726:, it is also important to make sure that one has paid partial taxes throughout the tax year in the form of estimated tax payments or employer tax withholding. If one has not done so, then a tax penalty may be assessed. The minimum amount of estimated taxes that need to be paid to avoid penalties depends on a variety of factors, including one's income in the tax year in question as well as one's income in the previous year (in general, if one pays 90% of the current year's tax liability or 100% of the previous year's tax liability during the tax year, one is not subject to estimated tax penalty even if this year's taxes are higher, but there are some caveats to that rule). Employer withholding is also treated differently from estimated tax payment, in that for the latter, the time of the year when the payment was made matters, whereas for the former, all that matters is how much has been withheld as of the end of the year (though there are other restrictions on how one can adjust one's withholding pattern that need to be enforced by the employer).

954:, the tax return deadline was changed to April 15 from March 15, as part of a large-scale overhaul of the tax code. The reason for March 1 was not explained in the law, but was presumably to give time after the end of the tax (and calendar) year to prepare tax returns. The two-week extension from March 1 to March 15 occurred after the Revenue Act of 1918 was passed in February 1919, given only a few weeks to complete returns under the new law. The month extension from March 15 to April 15 was to give additional time for taxpayers and accountants to prepare taxes, owing to the more complex tax code, and also helped spread work by the IRS over a longer time, as it would receive returns over a longer time.

711:

2911:, Originally published in Tax Notes magazine on April 16, 2012: "According to the 1913 revenue act, anyone with an annual income exceeding the exemption ... was required to file a return "on or before the first day of March, nineteen hundred and fourteen." Lawmakers offered no explanation for that date, but it seems likely that it was selected to give taxpayers adequate time to gather materials and complete their returns following the end of the tax (and calendar) year."

864:

for the failure to complete a form where the information request at issue does not comply with the PRA... Yet

Lawrence conceded at oral argument that no case from this circuit establishes such a proposition, and in fact Lawrence cites no caselaw from any jurisdiction that so holds. In contrast, the government referenced numerous cases supporting its position that the PRA does not present a defense to a criminal action for failure to file income taxes."

33:

924:

113:, although there are also some other cases; individuals who have taxable income in the United States but fail the criteria for being resident aliens must file as nonresident aliens for tax purposes. While residents of the United States for tax purposes file Form 1040, nonresident aliens must file Form 1040NR or 1040NR-EZ. There is also a "dual status alien" for aliens whose status changed during the year.

879:

1028:

911:

288:

240:

149:

used, with some content filled in electronically and additional content written in by hand. As a general rule, where possible, it makes sense to fill electronically, but in some cases filling by hand may be necessary (for instance, if additional notes of explanation need to be added, or the font used for electronic filling is too large to fit the information in the space provided).

1306:

subtlety of the rules governing taxation and the edge cases explicitly spelled out based on historical experience, and an increase in the base of taxpayers making it necessary to offer longer, more explicit instructions for less sophisticated taxpayers. As an example, whereas the initial versions of Form 1040 came only with a

1310:

included in the tax form itself, the IRS now publishes a complete tax table for taxable income up to $ 100,000 so that people can directly look up their tax liability from their taxable income without having to do complicated arithmetic calculations based on the rate schedule. The IRS still publishes

863:

According to

Lawrence, the Paperwork Reduction Act of 1995 (PRA) required the Internal Revenue Service to display valid Office of Management and Budget (OMB) numbers on its Form 1040.... Lawrence argues that the PRA by its terms prohibits the government from imposing a criminal penalty upon a citizen

665:

forms such as Form W-2 must be attached to the Form 1040, in addition to the Form 1040 schedules. There are over 100 other specialized forms that may need to be completed along with

Schedules and the Form 1040. However, Form 1099 need not be attached if no tax was withheld. In general, employer-sent

317:

Since 1961 Form 1040 has had various separate attachments to the form. These attachments are usually called "schedules" because prior to the 1961, the related sections were schedules on the main form identified by letter. Form 1040 currently has 20 attachments, which may need to be filed depending on

258:

may be used by taxpayers who are 65 or older. The 1040-SR form is functionally the same as 1040, but 1040-SR is easier to fill-out by hand, because the text is larger and the checkboxes are larger. Seniors may continue to use the standard 1040 for tax filing if they prefer. Its creation was mandated

902:

High earners had to pay additional taxes. The first high-earning tax bracket, $ 20,000–$ 50,000, has an additional tax of 1% on the part of net income above $ 20,000. Thus, somebody with a taxable income of $ 50,000 (over a million dollars in 2015 dollars according to the BLS) would pay a total of $

844:

The United States Court of

Appeals for the Seventh Circuit rejected the convicted taxpayer's OMB control number argument by stating "Finally, we have no doubt that the IRS has complied with the Paperwork Reduction Act. Form 1040 bears a control number from OMB, as do the other forms the IRS commonly

718:

An automatic extension until

October 15 to file Form 1040 can be obtained by filing Form 4868. There is a penalty for not filing a tax return by April 15 that depends on whether the individual got a filing extension and the amount of unpaid taxes. However, since the maximum penalty is 25% of unpaid

203:

If one is not eligible for IRS Free File, depending on the company used it might cost hundreds of dollars to file electronically, whereas paper filing has no costs beyond those of printing and mailing. Furthermore, the available existing electronic filing options may not offer sufficient flexibility

1329:

For tax return preparation, Americans spent roughly 20 percent of the amount collected in taxes (estimating the compliance costs and efficiency costs is difficult because neither the government nor taxpayers maintain regular accounts of these costs). As of 2013, there were more tax preparers in the

887:

three pages and 31 lines long, with the first page focused on computing one's income tax, the second page focused on more detailed documentation of one's income and the third page describing deductions and including a signature area. There is an additional page of instructions. The main rules were:

819:

The Courts have responded to the OMB Control Number arguments with the following arguments. 1) Form 1040, U.S. Individual Income Tax Return has contained the OMB Control number since 1981. 2) As ruled in a number of cases, the absence of an OMB Control number does not eliminate the legal obligation

886:

The first Form 1040 was published for use for the tax years 1913, 1914, and 1915; the number 1040 was simply the next number in the sequential numbering of forms. For 1913, taxes applied only from March 1 to

December 31. The original Form 1040, available on the IRS website as well as elsewhere, is

745:

The federal government allows individuals to deduct their state income tax or their state sales tax from their federal tax through

Schedule A of Form 1040, but not both. In addition to deducting either income tax or sales tax, an individual can further deduct any state real estate taxes or private

1758:

IRS employees reported the loss or theft of at least 490 computers between

January 2, 2003, and June 13, 2006 ... we conducted a separate test on 100 laptop computers currently in use by employees and determined 44 laptop computers contained unencrypted sensitive data, including taxpayer data and

931:

For 1916, Form 1040 was converted to an annual form (i.e., updated each year with the new tax year printed on the form). Initially, the IRS mailed tax booklets (Form 1040, instructions, and most common attachments) to all households. As alternative delivery methods (CPA/Attorneys, Internet forms)

891:

The taxable income was calculated starting from gross income, subtracting business-related expenses to get net income, and then subtracting specific exemptions (usually $ 3,000 or $ 4,000). In other words, people with net incomes below $ 3,000 would have to pay no income tax at all. The inflation

855:

In this Case, IRS agents who had calculated

Lawrence's tax liability had made an error and it was discovered that Lawrence owed less taxes than originally determined. Lawrence asked the trial court to order the government to reimburse him for his legal fees, to which the trial court ruled against

813:(e) The protection provided by paragraph (a) of this section does not preclude the imposition of a penalty on a person for failing to comply with a collection of information that is imposed on the person by statute—e.g., 26 U.S.C. §6011(a) (statutory requirement for person to file a tax return)...

738:

Each state has separate tax codes in addition to federal taxes. Form 1040 is only used for federal taxes, and state taxes should be filed separately based on the individual state's form. Some states do not have any income tax. Although state taxes are filed separately, many state tax returns will

729:

When filing Form 1040, the penalty for failing to pay estimated taxes must be included on the form (on line 79) and included in the total on line 78 (if a net payment is due). The taxpayer is not required to compute other interest and penalties (such as penalty for late filing or late payment of

148:

Paper forms can be filled and saved electronically using a compatible PDF reader, and then printed. This way, it is easy to keep electronic copies of one's filled forms despite filing by paper. Alternatively, they can be printed out and filled by hand. A combination of the approaches may also be

116:

Resident aliens of the United States for tax purposes must generally file if their income crosses a threshold where their taxable income is likely to be positive, but there are many other cases where it may be legally desirable to file. For instance, even if not required, individuals can file a

1305:

The number of pages in the federal tax law grew from 400 in 1913 to over 72,000 in 2011. The increase in complexity can be attributed to an increase in the number and range of activities being taxed, an increase in the number of exemptions, credits, and deductions available, an increase in the

84:, which allows individuals to designate that the federal government give $ 3 of the tax it receives to the presidential election campaign fund. Altogether, 142 million individual income tax returns were filed for the tax year 2018 (filing season 2019), 92% of which were filed electronically.

79:

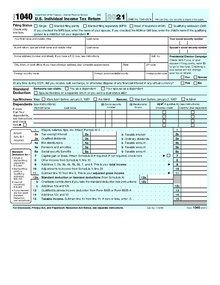

is reported on this page. The second page reports income, calculates the allowable deductions and credits, figures the tax due given adjusted income, and applies funds already withheld from wages or estimated payments made towards tax liability. On the right side of the first page is the

339:

In addition to the listed schedules, there are dozens of other forms that may be required when filing a personal income tax return. Typically these will provide additional details for deductions taken or income earned that are listed either on form 1040 or its subsequent schedules.

833:

The United States Court of

Appeals for the Sixth Circuit argues that the provisions on the Paperwork Reduction Act are not relevant as the act applies only to information requests made after December 31, 1981, and tax returns starting from 1981 contained an OMB Control Number.

104:

An individual is considered a resident of the United States for tax purposes if he or she is a citizen of the United States or a resident alien of the United States for tax purposes. An individual is a resident alien of the United States if he or she passes either the

175:

Those with incomes of $ 66,000 or less may file electronically using IRS Free File, a free e-filing tool (there are some other conditions necessary to be eligible for free filing; in particular, some kinds of income and deductions cannot be handled by free

66:, which is usually April 15 of the following year, except when April 15 falls on a Saturday, a Sunday, or a legal holiday. In those circumstances, the returns are due on the next business day after April 15. An automatic extension until October 15 to

760:

One argument used by tax protesters against the legitimacy of the 1040 Form is the OMB Control Number of the Paperwork Reduction Act argument. Tax protesters contend that Form 1040 does not contain an "OMB Control Number" which is issued by the U.S.

204:

with respect to arranging one's tax return, adding attachments, or putting written notes of explanation that can help preempt IRS questions. In the past, filing electronically may have exposed the taxpayer's data to the risk of accidental loss or

155:

The paper Form 1040, along with all relevant schedules and additional forms, must be sent in a single packet by mail or courier to an IRS address determined by the US state the taxpayer is filing from and whether or not a payment is enclosed.

1314:

In addition to an increase in the complexity of the form, the tax rates have also increased, though the increase in tax rates has not been steady (with huge upswings and downswings) in contrast with the steady increase in tax complexity.

678:

is the main way through which taxes are paid. However, income that is not subject to withholding must be estimated using Form 1040-ES. (It may be possible to avoid filing Form 1040-ES by increasing one's withholding and instead filing a

1002:, a new, redesigned Form 1040 was released for tax year 2018. It reduced the number of lines from 79 to 23, removed two of the variants (1040A and 1040EZ) in favor of the redesigned Form 1040, and redesigned the supplemental schedules.

1338:(310,400) combined. The National Taxpayers Union estimated the 2018 compliance cost at 11 hours per form 1040 vs. 12 hours in 2017, with a total of $ 92.5 billion spent in individual income tax compliance vs. $ 94.27 billion in 2017.

335:

Starting in 2018, 1040 was "simplified" by separating out 6 new schedules numbers Schedule 1 through Schedule 6 to make parts of the main form optional. The new schedules had the prior old 1040 line numbers to make transition easier.

219:

Form 1040 must be signed and dated in order to be considered valid. If filing jointly with a spouse, both must sign and date. If a return is submitted electronically, individuals must use either a Self-Select PIN or Practitioner PIN.

856:

him. He appealed to the United States Court of Appeals for the Seventh Circuit, contending that the government's conduct against him had been "vexatious, frivolous, or in bad faith." and also raising the OMB Control Number Argument.

903:

800 (1% of $ 50,000 + 1% of $ (50,000 − 20,000)) in federal income tax. At the time (when the United States as a whole was much poorer) these higher taxes applied to fewer than 0.5% of the residents of the United States.

194:

file electronically on the taxpayer's behalf. Even the tax preparers who are not so required, must file Form 8948 if they choose paper filing, providing an explanation for why they are not filing electronically.

1311:

its rate schedule so that people can quickly compute their approximate tax liability, and lets people with incomes of over $ 100,000 compute their taxes directly using the Tax Computation Worksheet.

787:(a) Notwithstanding any other provision of law, no person shall be subject to any penalty for failing to comply with a collection of information that is subject to the requirements of this part if:

730:

taxes). If the taxpayer does choose to compute these, the computed penalty can be listed on the bottom margin of page 2 of the form, but should not be included on the amount due line (line 78).

800:(1) The collection of information does not display, in accordance with §1320.3(f) and §1320.5(b)(1), a currently valid OMB control number assigned by the Director in accordance with the Act...

1893:

97:

Form 1040 (or a variant thereof) is the main tax form filed by individuals who are deemed residents of the United States for tax purposes. The corresponding main form filed by businesses is

587:

Nonrefundable Credits - Former lines 48-55 that were moved from 1040 with those kept on 1040 omitted. Since 2019, this form is also used for non-refundable credits, obsoleting schedule 5.

2211:

2384:

299:(officially, the "Payment Voucher for Form 1040") is used as an optional payment voucher to be sent in along with a payment for any balance due on the "Amount you owe" line of the 1040.

75:

Form 1040 consists of two pages (23 lines in total), not counting attachments. The first page collects information about the taxpayer(s) and dependents. In particular, the taxpayer's

266:(officially, the "Amended U.S. Individual Tax Return") is used to make corrections on Form 1040, Form 1040A, and Form 1040EZ tax returns that have been previously filed (note: forms

2920:"More Time for Taxpayers: One-Month Extension in Filing Individual Income Tax Returns, Making Deadline April 15, Passes House Unit," The Wall Street Journal, Feb. 17, 1954, at 3.

961:

was introduced by the 1930s to simplify the filing process and discontinued after tax year 2017. It was limited to taxpayers with taxable income below $ 100,000 who take the

2259:

2359:

1341:

In 2008, 57.8 percent of tax returns were filed with assistance from paid tax preparers, compared to about 20 percent of taxpayers employing a paid preparer in the 1950s.

3267:

145:

website. Finalized versions of the forms for the tax year (which in the US is the same as the calendar year) are released near the end of January of the following year.

2554:

302:

The form is entirely optional. The IRS will accept payment without the 1040V form. However including the 1040-V allows the IRS to process payments more efficiently.

72:

Form 1040 can be obtained by filing Form 4868 (but that filing does not extend a taxpayer's required payment date if tax is owed; it must still be paid by Tax Day).

390:

income, and is required if either interest or dividends received during the tax year exceed $ 1,500 from all sources or if the filer had certain foreign accounts.

3030:

2431:

329:

435:

Is used to report income and expenses arising from the rental of real property, royalties, or from pass-through entities (like trusts, estates, partnerships, or

762:

914:

Form 1040 for the 1941 tax year: The basic layout and main entries are familiar, but there are more of them now and the Schedules letters have been reassigned

576:

Tax - Former lines 38-47 that were moved from 1040 with those kept on 1040 omitted. Since 2019, this form includes the contents of schedule 4, obsoleting it.

3262:

81:

1962:

2079:

1941:

2178:

2011:

2746:

2682:

The fact is, the number 1040 was simply the next number up in the system of sequential numbering of forms developed by the Bureau of Internal Revenue.

2587:

The OMB control number is in the upper right corner of page 1 of the form. The short forms, Form 1040A and Form 1040EZ, also bear OMB control numbers.

2054:

1884:

1742:

159:

The IRS accepts returns that are stapled or paperclipped together. However, any check or payment voucher, as well as accompanying Form 1040-V, must

976:

was used for tax years 1982–2017. Its use was limited to taxpayers with no dependents to claim, with taxable income below $ 100,000 who take the

2215:

59:

residents. The form calculates the total taxable income of the taxpayer and determines how much is to be paid to or refunded by the government.

755:

554:

Is used to calculate the self-employment tax owed on income from self-employment (such as on a Schedule C or Schedule F, or in a partnership).

236:

For filing the regular tax return, in addition to the standard Form 1040, there are currently three variants: the 1040-NR 1040-SR, and 1040-X.

137:

Paper filing is the universally accepted filing method. Form 1040, along with its variants, schedules, and instructions, can be downloaded as

2157:

988:

687:

1772:

739:

reference items from Form 1040. For example, California's 540 Resident Income Tax form makes a reference to Form 1040's line 37 in line 13.

1331:

675:

2976:

2954:

2304:

1732:"The Internal Revenue Service Is Not Adequately Protecting Taxpayer Data on Laptop Computers and Other Portable Electronic Media Devices"

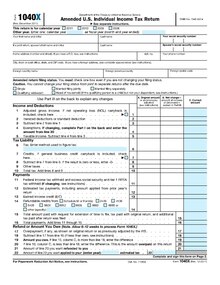

274:

were discontinued starting with tax year 2018, but a 1040X may still be filed amending one of these tax forms filed for previous years).

1014:

has documented the steady increase in complexity from a 34-line form in 1935 to a 79-line form in 2014, decreasing to 23 lines in 2018.

742:

Certain tax filing software, such as TurboTax, will simultaneously file state tax returns using information filled in on the 1040 form.

3002:

1307:

3224:

1335:

940:

2931:

704:

There is a three-year limit to when individuals can claim a tax refund. However, payments that are due must be paid immediately.

1975:

3216:

936:

2655:

2483:

1350:

1010:

The complexity and compliance burden of the form and its associated instructions have increased considerably since 1913. The

662:

609:(2018) Other Payments and Refundable Credits - Former lines 65-75 that were moved from 1040 with those kept on 1040 omitted.

3184:

565:

Additional Income and Adjustments to Income - Former lines 1-36 that were moved from 1040 with those kept on 1040 omitted.

228:

If an individual decides not to file a return, the IRS may (after it has sent several reminders) file a substitute return.

2237:

2182:

999:

951:

2781:

2281:

1963:

https://turbotax.intuit.com/tax-tips/irs-tax-forms/everything-to-know-about-the-1040-sr-form-for-filing-seniors/L10yEzLJf

1519:

3094:

2454:

2133:

1706:

1024:

showing the gradual changes to the structure and complexity of the form. The NTU table is below with data through 2014:

992:

2904:

1380:

845:

distributes to taxpayers. That this number has been constant since 1981 does not imply that OMB has shirked its duty."

1568:

1021:

3086:

2896:

1551:

620:(2018) Foreign Address and Third Party Designee. Since 2019, this is part of the header of the 1040, so is obsolete.

491:(Since 1995) Is used to report taxes owed due to the employment of household help. Previously these were reported on

1989:

1456:

633:

Is used to calculate the Child Tax Credit. (From 1998 to 2011 this was called Form 8812 rather than Schedule 8812.)

2816:

2105:

893:

529:

325:

666:

forms are used to substantiate claims of withholding, so only forms that involve withholding need to be attached.

2639:

How You Must Pay Your Income Tax: Treasury Issues Form 1,040, Which Individuals Must Fill Out and File by March 1

1916:

106:

3056:

2072:

3123:

3006:

2724:

2533:

2338:

1813:

1710:

1685:

1660:

1608:

1011:

658:

142:

138:

118:

710:

305:

Form 1040-V and any accompanying payment should be included in the same packet as the tax return, but should

2186:

2015:

766:

707:

In addition it is possible to apply one's refunds to next year's taxes and also to change one's mind later.

191:

180:

2754:

3257:

1731:

984:

477:

2695:

1604:

1681:

932:

increased in popularity, the IRS sent fewer packets via mail. In 2009 this practice was discontinued.

3150:

3061:

2504:

1838:

1016:

451:

259:

by the Bipartisan Budget Act of 2018, and it was first used for filing taxes for the 2019 tax year.

2260:"What if I chose to apply my federal refund to next year's taxes, filed, and later changed my mind?"

1431:

1976:"New Form 1040-SR, alternative filing option available for seniors | Internal Revenue Service"

947:

643:

598:(2018) Other Taxes - Former lines 57-64 that were moved from 1040 with those kept on 1040 omitted.

406:

859:

The United States Court of Appeals for the Seventh Circuit rejected the OMB argument stating that

977:

966:

962:

651:

647:

364:

360:

352:

Lines where schedule is referenced or needed in Form 1040 or associated numbered schedule (2021)

163:

be stapled or paperclipped with the rest of the return, since payments are processed separately.

3220:

3188:

2409:

3210:

190:

Many paid tax preparers are required to file individual tax returns electronically, and most

3031:"Tax Reform Bill Made Modest Progress Toward Simplification, But Significant Hurdles Remain"

2670:

1883:

2871:

1860:

117:

return in order to receive a refund on withheld income or to receive certain credits (e.g.

2786:

2432:"Where is payment for failure-to-file and failure-to-pay penalties included on Form 1040?"

1406:

1324:

110:

946:

The tax return deadline was original set at March 1. This was changed to March 15 in the

309:

be stapled or paper-clipped along with the tax return, since it is processed separately.

208:, but now e-filing with reputable companies is considered more secure than paper filing.

152:

The only parts of the form that cannot be filled electronically are the signature lines.

2153:

2750:

987:, and starting 1992, taxpayers who owed money were allowed to file electronically. The

436:

205:

719:

taxes, if an individual has paid all their taxes, there is no penalty for not filing.

186:

One can use a tax professional who has been accepted by the IRS for electronic filing.

3251:

699:

492:

368:

76:

56:

48:

3242:

983:

Electronic filing was introduced in a limited form in 1986, with the passage of the

3145:

2812:

1777:

476:(Until 1986) Was used for income averaging over four years until eliminated by the

421:

171:

The IRS allows US residents for tax purposes to file electronically in three ways:

2674:

2388:

2334:

1457:"Filing Season Statistics for Week Ending May 10, 2019 | Internal Revenue Service"

517:(Until 2010) was used to figure an increased standard deduction in certain cases.

363:

against income; instead of filling out Schedule A, taxpayers may choose to take a

1799:

642:

In 2014 there were two additions to Form 1040 due to the implementation of the

251:

is used by taxpayers who are considered "non-resident aliens" for tax purposes.

2638:

2476:

1942:"If you don't file a tax return, when will the IRS file a "substitute return"?"

923:

878:

32:

3116:

2126:

2040:

2036:

1508:

910:

628:

52:

714:

Considering whether to file an extension for the 2010 tax year with Form 4868

2608:, 507 F.3d 1092, 2007-2 U.S. Tax Cas. (CCH) paragr. 50,806 (7th Cir. 2007),

1920:

1656:

1634:

1481:

1369:

98:

3212:

Learning to Love Form 1040: Two Cheers for the Return-Based Mass Income Tax

2717:

2529:

1544:

17:

1590:

1027:

287:

3171:

2558:

2508:

2363:

680:

387:

383:

183:

approved by the IRS and have the software file the return electronically.

239:

3172:

Tax Policy: Summary of Estimates of the Costs of the Federal Tax System

2854:(rev. Feb. 2007), Internal Revenue Service, U.S. Dep't of the Treasury.

723:

367:

of between $ 6,300 and $ 12,600 (for tax year 2015), depending on age,

63:

2625:, United States Court of Appeals for the Seventh Circuit, No. 06-3205.

2932:"Tax History: The Love-Hate Relationship With the Standard Deduction"

2596:

919 F.2d 34, 90-2 U.S. Tax Cas. (CCH) paragr. 50,575 (6th Cir. 1990).

2309:

1741:. Treasury Inspector General for Tax Administration. March 23, 2007.

722:

In addition to making sure that one pays one's taxes for the year by

405:

Lists income and expenses related to self-employment, and is used by

62:

Income tax returns for individual calendar-year taxpayers are due by

2212:"IRS Penalties for Not Filing a Tax Return or Not Paying Taxes Owed"

1026:

922:

909:

877:

709:

286:

238:

31:

2830:

995:, started in 1996 and allowed people to make estimated payments.

543:

Is used to calculate the Credit for the Elderly or the Disabled.

506:

Is used when averaging farm income over a period of three years.

907:

Just over 350,000 forms were filed in 1914 and all were audited.

772:

The relevant clauses of the Paperwork Reduction Act state that:

36:

U.S. Individual Income Tax Return Form 1040 for fiscal year 2021

1707:"Form 8948, Preparer Explanation for Not Filing Electronically"

896:

estimates the corresponding amount in 2015 dollars as $ 71,920.

2944:

Apparently gives date as 1941, which is evidently not correct.

2073:"Forms & Attachments Listing 1040/1040SSPR/1040-A/1040-EZ"

1773:"Inspectors: IRS lost 490 laptops, many with unencrypted data"

1432:"IRS efile Tax Return and Refund Statistics for All Tax Years"

318:

the taxpayer. For 2009 and 2010 there was an additional form,

1605:"Where to File Addresses for Taxpayers and Tax Professionals"

1545:"U.S. Tax Guide for Aliens For use in preparing 2014 Returns"

2055:"IRS Commissioner Predicts Miserable 2015 Tax Filing Season"

3146:"Check your US tax rate for 2012—and every year since 1913"

3057:"Line for line, US income taxes are more complex than ever"

3003:"A Complex Problem: The Compliance Burdens of the Tax Code"

2977:"What's the difference between IRS Forms 1040EZ and 1040A?"

2106:"Do You Need to Attach 1099 Forms to a Federal Tax Return?"

2335:"IRS Publication 505, Chapter 1. Tax Withholding for 2015"

465:

Is used to report income and expenses related to farming.

823:

Cases involving the OMB Control Number Argument include:

2866:

2864:

2862:

2860:

2360:"Estimated Taxes: How to Determine What to Pay and When"

2807:

2805:

2477:"2015 Form 540 - California Resident Income Tax Return"

2305:"Adjusting Your Withholding and Estimated Tax Payments"

2282:"Eight Facts on Late Filing and Late Payment Penalties"

101:, also called the U.S. Corporation Income Tax Return.

450:

Is used to document a taxpayer's eligibility for the

2621:Judgment, page 2, docket entry 39, March 26, 2007,

371:, and whether the taxpayer and/or spouse is blind.

179:It is possible to prepare one's tax return using a

2555:"How to Claim State Taxes on a Federal Tax Return"

2206:

2204:

2127:"Form 1040-ES 2015: Estimated Tax for Individuals"

899:The base income tax rate on taxable income was 1%.

129:The form may be filed either by paper or online.

2633:

2631:

2238:"How do I apply my refund to next year's taxes?"

1407:"The real story behind the $ 3 tax checkoff box"

3185:"Why do low-income families use tax preparers?"

3081:

3079:

2078:. Internal Revenue Service. September 5, 2014.

1503:

1501:

1482:"Form 1120, U.S. Corporation Income Tax Return"

3087:"When tax complexity puts dinner on the table"

2148:

2146:

1917:"What Are The Penalties For Not Filing Taxes?"

1591:"Form 1040, U.S. Individual Income Tax Return"

330:American Recovery and Reinvestment Act of 2009

2782:"History Of The 1040 Form Runs Only 80 Years"

2455:"States With No Income Tax: Better or Worse?"

1944:. Personal Finance & Money Stack Exchange

939:, income tax withholding was introduced. The

8:

3174:by the U.S. Government Accountability Office

2891:

2889:

2718:"Return of Annual Net Income of Individuals"

1885:"If You Don't File, Beware the Ghost Return"

1863:. Internal Revenue Service. November 6, 2014

1814:"Is It Safe To File Your Tax Return Online?"

1635:"Form 1040-V, Payment Voucher for Form 1040"

82:presidential election campaign fund checkoff

2154:"Welcome to EFTPS - Help & Information"

1682:"Free File: Do Your Federal Taxes for Free"

3025:

3023:

2776:

2774:

2772:

2329:

2327:

2284:. Internal Revenue Service. April 18, 2013

1629:

1627:

1625:

1034:

532:(6.2% earned income credit, up to $ 400).

2831:"True Origin of the 1040 Income Tax Form"

2747:"1913 Internal Revenue Service 1040 Form"

1882:Delafuente, Charles (February 11, 2012).

943:created standard deductions on the 1040.

686:Estimated payments can be made using the

424:and losses incurred during the tax year.

3268:1913 establishments in the United States

2179:"Frequently asked questions about EFTPS"

342:

2612:, 552 U.S. ___, 128 S. Ct. 1721 (2008).

1915:Morrow, Stephanie (September 1, 2009).

1361:

2996:

2994:

1748:from the original on November 29, 2011

1386:from the original on September 4, 2019

756:Tax protester administrative arguments

528:(2009 and 2010) was used to claim the

3055:Yanofsky, David (December 13, 2012).

3001:Tasselmyer, Michael (April 8, 2015).

2158:Electronic Federal Tax Payment System

1047:Pages, Form 1040 Instruction Booklet

989:Electronic Federal Tax Payment System

874:Original form structure and tax rates

688:Electronic Federal Tax Payment System

7:

2012:"Schedule L and Schedule M are gone"

1896:from the original on January 2, 2022

1525:from the original on August 31, 2019

3263:Personal taxes in the United States

2663:SOI Bulletin (Statistics of Income)

2656:"80 Years of Income Tax Statistics"

2053:Ashlea Ebeling (November 4, 2014).

1006:Changes to complexity and tax rates

734:Relationship with state tax returns

2872:"Historical Highlights of the IRS"

2139:from the original on May 31, 2004.

2085:from the original on March 5, 2016

1861:"Signing an Electronic Tax Return"

1557:from the original on June 6, 2003.

1325:Tax preparation § Controversy

670:Estimated payments and withholding

25:

2694:Jonnelle Marte (April 15, 2015).

2303:Blankenship, Jim (May 17, 2011).

1330:US (1.2 million) than there were

991:, jointly managed by the IRS and

980:instead of itemizing deductions.

941:Individual Income Tax Act of 1944

45:U.S. Individual Income Tax Return

3144:King, Ritchie (April 14, 2013).

1771:Anderson, Nate (April 6, 2007).

1657:"E-File Options for Individuals"

882:Form 1040A for the 1937 tax year

694:Payments, refunds, and penalties

291:Form 1040-V payment voucher form

3217:The University of Chicago Press

2905:Why Tax Day Is Usually April 15

2530:"Tax Topics - Deductible Taxes"

2385:"Underpayment of Estimated Tax"

937:Current Tax Payment Act of 1943

763:Office of Management and Budget

2753:. January 2005. Archived from

2484:California Franchise Tax Board

2014:. Bankrate.com. Archived from

1351:List of countries by tax rates

750:OMB control number controversy

663:Social Security Administration

1:

2955:"What is the IRS 1040A Form?"

2183:Bethpage Federal Credit Union

1800:"Common Myths About E-filing"

1569:"Aliens - Which Form to File"

1000:Tax Cuts and Jobs Act of 2017

952:Internal Revenue Code of 1954

361:Itemizes allowable deductions

3095:George Washington University

2696:"100 years of tax form 1040"

2505:"Frequently Asked Questions"

2132:. Internal Revenue Service.

1550:. Internal Revenue Service.

1518:. Internal Revenue Service.

993:Financial Management Service

2852:IRS Historical Tax Products

2214:. efile.com. Archived from

778:§ 1320.6 Public protection.

3284:

2874:. Internal Revenue Service

2817:Bureau of Labor Statistics

2412:. Internal Revenue Service

1990:"What is IRS Form 1040-V?"

1841:. Internal Revenue Service

1637:. Internal Revenue Service

1571:. Internal Revenue Service

1322:

894:Bureau of Labor Statistics

753:

697:

657:In most situations, other

530:Making Work Pay tax credit

51:used for personal federal

3243:2021 version of Form 1040

3209:Lawrence Zelenak (2013).

2623:United States v. Lawrence

2606:United States v. Patridge

2434:. money.stackexchange.com

927:Form 1040A, 2015 tax year

850:United States v. Lawrence

839:United States v. Patridge

313:Schedules and extra forms

107:Substantial Presence Test

3124:Internal Revenue Service

3035:National Taxpayers Union

3007:National Taxpayers Union

2897:Why Is Tax Day April 15?

2850:See Publication 1796-A,

2725:Internal Revenue Service

2645:. January 6, 1914. p. 3.

2534:Internal Revenue Service

2339:Internal Revenue Service

1711:Internal Revenue Service

1686:Internal Revenue Service

1661:Internal Revenue Service

1609:Internal Revenue Service

1509:"1040 Instructions 2018"

1377:Internal Revenue Service

1332:law enforcement officers

1012:National Taxpayers Union

998:With the passage of the

659:Internal Revenue Service

143:Internal Revenue Service

119:earned income tax credit

1759:employee personnel data

892:calculator used by the

828:United States v. Wunder

767:Paperwork Reduction Act

192:tax compliance software

181:tax compliance software

2813:"Inflation Calculator"

1032:

985:Tax Reform Act of 1986

928:

915:

883:

866:

820:to file or pay taxes.

715:

674:For most individuals,

478:Tax Reform Act of 1986

292:

244:

37:

2934:. Tax History Project

2930:Thorndike, Joseph J.

2578:5 C.F.R. sec. 1320.6.

1030:

926:

913:

881:

861:

713:

290:

278:Accompanying payments

242:

215:Signature requirement

35:

2218:on December 20, 2015

1839:"Taxpayer Signature"

1020:created an animated

967:itemizing deductions

452:Earned Income Credit

2895:Joseph Thorndike, "

2757:on November 1, 2015

1334:(765 thousand) and

948:Revenue Act of 1918

644:Affordable Care Act

420:Is used to compute

328:" provision of the

88:Filing requirements

3091:Face the Facts USA

2643:The New York Times

1890:The New York Times

1370:"Form 1040 (2018)"

1033:

978:standard deduction

963:standard deduction

929:

919:Subsequent changes

916:

884:

716:

652:individual mandate

648:premium tax credit

365:standard deduction

332:("the stimulus").

293:

245:

43:, officially, the

38:

3189:Tax Policy Center

3117:"Tax Tables 2014"

3097:. August 15, 2012

2727:. October 3, 1913

2680:on May 17, 2017.

2189:on March 29, 2014

1303:

1302:

1031:Form 1040EZ, 2011

640:

639:

224:Substitute return

167:Electronic filing

125:Filing modalities

55:returns filed by

16:(Redirected from

3275:

3231:

3230:

3206:

3200:

3199:

3197:

3195:

3181:

3175:

3169:

3163:

3162:

3160:

3158:

3141:

3135:

3134:

3132:

3130:

3121:

3113:

3107:

3106:

3104:

3102:

3083:

3074:

3073:

3071:

3069:

3052:

3046:

3045:

3043:

3041:

3027:

3018:

3017:

3015:

3013:

2998:

2989:

2988:

2986:

2984:

2973:

2967:

2966:

2964:

2962:

2951:

2945:

2943:

2941:

2939:

2927:

2921:

2918:

2912:

2893:

2884:

2883:

2881:

2879:

2868:

2855:

2848:

2842:

2841:

2839:

2837:

2827:

2821:

2820:

2809:

2800:

2799:

2797:

2795:

2790:. March 27, 1994

2778:

2767:

2766:

2764:

2762:

2743:

2737:

2736:

2734:

2732:

2722:

2714:

2708:

2707:

2705:

2703:

2691:

2685:

2684:

2679:

2673:. Archived from

2660:

2652:

2646:

2635:

2626:

2619:

2613:

2603:

2597:

2594:

2588:

2585:

2579:

2576:

2570:

2569:

2567:

2565:

2551:

2545:

2544:

2542:

2540:

2526:

2520:

2519:

2517:

2515:

2501:

2495:

2494:

2492:

2490:

2481:

2473:

2467:

2466:

2464:

2462:

2450:

2444:

2443:

2441:

2439:

2428:

2422:

2421:

2419:

2417:

2406:

2400:

2399:

2397:

2395:

2381:

2375:

2374:

2372:

2370:

2356:

2350:

2349:

2347:

2345:

2331:

2322:

2321:

2319:

2317:

2300:

2294:

2293:

2291:

2289:

2278:

2272:

2271:

2269:

2267:

2256:

2250:

2249:

2247:

2245:

2234:

2228:

2227:

2225:

2223:

2208:

2199:

2198:

2196:

2194:

2185:. Archived from

2175:

2169:

2168:

2166:

2164:

2150:

2141:

2140:

2138:

2131:

2123:

2117:

2116:

2114:

2112:

2101:

2095:

2094:

2092:

2090:

2084:

2077:

2069:

2063:

2062:

2050:

2044:

2034:

2028:

2027:

2025:

2023:

2008:

2002:

2001:

1999:

1997:

1986:

1980:

1979:

1972:

1966:

1960:

1954:

1953:

1951:

1949:

1938:

1932:

1931:

1929:

1927:

1912:

1906:

1905:

1903:

1901:

1887:

1879:

1873:

1872:

1870:

1868:

1857:

1851:

1850:

1848:

1846:

1835:

1829:

1828:

1826:

1824:

1810:

1804:

1803:

1796:

1790:

1789:

1787:

1785:

1768:

1762:

1761:

1755:

1753:

1747:

1736:

1728:

1722:

1721:

1719:

1717:

1703:

1697:

1696:

1694:

1692:

1678:

1672:

1671:

1669:

1667:

1653:

1647:

1646:

1644:

1642:

1631:

1620:

1619:

1617:

1615:

1601:

1595:

1594:

1587:

1581:

1580:

1578:

1576:

1565:

1559:

1558:

1556:

1549:

1541:

1535:

1534:

1532:

1530:

1524:

1513:

1505:

1496:

1495:

1493:

1491:

1486:

1478:

1472:

1471:

1469:

1467:

1453:

1447:

1446:

1444:

1442:

1428:

1422:

1421:

1419:

1417:

1402:

1396:

1395:

1393:

1391:

1385:

1374:

1366:

1044:Pages, Form 1040

1041:Lines, Form 1040

1035:

746:property taxes.

407:sole proprietors

402:

401:

343:

323:

322:

243:Form 1040X, 2011

21:

3283:

3282:

3278:

3277:

3276:

3274:

3273:

3272:

3248:

3247:

3239:

3234:

3227:

3208:

3207:

3203:

3193:

3191:

3183:

3182:

3178:

3170:

3166:

3156:

3154:

3143:

3142:

3138:

3128:

3126:

3119:

3115:

3114:

3110:

3100:

3098:

3085:

3084:

3077:

3067:

3065:

3054:

3053:

3049:

3039:

3037:

3029:

3028:

3021:

3011:

3009:

3000:

2999:

2992:

2982:

2980:

2975:

2974:

2970:

2960:

2958:

2953:

2952:

2948:

2937:

2935:

2929:

2928:

2924:

2919:

2915:

2894:

2887:

2877:

2875:

2870:

2869:

2858:

2849:

2845:

2835:

2833:

2829:

2828:

2824:

2811:

2810:

2803:

2793:

2791:

2787:Chicago Tribune

2780:

2779:

2770:

2760:

2758:

2745:

2744:

2740:

2730:

2728:

2720:

2716:

2715:

2711:

2701:

2699:

2693:

2692:

2688:

2677:

2658:

2654:

2653:

2649:

2636:

2629:

2620:

2616:

2604:

2600:

2595:

2591:

2586:

2582:

2577:

2573:

2563:

2561:

2553:

2552:

2548:

2538:

2536:

2528:

2527:

2523:

2513:

2511:

2503:

2502:

2498:

2488:

2486:

2479:

2475:

2474:

2470:

2460:

2458:

2452:

2451:

2447:

2437:

2435:

2430:

2429:

2425:

2415:

2413:

2408:

2407:

2403:

2393:

2391:

2383:

2382:

2378:

2368:

2366:

2358:

2357:

2353:

2343:

2341:

2333:

2332:

2325:

2315:

2313:

2302:

2301:

2297:

2287:

2285:

2280:

2279:

2275:

2265:

2263:

2258:

2257:

2253:

2243:

2241:

2236:

2235:

2231:

2221:

2219:

2210:

2209:

2202:

2192:

2190:

2177:

2176:

2172:

2162:

2160:

2152:

2151:

2144:

2136:

2129:

2125:

2124:

2120:

2110:

2108:

2103:

2102:

2098:

2088:

2086:

2082:

2075:

2071:

2070:

2066:

2052:

2051:

2047:

2035:

2031:

2021:

2019:

2018:on May 24, 2013

2010:

2009:

2005:

1995:

1993:

1988:

1987:

1983:

1974:

1973:

1969:

1961:

1957:

1947:

1945:

1940:

1939:

1935:

1925:

1923:

1914:

1913:

1909:

1899:

1897:

1881:

1880:

1876:

1866:

1864:

1859:

1858:

1854:

1844:

1842:

1837:

1836:

1832:

1822:

1820:

1812:

1811:

1807:

1798:

1797:

1793:

1783:

1781:

1770:

1769:

1765:

1751:

1749:

1745:

1734:

1730:

1729:

1725:

1715:

1713:

1705:

1704:

1700:

1690:

1688:

1680:

1679:

1675:

1665:

1663:

1655:

1654:

1650:

1640:

1638:

1633:

1632:

1623:

1613:

1611:

1603:

1602:

1598:

1589:

1588:

1584:

1574:

1572:

1567:

1566:

1562:

1554:

1547:

1543:

1542:

1538:

1528:

1526:

1522:

1511:

1507:

1506:

1499:

1489:

1487:

1484:

1480:

1479:

1475:

1465:

1463:

1455:

1454:

1450:

1440:

1438:

1430:

1429:

1425:

1415:

1413:

1404:

1403:

1399:

1389:

1387:

1383:

1372:

1368:

1367:

1363:

1359:

1347:

1327:

1321:

1008:

921:

876:

871:

758:

752:

736:

702:

696:

672:

546:Sch. 3 line 6d

399:

398:

326:Making Work Pay

320:

319:

315:

285:

280:

234:

226:

217:

211:

201:

169:

135:

127:

111:Green Card Test

95:

90:

28:

23:

22:

15:

12:

11:

5:

3281:

3279:

3271:

3270:

3265:

3260:

3250:

3249:

3246:

3245:

3238:

3237:External links

3235:

3233:

3232:

3225:

3201:

3176:

3164:

3136:

3108:

3075:

3047:

3019:

2990:

2979:. Investopedia

2968:

2946:

2922:

2913:

2885:

2856:

2843:

2822:

2801:

2768:

2751:Tax Foundation

2738:

2709:

2686:

2647:

2627:

2614:

2598:

2589:

2580:

2571:

2546:

2521:

2496:

2468:

2445:

2423:

2401:

2376:

2351:

2323:

2295:

2273:

2251:

2229:

2200:

2170:

2142:

2118:

2104:Smith, Naomi.

2096:

2064:

2045:

2029:

2003:

1981:

1967:

1955:

1933:

1907:

1874:

1852:

1830:

1805:

1791:

1763:

1723:

1698:

1673:

1648:

1621:

1596:

1582:

1560:

1536:

1497:

1473:

1448:

1423:

1405:Ellis, Blake.

1397:

1360:

1358:

1355:

1354:

1353:

1346:

1343:

1323:Main article:

1320:

1319:Cost of filing

1317:

1301:

1300:

1297:

1294:

1291:

1287:

1286:

1283:

1280:

1277:

1273:

1272:

1269:

1266:

1263:

1259:

1258:

1255:

1252:

1249:

1245:

1244:

1241:

1238:

1235:

1231:

1230:

1227:

1224:

1221:

1217:

1216:

1213:

1210:

1207:

1203:

1202:

1199:

1196:

1193:

1189:

1188:

1185:

1182:

1179:

1175:

1174:

1171:

1168:

1165:

1161:

1160:

1157:

1154:

1151:

1147:

1146:

1143:

1140:

1137:

1133:

1132:

1129:

1126:

1123:

1119:

1118:

1115:

1112:

1109:

1105:

1104:

1101:

1098:

1095:

1091:

1090:

1087:

1084:

1081:

1077:

1076:

1073:

1070:

1067:

1063:

1062:

1059:

1056:

1053:

1049:

1048:

1045:

1042:

1039:

1007:

1004:

920:

917:

905:

904:

900:

897:

875:

872:

870:

867:

853:

852:

842:

841:

831:

830:

817:

816:

815:

814:

808:

807:

806:

805:

804:

803:

802:

801:

791:

790:

789:

788:

782:

781:

780:

779:

754:Main article:

751:

748:

735:

732:

698:Main article:

695:

692:

671:

668:

638:

637:

634:

631:

625:

624:

621:

618:

614:

613:

610:

607:

603:

602:

599:

596:

592:

591:

588:

585:

581:

580:

577:

574:

570:

569:

566:

563:

559:

558:

557:Sch. 2 line 4

555:

552:

548:

547:

544:

541:

537:

536:

533:

526:

522:

521:

518:

515:

511:

510:

507:

504:

500:

499:

498:Sch. 2 line 9

496:

489:

485:

484:

481:

474:

470:

469:

468:Sch. 1 line 6

466:

463:

459:

458:

455:

448:

444:

443:

442:Sch. 1 line 5

440:

437:S corporations

433:

429:

428:

425:

418:

414:

413:

412:Sch. 1 line 3

410:

403:

395:

394:

391:

380:

376:

375:

372:

358:

354:

353:

350:

347:

324:, due to the "

314:

311:

284:

281:

279:

276:

233:

230:

225:

222:

216:

213:

206:identity theft

200:

197:

188:

187:

184:

177:

168:

165:

134:

131:

126:

123:

94:

93:Who must file?

91:

89:

86:

27:IRS tax record

26:

24:

14:

13:

10:

9:

6:

4:

3:

2:

3280:

3269:

3266:

3264:

3261:

3259:

3258:IRS tax forms

3256:

3255:

3253:

3244:

3241:

3240:

3236:

3228:

3226:9780226019086

3222:

3218:

3214:

3213:

3205:

3202:

3194:September 16,

3190:

3186:

3180:

3177:

3173:

3168:

3165:

3153:

3152:

3147:

3140:

3137:

3125:

3118:

3112:

3109:

3096:

3092:

3088:

3082:

3080:

3076:

3064:

3063:

3058:

3051:

3048:

3036:

3032:

3026:

3024:

3020:

3008:

3004:

2997:

2995:

2991:

2978:

2972:

2969:

2956:

2950:

2947:

2933:

2926:

2923:

2917:

2914:

2910:

2906:

2902:

2898:

2892:

2890:

2886:

2873:

2867:

2865:

2863:

2861:

2857:

2853:

2847:

2844:

2832:

2826:

2823:

2818:

2814:

2808:

2806:

2802:

2789:

2788:

2783:

2777:

2775:

2773:

2769:

2756:

2752:

2748:

2742:

2739:

2726:

2719:

2713:

2710:

2698:. MarketWatch

2697:

2690:

2687:

2683:

2676:

2672:

2668:

2664:

2657:

2651:

2648:

2644:

2640:

2634:

2632:

2628:

2624:

2618:

2615:

2611:

2607:

2602:

2599:

2593:

2590:

2584:

2581:

2575:

2572:

2560:

2556:

2550:

2547:

2535:

2531:

2525:

2522:

2510:

2506:

2500:

2497:

2485:

2478:

2472:

2469:

2456:

2449:

2446:

2433:

2427:

2424:

2411:

2410:"1040 (2015)"

2405:

2402:

2390:

2389:H&R Block

2386:

2380:

2377:

2365:

2361:

2355:

2352:

2340:

2336:

2330:

2328:

2324:

2312:

2311:

2306:

2299:

2296:

2283:

2277:

2274:

2261:

2255:

2252:

2239:

2233:

2230:

2217:

2213:

2207:

2205:

2201:

2188:

2184:

2180:

2174:

2171:

2159:

2155:

2149:

2147:

2143:

2135:

2128:

2122:

2119:

2107:

2100:

2097:

2081:

2074:

2068:

2065:

2060:

2056:

2049:

2046:

2042:

2038:

2033:

2030:

2017:

2013:

2007:

2004:

1991:

1985:

1982:

1977:

1971:

1968:

1964:

1959:

1956:

1943:

1937:

1934:

1922:

1918:

1911:

1908:

1895:

1891:

1886:

1878:

1875:

1862:

1856:

1853:

1840:

1834:

1831:

1819:

1815:

1809:

1806:

1801:

1795:

1792:

1780:

1779:

1774:

1767:

1764:

1760:

1744:

1740:

1733:

1727:

1724:

1712:

1708:

1702:

1699:

1687:

1683:

1677:

1674:

1662:

1658:

1652:

1649:

1636:

1630:

1628:

1626:

1622:

1610:

1606:

1600:

1597:

1592:

1586:

1583:

1570:

1564:

1561:

1553:

1546:

1540:

1537:

1521:

1517:

1510:

1504:

1502:

1498:

1483:

1477:

1474:

1462:

1458:

1452:

1449:

1437:

1436:www.efile.com

1433:

1427:

1424:

1412:

1408:

1401:

1398:

1382:

1378:

1371:

1365:

1362:

1356:

1352:

1349:

1348:

1344:

1342:

1339:

1337:

1333:

1326:

1318:

1316:

1312:

1309:

1308:rate schedule

1298:

1295:

1292:

1289:

1288:

1284:

1281:

1278:

1275:

1274:

1270:

1267:

1264:

1261:

1260:

1256:

1253:

1250:

1247:

1246:

1242:

1239:

1236:

1233:

1232:

1228:

1225:

1222:

1219:

1218:

1214:

1211:

1208:

1205:

1204:

1200:

1197:

1194:

1191:

1190:

1186:

1183:

1180:

1177:

1176:

1172:

1169:

1166:

1163:

1162:

1158:

1155:

1152:

1149:

1148:

1144:

1141:

1138:

1135:

1134:

1130:

1127:

1124:

1121:

1120:

1116:

1113:

1110:

1107:

1106:

1102:

1099:

1096:

1093:

1092:

1088:

1085:

1082:

1079:

1078:

1074:

1071:

1068:

1065:

1064:

1060:

1057:

1054:

1051:

1050:

1046:

1043:

1040:

1037:

1036:

1029:

1025:

1023:

1019:

1018:

1013:

1005:

1003:

1001:

996:

994:

990:

986:

981:

979:

975:

970:

968:

964:

960:

955:

953:

950:, and in the

949:

944:

942:

938:

933:

925:

918:

912:

908:

901:

898:

895:

890:

889:

888:

880:

873:

868:

865:

860:

857:

851:

848:

847:

846:

840:

837:

836:

835:

829:

826:

825:

824:

821:

812:

811:

810:

809:

799:

798:

797:

796:

795:

794:

793:

792:

786:

785:

784:

783:

777:

776:

775:

774:

773:

770:

768:

764:

757:

749:

747:

743:

740:

733:

731:

727:

725:

720:

712:

708:

705:

701:

700:IRS penalties

693:

691:

689:

684:

682:

677:

669:

667:

664:

660:

655:

653:

649:

645:

635:

632:

630:

629:Schedule 8812

627:

626:

622:

619:

616:

615:

611:

608:

605:

604:

600:

597:

594:

593:

589:

586:

583:

582:

578:

575:

572:

571:

567:

564:

561:

560:

556:

553:

550:

549:

545:

542:

539:

538:

534:

531:

527:

524:

523:

519:

516:

513:

512:

508:

505:

502:

501:

497:

494:

490:

487:

486:

482:

479:

475:

472:

471:

467:

464:

461:

460:

456:

453:

449:

447:Schedule EIC

446:

445:

441:

438:

434:

431:

430:

426:

423:

422:capital gains

419:

416:

415:

411:

408:

404:

397:

396:

392:

389:

385:

381:

378:

377:

373:

370:

369:filing status

366:

362:

359:

356:

355:

351:

348:

345:

344:

341:

337:

333:

331:

327:

312:

310:

308:

303:

300:

298:

289:

282:

277:

275:

273:

269:

265:

260:

257:

252:

250:

241:

237:

231:

229:

223:

221:

214:

212:

209:

207:

198:

196:

193:

185:

182:

178:

174:

173:

172:

166:

164:

162:

157:

153:

150:

146:

144:

140:

132:

130:

124:

122:

120:

114:

112:

108:

102:

100:

92:

87:

85:

83:

78:

77:filing status

73:

71:

70:

65:

60:

58:

57:United States

54:

50:

46:

42:

34:

30:

19:

3211:

3204:

3192:. Retrieved

3179:

3167:

3155:. Retrieved

3149:

3139:

3127:. Retrieved

3111:

3099:. Retrieved

3090:

3066:. Retrieved

3060:

3050:

3040:September 8,

3038:. Retrieved

3034:

3010:. Retrieved

2983:December 31,

2981:. Retrieved

2971:

2961:December 31,

2959:. Retrieved

2949:

2938:December 31,

2936:. Retrieved

2925:

2916:

2908:

2900:

2878:December 31,

2876:. Retrieved

2851:

2846:

2834:. Retrieved

2825:

2792:. Retrieved

2785:

2759:. Retrieved

2755:the original

2741:

2729:. Retrieved

2712:

2700:. Retrieved

2689:

2681:

2675:the original

2666:

2662:

2650:

2642:

2622:

2617:

2610:cert. denied

2609:

2605:

2601:

2592:

2583:

2574:

2562:. Retrieved

2549:

2537:. Retrieved

2524:

2512:. Retrieved

2499:

2487:. Retrieved

2471:

2459:. Retrieved

2453:Chris Khan.

2448:

2436:. Retrieved

2426:

2414:. Retrieved

2404:

2392:. Retrieved

2379:

2367:. Retrieved

2354:

2342:. Retrieved

2314:. Retrieved

2308:

2298:

2288:December 31,

2286:. Retrieved

2276:

2266:December 31,

2264:. Retrieved

2254:

2244:December 31,

2242:. Retrieved

2232:

2222:December 31,

2220:. Retrieved

2216:the original

2191:. Retrieved

2187:the original

2173:

2161:. Retrieved

2121:

2109:. Retrieved

2099:

2089:December 31,

2087:. Retrieved

2067:

2058:

2048:

2041:Instructions

2032:

2020:. Retrieved

2016:the original

2006:

1994:. Retrieved

1984:

1970:

1958:

1946:. Retrieved

1936:

1924:. Retrieved

1910:

1898:. Retrieved

1889:

1877:

1865:. Retrieved

1855:

1843:. Retrieved

1833:

1821:. Retrieved

1817:

1808:

1794:

1782:. Retrieved

1778:Ars Technica

1776:

1766:

1757:

1750:. Retrieved

1739:Treasury.gov

1738:

1726:

1714:. Retrieved

1701:

1689:. Retrieved

1676:

1664:. Retrieved

1651:

1639:. Retrieved

1612:. Retrieved

1599:

1585:

1575:December 31,

1573:. Retrieved

1563:

1539:

1529:September 7,

1527:. Retrieved

1515:

1488:. Retrieved

1476:

1466:September 8,

1464:. Retrieved

1460:

1451:

1441:September 8,

1439:. Retrieved

1435:

1426:

1414:. Retrieved

1410:

1400:

1390:September 7,

1388:. Retrieved

1376:

1364:

1340:

1336:firefighters

1328:

1313:

1304:

1015:

1009:

997:

982:

973:

971:

958:

956:

945:

934:

930:

906:

885:

862:

858:

854:

849:

843:

838:

832:

827:

822:

818:

771:

759:

744:

741:

737:

728:

721:

717:

706:

703:

685:

673:

656:

641:

551:Schedule SE

338:

334:

316:

306:

304:

301:

296:

294:

271:

267:

263:

261:

255:

253:

248:

246:

235:

227:

218:

210:

202:

189:

170:

160:

158:

154:

151:

147:

136:

133:Paper filing

128:

115:

103:

96:

74:

68:

67:

61:

49:IRS tax form

44:

40:

39:

29:

2901:taxanalysts

1823:October 12,

1818:The Balance

1691:January 10,

1461:www.irs.gov

1416:February 6,

965:instead of

676:withholding

617:Schedule 6

606:Schedule 5

595:Schedule 4

584:Schedule 3

573:Schedule 2

562:Schedule 1

540:Schedule R

525:Schedule M

514:Schedule L

503:Schedule J

488:Schedule H

473:Schedule G

462:Schedule F

432:Schedule E

417:Schedule D

382:Enumerates

379:Schedule B

357:Schedule A

349:Explanation

283:Form 1040-V

18:Form 1040EZ

3252:Categories

3157:January 1,

3129:January 1,

3101:August 27,

3068:January 1,

3012:January 1,

2957:. TurboTax

2836:January 1,

2761:January 1,

2731:January 1,

2457:. Bankrate

2394:January 1,

2369:January 1,

2344:January 1,

2316:January 1,

2262:. TurboTax

2240:. TurboTax

2111:January 1,

2037:Schedule M

1992:. TurboTax

1926:January 1,

1900:January 1,

1867:January 1,

1845:January 1,

1716:January 7,

1666:January 1,

1614:January 1,

1490:January 1,

1357:References

765:under the

400:Schedule C

321:Schedule M

199:Comparison

53:income tax

2193:April 14,

2163:April 14,

2022:March 10,

1921:LegalZoom

1784:August 2,

1752:August 2,

1411:CNN Money

935:With the

141:from the

99:Form 1120

41:Form 1040

2794:July 31,

2702:July 31,

2559:TurboTax

2514:June 18,

2509:TurboTax

2489:June 18,

2438:June 28,

2416:June 28,

2364:TurboTax

2134:Archived

2080:Archived

1996:June 18,

1894:Archived

1743:Archived

1641:June 18,

1552:Archived

1520:Archived

1381:Archived

1345:See also

1038:Tax year

681:Form W-4

650:and the

493:Form 942

388:dividend

384:interest

232:Variants

176:filing).

47:, is an

2564:July 6,

2539:July 6,

2461:July 6,

1948:July 1,

869:History

724:Tax Day

636:19, 28

590:20, 31

386:and/or

272:1040-EZ

256:1040-SR

249:1040-NR

109:or the

64:Tax Day

3223:

3151:Quartz

3062:Quartz

2909:Forbes

2310:Forbes

2059:Forbes

1593:. IRS.

1017:Quartz

974:1040EZ

297:1040-V

268:1040-A

264:1040-X

3120:(PDF)

2721:(PDF)

2678:(PDF)

2669:(2):

2659:(PDF)

2480:(PDF)

2137:(PDF)

2130:(PDF)

2083:(PDF)

2076:(PDF)

1746:(PDF)

1735:(PDF)

1555:(PDF)

1548:(PDF)

1523:(PDF)

1512:(PDF)

1485:(PDF)

1384:(PDF)

1373:(PDF)

1094:2015

1080:2016

1066:2017

1052:2018

959:1040A

646:—the

262:Form

254:Form

247:Form

3221:ISBN

3196:2016

3159:2016

3131:2016

3103:2012

3070:2016

3042:2019

3014:2016

2985:2015

2963:2015

2940:2015

2880:2015

2838:2016

2796:2016

2763:2016

2733:2016

2704:2016

2566:2016

2541:2016

2516:2016

2491:2016

2463:2016

2440:2016

2418:2016

2396:2016

2371:2016

2346:2016

2318:2016

2290:2015

2268:2015

2246:2015

2224:2015

2195:2014

2165:2014

2113:2015

2091:2015

2024:2013

1998:2015

1950:2016

1928:2016

1902:2016

1869:2016

1847:2016

1825:2023

1786:2016

1754:2016

1718:2015

1693:2017

1668:2016

1643:2015

1616:2016

1577:2015

1531:2019

1492:2016

1468:2019

1443:2019

1418:2017

1392:2019

1290:1935

1276:1945

1262:1955

1248:1965

1234:1975

1220:1985

1206:1995

1201:117

1192:2000

1187:142

1178:2005

1173:179

1164:2010

1159:189

1150:2011

1145:214

1136:2012

1131:206

1122:2013

1117:209

1108:2014

1103:211

1089:215

1075:220

1061:221

972:The

957:The

623:N/A

612:N/A

601:N/A

535:N/A

520:N/A

483:N/A

457:27a

374:12a

346:Type

295:The

270:and

139:PDFs

69:file

2907:",

2903:; "

2899:",

2641:".

2039:, (

1516:IRS

1271:16

1257:17

1243:39

1229:52

1215:84

1097:79

1083:79

1069:79

1055:23

1022:GIF

683:.)

661:or

579:17

509:16

439:).

393:3b

307:not

161:not

121:).

3254::

3219:.

3215:.

3187:.

3148:.

3122:.

3093:.

3089:.

3078:^

3059:.

3033:.

3022:^

3005:.

2993:^

2888:^

2859:^

2815:.

2804:^

2784:.

2771:^

2749:.

2723:.

2667:13

2665:.

2661:.

2630:^

2557:.

2532:.

2507:.

2482:.

2387:.

2362:.

2337:.

2326:^

2307:.

2203:^

2181:.

2156:.

2145:^

2057:.

1965:.

1919:.

1892:.

1888:.

1816:.

1775:.

1756:.

1737:.

1709:.

1684:.

1659:.

1624:^

1607:.

1514:.

1500:^

1459:.

1434:.

1409:.

1379:.

1375:.

1299:2

1293:34

1285:4

1279:24

1265:28

1251:54

1237:67

1223:68

1209:66

1195:70

1181:76

1167:77

1153:77

1139:77

1125:77

1111:79

1100:2

1086:2

1072:2

1058:2

969:.

769:.

690:.

654:.

568:8

495:.

480:.

454:.

427:7

409:.

3229:.

3198:.

3161:.

3133:.

3105:.

3072:.

3044:.

3016:.

2987:.

2965:.

2942:.

2882:.

2840:.

2819:.

2798:.

2765:.

2735:.

2706:.

2671:6

2637:"

2568:.

2543:.

2518:.

2493:.

2465:.

2442:.

2420:.

2398:.

2373:.

2348:.

2320:.

2292:.

2270:.

2248:.

2226:.

2197:.

2167:.

2115:.

2093:.

2061:.

2043:)

2026:.

2000:.

1978:.

1952:.

1930:.

1904:.

1871:.

1849:.

1827:.

1802:.

1788:.

1720:.

1695:.

1670:.

1645:.

1618:.

1579:.

1533:.

1494:.

1470:.

1445:.

1420:.

1394:.

1296:1

1282:2

1268:2

1254:2

1240:2

1226:2

1212:2

1198:2

1184:2

1170:2

1156:2

1142:2

1128:2

1114:2

20:)

Text is available under the Creative Commons Attribution-ShareAlike License. Additional terms may apply.