830:

profit-maximizing quantity and price would not change. This can be illustrated by graphing the short run total cost curve and the short-run variable cost curve. The shapes of the curves are identical. Each curve initially increases at a decreasing rate, reaches an inflection point, then increases at an increasing rate. The only difference between the curves is that the SRVC curve begins from the origin while the SRTC curve originates on the positive part of the vertical axis. The distance of the beginning point of the SRTC above the origin represents the fixed cost – the vertical distance between the curves. This distance remains constant as the quantity produced, Q, increases. MC is the slope of the SRVC curve. A change in fixed cost would be reflected by a change in the vertical distance between the SRTC and SRVC curve. Any such change would have no effect on the shape of the SRVC curve and therefore its slope MC at any point. The changing law of marginal cost is similar to the changing law of average cost. They are both decrease at first with the increase of output, then start to increase after reaching a certain scale. While the output when marginal cost reaches its minimum is smaller than the average total cost and average variable cost. When the average total cost and the average variable cost reach their lowest point, the marginal cost is equal to the average cost.

972:

higher than average cost(n). If the marginal cost is found lying under the average cost curve, it will bend the average cost curve downwards and if the marginal cost is above the average cost curve, it will bend the average cost curve upwards. You can see the table above where before the marginal cost curve and the average cost curve intersect, the average cost curve is downwards sloping, however after the intersection, the average cost curve is sloping upwards. The U-shape graph reflects the law of diminishing returns. A firm can only produce so much but after the production of (n+1)th output reaches a minimum cost, the output produced after will only increase the average total cost (Nwokoye, Ebele & Ilechukwu, Nneamaka, 2018).

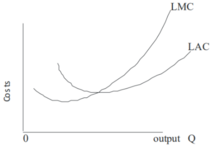

800:). Economies of scale are said to exist if an additional unit of output can be produced for less than the average of all previous units – that is, if long-run marginal cost is below long-run average cost, so the latter is falling. Conversely, there may be levels of production where marginal cost is higher than average cost, and the average cost is an increasing function of output. Where there are economies of scale, prices set at marginal cost will fail to cover total costs, thus requiring a subsidy. For this generic case, minimum average cost occurs at the point where average cost and marginal cost are equal (when plotted, the marginal cost curve intersects the average cost curve from below).

981:

black vertical line marked as "profit-maximising quantity" is where the marginal revenue is larger than marginal cost. If a firm sets its production on the left side of the graph and decides to increase the output, the additional revenue per output obtained will exceed the additional cost per output. From the "profit maximizing graph", we could observe that the revenue covers both bar A and B, meanwhile the cost only covers B. Of course A+B earns you a profit but the increase in output to the point of MR=MC yields extra profit that can cover the revenue for the missing A. The firm is recommended to increase output to reach (Theory and

Applications of Microeconomics, 2012).

518:. This reduction in productivity is not limited to the additional labor needed to produce the marginal unit – the productivity of every unit of labor is reduced. Thus the cost of producing the marginal unit of output has two components: the cost associated with producing the marginal unit and the increase in average costs for all units produced due to the "damage" to the entire productive process. The first component is the per-unit or average cost. The second component is the small increase in cost due to the law of diminishing marginal returns which increases the costs of all units sold.

964:

812:(the portion of the MC curve below its intersection with the AVC curve is not part of the supply curve because a firm would not operate at a price below the shutdown point). This is not true for firms operating in other market structures. For example, while a monopoly has an MC curve, it does not have a supply curve. In a perfectly competitive market, a supply curve shows the quantity a seller is willing and able to supply at each price – for each price, there is a unique quantity that would be supplied.

302:

unit is high, if the firm operates at too low a level of output, or it may start flat or rise immediately. At some point, the marginal cost rises as increases in the variable inputs such as labor put increasing pressure on the fixed assets such as the size of the building. In the long run, the firm would increase its fixed assets to correspond to the desired output; the short run is defined as the period in which those assets cannot be changed.

989:

290:

311:

1991:

1980:

917:

885:

952:

764:...many more companies state that they have falling, rather than rising, marginal cost curves. While there are reasons to wonder whether respondents interpreted these questions about costs correctly, their answers paint an image of the cost structure of the typical firm that is very different from the one immortalized in textbooks.

346:

Fixed costs represent the costs that do not change as the production quantity changes. Fixed costs are costs incurred by things like rent, building space, machines, etc. Variable costs change as the production quantity changes, and are often associated with labor or materials. The derivative of fixed

301:

On the short run, the firm has some costs that are fixed independently of the quantity of output (e.g. buildings, machinery). Other costs such as labor and materials vary with output, and thus show up in marginal cost. The marginal cost may first decline, as in the diagram, if the additional cost per

984:

On the other hand, the right side of the black line (Marginal revenue = marginal cost), shows that marginal cost is more than marginal revenue. Suppose a firm sets its output on this side, if it reduces the output, the cost will decrease from C and D which exceeds the decrease in revenue which is D.

820:

In perfectly competitive markets, firms decide the quantity to be produced based on marginal costs and sale price. If the sale price is higher than the marginal cost, then they produce the unit and supply it. If the marginal cost is higher than the price, it would not be profitable to produce it. So

46:

of producing additional quantity. In some contexts, it refers to an increment of one unit of output, and in others it refers to the rate of change of total cost as output is increased by an infinitesimal amount. As Figure 1 shows, the marginal cost is measured in dollars per unit, whereas total cost

734:

is the change in quantity of labor that brings about a one-unit change in output. Since the wage rate is assumed constant, marginal cost and marginal product of labor have an inverse relationship—if the marginal product of labor is decreasing (or, increasing), then marginal cost is increasing

432:

For instance, suppose the total cost of making 1 shoe is $ 30 and the total cost of making 2 shoes is $ 40. The marginal cost of producing shoes decreases from $ 30 to $ 10 with the production of the second shoe ($ 40 – $ 30 = $ 10). In another example, when a fixed cost is associated, the marginal

904:

Such externalities are a result of firms externalizing their costs onto a third party in order to reduce their own total cost. As a result of externalizing such costs, we see that members of society who are not included in the firm will be negatively affected by such behavior of the firm. In this

759:

and colleagues conducted a survey of 200 executives of corporations with sales exceeding $ 10 million, in which they were asked, among other questions, about the structure of their marginal cost curves. Strikingly, just 11% of respondents answered that their marginal costs increased as production

513:

Marginal cost is not the cost of producing the "next" or "last" unit. The cost of the last unit is the same as the cost of the first unit and every other unit. In the short run, increasing production requires using more of the variable input — conventionally assumed to be labor. Adding more

980:

The profit maximizing graph on the right side of the page represents optimal production quantity when both marginal cost and the marginal profit line intercepts. The black line represents the intersection where the profits are the greatest (marginal revenue = marginal cost). The left side of the

971:

In this case, when the marginal cost of the (n+1)th unit is less than the average cost(n), the average cost (n+1) will get a smaller value than average cost(n). It goes the opposite way when the marginal cost of (n+1)th is higher than average cost(n). In this case, The average cost(n+1) will be

875:

the environment, and others may bear those costs. A consumer may consume a good which produces benefits for society, such as education; because the individual does not receive all of the benefits, he may consume less than efficiency would suggest. Alternatively, an individual may be a smoker or

321:

is defined as the length of time in which no input is fixed. Everything, including building size and machinery, can be chosen optimally for the quantity of output that is desired. As a result, even if short-run marginal cost rises because of capacity constraints, long-run marginal cost can be

829:

Marginal costs are not affected by the level of fixed cost. Marginal costs can be expressed as ∆C/∆Q. Since fixed costs do not vary with (depend on) changes in quantity, MC is ∆VC/∆Q. Thus if fixed cost were to double, the marginal cost MC would not be affected, and consequently, the

939:

Such production creates a social cost curve that is below the private cost curve. In an equilibrium state, markets creating positive externalities of production will underproduce their good. As a result, the socially optimal production level would be greater than that observed.

297:

Short run marginal cost is the change in total cost when an additional output is produced in the short run and some costs are fixed. On the right side of the page, the short-run marginal cost forms a U-shape, with quantity on the x-axis and cost per unit on the y-axis.

750:

models broadly assume that marginal cost will increase as production increases, several empirical studies conducted throughout the 20th century have concluded that the marginal cost is either constant or falling for the vast majority of firms. Most recently, former

892:

Much of the time, private and social costs do not diverge from one another, but at times social costs may be either greater or less than private costs. When the marginal social cost of production is greater than that of the private cost function, there is a

62:

of the factory building that do not change with output. The marginal cost can be either short-run or long-run marginal cost, depending on what costs vary with output, since in the long run even building size is chosen to fit the desired output.

326:

if technological or management productivity changes with the quantity. Or, there may be both, as in the diagram at the right, in which the marginal cost first falls (increasing returns to scale) and then rises (decreasing returns to scale).

959:

Say the starting point of level of output produced is n. Marginal cost is the change of the total cost from an additional output . Therefore, (refer to "Average cost" labelled picture on the right side of the screen.

688:

521:

Marginal costs can also be expressed as the cost per unit of labor divided by the marginal product of labor. Denoting variable cost as VC, the constant wage rate as w, and labor usage as L, we have

429:, marginal cost equals the change in total (or variable) cost that comes with each additional unit produced. Since fixed cost does not change in the short run, it has no effect on marginal cost.

908:

In an equilibrium state, markets creating negative externalities of production will overproduce that good. As a result, the socially optimal production level would be lower than that observed.

571:

420:

256:

796:

apply to the long run, a span of time in which all inputs can be varied by the firm so that there are no fixed inputs or fixed costs. Production may be subject to economies of scale (or

732:

201:

54:

At each level of production and time period being considered, marginal cost includes all costs that vary with the level of production, whereas costs that do not vary with production are

932:

is a textbook example of production that creates positive externalities. An example of such a public good, which creates a divergence in social and private costs, is the production of

864:, of both production and consumption. Examples include a social cost from air pollution affecting third parties and a social benefit from flu shots protecting others from infection.

612:

985:

Therefore, decreasing output until the point of (marginal revenue=marginal cost) will lead to an increase in profit (Theory and

Applications of Microeconomics, 2012).

279:

852:

costs. The marginal private cost shows the cost borne by the firm in question. It is the marginal private cost that is used by business decision makers in their

114:

134:

87:

860:

any other cost (or offsetting benefit) to parties having no direct association with purchase or sale of the product. It incorporates all negative and positive

58:. For example, the marginal cost of producing an automobile will include the costs of labor and parts needed for the additional automobile but not the

1861:

1360:

948:

The marginal cost intersects with the average total cost and the average variable cost at their lowest point. Take the graph as a representation.

1161:

808:

The portion of the marginal cost curve above its intersection with the average variable cost curve is the supply curve for a firm operating in a

47:

is in dollars, and the marginal cost is the slope of the total cost, the rate at which it increases with output. Marginal cost is different from

1204:

876:

alcoholic and impose costs on others. In these cases, production or consumption of the good in question may differ from the optimum level.

936:. It is often seen that education is a positive for any whole society, as well as a positive for those directly involved in the market.

620:

760:

increased, while 48% answered that they were constant, and 41% answered that they were decreasing. Summing up the results, they wrote:

905:

case, an increased cost of production in society creates a social cost curve that depicts a greater cost than the private cost curve.

1237:

1098:

1078:

1123:

1552:

1353:

1846:

1798:

1486:

1023:

527:

365:

212:

1320:

2020:

1508:

1496:

1491:

1481:

1451:

963:

700:

339:

are expressed as follows, where Q represents the production quantity, VC represents variable costs, FC represents

1926:

1402:

1048:

856:

behavior. Marginal social cost is similar to private cost in that it includes the cost of private enterprise but

694:

142:

1592:

1461:

1162:

http://ocw.mit.edu/courses/economics/14-01-principles-of-microeconomics-fall-2007/lecture-notes/14_01_lec13.pdf

778:

1151:

Silberberg & Suen, The

Structure of Economics, A Mathematical Analysis 3rd ed. (McGraw-Hill 2001) at 181.

1994:

1891:

1886:

1836:

1709:

1587:

1346:

929:

90:

577:

1911:

1871:

1866:

1648:

1619:

1476:

1398:

1028:

747:

318:

1856:

1841:

1557:

1266:"Piana V. (2011), Refusal to sell – a key concept in Economics and Management, Economics Web Institute."

868:

797:

693:

Here MPL is the ratio of increase in the quantity produced per unit increase in labour: i.e. ΔQ/ΔL, the

1173:

Chia-Hui Chen, course materials for 14.01 Principles of

Microeconomics, Fall 2007. MIT OpenCourseWare (

924:

When the marginal social cost of production is less than that of the private cost function, there is a

901:

or other environmental waste are textbook examples of production that creates negative externalities.

1906:

1826:

1758:

1673:

1567:

1503:

1043:

925:

894:

785:

theories of the firm, which generally assume that marginal cost is constant as production increases.

1281:

1921:

1748:

1597:

1540:

1383:

1008:

853:

809:

782:

515:

1265:

1831:

1777:

1704:

1614:

1572:

1562:

1530:

1525:

1471:

1466:

793:

352:

1090:

1964:

1952:

1931:

1901:

1763:

1687:

1643:

1233:

1200:

1119:

1094:

1038:

264:

1916:

1896:

1803:

1753:

1724:

1582:

1547:

1444:

1422:

1082:

1053:

1033:

347:

cost is zero, and this term drops out of the marginal cost equation: that is, marginal cost

323:

844:

Of great importance in the theory of marginal cost is the distinction between the marginal

206:

If the cost function is not differentiable, the marginal cost can be expressed as follows:

1984:

1456:

1393:

752:

988:

867:

Externalities are costs (or benefits) that are not borne by the parties to the economic

289:

96:

2015:

1959:

1699:

1658:

1577:

1369:

821:

the production will be carried out until the marginal cost is equal to the sale price.

310:

119:

72:

2009:

1881:

1781:

1772:

1743:

1729:

1719:

1663:

1427:

1407:

1302:

1083:

861:

1252:

Vickrey W. (2008) "Marginal and

Average Cost Pricing". In: Palgrave Macmillan (eds)

514:

labor to a fixed capital stock reduces the marginal product of labor because of the

1851:

1683:

1678:

1412:

1286:

1223:

1003:

756:

48:

1227:

1194:

116:

is the first derivative of the cost function with respect to the output quantity

1876:

1788:

1668:

1520:

1434:

1190:

839:

17:

1636:

1388:

1058:

1018:

340:

336:

67:

59:

55:

39:

1947:

1714:

1631:

1626:

1439:

933:

898:

872:

31:

1979:

1739:

1734:

1609:

426:

916:

884:

1793:

1692:

1604:

951:

1138:

The classic reference is Jakob Viner, "Cost Curves and Supply Curve",

1768:

1229:

Asking About Prices: A New

Approach to Understanding Price Stickiness

770:

Asking About Prices: A New

Approach to Understanding Price Stickiness

51:, which is the total cost divided by the number of units produced.

27:

Cost added by producing one additional unit of a product or service

1653:

1535:

1515:

987:

962:

950:

915:

883:

683:{\displaystyle MC={\frac {w\Delta L}{\Delta Q}}={\frac {w}{MPL}}.}

309:

288:

1338:

355:(ATC), which is the total cost (including fixed costs, denoted C

1810:

1226:; Canetti, Elie R. D.; Lebow, David E.; Rudd, Jeremy B. (1998).

1013:

781:

have pointed to these results as evidence in favor of their own

43:

1342:

1321:"Theory and Applications of Microeconomics - Table of Contents"

1199:. Northampton, MA: Edward Elgar Publishing, Inc. p. 151.

42:

that arises when the quantity produced is increased, i.e. the

1301:

Nwokoye, Ebele Stella; Ilechukwu, Nneamaka (2018-08-06).

1177:), Massachusetts Institute of Technology. Downloaded on .

1089:. Upper Saddle River, NJ: Pearson Prentice Hall. p.

955:

Relationship between marginal cost and average total cost

944:

Relationship between marginal cost and average total cost

433:

cost can be calculated as presented in the table below.

335:

In the simplest case, the total cost function and its

1174:

703:

623:

580:

530:

368:

267:

215:

145:

122:

99:

75:

322:

constant. Or, there may be increasing or decreasing

1940:

1819:

1376:

897:of production. Productive processes that result in

735:(decreasing), and AVC = VC/Q=wL/Q = w/(Q/L) = w/AP

726:

682:

606:

565:

414:

273:

250:

195:

128:

108:

81:

1218:

1216:

566:{\displaystyle MC={\frac {\Delta VC}{\Delta Q}}}

415:{\displaystyle ATC={\frac {C_{0}+\Delta C}{Q}}.}

251:{\displaystyle MC={\frac {\Delta C}{\Delta Q}},}

762:

331:Cost functions and relationship to average cost

1354:

8:

727:{\displaystyle {\frac {\Delta L}{\Delta Q}}}

359:) divided by the number of units produced:

281:denotes an incremental change of one unit.

196:{\displaystyle MC(Q)={\frac {\ dC}{\ dQ}}.}

1361:

1347:

1339:

1196:Post-Keynesian Economics: New Foundations

704:

702:

659:

633:

622:

593:

579:

540:

529:

388:

381:

367:

266:

225:

214:

164:

144:

121:

98:

74:

1282:"Marginal Cost Of Production Definition"

1254:The New Palgrave Dictionary of Economics

1185:

1183:

435:

1070:

816:Decisions taken based on marginal costs

351:fixed costs. This can be compared with

1232:. New York: Russell Sage Foundation.

1114:Simon, Carl; Blume, Lawrence (1994).

607:{\displaystyle \Delta VC={w\Delta L}}

7:

920:Positive Externalities of Production

912:Positive externalities of production

888:Negative Externalities of Production

880:Negative externalities of production

834:Private versus social marginal cost

1917:Microfoundations of macroeconomics

804:Perfectly competitive supply curve

715:

707:

697:. The last equality holds because

647:

639:

597:

581:

554:

543:

397:

268:

236:

228:

25:

425:For discrete calculation without

1990:

1989:

1978:

1140:Zeitschrift fur Nationalokonomie

1085:Economics: Principles in Action

871:. A producer may, for example,

742:Empirical data on marginal cost

343:and TC represents total costs.

1303:"CHAPTER FIVE THEORY OF COSTS"

1118:. W. W. Norton & Company.

1081:; Sheffrin, Steven M. (2003).

158:

152:

1:

1256:. Palgrave Macmillan, London

928:of production. Production of

810:perfectly competitive market

516:diminishing marginal returns

1862:Civil engineering economics

1847:Statistical decision theory

1487:Income elasticity of demand

1024:Cost-Volume-Profit Analysis

825:Relationship to fixed costs

2037:

1497:Price elasticity of supply

1492:Price elasticity of demand

1482:Cross elasticity of demand

1116:Mathematics for Economists

837:

1973:

1049:Marginal product of labor

779:Post-Keynesian economists

695:marginal product of labor

1553:Income–consumption curve

1280:Bio, Full (2021-05-19).

1887:Industrial organization

992:Profit Maximizing Graph

293:Short Run Marginal Cost

285:Short run marginal cost

274:{\displaystyle \Delta }

1029:Cost-sharing mechanism

993:

968:

956:

921:

889:

775:

728:

684:

608:

567:

437:Marginal Cost Example

416:

315:

314:Long Run Marginal Cost

306:Long run marginal cost

294:

275:

252:

197:

130:

110:

83:

1857:Engineering economics

1452:Cost–benefit analysis

991:

966:

954:

919:

887:

798:diseconomies of scale

729:

685:

609:

568:

417:

313:

292:

276:

253:

198:

131:

111:

84:

38:is the change in the

1674:Price discrimination

1568:Intertemporal choice

1044:Marginal factor cost

926:positive externality

895:negative externality

701:

621:

578:

528:

366:

265:

213:

143:

120:

97:

93:, the marginal cost

73:

1985:Business portal

1922:Operations research

1749:Substitution effect

1009:Break even analysis

976:Profit maximization

854:profit maximization

438:

1563:Indifference curve

1531:Goods and services

1472:Economies of scope

1467:Economies of scale

1175:http://ocw.mit.edu

1142:, 3:23-46 (1932).

1079:O'Sullivan, Arthur

994:

969:

957:

922:

890:

794:Economies of scale

789:Economies of scale

724:

680:

604:

563:

436:

412:

353:average total cost

349:does not depend on

316:

295:

271:

248:

193:

126:

109:{\displaystyle MC}

106:

89:is continuous and

79:

2021:Marginal concepts

2003:

2002:

1965:Political economy

1764:Supply and demand

1644:Pareto efficiency

1325:2012 Book Archive

1206:978-1-84720-483-7

1039:Marginal concepts

722:

675:

654:

561:

511:

510:

407:

243:

188:

180:

169:

129:{\displaystyle Q}

82:{\displaystyle C}

16:(Redirected from

2028:

1993:

1992:

1983:

1982:

1725:Returns to scale

1583:Market structure

1363:

1356:

1349:

1340:

1335:

1333:

1332:

1316:

1314:

1313:

1297:

1295:

1294:

1268:

1263:

1257:

1250:

1244:

1243:

1224:Blinder, Alan S.

1220:

1211:

1210:

1187:

1178:

1171:

1165:

1158:

1152:

1149:

1143:

1136:

1130:

1129:

1111:

1105:

1104:

1088:

1075:

1054:Marginal revenue

1034:Economic surplus

773:

733:

731:

730:

725:

723:

721:

713:

705:

689:

687:

686:

681:

676:

674:

660:

655:

653:

645:

634:

613:

611:

610:

605:

603:

572:

570:

569:

564:

562:

560:

552:

541:

439:

421:

419:

418:

413:

408:

403:

393:

392:

382:

324:returns to scale

280:

278:

277:

272:

257:

255:

254:

249:

244:

242:

234:

226:

202:

200:

199:

194:

189:

187:

178:

176:

167:

165:

135:

133:

132:

127:

115:

113:

112:

107:

88:

86:

85:

80:

21:

18:Incremental cost

2036:

2035:

2031:

2030:

2029:

2027:

2026:

2025:

2006:

2005:

2004:

1999:

1977:

1969:

1936:

1815:

1457:Deadweight loss

1394:Consumer choice

1372:

1367:

1330:

1328:

1319:

1311:

1309:

1300:

1292:

1290:

1279:

1276:

1271:

1264:

1260:

1251:

1247:

1240:

1222:

1221:

1214:

1207:

1189:

1188:

1181:

1172:

1168:

1159:

1155:

1150:

1146:

1137:

1133:

1126:

1113:

1112:

1108:

1101:

1077:

1076:

1072:

1068:

1063:

999:

978:

946:

914:

882:

842:

836:

827:

818:

806:

791:

774:

768:

753:Federal Reserve

744:

738:

714:

706:

699:

698:

664:

646:

635:

619:

618:

576:

575:

553:

542:

526:

525:

459:10 (Fixed Cost)

384:

383:

364:

363:

358:

333:

308:

287:

263:

262:

235:

227:

211:

210:

177:

166:

141:

140:

118:

117:

95:

94:

71:

70:

28:

23:

22:

15:

12:

11:

5:

2034:

2032:

2024:

2023:

2018:

2008:

2007:

2001:

2000:

1998:

1997:

1987:

1974:

1971:

1970:

1968:

1967:

1962:

1960:Macroeconomics

1957:

1956:

1955:

1944:

1942:

1938:

1937:

1935:

1934:

1929:

1924:

1919:

1914:

1909:

1904:

1899:

1894:

1889:

1884:

1879:

1874:

1869:

1864:

1859:

1854:

1849:

1844:

1839:

1834:

1829:

1823:

1821:

1817:

1816:

1814:

1813:

1808:

1807:

1806:

1801:

1791:

1786:

1785:

1784:

1775:

1761:

1756:

1751:

1746:

1737:

1732:

1727:

1722:

1717:

1712:

1707:

1702:

1697:

1696:

1695:

1690:

1681:

1676:

1671:

1666:

1661:

1659:Price controls

1651:

1646:

1641:

1640:

1639:

1634:

1629:

1624:

1623:

1622:

1617:

1607:

1602:

1601:

1600:

1595:

1580:

1578:Market failure

1575:

1570:

1565:

1560:

1555:

1550:

1545:

1544:

1543:

1538:

1528:

1523:

1518:

1513:

1512:

1511:

1501:

1500:

1499:

1494:

1489:

1484:

1474:

1469:

1464:

1459:

1454:

1449:

1448:

1447:

1442:

1437:

1432:

1431:

1430:

1420:

1415:

1405:

1396:

1391:

1386:

1380:

1378:

1374:

1373:

1370:Microeconomics

1368:

1366:

1365:

1358:

1351:

1343:

1337:

1336:

1317:

1298:

1275:

1274:External links

1272:

1270:

1269:

1258:

1245:

1238:

1212:

1205:

1179:

1166:

1153:

1144:

1131:

1124:

1106:

1099:

1069:

1067:

1064:

1062:

1061:

1056:

1051:

1046:

1041:

1036:

1031:

1026:

1021:

1016:

1011:

1006:

1000:

998:

995:

977:

974:

945:

942:

913:

910:

881:

878:

838:Main article:

835:

832:

826:

823:

817:

814:

805:

802:

790:

787:

766:

743:

740:

736:

720:

717:

712:

709:

691:

690:

679:

673:

670:

667:

663:

658:

652:

649:

644:

641:

638:

632:

629:

626:

615:

614:

602:

599:

596:

592:

589:

586:

583:

573:

559:

556:

551:

548:

545:

539:

536:

533:

509:

508:

505:

502:

499:

495:

494:

491:

488:

485:

481:

480:

477:

474:

471:

467:

466:

463:

460:

457:

453:

452:

451:Marginal Cost

449:

446:

443:

442:Output (units)

423:

422:

411:

406:

402:

399:

396:

391:

387:

380:

377:

374:

371:

356:

332:

329:

307:

304:

286:

283:

270:

259:

258:

247:

241:

238:

233:

230:

224:

221:

218:

204:

203:

192:

186:

183:

175:

172:

163:

160:

157:

154:

151:

148:

125:

105:

102:

91:differentiable

78:

26:

24:

14:

13:

10:

9:

6:

4:

3:

2:

2033:

2022:

2019:

2017:

2014:

2013:

2011:

1996:

1988:

1986:

1981:

1976:

1975:

1972:

1966:

1963:

1961:

1958:

1954:

1951:

1950:

1949:

1946:

1945:

1943:

1939:

1933:

1930:

1928:

1925:

1923:

1920:

1918:

1915:

1913:

1910:

1908:

1905:

