2098:

fixed costs has no effect on the profit maximizing output or price. The firm merely treats short term fixed costs as sunk costs and continues to operate as before. This can be confirmed graphically. Using the diagram illustrating the total cost–total revenue perspective, the firm maximizes profit at the point where the slopes of the total cost line and total revenue line are equal. An increase in fixed cost would cause the total cost curve to shift up rigidly by the amount of the change. There would be no effect on the total revenue curve or the shape of the total cost curve. Consequently, the profit maximizing output would remain the same. This point can also be illustrated using the diagram for the marginal revenue–marginal cost perspective. A change in fixed cost would have no effect on the position or shape of these curves. In simple terms, although profit is related to total cost,

1106:). Then, if marginal revenue is greater than marginal cost at some level of output, marginal profit is positive and thus a greater quantity should be produced, and if marginal revenue is less than marginal cost, marginal profit is negative and a lesser quantity should be produced. At the output level at which marginal revenue equals marginal cost, marginal profit is zero and this quantity is the one that maximizes profit. Since total profit increases when marginal profit is positive and total profit decreases when marginal profit is negative, it must reach a maximum where marginal profit is zero—where marginal cost equals marginal revenue—and where lower or higher output levels give lower profit levels. In calculus terms, the requirement that the optimal output have higher profit than adjacent output levels is that:

638:, which chooses its level of output simultaneously with its selling price. In the case of monopoly, the company will produce more products because it can still make normal profits. To get the most profit, you need to set higher prices and lower quantities than the competitive market. However, the revenue function takes into account the fact that higher levels of output require a lower price in order to be sold. An analogous feature holds for the input markets: in a perfectly competitive input market the firm's cost of the input is simply the amount purchased for use in production times the market-determined unit input cost, whereas a

747:. Fixed costs, which occur only in the short run, are incurred by the business at any level of output, including zero output. These may include equipment maintenance, rent, wages of employees whose numbers cannot be increased or decreased in the short run, and general upkeep. Variable costs change with the level of output, increasing as more product is generated. Materials consumed during production often have the largest impact on this category, which also includes the wages of employees who can be hired and laid off in the short run span of time under consideration. Fixed cost and variable cost, combined, equal

856:

2204:) to maximize profit. In the long run, a firm will theoretically have zero expected profits under the competitive equilibrium. The market should adjust to clear any profits if there is perfect competition. In situations where there are non-zero profits, we should expect to see either some form of long run disequilibrium or non-competitive conditions, such as barriers to entry, where there is not perfect competition between firms.

1026:

78:

2463:. Moreover, one must consider "the revenue the firm loses on the units it could have sold at the higher price"—that is, if the price of all units had not been pulled down by the effort to sell more units. These units that have lost revenue are called the infra-marginal units. That is, selling the extra unit results in a small drop in price which reduces the revenue for all units sold by the amount

1018:

3540:

1959:

795:

675:

36:

3284:. The profit maximization issue can also be approached from the input side. That is, what is the profit maximizing usage of the variable input? To maximize profit the firm should increase usage of the input "up to the point where the input's marginal revenue product equals its marginal costs". Mathematically, the profit-maximizing rule is

2352:

508:), then its total profit is not maximized, because the firm can produce additional units to earn additional profit. In other words, in this case, it is in the "rational" interest of the firm to increase its output level until its total profit is maximized. On the other hand, if the marginal revenue is less than the marginal cost (

618:) functions in terms of output are directly available one can equate these, using either equations or a graph. Fourth, rather than a function giving the cost of producing each potential output level, the firm may have input cost functions giving the cost of acquiring any amount of each input, along with a

761:

The five ways formula is to increase leads, conversation rates, average dollar sales, the average number of sales, and average product profit. Profits can be increased by up to 1,000 percent, this is important for sole traders and small businesses let alone big businesses but none the less all profit

2097:

A firm maximizes profit by operating where marginal revenue equals marginal cost. This is stipulated under neoclassical theory, in which a firm maximizes profit in order to determine a level of output and inputs, which provides the price equals marginal cost condition. In the short run, a change in

780:

of cost or revenue with respect to the quantity of output. For instance, taking the first definition, if it costs a firm $ 400 to produce 5 units and $ 480 to produce 6, the marginal cost of the sixth unit is 80 dollars. Conversely, the marginal income from the production of 6 units is the income

403:

Measuring the total cost and total revenue is often impractical, as the firms do not have the necessary reliable information to determine costs at all levels of production. Instead, they take more practical approach by examining how small changes in production influence revenues and costs. When a

1945:

revenue equals zero when the total revenue curve has reached its maximum value. An example would be a scheduled airline flight. The marginal costs of flying one more passenger on the flight are negligible until all the seats are filled. The airline would maximize profit by filling all the seats.

1944:

rule implies that output should be produced at the maximum level, which also happens to be the level that maximizes revenue. In other words, the profit-maximizing quantity and price can be determined by setting marginal revenue equal to zero, which occurs at the maximal level of output. Marginal

2038:

Companies can seek to maximize profits through estimation. When the price increase leads to a small decline in demand, the company can increase the price as much as possible before the demand becomes elastic. Generally, it is difficult to change the impact of the price according to the demand,

2212:

In addition to using methods to determine a firm's optimal level of output, a firm that is not perfectly competitive can equivalently set price to maximize profit (since setting price along a given demand curve involves picking a preferred point on that curve, which is equivalent to picking a

2636:

918:

In the accompanying diagram, the linear total revenue curve represents the case in which the firm is a perfect competitor in the goods market, and thus cannot set its own selling price. The profit-maximizing output level is represented as the one at which total revenue is the height of

622:

showing how much output results from using any combination of input quantities. In this case one can use calculus to maximize profit with respect to input usage levels, subject to the input cost functions and the production function. The first order condition for each input equates the

538:), then too its total profit is not maximized, because producing one unit less will reduce total cost more than total revenue gained, thus giving the firm more total profit. In this case, a "rational" firm has an incentive to reduce its output level until its total profit is maximized.

1210:

2166:) to maximize profit. But when the total cost increases, it does not mean maximizing profit Will change, because the increase in total cost does not necessarily change the marginal cost. If the marginal cost remains the same, the enterprise can still produce to the unit of (

2087:

when implementing a "what if" solution to help in sales and operation planning process, familiarity with the company's operations, including the supply chain, inventory management and sales process is useful. Constraints are required to prevent corporate plans from becoming

2057:). However, moving the production line to a foreign location may cause unnecessary transportation costs. Close market locations for producing and selling products can improve demand optimization, but when the production cost is much higher, it is not a good choice.

2218:

2071:

Habitually recording and analyzing the business costs of all products/services sold. There are many miscellaneous items in the cost including labor, materials, transportation, advertising, storage, etc. related to any goods or services sold, which become

1912:

In some cases a firm's demand and cost conditions are such that marginal profits are greater than zero for all levels of production up to a certain maximum. In this case marginal profit plunges to zero immediately after that maximum is reached; hence the

2396:

refer to the midpoints between the old and new values of price and quantity respectively. The marginal revenue from an incremental unit of output has two parts: first, the revenue the firm gains from selling the additional units or, giving the term

2213:

preferred quantity to produce and sell). The profit maximization conditions can be expressed in a "more easily applicable" form or rule of thumb than the above perspectives use. The first step is to rewrite the expression for marginal revenue as

1838:

340:), as shown in the blue part, the firm's overall profit will decrease because the additional unit produced will increase the overall cost. Here too the profit is not maximized and the firm has to lower its output level to maximize profits.

2925:

283:), and the profit is not maximized. The firm has in its interest to raise its output level to maximize profits, because the revenue gained will be more than the cost to pay. However, if the output level is greater than

2517:

553:

each of the variables revenue and cost as functions of the level of output and find the output level that maximizes the difference (or this can be done with a table of values instead of a graph). Second, if specific

3409:

2984:

2849:

915:). Given a table of costs and revenues at each quantity, we can either compute equations or plot the data directly on a graph. The profit-maximizing output is the one at which this difference reaches its maximum.

757:

is the amount of money that a company receives from its normal business activities, usually from the sale of goods and services (as opposed to monies from security sales such as equity shares or debt issuances).

1112:

2788:

3492:

2512:

2034:

of demand for goods depends on the response of other companies. When it is the only company raising prices, demand will be elastic. If one family raises prices and others follow, demand may be inelastic.

1673:

1544:

2134:

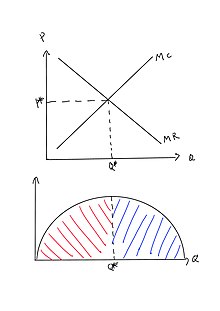

1409:, the marginal revenue curve would have a negative slope as shown in the next graph, because it would be based on the downward-sloping market demand curve. The optimal output, shown in the graph as

2202:

2733:

2223:

3326:

2347:{\displaystyle {\begin{aligned}{\text{MR}}=&{\frac {\Delta {\text{TR}}}{\Delta Q}}\\=&{\frac {P\Delta Q+Q\Delta P}{\Delta Q}}\\=&P+{\frac {Q\Delta P}{\Delta Q}}\\\end{aligned}}}

3036:

3612:

and other behaviors are reflecting the crisis of excessive power of monopolists in the market. In an attempt to prevent businesses from abusing their power to maximize their own profits,

536:

506:

338:

281:

1380:

2692:

2164:

988:

476:

180:

1436:, is the level of output at which marginal cost equals marginal revenue. The price that induces that quantity of output is the height of the demand curve at that quantity (denoted

2990:

In other words, the rule is that the size of the markup of price over the marginal cost is inversely related to the absolute value of the price elasticity of demand for the good.

3907:

Cheng, Ho Fung

Griffith (1 September 2020). "An economic perspective on the inherent plausibility and frequency of predatory pricing: the case for more aggressive regulation".

3440:

1942:

2081:

may be needed to integrate all financial information to record expense reports so that the business can clearly understand all costs related to operations and their accuracy.

1060:

3084:

2658:

1349:

1591:

1569:

1323:

1257:

1235:

1104:

1082:

913:

887:

616:

594:

446:

424:

251:

229:

150:

128:

1744:

1301:

1279:

961:

939:

2421:

3600:

Market quotas reflect the power of a firm in the market, a firm dominating a market is very common, and too much power often becomes the motive for non-Hong behavior.

3223:

3130:

3624:. Through this regulation, consumers enjoy a better relationship with the companies that serve them, even though the company itself may suffer, financially speaking.

3062:

2857:

3270:

3157:

2993:

The optimal markup rule also implies that a non-competitive firm will produce on the elastic region of its market demand curve. Marginal cost is positive. The term

1895:

1868:

1461:

1434:

308:

207:

106:

3352:

3107:

3243:

3197:

3177:

2461:

2441:

2394:

2374:

1736:

1716:

1696:

1484:

1400:

993:

If, contrary to what is assumed in the graph, the firm is not a perfect competitor in the output market, the price to sell the product at can be read off the

627:

of the input (the increment to revenue from selling the product caused by an increment to the amount of the input used) to the marginal cost of the input.

2042:

The company may also have other goals and considerations. For example, companies may choose to earn less than the maximum profit in pursuit of higher

2631:{\displaystyle {\text{MR}}=P+Q\cdot {\frac {\Delta P}{\Delta Q}}=P+P\cdot {\frac {Q}{P}}\cdot {\frac {\Delta P}{\Delta Q}}=P+{\frac {P}{\text{PED}}}}

53:

45:

3969:

3360:

2938:

1205:{\displaystyle {\frac {\operatorname {d} ^{2}R}{{\operatorname {d} Q}^{2}}}<{\frac {\operatorname {d} ^{2}C}{{\operatorname {d} Q}^{2}}}.}

2793:

645:

The principal difference between short run and long run profit maximization is that in the long run the quantities of all inputs, including

3561:

1980:

816:

696:

182:. The firm which produces at this output level is said to maximize profits. If the output produced is less than the equilibrium quantity (

2738:

3132:(that is, if demand is elastic at that level of output). The intuition behind this result is that, if demand is inelastic at some value

1466:

A generic derivation of the profit maximisation level of output is given by the following steps. Firstly, suppose a representative firm

3445:

3673:

2466:

400:

market or otherwise) which wants to maximize its total profit, which is the difference between its total revenue and its total cost.

3956:

3990:

3587:

2006:

842:

722:

634:

market for its output, the revenue function will simply equal the market price times the quantity produced and sold, whereas for a

1599:

2019:

In the real world, it is not easy to achieve profit maximization. The company must accurately know the marginal income and the

3245:

would also lead to lower total cost, profit would go up due to the combination of increased revenue and decreased cost. Thus,

1900:

In an environment that is competitive but not perfectly so, more complicated profit maximization solutions involve the use of

1492:

4029:

4009:

3565:

2101:

1984:

820:

700:

2169:

2697:

781:

from the production of 6 units minus the income from the production of 5 units (the latter item minus the preceding item).

4077:

1738:

marginal cost. The firm maximises their profit with respect to quantity to yield the profit maximisation level of output:

776:

approach is taken or not, are defined as either the change in cost or revenue as each additional unit is produced or the

762:

maximization is a matter of each business stage and greater returns for profit sharing thus higher wages and motivation.

3633:

4082:

3287:

3280:

The general rule is that the firm maximizes profit by producing that quantity of output where marginal revenue equals

404:

firm produces an extra unit of product, the additional revenue gained from selling it is called the marginal revenue (

3550:

1969:

805:

685:

2046:. Because price increases maximize profits in the short term, they will attract more companies to enter the market.

478:), then the firm's total profit is said to be maximized. If the marginal revenue is greater than the marginal cost (

3511:

2996:

2661:

3569:

3554:

1988:

1973:

824:

809:

704:

689:

4051:

511:

481:

313:

256:

3523:

1358:

624:

3518:. Maximization of short-term producer profit can reduce long-term producer profit, which can be exploited by

2667:

2139:

966:

451:

155:

4025:

3357:

The marginal revenue product is the change in total revenue per unit change in the variable input, that is,

3678:

3653:

1281:. If the industry is perfectly competitive (as is assumed in the diagram), the firm faces a demand curve (

650:

555:

377:

4045:

4039:

2075:

563:

365:

2423:. The additional units are called the marginal units. Producing one extra unit and selling it at price

998:

3416:

1916:

3638:

2066:

381:

1040:

1833:{\displaystyle {\frac {\left(\partial \pi _{i}\right)}{\left(\partial q_{i}\right)}}=p_{i}-c_{i}=0}

631:

619:

550:

397:

3067:

2641:

1332:

1574:

1552:

1326:

1306:

1240:

1218:

1087:

1065:

896:

870:

863:

To obtain the profit maximizing output quantity, we start by recognizing that profit is equal to

599:

577:

429:

407:

373:

369:

234:

212:

133:

111:

1284:

1262:

944:

922:

2920:{\displaystyle {\frac {\left(P-{\text{MC}}\right)}{P}}={\frac {1}{\left(-{\text{PED}}\right)}}}

2400:

1021:

Profit maximization using the marginal revenue and marginal cost curves of a perfect competitor

541:

There are several perspectives one can take on profit maximization. First, since profit equals

4005:

3986:

3965:

3924:

3882:

3683:

3601:

3519:

3202:

3112:

2136:, the enterprise can maximize profit by producing to the maximum profit (the maximum value of

649:, are choice variables, while in the short run the amount of capital is predetermined by past

448:). When the level of output is such that the marginal revenue is equal to the marginal cost (

4072:

3916:

3688:

3658:

3605:

3507:

3503:

3041:

2031:

2024:

1002:

769:

646:

567:

3248:

3135:

1873:

1846:

1439:

1412:

1017:

286:

185:

84:

4067:

4035:

3515:

3331:

1352:

1034:

2664:

characterizing the demand curve of the firms' customers, which is negative. Then setting

859:

Profit maximization using the total revenue and total cost curves of a perfect competitor

81:

An example diagram of Profit

Maximization: In the supply and demand graph, the output of

3089:

3663:

3228:

3182:

3162:

2446:

2426:

2379:

2359:

1721:

1701:

1681:

1469:

1385:

990:. This output level is also the one at which the total profit curve is at its maximum.

855:

393:

385:

2049:

Many companies try to minimize costs by shifting production to foreign locations with

1325:), and this is a horizontal line at a price determined by industry supply and demand.

4061:

3698:

3693:

3609:

3281:

3276:

Marginal product of labor, marginal revenue product of labor, and profit maximization

2020:

1006:

864:

765:

744:

658:

571:

546:

2043:

994:

654:

77:

3920:

1025:

3616:

often intervene to stop them in their tracks. A major example of this is through

3648:

3539:

2050:

1958:

1901:

794:

736:

674:

639:

1033:

An equivalent perspective relies on the relationship that, for each unit sold,

17:

3617:

3613:

2054:

1406:

890:

777:

748:

740:

635:

3928:

642:’s input price per unit is higher for higher amounts of the input purchased.

426:), and the additional cost to produce that unit is called the marginal cost (

353:

345:

2039:

because the demand may occur due to many other factors besides the price.

3621:

773:

559:

357:

3883:"Consumer Surplus as the Appropriate Standard for Antitrust Enforcement"

3442:

is the product of marginal revenue and the marginal product of labor or

3668:

3643:

3404:{\displaystyle {\text{MRP}}_{L}={\frac {\Delta {\text{TR}}}{\Delta L}}}

2979:{\displaystyle P={\frac {\text{PED}}{1+{\text{PED}}}}\cdot {\text{MC}}}

754:

542:

2844:{\displaystyle P={\frac {MC}{1+\left({\frac {1}{\text{PED}}}\right)}}}

562:

to maximize profit with respect to the output level. Third, since the

1843:

As such, the profit maximisation level of output is marginal revenue

2783:{\displaystyle {\frac {P-{\text{MC}}}{P}}={\frac {-1}{\text{PED}}}}

1024:

1016:

854:

361:

76:

3487:{\displaystyle {\text{MRP}}_{L}={\text{MR}}\cdot {\text{MP}}_{L}}

2507:{\displaystyle Q\cdot \left({\frac {\Delta P}{\Delta Q}}\right)}

1593:

denotes total costs. The above expression can be re-written as:

389:

558:

are known for revenue and cost in terms of output, one can use

3533:

1952:

963:; the maximal profit is measured as the length of the segment

788:

668:

29:

3985:(fourth ed.). Weidenfeld and Nicolson. pp. 214–7.

3510:. Some forms of producer profit maximization are considered

1402:) is the same as the optimum quantity in the first diagram.

1001:. This optimal quantity of output is the quantity at which

1668:{\displaystyle \pi _{i}=p_{i}\cdot q_{i}-c_{i}\cdot q_{i}}

4052:

Three Steps to

Mastering Prescriptive Profit Maximization

1539:{\displaystyle \pi _{i}={\text{TR}}_{i}-{\text{TC}}_{i}}

2129:{\displaystyle {\text{Profit}}={\text{TR}}-{\text{TC}}}

57:

3354:

refers to the commonly assumed variable input, labor.

3199:

more than proportionately, thereby increasing revenue

2197:{\displaystyle {\text{MR}}={\text{MC}}={\text{Price}}}

3448:

3419:

3363:

3334:

3290:

3251:

3231:

3205:

3185:

3165:

3138:

3115:

3092:

3070:

3044:

2999:

2941:

2860:

2796:

2741:

2728:{\displaystyle {\text{MC}}=P+{\frac {P}{\text{PED}}}}

2700:

2670:

2644:

2520:

2469:

2449:

2429:

2403:

2382:

2362:

2221:

2172:

2142:

2104:

1919:

1876:

1849:

1747:

1724:

1704:

1684:

1602:

1577:

1555:

1495:

1472:

1442:

1415:

1388:

1361:

1335:

1309:

1287:

1265:

1243:

1221:

1115:

1090:

1068:

1043:

969:

947:

925:

899:

873:

602:

580:

514:

484:

454:

432:

410:

316:

289:

259:

237:

215:

188:

158:

136:

114:

87:

1486:

has perfect information about its profit, given by:

372:

levels that will lead to the highest possible total

3718:Karl E. Case; Ray C. Fair; Sharon M. Oster (2012),

1303:) that is identical to its marginal revenue curve (

27:

Process to determine the highest profits for a firm

3486:

3434:

3403:

3346:

3320:

3264:

3237:

3217:

3191:

3171:

3151:

3124:

3101:

3078:

3056:

3030:

2978:

2919:

2843:

2782:

2727:

2686:

2652:

2630:

2506:

2455:

2435:

2415:

2388:

2368:

2346:

2196:

2158:

2128:

1936:

1889:

1862:

1832:

1730:

1710:

1690:

1667:

1585:

1563:

1538:

1478:

1455:

1428:

1394:

1374:

1343:

1317:

1295:

1273:

1251:

1229:

1204:

1098:

1076:

1054:

982:

955:

933:

907:

881:

610:

588:

530:

500:

470:

440:

418:

332:

302:

275:

245:

223:

201:

174:

144:

122:

100:

3321:{\displaystyle {\text{MRP}}_{L}={\text{MC}}_{L}}

3828:

3826:

3772:

3770:

653:decisions. In either case, there are inputs of

3722:(10 ed.), Prentice Hall, pp. 180–181

2093:Changes in total costs and profit maximization

1908:Case in which maximizing revenue is equivalent

3031:{\displaystyle {\frac {PED}{1+{\text{PED}}}}}

8:

4036:Profit Maximization: The Comprehensive Guide

3832:Samuelson, W and Marks, S (2003). p. 103–05.

3820:Besanko, D. and Beautigam, R, (2001) p. 408.

1355:is represented by the area of the rectangle

1013:Marginal revenue – marginal cost perspective

3760:

3758:

3756:

3754:

3752:

3568:. Unsourced material may be challenged and

3272:does not give the highest possible profit.

1987:. Unsourced material may be challenged and

823:. Unsourced material may be challenged and

703:. Unsourced material may be challenged and

4026:Profit Maximization in Perfect Competition

3841:Pindyck, R and Rubinfeld, D (2001) p. 341.

3806:Pindyck, R and Rubinfeld, D (2001) p. 333.

531:{\displaystyle {\text{MR}}<{\text{MC}}}

501:{\displaystyle {\text{MR}}>{\text{MC}}}

360:process by which a firm may determine the

333:{\displaystyle {\text{MR}}<{\text{MC}}}

276:{\displaystyle {\text{MR}}>{\text{MC}}}

3859:Samuelson, W and Marks, S (2003). p. 230.

3816:

3814:

3812:

3802:

3800:

3588:Learn how and when to remove this message

3478:

3473:

3464:

3455:

3450:

3447:

3426:

3421:

3418:

3385:

3379:

3370:

3365:

3362:

3338:

3333:

3312:

3307:

3297:

3292:

3289:

3256:

3250:

3230:

3204:

3184:

3164:

3143:

3137:

3114:

3091:

3071:

3069:

3043:

3020:

3000:

2998:

2971:

2960:

2948:

2940:

2905:

2892:

2874:

2861:

2859:

2824:

2803:

2795:

2765:

2751:

2742:

2740:

2715:

2701:

2699:

2679:

2671:

2669:

2645:

2643:

2618:

2589:

2576:

2541:

2521:

2519:

2480:

2468:

2448:

2428:

2402:

2381:

2361:

2317:

2267:

2242:

2236:

2226:

2222:

2220:

2189:

2181:

2173:

2171:

2151:

2143:

2141:

2121:

2113:

2105:

2103:

2007:Learn how and when to remove this message

1920:

1918:

1881:

1875:

1854:

1848:

1818:

1805:

1785:

1762:

1748:

1746:

1723:

1703:

1683:

1659:

1646:

1633:

1620:

1607:

1601:

1578:

1576:

1556:

1554:

1530:

1525:

1515:

1510:

1500:

1494:

1471:

1447:

1441:

1420:

1414:

1387:

1375:{\displaystyle {\overline {\text{PABC}}}}

1362:

1360:

1336:

1334:

1310:

1308:

1288:

1286:

1266:

1264:

1244:

1242:

1222:

1220:

1191:

1180:

1166:

1159:

1148:

1137:

1123:

1116:

1114:

1091:

1089:

1069:

1067:

1044:

1042:

970:

968:

948:

946:

926:

924:

900:

898:

874:

872:

843:Learn how and when to remove this message

723:Learn how and when to remove this message

603:

601:

581:

579:

523:

515:

513:

493:

485:

483:

463:

455:

453:

433:

431:

411:

409:

325:

317:

315:

294:

288:

268:

260:

258:

238:

236:

216:

214:

193:

187:

167:

159:

157:

137:

135:

115:

113:

92:

86:

3881:Pittman, Russell W. (17 December 2007).

3868:Samuelson, W and Marks, S (2003). p. 23.

3785:Samuelson, W and Marks, S (2003). p. 52.

3764:Samuelson, W and Marks, S (2003). p. 47.

3742:

3740:

3738:

3620:which effectively outlaws most industry

3876:

3874:

3710:

2687:{\displaystyle {\text{MC}}={\text{MR}}}

2159:{\displaystyle {\text{TR}}-{\text{TC}}}

983:{\displaystyle {\overline {\text{CB}}}}

471:{\displaystyle {\text{MR}}={\text{MC}}}

175:{\displaystyle {\text{MR}}={\text{MC}}}

2023:of the last commodity sold because of

1259:is shown in the next diagram as point

785:Total revenue – total cost perspective

3983:An introduction to positive economics

3850:Besanko and Braeutigam (2005) p. 419.

7:

3566:adding citations to reliable sources

2851:. Thus, the optimal markup rule is:

1985:adding citations to reliable sources

1949:Maximizing profits in the real world

821:adding citations to reliable sources

701:adding citations to reliable sources

58:move details into the article's body

739:may be classified into two groups:

3674:Outline of industrial organization

3392:

3382:

3119:

2600:

2592:

2552:

2544:

2491:

2483:

2407:

2331:

2323:

2293:

2285:

2273:

2249:

2239:

1778:

1755:

1698:denotes price (marginal revenue),

1181:

1163:

1138:

1120:

209:), as shown in the red part, then

25:

4000:Samuelson, W.; Marks, S. (2003).

3964:(ninth ed.). South-Western.

3950:(fifth ed.). South-Western.

3538:

3435:{\displaystyle {\text{MRP}}_{L}}

1957:

1937:{\displaystyle {\text{M}}\pi =0}

941:and total cost is the height of

793:

673:

34:

4030:Wolfram Demonstrations Project

1055:{\displaystyle {\text{M}}\pi }

376:(or just profit in short). In

1:

3958:Price Theory and Applications

3948:Price Theory and Applications

3921:10.1080/17441056.2020.1770478

2084:Planning and actual execution

1029:Price setting by a monopolist

566:for the optimization equates

108:is the intersection point of

3909:European Competition Journal

3634:Utility maximization problem

3079:{\displaystyle {\text{PED}}}

2653:{\displaystyle {\text{PED}}}

1367:

1344:{\displaystyle {\text{ATC}}}

975:

3981:Lipsey, Richard G. (1975).

1586:{\displaystyle {\text{TC}}}

1564:{\displaystyle {\text{TR}}}

1318:{\displaystyle {\text{MR}}}

1252:{\displaystyle {\text{MC}}}

1230:{\displaystyle {\text{MR}}}

1099:{\displaystyle {\text{MC}}}

1077:{\displaystyle {\text{MR}}}

1062:) equals marginal revenue (

908:{\displaystyle {\text{TC}}}

882:{\displaystyle {\text{TR}}}

772:, depending on whether the

611:{\displaystyle {\text{MC}}}

589:{\displaystyle {\text{MR}}}

441:{\displaystyle {\text{MC}}}

419:{\displaystyle {\text{MR}}}

246:{\displaystyle {\text{MC}}}

224:{\displaystyle {\text{MR}}}

145:{\displaystyle {\text{MC}}}

123:{\displaystyle {\text{MR}}}

4099:

4004:(Fourth ed.). Wiley.

3746:Lipsey (1975). pp. 245–47.

3512:anti-competitive practices

2662:price elasticity of demand

1870:equating to marginal cost

1571:denotes total revenue and

1296:{\displaystyle {\text{D}}}

1274:{\displaystyle {\text{A}}}

999:optimal quantity of output

956:{\displaystyle {\text{B}}}

934:{\displaystyle {\text{C}}}

396:" (whether operating in a

3506:can in some cases reduce

2416:{\displaystyle P\Delta Q}

1329:are represented by curve

380:, which is currently the

3218:{\displaystyle P\cdot Q}

3125:{\displaystyle -\infty }

1382:. The optimum quantity (

735:Any costs incurred by a

625:marginal revenue product

3720:Principles of Economics

1084:) minus marginal cost (

574:, if marginal revenue (

152:(Marginal Cost), where

130:(Marginal Revenue) and

3955:Landsburg, S. (2013).

3946:Landsburg, S. (2002).

3679:Rational choice theory

3654:Duality (optimization)

3488:

3436:

3405:

3348:

3328:, where the subscript

3322:

3266:

3239:

3219:

3193:

3173:

3153:

3126:

3103:

3080:

3058:

3057:{\displaystyle P>0}

3032:

2980:

2921:

2845:

2784:

2729:

2688:

2654:

2632:

2508:

2457:

2437:

2417:

2390:

2370:

2348:

2198:

2160:

2130:

1938:

1891:

1864:

1834:

1732:

1712:

1692:

1669:

1587:

1565:

1540:

1480:

1457:

1430:

1396:

1376:

1345:

1319:

1297:

1275:

1253:

1231:

1206:

1100:

1078:

1056:

1030:

1022:

984:

957:

935:

909:

883:

860:

612:

590:

532:

502:

472:

442:

420:

378:neoclassical economics

341:

334:

304:

277:

247:

225:

203:

176:

146:

124:

102:

4028:by Fiona Maclachlan,

3644:Business organization

3618:anti-trust regulation

3530:Government Regulation

3514:and are regulated by

3489:

3437:

3406:

3349:

3323:

3267:

3265:{\displaystyle Q_{1}}

3240:

3220:

3194:

3174:

3154:

3152:{\displaystyle Q_{1}}

3127:

3104:

3081:

3059:

3038:would be positive so

3033:

2981:

2922:

2846:

2785:

2730:

2689:

2655:

2633:

2509:

2458:

2443:brings in revenue of

2438:

2418:

2391:

2371:

2349:

2199:

2161:

2131:

2076:Business intelligence

1939:

1892:

1890:{\displaystyle c_{i}}

1865:

1863:{\displaystyle p_{i}}

1835:

1733:

1713:

1693:

1670:

1588:

1566:

1541:

1481:

1458:

1456:{\displaystyle P_{m}}

1431:

1429:{\displaystyle Q_{m}}

1397:

1377:

1346:

1320:

1298:

1276:

1254:

1232:

1207:

1101:

1079:

1057:

1028:

1020:

985:

958:

936:

910:

884:

858:

632:perfectly competitive

613:

596:) and marginal cost (

591:

564:first order condition

533:

503:

473:

443:

421:

398:perfectly competitive

335:

305:

303:{\displaystyle Q^{*}}

278:

248:

226:

204:

202:{\displaystyle Q^{*}}

177:

147:

125:

103:

101:{\displaystyle Q^{*}}

80:

4078:Financial management

4048:by Tejvan Pettinger.

4002:Managerial Economics

3794:Landsburg, S (2002).

3639:Welfare maximization

3562:improve this section

3502:The maximization of

3446:

3417:

3361:

3347:{\displaystyle _{L}}

3332:

3288:

3249:

3229:

3203:

3183:

3163:

3136:

3113:

3090:

3068:

3042:

2997:

2939:

2858:

2794:

2739:

2698:

2668:

2642:

2518:

2467:

2447:

2427:

2401:

2380:

2360:

2219:

2170:

2140:

2102:

1981:improve this section

1917:

1874:

1847:

1745:

1722:

1702:

1682:

1600:

1575:

1553:

1493:

1470:

1440:

1413:

1386:

1359:

1333:

1307:

1285:

1263:

1241:

1219:

1215:The intersection of

1113:

1088:

1066:

1041:

967:

945:

923:

897:

871:

817:improve this section

697:improve this section

600:

578:

512:

482:

452:

430:

408:

392:is assumed to be a "

314:

287:

257:

235:

213:

186:

156:

134:

112:

85:

4046:Profit Maximisation

3159:then a decrease in

1327:Average total costs

620:production function

350:profit maximization

4083:Capital management

4040:Techfunnel Project

4038:by Richard Gulle,

3484:

3432:

3401:

3344:

3318:

3262:

3235:

3215:

3189:

3169:

3149:

3122:

3102:{\displaystyle -1}

3099:

3076:

3054:

3028:

2976:

2917:

2841:

2780:

2725:

2684:

2650:

2628:

2504:

2453:

2433:

2413:

2386:

2366:

2344:

2342:

2194:

2156:

2126:

1934:

1887:

1860:

1830:

1728:

1708:

1688:

1665:

1583:

1561:

1536:

1476:

1453:

1426:

1392:

1372:

1341:

1315:

1293:

1271:

1249:

1227:

1202:

1096:

1074:

1052:

1031:

1023:

980:

953:

931:

905:

879:

861:

608:

586:

528:

498:

468:

438:

416:

342:

330:

300:

273:

243:

221:

199:

172:

142:

120:

98:

3971:978-1-285-42352-4

3684:Supply and demand

3602:Predatory pricing

3598:

3597:

3590:

3520:predatory pricing

3476:

3467:

3453:

3424:

3399:

3388:

3368:

3310:

3295:

3238:{\displaystyle Q}

3192:{\displaystyle P}

3172:{\displaystyle Q}

3074:

3026:

3023:

2974:

2966:

2963:

2952:

2915:

2908:

2887:

2877:

2839:

2832:

2831:

2778:

2777:

2760:

2754:

2723:

2722:

2704:

2682:

2674:

2648:

2626:

2625:

2607:

2584:

2559:

2524:

2498:

2456:{\displaystyle P}

2436:{\displaystyle P}

2389:{\displaystyle Q}

2369:{\displaystyle P}

2338:

2300:

2256:

2245:

2229:

2192:

2184:

2176:

2154:

2146:

2124:

2116:

2108:

2017:

2016:

2009:

1923:

1796:

1731:{\displaystyle c}

1711:{\displaystyle q}

1691:{\displaystyle p}

1581:

1559:

1528:

1513:

1479:{\displaystyle i}

1405:If the firm is a

1395:{\displaystyle Q}

1370:

1366:

1339:

1313:

1291:

1269:

1247:

1225:

1197:

1154:

1094:

1072:

1047:

978:

974:

951:

929:

903:

877:

853:

852:

845:

733:

732:

725:

665:Basic definitions

606:

584:

526:

518:

496:

488:

466:

458:

436:

414:

328:

320:

271:

263:

241:

219:

170:

162:

140:

118:

75:

74:

54:length guidelines

16:(Redirected from

4090:

4015:

3996:

3975:

3963:

3951:

3933:

3932:

3915:(2–3): 343–367.

3904:

3898:

3897:

3895:

3893:

3878:

3869:

3866:

3860:

3857:

3851:

3848:

3842:

3839:

3833:

3830:

3821:

3818:

3807:

3804:

3795:

3792:

3786:

3783:

3777:

3776:Desai, M (2017).

3774:

3765:

3762:

3747:

3744:

3733:

3732:entrepreneur.com

3730:

3724:

3723:

3715:

3689:Marginal revenue

3659:Market structure

3593:

3586:

3582:

3579:

3573:

3542:

3534:

3508:consumer surplus

3504:producer surplus

3493:

3491:

3490:

3485:

3483:

3482:

3477:

3474:

3468:

3465:

3460:

3459:

3454:

3451:

3441:

3439:

3438:

3433:

3431:

3430:

3425:

3422:

3410:

3408:

3407:

3402:

3400:

3398:

3390:

3389:

3386:

3380:

3375:

3374:

3369:

3366:

3353:

3351:

3350:

3345:

3343:

3342:

3327:

3325:

3324:

3319:

3317:

3316:

3311:

3308:

3302:

3301:

3296:

3293:

3271:

3269:

3268:

3263:

3261:

3260:

3244:

3242:

3241:

3236:

3224:

3222:

3221:

3216:

3198:

3196:

3195:

3190:

3178:

3176:

3175:

3170:

3158:

3156:

3155:

3150:

3148:

3147:

3131:

3129:

3128:

3123:

3108:

3106:

3105:

3100:

3085:

3083:

3082:

3077:

3075:

3072:

3063:

3061:

3060:

3055:

3037:

3035:

3034:

3029:

3027:

3025:

3024:

3021:

3012:

3001:

2985:

2983:

2982:

2977:

2975:

2972:

2967:

2965:

2964:

2961:

2950:

2949:

2926:

2924:

2923:

2918:

2916:

2914:

2910:

2909:

2906:

2893:

2888:

2883:

2879:

2878:

2875:

2862:

2850:

2848:

2847:

2842:

2840:

2838:

2837:

2833:

2829:

2825:

2812:

2804:

2789:

2787:

2786:

2781:

2779:

2775:

2774:

2766:

2761:

2756:

2755:

2752:

2743:

2734:

2732:

2731:

2726:

2724:

2720:

2716:

2705:

2702:

2693:

2691:

2690:

2685:

2683:

2680:

2675:

2672:

2659:

2657:

2656:

2651:

2649:

2646:

2637:

2635:

2634:

2629:

2627:

2623:

2619:

2608:

2606:

2598:

2590:

2585:

2577:

2560:

2558:

2550:

2542:

2525:

2522:

2513:

2511:

2510:

2505:

2503:

2499:

2497:

2489:

2481:

2462:

2460:

2459:

2454:

2442:

2440:

2439:

2434:

2422:

2420:

2419:

2414:

2395:

2393:

2392:

2387:

2375:

2373:

2372:

2367:

2353:

2351:

2350:

2345:

2343:

2339:

2337:

2329:

2318:

2301:

2299:

2291:

2268:

2257:

2255:

2247:

2246:

2243:

2237:

2230:

2227:

2203:

2201:

2200:

2195:

2193:

2190:

2185:

2182:

2177:

2174:

2165:

2163:

2162:

2157:

2155:

2152:

2147:

2144:

2135:

2133:

2132:

2127:

2125:

2122:

2117:

2114:

2109:

2106:

2032:price elasticity

2012:

2005:

2001:

1998:

1992:

1961:

1953:

1943:

1941:

1940:

1935:

1924:

1921:

1896:

1894:

1893:

1888:

1886:

1885:

1869:

1867:

1866:

1861:

1859:

1858:

1839:

1837:

1836:

1831:

1823:

1822:

1810:

1809:

1797:

1795:

1791:

1790:

1789:

1772:

1768:

1767:

1766:

1749:

1737:

1735:

1734:

1729:

1717:

1715:

1714:

1709:

1697:

1695:

1694:

1689:

1674:

1672:

1671:

1666:

1664:

1663:

1651:

1650:

1638:

1637:

1625:

1624:

1612:

1611:

1592:

1590:

1589:

1584:

1582:

1579:

1570:

1568:

1567:

1562:

1560:

1557:

1545:

1543:

1542:

1537:

1535:

1534:

1529:

1526:

1520:

1519:

1514:

1511:

1505:

1504:

1485:

1483:

1482:

1477:

1462:

1460:

1459:

1454:

1452:

1451:

1435:

1433:

1432:

1427:

1425:

1424:

1401:

1399:

1398:

1393:

1381:

1379:

1378:

1373:

1371:

1364:

1363:

1350:

1348:

1347:

1342:

1340:

1337:

1324:

1322:

1321:

1316:

1314:

1311:

1302:

1300:

1299:

1294:

1292:

1289:

1280:

1278:

1277:

1272:

1270:

1267:

1258:

1256:

1255:

1250:

1248:

1245:

1236:

1234:

1233:

1228:

1226:

1223:

1211:

1209:

1208:

1203:

1198:

1196:

1195:

1190:

1178:

1171:

1170:

1160:

1155:

1153:

1152:

1147:

1135:

1128:

1127:

1117:

1105:

1103:

1102:

1097:

1095:

1092:

1083:

1081:

1080:

1075:

1073:

1070:

1061:

1059:

1058:

1053:

1048:

1045:

1003:marginal revenue

989:

987:

986:

981:

979:

972:

971:

962:

960:

959:

954:

952:

949:

940:

938:

937:

932:

930:

927:

914:

912:

911:

906:

904:

901:

888:

886:

885:

880:

878:

875:

848:

841:

837:

834:

828:

797:

789:

770:marginal revenue

728:

721:

717:

714:

708:

677:

669:

647:physical capital

630:For a firm in a

617:

615:

614:

609:

607:

604:

595:

593:

592:

587:

585:

582:

568:marginal revenue

556:functional forms

537:

535:

534:

529:

527:

524:

519:

516:

507:

505:

504:

499:

497:

494:

489:

486:

477:

475:

474:

469:

467:

464:

459:

456:

447:

445:

444:

439:

437:

434:

425:

423:

422:

417:

415:

412:

339:

337:

336:

331:

329:

326:

321:

318:

309:

307:

306:

301:

299:

298:

282:

280:

279:

274:

272:

269:

264:

261:

252:

250:

249:

244:

242:

239:

231:is greater than

230:

228:

227:

222:

220:

217:

208:

206:

205:

200:

198:

197:

181:

179:

178:

173:

171:

168:

163:

160:

151:

149:

148:

143:

141:

138:

129:

127:

126:

121:

119:

116:

107:

105:

104:

99:

97:

96:

70:

67:

61:

52:Please read the

38:

37:

30:

21:

4098:

4097:

4093:

4092:

4091:

4089:

4088:

4087:

4058:

4057:

4022:

4012:

3999:

3993:

3980:

3972:

3961:

3954:

3945:

3942:

3937:

3936:

3906:

3905:

3901:

3891:

3889:

3887:Search eLibrary

3880:

3879:

3872:

3867:

3863:

3858:

3854:

3849:

3845:

3840:

3836:

3831:

3824:

3819:

3810:

3805:

3798:

3793:

3789:

3784:

3780:

3775:

3768:

3763:

3750:

3745:

3736:

3731:

3727:

3717:

3716:

3712:

3707:

3630:

3594:

3583:

3577:

3574:

3559:

3543:

3532:

3516:competition law

3500:

3472:

3449:

3444:

3443:

3420:

3415:

3414:

3391:

3381:

3364:

3359:

3358:

3335:

3330:

3329:

3306:

3291:

3286:

3285:

3278:

3252:

3247:

3246:

3227:

3226:

3201:

3200:

3181:

3180:

3179:would increase

3161:

3160:

3139:

3134:

3133:

3111:

3110:

3088:

3087:

3066:

3065:

3040:

3039:

3013:

3002:

2995:

2994:

2953:

2937:

2936:

2931:or equivalently

2901:

2897:

2867:

2863:

2856:

2855:

2820:

2813:

2805:

2792:

2791:

2767:

2744:

2737:

2736:

2696:

2695:

2666:

2665:

2640:

2639:

2599:

2591:

2551:

2543:

2516:

2515:

2490:

2482:

2476:

2465:

2464:

2445:

2444:

2425:

2424:

2399:

2398:

2378:

2377:

2358:

2357:

2341:

2340:

2330:

2319:

2309:

2303:

2302:

2292:

2269:

2265:

2259:

2258:

2248:

2238:

2234:

2217:

2216:

2210:

2168:

2167:

2138:

2137:

2100:

2099:

2095:

2067:Profit analysis

2063:

2013:

2002:

1996:

1993:

1978:

1962:

1951:

1915:

1914:

1910:

1877:

1872:

1871:

1850:

1845:

1844:

1814:

1801:

1781:

1777:

1773:

1758:

1754:

1750:

1743:

1742:

1720:

1719:

1700:

1699:

1680:

1679:

1655:

1642:

1629:

1616:

1603:

1598:

1597:

1573:

1572:

1551:

1550:

1524:

1509:

1496:

1491:

1490:

1468:

1467:

1443:

1438:

1437:

1416:

1411:

1410:

1384:

1383:

1357:

1356:

1353:economic profit

1331:

1330:

1305:

1304:

1283:

1282:

1261:

1260:

1239:

1238:

1217:

1216:

1179:

1162:

1161:

1136:

1119:

1118:

1111:

1110:

1086:

1085:

1064:

1063:

1039:

1038:

1035:marginal profit

1015:

965:

964:

943:

942:

921:

920:

895:

894:

869:

868:

849:

838:

832:

829:

814:

798:

787:

729:

718:

712:

709:

694:

678:

667:

598:

597:

576:

575:

549:, one can plot

510:

509:

480:

479:

450:

449:

428:

427:

406:

405:

312:

311:

290:

285:

284:

255:

254:

233:

232:

211:

210:

189:

184:

183:

154:

153:

132:

131:

110:

109:

88:

83:

82:

71:

65:

62:

51:

48:may be too long

43:This article's

39:

35:

28:

23:

22:

18:Profit function

15:

12:

11:

5:

4096:

4094:

4086:

4085:

4080:

4075:

4070:

4060:

4059:

4056:

4055:

4054:by Riverlogic.

4049:

4043:

4033:

4021:

4020:External links

4018:

4017:

4016:

4010:

3997:

3991:

3978:

3977:

3976:

3970:

3941:

3938:

3935:

3934:

3899:

3870:

3861:

3852:

3843:

3834:

3822:

3808:

3796:

3787:

3778:

3766:

3748:

3734:

3725:

3709:

3708:

3706:

3703:

3702:

3701:

3696:

3691:

3686:

3681:

3676:

3671:

3666:

3664:Microeconomics

3661:

3656:

3651:

3646:

3641:

3636:

3629:

3626:

3596:

3595:

3546:

3544:

3537:

3531:

3528:

3499:

3496:

3481:

3471:

3463:

3458:

3429:

3397:

3394:

3384:

3378:

3373:

3341:

3337:

3315:

3305:

3300:

3277:

3274:

3259:

3255:

3234:

3225:; since lower

3214:

3211:

3208:

3188:

3168:

3146:

3142:

3121:

3118:

3098:

3095:

3053:

3050:

3047:

3019:

3016:

3011:

3008:

3005:

2988:

2987:

2970:

2959:

2956:

2947:

2944:

2933:

2932:

2928:

2927:

2913:

2904:

2900:

2896:

2891:

2886:

2882:

2873:

2870:

2866:

2836:

2828:

2823:

2819:

2816:

2811:

2808:

2802:

2799:

2773:

2770:

2764:

2759:

2750:

2747:

2719:

2714:

2711:

2708:

2678:

2622:

2617:

2614:

2611:

2605:

2602:

2597:

2594:

2588:

2583:

2580:

2575:

2572:

2569:

2566:

2563:

2557:

2554:

2549:

2546:

2540:

2537:

2534:

2531:

2528:

2502:

2496:

2493:

2488:

2485:

2479:

2475:

2472:

2452:

2432:

2412:

2409:

2406:

2385:

2365:

2336:

2333:

2328:

2325:

2322:

2316:

2313:

2310:

2308:

2305:

2304:

2298:

2295:

2290:

2287:

2284:

2281:

2278:

2275:

2272:

2266:

2264:

2261:

2260:

2254:

2251:

2241:

2235:

2233:

2225:

2224:

2209:

2208:Markup pricing

2206:

2188:

2180:

2150:

2120:

2112:

2094:

2091:

2090:

2089:

2085:

2082:

2079:

2073:

2069:

2062:

2059:

2015:

2014:

1965:

1963:

1956:

1950:

1947:

1933:

1930:

1927:

1909:

1906:

1884:

1880:

1857:

1853:

1841:

1840:

1829:

1826:

1821:

1817:

1813:

1808:

1804:

1800:

1794:

1788:

1784:

1780:

1776:

1771:

1765:

1761:

1757:

1753:

1727:

1718:quantity, and

1707:

1687:

1676:

1675:

1662:

1658:

1654:

1649:

1645:

1641:

1636:

1632:

1628:

1623:

1619:

1615:

1610:

1606:

1547:

1546:

1533:

1523:

1518:

1508:

1503:

1499:

1475:

1450:

1446:

1423:

1419:

1391:

1369:

1213:

1212:

1201:

1194:

1189:

1186:

1183:

1177:

1174:

1169:

1165:

1158:

1151:

1146:

1143:

1140:

1134:

1131:

1126:

1122:

1051:

1014:

1011:

997:at the firm's

977:

851:

850:

801:

799:

792:

786:

783:

745:variable costs

731:

730:

681:

679:

672:

666:

663:

522:

492:

462:

394:rational agent

386:microeconomics

324:

297:

293:

267:

196:

192:

166:

95:

91:

73:

72:

42:

40:

33:

26:

24:

14:

13:

10:

9:

6:

4:

3:

2:

4095:

4084:

4081:

4079:

4076:

4074:

4071:

4069:

4066:

4065:

4063:

4053:

4050:

4047:

4044:

4041:

4037:

4034:

4031:

4027:

4024:

4023:

4019:

4013:

4007:

4003:

3998:

3994:

3992:0-297-76899-9

3988:

3984:

3979:

3973:

3967:

3960:

3959:

3953:

3952:

3949:

3944:

3943:

3939:

3930:

3926:

3922:

3918:

3914:

3910:

3903:

3900:

3888:

3884:

3877:

3875:

3871:

3865:

3862:

3856:

3853:

3847:

3844:

3838:

3835:

3829:

3827:

3823:

3817:

3815:

3813:

3809:

3803:

3801:

3797:

3791:

3788:

3782:

3779:

3773:

3771:

3767:

3761:

3759:

3757:

3755:

3753:

3749:

3743:

3741:

3739:

3735:

3729:

3726:

3721:

3714:

3711:

3704:

3700:

3699:Marginal cost

3697:

3695:

3694:Total revenue

3692:

3690:

3687:

3685:

3682:

3680:

3677:

3675:

3672:

3670:

3667:

3665:

3662:

3660:

3657:

3655:

3652:

3650:

3647:

3645:

3642:

3640:

3637:

3635:

3632:

3631:

3627:

3625:

3623:

3619:

3615:

3611:

3610:price gouging

3607:

3603:

3592:

3589:

3581:

3571:

3567:

3563:

3557:

3556:

3552:

3547:This section

3545:

3541:

3536:

3535:

3529:

3527:

3525:

3521:

3517:

3513:

3509:

3505:

3497:

3495:

3479:

3469:

3461:

3456:

3427:

3412:

3395:

3376:

3371:

3355:

3339:

3336:

3313:

3303:

3298:

3283:

3282:marginal cost

3275:

3273:

3257:

3253:

3232:

3212:

3209:

3206:

3186:

3166:

3144:

3140:

3116:

3096:

3093:

3051:

3048:

3045:

3017:

3014:

3009:

3006:

3003:

2991:

2968:

2957:

2954:

2945:

2942:

2935:

2934:

2930:

2929:

2911:

2902:

2898:

2894:

2889:

2884:

2880:

2871:

2868:

2864:

2854:

2853:

2852:

2834:

2826:

2821:

2817:

2814:

2809:

2806:

2800:

2797:

2771:

2768:

2762:

2757:

2748:

2745:

2717:

2712:

2709:

2706:

2676:

2663:

2620:

2615:

2612:

2609:

2603:

2595:

2586:

2581:

2578:

2573:

2570:

2567:

2564:

2561:

2555:

2547:

2538:

2535:

2532:

2529:

2526:

2500:

2494:

2486:

2477:

2473:

2470:

2450:

2430:

2410:

2404:

2383:

2363:

2354:

2334:

2326:

2320:

2314:

2311:

2306:

2296:

2288:

2282:

2279:

2276:

2270:

2262:

2252:

2231:

2214:

2207:

2205:

2186:

2178:

2148:

2118:

2110:

2092:

2086:

2083:

2080:

2077:

2074:

2070:

2068:

2065:

2064:

2060:

2058:

2056:

2052:

2047:

2045:

2040:

2036:

2033:

2028:

2026:

2022:

2021:marginal cost

2011:

2008:

2000:

1997:November 2022

1990:

1986:

1982:

1976:

1975:

1971:

1966:This section

1964:

1960:

1955:

1954:

1948:

1946:

1931:

1928:

1925:

1907:

1905:

1903:

1898:

1882:

1878:

1855:

1851:

1827:

1824:

1819:

1815:

1811:

1806:

1802:

1798:

1792:

1786:

1782:

1774:

1769:

1763:

1759:

1751:

1741:

1740:

1739:

1725:

1705:

1685:

1660:

1656:

1652:

1647:

1643:

1639:

1634:

1630:

1626:

1621:

1617:

1613:

1608:

1604:

1596:

1595:

1594:

1531:

1521:

1516:

1506:

1501:

1497:

1489:

1488:

1487:

1473:

1464:

1448:

1444:

1421:

1417:

1408:

1403:

1389:

1354:

1328:

1199:

1192:

1187:

1184:

1175:

1172:

1167:

1156:

1149:

1144:

1141:

1132:

1129:

1124:

1109:

1108:

1107:

1049:

1036:

1027:

1019:

1012:

1010:

1008:

1007:marginal cost

1004:

1000:

996:

991:

916:

892:

866:

865:total revenue

857:

847:

844:

836:

833:November 2022

826:

822:

818:

812:

811:

807:

802:This section

800:

796:

791:

790:

784:

782:

779:

775:

771:

767:

766:Marginal cost

763:

759:

756:

752:

750:

746:

742:

738:

727:

724:

716:

713:November 2022

706:

702:

698:

692:

691:

687:

682:This section

680:

676:

671:

670:

664:

662:

660:

659:raw materials

656:

652:

648:

643:

641:

637:

633:

628:

626:

621:

573:

572:marginal cost

569:

565:

561:

557:

552:

548:

544:

539:

520:

490:

460:

401:

399:

395:

391:

387:

383:

379:

375:

371:

367:

363:

359:

355:

351:

347:

322:

295:

291:

265:

194:

190:

164:

93:

89:

79:

69:

66:November 2022

59:

55:

49:

47:

41:

32:

31:

19:

4001:

3982:

3957:

3947:

3912:

3908:

3902:

3890:. Retrieved

3886:

3864:

3855:

3846:

3837:

3790:

3781:

3728:

3719:

3713:

3599:

3584:

3575:

3560:Please help

3548:

3501:

3413:

3356:

3279:

2992:

2989:

2355:

2215:

2211:

2096:

2048:

2044:market share

2041:

2037:

2029:

2018:

2003:

1994:

1979:Please help

1967:

1911:

1899:

1842:

1677:

1548:

1465:

1404:

1214:

1032:

995:demand curve

992:

917:

862:

839:

830:

815:Please help

803:

764:

760:

753:

734:

719:

710:

695:Please help

683:

644:

629:

540:

402:

384:approach to

349:

343:

63:

46:lead section

44:

3649:Corporation

3614:governments

3086:is between

2088:unfeasible.

2051:cheap labor

1902:game theory

741:fixed costs

640:monopsonist

551:graphically

4062:Categories

4011:0470000449

3940:References

3622:monopolies

2055:Nike, Inc.

1407:monopolist

891:total cost

778:derivative

749:total cost

651:investment

636:monopolist

382:mainstream

3929:1744-1056

3892:24 August

3578:June 2023

3549:does not

3498:Criticism

3470:⋅

3393:Δ

3383:Δ

3210:⋅

3120:∞

3117:−

3094:−

2969:⋅

2903:−

2872:−

2769:−

2749:−

2601:Δ

2593:Δ

2587:⋅

2574:⋅

2553:Δ

2545:Δ

2539:⋅

2492:Δ

2484:Δ

2474:⋅

2408:Δ

2332:Δ

2324:Δ

2294:Δ

2286:Δ

2274:Δ

2250:Δ

2240:Δ

2149:−

2119:−

2072:expenses.

1968:does not

1926:π

1812:−

1779:∂

1760:π

1756:∂

1653:⋅

1640:−

1627:⋅

1605:π

1522:−

1498:π

1368:¯

1185:

1173:

1142:

1130:

1050:π

976:¯

804:does not

684:does not

354:short run

346:economics

296:∗

195:∗

94:∗

56:and help

3628:See also

3522:such as

3064:only if

2638:, where

2514:. Thus,

2356:, where

1351:. Total

889:) minus

774:calculus

560:calculus

358:long run

4073:Pricing

3669:Pricing

3570:removed

3555:sources

3524:dumping

2660:is the

1989:removed

1974:sources

1005:equals

825:removed

810:sources

755:Revenue

705:removed

690:sources

543:revenue

352:is the

4068:Profit

4008:

3989:

3968:

3927:

2694:gives

2107:Profit

2053:(e.g.

1678:where

1549:where

545:minus

388:, the

374:profit

370:output

3962:(PDF)

3705:Notes

3606:tying

2191:Price

2078:tools

2061:Tools

655:labor

366:input

362:price

4006:ISBN

3987:ISBN

3966:ISBN

3925:ISSN

3894:2024

3553:any

3551:cite

3109:and

3049:>

2790:and

2376:and

2030:The

1972:any

1970:cite

1365:PABC

1237:and

1157:<

808:any

806:cite

768:and

743:and

737:firm

688:any

686:cite

657:and

570:and

547:cost

521:<

491:>

390:firm

368:and

323:<

266:>

3917:doi

3564:by

3452:MRP

3423:MRP

3367:MRP

3294:MRP

3073:PED

3022:PED

2962:PED

2951:PED

2907:PED

2830:PED

2776:PED

2735:so

2721:PED

2647:PED

2624:PED

1983:by

1463:).

1338:ATC

819:by

699:by

356:or

344:In

4064::

3923:.

3913:16

3911:.

3885:.

3873:^

3825:^

3811:^

3799:^

3769:^

3751:^

3737:^

3608:,

3604:,

3526:.

3494:.

3475:MP

3466:MR

3411:.

3387:TR

3309:MC

2973:MC

2876:MC

2753:MC

2703:MC

2681:MR

2673:MC

2523:MR

2244:TR

2228:MR

2183:MC

2175:MR

2153:TC

2145:TR

2123:TC

2115:TR

2027:.

2025:MR

1904:.

1897:.

1580:TC

1558:TR

1527:TC

1512:TR

1312:MR

1246:MC

1224:MR

1093:MC

1071:MR

1009:.

973:CB

902:TC

876:TR

751:.

661:.

605:MC

583:MR

525:MC

517:MR

495:MC

487:MR

465:MC

457:MR

435:MC

413:MR

364:,

348:,

327:MC

319:MR

270:MC

262:MR

240:MC

218:MR

169:MC

161:MR

139:MC

117:MR

4042:.

4032:.

4014:.

3995:.

3974:.

3931:.

3919::

3896:.

3591:)

3585:(

3580:)

3576:(

3572:.

3558:.

3480:L

3462:=

3457:L

3428:L

3396:L

3377:=

3372:L

3340:L

3314:L

3304:=

3299:L

3258:1

3254:Q

3233:Q

3213:Q

3207:P

3187:P

3167:Q

3145:1

3141:Q

3097:1

3052:0

3046:P

3018:+

3015:1

3010:D

3007:E

3004:P

2986:.

2958:+

2955:1

2946:=

2943:P

2912:)

2899:(

2895:1

2890:=

2885:P

2881:)

2869:P

2865:(

2835:)

2827:1

2822:(

2818:+

2815:1

2810:C

2807:M

2801:=

2798:P

2772:1

2763:=

2758:P

2746:P

2718:P

2713:+

2710:P

2707:=

2677:=

2621:P

2616:+

2613:P

2610:=

2604:Q

2596:P

2582:P

2579:Q

2571:P

2568:+

2565:P

2562:=

2556:Q

2548:P

2536:Q

2533:+

2530:P

2527:=

2501:)

2495:Q

2487:P

2478:(

2471:Q

2451:P

2431:P

2411:Q

2405:P

2384:Q

2364:P

2335:Q

2327:P

2321:Q

2315:+

2312:P

2307:=

2297:Q

2289:P

2283:Q

2280:+

2277:Q

2271:P

2263:=

2253:Q

2232:=

2187:=

2179:=

2111:=

2010:)

2004:(

1999:)

1995:(

1991:.

1977:.

1932:0

1929:=

1922:M

1883:i

1879:c

1856:i

1852:p

1828:0

1825:=

1820:i

1816:c

1807:i

1803:p

1799:=

1793:)

1787:i

1783:q

1775:(

1770:)

1764:i

1752:(

1726:c

1706:q

1686:p

1661:i

1657:q

1648:i

1644:c

1635:i

1631:q

1622:i

1618:p

1614:=

1609:i

1532:i

1517:i

1507:=

1502:i

1474:i

1449:m

1445:P

1422:m

1418:Q

1390:Q

1290:D

1268:A

1200:.

1193:2

1188:Q

1182:d

1176:C

1168:2

1164:d

1150:2

1145:Q

1139:d

1133:R

1125:2

1121:d

1046:M

1037:(

950:B

928:C

893:(

867:(

846:)

840:(

835:)

831:(

827:.

813:.

726:)

720:(

715:)

711:(

707:.

693:.

461:=

310:(

292:Q

253:(

191:Q

165:=

90:Q

68:)

64:(

60:.

50:.

20:)

Text is available under the Creative Commons Attribution-ShareAlike License. Additional terms may apply.