:

2215:is zero for all

2214:

2212:

2211:

2206:

2204:

2203:

2186:

2184:

2183:

2178:

2160:

2158:

2157:

2152:

2150:

2149:

2132:

2130:

2129:

2124:

2122:

2121:

2102:

2100:

2099:

2094:

2082:

2080:

2079:

2074:

2072:

2071:

2040:

2038:

2037:

2032:

2024:

2023:

2005:

2004:

1968:

1967:

1949:

1948:

1913:

1911:

1910:

1905:

1903:

1902:

1875:

1874:

1866:

1862:

1861:

1856:

1855:

1840:

1823:

1822:

1810:

1809:

1804:

1800:

1799:

1794:

1793:

1778:

1735:

1733:

1732:

1727:

1714:

1712:

1711:

1706:

1693:

1691:

1690:

1685:

1662:

1660:

1659:

1654:

1652:

1651:

1635:

1603:

1601:

1600:

1595:

1579:

1577:

1576:

1571:

1556:

1554:

1553:

1548:

1536:

1534:

1533:

1528:

1526:

1525:

1502:

1500:

1499:

1494:

1481:

1479:

1478:

1473:

1471:

1470:

1445:

1443:

1442:

1437:

1424:

1422:

1421:

1416:

1414:

1413:

1408:

1382:

1380:

1379:

1374:

1372:

1371:

1366:

1340:

1338:

1337:

1332:

1318:

1316:

1315:

1310:

1308:

1307:

1299:

1249:

1247:

1246:

1241:

1225:

1223:

1222:

1217:

1215:

1214:

1196:

1194:

1180:

1158:

1156:

1155:

1150:

1135:

1133:

1132:

1127:

1125:

1124:

1101:

1099:

1098:

1093:

1070:

1068:

1067:

1062:

1060:

1059:

1035:

1034:

1026:

987:

985:

984:

979:

952:

950:

949:

944:

936:

935:

930:

926:

925:

917:

895:

893:

892:

887:

879:

878:

855:

853:

852:

847:

808:

806:

805:

800:

798:

797:

774:

772:

771:

766:

758:

757:

734:

732:

731:

726:

715:

710:

709:

686:

684:

683:

678:

670:

669:

646:

644:

643:

638:

633:

628:

627:

604:

602:

601:

596:

594:

593:

570:

568:

567:

562:

550:

548:

547:

542:

530:

528:

527:

522:

502:

500:

499:

494:

492:

491:

466:

464:

463:

458:

431:

429:

428:

423:

403:Example notation

357:

355:

354:

349:

347:

346:

336:

335:

312:

311:

304:

303:

282:

280:

279:

274:

269:

268:

262:

261:

252:

251:

244:

243:

226:

225:

210:

209:

184:

182:

181:

176:

161:

159:

158:

153:

141:

139:

138:

133:

112:

110:

109:

104:

92:

90:

89:

84:

66:

64:

63:

58:

46:

44:

43:

38:

6705:

6704:

6700:

6699:

6698:

6696:

6695:

6694:

6665:

6664:

6648:

6621:

6583:

6576:

6552:

6529:

6528:

6498:random variable

6487:

6441:

6431:

6411:

6379:

6378:

6301:

6296:

6295:

6270:

6243:refers to what

6237:

6212:

6211:

6191:

6190:

6170:

6169:

6149:

6148:

6141:

6108:

6102:

6101:

6061:

6060:

6037:

6031:

6030:

5990:

5985:

5984:

5960:

5959:

5952:

5921:

5920:

5901:

5900:

5881:

5880:

5861:

5860:

5818:

5800:

5799:

5796:or in general:

5764:

5759:

5758:

5719:

5718:

5688:

5682:

5677:

5676:

5647:

5642:

5641:

5611:

5598:

5593:

5592:

5563:

5557:

5552:

5551:

5528:

5522:

5521:

5510:of an annuity.

5504:

5475:

5474:

5455:

5454:

5435:

5434:

5396:

5380:

5346:

5307:

5293:

5259:

5229:

5222:

5217:

5216:

5183:

5176:

5151:

5137:

5132:

5131:

5105:

5104:

5062:

5049:

5048:

5017:

5003:

4998:

4997:

4966:

4955:

4948:

4912:

4891:

4890:

4861:

4850:

4843:

4807:

4795:

4794:

4772:

4771:

4752:

4751:

4732:

4731:

4705:

4704:

4670:

4654:

4649:

4648:

4617:

4610:

4604:

4603:

4582:

4581:

4551:

4544:

4523:

4482:

4466:

4461:

4460:

4434:

4433:

4398:

4382:

4377:

4376:

4355:

4354:

4324:

4317:

4302:

4283:

4254:

4247:

4241:

4240:

4214:

4213:

4174:

4167:

4162:

