335:, the accession to Euro was a root cause for the 2000s crisis, but for different reasons than the ones put forward by Ferreira do Amaral: the low interest rates allowed an influx of foreign capital, which the country's weak financial system misallocated to the low-productive non-tradable sector, reducing the economy's overall productivity. Meanwhile, the Social Security system was demanding increasing public spending, and the constant tax hikes in the 2000s limited the potential for growth of the Portuguese economy. It is noteworthy that from 2000 to 2007, taxes as share of GDP increased 1.7% in Portugal but declined 0.9% in Eurozone. Another factor at the root of the stagnation may be that Portuguese economy faced increasing competition by Eastern European countries and China, which were economies also specialized in low wages and low-value-added goods. Other more structural problems identified were excessive corruption, and regulation, which makes difficult for business to get bigger and achieve economies-of-scale, as also the low educational attainment of Portuguese adults, low total factor productivity, rigid labour market laws and an inefficient and slow judicial system.

523:, the ruling right wing party failed to achieve an operating majority despite having won the elections by a solid margin. An anti-austerity post-electoral left wing coalition was formed achieving 51% of the vote and 53% of elected MPs, however, the President of Portugal at first refused to allow the left wing coalition to govern, inviting the minority right wing coalition to form a government. This was formed in November 2015 and lasted 11 days when it lost motion of confidence. The President eventually invited and asked the Socialist Party to form a government supported by 123 of 230 MPs in parliament from all parties except the former right wing coalition which broke into two parties. The new government (of the Socialist Party and independents) took office in November 2015 with a parliamentary majority thanks to the support of the Left Bloc, the Green Party and the Communist Party and the abstention of the Animal Welfare Party (PAN). In 2017, the IMF saw a 2.5 percent growth rate and an unemployment rate below 10 percent, but the European Commission expected Portugal's Government debt to reach 128.5 percent of GDP.

507:

Before the bond exchange, the state had a total of €9.6 billion outstanding notes due in 2013, which according to the bailout plan should be renewed by the sale of new bonds on the market. As

Portugal was already able to renew one-third of the outstanding bonds at a reasonable yield level, the market now expect the upcoming renewals in 2013 also to be conducted at reasonable yield levels. The bailout funding programme will run until June 2014, but at the same time require Portugal to regain a complete bond market access in September 2013. The recent sale of bonds with a 3-year maturity, was the first bond sale of the Portuguese state since requesting the bailout in April 2011, and the first step slowly to open up its governmental bond market again. Recently the ECB announced they will be ready also, to begin additional support to Portugal, with some yield-lowering bond purchases (

374:

the best rates of economic recovery in the EU. From the perspective of

Portugal's industrial orders, exports, entrepreneurial innovation and high-school achievement, the country matched or even surpassed its neighbors in Western Europe. However, the Portuguese economy had been creating its own problems over a lengthy period of time, which came to a head with the financial crisis. Persistent and lasting recruitment policies boosted the number of redundant public servants. Risky credit, public debt creation, and European structural and cohesion funds were mismanaged across almost four decades. Portugal would be persistently criticized for years to come by institutions and organizations like the

464:

stronger because the economic adjustment was producing the desirable effects on the

Portuguese economy and public debt situation. Elections were held on 4 October 2015, with the Portugal à Frente (PaF) coalition between PSD and CDS-PP parties led by PSD's Pedro Passos Coelho, being the most voted political force with 38.5% of the votes – but it lost the absolute majority that the two parties had in parliament, leaving it with 107 deputies (89 from PSD and 18 from CDS-PP), out of a total of 230. Without that majority, socialist and communist parties banded together to form a coalition in the parliament and after avail of the President Aníbal Cavaco Silva and according to the law, the

158:

300:. Despite government policies openly aimed to consolidate the Portuguese public finances, Portugal was almost always under excessive deficit procedure and government debt-to-GDP ratio rose from 50% in 2000 to 68% in 2007 and 126% in 2012. The causes of the stagnation are complex, as many potential causes also affect other Southern European countries and did not prevent them from growing in the 2000s, nor did prevent Portugal from growing before the early 2000s. Economist

289:(which called for anti-cyclic policies), but was resumed in May 2010. In 2010 there was economic growth (1.9%) but the financial status remained very difficult (8.6% budget deficit); the country eventually became unable to repay or refinance its government debt and requested a bailout in April 2011; in 2011 the economy fell 1.3% and the government reported a 4.2% budget deficit. Meanwhile, government debt-to-GDP ratio sharply rose from 68% in 2007 to 111% in 2011.

123:

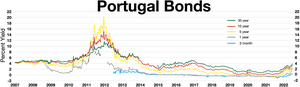

511:), when the country regained complete market access. All together this bodes well for a further decline of the governmental interest rates in Portugal, which on 30 January 2012 had a peak for the 10-year rate at 17.3% (after the rating agencies had cut the governments credit rating to "non-investment grade" -also referred to as "junk"), and as of 24 November 2012 has been more than halved to only 7.9%.

33:

142:

359:, and some of his political allies, maintained personal and business relationships with the bank and its CEO, who was eventually charged and arrested for fraud and other crimes. In the grounds of avoiding a potentially serious financial crisis in the Portuguese economy, the Portuguese government decided to give them a bailout, eventually at a future loss to taxpayers.

235:. Portuguese economy grew a combined 0.8% in 2002, was in recession in 2003 (-0.9%) and grew 1.6% in 2004. Ferreira Leite managed to keep deficit on 2.9% both in 2003 and in 2004, but through one-off and extraordinary measures. Otherwise, the deficit would have hit the 5% mark. Meanwhile, the first half of the 2000s also saw the end of the downward trend in the

250:; like his conservative predecessor, Sócrates tried to reduce the government's budget deficit through austerity and tax hikes. By then, the Portuguese economy was clearly lagging behind European partners and the 2005 budget deficit was expected to be above 6% if no extraordinary measures were used. In the Stability and Growth Programme for 2005–2009, the

207:

previous centuries, a catching-up process which was expected to continue. Portugal still entered well in the 2000s, registering an almost 4% GDP growth rate in 2000, but growth slowed along 2001; that year's growth rate was 2.0% and the unexpected slowdown was one of the causes that made the government's (still led by socialist

498:(PS) announced on television that the country, facing a status of bankruptcy, would request financial assistance to the IMF and the European Financial Stability Facility, like Greece and the Republic of Ireland had done before. On 16 May 2011, the eurozone leaders officially approved a €78 billion bailout package for Portugal.

194:), in Portugal the 2000s were not marked by economic growth, but instead were already a period of economic crisis, marked by stagnation, two recessions (in 2002–03 and 2008–09) and government-sponsored fiscal austerity in order to reduce the budget deficit to the limits allowed by the European Union's

458:

motion sponsored by all five opposition parties in parliament over spending cuts and tax increases. On 6 April 2011, José Sócrates, still in charge of the country, announced the requesting of an international financial rescue package to the

Portuguese Republic. In May 2011, the European Union and the

206:

to rise from 39% of the

Northern-Central European average in 1960 to 70% in 2000. Although, by 2000, Portugal was still the poorest country in Western Europe, it nevertheless had achieved a level of convergence with the developed economies in Central and Northern Europe which had no precedents in the

506:

A positive turning point in

Portugal's strive to regain access to financial markets, was achieved on 3 October 2012, when the state managed to convert €3.76 billion of bonds with maturity in September 2013 (carrying a 3.10% yield) to new bonds with maturity in October 2015 (carrying a 5.12% yield).

373:

Robert

Fishman, in the New York Times article "Portugal's Unnecessary Bailout", points out that Portugal fell victim to successive waves of speculation by pressure from bond traders, rating agencies and speculators. In the first quarter of 2010, before pressure from the markets, Portugal had one of

463:

managed to implement measures to improve the State's financial situation and the country started to be seen as moving on the right track. Despite the unemployment rate has reached new highs above 15 per cent in the second quarter 2012, the country would be able to overcome the crisis and emerge

1532:

313:

also thinks that the belonging to a currency union created numerous challenges to which the

Portuguese economy was not able to adapt. Bento also points out that Euro was the root cause for many of the internal macroeconomic disequilibria inside Eurozone – such as excessive external deficits in

280:

started to hit

Portugal in 2008; that year the Portuguese economy did not grow (0.0%) and fell almost 3% in 2009. Meanwhile, the government reported a 2.6% budget deficit in 2008 which rose to almost 10% in 2009. Austerity was somewhat waned in 2008–2010, as part of the

355:(BPP)) had been accumulating losses for years due to bad investments, embezzlement and accounting fraud. The case of BPN was particularly serious because of its size, market share, and the political implications - Portugal's then current President,

254:

proposed to let the budget deficit to be higher than 6% in 2005, but to structurally reduce it to below 3% until 2008, a plan which was accepted by the

European authorities. A notable milepost in the crisis happened in 2005, when the Portuguese

441:

hit euro lifetime highs as investors and creditors worried that the country would fail to rein in its budget deficit and debt. The yield on the country's 10-year government bonds reached 7 percent – a level the Portuguese Finance Minister

446:

had previously said would require the country to seek financial help from international institutions. Also in 2010, the country reached a record high unemployment rate of nearly 11%, a figure not seen for over two decades, while the number of

1077:

In 2000 (cell A222), Portugal had a GDP per capita of $ 13,922 (in 1990 US dollars) (cell Q222) while EU-12 countries had a GDP per capita of $ 20,131 (in 1990 US dollars) (cell N222). Thus, Portuguese GDP per capita was 69,2% of EU-12

326:

scholar and politician) points to the excessive size of the Portuguese government, whose total expenditures overtook 45% of the GDP in 2005. Such hypothesis was eventually the basis for the austerity requested as conditionality for the

1047:

In 1960 (cell A182), Portugal had a GDP per capita of $ 2,956 (in 1990 US dollars) (cell Q182) while EU-12 countries had a GDP per capita of $ 7,498 (in 1990 US dollars) (cell N182). Thus, Portuguese GDP per capita was 39,4% of EU-12

308:

in 1999–2002, which was too strong as a currency for Portugal's economy and industry and took away from the country the ability to direct its own monetary (rise or reduce interest rates) and cambial policy (currency devaluation).

201:

From the early 1960s to the early 2000s, Portugal endured three periods of robust economic growth and socio-economic development (approximately from 1960 to 1973, from 1985 to 1992 and from 1995 to 2001) which made the country's

532:

Budget deficit in 2016 was 2.1% of GDP, 0.4% the arbitrary limit set for it by the EC, the lowest since 1974, and less than half of the previous government's last year in power 2015. It is also 0.9% below the limits agreed at

362:

In the opening weeks of 2010, renewed anxiety about the excessive levels of debt in some EU countries and, more generally, about the health of the Euro spread from Ireland and Greece to Portugal, Spain, and Italy. In 2010,

459:

International Monetary Fund sealed a three-year €78 billion financial rescue plan for Portugal in a bid to stabilise its public finances. After the bailout was announced, the newly-elected Portuguese government headed by

231:; his government was marked by the introduction of harsh fiscal austerity policies and structural reforms, mainly justified by the need to reduce the budget deficit, a set of policies designed by his Finance Minister

110:. Portugal exited the bailout in May 2014, the same year that positive economic growth re-appeared following three years of recession. The government achieved a 2.1% budget deficit in 2016 (the lowest since the

78:

that started in 2001 and possibly ended between 2016 and 2017. The period from 2010 to 2014 was probably the hardest and more challenging part of the entire economic crisis; this period includes the

1788:

2433:

1466:

549:

In April 2017, the unemployment rate was 9.5%, over 8% below the all-time high reached in 2013 though still slightly above the 43-year average since the country became a democracy.

94:

in 2008 and eventually led to the country being unable to repay or refinance its government debt without the assistance of third parties. To prevent an insolvency situation in the

1332:

259:

overtook the European average for the first time since 1986. In 2007, the government achieved a 2.6% budget deficit (one year before target), below the 3.0% limit allowed by the

86:

policies, more intense than the wider 2001-2017 crisis. Economic growth stalled in Portugal between 2001 and 2002, and following years of internal economic crisis, the worldwide

318:(and were, to a great extent, more to important to explain the crisis than states' public finances). A set of economists (including former Prime Minister and eventual President

169:, from Spain, in October 2011. With economic downturn and a rising unemployment rate (over 10% unemployment rate in Portugal and 20% in Spain by 2011), the two countries of the

3594:

719:

1719:

1620:

4129:

4114:

2615:

4091:

367:

and PIGS acronyms were widely used by international bond analysts, academics, and the international economic press when referring to these under performing economies.

1004:

4076:

4015:

3978:

2657:

4194:

3812:

2548:

2034:

4136:

1222:

601:

In the 2000s and early 2010s, Portugal was under excessive deficit procedure (EDP) in 2002–2004, 2005–2008 and from 2009 on (this last EDP was closed in 2017).

3675:

2426:

1146:

615:

405:

had increased sharply compared to the gross domestic product. Moody noted that the rising debt would weigh heavily on the government's short-term finances.

370:

Some senior German policy makers went as far as to say that emergency bailouts to Greece and future EU aid recipients should bring with it harsh penalties.

745:

414:

4060:

3920:

3819:

2740:

485:

328:

251:

103:

79:

3403:

263:. That year, the economy grew 2.4%, the highest rate in the decade (excluding 2000). Nevertheless, also in 2007, the comparatively low growth rate made

314:

periphery countries (such as Portugal) and excessive external surplus in core countries – and that such disequilibria were the main cause of the 2010s

186:

Unlike other European countries that were also severely hit by the Great Recession in the late 2000s and received bailouts in the early 2010s (such as

3770:

2640:

2321:

1882:

1399:

465:

4001:

3854:

3847:

3652:

3341:

2505:

2475:

4084:

3971:

3791:

3784:

2564:

2164:

1444:

955:

869:

4158:

2085:

1794:

1422:

3777:

3030:

2951:

2662:

2419:

1931:

3964:

3868:

3833:

3528:

3023:

2500:

2460:

2190:

2059:

1266:

3690:

1745:

1121:

3645:

3558:

1643:

910:

4266:

3307:

3299:

2645:

2347:

107:

2465:

1357:

2667:

2594:

520:

247:

220:

1572:

1147:

Technical document by the Commission Services accompanying the Report on Portugal prepared in accordance with Article 104(3) of the Treaty

616:

Technical document by the Commission Services accompanying the Report on Portugal prepared in accordance with Article 104(3) of the Treaty

1510:

3993:

3262:

2538:

1324:

1098:

4022:

4281:

2576:

2533:

1491:[National Institute of Statistics corrects 2010 deficit to 8.6% of the GDP] (in Portuguese). Jornal de Notícias. 31 March 2011

224:

157:

1469:[Sócrates gives first interview following approval of the austerity package] (in Portuguese). Jornal de Negócios. 17 May 2010

344:

239:

that marked the 1990s: the ratio rose from 53% in 2000 to 62% in 2004 (the ratio overtook the SGP's arbitrary limit of 60% in 2003).

4261:

4256:

4251:

4246:

4241:

4151:

3957:

3609:

3476:

3226:

2528:

2480:

821:

282:

191:

3396:

2295:

1956:

1723:

348:

286:

1855:

3008:

2683:

2543:

2008:

669:

Perelman, Julian; Felix, Sónia; Santana, Rui (24 December 2014). "The Great Recession in Portugal: Impact on hospital care use".

292:

In the end, Portuguese economy grew less on a per capita basis in the 2000s and early 2010s than the American economy during the

2111:

1982:

165:(left) from Portugal (in office since 21 June 2011 after José Sócrates has called for a Portuguese bail-out in April 2011), and

3798:

3572:

3059:

2137:

1488:

1244:

3763:

546:

In 2016, combined sovereign and personal debt in Portugal was the 5th largest in the Eurozone, reaching a combined 390% of GDP

228:

134:

3986:

3950:

3861:

2733:

2630:

2582:

1595:

559:

508:

174:

130:

4122:

301:

1288:

4286:

4187:

3826:

3697:

3638:

3491:

2485:

3359:

3889:

3733:

3726:

3683:

3631:

3565:

3163:

2652:

2470:

1830:

1291:[Portuguese Stability and Growth Programme is approved today in Brussels] (in Portuguese). Público. 12 July 2005

1247:[Portugal’s Stability and Growth Programme was well received by Eurogroup] (in Portuguese). Público. 8 June 2005

569:

443:

187:

4045:

4037:

3711:

3704:

3624:

3551:

3543:

3535:

3513:

2912:

99:

705:"The elections of the Great Recession in Portugal: performance voting under a blurred responsibility for the economy"

4029:

3934:

3740:

3418:

3181:

2373:

2216:

495:

473:

352:

150:

1513:[Portugal ended 2011 with a deficit of 4.2% or the GDP] (in Portuguese). Jornal de Negócios. 23 April 2012

4276:

4236:

4231:

4226:

4221:

4216:

4144:

4068:

3840:

3323:

3315:

2726:

2495:

2446:

430:

260:

216:

195:

1311:

A economia continuou a registrar positivos, porém pequenos, índices de crescimentos em 2005 (0.8%) e 2006 (1.4%)

1225:[Government’s plan to reduce deficit raises doubts to Commission] (in Portuguese). Público. 22 June 2005

932:

4271:

3805:

3468:

3440:

3277:

1061:

1031:

2395:

4180:

4098:

3602:

3505:

3106:

1771:

3270:

3052:

2325:

4173:

3875:

3121:

3114:

3066:

2768:

2588:

1378:

356:

319:

232:

126:

536:

In 2016, Portuguese GDP was $ 259 billion, up by about 3% from 2015, and 21% from its record low in 2012.

4105:

3498:

3352:

3015:

2997:

2924:

2903:

2620:

2570:

773:

4052:

3882:

3426:

3038:

2943:

2935:

2847:

2707:

1749:

323:

315:

111:

4008:

3718:

3616:

3521:

3381:

3233:

3151:

2985:

2810:

2625:

1647:

564:

460:

425:. In 2009, the deficit had been 9.4 percent, one of the highest in the Eurozone and well above the

297:

208:

162:

75:

843:

796:

644:

491:

243:

146:

2891:

1907:

1701:

1447:[Eurostat validates 9.4% budget deficit for 2009] (in Portuguese). Público. 22 April 2010

1124:[National budget deficit was 4.1% of the GDP in 2001] (in Portuguese). Jornal de Negócios

270:

166:

98:, Portugal applied in April 2011 for bail-out programs and drew a cumulated €78 billion from the

219:'s 3% limit for the budget deficit, and thus, it was opened an excessive deficit procedure. The

2243:

1568:

2977:

2960:

2861:

958:[Austerity measures may avoid fines due to excessive deficit] (in Portuguese). Público

686:

540:

256:

236:

170:

401:

rating down two notches from an Aa2 to an A1 Due to spending on economic stimuli, Portugal's

3942:

3457:

3452:

2868:

2840:

2817:

2749:

2693:

2635:

2035:"Emprego nas Administrações Públicas: Central, Regional, Local e Fundos da Segurança Social"

1817:

1691:

678:

469:

293:

872:[Portugal entered recession in the fourth quarter of 2002] (in Portuguese). Público

17:

3902:

3752:

3587:

3433:

3389:

3288:

2789:

2688:

2442:

1831:"Misallocation and productivity in the lead up to the Eurozone crisis | Banco de Portugal"

1269:[Portugal has till 2008 to correct deficit] (in Portuguese). Público. 15 July 2005

589:

277:

87:

273:". From 2005 to 2007, public debt was stable at a ratio of approximately 68% of the GDP.

2396:"How Portugal came back from the brink — and why austerity could have played a key role"

2348:"Data archive for bonds and rates (Ten-year government bond spreads on 30 January 2012)"

3667:

3579:

3484:

2854:

2833:

476:, took office on 26 November 2015, 53 days after the legislative elections won by PaF.

448:

438:

426:

422:

398:

383:

310:

203:

122:

1169:

1167:

911:"Table A.1.1.8 - Gross domestic product at market prices (volume change rate; annual)"

4210:

3330:

3255:

3248:

3241:

3219:

3203:

3195:

3188:

3174:

3144:

3137:

3130:

3088:

3081:

3074:

3045:

2884:

2877:

2803:

2775:

1646:[Eurocrisis: another perspective] (in Portuguese). Observador. Archived from

1425:[Eurostat accepts 2008 deficit reported by Portugal] (in Portuguese). Público

704:

455:

265:

682:

3659:

3410:

3211:

2782:

1918:

434:

387:

332:

1720:"Expresso | BPN: Oliveira Costa vendeu a Cavaco e filha 250 mil ações da SLN"

2270:"IMF says Portugal bailout only "qualified success", leaving unfinished business"

935:[Portugal ended 2008 in recession] (in Portuguese). RTP. 13 February 2009

386:

for its anti-market, labor movement-inspired labor laws and rules which promoted

114:

in 1974) and in 2017 the economy grew 2.7% (the highest growth rate since 2000).

3913:

3370:

2969:

2826:

2796:

2269:

95:

141:

394:

32:

2411:

2063:

1360:[Lowest deficit in 30 years] (in Portuguese). Público. 26 March 2008

83:

690:

539:

In 2016, Portugal registered a 14-year sequence of continuous increases in

1571:[Portugal: a country from crisis to crisis] (in Portuguese). RTP.

1402:[Government: public debt as share of GDP] (in Portuguese). Pordata

2761:

1467:"Sócrates dá primeira entrevista após aprovação do pacote de austeridade"

418:

212:

91:

1932:"Portuguese government seeks support for austerity plan - Sep. 30, 2010"

1883:"Bruxelas sugere a Portugal reformas estruturais do mercado de trabalho"

1705:

977:

153:(PS) was the prime minister and the leader of the Portuguese Government.

1887:

Bruxelas sugere a Portugal reformas estruturais do mercado de trabalho

1562:

1560:

1558:

1556:

1554:

1552:

1550:

1223:"Programa do Governo para reduzir o défice levanta dúvidas à Comissão"

1209:

1197:

1185:

1173:

822:"Portuguese economy grows 2.7% in 2017, the largest growth since 2000"

588:

An "everyday" example of the tax hikes during the 2000s crisis is the

2718:

1772:"Dias Loureiro entre os dirigentes do PSD no processo-crime do BPN"

1696:

1679:

956:"Medidas de austeridade poderão evitar multas por défice excessivo"

2165:"Portugal anuncia 'saída limpa' de resgate após 3 anos de ajustes"

1007:[Budget, taxes, reforms: Portugal's lesson of austerity].

1005:"Budget, impôts, retraite : la leçon d'austérité du Portugal"

364:

156:

140:

121:

2086:"Cronologia. Os dias que levaram ao pedido de resgate há 10 anos"

211:) budget deficit to slip to 4.1%; Portugal thus became the first

2400:

454:

On 23 March 2011, José Sócrates resigned following passage of a

402:

375:

305:

2722:

2415:

2324:. Kathimerini (English Edition). 3 October 2012. Archived from

1790:

Merkel Economy Adviser Says Greece Bailout Should Bring Penalty

1152:(Report). Commission of the European Communities. 22 July 2005

621:(Report). Commission of the European Communities. 22 July 2005

409:

Austerity measures amid increased pressure on government bonds

379:

592:'s standard rate, which rose from 17% in 2002 to 23% in 2011.

746:"Bailout Is Over for Portugal, but Side Effects Will Linger"

421:

partners, through a series of tax hikes and salary cuts for

2296:"Resultados em 2015 criaram Impasse político de dois meses"

1394:

1392:

1390:

1122:"Défice orçamental nacional atingiu os 4,1% do PIB em 2001"

390:

and the misallocation of factors of production in general.

720:"Portugal exits bailout poorer and long way from recovery"

2322:"Portugal seeks market access with $ 5 bln bond exchange"

1856:"FMI sugere a Portugal aumento da flexibilização laboral"

1596:"Portuguese bestselling book recommends leaving the euro"

1445:"Eurostat validou défice de 9,4 por cento do PIB em 2009"

870:"Portugal entrou em recessão no quarto trimestre de 2002"

1400:"Administrações Públicas: dívida bruta em % do PIB"

797:"Portugal's budget deficit falls to 40-year low at 2.1%"

2112:"EU and IMF seal €78 billion bailout deal for Portugal"

1423:"Eurostat aceita défice de 2008 registado por Portugal"

776:[GDP real growth rate] (in Portuguese). Pordata

347:, it was known in 2008–2009 that two Portuguese banks (

515:

Rejection of Austerity Conditions and Political Crisis

3067:

Post-Napoleonic Irish grain price and land use shocks

2009:"Desemprego do último trimestre de 2010 foi de 11,1%"

768:

766:

2060:"Portuguese parliament votes against austerity plan"

1680:"The Portuguese Slump and Crash and the Euro Crisis"

1267:"Portugal tem até 2008 para corrigir défice público"

1092:

1090:

1088:

1086:

417:

announced a fresh austerity package following other

3901:

3751:

3451:

3369:

3340:

3287:

3162:

3098:

2996:

2923:

2901:

2676:

2608:

2557:

2521:

2514:

2453:

1983:"Desemprego supera 11% no último trimestre de 2010"

1981:Portugal, Rádio e Televisão de (16 February 2011).

1813:

1811:

543:, i.e., since the adoption of the Euro as currency.

2191:"Pedro Passos Coelho há de ter o lugar que merece"

2616:Economic and Monetary Union of the European Union

1987:Desemprego supera 11% no último trimestre de 2010

1141:

1139:

1533:"Closed Excessive Deficit Procedures – Portugal"

1511:"Portugal fechou 2011 com défice de 4,2% do PIB"

1358:"Défice ao valor mais baixo dos últimos 30 anos"

1309:

1489:"INE corrige o défice de 2010 para 8,6% do PIB"

1245:"PEC português foi bem recebido pelo Eurogrupo"

1327:[The Portuguese economy at the divan]

490:On 6 April 2011, the resigning Prime Minister

4195:List of stock market crashes and bear markets

2734:

2427:

905:

903:

901:

899:

897:

895:

893:

891:

889:

887:

8:

1673:

1671:

1669:

1667:

1665:

1289:"PEC português é hoje aprovado em Bruxelas"

1210:Commission of the European Communities 2005

1198:Commission of the European Communities 2005

1186:Commission of the European Communities 2005

1174:Commission of the European Communities 2005

718:Bugge, Alex; Khalip, Andrei (16 May 2014).

645:"Portugal grows at fastest rate since 2000"

415:XVIII Constitutional Government of Portugal

2741:

2727:

2719:

2518:

2434:

2420:

2412:

2374:"Portugal 10-Year Futures Historical Data"

2015:(in European Portuguese). 16 February 2011

1919:BBC News -Moody's downgrades Portugal debt

1099:"The Mystery of Why Portugal Is So Doomed"

486:Economic Adjustment Programme for Portugal

480:Economic Adjustment Programme for Portugal

4016:2015–2016 Chinese stock market turbulence

1695:

1062:"Maddison Project Database, version 2013"

1032:"Maddison Project Database, version 2013"

913:. Instituto Nacional de Estatística. 2013

80:2011–14 international bailout to Portugal

2302:(in European Portuguese). 6 October 2019

2197:(in European Portuguese). 5 October 2017

954:Arriaga e Cunha, Isabel (28 June 2002).

844:"Sócrates calls for Portuguese bail-out"

173:were trapped right in the middle of the

31:

2217:"Sócrates satisfeito com "saída limpa""

635:

581:

521:parliamentary elections of October 2015

3921:Venezuelan banking crisis of 2009–2010

3691:South American economic crisis of 2002

3588:Black Wednesday (1992 Sterling crisis)

1957:"Austerity measures – DW – 03/09/2010"

74:was part of the wider downturn of the

3972:2013 Chinese banking liquidity crisis

3928:2010–2014 Portuguese financial crisis

3404:Secondary banking crisis of 1973–1975

1684:Brookings Papers on Economic Activity

1569:"Portugal, um país de crise em crise"

1535:. European Commission. 3 October 2016

133:from 2002 to 2004, in the cabinet of

72:2010–2014 Portuguese financial crisis

7:

4002:Russian financial crisis (2014–2016)

3855:2008–2011 Icelandic financial crisis

3848:2008–2009 Ukrainian financial crisis

3813:2000s U.S. housing market correction

3653:1998–2002 Argentine great depression

2668:2010 European Union bank stress test

329:2011–2014 European Union/IMF bailout

4159:2023–2024 Egyptian financial crisis

3994:Puerto Rican government-debt crisis

3987:2014–2016 Brazilian economic crisis

3360:1963–1965 Indonesian hyperinflation

3263:Shanghai rubber stock market crisis

2952:Dutch Republic stock market crashes

2565:Icelandic financial crisis protests

1060:Bolt, J.; van Zanden, J.L. (2014).

1030:Bolt, J.; van Zanden, J.L. (2014).

296:or the Japanese economy during the

3965:2012–2013 Cypriot financial crisis

3869:2008–2014 Spanish financial crisis

3841:2008–2009 Russian financial crisis

3834:2008–2009 Belgian financial crisis

3529:1988–1992 Norwegian banking crisis

3024:British credit crisis of 1772–1773

2663:United Kingdom bank rescue package

1644:"Eurocrise: uma outra perspectiva"

1623:. Project Syndicate. 25 March 2014

1120:Domingos, Ricardo (25 July 2002).

933:"Portugal fechou 2008 em recessão"

25:

4152:2023 United States banking crisis

3958:2011 Bangladesh share market scam

3646:1998–1999 Ecuador economic crisis

3610:Venezuelan banking crisis of 1994

3536:Japanese asset price bubble crash

3477:Souk Al-Manakh stock market crash

3227:Australian banking crisis of 1893

3031:Dutch Republic financial collapse

2376:. ForexPros.com. 24 November 2012

2244:"Pedro Passos Coelho sai de cena"

1331:(in Portuguese). RTP. June 2017.

774:"Taxa de crescimento real do PIB"

433:three percent limit. In November

397:Investors Service cut Portugal's

3009:Amsterdam banking crisis of 1763

2684:List of countries by public debt

1881:Portugal, Rádio e Televisão de.

1642:Bento, Vítor (8 February 2015).

1594:Vergès, Marie de (4 June 2013).

1575:from the original on 5 July 2018

1421:Aníbal, Sérgio (22 April 2009).

1338:from the original on 5 July 2018

643:Wise, Peter (14 February 2018).

3734:2007 Chinese stock bubble crash

3060:Danish state bankruptcy of 1813

2138:"Saída limpa foi há cinco anos"

1325:"A economia portuguesa no divã"

1097:O'Brien, Mathew (5 June 2013).

868:Melo, Eduardo (13 March 2003).

683:10.1016/j.healthpol.2014.12.015

269:to describe Portugal as "a new

4115:Chinese property sector crisis

4023:2015–2016 stock market selloff

3951:August 2011 stock markets fall

3862:2008–2011 Irish banking crisis

3559:1990s Swedish financial crisis

3308:Weimar Republic hyperinflation

2571:May Day protests across Europe

1818:Portugal’s Unnecessary Bailout

1003:Cambon, Diane (27 June 2008).

744:Minder, Raphael (5 May 2014).

560:European sovereign debt crisis

502:Re-access to financial markets

283:European economy recovery plan

175:European sovereign debt crisis

27:Economic recession in Portugal

1:

4188:List of sovereign debt crises

4130:2022 Russian financial crisis

3827:2008 Latvian financial crisis

3820:U.S. bear market of 2007–2009

3698:Stock market downturn of 2002

3639:1998 Russian financial crisis

3492:1983 Israel bank stock crisis

2658:Société Générale trading loss

2577:French pension reform strikes

2092:(in Portuguese). 5 April 2021

1930:Interns (30 September 2010).

1678:Reis, Ricardo (August 2013).

795:Wise, Peter (24 March 2017).

466:XXI Constitutional Government

345:financial crisis of 2007–2008

215:country to clearly break the

4267:Economic history of Portugal

3890:Greek government-debt crisis

3727:2004 Argentine energy crisis

3684:2001 Turkish economic crisis

3573:1990s Armenian energy crisis

3566:1990s Finnish banking crisis

3427:1976 British currency crisis

3397:1973–1974 stock market crash

570:Economic history of Portugal

444:Fernando Teixeira dos Santos

339:Anxiety on financial markets

237:government debt to GDP ratio

4046:2017 Sri Lankan fuel crisis

3712:2003 Myanmar banking crisis

3705:2002 Uruguay banking crisis

3625:1997 Asian financial crisis

3552:1991 Indian economic crisis

3544:Rhode Island banking crisis

3514:Cameroonian economic crisis

3300:Early Soviet hyperinflation

2913:Crisis of the Third Century

349:Banco Português de Negócios

304:points to the accession to

18:Great Recession in Portugal

4303:

4077:Sri Lankan economic crisis

3935:Energy crisis in Venezuela

3914:2009 Dubai debt standstill

3764:2007–2008 financial crisis

3419:Latin American debt crisis

3182:Paris Bourse crash of 1882

1379:"A new sick man of Europe"

483:

287:resurgence of Keynesianism

82:and was marked by intense

4282:Great Recession in Europe

4168:

4145:2022 stock market decline

4137:Pakistani economic crisis

4123:2021–2023 inflation surge

4069:Lebanese liquidity crisis

4038:Venezuelan hyperinflation

4030:Brexit stock market crash

3979:Venezuela economic crisis

3741:Zimbabwean hyperinflation

3324:Wall Street Crash of 1929

3164:2nd Industrial Revolution

2998:1st Industrial Revolution

2756:

2702:

2171:(in Brazilian Portuguese)

1621:"Deconstructing the Euro"

1066:Maddison Project Database

1036:Maddison Project Database

527:Key economic data in 2016

431:Stability and Growth Pact

261:Stability and Growth Pact

246:became Prime Minister in

229:José Manuel Durão Barroso

196:Stability and Growth Pact

135:José Manuel Durão Barroso

4262:2014 in economic history

4257:2013 in economic history

4252:2012 in economic history

4247:2011 in economic history

4242:2010 in economic history

3806:Subprime mortgage crisis

3469:Brazilian hyperinflation

3441:Brazilian hyperinflation

3278:Financial crisis of 1914

2986:Mississippi bubble crash

2250:(in European Portuguese)

2144:(in European Portuguese)

1862:(in European Portuguese)

112:restoration of democracy

4181:List of economic crises

4099:2020 stock market crash

4092:Financial market impact

4061:Turkish economic crisis

3676:9/11 stock market crash

3632:October 1997 mini-crash

3603:1994 bond market crisis

3595:Yugoslav hyperinflation

3506:Savings and loan crisis

3107:European potato failure

2142:www.jornaldenegocios.pt

824:. ECO. 14 February 2018

413:In September 2010, the

393:In the summer of 2010,

353:Banco Privado Português

4174:List of banking crises

3943:Syrian economic crisis

3876:Blue Monday Crash 2009

3485:Chilean crisis of 1982

3316:Shōwa financial crisis

3122:Highland Potato Famine

2978:South Sea bubble crash

2769:Commodity price shocks

2653:Irish emergency budget

2589:March for a Better Way

2242:ECO (4 October 2017).

2163:EFE, Da (4 May 2014).

1567:Romano, Pedro (2017).

1310:

233:Manuela Ferreira Leite

178:

154:

138:

127:Manuela Ferreira Leite

67:

3499:Black Saturday (1983)

3353:Kennedy Slide of 1962

2925:Commercial revolution

2621:European social model

223:brought to power the

182:2000s economic crisis

160:

144:

125:

35:

4287:Stock market crashes

4053:Ghana banking crisis

3883:European debt crisis

3668:Dot-com bubble crash

3580:Cuban Special Period

3039:Copper Panic of 1789

2944:The Great Debasement

2936:Great Bullion Famine

2708:European debt crisis

2631:Irish banking crisis

1820:– The New York Times

1746:"Diário de Notícias"

451:remained very high.

324:economically liberal

316:European debt crisis

252:Sócrates' government

4009:2015 Nepal blockade

3719:2000s energy crisis

3617:Mexican peso crisis

3522:Black Monday (1987)

3382:1970s energy crisis

3342:Post–WWII expansion

3016:Bengal bubble crash

2811:Financial contagion

2626:Icelandic outvasion

2276:. 22 September 2016

1908:Bond credit ratings

1797:on 19 February 2010

565:Economy of Portugal

461:Pedro Passos Coelho

357:Aníbal Cavaco Silva

320:Aníbal Cavaco Silva

163:Pedro Passos Coelho

145:From 2005 to 2011,

131:Minister of Finance

3271:Panic of 1910–1911

3115:Great Irish Famine

3053:Panic of 1796–1797

2892:Stock market crash

1726:on 12 October 2013

750:The New York Times

541:debt-to-GDP ratios

302:Ferreira do Amaral

271:sick man of Europe

221:2002 snap election

179:

167:Rodriguez Zapatero

155:

139:

76:Portuguese economy

68:

65: 3 month bond

47: 10 year bond

41: 30 year bond

4204:

4203:

4085:COVID-19 pandemic

2970:Tulip mania crash

2961:Kipper und Wipper

2938:(c. 1400–c. 1500)

2716:

2715:

2604:

2603:

2354:. 30 January 2012

2328:on 5 October 2012

1752:on 16 August 2014

257:unemployment rate

171:Iberian Peninsula

59: 1 year bond

53: 5 year bond

16:(Redirected from

4294:

4277:Financial crises

4237:2014 in Portugal

4232:2013 in Portugal

4227:2012 in Portugal

4222:2011 in Portugal

4217:2010 in Portugal

4197:

4190:

4183:

4176:

4161:

4154:

4147:

4140:

4132:

4125:

4118:

4108:

4101:

4094:

4087:

4080:

4072:

4064:

4056:

4048:

4041:

4033:

4025:

4018:

4011:

4004:

3997:

3989:

3982:

3974:

3967:

3960:

3953:

3946:

3938:

3930:

3923:

3916:

3892:

3885:

3878:

3871:

3864:

3857:

3850:

3843:

3836:

3829:

3822:

3815:

3808:

3801:

3794:

3787:

3780:

3773:

3766:

3744:

3736:

3729:

3722:

3714:

3707:

3700:

3693:

3686:

3679:

3671:

3663:

3655:

3648:

3641:

3634:

3627:

3620:

3612:

3605:

3598:

3590:

3583:

3575:

3568:

3561:

3554:

3547:

3539:

3531:

3524:

3517:

3509:

3501:

3494:

3487:

3480:

3472:

3458:Great Regression

3453:Great Moderation

3444:

3436:

3429:

3422:

3414:

3406:

3399:

3392:

3385:

3362:

3355:

3333:

3326:

3319:

3311:

3303:

3280:

3273:

3266:

3258:

3251:

3244:

3237:

3229:

3222:

3215:

3207:

3199:

3191:

3184:

3177:

3155:

3147:

3140:

3133:

3124:

3117:

3110:

3091:

3084:

3077:

3070:

3062:

3055:

3048:

3041:

3034:

3026:

3019:

3011:

2989:

2981:

2973:

2965:

2955:

2947:

2939:

2916:

2894:

2887:

2880:

2871:

2864:

2857:

2850:

2843:

2841:Liquidity crisis

2836:

2829:

2820:

2818:Social contagion

2813:

2806:

2799:

2792:

2785:

2778:

2771:

2764:

2750:Financial crises

2743:

2736:

2729:

2720:

2677:Related articles

2636:Anglo Irish Bank

2519:

2436:

2429:

2422:

2413:

2406:

2405:

2404:. 2 August 2017.

2392:

2386:

2385:

2383:

2381:

2370:

2364:

2363:

2361:

2359:

2344:

2338:

2337:

2335:

2333:

2318:

2312:

2311:

2309:

2307:

2292:

2286:

2285:

2283:

2281:

2266:

2260:

2259:

2257:

2255:

2239:

2233:

2232:

2230:

2228:

2213:

2207:

2206:

2204:

2202:

2187:

2181:

2180:

2178:

2176:

2160:

2154:

2153:

2151:

2149:

2134:

2128:

2127:

2125:

2123:

2108:

2102:

2101:

2099:

2097:

2082:

2076:

2075:

2073:

2071:

2056:

2050:

2049:

2047:

2045:

2031:

2025:

2024:

2022:

2020:

2005:

1999:

1998:

1996:

1994:

1978:

1972:

1971:

1969:

1967:

1953:

1947:

1946:

1944:

1942:

1927:

1921:

1916:

1910:

1905:

1899:

1898:

1896:

1894:

1878:

1872:

1871:

1869:

1867:

1852:

1846:

1845:

1843:

1841:

1835:www.bportugal.pt

1827:

1821:

1815:

1806:

1805:

1804:

1802:

1793:, archived from

1786:

1782:

1776:

1775:

1768:

1762:

1761:

1759:

1757:

1748:. Archived from

1742:

1736:

1735:

1733:

1731:

1722:. Archived from

1716:

1710:

1709:

1699:

1675:

1660:

1659:

1657:

1655:

1639:

1633:

1632:

1630:

1628:

1617:

1611:

1610:

1608:

1606:

1591:

1585:

1584:

1582:

1580:

1564:

1545:

1544:

1542:

1540:

1529:

1523:

1522:

1520:

1518:

1507:

1501:

1500:

1498:

1496:

1485:

1479:

1478:

1476:

1474:

1463:

1457:

1456:

1454:

1452:

1441:

1435:

1434:

1432:

1430:

1418:

1412:

1411:

1409:

1407:

1396:

1385:

1376:

1370:

1369:

1367:

1365:

1354:

1348:

1347:

1345:

1343:

1337:

1330:

1321:

1315:

1313:

1307:

1301:

1300:

1298:

1296:

1285:

1279:

1278:

1276:

1274:

1263:

1257:

1256:

1254:

1252:

1241:

1235:

1234:

1232:

1230:

1219:

1213:

1207:

1201:

1195:

1189:

1183:

1177:

1171:

1162:

1161:

1159:

1157:

1151:

1143:

1134:

1133:

1131:

1129:

1117:

1111:

1110:

1108:

1106:

1094:

1081:

1080:

1074:

1072:

1057:

1051:

1050:

1044:

1042:

1027:

1021:

1020:

1018:

1016:

1000:

994:

993:

991:

989:

978:"Stability pays"

974:

968:

967:

965:

963:

951:

945:

944:

942:

940:

929:

923:

922:

920:

918:

907:

882:

881:

879:

877:

865:

859:

858:

856:

854:

840:

834:

833:

831:

829:

818:

812:

811:

809:

807:

792:

786:

785:

783:

781:

770:

761:

760:

758:

756:

741:

735:

734:

732:

730:

715:

709:

708:

701:

695:

694:

666:

660:

659:

657:

655:

640:

630:

628:

626:

620:

602:

599:

593:

586:

294:Great Depression

225:Social Democrats

209:António Guterres

161:Prime Ministers

64:

58:

52:

46:

40:

21:

4302:

4301:

4297:

4296:

4295:

4293:

4292:

4291:

4272:Eurozone crisis

4207:

4206:

4205:

4200:

4193:

4186:

4179:

4172:

4164:

4157:

4150:

4143:

4135:

4128:

4121:

4113:

4104:

4097:

4090:

4083:

4075:

4067:

4059:

4051:

4044:

4036:

4028:

4021:

4014:

4007:

4000:

3992:

3985:

3977:

3970:

3963:

3956:

3949:

3941:

3933:

3926:

3919:

3912:

3905:

3903:Information Age

3897:

3888:

3881:

3874:

3867:

3860:

3853:

3846:

3839:

3832:

3825:

3818:

3811:

3804:

3797:

3790:

3783:

3776:

3769:

3762:

3755:

3753:Great Recession

3747:

3739:

3732:

3725:

3717:

3710:

3703:

3696:

3689:

3682:

3674:

3666:

3658:

3651:

3644:

3637:

3630:

3623:

3615:

3608:

3601:

3593:

3586:

3578:

3571:

3564:

3557:

3550:

3542:

3534:

3527:

3520:

3512:

3504:

3497:

3490:

3483:

3475:

3467:

3460:

3456:

3447:

3439:

3434:1979 oil crisis

3432:

3425:

3417:

3409:

3402:

3395:

3390:1973 oil crisis

3388:

3380:

3373:

3371:Great Inflation

3365:

3358:

3351:

3344:

3336:

3329:

3322:

3314:

3306:

3298:

3291:

3289:Interwar period

3283:

3276:

3269:

3261:

3254:

3247:

3240:

3232:

3225:

3218:

3210:

3202:

3194:

3187:

3180:

3173:

3166:

3158:

3150:

3143:

3136:

3129:

3120:

3113:

3105:

3094:

3087:

3080:

3073:

3065:

3058:

3051:

3044:

3037:

3029:

3022:

3014:

3007:

3000:

2992:

2984:

2976:

2968:

2958:

2950:

2942:

2934:

2927:

2919:

2911:

2897:

2890:

2883:

2876:

2867:

2860:

2853:

2846:

2839:

2832:

2825:

2816:

2809:

2802:

2795:

2790:Currency crisis

2788:

2781:

2774:

2767:

2760:

2752:

2747:

2717:

2712:

2698:

2689:Occupy movement

2672:

2646:Nationalisation

2600:

2553:

2510:

2449:

2443:Great Recession

2440:

2410:

2409:

2394:

2393:

2389:

2379:

2377:

2372:

2371:

2367:

2357:

2355:

2352:Financial Times

2346:

2345:

2341:

2331:

2329:

2320:

2319:

2315:

2305:

2303:

2294:

2293:

2289:

2279:

2277:

2268:

2267:

2263:

2253:

2251:

2241:

2240:

2236:

2226:

2224:

2223:(in Portuguese)

2215:

2214:

2210:

2200:

2198:

2189:

2188:

2184:

2174:

2172:

2162:

2161:

2157:

2147:

2145:

2136:

2135:

2131:

2121:

2119:

2110:

2109:

2105:

2095:

2093:

2084:

2083:

2079:

2069:

2067:

2066:. 23 March 2011

2058:

2057:

2053:

2043:

2041:

2033:

2032:

2028:

2018:

2016:

2007:

2006:

2002:

1992:

1990:

1989:(in Portuguese)

1980:

1979:

1975:

1965:

1963:

1955:

1954:

1950:

1940:

1938:

1929:

1928:

1924:

1917:

1913:

1906:

1902:

1892:

1890:

1889:(in Portuguese)

1880:

1879:

1875:

1865:

1863:

1854:

1853:

1849:

1839:

1837:

1829:

1828:

1824:

1816:

1809:

1800:

1798:

1787:

1784:

1783:

1779:

1770:

1769:

1765:

1755:

1753:

1744:

1743:

1739:

1729:

1727:

1718:

1717:

1713:

1677:

1676:

1663:

1653:

1651:

1641:

1640:

1636:

1626:

1624:

1619:

1618:

1614:

1604:

1602:

1593:

1592:

1588:

1578:

1576:

1566:

1565:

1548:

1538:

1536:

1531:

1530:

1526:

1516:

1514:

1509:

1508:

1504:

1494:

1492:

1487:

1486:

1482:

1472:

1470:

1465:

1464:

1460:

1450:

1448:

1443:

1442:

1438:

1428:

1426:

1420:

1419:

1415:

1405:

1403:

1398:

1397:

1388:

1377:

1373:

1363:

1361:

1356:

1355:

1351:

1341:

1339:

1335:

1328:

1323:

1322:

1318:

1308:

1304:

1294:

1292:

1287:

1286:

1282:

1272:

1270:

1265:

1264:

1260:

1250:

1248:

1243:

1242:

1238:

1228:

1226:

1221:

1220:

1216:

1208:

1204:

1196:

1192:

1184:

1180:

1172:

1165:

1155:

1153:

1149:

1145:

1144:

1137:

1127:

1125:

1119:

1118:

1114:

1104:

1102:

1096:

1095:

1084:

1070:

1068:

1059:

1058:

1054:

1040:

1038:

1029:

1028:

1024:

1014:

1012:

1002:

1001:

997:

987:

985:

984:. 25 March 2004

976:

975:

971:

961:

959:

953:

952:

948:

938:

936:

931:

930:

926:

916:

914:

909:

908:

885:

875:

873:

867:

866:

862:

852:

850:

842:

841:

837:

827:

825:

820:

819:

815:

805:

803:

801:Financial Times

794:

793:

789:

779:

777:

772:

771:

764:

754:

752:

743:

742:

738:

728:

726:

717:

716:

712:

703:

702:

698:

668:

667:

663:

653:

651:

649:Financial Times

642:

641:

637:

624:

622:

618:

614:

611:

606:

605:

600:

596:

587:

583:

578:

556:

529:

517:

504:

496:Socialist Party

488:

482:

474:Socialist Party

449:public servants

423:public servants

411:

341:

278:Great Recession

184:

151:Socialist Party

120:

90:started to hit

88:Great Recession

66:

62:

60:

56:

54:

50:

48:

44:

42:

38:

36:Portugal bonds

28:

23:

22:

15:

12:

11:

5:

4300:

4298:

4290:

4289:

4284:

4279:

4274:

4269:

4264:

4259:

4254:

4249:

4244:

4239:

4234:

4229:

4224:

4219:

4209:

4208:

4202:

4201:

4199:

4198:

4191:

4184:

4177:

4169:

4166:

4165:

4163:

4162:

4155:

4148:

4141:

4139:(2022–present)

4133:

4126:

4119:

4117:(2020–present)

4111:

4110:

4109:

4102:

4095:

4081:

4079:(2019–present)

4073:

4071:(2019–present)

4065:

4063:(2018–present)

4057:

4049:

4042:

4034:

4026:

4019:

4012:

4005:

3998:

3990:

3983:

3981:(2013–present)

3975:

3968:

3961:

3954:

3947:

3945:(2011–present)

3939:

3937:(2010–present)

3931:

3924:

3917:

3909:

3907:

3906:(2009–present)

3899:

3898:

3896:

3895:

3894:

3893:

3886:

3879:

3872:

3865:

3858:

3851:

3844:

3837:

3830:

3823:

3816:

3809:

3802:

3795:

3788:

3781:

3774:

3771:September 2008

3759:

3757:

3749:

3748:

3746:

3745:

3743:(2007–present)

3737:

3730:

3723:

3715:

3708:

3701:

3694:

3687:

3680:

3672:

3664:

3656:

3649:

3642:

3635:

3628:

3621:

3613:

3606:

3599:

3591:

3584:

3576:

3569:

3562:

3555:

3548:

3540:

3532:

3525:

3518:

3510:

3502:

3495:

3488:

3481:

3473:

3464:

3462:

3449:

3448:

3446:

3445:

3437:

3430:

3423:

3415:

3407:

3400:

3393:

3386:

3377:

3375:

3367:

3366:

3364:

3363:

3356:

3348:

3346:

3338:

3337:

3335:

3334:

3327:

3320:

3312:

3304:

3295:

3293:

3285:

3284:

3282:

3281:

3274:

3267:

3259:

3252:

3245:

3238:

3230:

3223:

3216:

3208:

3200:

3192:

3185:

3178:

3170:

3168:

3160:

3159:

3157:

3156:

3148:

3141:

3134:

3127:

3126:

3125:

3118:

3102:

3100:

3096:

3095:

3093:

3092:

3085:

3078:

3071:

3063:

3056:

3049:

3042:

3035:

3033:(c. 1780–1795)

3027:

3020:

3012:

3004:

3002:

2994:

2993:

2991:

2990:

2982:

2974:

2966:

2956:

2954:(c. 1600–1760)

2948:

2940:

2931:

2929:

2921:

2920:

2918:

2917:

2908:

2906:

2899:

2898:

2896:

2895:

2888:

2881:

2874:

2873:

2872:

2865:

2858:

2851:

2837:

2834:Hyperinflation

2830:

2823:

2822:

2821:

2807:

2800:

2793:

2786:

2779:

2772:

2765:

2757:

2754:

2753:

2748:

2746:

2745:

2738:

2731:

2723:

2714:

2713:

2711:

2710:

2703:

2700:

2699:

2697:

2696:

2691:

2686:

2680:

2678:

2674:

2673:

2671:

2670:

2665:

2660:

2655:

2650:

2649:

2648:

2643:

2638:

2628:

2623:

2618:

2612:

2610:

2606:

2605:

2602:

2601:

2599:

2598:

2592:

2586:

2583:Irish students

2580:

2574:

2568:

2561:

2559:

2555:

2554:

2552:

2551:

2549:United Kingdom

2546:

2541:

2536:

2531:

2525:

2523:

2516:

2512:

2511:

2509:

2508:

2503:

2498:

2493:

2488:

2483:

2478:

2473:

2468:

2463:

2457:

2455:

2451:

2450:

2441:

2439:

2438:

2431:

2424:

2416:

2408:

2407:

2387:

2365:

2339:

2313:

2287:

2261:

2234:

2208:

2182:

2155:

2129:

2103:

2077:

2051:

2039:www.pordata.pt

2026:

2000:

1973:

1948:

1922:

1911:

1900:

1873:

1847:

1822:

1807:

1777:

1763:

1737:

1711:

1697:10.3386/w19288

1690:(1): 143–210.

1661:

1650:on 5 July 2018

1634:

1612:

1586:

1546:

1524:

1502:

1480:

1458:

1436:

1413:

1386:

1371:

1349:

1316:

1302:

1280:

1258:

1236:

1214:

1202:

1190:

1178:

1163:

1135:

1112:

1101:. The Atlantic

1082:

1052:

1022:

995:

969:

946:

924:

883:

860:

835:

813:

787:

762:

736:

710:

696:

677:(3): 307–315.

661:

634:

633:

632:

631:

610:

607:

604:

603:

594:

580:

579:

577:

574:

573:

572:

567:

562:

555:

552:

551:

550:

547:

544:

537:

534:

528:

525:

516:

513:

503:

500:

484:Main article:

481:

478:

437:on Portuguese

427:European Union

410:

407:

399:sovereign bond

384:European Union

340:

337:

204:GDP per capita

183:

180:

119:

116:

61:

55:

49:

43:

37:

26:

24:

14:

13:

10:

9:

6:

4:

3:

2:

4299:

4288:

4285:

4283:

4280:

4278:

4275:

4273:

4270:

4268:

4265:

4263:

4260:

4258:

4255:

4253:

4250:

4248:

4245:

4243:

4240:

4238:

4235:

4233:

4230:

4228:

4225:

4223:

4220:

4218:

4215:

4214:

4212:

4196:

4192:

4189:

4185:

4182:

4178:

4175:

4171:

4170:

4167:

4160:

4156:

4153:

4149:

4146:

4142:

4138:

4134:

4131:

4127:

4124:

4120:

4116:

4112:

4107:

4103:

4100:

4096:

4093:

4089:

4088:

4086:

4082:

4078:

4074:

4070:

4066:

4062:

4058:

4054:

4050:

4047:

4043:

4039:

4035:

4031:

4027:

4024:

4020:

4017:

4013:

4010:

4006:

4003:

3999:

3995:

3991:

3988:

3984:

3980:

3976:

3973:

3969:

3966:

3962:

3959:

3955:

3952:

3948:

3944:

3940:

3936:

3932:

3929:

3925:

3922:

3918:

3915:

3911:

3910:

3908:

3904:

3900:

3891:

3887:

3884:

3880:

3877:

3873:

3870:

3866:

3863:

3859:

3856:

3852:

3849:

3845:

3842:

3838:

3835:

3831:

3828:

3824:

3821:

3817:

3814:

3810:

3807:

3803:

3800:

3796:

3793:

3792:December 2008

3789:

3786:

3785:November 2008

3782:

3779:

3775:

3772:

3768:

3767:

3765:

3761:

3760:

3758:

3754:

3750:

3742:

3738:

3735:

3731:

3728:

3724:

3720:

3716:

3713:

3709:

3706:

3702:

3699:

3695:

3692:

3688:

3685:

3681:

3677:

3673:

3669:

3665:

3661:

3657:

3654:

3650:

3647:

3643:

3640:

3636:

3633:

3629:

3626:

3622:

3618:

3614:

3611:

3607:

3604:

3600:

3596:

3592:

3589:

3585:

3581:

3577:

3574:

3570:

3567:

3563:

3560:

3556:

3553:

3549:

3545:

3541:

3537:

3533:

3530:

3526:

3523:

3519:

3515:

3511:

3507:

3503:

3500:

3496:

3493:

3489:

3486:

3482:

3478:

3474:

3470:

3466:

3465:

3463:

3459:

3454:

3450:

3442:

3438:

3435:

3431:

3428:

3424:

3420:

3416:

3412:

3408:

3405:

3401:

3398:

3394:

3391:

3387:

3383:

3379:

3378:

3376:

3372:

3368:

3361:

3357:

3354:

3350:

3349:

3347:

3343:

3339:

3332:

3331:Panic of 1930

3328:

3325:

3321:

3317:

3313:

3309:

3305:

3301:

3297:

3296:

3294:

3290:

3286:

3279:

3275:

3272:

3268:

3264:

3260:

3257:

3256:Panic of 1907

3253:

3250:

3249:Panic of 1901

3246:

3243:

3242:Panic of 1896

3239:

3235:

3231:

3228:

3224:

3221:

3220:Panic of 1893

3217:

3213:

3209:

3205:

3204:Baring crisis

3201:

3197:

3196:Arendal crash

3193:

3190:

3189:Panic of 1884

3186:

3183:

3179:

3176:

3175:Panic of 1873

3172:

3171:

3169:

3165:

3161:

3153:

3149:

3146:

3145:Panic of 1866

3142:

3139:

3138:Panic of 1857

3135:

3132:

3131:Panic of 1847

3128:

3123:

3119:

3116:

3112:

3111:

3108:

3104:

3103:

3101:

3097:

3090:

3089:Panic of 1837

3086:

3083:

3082:Panic of 1825

3079:

3076:

3075:Panic of 1819

3072:

3068:

3064:

3061:

3057:

3054:

3050:

3047:

3046:Panic of 1792

3043:

3040:

3036:

3032:

3028:

3025:

3021:

3017:

3013:

3010:

3006:

3005:

3003:

2999:

2995:

2987:

2983:

2979:

2975:

2971:

2967:

2963:

2962:

2957:

2953:

2949:

2945:

2941:

2937:

2933:

2932:

2930:

2926:

2922:

2914:

2910:

2909:

2907:

2905:

2900:

2893:

2889:

2886:

2885:Social crisis

2882:

2879:

2878:Minsky moment

2875:

2870:

2866:

2863:

2859:

2856:

2852:

2849:

2845:

2844:

2842:

2838:

2835:

2831:

2828:

2824:

2819:

2815:

2814:

2812:

2808:

2805:

2804:Energy crisis

2801:

2798:

2794:

2791:

2787:

2784:

2780:

2777:

2776:Credit crunch

2773:

2770:

2766:

2763:

2759:

2758:

2755:

2751:

2744:

2739:

2737:

2732:

2730:

2725:

2724:

2721:

2709:

2705:

2704:

2701:

2695:

2692:

2690:

2687:

2685:

2682:

2681:

2679:

2675:

2669:

2666:

2664:

2661:

2659:

2656:

2654:

2651:

2647:

2644:

2642:

2639:

2637:

2634:

2633:

2632:

2629:

2627:

2624:

2622:

2619:

2617:

2614:

2613:

2611:

2607:

2596:

2593:

2590:

2587:

2584:

2581:

2578:

2575:

2572:

2569:

2566:

2563:

2562:

2560:

2556:

2550:

2547:

2545:

2542:

2540:

2537:

2535:

2532:

2530:

2527:

2526:

2524:

2520:

2517:

2513:

2507:

2504:

2502:

2499:

2497:

2494:

2492:

2489:

2487:

2484:

2482:

2479:

2477:

2474:

2472:

2469:

2467:

2464:

2462:

2459:

2458:

2456:

2452:

2448:

2444:

2437:

2432:

2430:

2425:

2423:

2418:

2417:

2414:

2403:

2402:

2397:

2391:

2388:

2375:

2369:

2366:

2353:

2349:

2343:

2340:

2327:

2323:

2317:

2314:

2301:

2297:

2291:

2288:

2275:

2271:

2265:

2262:

2249:

2245:

2238:

2235:

2222:

2218:

2212:

2209:

2196:

2192:

2186:

2183:

2170:

2166:

2159:

2156:

2143:

2139:

2133:

2130:

2118:. 16 May 2011

2117:

2113:

2107:

2104:

2091:

2087:

2081:

2078:

2065:

2061:

2055:

2052:

2040:

2036:

2030:

2027:

2014:

2010:

2004:

2001:

1988:

1984:

1977:

1974:

1962:

1958:

1952:

1949:

1937:

1933:

1926:

1923:

1920:

1915:

1912:

1909:

1904:

1901:

1888:

1884:

1877:

1874:

1861:

1857:

1851:

1848:

1836:

1832:

1826:

1823:

1819:

1814:

1812:

1808:

1796:

1792:

1791:

1781:

1778:

1773:

1767:

1764:

1751:

1747:

1741:

1738:

1725:

1721:

1715:

1712:

1707:

1703:

1698:

1693:

1689:

1685:

1681:

1674:

1672:

1670:

1668:

1666:

1662:

1649:

1645:

1638:

1635:

1622:

1616:

1613:

1601:

1597:

1590:

1587:

1574:

1570:

1563:

1561:

1559:

1557:

1555:

1553:

1551:

1547:

1534:

1528:

1525:

1512:

1506:

1503:

1490:

1484:

1481:

1468:

1462:

1459:

1446:

1440:

1437:

1424:

1417:

1414:

1401:

1395:

1393:

1391:

1387:

1384:

1383:The Economist

1380:

1375:

1372:

1359:

1353:

1350:

1334:

1326:

1320:

1317:

1312:

1306:

1303:

1290:

1284:

1281:

1268:

1262:

1259:

1246:

1240:

1237:

1224:

1218:

1215:

1212:, p. 11.

1211:

1206:

1203:

1199:

1194:

1191:

1188:, p. 13.

1187:

1182:

1179:

1175:

1170:

1168:

1164:

1148:

1142:

1140:

1136:

1123:

1116:

1113:

1100:

1093:

1091:

1089:

1087:

1083:

1079:

1067:

1063:

1056:

1053:

1049:

1037:

1033:

1026:

1023:

1010:

1006:

999:

996:

983:

982:The Economist

979:

973:

970:

957:

950:

947:

934:

928:

925:

912:

906:

904:

902:

900:

898:

896:

894:

892:

890:

888:

884:

871:

864:

861:

849:

845:

839:

836:

823:

817:

814:

802:

798:

791:

788:

775:

769:

767:

763:

751:

747:

740:

737:

725:

721:

714:

711:

706:

700:

697:

692:

688:

684:

680:

676:

672:

671:Health Policy

665:

662:

650:

646:

639:

636:

617:

613:

612:

608:

598:

595:

591:

585:

582:

575:

571:

568:

566:

563:

561:

558:

557:

553:

548:

545:

542:

538:

535:

531:

530:

526:

524:

522:

514:

512:

510:

501:

499:

497:

493:

492:José Sócrates

487:

479:

477:

475:

471:

470:António Costa

467:

462:

457:

456:no confidence

452:

450:

445:

440:

436:

435:risk premiums

432:

428:

424:

420:

416:

408:

406:

404:

400:

396:

391:

389:

385:

381:

377:

371:

368:

366:

360:

358:

354:

350:

346:

338:

336:

334:

330:

325:

321:

317:

312:

307:

303:

299:

295:

290:

288:

284:

279:

274:

272:

268:

267:

266:The Economist

262:

258:

253:

249:

245:

244:José Sócrates

240:

238:

234:

230:

226:

222:

218:

214:

210:

205:

199:

197:

193:

189:

181:

176:

172:

168:

164:

159:

152:

148:

147:José Sócrates

143:

136:

132:

128:

124:

117:

115:

113:

109:

105:

101:

97:

93:

89:

85:

81:

77:

73:

34:

30:

19:

3927:

3778:October 2008

3660:Samba effect

3516:(1987–2000s)

3411:Steel crisis

3234:Black Monday

3212:Encilhamento

3152:Black Friday

2959:

2915:(235–284 CE)

2783:Credit cycle

2641:Hidden loans

2490:

2399:

2390:

2378:. Retrieved

2368:

2356:. Retrieved

2351:

2342:

2330:. Retrieved

2326:the original

2316:

2304:. Retrieved

2299:

2290:

2278:. Retrieved

2273:

2264:

2252:. Retrieved

2247:

2237:

2225:. Retrieved

2221:CNN Portugal

2220:

2211:

2199:. Retrieved

2194:

2185:

2173:. Retrieved

2168: