104:

the slow U.S. GDP growth during 2009-2012 following the Great

Recession. Another possible cause is income inequality, which shifts more money to the wealthy, who tend to save it rather than spend it, thus increasing savings and perhaps driving up financial asset prices. Aging populations (which spend less per capita) and a slowdown in productivity may also reduce investment. Central banks face a difficult dilemma; do they raise interest rates to ward off inflation (e.g., implement monetary policy austerity) assuming the economy is in a cyclical boom, or assume the economy (even if temporarily booming) is in secular stagnation and therefore take a more stimulative approach?

251:

88:

secular stagnation behaves as if it is operating below capacity, even when the economy appears to be booming; inflation does not appear. In a healthy economy, if household savings exceed business investments, interest rates fall; lower interest rates stimulate spending and investment, which bring savings and investments into balance. However, an economy facing secular stagnation may require an interest rate below zero to bring savings and investment into balance. The surplus of savings over investment may be generating price appreciation in financial assets or real estate. For example, the U.S. had low unemployment but low inflation in the years leading up to the

73:

282:, writing in 2014, clarified that it refers to "the claim that underlying changes in the economy, such as slowing growth in the working-age population, have made episodes like the past five years in Europe and the United States, and the last 20 years in Japan, likely to happen often. That is, we will often find ourselves facing persistent shortfalls of demand, which can’t be overcome even with near-zero interest rates." At its root is "the problem of building consumer demand at a time when people are less motivated to spend".

118:

60:, it was used to "describe what he feared was the fate of the American economy following the Great Depression of the early 1930s: a check to economic progress as investment opportunities were stunted by the closing of the frontier and the collapse of immigration". Warnings of impending secular stagnation have been issued after all deep recessions since the

211:

automobile in its expansionary period), and the growth of finance. In the 1980s and 1990s

Magdoff and Sweezy argued that a financial explosion of long duration was lifting the economy, but this would eventually compound the contradictions of the system, producing ever bigger speculative bubbles, and leading eventually to a resumption of overt stagnation.

242:

demography, education, inequality, globalization, energy/environment, and the overhang of consumer and government debt. A provocative 'exercise in subtraction' suggests that future growth in consumption per capita for the bottom 99 percent of the income distribution could fall below 0.5 percent per year for an extended period of decades".

345:

and many related technological advances. Under this argument, diminishing and increasingly difficult to access fossil fuel reserves directly lead to significantly reduced EROEI, and therefore put a brake on, and potentially reverse, long-term economic growth, leading to secular stagnation. Linked to

103:

explained in 2018 that many factors may contribute to secular stagnation, by either driving up savings or reducing investment. Households paying down debt (i.e., deleveraging) increase savings and are spending less; businesses react to the lack of demand by investing less. This was a major factor in

322:

A third is that there is a "persistent and disturbing reluctance of businesses to invest and consumers to spend", perhaps in part because so much of the recent gains have gone to the people at the top, and they tend to save more of their money than people—ordinary working people who can't afford to

234:

presented his view during

November 2013 that secular (long-term) stagnation may be a reason that U.S. growth is insufficient to reach full employment: "Suppose then that the short term real interest rate that was consistent with full employment had fallen to negative two or negative three percent.

227:

wrote in

September 2013: "here is a case for believing that the problem of maintaining adequate aggregate demand is going to be very persistent – that we may face something like the 'secular stagnation' many economists feared after World War II." Krugman wrote that fiscal policy stimulus and higher

350:

school of thinking, whereby environmental and resource constraints in general are likely to impose an eventual limit on the continued expansion of human consumption and incomes. While 'limits to growth' thinking went out of fashion in the decades following the initial publication in 1972, a recent

87:

The term secular stagnation refers to a market economy with a chronic (secular or long-term) lack of demand. Historically, a booming economy with low unemployment and high GDP growth (i.e., an economy at or above capacity) would generate inflation in wages and products. However, an economy facing

241:

wrote in August 2012: "Even if innovation were to continue into the future at the rate of the two decades before 2007, the U.S. faces six headwinds that are in the process of dragging long-term growth to half or less of the 1.9 percent annual rate experienced between 1860 and 2007. These include

210:

Private accumulation had a strong tendency to weak growth and high levels of excess capacity and unemployment/underemployment, which could, however, be countered in part by such exogenous factors as state spending (military and civilian), epoch-making technological innovations (for example, the

275:

criticizes secular stagnation as "a baggy concept, arguably too capacious for its own good". Warnings of impending secular stagnation have been issued after all deep recessions, but turned out to be wrong because they underestimated the potential of existing technologies.

329:

A fifth is related to decreased fertility and increased longevity, thus changes in the demographic structure in advanced economies, affecting both demand, through increased savings, and supply, through reduced innovation activities.

207:, and Marx, and marshaling extensive empirical data, that, contrary to the usual way of thinking, stagnation or slow growth was the norm for mature, monopolistic (or oligopolistic) economies, while rapid growth was the exception.

351:

study shows human development continues to align well with the 'overshoot and collapse' projection outlined in the standard run of the original analysis, and this is before factoring in the potential effects of

254:

This chart compares U.S. potential GDP under two CBO forecasts (one from 2007 and one from 2016) versus the actual real GDP. It is based on a similar diagram from economist Larry

Summers from 2014.

235:

Even with artificial stimulus to demand you wouldn't see any excess demand. Even with a resumption in normal credit conditions you would have a lot of difficulty getting back to full employment."

312:, for example, has suggested that digital technologies are much less capital-absorbing, creating only little new investment demand relative to other revolutionary technologies.

685:

326:

A fourth is that advanced economies are just simply paying the price for years of inadequate investment in infrastructure and education, the basic ingredients of growth.

1097:

83:

surplus, where savings exceeds investment. Since 2008, the foreign sector surplus and private sector surplus have been offset by a government budget deficit.

631:

986:

341:

shot up to very high and historically unprecedented levels. This allowed, and in effect fueled, dramatic increases in human consumption since the

250:

942:

301:. The general form of the argument has been the subject of papers by Robert J. Gordon. It has also been written about by Owen. C. Paepke and

1045:

752:

334:

141:

128:

1028:

160:

50:. It suggests a change of fundamental dynamics which would play out only in its own time. The concept was originally put forth by

836:

1128:

617:

594:

875:

802:

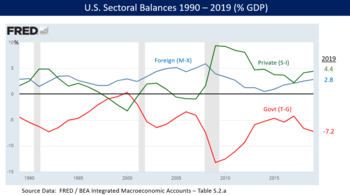

709:

228:

inflation (to achieve a negative real rate of interest necessary to achieve full employment) may be potential solutions.

958:

Frey, Carl

Benedikt (2015). "The End of Economic Growth? How the Digital Economy Could Lead to Secular Stagnation".

72:

34:

is a condition when there is negligible or no economic growth in a market-based economy. In this context, the term

219:

Economists have asked whether the low economic growth rate in the developed world leading up to and following the

408:

1133:

220:

851:

686:"Secular stagnation: it's time to admit that Larry Summers was right about this global economic growth trap"

359:

319:

was so long-lasting and permanent, so many workers will never get jobs again, that we really can't recover.

1138:

512:

79:

in U.S. economy 1990–2017. By definition, the three balances must net to zero. The green line indicates a

285:

One theory is that the boost in growth by the internet and technological advancement in computers of the

731:

342:

556:

396:

99:, when some economists feared that the United States had permanently entered a period of low growth.

530:

385:

309:

933:

The

Evolution of Progress: The End of Economic Growth and the Beginning of Human Transformation

815:

1024:

938:

644:

575:

490:

390:

204:

76:

1001:

967:

909:

783:

632:

The

Economist-America's recovery breeds complacency about macroeconomic risks-September 2018

567:

482:

424:

347:

259:

238:

192:

174:

96:

61:

470:

199:

administration, while Sweezy was a former

Harvard economics professor. In their 1987 book,

316:

89:

17:

380:

352:

187:

80:

971:

1122:

931:

444:

294:

271:

263:

262:

in a 2009 article dismissing the threat of inflation, and became popular again when

231:

178:

56:

618:

New Policy

Institute-United States Sectoral Balances over Five Decades-July 29, 2011

1072:"The Post-Growth Challenge—Secular Stagnation, Inequality and the Limits to Growth"

402:

338:

279:

224:

51:

803:

Larry Summers-U.S. Economic Prospects-Keynote Address at the NABE Conference 2014

776:"Is U.S. Economic Growth Over? Faltering Innovation Confronts the Six Headwinds"

419:

363:

302:

286:

182:

290:

579:

494:

1098:"Govt economic advisor warns British defence planners that growth is ending"

414:

375:

308:

Secular stagnation has also been linked to the rise of the digital economy.

1071:

557:

The Secular Stagnation Hypothesis: A Review of the Debate and Some Insights

366:

Challenge, argues that low growth rates might in fact be ‘the new normal’.

486:

1005:

571:

333:

And a sixth is that economic growth is largely related to the concept of

196:

39:

914:

895:"Does the 'New Economy' Measure Up to the Great Inventions of the Past?"

1051:(Report). London, UK: All-Party Parliamentary Group on Limits to Growth

985:

Aksoy, Yunus; Basso, Henrique S.; Smith, Ron P.; Grasl, Tobias (2019).

894:

837:"IMF Fourteenth Annual Research Conference in Honor of Stanley Fischer"

298:

469:

Eggertsson, Gauti B.; Mehrotra, Neil R.; Summers, Lawrence H. (2016).

788:

775:

249:

71:

645:"Secular stagnation: The history of a heretical economic idea"

266:

invoked the term and concept during a 2013 speech at the IMF.

111:

753:"Secular Stagnation, Coalmines, Bubbles, and Larry Summers"

595:"'Secular stagnation' even truer today, Larry Summers says"

191:. Magdoff was a former economic advisor to Vice President

1046:

Limits Revisited: A review of the limits to growth debate

293:

of the past. An example of such a great invention is the

337:(EROEI), or energy surplus, which with the discovery of

136:

627:

625:

555:

Pagano, Patrizio; Sbracia, Massimo (September 2014).

289:

does not measure up to the boost caused by the great

550:

548:

876:"Is The Economy Suffering From Secular Stagnation?"

643:Backhouse, Roger; Boianovsky, Mauro (19 May 2015).

42:"—century or lifetime), and is used in contrast to

930:

185:, coeditors of the independent socialist journal

173:An analysis of stagnation and what is now called

108:Stagnation and the financial explosion: the 1980s

95:The idea of secular stagnation dates back to the

64:, but the hypothesis has remained controversial.

987:"Demographic Structure and Macroeconomic Trends"

566:(Occasional papers), number 231. Bank of Italy.

346:the EROEI argument are those stemming from the

92:, although a massive housing bubble developed.

710:"Bubbles, Regulation, and Secular Stagnation"

145:that contextualizes different points of view.

131:to certain ideas, incidents, or controversies

8:

223:of 2007-2008 was due to secular stagnation.

1044:Jackon, Tim; Webster, Robin (April 2016).

869:

867:

865:

994:American Economic Journal: Macroeconomics

913:

787:

161:Learn how and when to remove this message

471:"Secular Stagnation in the Open Economy"

203:, they argued, based on Keynes, Hansen,

436:

315:Another is that the damage done by the

814:Sinn, Hans-Werner (26 February 2009).

732:"Secular stagnation and post-scarcity"

671:Stagnation and the Financial Explosion

201:Stagnation and the Financial Explosion

669:Magdoff, Harry; Sweezy, Paul (1987).

258:Secular stagnation was dusted off by

7:

506:

504:

27:Absence of long-term economic growth

1023:. Petersfield, UK: Harriman House.

937:. New York, Toronto: Random House.

874:Inskeep, Steve (9 September 2014).

513:"Secular stagnation: Fad or fact?"

445:"Definition of secular stagnation"

335:energy returned on energy invested

25:

972:10.1038/scientificamerican0115-12

774:Gordon, Robert J. (August 2012).

673:. New York: Monthly Review Press.

902:Journal of Economic Perspectives

850:Krugman, Paul (15 August 2014).

116:

564:Questioni di Economia e Finanza

1096:Ahmed, Nafeez (27 June 2018).

852:"Secular Stagnation: The Book"

1:

358:A 2018 CUSP working paper by

177:was provided in the 1980s by

38:means long-term (from Latin "

1070:Jackson, Tim (13 May 2018).

780:NBER Working Paper No. 18315

593:Wessel, David (2017-05-30).

1155:

893:Gordon, Robert J. (2000).

531:"U.S. Secular Stagnation?"

511:W., P. (16 August 2014).

409:Prosperity Without Growth

18:Secular stagnation theory

929:Paepke, C. Owen (1993).

475:American Economic Review

221:subprime mortgage crisis

1102:Insurgence Intelligence

1129:Macroeconomic problems

255:

84:

54:in 1938. According to

487:10.1257/aer.p20161106

343:Industrial Revolution

297:production method of

253:

139:by rewriting it in a

75:

1019:Morgan, Tim (2013).

1006:10.1257/mac.20170114

572:10.2139/ssrn.2564126

397:The Limits to Growth

960:Scientific American

915:10.1257/jep.14.4.49

386:Economic stagnation

839:. 8 November 2013.

816:"Forget Inflation"

533:. 23 December 2015

310:Carl Benedikt Frey

256:

85:

32:secular stagnation

1021:Life After Growth

944:978-0-679-41582-4

391:Era of Stagnation

171:

170:

163:

125:This article may

77:Sectoral balances

16:(Redirected from

1146:

1113:

1112:

1110:

1108:

1093:

1087:

1086:

1084:

1082:

1067:

1061:

1060:

1058:

1056:

1050:

1041:

1035:

1034:

1016:

1010:

1009:

991:

982:

976:

975:

955:

949:

948:

936:

926:

920:

919:

917:

899:

890:

884:

883:

871:

860:

859:

847:

841:

840:

833:

827:

826:

824:

822:

811:

805:

800:

794:

793:

791:

771:

765:

764:

762:

760:

749:

743:

742:

740:

738:

728:

722:

721:

719:

717:

706:

700:

699:

697:

696:

690:The Conversation

684:Probst, Julius.

681:

675:

674:

666:

660:

659:

657:

655:

640:

634:

629:

620:

615:

609:

608:

606:

605:

590:

584:

583:

561:

552:

543:

542:

540:

538:

527:

521:

520:

508:

499:

498:

466:

460:

459:

457:

455:

441:

425:Zero lower bound

348:Limits to Growth

260:Hans-Werner Sinn

239:Robert J. Gordon

193:Henry A. Wallace

175:financialization

166:

159:

155:

152:

146:

142:balanced fashion

120:

119:

112:

97:Great Depression

62:Great Depression

21:

1154:

1153:

1149:

1148:

1147:

1145:

1144:

1143:

1134:Economic growth

1119:

1118:

1117:

1116:

1106:

1104:

1095:

1094:

1090:

1080:

1078:

1069:

1068:

1064:

1054:

1052:

1048:

1043:

1042:

1038:

1031:

1018:

1017:

1013:

989:

984:

983:

979:

957:

956:

952:

945:

928:

927:

923:

897:

892:

891:

887:

873:

872:

863:

849:

848:

844:

835:

834:

830:

820:

818:

813:

812:

808:

801:

797:

773:

772:

768:

758:

756:

751:

750:

746:

736:

734:

730:

729:

725:

715:

713:

708:

707:

703:

694:

692:

683:

682:

678:

668:

667:

663:

653:

651:

642:

641:

637:

630:

623:

616:

612:

603:

601:

592:

591:

587:

559:

554:

553:

546:

536:

534:

529:

528:

524:

510:

509:

502:

468:

467:

463:

453:

451:

449:Financial Times

443:

442:

438:

433:

372:

317:Great Recession

248:

217:

195:in Roosevelt’s

167:

156:

150:

147:

137:help improve it

134:

121:

117:

110:

90:Great Recession

70:

28:

23:

22:

15:

12:

11:

5:

1152:

1150:

1142:

1141:

1136:

1131:

1121:

1120:

1115:

1114:

1088:

1062:

1036:

1029:

1011:

977:

950:

943:

921:

885:

861:

856:New York Times

842:

828:

806:

795:

789:10.3386/w18315

766:

744:

723:

701:

676:

661:

635:

621:

610:

585:

544:

522:

500:

481:(5): 503–507.

461:

435:

434:

432:

429:

428:

427:

422:

417:

412:

405:

400:

393:

388:

383:

381:Business cycle

378:

371:

368:

353:climate change

247:

244:

216:

213:

205:Michał Kalecki

188:Monthly Review

169:

168:

124:

122:

115:

109:

106:

81:private sector

69:

66:

30:In economics,

26:

24:

14:

13:

10:

9:

6:

4:

3:

2:

1151:

1140:

1139:Market trends

1137:

1135:

1132:

1130:

1127:

1126:

1124:

1103:

1099:

1092:

1089:

1077:

1073:

1066:

1063:

1047:

1040:

1037:

1032:

1030:9780857193391

1026:

1022:

1015:

1012:

1007:

1003:

999:

995:

988:

981:

978:

973:

969:

965:

961:

954:

951:

946:

940:

935:

934:

925:

922:

916:

911:

907:

903:

896:

889:

886:

881:

877:

870:

868:

866:

862:

857:

853:

846:

843:

838:

832:

829:

817:

810:

807:

804:

799:

796:

790:

785:

781:

777:

770:

767:

754:

748:

745:

733:

727:

724:

711:

705:

702:

691:

687:

680:

677:

672:

665:

662:

650:

646:

639:

636:

633:

628:

626:

622:

619:

614:

611:

600:

596:

589:

586:

581:

577:

573:

569:

565:

558:

551:

549:

545:

532:

526:

523:

518:

517:The Economist

514:

507:

505:

501:

496:

492:

488:

484:

480:

476:

472:

465:

462:

450:

446:

440:

437:

430:

426:

423:

421:

418:

416:

413:

411:

410:

406:

404:

401:

399:

398:

394:

392:

389:

387:

384:

382:

379:

377:

374:

373:

369:

367:

365:

361:

356:

354:

349:

344:

340:

336:

331:

327:

324:

320:

318:

313:

311:

306:

304:

300:

296:

295:assembly line

292:

288:

283:

281:

277:

274:

273:

272:The Economist

267:

265:

264:Larry Summers

261:

252:

245:

243:

240:

236:

233:

232:Larry Summers

229:

226:

222:

214:

212:

208:

206:

202:

198:

194:

190:

189:

184:

180:

179:Harry Magdoff

176:

165:

162:

154:

151:December 2019

144:

143:

138:

132:

130:

123:

114:

113:

107:

105:

102:

101:The Economist

98:

93:

91:

82:

78:

74:

67:

65:

63:

59:

58:

57:The Economist

53:

49:

45:

41:

37:

33:

19:

1105:. Retrieved

1101:

1091:

1079:. Retrieved

1075:

1065:

1053:. Retrieved

1039:

1020:

1014:

997:

993:

980:

963:

959:

953:

932:

924:

908:(4): 49–74.

905:

901:

888:

879:

855:

845:

831:

819:. Retrieved

809:

798:

779:

769:

757:. Retrieved

755:. 2013-11-16

747:

735:. Retrieved

726:

714:. Retrieved

712:. 2013-09-25

704:

693:. Retrieved

689:

679:

670:

664:

652:. Retrieved

648:

638:

613:

602:. Retrieved

598:

588:

563:

535:. Retrieved

525:

516:

478:

474:

464:

452:. Retrieved

448:

439:

407:

403:Productivity

395:

357:

339:fossil fuels

332:

328:

325:

321:

314:

307:

284:

280:Paul Krugman

278:

270:

268:

257:

237:

230:

225:Paul Krugman

218:

209:

200:

186:

172:

157:

148:

140:

129:undue weight

126:

100:

94:

86:

55:

52:Alvin Hansen

47:

43:

35:

31:

29:

1055:October 23,

1000:: 193–222.

420:Stagflation

364:Post-Growth

360:Tim Jackson

303:Tyler Cowen

287:new economy

183:Paul Sweezy

1123:Categories

695:2019-11-21

604:2019-05-03

562:(Report).

431:References

291:inventions

68:Definition

48:short-term

654:1 October

649:VoxEU.org

599:Brookings

580:1556-5068

495:0002-8282

454:9 October

415:Recession

376:Biflation

323:do that.

269:However,

246:Post-2009

215:2008–2009

370:See also

197:New Deal

44:cyclical

40:saeculum

821:2 March

759:2 March

737:2 March

716:2 March

537:2 March

299:Fordism

135:Please

36:secular

1107:6 July

1081:6 July

1027:

966:: 12.

941:

578:

493:

362:, The

1049:(PDF)

990:(PDF)

898:(PDF)

560:(PDF)

127:lend

1109:2018

1083:2018

1076:CUSP

1057:2016

1025:ISBN

939:ISBN

823:2017

761:2017

739:2017

718:2017

656:2019

576:ISSN

539:2017

491:ISSN

456:2014

305:.

181:and

1002:doi

968:doi

964:312

910:doi

880:NPR

784:doi

568:doi

483:doi

479:106

46:or

1125::

1100:.

1074:.

998:11

996:.

992:.

962:.

906:14

904:.

900:.

878:.

864:^

854:.

782:.

778:.

688:.

647:.

624:^

597:.

574:.

547:^

515:.

503:^

489:.

477:.

473:.

447:.

355:.

1111:.

1085:.

1059:.

1033:.

1008:.

1004::

974:.

970::

947:.

918:.

912::

882:.

858:.

825:.

792:.

786::

763:.

741:.

720:.

698:.

658:.

607:.

582:.

570::

541:.

519:.

497:.

485::

458:.

164:)

158:(

153:)

149:(

133:.

20:)

Text is available under the Creative Commons Attribution-ShareAlike License. Additional terms may apply.