473:

187:

571:"According to standard theory, a decrease in price typically leads to less supply and more demand, while an increase in price has the opposite effect. While this principle holds true for many assets, it often operates in reverse for stocks due to the common mistake made by investors—buying high in a state of euphoria and selling low in a state of fear or panic, driven by the herding instinct. In cases where an increase in price leads to an increase in demand, or a decrease in price leads to an increase in supply, the expected

79:

272:

1422:

297:

Bear markets conclude when stocks recover, reaching new highs. The bear market is then assessed retrospectively from the recent highs to the lowest closing price, and its recovery period spans from the lowest closing price to the attainment of new highs. Another commonly accepted indicator of the end

548:

The price of assets, such as stocks, is determined by supply and demand. By definition, the market balances buyers and sellers, making it impossible to have 'more buyers than sellers' or vice versa, despite the common use of that expression. During a surge in demand, buyers are willing to pay higher

399:

A market top (or market high) is usually not a dramatic event. The market has simply reached the highest point that it will, for some time. This identification is retrospective, as market participants are generally unaware of it when it occurs. Thus prices subsequently fall, either slowly or more

567:

to buy low and sell high, but in practice, they may end up buying high and selling low. Contrarian investors and traders employ a strategy of 'fading' investors' actions—buying when others are selling and selling when others are buying. A period when most investors are selling stocks is known as

457:

Identifying a market bottom, often referred to as 'bottom picking,' is a challenging task, as it's difficult to recognize before it passes. The upturn following a decline may be short-lived, and prices might resume their descent, resulting in a loss for the investor who purchased stocks during a

495:

A bottom of 7,286.27 was reached on the DJIA on

October 9, 2002, following a decline from 11,722.98 on January 14, 2000. This decline included an intermediate bottom of 8,235.81 on September 21, 2001 (a 14% change from September 10), leading to an intermediate top of 10,635.25 on March 19, 2002

604:

The

Investor Intelligence Sentiment Index evaluates market sentiment through the Bull-Bear spread (% of Bulls − % of Bears). A close-to-historic-low spread may signal a bottom, indicating a potential market turnaround. Conversely, an extreme high in bullish sentiment and an extreme low in

69:

A future market trend can only be determined in hindsight, since at any time prices in the future are not known. Past trends are identified by drawing lines, known as trendlines, that connect price action making higher highs and higher lows for an uptrend, or lower lows and lower highs for a

139:

A secular market trend is a lasting long-term trend that lasts 5 to 25 years and consists of a series of primary trends. A secular bear market consists of smaller bull markets and larger bear markets; a secular bull market consists of larger bull markets and smaller bear markets.

108:

were called "bear-skin jobbers" because they sold a bear's skin (the shares) before catching the bear. This was simplified to "bears," while traders who bought shares on credit were called "bulls." The latter term might have originated by analogy to

555:

dynamics vary as investors attempt to reallocate their investments between asset types. For instance, investors may seek to move funds from government bonds to 'tech' stocks, but the success of this shift depends on finding buyers for the

127:. He remarked that bulls who bought in excess of present demand might be seen wandering among brokers' offices moaning for a buyer, while bears rushed about devouring any shares they could find to close their short positions. An unrelated

30:

This article is about market trend in finance. For the trend of a market that is used in a company's planning activities, especially regarding inventory decisions, purchasing, facility expansion, and promotional activities, see

222:

stock market data from 1926 to 2014 revealed that, on average, a typical bull market lasted 8.5 years with a cumulative total return averaging 458%. Additionally, annualized gains for bull markets ranged from 14.9% to 34.1%.

208:. This point is when the "crowd" is the most "bearish". The feeling of despondency changes to hope, "optimism", and eventually euphoria as the bull runs its course. This often leads the economic cycle, for example, in a full

99:

The terms "bull market" and "bear market" describe upward and downward market trends, respectively, and can be used to describe either the market as a whole or specific sectors and securities. The terms come from London's

245:

Notable bull markets characterized the 1925–1929, 1953–1957, and 1993–1997 periods when the U.S. and many other stock markets experienced significant growth. While the first period ended abruptly with the start of the

170:. During this period, the market price of gold fell from a high of $ 850/oz ($ 30/g) to a low of $ 253/oz ($ 9/g). The stock market was also described as being in a secular bear market from 1929 to 1949.

215:

Generally, bull markets begin when stocks rise 20% from their low and end when stocks experience a 20% drawdown. However, some analysts suggest a bull market cannot happen within a bear market.

605:

bearish sentiment may suggest a market top or an imminent occurrence. It's worth noting that this contrarian measure is more reliable for coincidental timing at market lows than at market tops.

492:

The Dow Jones

Industrial Average hit a bottom at 1,738.74 on October 19, 1987, following a decline from 2,722.41 on August 25, 1987. This day is commonly referred to as Black Monday (chart).

464:

is often quoted as advising that the best time to buy is when there is 'blood in the streets'—that is, when the markets have fallen drastically and investor sentiment is extremely negative.

301:

From 1926 to 2014, the average duration of a bear market was 13 months, accompanied by an average cumulative loss of 30%. Annualized declines for bear markets ranged from −19.7% to −47%.

166:

In a secular bear market, the prevailing trend is "bearish" or downward-moving. An example of a secular bear market occurred in gold from

January 1980 to June 1999, culminating with the

560:

they are selling. Conversely, they might aim to move funds from 'tech' stocks to government bonds at another time. In each case, these actions influence the prices of both asset types.

916:

2107:

496:(chart). Meanwhile, the "tech-heavy" Nasdaq experienced a more precipitous fall, declining 79% from its peak of 5,132 on March 10, 2000, to its bottom of 1,108 on October 10, 2002.

961:

1060:

240:, experienced a major bull market trend from April 2003 to January 2008. It increased from 2,900 points to 21,000 points, representing a more than 600% return in 5 years.

593:

When an extremely high proportion of investors express a bearish (negative) sentiment, some analysts consider it to be a strong signal that a market bottom may be near.

276:

1211:

612:(AAII) sentiment indicator is often interpreted to suggest that the majority of the decline has already occurred when it gives a reading of minus 15% or below.

287:

to widespread investor fear and pessimism. One generally accepted measure of a bear market is a price decline of 20% or more over at least a two-month period.

3646:

1453:

609:

2898:

2100:

1139:

472:

3380:

411:

occurring within a relatively short period of time. Distribution is identified as a decline in price with higher volume than the preceding session.

3543:

3025:

3014:

461:

1326:

454:

A market bottom marks a trend reversal, signifying the end of a market downturn and the commencement of an upward-moving trend (bull market).

2093:

1377:

768:

2338:

1293:

1268:

1243:

913:

597:

observes a trend phenomenon that follows a path starting with under-reaction and culminating in overreaction by investors and traders.

3519:

1761:

1667:

1592:

512:

Secondary trends are short-term changes in price direction within a primary trend, typically lasting for a few weeks or a few months.

329:. After regaining nearly 50% of its losses, a longer bear market from 1937 to 1942 occurred in which the market was again cut in half.

