194:, blossomed and became highly profitable. More conventional retailers found online merchandising to be a profitable additional source of revenue. While some online entertainment and news outlets failed when their seed capital ran out, others persisted and eventually became economically self-sufficient. Traditional media outlets (newspaper publishers, broadcasters and cablecasters in particular) also found the Web to be a useful and profitable additional channel for content distribution, and an additional means to generate advertising revenue. The sites that survived and eventually prospered after the bubble burst had two things in common: a sound business plan, and a niche in the marketplace that was, if not unique, particularly well-defined and well-served.

230:. While some of the new entrepreneurs had experience in business and economics, the majority were simply people with ideas, and did not manage the capital influx prudently. Additionally, many dot-com business plans were predicated on the assumption that by using the Internet, they would bypass the distribution channels of existing businesses and therefore not have to compete with them; when the established businesses with strong existing brands developed their own Internet presence, these hopes were shattered, and the newcomers were left attempting to break into markets dominated by larger, more established businesses.

33:

4258:

444:

573:

435:

45:

584:. There were concerns that computer systems would have trouble changing their clock and calendar systems from 1999 to 2000 which might trigger wider social or economic problems, but there was virtually no impact or disruption due to adequate preparation. Spending on marketing also reached new heights for the sector: Two dot-com companies purchased ad spots for

729:, a much-hyped company that had backing from Amazon.com, went out of business only nine months after completing its IPO. By that time, most Internet stocks had declined in value by 75% from their highs, wiping out $ 1.755 trillion in value. In January 2001, just three dot-com companies bought advertising spots during

237:

index peaking at 5,048.62 on March 10 (5,132.52 intraday), more than double its value just a year before. By 2001, the bubble's deflation was running full speed. A majority of the dot-coms had ceased trading, after having burnt through their venture capital and IPO capital, often without ever making

420:

many dot-com stocks at the peak of the bubble during what he called "temporary insanity" and a "once-in-a-lifetime opportunity". He shorted stocks just before the expiration of lockup periods ending six months after initial public offerings, correctly anticipating many dot-com company executives

197:

In the aftermath of the dot-com bubble, telecommunications companies had a great deal of overcapacity as many

Internet business clients went bust. That, plus ongoing investment in local cell infrastructure kept connectivity charges low, and helped to make high-speed Internet connectivity more

899:." Meaning that you need some of this mania to cause investors to open up their pocketbooks and finance the building of the railroads or the automobile or aerospace industry or whatever. And in this case, much of the capital invested was lost, but also much of it was invested in a very high

642:, however, "he didn't raise interest rates to curb the market's enthusiasm; he didn't even seek to impose margin requirements on stock market investors. Instead, he waited until the bubble burst, as it did in 2000, then tried to clean up the mess afterward". Finance author and commentator

272:" and advances in connectivity, uses of the Internet, and computer education. Between 1990 and 1997, the percentage of households in the United States owning computers increased from 15% to 35% as computer ownership progressed from a luxury to a necessity. This marked the shift to the

683:

announced a revenue restatement due to aggressive accounting practices. Its stock price, which had risen from $ 7 per share to as high as $ 333 per share in a year, fell $ 140 per share, or 62%, in a day. The next day, the

Federal Reserve raised interest rates, leading to an

786:. Supporting industries, such as advertising and shipping, scaled back their operations as demand for services fell. However, many companies were able to endure the crash; 48% of dot-com companies survived through 2004, albeit at lower valuations.

214:'s online department store. The low price of reaching millions worldwide, and the possibility of selling to or hearing from those people at the same moment when they were reached, promised to overturn established business dogma in advertising,

678:

featured a cover article titled "Burning Up; Warning: Internet companies are running out of cash—fast", which predicted the imminent bankruptcy of many

Internet companies. This led many people to rethink their investments. That same day,

494:" invincibility led some companies to engage in lavish spending on elaborate business facilities and luxury vacations for employees. Upon the launch of a new product or website, a company would organize an expensive event called a

1573:

537:

in the United States in 1999 had to be re-run when the winners defaulted on their bids of $ 4 billion. The re-auction netted 10% of the original sales prices. When financing became hard to find as the bubble burst, the high

903:

backbone for the

Internet, and lots of software that works, and databases and server structure. All that stuff has allowed what we have today, which has changed all our lives... that's what all this speculative mania

714:. This led to a one-day 15% decline in the value of shares in Microsoft and a 350-point, or 8%, drop in the value of the Nasdaq. Many people saw the legal actions as bad for technology in general. That same day,

482:

as fast as possible, using the mottos "get big fast" and "get large or get lost". These companies offered their services or products for free or at a discount with the expectation that they could build enough

1129:

2712:

363:

rose in value by 2,619%, 12 other large-cap stocks each rose over 1,000% in value, and seven additional large-cap stocks each rose over 900% in value. Even though the Nasdaq

Composite rose 85.6% and the

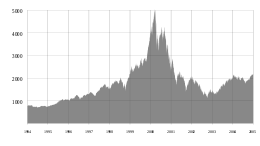

80:. Between 1995 and its peak in March 2000, investments in the NASDAQ composite stock market index rose by 800%, only to fall 78% from its peak by October 2002, giving up all its gains during the bubble.

1162:

518:

in

Virginia, governments funded technology infrastructure and created favorable business and tax law to encourage companies to expand. The growth in capacity vastly outstripped the growth in demand.

198:

affordable. During this time, a handful of companies found success developing business models that helped make the World Wide Web a more compelling experience. These include airline booking sites,

2010:

1428:

725:, the due date to pay taxes on gains realized in the previous year. By June 2000, dot-com companies were forced to reevaluate their spending on advertising campaigns. On November 9, 2000,

396:

via an IPO and raise a substantial amount of money even if it had never made a profit—or, in some cases, realized any material revenue or even have a finished product. People who received

2168:

514:

companies invested more than $ 500 billion, mostly financed with debt, into laying fiber optic cable, adding new switches, and building wireless networks. In many areas, such as the

1562:

1942:

351:. Between 1995 and 2000, the Nasdaq Composite stock market index rose 400%. It reached a price–earnings ratio of 200, dwarfing the peak price–earnings ratio of 80 for the Japanese

5929:

3136:

226:—it could bring together unrelated buyers and sellers in seamless and low-cost ways. Entrepreneurs around the world developed new business models, and ran to their nearest

6464:

6449:

2588:

1263:

1043:

778:

After venture capital was no longer available, the operational mentality of executives and investors completely changed. A dot-com company's lifespan was measured by its

2523:

6426:

1977:

773:

2102:

343:

and confidence that the companies would turn future profits created an environment in which many investors were willing to overlook traditional metrics, such as the

371:

An unprecedented amount of personal investing occurred during the boom and stories of people quitting their jobs to trade on the financial market were common. The

2701:

1125:

6411:

6350:

6313:

1195:

6529:

6147:

924:

6471:

2644:

6010:

5042:

1343:

1231:

1152:

953:

4294:

3070:

2071:

6395:

6255:

6154:

2840:

1909:

5075:

6262:

5738:

2873:

2044:

2000:

6105:

4160:

2201:

1418:

64:

that ballooned during the late-1990s and peaked on Friday, March 10, 2000. This period of market growth coincided with the widespread adoption of the

6336:

6189:

6182:

5987:

5676:

4776:

1392:

6419:

6306:

6126:

6119:

3433:

1744:

368:

rose 19.5% in 1999, more stocks fell in value than rose in value as investors sold stocks in slower growing companies to invest in

Internet stocks.

6493:

4939:

6112:

5365:

5286:

4421:

4410:

1844:

1779:

806:

696:

6299:

6203:

6168:

5863:

5358:

1463:

884:

gained market share and came to dominate their respective fields. The most valuable public companies are now generally in the technology sector.

721:

On Friday, April 14, 2000, the Nasdaq

Composite index fell 9%, ending a week in which it fell 25%. Investors were forced to sell stocks ahead of

400:

became instant paper millionaires when their companies executed IPOs; however, most employees were barred from selling shares immediately due to

6025:

2906:

288:

5980:

5893:

2158:

5642:

5634:

3364:

3334:

3268:

3178:

2268:

2243:

1544:

1386:

1010:

4228:

3037:

1876:

638:, raised interest rates several times; these actions were believed by many to have caused the bursting of the dot-com bubble. According to

1932:

546:. Bond investors recovered just over 20% of their investments. However, several telecom executives sold stock before the crash including

6328:

5597:

2777:

1157:

750:

6357:

2555:

2490:

2458:

2426:

2359:

2327:

238:

a profit. But despite this, the

Internet continues to grow, driven by commerce, ever greater amounts of online information, knowledge,

6566:

6556:

4915:

3243:

2938:

2744:

1643:

6486:

6292:

5944:

5811:

5561:

3392:

3310:

3224:

5731:

2677:

2394:

5343:

4515:

3126:

340:

219:

2578:

6133:

5907:

5394:

4909:

4287:

3004:

2868:

2612:

2135:

1678:

1253:

1033:

6098:

1607:

619:. The merger was the largest to date and was questioned by many analysts. Then, on January 30, 2000, 12 ads of the 61 ads for

6561:

6321:

6285:

6196:

5068:

4730:

4613:

2513:

1498:

507:

300:

6457:

3278:

Goldfarb, Brent D.; Kirsch, David; Miller, David A. (April 24, 2006). "Was There Too Little Entry During the Dot Com Era?".

2295:

1966:

1811:

649:

On Friday March 10, 2000, the NASDAQ Composite stock market index peaked at 5,048.62. However, on March 13, 2000, news that

143:

Historically, the dot-com boom can be seen as similar to a number of other technology-inspired booms of the past, including

339:(IPO), fueled speculation and encouraged investment in technology. A combination of rapidly increasing stock prices in the

6571:

6522:

6161:

6032:

5973:

5826:

2094:

2067:

919:

757:

386:

5694:

3103:

6224:

6068:

6061:

6018:

5966:

5900:

5498:

4953:

4891:

4574:

3426:

2807:

891:, who funded many dot-com companies and lost 90% of his net worth when the bubble burst, said about the dot-com bubble:

635:

511:

296:

1711:

6380:

6372:

6046:

6039:

5959:

5886:

5878:

5870:

5848:

5247:

4879:

4867:

4836:

4099:

3486:

1184:

820:

After suffering losses, retail investors transitioned their investment portfolios to more cautious positions. Popular

527:

356:

284:

6364:

6269:

6075:

5753:

5516:

4996:

4765:

4667:

4631:

4625:

4533:

4455:

4280:

3526:

3374:

3065:

2634:

515:

3188:

Aharon, David Y.; Gavious, Ilanit; Yosef, Rami (2010). "Stock market bubble effects on mergers and acquisitions".

1333:

1221:

6576:

6479:

6403:

6175:

5658:

5650:

5061:

5032:

4467:

3942:

943:

316:

239:

108:

3060:

2079:

344:

6140:

5803:

5775:

5612:

4933:

4921:

4551:

3977:

3862:

2830:

1899:

1191:

764:

since the peak. At its trough on

October 9, 2002, the NASDAQ-100 had dropped to 1,114, down 78% from its peak.

669:

rose 2.4% as investors shifted from strong performing technology stocks to poor performing established stocks.

608:

251:

4485:

782:, the rate at which it spent its existing capital. Many dot-com companies ran out of capital and went through

178:

In 2000, the dot-com bubble burst, and many dot-com startups went out of business after burning through their

2971:

2863:

2033:

1563:"John Templeton profited from 'temporary insanity' in 2000 — now it's your turn, says longtime money manager"

452:

Dot-com companies spent most of their investments in marketing efforts. Left: A promotional music CD for the

6551:

6515:

6433:

5937:

5840:

5441:

4984:

4945:

4873:

4655:

4643:

4479:

4261:

3491:

3419:

2999:

2389:

2163:

1673:

1493:

888:

722:

692:

674:

377:

336:

5605:

5387:

4150:

2191:

623:

were purchased by dot-coms (sources state ranges from 12 up to 19 companies depending on the definition of

6508:

6210:

5456:

5449:

5401:

5103:

4978:

4958:

4927:

4903:

4819:

4589:

4473:

4022:

3384:

3260:

2039:

453:

277:

1734:

6440:

5833:

5687:

5350:

5332:

5259:

5238:

5002:

4990:

4897:

4679:

4601:

4503:

4497:

4388:

4377:

4349:

4324:

4196:

4145:

1368:

1338:

896:

761:

711:

567:

397:

1834:

1768:

643:

299:, allegedly fueled investments in the stock market by putting a positive spin on stock valuations. The

1452:

6387:

6217:

5761:

5373:

5278:

5270:

5182:

4673:

4607:

4539:

4491:

4449:

4094:

3892:

3302:

734:

685:

257:

2896:

718:

published a widely read article that stated: "It's time, at last, to pay attention to the numbers".

6343:

6053:

5951:

5856:

5716:

5568:

5486:

5320:

5145:

4792:

4754:

4736:

4709:

4691:

4461:

4426:

4365:

4339:

4189:

4182:

4049:

3992:

3797:

3662:

3611:

3098:

2196:

1972:

421:

would sell shares as soon as possible, and that large-scale selling would force down share prices.

348:

183:

61:

32:

1292:

Teeter, Preston; Sandberg, Jorgen (2017). "Cracking the enigma of asset bubbles with narratives".

999:

627:). At that time, the cost for a 30-second commercial was between $ 1.9 million and $ 2.2 million.

5226:

4760:

4748:

4703:

4661:

4557:

4545:

4404:

4334:

4242:

4017:

3792:

3320:

3032:

2707:

1638:

1423:

1309:

914:

738:

580:

Nearing the turn of the 2000s, spending on technology was volatile as companies prepared for the

467:

413:

227:

3027:

1866:

268:, popularizing use of the Internet. Internet use increased as a result of the reduction of the "

5312:

5295:

5196:

5008:

4637:

4584:

4563:

4527:

4509:

4415:

4371:

4069:

3937:

3682:

3667:

3652:

3606:

3591:

3506:

3388:

3360:

3330:

3306:

3283:

3264:

3239:

3220:

3174:

2835:

2264:

2239:

2235:

2005:

1739:

1540:

1536:

1382:

1222:"If you're too young to remember the insanity of the dot-com bubble, check out these pictures"

1064:

A revealing look at the dot-com bubble of 2000 — and how it shapes our lives today | (ted.com)

585:

581:

385:

reported on the stock market with the same level of suspense as many networks provided to the

135:

lost large portions of their market capitalization, with Cisco losing 80% of its stock value.

3287:

2767:

2159:"Dot-Com Super Bowl Advertisers Fumble / But Down Under, LifeMinders.com may win at Olympics"

1076:‘Wallets and eyeballs’: how eBay turned the internet into a marketplace | eBay | The Guardian

6277:

5792:

5787:

5203:

5175:

5152:

5084:

4852:

4847:

4824:

4619:

4329:

4165:

3997:

3867:

3832:

3782:

3737:

3697:

3672:

3657:

3616:

3596:

3581:

3571:

3378:

3344:

3197:

2545:

2480:

2448:

2416:

2349:

2317:

2290:

1937:

1520:

1378:

1301:

1258:

1226:

1038:

829:

794:

746:

707:

657:

triggered a global sell off that disproportionately affected technology stocks. Soon after,

650:

620:

589:

534:

519:

311:

As a result of these factors, many investors were eager to invest, at any valuation, in any

191:

128:

37:

2928:

1633:

6237:

6087:

5922:

5768:

5724:

5623:

5124:

4968:

4830:

4798:

4720:

4595:

4521:

4303:

4203:

4029:

3822:

3757:

3722:

3692:

3677:

3461:

3456:

3061:"After the Dot-Com Bubble: Silicon Valley High-Tech Employment And Wages in 2001 and 2008"

2734:

1774:

1706:

1458:

1005:

895:

A friend of mine has a great line. He says "Nothing important has ever been built without

856:

in the job market. University enrollment for computer-related degrees dropped noticeably.

837:

730:

616:

547:

533:, raised £22.5 billion. In Germany, in August 2000, the auctions raised £30 billion. A 3G

484:

417:

409:

332:

328:

312:

273:

179:

112:

88:

77:

73:

303:

was expected to result in many new technologies from which many people wanted to profit.

283:

At the same time, a decline in interest rates increased the availability of capital. The

2667:

2383:

5914:

5819:

5189:

5168:

5037:

4862:

4786:

4742:

4697:

4685:

4155:

4044:

3972:

3887:

3546:

3516:

3511:

3496:

3481:

2518:

833:

821:

790:

715:

703:

631:

596:

551:

471:

401:

393:

392:

At the height of the boom, it was possible for a promising dot-com company to become a

292:

269:

265:

116:

65:

6545:

5665:

5590:

5583:

5576:

5554:

5538:

5530:

5523:

5509:

5479:

5472:

5465:

5423:

5416:

5409:

5380:

5219:

5212:

5138:

5110:

5022:

4443:

4140:

4064:

4007:

3917:

3717:

3702:

3601:

3556:

3476:

3356:

3349:

3216:

3163:

2228:

2125:

1532:

1525:

1313:

868:

As growth in the technology sector stabilized, companies consolidated; some, such as

814:

742:

737:

accelerated the stock-market drop. Investor confidence was further eroded by several

680:

495:

203:

164:

160:

144:

132:

2994:

2602:

1667:

5994:

5745:

5546:

5117:

5027:

4649:

4319:

4314:

4119:

4034:

4002:

3897:

3762:

3727:

3566:

3541:

3536:

3531:

3521:

3405:

2901:

2223:

1904:

1839:

1596:

1414:

1106:

Where Are They Now: 17 Dot-Com Bubble Companies And Their Founders (cbinsights.com)

853:

654:

639:

555:

530:

475:

443:

375:

took advantage of the public's desire to invest in the stock market; an article in

1487:

1097:

The new dot com bubble is here: it’s called online advertising – The Correspondent

3400:

3324:

3296:

3254:

3210:

3165:

Digital Phoenix; Why the Information Economy Collapsed and How it Will Rise Again

2285:

1801:

1372:

6248:

5705:

5304:

5161:

5131:

4809:

4398:

4359:

4235:

4089:

4039:

3767:

3742:

3642:

3561:

3551:

3466:

3131:

1568:

857:

798:

783:

612:

604:

491:

261:

124:

3201:

1000:"Investors should not dismiss Cisco's dot com collapse as a historical anomaly"

4104:

3982:

3947:

3912:

3842:

3621:

3576:

3501:

3471:

3093:

2799:

900:

869:

849:

666:

600:

572:

543:

539:

479:

405:

372:

365:

352:

223:

215:

211:

156:

152:

1305:

175:

Low interest rates in 1998–99 facilitated an increase in start-up companies.

40:

index spiked in 2000 and then fell sharply as a result of the dot-com bubble.

17:

4054:

3987:

3922:

3902:

3882:

3852:

3837:

3817:

3802:

3170:

1701:

825:

810:

779:

434:

44:

1034:"One of the kings of the '90s dot-com bubble now faces 20 years in prison"

5096:

4221:

4114:

3957:

3932:

3872:

3847:

3827:

3647:

3586:

1806:

983:

726:

457:

360:

104:

92:

69:

127:

remained through its sale and buyers acquisition. Larger companies like

4079:

3967:

3927:

3857:

3812:

3712:

3687:

120:

100:

2702:"In Super Commercial Bowl XXXV, the not-coms are beating the dot-coms"

2384:"Burning Up; Warning: Internet companies are running out of cash—fast"

1419:"THE YEAR IN THE MARKETS; 1999: Extraordinary Winners and More Losers"

381:

suggested that investors "re-think" the "quaint idea" of profits, and

291:, also made people more willing to make more speculative investments.

4124:

4109:

4012:

3962:

3952:

3752:

2583:

1602:

881:

877:

658:

324:

234:

206:

and its profitable approach to keyword-based advertising, as well as

199:

96:

4272:

3212:

Dot.con: How America Lost Its Mind and Its Money in the Internet Era

2800:"SEC Charges Adelphia and Rigas Family With Massive Financial Fraud"

5053:

2962:"Hard Times Investing: For Some, Cash Is Everything And Only Thing"

2961:

2929:"Ex-WorldCom CEO Ebbers found guilty on all counts – Mar. 15, 2005"

4084:

4074:

3907:

3807:

3787:

3777:

3747:

3732:

3707:

2639:

802:

588:, and 17 dot-com companies bought ad spots the following year for

571:

347:, and base confidence on technological advancements, leading to a

233:

The dot-com bubble burst in March 2000, with the technology heavy

159:

electronics in the 1950s, computer time-sharing in the 1960s, and

148:

31:

3411:

4059:

3877:

3772:

3637:

2995:"Raging Bull Goes for a Bargain As Interest in Stock Chat Wanes"

2966:

1668:"MotherNature.com's CEO Defends Dot-Coms' Get-Big-Fast Strategy"

948:

873:

662:

382:

320:

207:

187:

5057:

4276:

3415:

470:

as they spent heavily on advertising and promotions to harness

3127:"Here's what the future of bitcoin looks like—and it's bright"

3028:"The real reason U.S. students lag behind in computer science"

2933:

2772:

2739:

2672:

2607:

2550:

2485:

2453:

2421:

2354:

2322:

2130:

1871:

3380:

Burn Rate: How I Survived the Gold Rush Years on the Internet

860:, which retailed for $ 1,100 each, were liquidated en masse.

487:

to charge profitable rates for their services in the future.

264:

during the following years gave computer users access to the

2072:"Preparation pays off; world reports only tiny Y2K glitches"

523:

186:. However, many others, particularly online retailers like

3298:

Manias, Panics, and Crashes: A History of Financial Crises

2230:

The Return of Depression Economics and the Crisis of 2008

576:

Historical government interest rates in the United States

1115:

The Dotcom Bubble Burst (2000) (internationalbanker.com)

1374:

Totally Wired: On the Trail of the Great Dotcom Swindle

1254:"Here's Why The Dot Com Bubble Began And Why It Popped"

3351:

Origins of the Crash: The Great Bubble and Its Undoing

2829:

Gaither, Chris; Chmielewski, Dawn C. (July 16, 2006).

1527:

Origins of the Crash: The Great Bubble and Its Undoing

1488:"Companies Chose to Rethink A Quaint Concept: Profits"

809:

levied large fines against investment firms including

103:, as well as several communication companies, such as

5402:

Post-Napoleonic Irish grain price and land use shocks

2192:"Revisiting the Ads From 2000's 'Dot-Com Super Bowl'"

2095:"20 years ago, the dot-coms took over the Super Bowl"

1766:

Donnelly, Sally B.; Zagorin, Adam (August 14, 2000).

944:"The greatest defunct Web sites and dotcom disasters"

665:

ended merger talks and the Nasdaq fell 2.6%, but the

490:

The "growth over profits" mentality and the aura of "

147:

in the 1840s, automobiles in the early 20th century,

48:

Quarterly U.S. venture capital investments, 1995–2017

6236:

6086:

5786:

5704:

5675:

5622:

5497:

5433:

5331:

5258:

5236:

4967:

4846:

4808:

4775:

4719:

4573:

4436:

4387:

4348:

4213:

4174:

4133:

3630:

3449:

3326:

dot.bomb: My Days and Nights at an Internet Goliath

2001:"Oil bust on par with telecom crash of dot-com era"

1088:

How Amazon Survived the Dot-Com Bubble | HBS Online

3348:

3162:

2700:

2579:"IQ News: Dot-Coms Re-Evaluate Ad Spending Habits"

2382:

2227:

2032:

1965:

1767:

1666:

1595:

1561:

1524:

1486:

1451:

998:

789:Several companies and their executives, including

76:and the rapid growth of valuations in new dot-com

1999:Hunn, David; Eaton, Collin (September 12, 2016).

774:List of companies affected by the dot-com bubble

1334:"The Telecommunications Crash: What To Do Now?"

893:

3256:Twenty-one Dog Years: Doing Time at Amazon.com

3236:Dot.Bomb: The Rise and Fall of Dot.com Britain

2864:"3 Lessons for Investors From the Tech Bubble"

741:and the resulting bankruptcies, including the

6530:List of stock market crashes and bear markets

5069:

4288:

3427:

3190:The Quarterly Review of Economics and Finance

1634:"Lessons of Survival, From the Dot-Com Attic"

925:List of stock market crashes and bear markets

695:issued his conclusions of law in the case of

404:. The most successful entrepreneurs, such as

8:

2190:Kircher, Madison Malone (February 3, 2019).

1967:"Telecoms crash 'like the South Sea Bubble'"

526:in the United Kingdom in April 2000, led by

973:

971:

72:, resulting in a dispensation of available

5076:

5062:

5054:

4295:

4281:

4273:

3434:

3420:

3412:

2514:"Commentary: Earth To Dot Com Accountants"

1627:

1625:

1363:

1361:

805:for misusing shareholders' money, and the

691:Tangentially to all of speculation, Judge

558:, who sold $ 748 million worth of shares.

27:Tech stock speculative craze, c. 1997–2003

6351:2015–2016 Chinese stock market turbulence

4161:Trial of Kenneth Lay and Jeffrey Skilling

1287:

1285:

1283:

1281:

222:, and many more areas. The web was a new

2862:Glassman, James K. (February 11, 2015).

2768:"WorldCom files largest bankruptcy ever"

1153:"Mosaic started Web rush, Internet boom"

425:Spending tendencies of dot-com companies

43:

2747:from the original on September 20, 2020

2157:Pender, Kathleen (September 13, 2000).

1835:"Consumers pay the price in 3G auction"

1802:"UK mobile phone auction nets billions"

1733:HuffStutter, P.J. (December 25, 2000).

1072:

1070:

935:

807:U.S. Securities and Exchange Commission

702:and ruled that Microsoft was guilty of

688:, although stocks rallied temporarily.

280:, and many new companies were founded.

6256:Venezuelan banking crisis of 2009–2010

6026:South American economic crisis of 2002

5923:Black Wednesday (1992 Sterling crisis)

3073:from the original on November 16, 2018

3026:desJardins, Marie (October 22, 2015).

2843:from the original on December 18, 2019

2558:from the original on November 27, 2020

2286:"March 10, 2000: Pop Goes the Nasdaq!"

2263:. World Scientific. pp. 123–135.

2138:from the original on December 11, 2017

1646:from the original on September 6, 2017

1327:

1325:

1323:

1132:from the original on November 11, 2017

1084:

1082:

1013:from the original on December 10, 2022

289:capital gains tax in the United States

6307:2013 Chinese banking liquidity crisis

6263:2010–2014 Portuguese financial crisis

5739:Secondary banking crisis of 1973–1975

3280:Robert H. Smith School Research Paper

3125:Donnelly, Jacob (February 14, 2016).

3092:Kennedy, Brian (September 15, 2006).

3007:from the original on December 9, 2018

2831:"Fears of Dot-Com Crash, Version 2.0"

2810:from the original on November 9, 2010

2780:from the original on October 30, 2018

2680:from the original on October 24, 2018

2666:Kleinbard, David (November 9, 2000).

2461:from the original on October 11, 2018

2429:from the original on October 11, 2018

2362:from the original on October 30, 2018

2330:from the original on October 30, 2018

1912:from the original on February 5, 2021

1332:Litan, Robert E. (December 1, 2002).

1220:Weinberger, Matt (February 3, 2016).

1046:from the original on October 11, 2018

506:In the five years after the American

115:, failed and shut down. Others, like

7:

6337:Russian financial crisis (2014–2016)

6190:2008–2011 Icelandic financial crisis

6183:2008–2009 Ukrainian financial crisis

6148:2000s U.S. housing market correction

5988:1998–2002 Argentine great depression

4229:Enron: The Smartest Guys in the Room

2909:from the original on January 4, 2018

2715:from the original on August 31, 2017

2493:from the original on August 11, 2018

1964:White, Dominic (December 30, 2002).

1933:"Policy lessons from the 3G failure"

1833:Osborn, Andrew (November 17, 2000).

1814:from the original on August 23, 2017

1632:BERLIN, LESLIE (November 21, 2008).

1431:from the original on August 31, 2017

956:from the original on August 28, 2019

844:Job market and office equipment glut

408:, sold their shares or entered into

335:, which profited significantly from

6494:2023–2024 Egyptian financial crisis

6329:Puerto Rican government-debt crisis

6322:2014–2016 Brazilian economic crisis

5695:1963–1965 Indonesian hyperinflation

5598:Shanghai rubber stock market crisis

5287:Dutch Republic stock market crashes

3139:from the original on April 15, 2017

2993:Forster, Stacy (January 31, 2001).

2699:Elliott, Stuart (January 8, 2001).

2668:"The $ 1.7 trillion dot.com lesson"

2397:from the original on March 30, 2018

2381:Willoughby, Jack (March 10, 2010).

1681:from the original on April 15, 2017

1501:from the original on August 8, 2021

1466:from the original on April 15, 2017

1395:from the original on August 1, 2020

1346:from the original on March 30, 2018

1234:from the original on March 13, 2020

887:In a 2015 book, venture capitalist

751:Adelphia Communications Corporation

6300:2012–2013 Cypriot financial crisis

6204:2008–2014 Spanish financial crisis

6176:2008–2009 Russian financial crisis

6169:2008–2009 Belgian financial crisis

5864:1988–1992 Norwegian banking crisis

5359:British credit crisis of 1772–1773

3040:from the original on March 7, 2020

2876:from the original on April 4, 2020

2647:from the original on June 12, 2018

2615:from the original on July 27, 2018

2591:from the original on May 25, 2017.

2298:from the original on March 8, 2018

2204:from the original on March 2, 2020

2171:from the original on March 2, 2020

2105:from the original on March 2, 2020

1747:from the original on June 13, 2020

1714:from the original on March 9, 2018

1610:from the original on March 7, 2021

1576:from the original on July 31, 2020

1453:"Day Trading: It's a Brutal World"

1266:from the original on April 6, 2020

1165:from the original on June 13, 2020

978:Kumar, Rajesh (December 5, 2015).

760:, stocks had lost $ 5 trillion in

315:, especially if it had one of the

25:

6487:2023 United States banking crisis

6293:2011 Bangladesh share market scam

5981:1998–1999 Ecuador economic crisis

5945:Venezuelan banking crisis of 1994

5871:Japanese asset price bubble crash

5812:Souk Al-Manakh stock market crash

5562:Australian banking crisis of 1893

5366:Dutch Republic financial collapse

3295:Kindleberger, Charles P. (2005).

3106:from the original on June 6, 2020

2974:from the original on May 25, 2017

2941:from the original on July 3, 2018

2577:Owens, Jennifer (June 19, 2000).

2526:from the original on May 25, 2017

2512:Yang, Catherine (April 3, 2000).

2124:Johnson, Tom (January 10, 2000).

2047:from the original on June 7, 2020

2013:from the original on June 7, 2020

1980:from the original on June 7, 2020

1945:from the original on June 7, 2020

1898:Keegan, Victor (April 13, 2000).

1879:from the original on June 7, 2020

1847:from the original on June 7, 2020

1782:from the original on June 7, 2020

1485:Wysocki, Bernard (May 19, 1999).

1450:Kadlec, Daniel (August 9, 1999).

1201:from the original on May 12, 2017

1032:Edwards, Jim (December 6, 2016).

646:agreed with Krugman's criticism.

287:, which lowered the top marginal

5344:Amsterdam banking crisis of 1763

4422:1830s Chicago real estate bubble

4411:1810s Alabama real estate bubble

4257:

4256:

3094:"Remembering the Dot-Com Throne"

3059:Mann, Amar; Nunes, Tony (2009).

2960:Reuteman, Rob (August 9, 2010).

2766:Beltran, Luisa (July 22, 2002).

980:Valuation: Theories and Concepts

698:United States v. Microsoft Corp.

554:, who reaped $ 248 million, and

466:Most dot-com companies incurred

442:

433:

341:quaternary sector of the economy

220:customer relationship management

6069:2007 Chinese stock bubble crash

5395:Danish state bankruptcy of 1813

3753:Digital Convergence Corporation

2895:Alden, Chris (March 10, 2005).

2093:Beer, Jeff (January 20, 2020).

1700:Cave, Damien (April 25, 2000).

1560:Langlois, Shawn (May 9, 2019).

997:Powell, Jamie (March 8, 2021).

840:declined in use significantly.

801:, were accused or convicted of

6450:Chinese property sector crisis

6358:2015–2016 stock market selloff

6286:August 2011 stock markets fall

6197:2008–2011 Irish banking crisis

5894:1990s Swedish financial crisis

5643:Weimar Republic hyperinflation

4614:Western Australian gold rushes

1931:Sukumar, R. (April 11, 2012).

1151:Kline, Greg (April 20, 2003).

508:Telecommunications Act of 1996

301:Telecommunications Act of 1996

242:and access by mobile devices.