4161:

4148:annuity-certain

4112:

4111:

4096:

4064:

4048:

4014:

4008:

4007:

3977:

3971:

3970:

3949:

3943:

3942:

3911:

3905:

3904:

3879:

3869:

3835:

3829:

3828:

3806:

3805:

3784:

3778:

3777:

3772:life expectancy

3747:

3726:

3713:

3705:

3700:

3699:

3671:

3670:

3651:

3650:

3629:

3621:

3616:

3615:

3592:

3577:

3568:

3555:

3547:

3542:

3541:

3513:

3512:

3493:

3492:

3471:

3463:

3458:

3457:

3430:

3429:

3410:

3409:

3382:

3369:

3344:

3319:

3306:

3293:

3285:

3280:

3279:

3247:

3234:

3228:

3227:

3199:

3198:

3197:) to the next (

3179:

3178:

3154:

3133:

3120:

3114:

3113:

3085:

3084:

3065:

3064:

3043:

3037:

3036:

3013:

2998:

2985:

2979:

2978:

2950:

2949:

2930:

2929:

2908:

2902:

2901:

2872:

2871:

2841:

2822:

2817:

2816:

2788:

2783:

2782:

2756:

2755:

2714:

2709:

2708:

2680:

2675:

2674:

2648:

2647:

2617:

2604:

2591:

2586:

2585:

2563:

2558:

2557:

2537:

2536:

2499:

2494:

2493:

2466:

2461:

2460:

2438:

2433:

2432:

2412:

2411:

2380:

2367:

2354:

2348:

2347:

2326:

2320:

2319:

2294:

2293:

2274:

2273:

2252:

2246:

2245:

2217:

2216:

2195:

2189:

2188:

2169:

2168:

2141:

2135:

2134:

2113:

2107:

2106:

2085:

2084:

2063:

2057:

2056:

2047:

2009:

1990:

1953:

1934:

1922:

1921:

1891:

1841:

1832:

1828:

1827:

1814:

1779:

1770:

1766:

1765:

1741:

1740:

1717:

1716:

1696:

1695:

1675:

1674:

1637:

1609:

1608:

1586:

1585:

1561:

1560:

1539:

1538:

1511:

1505:

1504:

1484:

1483:

1456:

1450:

1449:

1427:

1426:

1391:

1385:

1384:

1349:

1343:

1342:

1322:

1321:

1282:

1252:

1251:

1231:

1230:

1206:

1184:

1168:

1167:

1140:

1139:

1116:

1104:

1103:

1077:

1076:

1051:

1009:

997:

996:

988:represents the

969:

968:

909:

905:

904:

898:

897:

864:

858:

857:

831:

830:

783:

777:

776:

743:

737:

736:

695:

689:

688:

661:

649:

648:

613:

607:

606:

579:

573:

572:

553:

552:

533:

532:

513:

512:

503:(pronounced "i

477:

471:

470:

442:

441:

413:

412:

410:

405:

361:

327:

316:

295:

290:

285:

284:

253:

235:

230:

201:

190:

189:

167:

166:

144:

143:

118:

117:

95:

94:

75:

74:

49:

48:

29:

28:

17:

12:

11:

5:

6703:

6701:

6693:

6692:

6687:

6682:

6677:

6667:

6666:

6663:

6662:

6657:

6647:

6646:External links

6644:

6643:

6642:

6637:

6632:

6627:

6620:

6617:

6616:

6615:

6601:

6598:

6595:

6590:

6586:

6582:

6579:

6574:

6571:

6568:

6564:

6560:

6556:

6549:

6546:

6543:

6540:

6536:

6483:

6477:

6476:

6462:

6459:

6456:

6453:

6448:

6444:

6440:

6437:

6434:

6429:

6426:

6423:

6418:

6414:

6410:

6407:

6404:

6400:

6397:

6394:

6391:

6386:

6382:

6375:

6372:

6369:

6366:

6363:

6359:

6356:

6352:

6349:

6346:

6343:

6340:

6337:

6334:

6331:

6328:

6325:

6322:

6319:

6316:

6311:

6308:

6304:

6287: + Δ

6266:

6236:

6233:

6220:

6199:

6178:

6157:

6140:

6137:

6122:

6116:

6113:

6085:

6082:

6079:

6074:

6070:

6044:

6040:

6025:

6024:

6020:

6017:

6003:

6000:

5997:

5993:

5968:

5956:life insurance

5951:

5950:Life insurance

5948:

5928:

5908:

5888:

5868:

5846:

5843:

5840:

5835:

5830:

5825:

5821:

5815:

5812:

5808:

5780:

5773:

5770:

5742:

5739:

5736:

5731:

5727:

5701:

5697:

5694:

5691:

5685:

5660:

5657:

5654:

5650:

5623:

5618:

