323:. The stock price S will disappear if we subtract one equation from the other, thus enabling one to exploit a violation of put/call parity without the need to invest in the underlying stock. The subtraction done one way corresponds to a long-box spread; done the other way it yields a short box-spread. The pay-off for the long box-spread will be the difference between the two strike prices, and the profit will be the amount by which the discounted payoff exceeds the net premium. For parity, the profit should be zero. Otherwise, there is a certain profit to be had by creating either a long box-spread if the profit is positive or a short box-spread if the profit is negative.

2636:

31:

1419:, and had his spread liquidated entirely when this happened to one of its legs. (He had been exposed to as much as $ 212,500 in risk with the spread open.) Robinhood subsequently announced that investors on the platform would no longer be able to open box spreads, a policy that remains in place as of October 2022.

54:

constructed from puts (e.g., long a 60 put, short a 50 put) has a constant payoff of the difference in exercise prices (e.g. 10) assuming that the underlying stock does not go ex-dividend before the expiration of the options. If the underlying asset has a dividend of X, then the settled value of the

96:

of B is positive, or with all transactions reversed if the present value of B is negative. However, market forces tend to close any arbitrage windows which might open; hence the present value of B is usually insufficiently different from zero for transaction costs to be covered. This is considered

91:

operation may be represented as a sequence which begins with zero balance in an account, initiates transactions at time t = 0, and unwinds transactions at time t = T so that all that remains at the end is a balance whose value B will be known for certain at the beginning of the sequence. If there

1382:

for ten major countries and is approximately 35 basis points for

Treasuries, the most widely held government security. The difference between box spreads and government securities will tend to increase when there is financial instability, increase as interest rates rise, and increase for shorter

66:

Box spreads' name derives from the fact that the prices for the underlying options form a rectangular box in two columns of a quotation. An alternate name is "alligator spread," derived from the large number of trades required to open and close them "eating" one's profit via commission fees.

97:

typically to be a "Market Maker/ Floor trader" strategy only, due to extreme commission costs of the multiple-leg spread. If the box is for example 20 dollars as per lower example getting short the box anything under 20 is profit and long anything over, has hedged all risk .

1347:

The terminal payoff has a value of $ 20 independent of the terminal value of the share price. The discounted value of the payoff is $ 19.60. Hence there is a nominal profit of 30 cents to be had by investing in the long box-spread.

78:

is not allowed until the option's expiration. Most other styles of options, such as

American, are less suitable, because they may expose traders to unwanted risk if one or more "legs" of a spread are exercised prematurely.

739:

As an example, consider a three-month option on a stock whose current price is $ 100. If the interest rate is 8% per annum and the volatility is 30% per annum, then the prices for the options might be:

1378:, or similar investments in other countries' central banks, is a "convenience yield" for the ease of investment in the central bank's securities. This convenience yield is between 10 and 60

1367:

showed that between 1999 and 2000, some 25% of the trading volume was in outright options, 25% in straddles and vertical spreads (call-spreads and put-spreads), and about 5% in strangles.

326:

The long box-spread comprises four options, on the same underlying asset with the same terminal date. They can be paired in two ways as shown in the following table (assume strike-prices

965:

841:

The initial investment for a long box-spread would be $ 19.30. The following table displays the payoffs of the 4 options for the three ranges of values for the terminal stock price

1006:

911:

256:

151:

1319:

1285:

1230:

828:

1152:

1097:

1063:

786:

198:

1371:

constituted only about 0.1%, and box-spreads even less (about 0.01%). Ratio spreads took more than 15%, and about a dozen other instruments took the remaining 30%.

866:

706:

679:

640:

613:

579:

552:

516:

487:

453:

424:

378:

351:

321:

294:

1340:

1251:

1196:

1173:

1118:

1029:

1536:

2179:

1754:

46:

is a combination of positions that has a certain (i.e., riskless) payoff, considered to be simply "delta neutral interest rate position". For example, a

1490:

2519:

92:

were no transaction costs then a non-zero value for B would allow an arbitrageur to profit by following the sequence either as it stands if the

2209:

2341:

261:

Note that directly exploiting deviations from either of these two parity relations involves purchasing or selling the underlying stock.

1664:

Hemler, Michael L.; Miller, Thomas W. Jr. (1997). "Box spread arbitrage profits following the 1987 market crash: real or illusory?".

2077:

2579:

1747:

107:: The current price of a stock equals the current price of a futures contract discounted by the time remaining until settlement:

1698:. Post-market simulations with box-spreads on the S&P 500 Index show that market ineffiency increased after the 1987 crash.

1449:

1375:

2514:

2159:

1711:

Ronn, Edud; Gerbarg Ronn, Aimee (1989). "The Box spread arbitrage conditions: theory, tests, and investment strategies".

1591:

Bharadwaj, Anu; Wiggins, James B. (2001). "Box spread and put-call parity tests for the S&P 500 index LEAPS market".

650:

We can obtain a third view of the long box-spread by reading the table diagonally. A long box-spread can be viewed as a

2554:

2092:

1946:

1740:

1357:

2173:

1532:

164:: A long European call c together with a short European put p at the same strike price K is equivalent to borrowing

2661:

2351:

1508:

1464:

2455:

2266:

200:

and buying the stock at price S. In other words, we can combine options with cash to construct a synthetic stock:

2574:

2569:

1562:

Uri, Benzion; Shmuel, Danan; Joseph, Yagil (Spring 2005). "Box Spread

Strategies and Arbitrage Opportunities".

2224:

2169:

1407:, which provides commission-free options trading. The user, who initially asserted that " literally cannot go

1374:

Diamond and van Tassel found that the difference between the implied "risk free" rate through box spreads and

917:

2524:

2194:

2184:

2052:

1893:

1825:

2473:

2321:

2306:

2271:

2214:

2666:

2534:

2385:

2301:

1878:

2199:

2488:

2445:

2435:

2425:

2146:

2087:

2022:

1976:

1971:

1845:

1805:

1772:

1428:

2204:

971:

876:

207:

2493:

2281:

2027:

1621:

Billingsley, R.S.; Chance, Don M. (1987). "Options market efficiency and the box spread strategy".

1404:

56:

1729:

The box-spread is used to test for arbitrage opportunities on

Chicago Board Options Exchange data.

2544:

2529:

2498:

2483:

2450:

2316:

2107:

2072:

1835:

1800:

1763:

1689:

1681:

1608:

1579:

1416:

1368:

75:

1651:

Chaput, J. Scott; Ederington, Louis H. (January 2002). "Option spread and combination trading".

114:

1291:

1257:

1202:

800:

100:

A present value of zero for B leads to a parity relation. Two well-known parity relations are:

2549:

2539:

2478:

2465:

2440:

2326:

2112:

1908:

1652:

1124:

1069:

1035:

758:

167:

1656:

2430:

2420:

2410:

2369:

2364:

2346:

2276:

2042:

2037:

2009:

1961:

1840:

1780:

1720:

1673:

1630:

1600:

1571:

1396:

1364:

585:

39:

844:

684:

657:

618:

591:

557:

530:

494:

465:

431:

402:

356:

329:

299:

272:

2640:

2610:

2605:

2559:

2395:

2390:

2336:

2246:

2154:

2127:

2067:

2062:

2032:

1981:

1966:

1883:

1863:

1408:

643:

159:

523:

Reading the table horizontally and vertically, we obtain two views of a long box-spread.

34:

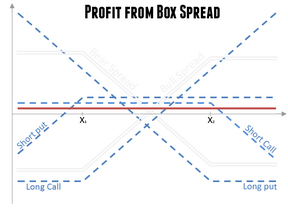

Profit diagram of a box spread. It is a combination of positions with a riskless payoff.

2615:

2600:

2400:

2311:

2261:

2238:

2219:

2047:

1989:

1956:

1951:

1931:

1855:

1634:

1325:

1236:

1181:

1158:

1103:

1014:

724:

709:

2655:

2595:

2564:

2405:

2331:

2291:

2286:

2122:

1994:

1941:

1936:

1918:

1815:

1795:

1693:

1612:

1583:

717:

651:

93:

60:

59:

assumption, the net premium paid out to acquire this position should be equal to the

17:

2415:

2189:

2117:

2097:

2057:

1926:

1898:

1888:

1830:

1617:

The box-spread reveals an arbitrage profit insufficient to cover transaction costs.

1412:

71:

2296:

2164:

2135:

2131:

2082:

1873:

1868:

1379:

51:

47:

50:

constructed from calls (e.g., long a 50 call, short a 60 call) combined with a

2620:

2256:

2251:

2017:

1903:

1361:

1810:

1604:

1575:

88:

2635:

1491:"Trader says he has 'no money at risk,' then promptly loses almost 2,000%"

2380:

2102:

1999:

1820:

1724:

269:

Now consider the put/call parity equation at two different strike prices

1685:

30:

1732:

1392:

527:

A long box-spread can be viewed as a long synthetic stock at a price

1677:

1400:

1736:

1450:"An Important Word of Caution on Short Box-Spread Trades!"

1465:"Risk-Free Rates and Convenience Yields Around the World"

1328:

1294:

1260:

1239:

1205:

1184:

1161:

1127:

1106:

1072:

1038:

1017:

974:

920:

879:

847:

803:

761:

687:

660:

621:

594:

560:

533:

497:

468:

434:

405:

359:

332:

302:

275:

210:

170:

117:

2588:

2507:

2464:

2360:

2237:

2145:

2008:

1917:

1854:

1788:

1779:

1463:Diamond, William; Van Tassel, Peter (2023-02-01).

1334:

1313:

1279:

1245:

1224:

1190:

1167:

1146:

1112:

1091:

1057:

1023:

1000:

959:

905:

860:

822:

780:

700:

673:

634:

607:

573:

546:

510:

481:

447:

418:

372:

345:

315:

288:

250:

192:

145:

1399:realized a loss of more than $ 57,000 on $ 5,000

554:plus a short synthetic stock at a higher price

1666:Journal of Financial and Quantitative Analysis

1472:Federal Reserve Bank of New York Staff Reports

1748:

1356:Surveys done by Chaput and Ederington on the

731:A short box-spread can be treated similarly.

8:

1704:Fundamentals of Futures and Options Markets

1785:

1755:

1741:

1733:

870:

742:

584:A long box-spread can be viewed as a long

1327:

1305:

1293:

1271:

1259:

1238:

1216:

1204:

1183:

1160:

1132:

1126:

1105:

1077:

1071:

1043:

1037:

1016:

992:

979:

973:

951:

938:

925:

919:

897:

884:

878:

852:

846:

808:

802:

766:

760:

692:

686:

665:

659:

626:

620:

599:

593:

565:

559:

538:

532:

502:

496:

473:

467:

439:

433:

410:

404:

364:

358:

337:

331:

307:

301:

280:

274:

236:

209:

178:

169:

131:

116:

70:Box spreads are usually only opened with

382:

29:

2580:Power reverse dual-currency note (PRDC)

2520:Constant proportion portfolio insurance

1509:"Advanced Options Strategies (Level 3)"

1440:

1415:he was using carried the risk of being

960:{\displaystyle K_{1}<S_{T}<K_{2}}

727:contains the two short (sell) options.

7:

2515:Collateralized debt obligation (CDO)

1448:Claussen, Steve (10 December 2010).

720:contains the two long (buy) options.

1489:Langlois, Shawn (22 January 2019).

1403:by attempting a box spread through

712:at the same pair of strike prices.

1635:10.1111/j.1540-6288.1985.tb00309.x

646:at the same pair of strike prices.

25:

1391:In January 2019, a member of the

2634:

1539:from the original on 2019-01-11

2342:Year-on-year inflation-indexed

1706:(4th ed.). Prentice-Hall.

1644:An Introduction to Derivatives

1533:"I don't know when to stop..."

1001:{\displaystyle K_{2}<S_{T}}

906:{\displaystyle S_{T}<K_{1}}

654:at one pair of strike prices,

588:at one pair of strike prices,

251:{\displaystyle c-p=S-Ke^{-rT}}

55:box will be 10 + x. Under the

1:

2352:Zero-coupon inflation-indexed

1411:," did not realize that the

2555:Foreign exchange derivative

1947:Callable bull/bear contract

1713:Review of Financial Studies

1358:Chicago Mercantile Exchange

2683:

1593:The Journal of Derivatives

1564:The Journal of Derivatives

146:{\displaystyle S=Fe^{-rT}}

2629:

2456:Stock market index future

1770:

1360:'s market for options on

1314:{\displaystyle 110-S_{T}}

1280:{\displaystyle 110-S_{T}}

1225:{\displaystyle 110-S_{T}}

968:

914:

873:

823:{\displaystyle K_{2}=110}

2575:Mortgage-backed security

2570:Interest rate derivative

2545:Equity-linked note (ELN)

2530:Credit-linked note (CLN)

1646:(5th ed.). Thomson.

1147:{\displaystyle S_{T}-90}

1092:{\displaystyle S_{T}-90}

1058:{\displaystyle S_{T}-90}

781:{\displaystyle K_{1}=90}

193:{\displaystyle Ke^{-rT}}

2525:Contract for difference

1826:Risk-free interest rate

1642:Chance, Don M. (2001).

1605:10.3905/jod.2001.319163

1576:10.3905/jod.2005.479379

27:Term in options trading

2307:Forward Rate Agreement

1702:Hull, John C. (2002).

1336:

1315:

1281:

1247:

1226:

1192:

1169:

1148:

1114:

1093:

1059:

1025:

1002:

961:

907:

862:

824:

782:

702:

675:

636:

609:

575:

548:

512:

483:

459:Short synthetic stock

449:

420:

388:Long bull call-spread

374:

347:

317:

290:

252:

194:

147:

35:

2535:Credit default option

1879:Employee stock option

1337:

1316:

1282:

1248:

1227:

1193:

1170:

1149:

1115:

1094:

1060:

1026:

1003:

962:

908:

863:

861:{\displaystyle S_{T}}

825:

783:

703:

701:{\displaystyle K_{2}}

676:

674:{\displaystyle K_{1}}

637:

635:{\displaystyle K_{2}}

610:

608:{\displaystyle K_{1}}

576:

574:{\displaystyle K_{2}}

549:

547:{\displaystyle K_{1}}

513:

511:{\displaystyle K_{2}}

484:

482:{\displaystyle K_{2}}

450:

448:{\displaystyle K_{1}}

421:

419:{\displaystyle K_{1}}

396:Long synthetic stock

391:Long bear put-spread

375:

373:{\displaystyle K_{2}}

348:

346:{\displaystyle K_{1}}

318:

316:{\displaystyle K_{2}}

291:

289:{\displaystyle K_{1}}

253:

195:

148:

33:

2489:Inflation derivative

2474:Commodity derivative

2446:Single-stock futures

2436:Normal backwardation

2426:Interest rate future

2267:Conditional variance

1773:Derivative (finance)

1429:Jelly roll (options)

1326:

1292:

1258:

1237:

1203:

1182:

1159:

1125:

1104:

1070:

1036:

1015:

972:

918:

877:

845:

801:

759:

685:

658:

619:

592:

558:

531:

495:

466:

432:

403:

357:

330:

300:

273:

208:

168:

115:

18:Box spread (options)

2641:Business portal

2494:Property derivative

105:Spot futures parity

2499:Weather derivative

2484:Freight derivative

2466:Exotic derivatives

2386:Commodities future

2073:Intermarket spread

1836:Synthetic position

1764:Derivatives market

1725:10.1093/rfs/2.1.91

1387:Robinhood incident

1332:

1311:

1277:

1243:

1222:

1188:

1165:

1144:

1110:

1089:

1055:

1021:

998:

957:

903:

858:

820:

778:

698:

671:

632:

605:

571:

544:

508:

479:

445:

416:

370:

343:

313:

286:

248:

190:

143:

36:

2662:Options (finance)

2649:

2648:

2550:Equity derivative

2540:Credit derivative

2508:Other derivatives

2479:Energy derivative

2441:Perpetual futures

2322:Overnight indexed

2272:Constant maturity

2233:

2232:

2180:Finite difference

2113:Protective option

1535:11 January 2019.

1397:/r/WallStreetBets

1345:

1344:

1335:{\displaystyle 0}

1246:{\displaystyle 0}

1191:{\displaystyle 0}

1168:{\displaystyle 0}

1113:{\displaystyle 0}

1024:{\displaystyle 0}

839:

838:

521:

520:

16:(Redirected from

2674:

2639:

2638:

2411:Forwards pricing

2185:Garman–Kohlhagen

1786:

1757:

1750:

1743:

1734:

1728:

1707:

1697:

1660:

1647:

1638:

1623:Financial Review

1616:

1587:

1549:

1548:

1546:

1544:

1529:

1523:

1522:

1520:

1519:

1505:

1499:

1498:

1486:

1480:

1479:

1469:

1460:

1454:

1453:

1445:

1413:American options

1341:

1339:

1338:

1333:

1320:

1318:

1317:

1312:

1310:

1309:

1286:

1284:

1283:

1278:

1276:

1275:

1252:

1250:

1249:

1244:

1231:

1229:

1228:

1223:

1221:

1220:

1197:

1195:

1194:

1189:

1174:

1172:

1171:

1166:

1153:

1151:

1150:

1145:

1137:

1136:

1119:

1117:

1116:

1111:

1098:

1096:

1095:

1090:

1082:

1081:

1064:

1062:

1061:

1056:

1048:

1047:

1030:

1028:

1027:

1022:

1007:

1005:

1004:

999:

997:

996:

984:

983:

966:

964:

963:

958:

956:

955:

943:

942:

930:

929:

912:

910:

909:

904:

902:

901:

889:

888:

871:

867:

865:

864:

859:

857:

856:

829:

827:

826:

821:

813:

812:

787:

785:

784:

779:

771:

770:

743:

707:

705:

704:

699:

697:

696:

680:

678:

677:

672:

670:

669:

641:

639:

638:

633:

631:

630:

614:

612:

611:

606:

604:

603:

586:bull call spread

580:

578:

577:

572:

570:

569:

553:

551:

550:

545:

543:

542:

517:

515:

514:

509:

507:

506:

488:

486:

485:

480:

478:

477:

454:

452:

451:

446:

444:

443:

425:

423:

422:

417:

415:

414:

383:

379:

377:

376:

371:

369:

368:

352:

350:

349:

344:

342:

341:

322:

320:

319:

314:

312:

311:

295:

293:

292:

287:

285:

284:

257:

255:

254:

249:

247:

246:

199:

197:

196:

191:

189:

188:

152:

150:

149:

144:

142:

141:

72:European options

21:

2682:

2681:

2677:

2676:

2675:

2673:

2672:

2671:

2652:

2651:

2650:

2645:

2633:

2625:

2611:Great Recession

2606:Government debt

2584:

2560:Fund derivative

2503:

2460:

2421:Futures pricing

2396:Dividend future

2391:Currency future

2374:

2356:

2229:

2205:Put–call parity

2141:

2128:Vertical spread

2063:Diagonal spread

2033:Calendar spread

2004:

1913:

1850:

1775:

1766:

1761:

1710:

1701:

1678:10.2307/2331317

1663:

1650:

1641:

1620:

1590:

1561:

1558:

1556:Further reading

1553:

1552:

1542:

1540:

1531:

1530:

1526:

1517:

1515:

1507:

1506:

1502:

1488:

1487:

1483:

1467:

1462:

1461:

1457:

1447:

1446:

1442:

1437:

1425:

1389:

1354:

1324:

1323:

1301:

1290:

1289:

1267:

1256:

1255:

1235:

1234:

1212:

1201:

1200:

1180:

1179:

1157:

1156:

1128:

1123:

1122:

1102:

1101:

1073:

1068:

1067:

1039:

1034:

1033:

1013:

1012:

988:

975:

970:

969:

947:

934:

921:

916:

915:

893:

880:

875:

874:

848:

843:

842:

804:

799:

798:

762:

757:

756:

737:

688:

683:

682:

661:

656:

655:

644:bear put spread

622:

617:

616:

595:

590:

589:

561:

556:

555:

534:

529:

528:

498:

493:

492:

469:

464:

463:

435:

430:

429:

406:

401:

400:

360:

355:

354:

333:

328:

327:

303:

298:

297:

276:

271:

270:

267:

259:

232:

206:

205:

174:

166:

165:

160:Put call parity

154:

127:

113:

112:

85:

63:of the payoff.

28:

23:

22:

15:

12:

11:

5:

2680:

2678:

2670:

2669:

2664:

2654:

2653:

2647:

2646:

2644:

2643:

2630:

2627:

2626:

2624:

2623:

2618:

2616:Municipal debt

2613:

2608:

2603:

2601:Corporate debt

2598:

2592:

2590:

2586:

2585:

2583:

2582:

2577:

2572:

2567:

2562:

2557:

2552:

2547:

2542:

2537:

2532:

2527:

2522:

2517:

2511:

2509:

2505:

2504:

2502:

2501:

2496:

2491:

2486:

2481:

2476:

2470:

2468:

2462:

2461:

2459:

2458:

2453:

2448:

2443:

2438:

2433:

2428:

2423:

2418:

2413:

2408:

2403:

2401:Forward market

2398:

2393:

2388:

2383:

2377:

2375:

2373:

2372:

2367:

2361:

2358:

2357:

2355:

2354:

2349:

2344:

2339:

2334:

2329:

2324:

2319:

2314:

2309:

2304:

2299:

2294:

2289:

2284:

2282:Credit default

2279:

2274:

2269:

2264:

2259:

2254:

2249:

2243:

2241:

2235:

2234:

2231:

2230:

2228:

2227:

2222:

2217:

2212:

2207:

2202:

2197:

2192:

2187:

2182:

2177:

2167:

2162:

2157:

2151:

2149:

2143:

2142:

2140:

2139:

2125:

2120:

2115:

2110:

2105:

2100:

2095:

2090:

2085:

2080:

2078:Iron butterfly

2075:

2070:

2065:

2060:

2055:

2050:

2048:Covered option

2045:

2040:

2035:

2030:

2025:

2020:

2014:

2012:

2006:

2005:

2003:

2002:

1997:

1992:

1987:

1986:Mountain range

1984:

1979:

1974:

1969:

1964:

1959:

1954:

1949:

1944:

1939:

1934:

1929:

1923:

1921:

1915:

1914:

1912:

1911:

1906:

1901:

1896:

1891:

1886:

1881:

1876:

1871:

1866:

1860:

1858:

1852:

1851:

1849:

1848:

1843:

1838:

1833:

1828:

1823:

1818:

1813:

1808:

1803:

1798:

1792:

1790:

1783:

1777:

1776:

1771:

1768:

1767:

1762:

1760:

1759:

1752:

1745:

1737:

1731:

1730:

1708:

1699:

1661:

1648:

1639:

1629:(4): 287–301.

1618:

1588:

1557:

1554:

1551:

1550:

1524:

1500:

1481:

1455:

1439:

1438:

1436:

1433:

1432:

1431:

1424:

1421:

1388:

1385:

1353:

1350:

1343:

1342:

1331:

1321:

1308:

1304:

1300:

1297:

1287:

1274:

1270:

1266:

1263:

1253:

1242:

1232:

1219:

1215:

1211:

1208:

1198:

1187:

1176:

1175:

1164:

1154:

1143:

1140:

1135:

1131:

1120:

1109:

1099:

1088:

1085:

1080:

1076:

1065:

1054:

1051:

1046:

1042:

1031:

1020:

1009:

1008:

995:

991:

987:

982:

978:

967:

954:

950:

946:

941:

937:

933:

928:

924:

913:

900:

896:

892:

887:

883:

855:

851:

837:

836:

833:

830:

819:

816:

811:

807:

795:

794:

791:

788:

777:

774:

769:

765:

753:

752:

749:

746:

736:

733:

729:

728:

725:short strangle

721:

710:short strangle

695:

691:

668:

664:

648:

647:

642:, plus a long

629:

625:

602:

598:

582:

568:

564:

541:

537:

519:

518:

505:

501:

489:

476:

472:

460:

456:

455:

442:

438:

426:

413:

409:

397:

393:

392:

389:

386:

367:

363:

340:

336:

310:

306:

283:

279:

266:

265:The box spread

263:

245:

242:

239:

235:

231:

228:

225:

222:

219:

216:

213:

203:

202:

201:

187:

184:

181:

177:

173:

140:

137:

134:

130:

126:

123:

120:

110:

109:

108:

84:

81:

26:

24:

14:

13:

10:

9:

6:

4:

3:

2:

2679:

2668:

2665:

2663:

2660:

2659:

2657:

2642:

2637:

2632:

2631:

2628:

2622:

2619:

2617:

2614:

2612:

2609:

2607:

2604:

2602:

2599:

2597:

2596:Consumer debt

2594:

2593:

2591:

2589:Market issues

2587:

2581:

2578:

2576:

2573:

2571:

2568:

2566:

2565:Fund of funds

2563:

2561:

2558:

2556:

2553:

2551:

2548:

2546:

2543:

2541:

2538:

2536:

2533:

2531:

2528:

2526:

2523:

2521:

2518:

2516:

2513:

2512:

2510:

2506:

2500:

2497:

2495:

2492:

2490:

2487:

2485:

2482:

2480:

2477:

2475:

2472:

2471:

2469:

2467:

2463:

2457:

2454:

2452:

2449:

2447:

2444:

2442:

2439:

2437:

2434:

2432:

2429:

2427:

2424:

2422:

2419:

2417:

2414:

2412:

2409:

2407:

2406:Forward price

2404:

2402:

2399:

2397:

2394:

2392:

2389:

2387:

2384:

2382:

2379:

2378:

2376:

2371:

2368:

2366:

2363:

2362:

2359:

2353:

2350:

2348:

2345:

2343:

2340:

2338:

2335:

2333:

2330:

2328:

2325:

2323:

2320:

2318:

2317:Interest rate

2315:

2313:

2310:

2308:

2305:

2303:

2300:

2298:

2295:

2293:

2290:

2288:

2285:

2283:

2280:

2278:

2275:

2273:

2270:

2268:

2265:

2263:

2260:

2258:

2255:

2253:

2250:

2248:

2245:

2244:

2242:

2240:

2236:

2226:

2223:

2221:

2218:

2216:

2213:

2211:

2210:MC Simulation

2208:

2206:

2203:

2201:

2198:

2196:

2193:

2191:

2188:

2186:

2183:

2181:

2178:

2175:

2171:

2170:Black–Scholes

2168:

2166:

2163:

2161:

2158:

2156:

2153:

2152:

2150:

2148:

2144:

2137:

2133:

2129:

2126:

2124:

2123:Risk reversal

2121:

2119:

2116:

2114:

2111:

2109:

2106:

2104:

2101:

2099:

2096:

2094:

2091:

2089:

2086:

2084:

2081:

2079:

2076:

2074:

2071:

2069:

2066:

2064:

2061:

2059:

2056:

2054:

2053:Credit spread

2051:

2049:

2046:

2044:

2041:

2039:

2036:

2034:

2031:

2029:

2026:

2024:

2021:

2019:

2016:

2015:

2013:

2011:

2007:

2001:

1998:

1996:

1993:

1991:

1988:

1985:

1983:

1980:

1978:

1977:Interest rate

1975:

1973:

1972:Forward start

1970:

1968:

1965:

1963:

1960:

1958:

1955:

1953:

1950:

1948:

1945:

1943:

1940:

1938:

1935:

1933:

1930:

1928:

1925:

1924:

1922:

1920:

1916:

1910:

1907:

1905:

1902:

1900:

1899:Option styles

1897:

1895:

1892:

1890:

1887:

1885:

1882:

1880:

1877:

1875:

1872:

1870:

1867:

1865:

1862:

1861:

1859:

1857:

1853:

1847:

1844:

1842:

1839:

1837:

1834:

1832:

1829:

1827:

1824:

1822:

1819:

1817:

1816:Open interest

1814:

1812:

1809:

1807:

1804:

1802:

1799:

1797:

1796:Delta neutral

1794:

1793:

1791:

1787:

1784:

1782:

1778:

1774:

1769:

1765:

1758:

1753:

1751:

1746:

1744:

1739:

1738:

1735:

1726:

1722:

1719:(1): 91–108.

1718:

1714:

1709:

1705:

1700:

1695:

1691:

1687:

1683:

1679:

1675:

1671:

1667:

1662:

1658:

1654:

1649:

1645:

1640:

1636:

1632:

1628:

1624:

1619:

1614:

1610:

1606:

1602:

1598:

1594:

1589:

1585:

1581:

1577:

1573:

1569:

1565:

1560:

1559:

1555:

1538:

1534:

1528:

1525:

1514:

1510:

1504:

1501:

1496:

1492:

1485:

1482:

1477:

1473:

1466:

1459:

1456:

1451:

1444:

1441:

1434:

1430:

1427:

1426:

1422:

1420:

1418:

1414:

1410:

1406:

1402:

1398:

1394:

1386:

1384:

1381:

1377:

1372:

1370:

1366:

1363:

1359:

1351:

1349:

1329:

1322:

1306:

1302:

1298:

1295:

1288:

1272:

1268:

1264:

1261:

1254:

1240:

1233:

1217:

1213:

1209:

1206:

1199:

1185:

1178:

1177:

1162:

1155:

1141:

1138:

1133:

1129:

1121:

1107:

1100:

1086:

1083:

1078:

1074:

1066:

1052:

1049:

1044:

1040:

1032:

1018:

1011:

1010:

993:

989:

985:

980:

976:

952:

948:

944:

939:

935:

931:

926:

922:

898:

894:

890:

885:

881:

872:

869:

853:

849:

834:

831:

817:

814:

809:

805:

797:

796:

792:

789:

775:

772:

767:

763:

755:

754:

750:

747:

745:

744:

741:

734:

732:

726:

722:

719:

718:long strangle

715:

714:

713:

711:

693:

689:

666:

662:

653:

652:long strangle

645:

627:

623:

600:

596:

587:

583:

566:

562:

539:

535:

526:

525:

524:

503:

499:

490:

474:

470:

462:Sell call at

461:

458:

457:

440:

436:

427:

411:

407:

398:

395:

394:

390:

387:

385:

384:

381:

365:

361:

338:

334:

324:

308:

304:

281:

277:

264:

262:

258:

243:

240:

237:

233:

229:

226:

223:

220:

217:

214:

211:

185:

182:

179:

175:

171:

163:

162:

161:

156:

155:

153:

138:

135:

132:

128:

124:

121:

118:

106:

103:

102:

101:

98:

95:

94:present value

90:

82:

80:

77:

73:

68:

64:

62:

61:present value

58:

53:

49:

45:

41:

32:

19:

2667:Stock market

2416:Forward rate

2327:Total return

2215:Real options

2118:Ratio spread

2098:Naked option

2058:Debit spread

1889:Fixed income

1831:Strike price

1716:

1712:

1703:

1672:(1): 71–90.

1669:

1665:

1643:

1626:

1622:

1599:(4): 62–71.

1596:

1592:

1570:(3): 47–62.

1567:

1563:

1541:. Retrieved

1527:

1516:. Retrieved

1512:

1503:

1494:

1484:

1475:

1471:

1458:

1443:

1390:

1383:maturities.

1380:basis points

1373:

1355:

1346:

840:

738:

730:

649:

522:

428:Sell put at

399:Buy call at

325:

268:

260:

204:

158:

157:

111:

104:

99:

86:

69:

65:

57:no-arbitrage

43:

37:

2347:Zero Coupon

2277:Correlation

2225:Vanna–Volga

2083:Iron condor

1869:Bond option

1495:MarketWatch

491:Buy put at

52:bear spread

48:bull spread

42:trading, a

2656:Categories

2621:Tax policy

2337:Volatility

2247:Amortising

2088:Jelly roll

2023:Box spread

2018:Backspread

2010:Strategies

1846:Volatility

1841:the Greeks

1806:Expiration

1543:8 February

1518:2022-04-21

1435:References

1395:community

1376:Treasuries

1362:Eurodollar

1352:Prevalence

83:Background

44:box spread

2312:Inflation

2262:Commodity

2220:Trinomial

2155:Bachelier

2147:Valuation

2028:Butterfly

1962:Commodore

1811:Moneyness

1694:154839868

1613:154906523

1584:154340695

1513:Robinhood

1452:. Nasdaq.

1417:exercised

1405:Robinhood

1401:principal

1299:−

1265:−

1210:−

1139:−

1084:−

1050:−

793:$ 1.65

708:, plus a

238:−

227:−

215:−

180:−

133:−

89:arbitrage

2451:Slippage

2381:Contango

2365:Forwards

2332:Variance

2292:Dividend

2287:Currency

2200:Margrabe

2195:Lattices

2174:equation

2160:Binomial

2108:Strangle

2103:Straddle

2000:Swaption

1982:Lookback

1967:Compound

1909:Warrants

1884:European

1864:American

1856:Vanillas

1821:Pin risk

1801:Exercise

1537:Archived

1423:See also

835:$ 10.90

76:exercise

74:, whose

2370:Futures

1990:Rainbow

1957:Cliquet

1952:Chooser

1932:Barrier

1919:Exotics

1781:Options

1686:2331317

1409:tits up

1365:futures

790:$ 13.10

735:Example

40:options

2431:Margin

2297:Equity

2190:Heston

2093:Ladder

2043:Condor

2038:Collar

1995:Spread

1942:Binary

1937:Basket

1692:

1684:

1657:296036

1655:

1611:

1582:

1393:Reddit

832:$ 3.05

2302:Forex

2257:Basis

2252:Asset

2239:Swaps

2165:Black

2068:Fence

1927:Asian

1789:Terms

1690:S2CID

1682:JSTOR

1609:S2CID

1580:S2CID

1468:(PDF)

748:Call

353:<

2136:Bull

2132:Bear

1874:Call

1653:SSRN

1545:2021

1476:1032

1369:Guts

986:<

945:<

932:<

891:<

751:Put

723:The

716:The

681:and

615:and

296:and

1904:Put

1721:doi

1674:doi

1631:doi

1601:doi

1572:doi

1296:110

1262:110

1207:110

818:110

380:):

87:An

38:In

2658::

2134:,

1894:FX

1715:.

1688:.

1680:.

1670:32

1668:.

1627:20

1625:.

1607:.

1595:.

1578:.

1568:12

1566:.

1511:.

1493:.

1474:.

1470:.

1142:90

1087:90

1053:90

868::

776:90

2176:)

2172:(

2138:)

2130:(

1756:e

1749:t

1742:v

1727:.

1723::

1717:2

1696:.

1676::

1659:.

1637:.

1633::

1615:.

1603::

1597:8

1586:.

1574::

1547:.

1521:.

1497:.

1478:.

1330:0

1307:T

1303:S

1273:T

1269:S

1241:0

1218:T

1214:S

1186:0

1163:0

1134:T

1130:S

1108:0

1079:T

1075:S

1045:T

1041:S

1019:0

994:T

990:S

981:2

977:K

953:2

949:K

940:T

936:S

927:1

923:K

899:1

895:K

886:T

882:S

854:T

850:S

815:=

810:2

806:K

773:=

768:1

764:K

694:2

690:K

667:1

663:K

628:2

624:K

601:1

597:K

581:.

567:2

563:K

540:1

536:K

504:2

500:K

475:2

471:K

441:1

437:K

412:1

408:K

366:2

362:K

339:1

335:K

309:2

305:K

282:1

278:K

244:T

241:r

234:e

230:K

224:S

221:=

218:p

212:c

186:T

183:r

176:e

172:K

139:T

136:r

129:e

125:F

122:=

119:S

20:)

Text is available under the Creative Commons Attribution-ShareAlike License. Additional terms may apply.