439:

358:

1025:

898:

734:

655:

1164:

3119:

2363:

1742:

1446:

1184:

3513:

2891:

2069:

1895:

1819:

365:

186:

3334:

3217:

199:

90:

383:

2357:

1476:

962:"Does the Dow's 21% surge in 3 days put it back in a bull market? 'The market doesn't work that way,' says one researcher"

784:

Preis, Tobias; Stanley, H. Eugene (2011). "Bubble trouble: Can a Law

Describe Bubbles and Crashes in Financial Markets?".

351:

340:

283:

A bear market is a general decline in the stock market over a period of time. It involves a transition from high investor

152:

528:', is characterized by a price increase of 5% or more before prices fall again. Bear market rallies were observed in the

3677:

3557:

3495:

3178:

2840:

2780:

2576:

2482:

1612:

1577:

1106:

529:

485:

318:

3687:

3483:

3471:

3440:

2566:

2534:

2438:

2392:

2375:

2328:

1439:

540:

has had several bear-market rallies between the 1980s and 2011, while undergoing an overall long-term downward trend.

1225:

62:, a framework which characterizes market trends as predictable price tendencies within the market when price reaches

3672:

3600:

3369:

3271:

3235:

3229:

3137:

3059:

2884:

2351:

2345:

1773:

178:

A primary trend has broad support throughout the entire market, across most sectors, and lasts for a year or more.

3636:

3071:

1824:

1582:

1532:

549:

prices, while sellers seek higher prices in return. Conversely, in a surge in supply, the dynamics are reversed.

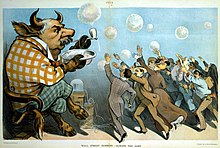

533:

314:

1996:

1081:

255:

3537:

3525:

3155:

2740:

2415:

1607:

1426:

890:

500:

251:

147:

was described as being in a secular bull market from about 1983 to 2000 (or 2007), with brief upsets including

123:

118:

83:

3089:

1785:

131:

supposes that the terms refer to a bear clawing downward to attack and a bull bucking upward with its horns.

3588:

3549:

3477:

3259:

3247:

3083:

2694:

2555:

2450:

2333:

1854:

1767:

1404:

650:

630:

575:

loop is disrupted, resulting in price instability. This phenomenon is evident in bubbles or market crashes.

376:

1930:

3667:

3582:

3562:

3531:

3507:

3423:

3193:

3077:

2582:

1727:

1691:

1537:

1491:

160:

63:

536:, leading down to the market bottom in 1932, and throughout the late 1960s and early 1970s. The Japanese

204:

A bull market is a period of generally rising prices. The start of a bull market is marked by widespread

3606:

3594:

3501:

3283:

3205:

3107:

3101:

2992:

2981:

2953:

2928:

2720:

2529:

1912:

1860:

1737:

322:

233:

615:

Other sentiment indicators include the Nova-Ursa ratio, the Short

Interest/Total Market Float, and the

3277:

3211:

3143:

3095:

3053:

2855:

2775:

2540:

2524:

2487:

2369:

2312:

2280:

2064:

2008:

1941:

1677:

675:

587:

521:

3692:

3682:

3396:

3358:

3340:

3313:

3295:

3065:

3030:

2969:

2943:

2785:

2730:

2654:

2514:

2444:

2273:

2246:

2054:

1871:

1865:

1718:

1654:

1636:

1627:

1587:

635:

333:

148:

105:

2634:

94:

3364:

3352:

3307:

3265:

3161:

3149:

3008:

2938:

2825:

2800:

2760:

2745:

2664:

2603:

2561:

2305:

2215:

2205:

1977:

1949:

1840:

1462:

1061:"Stop saying the Dow is moving in and out of correction! That is not how stock-market moves work"

686:

660:

408:

387:

59:

1341:

143:

In a secular bull market, the prevailing trend is "bullish" or upward-moving. The United States

914:

The 6 Stages Of Bull

Markets – And Where We Are Right Now | Markets | Minyanville's Wall Street

407:, since the 1950s, a market top is characterized by three to five distribution days in a major

78:

3612:

3241:

3188:

3167:

3131:

3113:

3019:

2975:

2689:

2674:

2426:

1988:

1918:

1813:

1672:

1512:

1373:

1346:

1165:"The stock market loses 13% in a correction on average, if it doesn't turn into a bear market"

1114:

1021:

894:

884:

814:

764:

730:

726:

594:

572:

552:

404:

372:

291:

219:

720:

568:

distribution, while a period when most investors are buying stocks is known as accumulation.

3456:

3451:

3428:

3223:

2933:

2790:

2710:

2506:

2387:

2263:

2182:

2138:

2116:

1961:

1900:

1887:

1848:

1829:

1542:

1307:

795:

670:

583:

499:

A bottom of 6,440.08 (DJIA) on 9 March 2009 was reached after a decline associated with the

443:

432:

326:

247:

43:

271:

3572:

3434:

3402:

3324:

3199:

3125:

2907:

2865:

2860:

2795:

2770:

2705:

2679:

2659:

2618:

2613:

2608:

2593:

2588:

2476:

2410:

2402:

2290:

2177:

1966:

1955:

1662:

1597:

1481:

920:

696:

557:

525:

32:

985:

3641:

3489:

3466:

3390:

3346:

3301:

3289:

2820:

2815:

2715:

2700:

2461:

2456:

2421:

2220:

2187:

2133:

2125:

2049:

2002:

1924:

1801:

1779:

1602:

1572:

1567:

665:

645:

640:

616:

420:

259:

156:

128:

101:

1041:

936:

82:

Statues of the two symbolic beasts of finance, the bear and the bull, in front of the

3661:

3626:

3047:

2684:

2669:

2644:

2598:

2550:

2253:

2210:

2197:

2148:

2024:

1807:

1617:

1559:

1017:

837:

799:

786:

564:

344:

1398:

3631:

3253:

2923:

2845:

2765:

2725:

2545:

2519:

2268:

2258:

2241:

2172:

2167:

2143:

2074:

1876:

1393:

1311:

1229:

1045:

880:

841:

191:

167:

144:

114:

110:

17:

1082:"This Is The Best Illustration Of History's Bull And Bear Markets We've Seen Yet"

1011:

754:

3413:

3002:

2963:

2850:

2830:

2810:

2805:

2750:

2639:

2571:

2059:

2029:

1906:

1704:

1517:

1065:

923:

46:

to move in a particular direction over time. Analysts classify these trends as

2835:

2755:

2432:

2295:

1796:

1527:

1522:

1486:

681:

537:

424:

237:

1118:

2471:

2466:

2381:

2300:

1699:

760:

691:

484:

Some more examples of market bottoms, in terms of the closing values of the

209:

205:

855:

332:

A long-term bear market occurred from about 1973 to 1982, encompassing the

1421:

2649:

2285:

1212:"Know This Sell Rule: When Distribution Days Pile Up In The Stock Market"

284:

2493:

1140:"The Nasdaq escapes longest bear market — by one measure — in 28 years"

58:

for short time-frames. Traders attempt to identify market trends using

2236:

1431:

753:

Edwards, Robert D.; McGee, John; Bessetti, W. H. C. (July 24, 2018).

428:

427:, occurred on March 24, 2000, when the index closed at 4,704.73. The

2876:

2085:

2159:

1327:"30 years since Japan's stock market peaked, climb back continues"

471:

270:

185:

77:

1370:

Financial advice and investment decisions: a manifesto for change

1790:

1644:

1169:

298:

of a bear market is indices gaining 20% or more from their low.