5614:

5608:

5605:

5601:

5575:

5570:

5566:

5560:

5535:

5531:

5516:

5515:

5503:

5502:Life annuities

5500:

5499:

5498:

5494:

5482:

5462:

5442:

5433:The subscript

5427:

5426:

5413:

5408:

5403:

5399:

5389:

5386:

5379:

5374:

5371:

5368:

5363:

5358:

5353:

5349:

5339:

5336:

5329:

5324:

5319:

5314:

5310:

5301:

5298:

5292:

5287:

5284:

5281:

5276:

5271:

5266:

5262:

5255:

5251:

5246:

5241:

5236:

5232:

5225:

5210:

5209:

5196:

5190:

5186:

5182:

5179:

5173:

5168:

5163:

5158:

5154:

5145:

5142:

5112:

5090:

5087:

5084:

5079:

5074:

5069:

5065:

5058:

5034:

5029:

5024:

5020:

5011:

5008:

4995:

4994:

4979:

4976:

4973:

4969:

4962:

4958:

4954:

4951:

4945:

4940:

4937:

4934:

4929:

4924:

4919:

4915:

4905:

4902:

4874:

4871:

4868:

4864:

4857:

4853:

4849:

4846:

4840:

4835:

4832:

4829:

4824:

4819:

4814:

4810:

4803:

4790:th of a unit.

4779:

4759:

4739:

4719:

4716:

4713:

4703:If the symbol

4687:

4682:

4677:

4673:

4663:

4660:

4634:

4629:

4624:

4620:

4613:

4589:

4578:

4577:

4564:

4558:

4554:

4550:

4547:

4541:

4536:

4533:

4530:

4526:

4522:

4519:

4516:

4513:

4510:

4507:

4504:

4499:

4494:

4489:

4485:

4475:

4472:

4441:

4415:

4410:

4405:

4401:

4391:

4388:

4362:

4351:

4350:

4337:

4331:

4327:

4323:

4320:

4314:

4309:

4305:

4301:

4298:

4295:

4290:

4286:

4282:

4279:

4276:

4271:

4266:

4261:

4257:

4250:

4221:

4206:a-angle-n at i

4191:

4186:

4181:

4177:

4170:

4144:

4143:

4139:

4136:

4120:

4095:

4092:

4091:

4090:

4077:

4074:

4071:

4067:

4063:

4060:

4055:

4051:

4047:

4044:

4041:

4038:

4035:

4032:

4027:

4024:

4021:

4017:

3990:

3987:

3984:

3980:

3956:

3952:

3924:

3921:

3918:

3914:

3900:

3899:

3886:

3882:

3876:

3866:

3861:

3858:

3855:

3851:

3847:

3842:

3838:

3813:

3791:

3787:

3768:

3767:

3754:

3750:

3745:

3739:

3736:

3733:

3729:

3725:

3720:

3716:

3710:

3684:

3681:

3678:

3658:

3636:

3632:

3626:

3613:

3612:

3599:

3595:

3590:

3584:

3580:

3574:

3567:

3562:

3558:

3552:

3526:

3523:

3520:

3500:

3478:

3474:

3468:

3443:

3440:

3437:

3417:

3395:

3392:

3389:

3385:

3381:

3376:

3372:

3368:

3363:

3360:

3357:

3354:

3351:

3347:

3343:

3340:

3337:

3332:

3329:

3326:

3322:

3318:

3313:

3309:

3305:

3300:

3296:

3290:

3274:

3273:

3262:

3259:

3254:

3250:

3246:

3241:

3237:

3212:

3209:

3206:

3186:

3175:

3174:

3161:

3157:

3152:

3146:

3143:

3140:

3136:

3132:

3127:

3123:

3098:

3095:

3092:

3072:

3050:

3046:

3034:

3033:

3020:

3016:

3011:

3005:

3001:

2997:

2992:

2988:

2963:

2960:

2957:

2937:

2915:

2911:

2897:

2896:

2893:

2890:

2879:

2868:

2867:

2854:

2851:

2848:

2844:

2840:

2835:

2832:

2829:

2825:

2814:

2801:

2798:

2795:

2791:

2780:

2769:

2766:

2763:

2752:

2751:

2748:

2745:

2741:

2740:

2727:

2724:

2721:

2717:

2706:

2693:

2690:

2687:

2683:

2672:

2661:

2658:

2655:

2644:

2643:

2630:

2627:

2624:

2620:

2616:

2611:

2607:

2603:

2598:

2594:

2583:

2570:

2566:

2555:

2544:

2533:

2532:

2529:

2526:

2522:

2521:

2519:

2506:

2502:

2491:

2487:

2486:

2473:

2469:

2458:

2445:

2441:

2430:

2419:

2393:

2390:

2387:

2383:

2379:

2374:

2370:

2366:

2361:

2357:

2333:

2329:

2307:

2304:

2301:

2281:

2259:

2255:

2231:

2228:

2225:

2202:

2198:

2176:

2148:

2144:

2120:

2116:

2092:

2070:

2066:

2046:

2043:

2042:

2041:

2030:

2027:

2022:

2019:

2016:

2012:

2008:

2003:

2000:

1997:

1993:

1989:

1986:

1983:

1980:

1977:

1974:

1971:

1966:

1963:

1960:

1956:

1952:

1947:

1944:

1941:

1937:

1933:

1930:

1915:

1914:

1901:

1898:

1894:

1890:

1887:

1884:

1881:

1878:

1873:

1870:

1865:

1859:

1854:

1851:

1848:

1844:

1838:

1835:

1831:

1826:

1821:

1817:

1813:

1808:

1803:

1797:

1792:

1789:

1786:

1782:

1776:

1773:

1769:

1764:

1761:

1758:

1755:

1752:

1749:

1725:

1704:

1683:

1664:

1663:

1650:

1647:

1644:

1640:

1634:

1631:

1628:

1624:

1620:

1617:

1593:

1569:

1546:

1524:

1521:

1518:

1514:

1492:

1469:

1466:

1463:

1459:

1435:

1412:

1407:

1404:

1401:

1398:

1395:

1370:

1365:

1362:

1359:

1356:

1353:

1330:

1306:

1303:

1298:

1295:

1292:

1289:

1286:

1281:

1278:

1275:

1272:

1269:

1266:

1263:

1260:

1239:

1227:

1226:

1213:

1209:

1205:

1202:

1199:

1193:

1190:

1187:

1183:

1178:

1175:

1148:

1123:

1119:

1115:

1112:

1091:

1088:

1085:

1072:

1071:

1058:

1054:

1050:

1047:

1044:

1041:

1038:

1033:

1030:

1025:

1022:

1019:

1016:

1013:

1008:

1005:

977:

942:

939:

934:

929:

923:

920:

915:

912:

908:

885:

882:

877:

874:

871:

867:

845:

842:

839:

821:) and similar

796:

793:

790:

786:

764:

761:

756:

753:

750:

746:

724:

721:

718:

714:

708:

705:

702:

698:

676:

673:

668:

664:

660:

657:

636:

632:

626:

623:

620:

616:

592:

589:

586:

582:

560:

540:

520:

490:

487:

484:

480:

456:

453:

450:

432:is the annual

421:

409:

408:Interest rates

406:

404:

401:

374:interest rates

360:

359:

345:

342:

339:

334:

330:

326:

323:

319:

315:

310:

307:

302:

298:

293:

272:

267:

260:

256:

250:

247:

242:

238:

233:

229:

224:

219:

216:

213:

208:

204:

200:

197:

186:

174:

163:

151:

131:

128:

125:

114:

102:

82:

71:

68:

56:

36:

27:An upper-case

24:

15:

13:

10:

9:

6:

4:

3:

2:

6702:

6691:

6688:

6686:

6683:

6681:

6678:

6676:

6673:

6672:

6670:

6661:

6658:

6656:

6655:

6650:

6649:

6645:

6641:

6638:

6636:

6633:

6631:

6628:

6626:

6623:

6622:

6618:

6596:

6588:

6584:

6580:

6577:

6569:

6562:

6558:

6554:

6547:

6541:

6534:

6527:

6526:

6525:

6523:

6519:

6516:, denoted as

6515:

6511:

6508:. If we let Δ

6507:

6503:

6499:

6495:

6491:

6486:

6482:

6454:

6446:

6442:

6438:

6435:

6424:

6416:

6412:

6408:

6402:

6395:

6392:

6384:

6380:

6373:

6367:

6364:

6361:

6357:

6354:

6347:

6344:

6341:

6338:

6335:

6332:

6326:

6323:

6317:

6309:

6302:

6294:

6293:

6292:

6290:

6286:

6282:

6278:

6274:

6269:

6265:

6261:

6257:

6252:

6250:

6246:

6242:

6234:

6232:

6218:

6197:

6176:

6155:

6146:

6138:

6136:

6120:

6111:

6099:

6080:

6072:

6068:

6058:

6042:

6038:

6028:

6027:For example:

6021:

6018:

5998:

5991:

5982:

5981:

5980:

5966:

5957:

5949:

5947:

5944:

5940:

5926:

5906:

5886:

5866:

5841:

5833:

5819:

5813:

5810:

5806:

5797:

5794:

5778:

5771:

5768:

5756:

5737:

5729:

5725:

5716:

5695:

5692:

5689:

5683:

5674:

5658:

5655:

5652:

5648:

5639:

5612:

5606:

5603:

5599:

5590:

5564:

5558:

5549:

5533: