585:

701:

38:

591:

124:

596:

86:

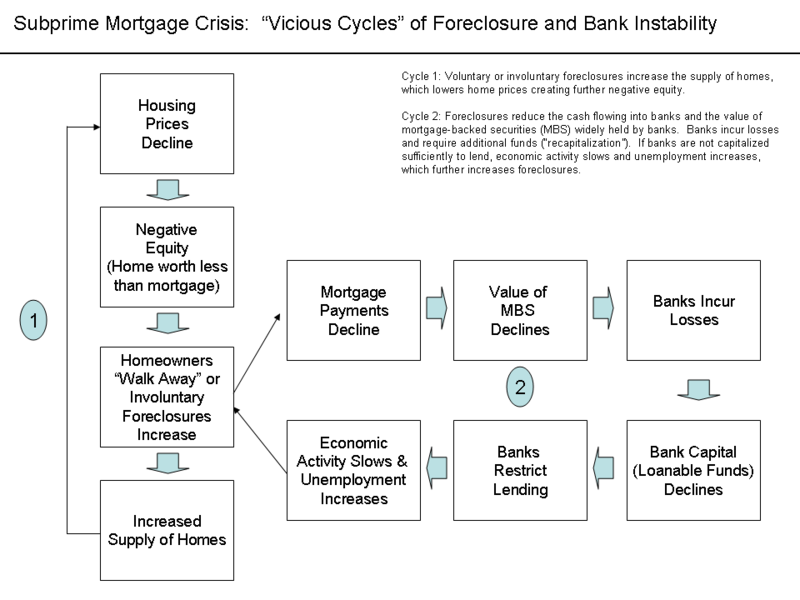

331:; once the creditor has regained the property purchased with a mortgage in default, he has no further claim against the defaulting borrower's income or assets. As more borrowers stop paying their mortgage payments, foreclosures and the supply of homes for sale increase. This places downward pressure on housing prices, which further lowers homeowners'

1206:

1083:

351:

Foreclosures reduce the cash flowing into banks and the value of mortgage-backed securities (MBS) widely held by banks. Banks incur losses and require additional funds (“recapitalization”). If banks are not capitalized sufficiently to lend, economic activity slows and unemployment increases, which

326:

in their homes, meaning their homes were worth less than their mortgages. As of March 2008, an estimated 8.8 million borrowers — 10.8% of all homeowners — had negative equity in their homes, a number that is believed to have risen to 12 million by

November 2008. Borrowers in this situation have an

368:

to decline from $ 35.2 billion in 2006 Q4 billion to $ 646 million in the same quarter a year later, a decline of 98%. 2007 Q4 saw the worst bank and thrift quarterly performance since 1990. In all of 2007, insured depository institutions earned approximately $ 100 billion, down 31% from a record

389:

in

September and October 2008. He further describes the crisis in these other video segments. He called for an additional $ 250 billion to help recapitalize the banks, closure of insolvent "zombie" banks, regulatory overhaul, and $ 300 billion in infrastructure spending during these interviews.

321:

The first cycle is within the housing market. Voluntary or involuntary foreclosures increase the supply of homes, which lowers home prices creating further negative equity. By

September 2008, average U.S. housing prices had declined by over 20% from their mid-2006 peak. This major and unexpected

1171:

327:

incentive to "walk away" from their mortgages and abandon their homes, even though doing so will damage their credit rating for a number of years. The reason is that unlike what is the case in most other countries, American residential mortgages are

662:– You must give appropriate credit, provide a link to the license, and indicate if changes were made. You may do so in any reasonable manner, but not in any way that suggests the licensor endorses you or your use.

786:{{Information |Description=Chart showing feedback loops within housing market and with financial market and economy |Source=I created this work entirely by myself. |Date= |Author=~~~~ |other_versions= }}

97:

52:

48:

42:

65:

1118:

404:

1100:{{Information |Description={{en|Chart showing feedback loops within housing market and with financial market and economy<br/> ==Description== This diagram explains two

373:

data indicates banks have significantly tightened lending standards throughout the crisis. Unemployment in the U.S. has increased to a 14-year high as of

November 2008.

1186:

718:

150:

for more information. If an SVG form of this image is available, please upload it and afterwards replace this template with

360:

their holdings of subprime related securities by US$ 501 billion. Mortgage defaults and provisions for future defaults caused profits at the 8533 USA

408:

1123:

507:

147:

716:; with no Invariant Sections, no Front-Cover Texts, and no Back-Cover Texts. A copy of the license is included in the section entitled

708:

369:

profit of $ 145 billion in 2006. Profits declined from $ 35.6 billion in 2007 Q1 to $ 19.3 billion in 2008 Q1, a decline of 46%.

994:

958:

941:

924:

907:

890:

854:

669:

1082:

1077:

56:

37:

978:

838:

713:

167:

153:

1014:

874:

821:

336:

166:

It is recommended to name the SVG file “Subprime crisis - Foreclosures & Bank

Instability.svg”—then the template

519:

310:

141:

471:

385:

described the vicious cycles within and across the housing market and financial markets during interviews with

1128:

619:

615:

611:

607:

361:

353:

1143:

1114:

The following pages on the

English Knowledge (XXG) use this file (pages on other projects are not listed):

668:– If you remix, transform, or build upon the material, you must distribute your contributions under the

483:

453:

603:

627:

571:

105:

328:

695:

706:

Permission is granted to copy, distribute and/or modify this document under the terms of the

382:

370:

332:

323:

403:

The images below contain additional high-level explanation of the crisis further citations.

137:

1181:

781:

772:

763:

495:

449:

1161:

340:

306:

201:

Chart showing feedback loops within housing market and with financial market and economy

1138:

1133:

578:, the copyright holder of this work, hereby publishes it under the following licenses:

386:

1101:

1093:

92:

544:

532:

357:

236:

520:

https://www.nytimes.com/2008/11/08/business/economy/08econ.html?pagewanted=print

419:

171:

556:

204:

1050:

Click on a date/time to view the file as it appeared at that time.

365:

210:

1196:

631:

575:

339:, which erodes the net worth and financial health of banks. This

203:

409:

thumb|Domino Effect As

Housing Prices Declined – Diagram 2 of 2

322:

decline in house prices means that many borrowers have zero or

118:

80:

405:

thumb|Factors

Contributing to Housing Bubble – Diagram 1 of 2

335:. The decline in mortgage payments also reduces the value of

347:

Cycle Two: Financial Market and

Feedback into Housing Market

241:

Cycle Two: Financial Market and

Feedback into Housing Market

191:

Subprime crisis - Foreclosures & Bank Instability.png

805:

Add a one-line explanation of what this file represents

755:

1119:

Fair value accounting and the subprime mortgage crisis

925:

Creative Commons Attribution-ShareAlike 3.0 Unported

891:

GNU Free Documentation License, version 1.2 or later

712:, Version 1.2 or any later version published by the

185:

104:

Commons is a freely licensed media file repository.

959:

Creative Commons Attribution-ShareAlike 2.5 Generic

942:

Creative Commons Attribution-ShareAlike 2.0 Generic

908:

Creative Commons Attribution-ShareAlike 1.0 Generic

496:

NYT - How to Help People Who's Homes are Underwater

352:further increases foreclosures. As of August 2008,

1104:at the heart of the [[:en:subprime mortgage crisis

248:

758:. All following user names refer to en.wikipedia.

70:(960 × 720 pixels, file size: 16 KB, MIME type:

679:https://creativecommons.org/licenses/by-sa/3.0

226:

85:

685:Creative Commons Attribution-Share Alike 3.0

584:

8:

645:– to copy, distribute and transmit the work

1052:

801:

744:You may select the license of your choice.

1154:The following other wikis use this file:

288:

146:. This has several advantages; see

1116:

1028:

1012:

992:

976:

956:

939:

922:

905:

888:

872:

852:

836:

819:

816:

797:

790:

463:

437:I created this work entirely by myself.

1124:Subprime crisis background information

484:Economist-A Helping Hand to Homeowners

1207:இரண்டாம் நிலை அடமானச் சந்தைச் சிக்கல்

7:

724:http://www.gnu.org/copyleft/fdl.html

1041:

595:

590:

433:

810:

804:

754:The original description page was

753:

743:

581:

570:

533:Charlie Rose - Roubini & Panel

205:

195:

129:

117:

63:

809:

795:

700:

699:

656:Under the following conditions:

602:This file is licensed under the

594:

589:

583:

122:

84:

31:

21:

792:

551:

539:

527:

514:

508:Banks Tighten Lending Standards

502:

490:

478:

466:

456:) 17:06, 26 December 2008 (UTC)

343:is at the heart of the crisis.

258:

196:

14:

791:

730:GNU Free Documentation License

719:GNU Free Documentation License

709:GNU Free Documentation License

278:

26:

1:

995:original creation by uploader

545:Rose & Roubini Discussion

377:Further Sources and Solutions

268:

253:Further Sources and Solutions

817:Items portrayed in this file

216:

1225:

1203:Usage on ta.wikipedia.org

1193:Usage on pt.wikipedia.org

1178:Usage on ja.wikipedia.org

1172:सबप्राइम मोर्टगेज क्राइसिस

1168:Usage on hi.wikipedia.org

1158:Usage on fa.wikipedia.org

670:same or compatible license

337:mortgage-backed securities

305:This diagram explains two

134:image could be re-created

1042:

429:

317:Cycle One: Housing Market

231:Cycle One: Housing Market

148:Commons:Media for cleanup

16:

1129:Subprime mortgage crisis

794:

714:Free Software Foundation

636:

606:Attribution-Share Alike

522:NY Times - Unemployment]

311:subprime mortgage crisis

168:Vector version available

154:vector version available

91:This is a file from the

1144:User:Penn Station/draft

1099:

784:960×720× (16314 bytes)

775:960×720× (16314 bytes)

766:960×720× (16380 bytes)

632:English Knowledge (XXG)

576:English Knowledge (XXG)

445:

425:

418:

415:

362:depository institutions

188:

95:. Information from its

1182:利用者:Penn Station/draft

1078:00:51, 14 October 2010

436:

356:around the globe have

98:description page there

41:Size of this preview:

309:at the heart of the

174:) does not need the

750:Original upload log

651:– to adapt the work

293:Original upload log

47:Other resolutions:

557:Rose & Roubini

472:Case Shiller Index

329:non-recourse loans

1150:Global file usage

1107:

875:copyright license

803:

780:2008-12-26 17:06

771:2008-12-26 17:29

762:2008-12-26 17:34

741:

740:

460:

459:

211:

183:

182:

113:

112:

93:Wikimedia Commons

32:Global file usage

1216:

1090:

1030:26 December 2008

839:copyright status

737:

734:

731:

728:

725:

703:

702:

696:

692:

689:

686:

683:

680:

672:as the original.

634:

604:Creative Commons

598:

597:

593:

592:

587:

586:

559:

554:

547:

542:

535:

530:

523:

517:

510:

505:

498:

493:

486:

481:

474:

469:

440:

431:

421:

420:26 December 2008

294:

291:

284:

281:

274:

271:

264:

261:

254:

251:

242:

239:

232:

229:

222:

219:

212:

200:

192:

186:

161:

126:

125:

119:

109:

88:

87:

81:

75:

73:

60:

57:960 × 720 pixels

53:640 × 480 pixels

49:320 × 240 pixels

43:800 × 600 pixels

1224:

1223:

1219:

1218:

1217:

1215:

1214:

1213:

1197:Círculo vicioso

1148:

1115:

1108:

1096:

1088:

1044:

1043:

1040:

1039:

1038:

1037:

1036:

1035:

1034:

1033:

1031:

1021:

1020:

1019:

1017:

1006:

1005:

1004:

1003:

1002:

1001:

1000:

999:

997:

985:

984:

983:

981:

970:

969:

968:

967:

966:

965:

964:

963:

961:

950:

949:

948:

947:

946:

944:

933:

932:

931:

930:

929:

927:

916:

915:

914:

913:

912:

910:

899:

898:

897:

896:

895:

893:

881:

880:

879:

877:

866:

865:

864:

863:

862:

861:

860:

859:

857:

845:

844:

843:

841:

830:

829:

828:

827:

826:

824:

808:

807:

806:

759:

752:

747:

746:

745:

735:

732:

729:

726:

723:

694:

693:

690:

687:

684:

681:

678:

677:

635:

626:

623:

599:

580:

579:

567:

562:

555:

550:

543:

538:

531:

526:

518:

513:

506:

501:

494:

489:

482:

477:

470:

465:

461:

438:

434:Original text:

411:

401:

396:

383:Nouriel Roubini

379:

371:Federal Reserve

364:insured by the

354:financial firms

349:

324:negative equity

319:

303:

298:

292:

289:

282:

279:

272:

269:

262:

259:

252:

249:

240:

237:

230:

227:

220:

217:

213:

209:

190:

179:

151:

138:vector graphics

123:

115:

114:

103:

102:

101:is shown below.

77:

71:

69:

62:

61:

46:

12:

11:

5:

1222:

1220:

1212:

1211:

1210:

1209:

1201:

1200:

1199:

1191:

1190:

1189:

1184:

1176:

1175:

1174:

1166:

1165:

1164:

1152:

1151:

1147:

1146:

1141:

1139:User:Farcaster

1136:

1134:Vicious circle

1131:

1126:

1121:

1113:

1112:

1111:

1106:

1105:

1102:vicious cycles

1098:

1094:

1091:

1085:

1080:

1075:

1071:

1070:

1067:

1064:

1061:

1058:

1055:

1048:

1047:

1032:

1029:

1027:

1026:

1025:

1024:

1023:

1022:

1018:

1013:

1011:

1010:

1009:

1008:

1007:

998:

993:

991:

990:

989:

988:

987:

986:

982:

979:source of file

977:

975:

974:

973:

972:

971:

962:

957:

955:

954:

953:

952:

951:

945:

940:

938:

937:

936:

935:

934:

928:

923:

921:

920:

919:

918:

917:

911:

906:

904:

903:

902:

901:

900:

894:

889:

887:

886:

885:

884:

883:

882:

878:

873:

871:

870:

869:

868:

867:

858:

853:

851:

850:

849:

848:

847:

846:

842:

837:

835:

834:

833:

832:

831:

825:

820:

818:

815:

814:

813:

812:

811:

800:

799:

796:

793:

789:

788:

778:

769:

751:

748:

742:

739:

738:

704:

676:

675:

674:

673:

663:

654:

653:

652:

646:

639:You are free:

624:

601:

600:

582:

569:

568:

566:

563:

561:

560:

548:

536:

524:

511:

499:

487:

475:

462:

458:

457:

447:

443:

442:

427:

423:

422:

417:

413:

412:

400:

397:

395:

392:

378:

375:

348:

345:

318:

315:

307:vicious cycles

302:

299:

297:

296:

286:

276:

266:

256:

246:

245:

244:

234:

208:

193:

184:

181:

180:

176:new image name

158:new image name

127:

116:

111:

110:

89:

79:

78:

40:

36:

35:

34:

29:

24:

19:

13:

10:

9:

6:

4:

3:

2:

1221:

1208:

1205:

1204:

1202:

1198:

1195:

1194:

1192:

1188:

1187:サブプライム住宅ローン危機

1185:

1183:

1180:

1179:

1177:

1173:

1170:

1169:

1167:

1163:

1160:

1159:

1157:

1156:

1155:

1149:

1145:

1142:

1140:

1137:

1135:

1132:

1130:

1127:

1125:

1122:

1120:

1117:

1109:

1103:

1097:

1092:

1086:

1084:

1081:

1079:

1076:

1073:

1072:

1068:

1065:

1062:

1059:

1056:

1054:

1053:

1051:

1045:

1016:

996:

980:

960:

943:

926:

909:

892:

876:

856:

840:

823:

787:

783:

779:

777:

774:

770:

768:

765:

761:

760:

757:

749:

721:

720:

715:

711:

710:

705:

698:

697:

682:CC BY-SA 3.0

671:

667:

664:

661:

658:

657:

655:

650:

647:

644:

641:

640:

638:

637:

633:

629:

625:Attribution:

621:

617:

613:

609:

605:

588:

577:

573:

564:

558:

553:

549:

546:

541:

537:

534:

529:

525:

521:

516:

512:

509:

504:

500:

497:

492:

488:

485:

480:

476:

473:

468:

464:

455:

451:

448:

444:

439:

428:

424:

414:

410:

407:

406:

398:

393:

391:

388:

384:

376:

374:

372:

367:

363:

359:

355:

346:

344:

342:

341:vicious cycle

338:

334:

330:

325:

316:

314:

312:

308:

300:

295:

287:

285:

277:

275:

267:

265:

257:

255:

247:

243:

235:

233:

225:

224:

223:

215:

214:

206:

202:

199:

194:

187:

177:

173:

169:

165:

164:

159:

155:

149:

145:

143:

139:

133:

128:

121:

120:

107:

100:

99:

94:

90:

83:

82:

76:

67:

66:Original file

58:

54:

50:

44:

39:

33:

30:

28:

25:

23:

20:

18:

15:

1153:

1049:

1046:File history

785:

776:

767:

717:

707:

665:

659:

648:

642:

608:3.0 Unported

435:

402:

387:Charlie Rose

380:

358:written down

350:

320:

304:

197:

175:

163:

157:

135:

131:

106:You can help

96:

64:

22:File history

855:copyrighted

666:share alike

660:attribution

620:1.0 Generic

616:2.0 Generic

612:2.5 Generic

189:Description

1110:File usage

1087:960 × 720

1063:Dimensions

394:References

381:Economist

263:References

178:parameter.

27:File usage

1060:Thumbnail

1057:Date/Time

1015:inception

782:Farcaster

773:Farcaster

764:Farcaster

628:Farcaster

572:Farcaster

565:Licensing

450:Farcaster

283:Licensing

198:English:

72:image/png

1162:دور باطل

1095:Hideokun

798:Captions

649:to remix

643:to share

622:license.

430:Own work

399:See also

273:See also

207:Contents

1089:(16 KB)

1074:current

1069:Comment

822:depicts

802:English

301:Summary

221:Summary

132:diagram

68:

446:Author

426:Source

333:equity

140:as an

136:using

130:This

1066:User

756:here

736:true

733:true

727:GFDL

691:true

688:true

618:and

454:talk

416:Date

366:FDIC

313:.

170:(or

144:file

17:File

630:at

574:at

238:1.2

228:1.1

172:Vva

142:SVG

614:,

610:,

160:}}

152:{{

55:|

51:|

45:.

722:.

552:↑

540:↑

528:↑

515:↑

503:↑

491:↑

479:↑

467:↑

452:(

441:)

432:(

290:6

280:5

270:4

260:3

250:2

218:1

162:.

156:|

108:.

74:)

59:.

Text is available under the Creative Commons Attribution-ShareAlike License. Additional terms may apply.