2880:

2089:

1435:

1971:

1226:"Contrarian Investing: Buy When There's Blood in the Streets"

1185:"The S&P 500 is in a Bear Market; Here's What That Means"

361:, a bear market occurred between October 2007 and March 2009.

250:, the end of the later time periods were mostly periods of

600:

Indicators that measure investor sentiment may include:

104:

in the early 18th century, where traders who engaged in

27:

Perceived financial market movement tendency over time

1105:

Driebusch, Georgi

Kantchev and Corrie (2019-02-15).

3571:

3450:

3412:

3379:

3323:

3177:

3040:

2991:

2952:

2627:

2502:

2401:

2321:

2229:

2196:

2157:

2123:

2042:

2017:

1987:

1940:

1886:

1839:

1752:

1726:

1717:

1690:

1653:

1635:

1626:

1558:

1551:

1505:

1469:

1372:. The Frank J. Fabozzi series. Hoboken, NJ: Wiley.

1397:

524:, sometimes referred to as a 'sucker's rally' or '

1163:Franck, Thomas; Rooney, Kate (October 26, 2018).

1010:O'Sullivan, Arthur; Sheffrin, Steven M. (2003).

503:starting at 14164.41 on 9 October 2007 (chart).

339:A bear market occurred in India following the

2892:

2101:

1447:

438:The peak of the U.S. stock market before the

336:and the high unemployment of the early 1980s.

8:

610:American Association of Individual Investors

446:closed at 1,565 and the NASDAQ at 2,861.50.

719:Fontanills, George; Gentile, Tommy (2001).

317:, which erased 89% (from 386 to 40) of the

290:A decline of 10% to 20% is classified as a

2899:

2885:

2877:

2108:

2094:

2086:

1723:

1632:

1555:

1454:

1440:

1432:

1368:Wilcox, Jarrod; Fabozzi, Frank J. (2013).

1107:"Nasdaq Exits Bear Market as Stocks Rally"

813:Schneider, Daniel B. (November 30, 1997).

379:have led to bear markets across the world.

117:, two animal fighting sports of the time.

748:

746:

254:, which became large bear markets. (see:

714:

712:

309:Some examples of a bear market include:

1269:"$ INDU – Dow Jones Industrial Average"

1244:"$ INDU – Dow Jones Industrial Average"

708:

678:, developed the "Wolf Market" framework

458:misperceived or 'false' market bottom.

325:by July 1932, marking the start of the

277:International Financial Services Centre

275:Sculpture of stock market bear outside

1791:Moving average convergence/divergence

1210:David Saito-Chung (8 November 2016).

121:recorded both terms in his 1761 book

7:

476:The Battle of the Bulls and Bears (

190:A 1901 cartoon depicting financier

1340:Kinnel, Russel (August 15, 2019).

756:Technical Analysis of Stock Trends

371:In early 2020, as a result of the

25:

656:Economic Cycle Research Institute

442:occurred on October 9, 2007. The

3026:1830s Chicago real estate bubble

3015:1810s Alabama real estate bubble

2364:Electronic communication network

1420:

1294:"$ INDU – SharpCharts Workbench"

1059:DeCambre, Mark (April 6, 2018).

155:, triggered by the crash of the

1013:Economics: Principles in Action

366:2015 Chinese stock market crash

42:is a perceived tendency of the

3218:Western Australian gold rushes

1896:Accumulation/distribution line

1308:"Bear Market Rally Definition"

563:Ideally, investors aim to use

200:Bull (stock market speculator)

194:as a bull with eager investors

91:Bull (stock market speculator)

1:

2358:Multilateral trading facility

440:financial crisis of 2007–2008

359:financial crisis of 2007–2008

352:Stock market downturn of 2002

341:1992 Indian stock market scam

153:Stock market downturn of 2002

3647:U.S. higher education bubble

3558:Chinese stock bubble of 2007

3520:United States housing bubble

3514:2000s Danish property bubble

3496:Baltic states housing bubble

3272:Second Nova Scotia Gold Rush

2781:Returns-based style analysis

2577:Post-modern portfolio theory

2483:Security characteristic line

1972:CBOE Market Volatility Index

1613:Triple top and triple bottom

1578:Double top and double bottom

530:Dow Jones Industrial Average

486:Dow Jones Industrial Average

319:Dow Jones Industrial Average

54:for medium time-frames, and

3484:Japanese asset price bubble

3472:New Zealand property bubble

3441:New Zealand property bubble

3370:Third Nova Scotia Gold Rush

3138:First Nova Scotia Gold Rush

2535:Efficient-market hypothesis

2439:Capital asset pricing model

2376:Straight-through processing

431:peaked at 5,132.50 and the

386:and potential rises of the

66:levels, varying over time.

3709:

3601:Australian property bubble

3236:Tierra del Fuego gold rush

3120:Colorado River mining boom

3060:Queen Charlottes Gold Rush

2352:Alternative Trading System

1780:Know sure thing oscillator

1774:Detrended price oscillator

1399:"Trying to Plumb a Bottom"

800:10.1088/2058-7058/24/05/34

382:In 2022, concerns over an

197:

88:

29:

3637:Social media stock bubble

3622:

3179:2nd Industrial Revolution

3072:New South Wales gold rush

2993:1st Industrial Revolution

2914:

1762:Average directional index

534:Wall Street Crash of 1929

520:Similarly, a bear market

315:Wall Street Crash of 1929

159:. Another example is the

3538:Canadian property bubble

3526:Romanian property bubble

3365:1930s Kakamega gold rush

3156:Vermilion Lake gold rush

2416:Arbitrage pricing theory

937:"Bull Market Definition"

891:Grand Central Publishing

590:stock market indicator.

501:subprime mortgage crisis

124:Every Man His Own Broker

84:Frankfurt Stock Exchange

3589:Lebanese housing bubble

3550:Lebanese housing bubble

3544:Chinese property bubble

3478:Spanish property bubble

3335:1920s Florida land boom

3260:Cripple Creek Gold Rush

3248:Witwatersrand Gold Rush

3189:1870s Lapland gold rush

3084:Fraser Canyon Gold Rush

2695:Initial public offering

2556:Modern portfolio theory

2451:Dividend discount model

2334:List of stock exchanges

1855:Relative strength index

1768:Commodity channel index

1405:The Wall Street Journal

856:"Chart of gold 1968–99"

722:The Stock Market Course

544:Causes of market trends

3583:2000s commodities boom

3563:Uranium bubble of 2007

3532:Polish property bubble

3508:2000s commodities boom

3424:1970s commodities boom

3194:Coromandel Gold Rushes

3078:Australian gold rushes

2583:Random walk hypothesis

1492:Elliott wave principle

886:Winning on Wall Street

481:

280:

195:

161:2000s commodities boom

86:

64:support and resistance

50:for long time-frames,

3607:Cryptocurrency bubble

3595:Corporate debt bubble

3502:Irish property bubble

3284:Mount Baker gold rush

3206:Black Hills gold rush

3108:Similkameen Gold Rush

3102:Pennsylvania oil rush

3090:Pike's Peak gold rush

2982:Bengal Bubble of 1769

2954:Commercial revolution

2929:Irrational exuberance

2721:Market capitalization

2530:Dollar cost averaging

1913:Negative volume index

1861:Stochastic oscillator

1738:Fibonacci retracement

1429:at Wikimedia Commons

1396:(November 12, 2008).

480:, September 10, 1864)

475:

423:, as measured by the

390:caused a bear market.

323:market capitalization

274:

234:Bombay Stock Exchange

189:

89:Further information:

81:

3278:Kobuk River Stampede

3212:Colorado Silver Boom

3144:West Coast gold rush

3096:Rock Creek Gold Rush

3054:California gold rush

2541:Fundamental analysis

2525:Contrarian investing

2488:Security market line

2393:Liquidity aggregator

2370:Direct market access

2281:Quantitative analyst

2065:Ralph Nelson Elliott

2009:McClellan oscillator

1997:Advance–decline line

1678:Three white soldiers

676:Michael Ewing Purves

651:Don't fight the tape

377:stock market crashes

256:Recession of 1960–61

3678:Financial economics

3414:The Great Inflation

3397:Porcupine Gold Rush

3381:Post–WWII expansion

3359:Porcupine Gold Rush

3341:Fairbanks Gold Rush

3314:Porcupine Gold Rush

3296:Fairbanks Gold Rush

3066:Victorian gold rush

3031:Chilean silver rush

2944:Stock market bubble

2786:Reverse stock split

2731:Market manipulation

2655:Dual-listed company

2515:Algorithmic trading

2445:Capital market line

2247:Inter-dealer broker

1872:Ultimate oscillator

1866:True strength index

1533:Open-high-low-close

1342:"Mind the Gap 2019"

1111:Wall Street Journal

357:As a result of the

334:1970s energy crisis

106:naked short selling

18:Stock market bottom

3688:Behavioral finance

3353:Cobalt silver rush

3308:Cobalt silver rush

3266:Klondike Gold Rush

3162:Kildonan Gold Rush

3150:Big Bend Gold Rush

3009:Carolina gold rush

2970:Mississippi bubble

2939:Real-estate bubble

2826:Stock market index

2665:Efficient frontier

2604:Technical analysis

2562:Momentum investing

2384:(private exchange)

2274:Proprietary trader

2216:Shares outstanding

2206:Authorised capital

1978:Standard deviation

1950:Average true range

1931:Volume–price trend

1786:Ichimoku Kinkō Hyō

1593:Head and shoulders

1463:Technical analysis

1296:. StockCharts.com.

919:2019-05-07 at the

818:The New York Times

687:Real estate trends

661:Economic expansion

482:

409:stock market index

388:federal funds rate

281:

196:

87:

74:Market terminology

60:technical analysis

3673:Financial markets

3655:

3654:

3613:Everything bubble

3262:(c. 1890–c. 1910)

3242:Cayoosh Gold Rush

3232:(c. 1880–c. 1930)

3220:(c. 1880–c. 1900)

3202:(c. 1870–c. 1890)

3200:Cassiar Gold Rush

3196:(c. 1870–c. 1890)

3168:Omineca Gold Rush

3132:Cariboo Gold Rush

3114:Stikine Gold Rush

3050:(c. 1840–c. 1850)

3020:Georgia Gold Rush

3005:(c. 1790–c. 1810)

2908:Financial bubbles

2874:

2873:

2675:Flight-to-quality

2427:Buffett indicator

2117:Financial markets

2083:

2082:

2038:

2037:

1919:On-balance volume

1814:Smart money index

1713:

1712:

1686:

1685:

1673:Three black crows

1425:Media related to

1379:978-1-118-41532-0

1347:Morningstar, Inc.

1325:Masayuki Tamura.

986:"Historical Data"

883:(June 27, 2009).

770:978-0-8493-3772-7

595:David Hirshleifer

573:negative feedback

553:Supply and demand

516:Bear market rally

444:S&P 500 Index

433:S&P 500 Index

373:COVID-19 pandemic

220:Morningstar, Inc.

44:financial markets

16:(Redirected from

3700:

3457:Great Regression

3452:Great Moderation

3429:Mexican oil boom

3224:Indiana gas boom

2976:South Sea bubble

2934:Social contagion

2901:

2894:

2887:

2878:

2791:Share repurchase

2503:Trading theories

2388:Crossing network

2346:Over-the-counter

2183:Restricted stock

2139:Secondary market

2110:

2103:

2096:

2087:

1962:Donchian channel

1901:Ease of movement

1849:Money flow index

1830:Vortex indicator

1724:

1692:Point and figure

1633:

1583:Flag and pennant

1556:

1538:Point and figure

1456:

1449:

1442:

1433:

1424:

1410:

1409:

1401:

1390:

1384:

1383:

1365:

1359:

1358:

1356:

1354:

1337:

1331:

1330:

1322:

1316:

1315:

1304:

1298:

1297:

1290:

1284:

1283:

1281:

1279:

1265:

1259:

1258:

1256:

1254:

1240:

1234:

1233:

1222:

1216:

1215:

1214:. Investors.com.

1207:

1201:

1200:

1198:

1196:

1181:

1175:

1174:

1160:

1154:

1153:

1151:

1150:

1138:DeCambre, Mark.

1135:

1129:

1128:

1126:

1125:

1102:

1096:

1095:

1093:

1092:

1086:Business Insider

1077:

1071:

1070:

1056:

1050:

1049:

1038:

1032:

1031:

1007:

1001:

1000:

998:

996:

982:

976:

975:

973:

972:

960:DeCambre, Mark.

957:

951:

950:

948:

947:

932:

926:

911:

905:

904:

877:

871:

870:

868:

866:

852:

846:

845:

834:

828:

827:

825:

824:

810:

804:

803:

781:

775:

774:

750:

741:

740:

716:

671:Market sentiment

584:Market sentiment

579:Market sentiment

558:government bonds

532:index after the

508:Secondary trends

488:(DJIA) include:

462:Baron Rothschild

419:The peak of the

327:Great Depression

248:Great Depression

21:

3708:

3707:

3703:

3702:

3701:

3699:

3698:

3697:

3658:

3657:

3656:

3651:

3618:

3575:

3573:Information Age

3567:

3459:

3455:

3446:

3435:Silver Thursday

3416:

3408:

3403:Poseidon bubble

3383:

3375:

3327:

3325:Interwar period

3319:

3181:

3173:

3126:Otago gold rush

3036:

2995:

2987:

2956:

2948:

2910:

2905:

2875:

2870:

2861:Voting interest

2771:Public offering

2706:Mandatory offer

2680:Government bond

2660:DuPont analysis

2623:

2619:Value investing

2614:Value averaging

2609:Trend following

2594:Style investing

2589:Sector rotation

2504:

2498:

2477:Net asset value

2403:Stock valuation

2397:

2317:

2225:

2192:

2178:Preferred stock

2153:

2119:

2114:

2084:

2079:

2034:

2013:

1983:

1967:Keltner channel

1956:Bollinger Bands

1936:

1882:

1835:

1748:

1729:

1709:

1682:

1663:Hikkake pattern

1649:

1622:

1598:Island reversal

1547:

1501:

1482:Dead cat bounce

1465:

1460:

1418:

1413:

1392:

1391:

1387:

1380:

1367:

1366:

1362:

1352:

1350:

1339:

1338:

1334:

1324:

1323:

1319:

1306:

1305:

1301:

1292:

1291:

1287:

1277:

1275:

1273:stockcharts.com

1267:

1266:

1262:

1252:

1250:

1248:stockcharts.com

1242:

1241:

1237:

1224:

1223:

1219:

1209:

1208:

1204:

1194:

1192:

1183:

1182:

1178:

1162:

1161:

1157:

1148:

1146:

1137:

1136:

1132:

1123:

1121:

1104:

1103:

1099:

1090:

1088:

1079:

1078:

1074:

1058:

1057:

1053:

1040:

1039:

1035:

1028:

1020:. p. 290.

1009:

1008:

1004:

994:

992:

984:

983:

979:

970:

968:

959:

958:

954:

945:

943:

934:

933:

929:

921:Wayback Machine

912:

908:

901:

879:

878:

874:

864:

862:

854:

853:

849:

836:

835:

831:

822:

820:

812:

811:

807:

783:

782:

778:

771:

752:

751:

744:

737:

718:

717:

710:

706:

701:

697:Trend following

626:

581:

546:

526:dead cat bounce

518:

510:

478:Harper's Weekly

470:

452:

417:

397:

384:inflation surge

307:

269:

229:

218:An analysis of

202:

184:

176:

137:

119:Thomas Mortimer

97:

76:

36:

33:Market analysis

28:

23:

22:

15:

12:

11:

5:

3706:

3704:

3696:

3695:

3690:

3685:

3680:

3675:

3670:

3660:

3659:

3653:

3652:

3650:

3649:

3644:

3642:Unicorn bubble

3639:

3634:

3629:

3623:

3620:

3619:

3617:

3616:

3610:

3604:

3598:

3592:

3586:

3579:

3577:

3576:(2007–present)

3569:

3568:

3566:

3565:

3560:

3554:

3553:

3547:

3541:

3535:

3529:

3523:

3517:

3511:

3505:

3504:(c. 2000–2007)

3499:

3493:

3490:Dot-com bubble

3487:

3481:

3475:

3469:

3467:1980s oil glut

3463:

3461:

3448:

3447:

3445:

3444:

3443:(c. 1980–1982)

3438:

3432:

3426:

3420:

3418:

3410:

3409:

3407:

3406:

3400:

3399:(1945–c. 1960)

3394:

3393:(1945–c. 1950)

3391:Texas oil boom

3387:

3385:

3377:

3376:

3374:

3373:

3367:

3362:

3356:

3355:(1918–c. 1930)

3350:

3347:Texas oil boom

3344:

3343:(1918–c. 1930)

3338:

3337:(c. 1920–1925)

3331:

3329:

3321:

3320:

3318:

3317:

3311:

3305:

3302:Texas oil boom

3299:

3298:(c. 1900–1918)

3293:

3290:Nome Gold Rush

3287:

3286:(1897–c. 1925)

3281:

3275:

3269:

3263:

3257:

3251:

3245:

3239:

3233:

3227:

3226:(c. 1880–1903)

3221:

3215:

3209:

3203:

3197:

3191:

3185:

3183:

3175:

3174:

3172:

3171:

3165:

3159:

3153:

3147:

3141:

3135:

3129:

3123:

3117:

3111:

3105:

3099:

3093:

3087:

3081:

3075:

3069:

3068:(1851–c. 1870)

3063:

3057:

3051:

3044:

3042:

3038:

3037:

3035:

3034:

3028:

3023:

3022:(1828–c. 1840)

3017:

3012:

3006:

2999:

2997:

2989:

2988:

2986:

2985:

2979:

2973:

2967:

2960:

2958:

2950:

2949:

2947:

2946:

2941:

2936:

2931:

2926:

2921:

2915:

2912:

2911:

2906:

2904:

2903:

2896:

2889:

2881:

2872:

2871:

2869:

2868:

2863:

2858:

2853:

2848:

2843:

2838:

2833:

2828:

2823:

2821:Stock exchange

2818:

2816:Stock dilution

2813:

2808:

2803:

2798:

2793:

2788:

2783:

2778:

2773:

2768:

2763:

2758:

2753:

2748:

2743:

2741:Mean reversion

2738:

2733:

2728:

2723:

2718:

2716:Market anomaly

2713:

2708:

2703:

2698:

2692:

2687:

2682:

2677:

2672:

2667:

2662:

2657:

2652:

2647:

2642:

2637:

2635:Bid–ask spread

2631:

2629:

2625:

2624:

2622:

2621:

2616:

2611:

2606:

2601:

2596:

2591:

2586:

2580:

2574:

2569:

2564:

2559:

2553:

2548:

2543:

2538:

2532:

2527:

2522:

2517:

2511:

2509:

2500:

2499:

2497:

2496:

2491:

2485:

2480:

2474:

2469:

2464:

2462:Earnings yield

2459:

2457:Dividend yield

2454:

2448:

2442:

2436:

2430:

2424:

2419:

2413:

2407:

2405:

2399:

2398:

2396:

2395:

2390:

2385:

2379:

2373:

2367:

2361:

2355:

2349:

2348:(off-exchange)

2343:

2342:

2341:

2336:

2325:

2323:

2322:Trading venues

2319:

2318:

2316:

2315:

2310:

2309:

2308:

2298:

2293:

2288:

2283:

2278:

2277:

2276:

2271:

2261:

2256:

2251:

2250:

2249:

2244:

2233:

2231:

2227:

2226:

2224:

2223:

2221:Treasury stock

2218:

2213:

2208:

2202:

2200:

2194:

2193:

2191:

2190:

2188:Tracking stock

2185:

2180:

2175:

2170:

2164:

2162:

2155:

2154:

2152:

2151:

2146:

2141:

2136:

2134:Primary market

2130:

2128:

2121:

2120:

2115:

2113:

2112:

2105:

2098:

2090:

2081:

2080:

2078:

2077:

2072:

2067:

2062:

2057:

2052:

2050:John Bollinger

2046:

2044:

2040:

2039:

2036:

2035:

2033:

2032:

2027:

2021:

2019:

2015:

2014:

2012:

2011:

2006:

2000:

1993:

1991:

1985:

1984:

1982:

1981:

1975:

1969:

1964:

1959:

1953:

1946:

1944:

1938:

1937:

1935:

1934:

1928:

1925:Put/call ratio

1922:

1916:

1910:

1904:

1898:

1892:

1890:

1884:

1883:

1881:

1880:

1874:

1869:

1863:

1858:

1852:

1845:

1843:

1837:

1836:

1834:

1833:

1827:

1822:

1817:

1811:

1805:

1802:Moving average

1799:

1794:

1788:

1783:

1777:

1771:

1765:

1758:

1756:

1750:

1749:

1747:

1746:

1740:

1734:

1732:

1721:

1715:

1714:

1711:

1710:

1708:

1707:

1702:

1696:

1694:

1688:

1687:

1684:

1683:

1681:

1680:

1675:

1670:

1665:

1659:

1657:

1651:

1650:

1648:

1647:

1641:

1639:

1630:

1624:

1623:

1621:

1620:

1615:

1610:

1605:

1603:Price channels

1600:

1595:

1590:

1585:

1580:

1575:

1573:Cup and handle

1570:

1568:Broadening top

1564:

1562:

1553:

1549:

1548:

1546:

1545:

1540:

1535:

1530:

1525:

1520:

1515:

1509:

1507:

1503:

1502:

1500:

1499:

1494:

1489:

1484:

1479:

1473:

1471:

1467:

1466:

1461:

1459:

1458:

1451:

1444:

1436:

1417:

1416:External links

1414:

1412:

1411:

1385:

1378:

1360:

1332:

1329:. Asia Nikkei.

1317:

1299:

1285:

1260:

1235:

1217:

1202:

1191:. 13 June 2022

1176:

1155:

1130:

1097:

1072:

1051:

1033:

1026:

1002:

977:

952:

927:

906:

899:

872:

847:

829:

805:

776:

769:

742:

735:

729:. p. 91.

707:

705:

702:

700:

699:

694:

689:

684:

679:

673:

668:

666:Herd mentality

663:

658:

653:

648:

646:Business cycle

643:

641:Bull-bear line

638:

633:

631:Animal spirits

627:

625:

622:

621:

620:

617:put/call ratio

613:

606:

580:

577:

545:

542:

517:

514:

509:

506:

505:

504:

497:

493:

469:

466:

451:

448:

421:dot-com bubble

416:

413:

405:William O'Neil

396:

393:

392:

391:

380:

369:

362:

355:

348:

337:

330:

306:

303:

268:

265:

264:

263:

260:dot-com bubble

243:

241:

228:

225:

212:, or earlier.

183:

180:

175:

174:Primary trends

172:

157:dot-com bubble

136:

135:Secular trends

133:

129:folk etymology

102:Exchange Alley

95:Bull–bear line

75:

72:

26:

24:

14:

13:

10:

9:

6:

4:

3:

2:

3705:

3694:

3691:

3689:

3686:

3684:

3681:

3679:

3676:

3674:

3671:

3669:

3668:Market trends

3666:

3665:

3663:

3648:

3645:

3643:

3640:

3638:

3635:

3633:

3630:

3628:

3627:Carbon bubble

3625:

3624:

3621:

3614:

3611:

3608:

3605:

3602:

3599:

3596:

3593:

3590:

3587:

3584:

3581:

3580:

3578:

3574:

3570:

3564:

3561:

3559:

3556:

3555:

3551:

3548:

3545:

3542:

3539:

3536:

3533:

3530:

3527:

3524:

3521:

3518:

3515:

3512:

3509:

3506:

3503:

3500:

3497:

3494:

3491:

3488:

3485:

3482:

3479:

3476:

3473:

3470:

3468:

3465:

3464:

3462:

3458:

3453:

3449:

3442:

3439:

3436:

3433:

3430:

3427:

3425:

3422:

3421:

3419:

3415:

3411:

3404:

3401:

3398:

3395:

3392:

3389:

3388:

3386:

3382:

3378:

3371:

3368:

3366:

3363:

3360:

3357:

3354:

3351:

3348:

3345:

3342:

3339:

3336:

3333:

3332:

3330:

3326:

3322:

3315:

3312:

3309:

3306:

3303:

3300:

3297:

3294:

3291:

3288:

3285:

3282:

3279:

3276:

3273:

3270:

3267:

3264:

3261:

3258:

3255:

3252:

3249:

3246:

3243:

3240:

3237:

3234:

3231:

3230:Ohio oil rush

3228:

3225:

3222:

3219:

3216:

3213:

3210:

3207:

3204:

3201:

3198:

3195:

3192:

3190:

3187:

3186:

3184:

3180:

3176:

3169:

3166:

3163:

3160:

3157:

3154:

3151:

3148:

3145:

3142:

3139:

3136:

3133:

3130:

3127:

3124:

3121:

3118:

3115:

3112:

3109:

3106:

3103:

3100:

3097:

3094:

3091:

3088:

3085:

3082:

3079:

3076:

3073:

3070:

3067:

3064:

3061:

3058:

3055:

3052:

3049:

3048:Railway Mania

3046:

3045:

3043:

3039:

3032:

3029:

3027:

3024:

3021:

3018:

3016:

3013:

3010:

3007:

3004:

3001:

3000:

2998:

2994:

2990:

2983:

2980:

2977:

2974:

2971:

2968:

2965:

2962:

2961:

2959:

2955:

2951:

2945:

2942:

2940:

2937:

2935:

2932:

2930:

2927:

2925:

2922:

2920:

2917:

2916:

2913:

2909:

2902:

2897:

2895:

2890:

2888:

2883:

2882:

2879:

2867:

2864:

2862:

2859:

2857:

2854:

2852:

2849:

2847:

2844:

2842:

2839:

2837:

2834:

2832:

2829:

2827:

2824:

2822:

2819:

2817:

2814:

2812:

2809:

2807:

2804:

2802:

2799:

2797:

2796:Short selling

2794:

2792:

2789:

2787:

2784:

2782:

2779:

2777:

2774:

2772:

2769:

2767:

2764:

2762:

2759:

2757:

2754:

2752:

2749:

2747:

2744:

2742:

2739:

2737:

2734:

2732:

2729:

2727:

2724:

2722:

2719:

2717:

2714:

2712:

2709:

2707:

2704:

2702:

2699:

2696:

2693:

2691:

2688:

2686:

2685:Greenspan put

2683:

2681:

2678:

2676:

2673:

2671:

2670:Financial law

2668:

2666:

2663:

2661:

2658:

2656:

2653:

2651:

2648:

2646:

2645:Cross listing

2643:

2641:

2638:

2636:

2633:

2632:

2630:

2628:Related terms

2626:

2620:

2617:

2615:

2612:

2610:

2607:

2605:

2602:

2600:

2599:Swing trading

2597:

2595:

2592:

2590:

2587:

2584:

2581:

2578:

2575:

2573:

2570:

2568:

2567:Mosaic theory

2565:

2563:

2560:

2557:

2554:

2552:

2551:Market timing

2549:

2547:

2544:

2542:

2539:

2536:

2533:

2531:

2528:

2526:

2523:

2521:

2518:

2516:

2513:

2512:

2510:

2508:

2501:

2495:

2492:

2489:

2486:

2484:

2481:

2478:

2475:

2473:

2470:

2468:

2465:

2463:

2460:

2458:

2455:

2452:

2449:

2446:

2443:

2440:

2437:

2434:

2431:

2428:

2425:

2423:

2420:

2417:

2414:

2412:

2409:

2408:

2406:

2404:

2400:

2394:

2391:

2389:

2386:

2383:

2380:

2377:

2374:

2371:

2368:

2365:

2362:

2359:

2356:

2353:

2350:

2347:

2344:

2340:

2339:Trading hours

2337:

2335:

2332:

2331:

2330:

2327:

2326:

2324:

2320:

2314:

2311:

2307:

2304:

2303:

2302:

2299:

2297:

2294:

2292:

2289:

2287:

2284:

2282:

2279:

2275:

2272:

2270:

2267:

2266:

2265:

2262:

2260:

2257:

2255:

2254:Broker-dealer

2252:

2248:

2245:

2243:

2240:

2239:

2238:

2235:

2234:

2232:

2228:

2222:

2219:

2217:

2214:

2212:

2211:Issued shares

2209:

2207:

2204:

2203:

2201:

2199:

2198:Share capital

2195:

2189:

2186:

2184:

2181:

2179:

2176:

2174:

2171:

2169:

2166:

2165:

2163:

2161:

2156:

2150:

2149:Fourth market

2147:

2145:

2142:

2140:

2137:

2135:

2132:

2131:

2129:

2127:

2122:

2118:

2111:

2106:

2104:

2099:

2097:

2092:

2091:

2088:

2076:

2073:

2071:

2068:

2066:

2063:

2061:

2058:

2056:

2053:

2051:

2048:

2047:

2045:

2041:

2031:

2028:

2026:

2025:Coppock curve

2023:

2022:

2020:

2016:

2010:

2007:

2004:

2001:

1998:

1995:

1994:

1992:

1990:

1986:

1979:

1976:

1973:

1970:

1968:

1965:

1963:

1960:

1957:

1954:

1951:

1948:

1947:

1945:

1943:

1939:

1932:

1929:

1926:

1923:

1920:

1917:

1914:

1911:

1908:

1905:

1902:

1899:

1897:

1894:

1893:

1891:

1889:

1885:

1878:

1875:

1873:

1870:

1867:

1864:

1862:

1859:

1856:

1853:

1850:

1847:

1846:

1844:

1842:

1838:

1831:

1828:

1826:

1823:

1821:

1818:

1815:

1812:

1809:

1808:Parabolic SAR

1806:

1803:

1800:

1798:

1795:

1792:

1789:

1787:

1784:

1781:

1778:

1775:

1772:

1769:

1766:

1763:

1760:

1759:

1757:

1755:

1751:

1744:

1741:

1739:

1736:

1735:

1733:

1731:

1728:Support &

1725:

1722:

1720:

1716:

1706:

1703:

1701:

1698:

1697:

1695:

1693:

1689:

1679:

1676:

1674:

1671:

1669:

1666:

1664:

1661:

1660:

1658:

1656:

1652:

1646:

1643:

1642:

1640:

1638:

1634:

1631:

1629:

1625:

1619:

1618:Wedge pattern

1616:

1614:

1611:

1609:

1606:

1604:

1601:

1599:

1596:

1594:

1591:

1589:

1586:

1584:

1581:

1579:

1576:

1574:

1571:

1569:

1566:

1565:

1563:

1561:

1557:

1554:

1550:

1544:

1541:

1539:

1536:

1534:

1531:

1529:

1526:

1524:

1521:

1519:

1516:

1514:

1511:

1510:

1508:

1504:

1498:

1495:

1493:

1490:

1488:

1485:

1483:

1480:

1478:

1475:

1474:

1472:

1468:

1464:

1457:

1452:

1450:

1445:

1443:

1438:

1437:

1434:

1430:

1428:

1427:Market trends

1423:

1415:

1407:

1406:

1400:

1395:

1394:Hulbert, Mark

1389:

1386:

1381:

1375:

1371:

1364:

1361:

1349:

1348:

1343:

1336:

1333:

1328:

1321:

1318:

1313:

1309:

1303:

1300:

1295:

1289:

1286:

1274:

1270:

1264:

1261:

1249:

1245:

1239:

1236:

1231:

1227:

1221:

1218:

1213:

1206:

1203:

1190:

1186:

1180:

1177:

1172:

1171:

1166:

1159:

1156:

1145:

1141:

1134:

1131:

1120:

1116:

1112:

1108:

1101:

1098:

1087:

1083:

1076:

1073:

1068:

1067:

1062:

1055:

1052:

1047:

1043:

1042:"Bear Market"

1037:

1034:

1029:

1027:0-13-063085-3

1023:

1019:

1018:Prentice Hall

1015:

1014:

1006:

1003:

991:

987:

981:

978:

967:

963:

956:

953:

942:

938:

935:Chen, James.

931:

928:

925:

922:

918:

915:

910:

907:

902:

900:9780446561686

896:

892:

888:

887:

882:

881:Zweig, Martin

876:

873:

861:

860:www.kitco.com

857:

851:

848:

843:

839:

838:"Bull Market"

833:

830:

819:

816:

809:

806:

801:

797:

793:

789:

788:

787:Physics World

780:

777:

772:

766:

762:

758:

757:

749:

747:

743:

738:

736:9780471036708

732:

728:

724:

723:

715:

713:

709:

703:

698:

695:

693:

690:

688:

685:

683:

680:

677:

674:

672:

669:

667:

664:

662:

659:

657:

654:

652:

649:

647:

644:

642:

639:

637:

634:

632:

629:

628:

623:

618:

614:

611:

607:

603:

602:

601:

598:

596:

591:

589:

585:

578:

576:

574:

569:

566:

565:market timing

561:

559:

554:

550:

543:

541:

539:

535:

531:

527:

523:

515:

513:

507:

502:

498:

494:

491:

490:

489:

487:

479:

474:

467:

465:

463:

459:

455:

450:Market bottom

449:

447:

445:

441:

436:

434:

430:

426:

422:

414:

412:

410:

406:

403:According to

401:

394:

389:

385:

381:

378:

374:

370:

367:

363:

360:

356:

353:

349:

346:

345:Harshad Mehta

343:committed by

342:

338:

335:

331:

328:

324:

320:

316:

312:

311:

310:

304:

302:

299:

295:

293:

288:

286:

278:

273:

266:

262:in 2000–2001)

261:

257:

253:

249:

244:

242:

239:

235:

231:

230:

226:

224:

221:

216:

213:

211:

207:

201:

193:

188:

181:

179:

173:

171:

169:

164:

162:

158:

154:

150:

146:

141:

134:

132:

130:

126:

125:

120:

116:

112:

107:

103:

96:

92:

85:

80:

73:

71:

67:

65:

61:

57:

53:

49:

45:

41:

34:

19:

3632:Green bubble

3254:Encilhamento

2924:Credit cycle

2919:Market trend

2918:

2846:Tender offer

2766:Public float

2736:Market trend

2735:

2726:Market depth

2546:Growth stock

2520:Buy and hold

2429:(Cap-to-GDP)

2269:Floor trader

2259:Market maker

2242:Floor broker

2230:Participants

2173:Golden share

2168:Common stock

2144:Third market

2075:Mark Hulbert

1753:

1668:Morning star

1497:Market trend

1496:

1419:

1403:

1388:

1369:

1363:

1345:

1335:

1320:

1312:Investopedia

1302:

1288:

1276:. Retrieved

1272:

1263:

1251:. Retrieved

1247:

1238:

1230:Investopedia

1220:

1205:

1193:. Retrieved

1188:

1179:

1168:

1158:

1147:. Retrieved

1143:

1133:

1122:. Retrieved

1110:

1100:

1089:. Retrieved

1085:

1075:

1064:

1054:

1046:Investopedia

1036:

1012:

1005:

993:. Retrieved

989:

980:

969:. Retrieved

965:

955:

944:. Retrieved

941:Investopedia

940:

930:

909:

885:

875:

863:. Retrieved

859:

850:

842:Investopedia

832:

821:. Retrieved

817:

808:

791:

785:

779:

755:

721:

636:Black Monday

599:

592:

582:

570:

562:

551:

547:

519:

511:

483:

477:

460:

456:

453:

437:

435:at 1525.20.

418:

402:

398:

308:

300:

296:

289:

282:

252:soft landing

217:

214:

203:

192:J. P. Morgan

177:

168:Brown Bottom

165:

149:Black Monday

145:stock market

142:

138:

122:

115:bull-baiting

111:bear-baiting

98:

68:

55:

51:

47:

40:market trend

39:

37:

3585:(2008–2014)

3552:(2005–2008)

3546:(2005–2011)

3534:(2002–2008)

3528:(2002–2007)

3522:(2002–2006)

3516:(2001–2006)

3510:(2000–2008)

3498:(2000–2006)

3492:(1995–2000)

3486:(1986–1990)

3480:(1985–2008)

3460:(1982–2007)

3431:(1977–1981)

3417:(1973–1982)

3405:(1969–1970)

3384:(1945–1973)

3372:(1932–1942)

3361:(1918–1945)

3349:(1918–1945)

3328:(1918–1939)

3316:(1909–1918)

3310:(1903–1918)

3304:(1901–1918)

3292:(1899–1909)

3280:(1897–1899)

3274:(1896–1903)

3268:(1896–1899)

3256:(1886–1890)

3238:(1883–1906)

3214:(1879–1893)

3208:(1874–1880)

3182:(1870–1914)

3158:(1865–1867)

3146:(1864–1867)

3140:(1861–1874)

3134:(1861–1867)

3128:(1861–1864)

3122:(1861–1864)

3104:(1859–1891)

3092:(1858–1861)

3080:(1851–1914)

3074:(1851–1880)

3056:(1848–1855)

3033:(1830–1850)

3011:(1802–1825)

3003:Canal Mania

2996:(1760–1840)

2984:(1757–1769)

2978:(1711–1720)

2972:(1684–1720)

2966:(1634–1637)

2964:Tulip mania

2957:(1000–1760)

2851:Uptick rule

2831:Stock split

2811:Squeeze-out

2806:Speculation

2751:Open outcry

2640:Block trade

2572:Pairs trade

2070:John Murphy

2060:Charles Dow

2030:Ulcer index

1907:Force index

1877:Williams %R

1743:Pivot point

1628:Candlestick

1513:Candlestick

1144:MarketWatch

1066:MarketWatch

966:MarketWatch

924:Minyanville

375:, multiple

267:Bear market

182:Bull market

70:downtrend.

3693:Capitalism

3683:Investment

3662:Categories

2856:Volatility

2836:Stock swap

2756:Order book

2507:strategies

2433:Book value

2301:Arbitrager

2296:Speculator

2003:Arms index

1942:Volatility

1820:Trend line

1797:Mass index

1730:resistance

1719:Indicators

1543:Line break

1487:Dow theory

1351:Retrieved

1149:2020-03-18

1124:2020-03-18

1091:2020-03-18

971:2020-03-27

946:2020-03-26

823:2022-01-30

704:References

682:Mr. Market

588:contrarian

538:Nikkei 225

425:NASDAQ-100

395:Market top

292:correction

238:BSE SENSEX

198:See also:

3615:(2020–21)

3152:(c. 1865)

3041:1840–1870

2472:Fed model

2467:EV/EBITDA

2382:Dark pool

2313:Regulator

2158:Types of

2124:Types of

2055:Ned Davis

1705:Bear trap

1700:Bull trap

1119:0099-9660

1080:Ro, Sam.

990:BSE India

794:: 29–32.

761:CRC Press

692:Recession

400:rapidly.

210:recession

206:pessimism

56:secondary

2801:Slippage

2761:Position

2746:Momentum

2650:Dividend

2329:Exchange

2286:Investor

2043:Analysts

1841:Momentum

1764:(A.D.X.)

1608:Triangle

1552:Patterns

1477:Breakout

1470:Concepts

917:Archived

815:"F.Y.I."

624:See also

468:Examples

415:Examples

305:Examples

285:optimism

279:, Dublin

258:and the

232:India's

227:Examples

151:and the

3609:(2011–)

3603:(2010–)

3597:(2008–)

3591:(2008–)

3540:(2002–)

3474:(1982–)

2690:Haircut

2494:T-model

2306:Scalper

2126:markets

1989:Breadth

1655:Complex

1353:May 14,

1278:Mar 17,

1253:Mar 17,

1195:14 June

995:22 June

865:Mar 17,

236:Index,

52:primary

48:secular

3437:(1980)

3250:(1886)

3244:(1884)

3170:(1869)

3164:(1869)

3116:(1861)

3110:(1860)

3098:(1859)

3086:(1858)

3062:(1851)

2711:Margin

2579:(PMPT)

2441:(CAPM)

2291:Hedger

2264:Trader

2237:Broker

2160:stocks

2005:(TRIN)

1888:Volume

1793:(MACD)

1637:Simple

1506:Charts

1376:

1117:

1024:

897:

767:

733:

429:Nasdaq

2866:Yield

2841:Trade

2776:Rally

2697:(IPO)

2585:(RMH)

2558:(MPT)

2537:(EMH)

2490:(SML)

2479:(NAV)

2453:(DDM)

2447:(CML)

2418:(APT)

2411:Alpha

2378:(STP)

2372:(DMA)

2366:(ECN)

2360:(MTF)

2354:(ATS)

2018:Other

1999:(ADL)

1974:(VIX)

1952:(ATR)

1933:(VPT)

1927:(PCR)

1921:(OBV)

1915:(NVI)

1903:(EMV)

1868:(TSI)

1857:(RSI)

1851:(MFI)

1816:(SMI)

1810:(SAR)

1782:(KST)

1776:(DPO)

1770:(CCI)

1754:Trend

1560:Chart

1518:Renko

727:Wiley

586:is a

522:rally

2701:Long

2505:and

2435:(BV)

2422:Beta

1958:(BB)

1909:(FI)

1879:(%R)

1832:(VI)

1825:Trix

1804:(MA)

1745:(PP)

1645:Doji

1528:Line

1523:Kagi

1374:ISBN

1355:2020

1280:2023

1255:2023

1197:2022

1170:CNBC

1115:ISSN

1022:ISBN

997:2023

895:ISBN

867:2023

765:ISBN

731:ISBN

608:The

364:The

350:The

313:The

113:and

93:and

1980:(σ)

1588:Gap

1189:VOA

796:doi

321:'s

3664::

1402:.

1344:.

1310:.

1271:.

1246:.

1228:.

1187:.

1167:.

1142:.

1113:.

1109:.

1084:.

1063:.

1044:.

1016:.

988:.

964:.

939:.

893:.

889:.

858:.

840:.

792:24

790:.

763:.

759:.

745:^

725:.

711:^

294:.

163:.

38:A

3454:/

2900:e

2893:t

2886:v

2109:e

2102:t

2095:v

1455:e

1448:t

1441:v

1408:.

1382:.

1357:.

1314:.

1282:.

1257:.

1232:.

1199:.

1173:.

1152:.

1127:.

1094:.

1069:.

1048:.

1030:.

999:.

974:.

949:.

903:.

869:.

844:.

826:.

802:.

798::

773:.

739:.

619:.

368:.

354:.

347:.

35:.

20:)

Text is available under the Creative Commons Attribution-ShareAlike License. Additional terms may apply.