1:

6523:List of sovereign debt crises

6465:2022 Russian financial crisis

6162:2008 Latvian financial crisis

6155:U.S. bear market of 2007–2009

6033:Stock market downturn of 2002

5974:1998 Russian financial crisis

5827:1983 Israel bank stock crisis

2546:"Bleak Friday on Wall Street"

2284:Long, Tony (March 10, 2010).

920:Stock market crashes in India

758:stock market downturn of 2002

387:broadcasting of sports events

6225:Greek government-debt crisis

6062:2004 Argentine energy crisis

6019:2001 Turkish economic crisis

5908:1990s Armenian energy crisis

5901:1990s Finnish banking crisis

5762:1976 British currency crisis

5732:1973–1974 stock market crash

5043:U.S. higher education bubble

4954:Chinese stock bubble of 2007

4916:United States housing bubble

4910:2000s Danish property bubble

4892:Baltic states housing bubble

4668:Second Nova Scotia Gold Rush

2869:Kiplinger's Personal Finance

1665:Dodge, John (May 16, 2000).

1185:"Issues in labor Statistics"

636:Chair of the Federal Reserve

550:, who reaped $ 1.9 billion,

512:telecommunications equipment

359:of 1991. In 1999, shares of

297:Chair of the Federal Reserve

6381:2017 Sri Lankan fuel crisis

6047:2003 Myanmar banking crisis

6040:2002 Uruguay banking crisis

5960:1997 Asian financial crisis

5887:1991 Indian economic crisis

5879:Rhode Island banking crisis

5849:Cameroonian economic crisis

5635:Early Soviet hyperinflation

5248:Crisis of the Third Century

4880:Japanese asset price bubble

4868:New Zealand property bubble

4837:New Zealand property bubble

4766:Third Nova Scotia Gold Rush

4534:First Nova Scotia Gold Rush

4100:WebChat Broadcasting System

3234:Cellan-Jones, Rory (2001).

2897:"Looking back on the crash"

2449:"Wall St.: What rate hike?"

2259:Canterbery, E. Ray (2013).

1867:"German phone auction ends"

528:Chancellor of the Exchequer

357:Japanese asset price bubble

285:Taxpayer Relief Act of 1997

6593:

6412:Sri Lankan economic crisis

6270:Energy crisis in Venezuela

6249:2009 Dubai debt standstill

6099:2007–2008 financial crisis

5754:Latin American debt crisis

5517:Paris Bourse crash of 1882

4997:Australian property bubble

4632:Tierra del Fuego gold rush

4516:Colorado River mining boom

4456:Queen Charlottes Gold Rush

3202:10.1016/j.qref.2010.05.002

3066:Bureau of Labor Statistics

2603:"Pets.com at its tail end"

2261:The Global Great Recession

817:for misleading investors.

771:

565:

542:of these companies led to

516:Dulles Technology Corridor

249:

6567:2000s in economic history

6557:1990s in economic history

6503:

6480:2022 stock market decline

6472:Pakistani economic crisis

6458:2021–2023 inflation surge

6404:Lebanese liquidity crisis

6373:Venezuelan hyperinflation

6365:Brexit stock market crash

6314:Venezuela economic crisis

6076:Zimbabwean hyperinflation

5659:Wall Street Crash of 1929

5499:2nd Industrial Revolution

5333:1st Industrial Revolution

5091:

5033:Social media stock bubble

5018:

4575:2nd Industrial Revolution

4468:New South Wales gold rush

4389:1st Industrial Revolution

4310:

4252:

3943:NorthPoint Communications

2635:"The Pets.com Phenomenon"

2481:"Nasdaq sinks 350 points"

2318:"Nasdaq tumbles on Japan"

2034:"Inside the Telecom Game"

1126:"Nasdaq peak of 5,048.62"

653:had once again entered a

317:Internet-related prefixes

109:NorthPoint Communications

6141:Subprime mortgage crisis

5804:Brazilian hyperinflation

5776:Brazilian hyperinflation

5613:Financial crisis of 1914

5321:Mississippi bubble crash

4934:Canadian property bubble

4922:Romanian property bubble

4761:1930s Kakamega gold rush

4552:Vermilion Lake gold rush

3863:Interactive Intelligence

3161:Abramson, Bruce (2005).

2417:"MicroStrategy plummets"

1735:"Dot-Com Parties Dry Up"

1306:10.1177/1476127016629880

1192:U.S. Department of Labor

412:to protect their gains.

337:initial public offerings

252:1990s United States boom

6516:List of economic crises

6434:2020 stock market crash

6427:Financial market impact

6396:Turkish economic crisis

6011:9/11 stock market crash

5967:October 1997 mini-crash

5938:1994 bond market crisis

5930:Yugoslav hyperinflation

5841:Savings and loan crisis

5442:European potato failure

4985:Lebanese housing bubble

4946:Lebanese housing bubble

4940:Chinese property bubble

4874:Spanish property bubble

4731:1920s Florida land boom

4656:Cripple Creek Gold Rush

4644:Witwatersrand Gold Rush

4585:1870s Lapland gold rush

4480:Fraser Canyon Gold Rush

3000:The Wall Street Journal

2735:"World markets shatter"

2234:. W.W. Norton. p.

2164:San Francisco Chronicle

1702:"Dot-com party madness"

1674:The Wall Street Journal

1494:The Wall Street Journal

693:Thomas Penfield Jackson

378:The Wall Street Journal

6509:List of banking crises

6278:Syrian economic crisis

6211:Blue Monday Crash 2009

5820:Chilean crisis of 1982

5651:Shōwa financial crisis

5457:Highland Potato Famine

5313:South Sea bubble crash

5104:Commodity price shocks

4979:2000s commodities boom

4959:Uranium bubble of 2007

4928:Polish property bubble

4904:2000s commodities boom

4820:1970s commodities boom

4590:Coromandel Gold Rushes

4474:Australian gold rushes

3385:Orion Publishing Group

3209:Cassidy, John (2009).

2743:. September 11, 2001.

2350:"Dow wows Wall Street"

2040:Bloomberg Businessweek

1294:Strategic Organization

906:

753:scandal in July 2002.

749:in June 2002, and the

577:

398:employee stock options

278:information technology

276:, an economy based on

182:and failing to become

49:

41:

6562:1990s fads and trends

5834:Black Saturday (1983)

5688:Kennedy Slide of 1962

5260:Commercial revolution

5003:Cryptocurrency bubble

4991:Corporate debt bubble

4898:Irish property bubble

4680:Mount Baker gold rush

4602:Black Hills gold rush

4504:Similkameen Gold Rush

4498:Pennsylvania oil rush

4486:Pike's Peak gold rush

4378:Bengal Bubble of 1769

4350:Commercial revolution

4325:Irrational exuberance

4197:The Industry Standard

4146:Irrational exuberance

3303:John Wiley & Sons

3253:Daisey, Mike (2014).

1597:"Old Dog, New Tricks"

1339:Brookings Institution

1262:. December 15, 2010.

897:irrational exuberance

762:market capitalization

745:in October 2001, the

712:Sherman Antitrust Act

595:On January 10, 2000,

575:

568:Early 2000s recession

246:Prelude to the bubble

47:

35:

6572:Stock market crashes

6388:Ghana banking crisis

6218:European debt crisis

6003:Dot-com bubble crash

5915:Cuban Special Period

5374:Copper Panic of 1789

5279:The Great Debasement

5271:Great Bullion Famine

4674:Kobuk River Stampede

4608:Colorado Silver Boom

4540:West Coast gold rush

4492:Rock Creek Gold Rush

4450:California gold rush

4095:Vignette Corporation

3893:The Learning Company

2643:. October 19, 2016.

2611:. November 7, 2000.

2082:on December 7, 2004.

735:September 11 attacks

710:in violation of the

686:inverted yield curve

468:net operating losses

345:price–earnings ratio

256:The 1993 release of

210:'s auction site and

6344:2015 Nepal blockade

6054:2000s energy crisis

5952:Mexican peso crisis

5857:Black Monday (1987)

5717:1970s energy crisis

5677:Post–WWII expansion

5351:Bengal bubble crash

5146:Financial contagion

4810:The Great Inflation

4793:Porcupine Gold Rush

4777:Post–WWII expansion

4755:Porcupine Gold Rush

4737:Fairbanks Gold Rush

4710:Porcupine Gold Rush

4692:Fairbanks Gold Rush

4462:Victorian gold rush

4427:Chilean silver rush

4340:Stock market bubble

4190:Conspiracy of Fools

4183:Blood on the Street

4050:Tradex Technologies

3663:Akamai Technologies

3612:Kaleil Isaza Tuzman

2070:(January 1, 2000).

1973:The Daily Telegraph

1875:. August 17, 2000.

1417:(January 3, 2000).

739:accounting scandals

672:On March 20, 2000,

562:Bursting the bubble

349:stock market bubble

331:was easy to raise.

91:companies, notably

62:stock market bubble

5606:Panic of 1910–1911

5450:Great Irish Famine

5388:Panic of 1796–1797

5227:Stock market crash

4749:Cobalt silver rush

4704:Cobalt silver rush

4662:Klondike Gold Rush

4558:Kildonan Gold Rush

4546:Big Bend Gold Rush

4405:Carolina gold rush

4366:Mississippi bubble

4335:Real-estate bubble

4243:Valley of the Boom

4151:Sarbanes–Oxley Act

4018:Scout Electromedia

3793:Epidemic Marketing

2708:The New York Times

2554:. April 14, 2000.

2457:. March 21, 2000.

2425:. March 20, 2000.

2358:. March 15, 2000.

2326:. March 13, 2000.

2043:. August 5, 2002.

1810:. April 27, 2000.

1639:The New York Times

1424:The New York Times

915:Stock market crash

756:By the end of the

578:

510:went into effect,

456:pager. Right: The

414:Sir John Templeton

228:venture capitalist

50:

42:

6539:

6538:

6420:COVID-19 pandemic

5305:Tulip mania crash

5296:Kipper und Wipper

5273:(c. 1400–c. 1500)

5051:

5050:

5009:Everything bubble

4658:(c. 1890–c. 1910)

4638:Cayoosh Gold Rush

4628:(c. 1880–c. 1930)

4616:(c. 1880–c. 1900)

4598:(c. 1870–c. 1890)

4596:Cassiar Gold Rush

4592:(c. 1870–c. 1890)

4564:Omineca Gold Rush

4528:Cariboo Gold Rush

4510:Stikine Gold Rush

4446:(c. 1840–c. 1850)

4416:Georgia Gold Rush

4401:(c. 1790–c. 1810)

4304:Financial bubbles

4270:

4269:

4070:USinternetworking

3938:Network Solutions

3683:Blue Coat Systems

3668:Alteon WebSystems

3653:Actua Corporation

3607:Scott D. Sullivan

3592:Michael J. Saylor

3507:Charlie Gasparino

3366:978-1-59420-003-8

3345:Lowenstein, Roger

3336:978-0-316-60005-7

3329:. Little, Brown.

3270:978-0-7432-2580-9

3180:978-0-262-51196-4

2836:Los Angeles Times

2489:. April 3, 2000.

2270:978-981-4322-76-8

2245:978-0-393-33780-8

2126:"Thats AOL folks"

2006:Houston Chronicle

1740:Los Angeles Times

1546:978-1-59420-003-8

1521:Lowenstein, Roger

1388:978-1-84737-449-3

644:E. Ray Canterbery

586:Super Bowl XXXIII

582:Year 2000 problem

520:Spectrum auctions

502:Bubble in telecom

240:social networking

16:(Redirected from

6584:

6577:Economic bubbles

6532:

6525:

6518:

6511:

6496:

6489:

6482:

6475:

6467:

6460:

6453:

6443:

6436:

6429:

6422:

6415:

6407:

6399:

6391:

6383:

6376:

6368:

6360:

6353:

6346:

6339:

6332:

6324:

6317:

6309:

6302:

6295:

6288:

6281:

6273:

6265:

6258:

6251:

6227:

6220:

6213:

6206:

6199:

6192:

6185:

6178:

6171:

6164:

6157:

6150:

6143:

6136:

6129:

6122:

6115:

6108:

6101:

6079:

6071:

6064:

6057:

6049:

6042:

6035:

6028:

6021:

6014:

6006:

5998:

5990:

5983:

5976:

5969:

5962:

5955:

5947:

5940:

5933:

5925:

5918:

5910:

5903:

5896:

5889:

5882:

5874:

5866:

5859:

5852:

5844:

5836:

5829:

5822:

5815:

5807:

5793:Great Regression

5788:Great Moderation

5779:

5771:

5764:

5757:

5749:

5741:

5734:

5727:

5720:

5697:

5690:

5668:

5661:

5654:

5646:

5638:

5615:

5608:

5601:

5593:

5586:

5579:

5572:

5564:

5557:

5550:

5542:

5534:

5526:

5519:

5512:

5490:

5482:

5475:

5468:

5459:

5452:

5445:

5426:

5419:

5412:

5405:

5397:

5390:

5383:

5376:

5369:

5361:

5354:

5346:

5324:

5316:

5308:

5300:

5290:

5282:

5274:

5251:

5229:

5222:

5215:

5206:

5199:

5192:

5185:

5178:

5176:Liquidity crisis

5171:

5164:

5155:

5153:Social contagion

5148:

5141:

5134:

5127:

5120:

5113:

5106:

5099:

5085:Financial crises

5078:

5071:

5064:

5055:

4853:Great Regression

4848:Great Moderation

4825:Mexican oil boom

4620:Indiana gas boom

4372:South Sea bubble

4330:Social contagion

4297:

4290:

4283:

4274:

4260:

4259:

4166:WorldCom scandal

4080:VA Linux Systems

3998:Redback Networks

3868:Internet America

3783:Egghead Software

3738:Cyberian Outpost

3698:Broadband Sports

3658:Airspan Networks

3617:Julie Wainwright

3597:Jeffrey Skilling

3582:Stephan Paternot

3436:

3429:

3422:

3413:

3398:

3370:

3354:

3340:

3316:

3291:

3274:

3249:

3230:

3205:

3184:

3168:

3149:

3148:

3146:

3144:

3122:

3116:

3115:

3113:

3111:

3089:

3083:

3082:

3080:

3078:

3056:

3050:

3049:

3047:

3045:

3023:

3017:

3016:

3014:

3012:

2990:

2984:

2983:

2981:

2979:

2957:

2951:

2950:

2948:

2946:

2925:

2919:

2918:

2916:

2914:

2892:

2886:

2885:

2883:

2881:

2859:

2853:

2852:

2850:

2848:

2826:

2820:

2819:

2817:

2815:

2796:

2790:

2789:

2787:

2785:

2763:

2757:

2756:

2754:

2752:

2731:

2725:

2724:

2722:

2720:

2704:

2696:

2690:

2689:

2687:

2685:

2663:

2657:

2656:

2654:

2652:

2631:

2625:

2624:

2622:

2620:

2599:

2593:

2592:

2574:

2568:

2567:

2565:

2563:

2542:

2536:

2535:

2533:

2531:

2509:

2503:

2502:

2500:

2498:

2477:

2471:

2470:

2468:

2466:

2445:

2439:

2438:

2436:

2434:

2413:

2407:

2406:

2404:

2402:

2386:

2378:

2372:

2371:

2369:

2367:

2346:

2340:

2339:

2337:

2335:

2314:

2308:

2307:

2305:

2303:

2281:

2275:

2274:

2256:

2250:

2249:

2233:

2220:

2214:

2213:

2211:

2209:

2187:

2181:

2180:

2178:

2176:

2154:

2148:

2147:

2145:

2143:

2121:

2115:

2114:

2112:

2110:

2090:

2084:

2083:

2078:. Archived from

2063:

2057:

2056:

2054:

2052:

2036:

2029:

2023:

2022:

2020:

2018:

1996:

1990:

1989:

1987:

1985:

1969:

1961:

1955:

1954:

1952:

1950:

1928:

1922:

1921:

1919:

1917:

1900:"Dial-a-fortune"

1895:

1889:

1888:

1886:

1884:

1863:

1857:

1856:

1854:

1852:

1830:

1824:

1823:

1821:

1819:

1798:

1792:

1791:

1789:

1787:

1771:

1763:

1757:

1756:

1754:

1752:

1730:

1724:

1723:

1721:

1719:

1697:

1691:

1690:

1688:

1686:

1670:

1662:

1656:

1655:

1653:

1651:

1629:

1620:

1619:

1617:

1615:

1606:. May 28, 2001.

1599:

1592:

1586:

1585:

1583:

1581:

1565:

1557:

1551:

1550:

1530:

1517:

1511:

1510:

1508:

1506:

1490:

1482:

1476:

1475:

1473:

1471:

1455:

1447:

1441:

1440:

1438:

1436:

1411:

1405:

1404:

1402:

1400:

1379:Bloomsbury Books

1365:

1356:

1355:

1353:

1351:

1329:

1318:

1317:

1289:

1276:

1275:

1273:

1271:

1259:Business Insider

1250:

1244:

1243:

1241:

1239:

1227:Business Insider

1217:

1211:

1210:

1208:

1206:

1200:

1189:

1181:

1175:

1174:

1172:

1170:

1158:The News-Gazette

1148:

1142:

1141:

1139:

1137:

1122:

1116:

1113:

1107:

1104:

1098:

1095:

1089:

1086:

1077:

1074:

1065:

1062:

1056:

1055:

1053:

1051:

1039:Business Insider

1029:

1023:

1022:

1020:

1018:

1002:

994:

988:

987:

975:

966:

965:

963:

961:

952:. June 5, 2008.

940:

830:Silicon Investor

828:stocks, such as

824:that focused on

795:Jeffrey Skilling

747:WorldCom scandal

621:Super Bowl XXXIV

590:Super Bowl XXXIV

535:spectrum auction

446:

437:

333:Investment banks

235:NASDAQ Composite

38:NASDAQ Composite

21:

6592:

6591:

6587:

6586:

6585:

6583:

6582:

6581:

6542:

6541:

6540:

6535:

6528:

6521:

6514:

6507:

6499:

6492:

6485:

6478:

6470:

6463:

6456:

6448:

6439:

6432:

6425:

6418:

6410:

6402:

6394:

6386:

6379:

6371:

6363:

6356:

6349:

6342:

6335:

6327:

6320:

6312:

6305:

6298:

6291:

6284:

6276:

6268:

6261:

6254:

6247:

6240:

6238:Information Age

6232:

6223:

6216:

6209:

6202:

6195:

6188:

6181:

6174:

6167:

6160:

6153:

6146:

6139:

6132:

6125:

6118:

6111:

6104:

6097:

6090:

6088:Great Recession

6082:

6074:

6067:

6060:

6052:

6045:

6038:

6031:

6024:

6017:

6009:

6001:

5993:

5986:

5979:

5972:

5965:

5958:

5950:

5943:

5936:

5928:

5921:

5913:

5906:

5899:

5892:

5885:

5877:

5869:

5862:

5855:

5847:

5839:

5832:

5825:

5818:

5810:

5802:

5795:

5791:

5782:

5774:

5769:1979 oil crisis

5767:

5760:

5752:

5744:

5737:

5730:

5725:1973 oil crisis

5723:

5715:

5708:

5706:Great Inflation

5700:

5693:

5686:

5679:

5671:

5664:

5657:

5649:

5641:

5633:

5626:

5624:Interwar period

5618:

5611:

5604:

5596:

5589:

5582:

5575:

5567:

5560:

5553:

5545:

5537:

5529:

5522:

5515:

5508:

5501:

5493:

5485:

5478:

5471:

5464:

5455:

5448:

5440:

5429:

5422:

5415:

5408:

5400:

5393:

5386:

5379:

5372:

5364:

5357:

5349:

5342:

5335:

5327:

5319:

5311:

5303:

5293:

5285:

5277:

5269:

5262:

5254:

5246:

5232:

5225:

5218:

5211:

5202:

5195:

5188:

5181:

5174:

5167:

5160:

5151:

5144:

5137:

5130:

5125:Currency crisis

5123:

5116:

5109:

5102:

5095:

5087:

5082:

5052:

5047:

5014:

4971:

4969:Information Age

4963:

4855:

4851:

4842:

4831:Silver Thursday

4812:

4804:

4799:Poseidon bubble

4779:

4771:

4723:

4721:Interwar period

4715:

4577:

4569:

4522:Otago gold rush

4432:

4391:

4383:

4352:

4344:

4306:

4301:

4271:

4266:

4248:

4214:Broadcast media

4209:

4204:The PayPal Wars

4170:

4129:

3823:Global Crossing

3758:Digital Insight

3723:Cobalt Networks

3693:Books-A-Million

3678:Arthur Andersen

3626:

3462:Marc Andreessen

3457:Daniel Aegerter

3445:

3440:

3395:

3373:

3367:

3343:

3337:

3319:

3313:

3294:

3277:

3271:

3252:

3246:

3233:

3227:

3208:

3187:

3181:

3160:

3157:

3155:Further reading

3152:

3142:

3140:

3124:

3123:

3119:

3109:

3107:

3091:

3090:

3086:

3076:

3074:

3058:

3057:

3053:

3043:

3041:

3025:

3024:

3020:

3010:

3008:

2992:

2991:

2987:

2977:

2975:

2959:

2958:

2954:

2944:

2942:

2927:

2926:

2922:

2912:

2910:

2894:

2893:

2889:

2879:

2877:

2861:

2860:

2856:

2846:

2844:

2828:

2827:

2823:

2813:

2811:

2798:

2797:

2793:

2783:

2781:

2765:

2764:

2760:

2750:

2748:

2733:

2732:

2728:

2718:

2716:

2698:

2697:

2693:

2683:

2681:

2665:

2664:

2660:

2650:

2648:

2633:

2632:

2628:

2618:

2616:

2601:

2600:

2596:

2576:

2575:

2571:

2561:

2559:

2544:

2543:

2539:

2529:

2527:

2511:

2510:

2506:

2496:

2494:

2479:

2478:

2474:

2464:

2462:

2447:

2446:

2442:

2432:

2430:

2415:

2414:

2410:

2400:

2398:

2380:

2379:

2375:

2365:

2363:

2348:

2347:

2343:

2333:

2331:

2316:

2315:

2311:

2301:

2299:

2283:

2282:

2278:

2271:

2258:

2257:

2253:

2246:

2222:

2221:

2217:

2207:

2205:

2189:

2188:

2184:

2174:

2172:

2156:

2155:

2151:

2141:

2139:

2123:

2122:

2118:

2108:

2106:

2092:

2091:

2087:

2066:Marsha Walton;

2065:

2064:

2060:

2050:

2048:

2031:

2030:

2026:

2016:

2014:

1998:

1997:

1993:

1983:

1981:

1963:

1962:

1958:

1948:

1946:

1930:

1929:

1925:

1915:

1913:

1897:

1896:

1892:

1882:

1880:

1865:

1864:

1860:

1850:

1848:

1832:

1831:

1827:

1817:

1815:

1800:

1799:

1795:

1785:

1783:

1765:

1764:

1760:

1750:

1748:

1732:

1731:

1727:

1717:

1715:

1699:

1698:

1694:

1684:

1682:

1664:

1663:

1659:

1649:

1647:

1631:

1630:

1623:

1613:

1611:

1594:

1593:

1589:

1579:

1577:

1559:

1558:

1554:

1547:

1519:

1518:

1514:

1504:

1502:

1484:

1483:

1479:

1469:

1467:

1449:

1448:

1444:

1434:

1432:

1413:

1412:

1408:

1398:

1396:

1389:

1367:

1366:

1359:

1349:

1347:

1331:

1330:

1321:

1291:

1290:

1279:

1269:

1267:

1252:

1251:

1247:

1237:

1235:

1219:

1218:

1214:

1204:

1202:

1198:

1187:

1183:

1182:

1178:

1168:

1166:

1150:

1149:

1145:

1135:

1133:

1124:

1123:

1119:

1114:

1110:

1105:

1101:

1096:

1092:

1087:

1080:

1075:

1068:

1063:

1059:

1049:

1047:

1031:

1030:

1026:

1016:

1014:

1006:Financial Times

996:

995:

991:

977:

976:

969:

959:

957:

942:

941:

937:

933:

911:

866:

846:

838:The Motley Fool

822:Internet forums

776:

770:

731:Super Bowl XXXV

625:dot-com company

617:Gerald M. Levin

570:

564:

548:Philip Anschutz

504:

485:brand awareness

472:network effects

464:

463:

462:

461:

449:

448:

447:

439:

438:

427:

402:lock-up periods

329:Venture capital

313:dot-com company

309:

274:Information Age

260:and subsequent

254:

248:

180:venture capital

173:

141:

113:Global Crossing

89:online shopping

74:venture capital

28:

23:

22:

15:

12:

11:

5:

6590:

6588:

6580:

6579:

6574:

6569:

6564:

6559:

6554:

6552:Dot-com bubble

6544:

6543:

6537:

6536:

6534:

6533:

6526:

6519:

6512:

6504:

6501:

6500:

6498:

6497:

6490:

6483:

6476:

6474:(2022–present)

6468:

6461:

6454:

6452:(2020–present)

6446:

6445:

6444:

6437:

6430:

6416:

6414:(2019–present)

6408:

6406:(2019–present)

6400:

6398:(2018–present)

6392:

6384:

6377:

6369:

6361:

6354:

6347:

6340:

6333:

6325:

6318:

6316:(2013–present)

6310:

6303:

6296:

6289:

6282:

6280:(2011–present)

6274:

6272:(2010–present)

6266:

6259:

6252:

6244:

6242:

6241:(2009–present)

6234:

6233:

6231:

6230:

6229:

6228:

6221:

6214:

6207:

6200:

6193:

6186:

6179:

6172:

6165:

6158:

6151:

6144:

6137:

6130:

6123:

6116:

6109:

6106:September 2008

6094:

6092:

6084:

6083:

6081:

6080:

6078:(2007–present)

6072:

6065:

6058:

6050:

6043:

6036:

6029:

6022:

6015:

6007:

5999:

5991:

5984:

5977:

5970:

5963:

5956:

5948:

5941:

5934:

5926:

5919:

5911:

5904:

5897:

5890:

5883:

5875:

5867:

5860:

5853:

5845:

5837:

5830:

5823:

5816:

5808:

5799:

5797:

5784:

5783:

5781:

5780:

5772:

5765:

5758:

5750:

5742:

5735:

5728:

5721:

5712:

5710:

5702:

5701:

5699:

5698:

5691:

5683:

5681:

5673:

5672:

5670:

5669:

5662:

5655:

5647:

5639:

5630:

5628:

5620:

5619:

5617:

5616:

5609:

5602:

5594:

5587:

5580:

5573:

5565:

5558:

5551:

5543:

5535:

5527:

5520:

5513:

5505:

5503:

5495:

5494:

5492:

5491:

5483:

5476:

5469:

5462:

5461:

5460:

5453:

5437:

5435:

5431:

5430:

5428:

5427:

5420:

5413:

5406:

5398:

5391:

5384:

5377:

5370:

5368:(c. 1780–1795)

5362:

5355:

5347:

5339:

5337:

5329:

5328:

5326:

5325:

5317:

5309:

5301:

5291:

5289:(c. 1600–1760)

5283:

5275:

5266:

5264:

5256:

5255:

5253:

5252:

5243:

5241:

5234:

5233:

5231:

5230:

5223:

5216:

5209:

5208:

5207:

5200:

5193:

5186:

5172:

5169:Hyperinflation

5165:

5158:

5157:

5156:

5142:

5135:

5128:

5121:

5114:

5107:

5100:

5092:

5089:

5088:

5083:

5081:

5080:

5073:

5066:

5058:

5049:

5048:

5046:

5045:

5040:

5038:Unicorn bubble

5035:

5030:

5025:

5019:

5016:

5015:

5013:

5012:

5006:

5000:

4994:

4988:

4982:

4975:

4973:

4972:(2007–present)

4965:

4964:

4962:

4961:

4956:

4950:

4949:

4943:

4937:

4931:

4925:

4919:

4913:

4907:

4901:

4900:(c. 2000–2007)

4895:

4889:

4886:Dot-com bubble

4883:

4877:

4871:

4865:

4863:1980s oil glut

4859:

4857:

4844:

4843:

4841:

4840:

4839:(c. 1980–1982)

4834:

4828:

4822:

4816:

4814:

4806:

4805:

4803:

4802:

4796:

4795:(1945–c. 1960)

4790:

4789:(1945–c. 1950)

4787:Texas oil boom

4783:

4781:

4773:

4772:

4770:

4769:

4763:

4758:

4752:

4751:(1918–c. 1930)

4746:

4743:Texas oil boom

4740:

4739:(1918–c. 1930)

4734:

4733:(c. 1920–1925)

4727:

4725:

4717:

4716:

4714:

4713:

4707:

4701:

4698:Texas oil boom

4695:

4694:(c. 1900–1918)

4689:

4686:Nome Gold Rush

4683:

4682:(1897–c. 1925)

4677:

4671:

4665:

4659:

4653:

4647:

4641:

4635:

4629:

4623:

4622:(c. 1880–1903)

4617:

4611:

4605:

4599:

4593:

4587:

4581:

4579:

4571:

4570:

4568:

4567:

4561:

4555:

4549:

4543:

4537:

4531:

4525:

4519:

4513:

4507:

4501:

4495:

4489:

4483:

4477:

4471:

4465:

4464:(1851–c. 1870)

4459:

4453:

4447:

4440:

4438:

4434:

4433:

4431:

4430:

4424:

4419:

4418:(1828–c. 1840)

4413:

4408:

4402:

4395:

4393:

4385:

4384:

4382:

4381:

4375:

4369:

4363:

4356:

4354:

4346:

4345:

4343:

4342:

4337:

4332:

4327:

4322:

4317:

4311:

4308:

4307:

4302:

4300:

4299:

4292:

4285:

4277:

4268:

4267:

4265:

4264:

4253:

4250:

4249:

4247:

4246:

4239:

4232:

4225:

4217:

4215:

4211:

4210:

4208:

4207:

4200:

4193:

4186:

4178:

4176:

4172:

4171:

4169:

4168:

4163:

4158:

4156:Telecoms crash

4153:

4148:

4143:

4137:

4135:

4131:

4130:

4128:

4127:

4122:

4117:

4112:

4107:

4102:

4097:

4092:

4087:

4082:

4077:

4072:

4067:

4062:

4057:

4052:

4047:

4045:TIBCO Software

4042:

4037:

4032:

4027:

4026:

4025:

4015:

4010:

4005:

4000:

3995:

3990:

3985:

3980:

3975:

3973:PLX Technology

3970:

3965:

3960:

3955:

3950:

3945:

3940:

3935:

3930:

3925:

3920:

3915:

3910:

3905:

3900:

3895:

3890:

3888:lastminute.com

3885:

3880:

3875:

3870:

3865:

3860:

3855:

3850:

3845:

3840:

3835:

3830:

3825:

3820:

3815:

3810:

3805:

3800:

3795:

3790:

3785:

3780:

3775:

3770:

3765:

3760:

3755:

3750:

3745:

3740:

3735:

3730:

3725:

3720:

3715:

3710:

3705:

3700:

3695:

3690:

3685:

3680:

3675:

3670:

3665:

3660:

3655:

3650:

3645:

3640:

3634:

3632:

3628:

3627:

3625:

3624:

3619:

3614:

3609:

3604:

3599:

3594:

3589:

3584:

3579:

3574:

3569:

3564:

3559:

3554:

3549:

3547:Timothy Koogle

3544:

3539:

3534:

3529:

3524:

3519:

3517:Alan Greenspan

3514:

3512:Richard Grasso

3509:

3504:

3499:

3497:Bernard Ebbers

3494:

3489:

3487:Cynthia Cooper

3484:

3482:James H. Clark

3479:

3474:

3469:

3464:

3459:

3453:

3451:

3447:

3446:

3443:Dot-com bubble

3441:

3439:

3438:

3431:

3424:

3416:

3410:

3409:

3393:

3375:Wolff, Michael

3371:

3365:

3341:

3335:

3317:

3311:

3292:

3282:(RHS 06-029).

3275:

3269:

3250:

3245:978-1854107909

3244:

3231:

3225:

3206:

3185:

3179:

3156:

3153:

3151:

3150:

3117:

3084:

3051:

3018:

2985:

2952:

2920:

2887:

2854:

2821:

2791:

2758:

2726:

2691:

2658:

2626:

2594:

2569:

2537:

2519:Bloomberg News

2504:

2472:

2440:

2408:

2373:

2341:

2309:

2276:

2269:

2251:

2244:

2215:

2182:

2149:

2116:

2085:

2058:

2024:

1991:

1956:

1923:

1890:

1858:

1825:

1793:

1758:

1725:

1692:

1657:

1621:

1587:

1552: