304:

behind on making tax payments on the property. The HOLC eventually foreclosed on 20 percent of the loans that it refinanced. It tended to wait until the borrower had failed to make payments on the loan for more than a year before it foreclosed on the loan. When the HOLC foreclosed, it typically refurbished the home. In many cases it rented out the home until it could be resold. The HOLC tried to avoid selling too many homes quickly to avoid having negative effects on housing prices. Ultimately, more than 800,000 people repaid their HOLC loans, and many repaid them on time. HOLC officially ceased operations in 1951, when its last assets were sold to private lenders. HOLC was only applicable to nonfarm homes, worth less than $ 20,000. HOLC also assisted mortgage lenders by refinancing problematic loans and increasing the institutions' liquidity. When its last assets were sold in 1951, HOLC turned a small profit.

388:'s claim that they relied on the HOLC's maps to implement their own discriminatory practices has been widely repeated, the evidence is weak that private lenders had access to the maps. By contrast, it is well documented that private lenders understood which neighborhoods the FHA favored and disfavored; suburban greenfield developers often explicitly advertised the FHA-insurability of their properties in ads for prospective buyers. Redlining was an established practice in the real estate industry before the federal government had any significant role in it; to the extent that any federal agency is to blame for perpetuating the practice, it is the Federal Housing Administration and not the Home Owners' Loan Corporation.

345:

313:

100:

36:

295:

gained from selling the loans because the HOLC bought the loans by offering a value of bonds equal to the amount of principal owed by the borrower, plus unpaid interest on the loan, plus taxes that the lender paid on the property. This value of the loan was the amount of the loan that was refinanced for the borrower. The borrower gained because they were offered a loan with a longer time frame at a lower interest rate. It was rare to reduce the amount of principal owed.

337:

1935 until 1940. Perhaps ironically, HOLC had issued refinancing loans to

African American homeowners in its initial "rescue" phase before it started making its redlining maps. The racist attitudes and language found in HOLC appraisal sheets and Residential Security Maps created by the HOLC gave federal support to real-estate practices that helped segregate American housing throughout the 20th century.

303:

Between 1933 and 1935, the HOLC made slightly more than one million loans. At that point it stopped making new loans and then focused on the repayments of the loans. The typical borrower whose loan was refinanced by the HOLC was more than 2 years behind on payments of the loan and more than 2 years

364:

found that areas classified as high-risk on HOLC maps became increasingly segregated by race during the next 30–35 years, and suffered long-run declines in home ownership, house values, and credit scores. HOLC's evaluation of neighborhoods in the 1930s correlates with "health, employment, education,

294:

The HOLC issued bonds and then used the bonds to purchase mortgage loans from lenders. The loans purchased were for homeowners who were having problems making the payments on their mortgage loans "through no fault of their own". The HOLC refinanced the loans for the borrowers. Many of the lenders

373:

and three co-authors, issued in 2021, the blame placed on HOLC is misplaced. Far from "ironically" issuing a few loans to

African-Americans in an "initial phase" and then becoming a major promoter of redlining, HOLC actually refinanced mortgage loans for African-Americans in near proportion to the

336:

generated during the 1930s to assess credit-worthiness were color-coded by mortgage security risk, with majority

African-American areas disproportionately likely to be marked in red indicating designation as "hazardous." These maps were made as part of HOLC's City Survey project that ran from late

368:

Since the rediscovery of HOLC documents in the 1980s, there has been considerable debate about the exact role of HOLC and its maps in redlining: even as the neighborhood evaluations largely align with race and with ongoing disparities, it is unclear exactly how much of an effect HOLC itself had.

1156:

Recommended restrictions should include provision for the following: Prohibition of the occupancy of properties except by the race for which they are intended

Schools should be appropriate to the needs of the new community and they should not be attended in large numbers by inharmonious racial

340:

The effects of redlining, as noted in HOLC maps, endures to the present time. A study released in 2018 found that 74 percent of neighborhoods that HOLC graded as high-risk or "hazardous" are low-to-moderate income neighborhoods today, while 64 percent of the neighborhoods graded "hazardous" are

225:

The HOLC created a housing appraisal system of color-coded maps that categorized the riskiness of lending to households in different neighborhoods. While the maps relied on various housing and economic measures, they also used demographic information (such as the racial, ethnic, and immigrant

374:

share of

African-American homeowners. The pattern of loans had basically no relationship to the "redlining" maps because the program to create the maps did not even begin until after 90% of HOLC refinancing agreements had already been concluded.

341:

minority neighborhoods today. "It's as if some of these places have been trapped in the past, locking neighborhoods into concentrated poverty," said Jason

Richardson, director of research at the NCRC, a consumer advocacy group.

274:, by EO 9070, February 24, 1942. Its board of directors was abolished by Reorganization Plan No. 3 of 1947, effective July 27, 1947, and HOLC was assigned, for purposes of liquidation, to the Home Loan Bank Board within the

1774:

732:

1591:

1779:

677:

708:

1669:

381:. But, the FHA already had its own discriminatory program of systematically rating urban neighborhoods and the HOLC used the FHA's discriminatory guidelines for its maps.

1764:

1674:

1016:

White, Anna G.; Guikema, Seth D.; Logan, Tom M. (July 2021). "Urban population characteristics and their correlation with historic discriminatory housing practices".

1260:

794:

943:

1210:

235:

1635:

740:

1616:

1706:

1329:

1696:

1640:

1664:

1514:

239:

907:

105:

1655:

1439:

57:

278:. It was terminated by order of Home Loan Bank Board Secretary, effective February 3, 1954, pursuant to an act of June 30, 1953 (67

1689:

1601:

684:

1444:

643:

1606:

1586:

1519:

1384:

1253:

1136:

Underwriting Manual: Underwriting and

Valuation Procedure Under Title II of the National Housing Act With Revisions to February 1938

778:

79:

1555:

1218:

1469:

661:

1399:

279:

275:

1711:

1650:

1565:

1434:

1429:

1140:

378:

1169:

267:

1596:

1489:

1394:

1369:

1130:

1545:

1509:

1479:

1414:

1404:

1389:

1379:

1364:

1344:

1309:

1299:

1269:

1246:

1134:

251:

1424:

1716:

1701:

1645:

1570:

1484:

1474:

1449:

1349:

1294:

1284:

1314:

50:

44:

1769:

1611:

1464:

1359:

1334:

1289:

360:

found that HOLC led to substantial and persistent increases in racial residential segregation. A 2021 study in the

263:

207:

1319:

1185:

Brennana, John F. "The Impact of

Depression-era Homeowners' Loan Corporation Lending in Greater Cleveland, Ohio,"

1529:

1504:

1494:

1409:

1374:

61:

1623:

1499:

1454:

1354:

1339:

1550:

761:

Connolly, N. D. B.; Winling, LaDale; Nelson, Robert K.; Marciano, Richard (2018-01-19), "Mapping inequality",

255:

99:

416:

1628:

1206:

590:

397:

271:

814:"How the City Survey's Redlining Maps Were Made: A Closer Look at HOLC's Mortgagee Rehabilitation Division"

344:

312:

1721:

1560:

259:

1304:

211:

853:"New Perspectives on New Deal Housing Policy: Explicating and Mapping HOLC Loans to African Americans"

1736:

1524:

1238:

457:

1459:

1052:

1324:

1112:

1033:

998:

880:

852:

833:

572:

385:

227:

125:

1419:

990:

903:

872:

774:

639:

564:

517:

473:

370:

1731:

1684:

1104:

1096:

1064:

1025:

982:

974:

864:

825:

766:

658:

556:

548:

507:

465:

175:

165:

17:

1222:

962:

536:

266:, effective July 1, 1939. It was assigned with other components of abolished FHLBB to the

1215:

925:"HOLC "redlining" maps: The persistent structure of segregation and economic inequality"

496:"We Built This: Consequences of New Deal Era Intervention in America's Racial Geography"

1679:

377:

However, the HOLC shared their maps with the other major New Deal housing program, the

1758:

1144:

1116:

1037:

1002:

884:

837:

665:

576:

317:

709:"In U.S. Cities, The Health Effects Of Past Housing Discrimination Are Plain To See"

441:

1029:

258:

of 1933, June 13, 1933. It was transferred with FHLBB and its components to the

219:

215:

1227:

456:

Aaronson, Daniel; Hartley, Daniel; Mazumder, Bhashkar; Stinson, Martha (2022).

1068:

829:

333:

994:

876:

868:

770:

568:

521:

512:

495:

477:

230:

in the 1980s, a number of studies have found that HOLC was a key promoter of

900:

Colored

Property: State Policy and White Racial Politics in Suburban America

813:

349:

329:

321:

231:

1233:

Annual reports of the Home Owners' Loan

Corporation from 1933 through 1952

1216:

Security maps of the Home Owners' Loan Corporation for several U.S. cities

1087:

Fishback, Price; Rose, Jonathan; Snowden, Kenneth; Storrs, Thomas (2021).

733:"Racist housing policies have created some oppressively hot neighborhoods"

1232:

978:

552:

203:

1108:

986:

944:"Redlining was banned 50 years ago. It's still hurting minorities today"

560:

420:

283:

616:

1088:

1089:"New Evidence on Redlining by Federal Housing Programs in the 1930s"

226:

composition of neighborhoods) to categorize creditworthiness. Since

1100:

1741:

1726:

634:

Fishback, Price; Rose, Jonathan; Snowden, Kenneth (October 2013).

623:(1st ed.). New York: National Bureau of Economic Research: 1.

469:

417:"Renovation of the Home Owners Loan Corporation (HOLC) Building"

365:

and income measures" in these same neighborhoods decades later.

202:) was a government-sponsored corporation created as part of the

1242:

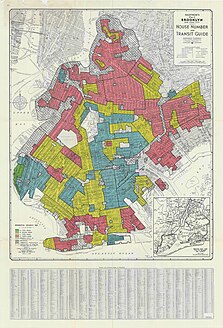

1194:

Well Worth Saving: How the New Deal Safeguarded Home Ownership.

961:

Aaronson, Daniel; Hartley, Daniel; Mazumder, Bhashkar (2021).

636:

Well Worth Saving: How the New Deal Safeguarded Home Ownership

535:

Aaronson, Daniel; Hartley, Daniel; Mazumder, Bhashkar (2021).

458:"The Long-Run Effects of the 1930s Redlining Maps on Children"

29:

591:"Records of the Federal Home Loan Bank Board [FHLBB]"

617:"History and Policies of the Home Owners' Loan Corporation"

1235:, included in reports of the Federal Home Loan Bank Board

1170:"Redlining Didn't Happen Quite the Way We Thought It Did"

924:

442:

First Annual Report of the Federal Home Loan Bank Board

638:(1st ed.). Chicago: University of Chicago Press.

1775:

Corporations chartered by the United States Congress

1192:

Price Fishback, Jonathan Rose, and Kenneth Snowden,

1579:

1538:

1277:

222:, as well as to expand home buying opportunities.

182:

171:

161:

146:

131:

121:

113:

1053:"Federal 'redlining' maps: A critical reappraisal"

328:HOLC is often cited as the originator of mortgage

250:HOLC was established as an emergency agency under

206:. The corporation was established in 1933 by the

188:20,000 (1935) and declined to less than 500 (1950)

1228:Mapping Inequality: Redlining in New Deal America

851:Michney, Todd M; Winling, LaDale (January 2020).

678:"Crossney and Bartelt 2006 Housing Policy Debate"

659:Crossney and Bartelt 2005 Urban Geography article

1780:Mortgage industry companies of the United States

963:"The Effects of the 1930s HOLC "Redlining" Maps"

537:"The Effects of the 1930s HOLC "Redlining" Maps"

218:home mortgages currently in default to prevent

27:United States government-sponsored corporation

1254:

8:

1211:National Archives and Records Administration

1207:Records of the Home Owners' Loan Corporation

1082:

1080:

1078:

92:

1196:Chicago: University of Chicago Press, 2013.

369:According to a paper by economic historian

1261:

1247:

1239:

967:American Economic Journal: Economic Policy

763:The Routledge Companion to Spatial History

541:American Economic Journal: Economic Policy

419:. John C. Grimberg Company. Archived from

98:

91:

929:National Community Reinvestment Coalition

511:

80:Learn how and when to remove this message

1765:1933 establishments in the United States

1131:"Part II, Section 9, Rating of Location"

902:. Chicago: University of Chicago Press.

343:

311:

299:Loan repayments and foreclosure policies

43:This article includes a list of general

408:

268:Federal Home Loan Bank Administration

7:

489:

487:

451:

449:

108:of the Home Owners' Loan Corporation

210:under the leadership of President

49:it lacks sufficient corresponding

25:

812:Michney, Todd M (November 2022).

264:Reorganization Plan No. I of 1939

208:Home Owners' Loan Corporation Act

117:Government-sponsored corporation

34:

1051:Markley, Scott (July 7, 2023).

765:, Routledge, pp. 502–524,

384:As for private lenders, though

276:Housing and Home Finance Agency

1141:Federal Housing Administration

923:Mitchell, Bruce (2018-03-20).

494:Faber, Jacob W. (2020-08-21).

462:Journal of Economic Literature

379:Federal Housing Administration

236:racial residential segregation

1:

196:Home Owners' Loan Corporation

93:Home Owners' Loan Corporation

1270:Housing in the United States

1030:10.1016/j.apgeog.2021.102445

739:. 2020-09-02. Archived from

500:American Sociological Review

358:American Sociological Review

252:Federal Home Loan Bank Board

18:Home Owners Loan Corporation

898:Freund, David M.P. (2007).

818:Journal of Planning History

615:Harriss, C. Lowell (1951).

254:(FHLBB) supervision by the

106:former federal headquarters

1796:

1093:Journal of Urban Economics

150:February 4, 1954

1069:10.1177/00420980231182336

830:10.1177/15385132211013361

801:. University of Richmond.

362:American Economic Journal

228:Kenneth T. Jackson's work

97:

1556:Northern Mariana Islands

869:10.1177/0096144218819429

857:Journal of Urban History

771:10.4324/9781315099781-29

513:10.1177/0003122420948464

240:racial wealth inequality

398:Federal Home Loan Banks

272:National Housing Agency

242:in the United States.

135:June 13, 1933

64:more precise citations.

1722:Missing middle housing

1636:Housing discrimination

1617:San Francisco Bay Area

1189:(2015) 36#1 pp: 1-28.

353:

325:

246:Organizational history

1272:by state or territory

347:

315:

256:Home Owners' Loan Act

214:. Its purpose was to

212:Franklin D. Roosevelt

1737:Single-family zoning

1172:. 21 September 2021.

1139:. Washington, D.C.:

979:10.1257/pol.20190414

795:"Mapping Inequality"

743:on September 3, 2020

553:10.1257/pol.20190414

356:A 2020 study in the

1566:U.S. Virgin Islands

423:on January 24, 2013

260:Federal Loan Agency

184:Number of employees

94:

1697:Subsidized housing

1641:Housing insecurity

1221:2015-03-31 at the

799:Mapping Inequality

793:Nelson, Robert K.

386:Kenneth T. Jackson

354:

352:HOLC redlining Map

326:

126:Financial services

1770:New Deal agencies

1752:

1751:

1665:Mortgage industry

1018:Applied Geography

909:978-0-226-26276-5

595:National Archives

371:Price V. Fishback

192:

191:

90:

89:

82:

16:(Redirected from

1787:

1732:Parking mandates

1685:Right to housing

1571:Washington, D.C.

1263:

1256:

1249:

1240:

1187:Urban Geography,

1174:

1173:

1166:

1160:

1159:

1153:

1152:

1143:. Archived from

1127:

1121:

1120:

1084:

1073:

1072:

1048:

1042:

1041:

1013:

1007:

1006:

958:

952:

951:

939:

933:

932:

920:

914:

913:

895:

889:

888:

848:

842:

841:

809:

803:

802:

790:

784:

783:

758:

752:

751:

749:

748:

729:

723:

722:

720:

719:

705:

699:

698:

696:

695:

689:

683:. Archived from

682:

674:

668:

656:

650:

649:

631:

625:

624:

612:

606:

605:

603:

602:

587:

581:

580:

532:

526:

525:

515:

491:

482:

481:

453:

444:

439:

433:

432:

430:

428:

413:

234:and a driver of

166:Washington, D.C.

157:

155:

142:

140:

102:

95:

85:

78:

74:

71:

65:

60:this article by

51:inline citations

38:

37:

30:

21:

1795:

1794:

1790:

1789:

1788:

1786:

1785:

1784:

1755:

1754:

1753:

1748:

1575:

1534:

1273:

1267:

1223:Wayback Machine

1203:

1182:

1180:Further reading

1177:

1168:

1167:

1163:

1150:

1148:

1129:

1128:

1124:

1086:

1085:

1076:

1050:

1049:

1045:

1015:

1014:

1010:

960:

959:

955:

948:Washington Post

941:

940:

936:

922:

921:

917:

910:

897:

896:

892:

850:

849:

845:

811:

810:

806:

792:

791:

787:

781:

760:

759:

755:

746:

744:

731:

730:

726:

717:

715:

707:

706:

702:

693:

691:

687:

680:

676:

675:

671:

657:

653:

646:

633:

632:

628:

614:

613:

609:

600:

598:

589:

588:

584:

534:

533:

529:

493:

492:

485:

455:

454:

447:

440:

436:

426:

424:

415:

414:

410:

406:

394:

310:

301:

292:

248:

185:

153:

151:

138:

136:

109:

86:

75:

69:

66:

56:Please help to

55:

39:

35:

28:

23:

22:

15:

12:

11:

5:

1793:

1791:

1783:

1782:

1777:

1772:

1767:

1757:

1756:

1750:

1749:

1747:

1746:

1745:

1744:

1739:

1734:

1729:

1724:

1714:

1709:

1704:

1699:

1694:

1693:

1692:

1690:Slum clearance

1687:

1682:

1680:Homestead Acts

1672:

1667:

1662:

1661:

1660:

1659:

1658:

1656:Silicon Valley

1653:

1638:

1633:

1632:

1631:

1626:

1621:

1620:

1619:

1604:

1602:Home ownership

1599:

1594:

1589:

1583:

1581:

1580:Related topics

1577:

1576:

1574:

1573:

1568:

1563:

1558:

1553:

1548:

1546:American Samoa

1542:

1540:

1536:

1535:

1533:

1532:

1527:

1522:

1517:

1512:

1507:

1502:

1497:

1492:

1487:

1482:

1480:South Carolina

1477:

1472:

1467:

1462:

1457:

1452:

1447:

1445:North Carolina

1442:

1437:

1432:

1427:

1422:

1417:

1412:

1407:

1402:

1397:

1392:

1387:

1382:

1377:

1372:

1367:

1362:

1357:

1352:

1347:

1342:

1337:

1332:

1327:

1322:

1317:

1312:

1307:

1302:

1297:

1292:

1287:

1281:

1279:

1275:

1274:

1268:

1266:

1265:

1258:

1251:

1243:

1237:

1236:

1230:

1225:

1213:

1202:

1201:External links

1199:

1198:

1197:

1190:

1181:

1178:

1176:

1175:

1161:

1122:

1101:10.3386/w29244

1074:

1063:(2): 195–213.

1043:

1008:

973:(4): 355–392.

953:

934:

915:

908:

890:

863:(1): 150–180.

843:

824:(4): 316–344.

804:

785:

779:

753:

724:

700:

669:

664:2012-07-09 at

651:

645:978-0226082448

644:

626:

607:

582:

547:(4): 355–392.

527:

506:(5): 739–775.

483:

445:

434:

407:

405:

402:

401:

400:

393:

390:

309:

306:

300:

297:

291:

288:

247:

244:

190:

189:

186:

183:

180:

179:

173:

169:

168:

163:

159:

158:

148:

144:

143:

133:

129:

128:

123:

119:

118:

115:

111:

110:

103:

88:

87:

42:

40:

33:

26:

24:

14:

13:

10:

9:

6:

4:

3:

2:

1792:

1781:

1778:

1776:

1773:

1771:

1768:

1766:

1763:

1762:

1760:

1743:

1740:

1738:

1735:

1733:

1730:

1728:

1725:

1723:

1720:

1719:

1718:

1715:

1713:

1710:

1708:

1705:

1703:

1700:

1698:

1695:

1691:

1688:

1686:

1683:

1681:

1678:

1677:

1676:

1673:

1671:

1670:Organizations

1668:

1666:

1663:

1657:

1654:

1652:

1651:San Francisco

1649:

1648:

1647:

1644:

1643:

1642:

1639:

1637:

1634:

1630:

1627:

1625:

1622:

1618:

1615:

1614:

1613:

1610:

1609:

1608:

1605:

1603:

1600:

1598:

1595:

1593:

1590:

1588:

1585:

1584:

1582:

1578:

1572:

1569:

1567:

1564:

1562:

1559:

1557:

1554:

1552:

1549:

1547:

1544:

1543:

1541:

1537:

1531:

1528:

1526:

1523:

1521:

1520:West Virginia

1518:

1516:

1513:

1511:

1508:

1506:

1503:

1501:

1498:

1496:

1493:

1491:

1488:

1486:

1483:

1481:

1478:

1476:

1473:

1471:

1468:

1466:

1463:

1461:

1458:

1456:

1453:

1451:

1448:

1446:

1443:

1441:

1438:

1436:

1433:

1431:

1428:

1426:

1425:New Hampshire

1423:

1421:

1418:

1416:

1413:

1411:

1408:

1406:

1403:

1401:

1398:

1396:

1393:

1391:

1388:

1386:

1385:Massachusetts

1383:

1381:

1378:

1376:

1373:

1371:

1368:

1366:

1363:

1361:

1358:

1356:

1353:

1351:

1348:

1346:

1343:

1341:

1338:

1336:

1333:

1331:

1328:

1326:

1323:

1321:

1318:

1316:

1313:

1311:

1308:

1306:

1303:

1301:

1298:

1296:

1293:

1291:

1288:

1286:

1283:

1282:

1280:

1276:

1271:

1264:

1259:

1257:

1252:

1250:

1245:

1244:

1241:

1234:

1231:

1229:

1226:

1224:

1220:

1217:

1214:

1212:

1208:

1205:

1204:

1200:

1195:

1191:

1188:

1184:

1183:

1179:

1171:

1165:

1162:

1158:

1147:on 2012-12-20

1146:

1142:

1138:

1137:

1132:

1126:

1123:

1118:

1114:

1110:

1106:

1102:

1098:

1094:

1090:

1083:

1081:

1079:

1075:

1070:

1066:

1062:

1058:

1057:Urban Studies

1054:

1047:

1044:

1039:

1035:

1031:

1027:

1023:

1019:

1012:

1009:

1004:

1000:

996:

992:

988:

984:

980:

976:

972:

968:

964:

957:

954:

949:

945:

938:

935:

930:

926:

919:

916:

911:

905:

901:

894:

891:

886:

882:

878:

874:

870:

866:

862:

858:

854:

847:

844:

839:

835:

831:

827:

823:

819:

815:

808:

805:

800:

796:

789:

786:

782:

780:9781315099781

776:

772:

768:

764:

757:

754:

742:

738:

734:

728:

725:

714:

710:

704:

701:

690:on 2008-04-14

686:

679:

673:

670:

667:

666:archive.today

663:

660:

655:

652:

647:

641:

637:

630:

627:

622:

618:

611:

608:

596:

592:

586:

583:

578:

574:

570:

566:

562:

558:

554:

550:

546:

542:

538:

531:

528:

523:

519:

514:

509:

505:

501:

497:

490:

488:

484:

479:

475:

471:

467:

463:

459:

452:

450:

446:

443:

438:

435:

422:

418:

412:

409:

403:

399:

396:

395:

391:

389:

387:

382:

380:

375:

372:

366:

363:

359:

351:

346:

342:

338:

335:

331:

323:

319:

314:

307:

305:

298:

296:

289:

287:

285:

281:

277:

273:

269:

265:

261:

257:

253:

245:

243:

241:

237:

233:

229:

223:

221:

217:

213:

209:

205:

201:

197:

187:

181:

177:

174:

170:

167:

164:

160:

149:

145:

134:

130:

127:

124:

120:

116:

112:

107:

101:

96:

84:

81:

73:

70:February 2015

63:

59:

53:

52:

46:

41:

32:

31:

19:

1607:Homelessness

1587:Architecture

1485:South Dakota

1475:Rhode Island

1470:Pennsylvania

1450:North Dakota

1193:

1186:

1164:

1155:

1149:. Retrieved

1145:the original

1135:

1125:

1109:10419/251011

1092:

1060:

1056:

1046:

1021:

1017:

1011:

987:10419/200568

970:

966:

956:

947:

942:Jan, Tracy.

937:

928:

918:

899:

893:

860:

856:

846:

821:

817:

807:

798:

788:

762:

756:

745:. Retrieved

741:the original

736:

727:

716:. Retrieved

712:

703:

692:. Retrieved

685:the original

672:

654:

635:

629:

620:

610:

599:. Retrieved

597:. 2016-08-15

594:

585:

561:10419/200568

544:

540:

530:

503:

499:

461:

437:

427:December 23,

425:. Retrieved

421:the original

411:

383:

376:

367:

361:

357:

355:

339:

327:

302:

293:

249:

224:

199:

195:

193:

162:Headquarters

114:Company type

76:

67:

48:

1707:Segregation

1561:Puerto Rico

1400:Mississippi

1315:Connecticut

470:10.1257/jel

220:foreclosure

62:introducing

1759:Categories

1646:California

1612:California

1539:Non-states

1515:Washington

1435:New Mexico

1430:New Jersey

1305:California

1151:2023-06-07

1024:: 102445.

747:2020-12-13

718:2020-12-13

694:2008-04-12

601:2017-10-24

316:Brooklyn,

290:Operations

154:1954-02-04

139:1933-06-13

45:references

1712:Squatting

1525:Wisconsin

1490:Tennessee

1395:Minnesota

1370:Louisiana

1209:from the

1117:239123963

1038:236261789

1003:204505153

995:1945-7731

885:149628183

877:0096-1442

838:236560695

577:204505153

569:1945-7731

522:0003-1224

478:0022-0515

404:Footnotes

348:Oshkosh,

334:HOLC maps

330:redlining

322:redlining

308:Redlining

270:(FHLBA),

232:redlining

216:refinance

1624:Colorado

1597:Eviction

1510:Virginia

1460:Oklahoma

1440:New York

1415:Nebraska

1405:Missouri

1390:Michigan

1380:Maryland

1365:Kentucky

1345:Illinois

1320:Delaware

1310:Colorado

1300:Arkansas

1219:Archived

662:Archived

392:See also

204:New Deal

178:services

172:Services

122:Industry

1629:Florida

1592:Economy

1530:Wyoming

1505:Vermont

1410:Montana

1350:Indiana

1330:Georgia

1325:Florida

1295:Arizona

1285:Alabama

737:Science

713:NPR.org

152: (

147:Defunct

137: (

132:Founded

58:improve

1717:Zoning

1702:Racism

1675:Policy

1465:Oregon

1420:Nevada

1360:Kansas

1335:Hawaii

1290:Alaska

1278:States

1157:groups

1115:

1036:

1001:

993:

906:

883:

875:

836:

777:

642:

575:

567:

520:

476:

282:

176:Credit

47:, but

1742:YIMBY

1727:NIMBY

1495:Texas

1375:Maine

1340:Idaho

1113:S2CID

1034:S2CID

999:S2CID

881:S2CID

834:S2CID

688:(PDF)

681:(PDF)

573:S2CID

320:HOLC

280:Stat.

1551:Guam

1500:Utah

1455:Ohio

1355:Iowa

991:ISSN

904:ISBN

873:ISSN

775:ISBN

640:ISBN

621:NBER

565:ISSN

518:ISSN

474:ISSN

429:2010

238:and

200:HOLC

194:The

104:The

1105:hdl

1097:doi

1065:doi

1026:doi

1022:132

983:hdl

975:doi

865:doi

826:doi

767:doi

557:hdl

549:doi

508:doi

466:doi

324:Map

286:).

284:121

262:by

1761::

1154:.

1133:.

1111:.

1103:.

1095:.

1091:.

1077:^

1061:61

1059:.

1055:.

1032:.

1020:.

997:.

989:.

981:.

971:13

969:.

965:.

946:.

927:.

879:.

871:.

861:46

859:.

855:.

832:.

822:21

820:.

816:.

797:.

773:,

735:.

711:.

619:.

593:.

571:.

563:.

555:.

545:13

543:.

539:.

516:.

504:85

502:.

498:.

486:^

472:.

464:.

460:.

448:^

350:WI

318:NY

1262:e

1255:t

1248:v

1119:.

1107::

1099::

1071:.

1067::

1040:.

1028::

1005:.

985::

977::

950:.

931:.

912:.

887:.

867::

840:.

828::

769::

750:.

721:.

697:.

648:.

604:.

579:.

559::

551::

524:.

510::

480:.

468::

431:.

332:.

198:(

156:)

141:)

83:)

77:(

72:)

68:(

54:.

20:)

Text is available under the Creative Commons Attribution-ShareAlike License. Additional terms may apply.