1903:

1900:

1898:

1895:

1893:

1892:Institutional

1890:

1888:

1885:

1883:

1880:

1878:

1875:

1873:

1870:

1868:

1865:

1863:

1860:

1858:

1855:

1853:

1850:

1848:

1845:

1843:

1840:

1838:

1837:Computational

1835:

1833:

1830:

1828:

1825:

1824:

1822:

1818:

1812:

1809:

1805:

1802:

1800:

1797:

1796:

1795:

1792:

1790:

1787:

1783:

1782:Law of supply

1779:

1776:

1774:

1773:Law of demand

1770:

1767:

1766:

1765:

1762:

1760:

1759:Social choice

1757:

1755:

1752:

1750:

1747:

1745:

1744:Excess supply

1741:

1738:

1736:

1733:

1731:

1730:Risk aversion

1728:

1726:

1723:

1721:

1718:

1716:

1713:

1711:

1708:

1706:

1703:

1701:

1698:

1694:

1691:

1689:

1685:

1682:

1680:

1677:

1675:

1672:

1670:

1667:

1665:

1664:Price ceiling

1662:

1660:

1657:

1656:

1655:

1652:

1650:

1647:

1645:

1642:

1638:

1635:

1633:

1630:

1628:

1625:

1621:

1620:Complementary

1618:

1616:

1613:

1612:

1611:

1608:

1606:

1603:

1599:

1596:

1594:

1591:

1590:

1589:

1586:

1585:

1584:

1581:

1579:

1576:

1574:

1571:

1569:

1566:

1564:

1561:

1559:

1556:

1554:

1551:

1549:

1546:

1542:

1539:

1537:

1534:

1533:

1532:

1529:

1527:

1524:

1522:

1519:

1517:

1514:

1510:

1507:

1506:

1505:

1502:

1498:

1495:

1493:

1490:

1488:

1485:

1483:

1480:

1479:

1478:

1475:

1473:

1470:

1468:

1465:

1463:

1460:

1458:

1455:

1453:

1450:

1446:

1443:

1441:

1438:

1436:

1433:

1429:

1426:

1425:

1424:

1421:

1419:

1416:

1414:

1411:

1410:

1409:

1406:

1404:

1403:non-convexity

1400:

1397:

1395:

1392:

1390:

1387:

1385:

1382:

1381:

1379:

1375:

1371:

1364:

1359:

1357:

1352:

1350:

1345:

1344:

1341:

1326:

1322:

1318:

1308:

1304:

1299:

1289:

1288:

1283:

1278:

1277:

1273:

1267:

1262:

1259:

1255:

1249:

1246:

1241:

1239:0-87154-121-1

1235:

1231:

1230:

1225:

1219:

1217:

1213:

1208:

1202:

1198:

1197:

1192:

1186:

1184:

1180:

1176:

1170:

1167:

1163:

1157:

1154:

1148:

1145:

1141:

1135:

1132:

1127:

1121:

1117:

1110:

1107:

1102:

1100:0-13-063085-3

1096:

1092:

1087:

1086:

1080:

1074:

1071:

1065:

1060:

1057:

1055:

1052:

1050:

1047:

1045:

1042:

1040:

1037:

1035:

1032:

1030:

1027:

1025:

1022:

1020:

1017:

1015:

1012:

1010:

1007:

1005:

1002:

1001:

996:

990:

986:

982:

975:

973:

965:

961:

953:

949:

943:

941:

937:

935:

931:

927:

918:

911:

909:

906:

902:

900:

896:

886:

879:

877:

874:

870:

865:

863:

862:externalities

859:

855:

851:

847:

841:

833:

831:

824:

822:

815:

813:

811:

803:

801:

799:

795:

788:

786:

784:

780:

771:

765:

761:

758:

754:

749:

741:

739:

718:

710:

696:

677:

671:

668:

665:

661:

656:

650:

642:

636:

630:

627:

624:

617:

616:

600:

594:

590:

587:

584:

574:

557:

549:

546:

537:

534:

531:

524:

523:

522:

519:

517:

506:

503:

500:

497:

496:

492:

489:

486:

483:

482:

478:

475:

472:

469:

468:

464:

461:

458:

455:

454:

450:

447:

444:

441:

440:

434:

430:

428:

409:

404:

400:

394:

389:

385:

378:

375:

372:

369:

362:

361:

360:

354:

350:

344:

342:

338:

330:

328:

325:

320:

312:

305:

303:

299:

291:

284:

282:

245:

239:

231:

222:

219:

216:

209:

208:

207:

190:

184:

181:

173:

170:

161:

155:

149:

146:

139:

138:

137:

123:

103:

100:

92:

76:

69:

68:cost function

64:

61:

57:

52:

50:

45:

41:

37:

36:marginal cost

33:

19:

1927:Optimization

1912:Mathematical

1872:Experimental

1867:Evolutionary

1852:Econometrics

1710:Public goods

1684:Price system

1679:Price signal

1593:Monopolistic

1462:Distribution

1417:

1377:Major topics

1329:. Retrieved

1327:. 2012-12-29

1324:

1310:. Retrieved

1307:ResearchGate

1306:

1291:. Retrieved

1287:Investopedia

1285:

1261:

1253:

1248:

1228:

1195:

1191:Lavoie, Marc

1169:

1156:

1147:

1139:

1134:

1115:

1109:

1084:

1073:

1004:Average cost

983:

979:

970:

967:Average cost

958:

947:

938:

930:public goods

923:

907:

903:

891:

866:

857:

849:

845:

843:

828:

819:

807:

792:

776:

769:

763:

757:Alan Blinder

748:neoclassical

745:

692:

520:

512:

448:Average Cost

431:

424:

348:

345:

334:

319:The long run

317:

300:

296:

260:

205:

65:

53:

49:average cost

35:

29:

1877:Game theory

1842:Development

1789:Uncertainty

1669:Price floor

1649:Preferences

1588:Competition

1558:Information

1521:Externality

1504:Equilibrium

1445:Transaction

1423:Opportunity

1384:Aggregation

1059:Merit goods

869:transaction

840:Social cost

755:Vice-Chair

341:fixed costs

2010:Categories

1907:Managerial

1827:Behavioral

1700:Production

1637:Oligopsony

1477:Elasticity

1389:Budget set

1331:2021-05-28

1312:2021-05-28

1293:2021-05-28

1125:0393957330

1066:References

1019:Cost curve

445:Total Cost

337:derivative

60:fixed cost

40:total cost

1948:Economics

1820:Subfields

1715:Rationing

1632:Oligopoly

1627:Monopsony

1615:Bilateral

1548:Household

1399:Convexity

934:education

899:pollution

783:heterodox

716:Δ

708:Δ

648:Δ

640:Δ

598:Δ

582:Δ

555:Δ

544:Δ

398:Δ

269:Δ

237:Δ

229:Δ

32:economics

1995:Category

1941:See also

1832:Business

1804:Marginal

1799:Expected

1740:Shortage

1735:Scarcity

1610:Monopoly

1516:Exchange

1428:Implicit

1418:Marginal

1193:(2014).

997:See also

772:, p. 105

767:—

427:calculus

1953:Applied

1932:Welfare

1794:Utility

1754:Surplus

1693:Pricing

1605:Duopoly

1598:Perfect

1541:Service

1509:General

1413:Average

873:pollute

846:private

66:If the

34:, the

1778:Supply

1769:Demand

1705:Profit

1573:Market

1435:Social

1236:

1203:

1122:

1097:

850:social

746:While

261:where

179:

168:

2016:Costs

1897:Labor

1882:Green

1654:Price

1536:Goods

1526:Firms

777:Many

56:fixed

1811:Wage

1720:Rent

1688:Free

1440:Sunk

1408:Cost

1401:and

1234:ISBN

1201:ISBN

1160:See

1120:ISBN

1095:ISBN

1014:Cost

858:also

848:and

44:cost

1902:Law

1091:111

493:10

479:20

30:In

2012::

1323:.

1305:.

1284:.

1215:^

1182:^

1093:.

507:8

504:16

501:48

490:20

487:40

476:30

473:30

465:-

136::

1780:/

1771:/

1742:/

1686:/

1362:e

1355:t

1348:v

1334:.

1315:.

1296:.

1242:.

1209:.

1164:.

1128:.

1103:.

737:L

719:Q

711:L

678:.

672:L

669:P

666:M

662:w

657:=

651:Q

643:L

637:w

631:=

628:C

625:M

601:L

595:w

591:=

588:C

585:V

558:Q

550:C

547:V

538:=

535:C

532:M

498:3

484:2

470:1

462:∞

456:0

410:.

405:Q

401:C

395:+

390:0

386:C

379:=

376:C

373:T

370:A

357:0

246:,

240:Q

232:C

223:=

220:C

217:M

191:.

185:Q

182:d

174:C

171:d

162:=

159:)

156:Q

153:(

150:C

147:M

124:Q

104:C

101:M

77:C

20:)

Text is available under the Creative Commons Attribution-ShareAlike License. Additional terms may apply.