122:

110:

389:

1119:

1103:

135:

857:

1472:

845:

377:

1313:... nearly 96.1 percent of the 1.2 million households in the top one percent by income were white, a total of about 1,150,000 households. In addition, these families were found to have a median net asset worth of $ 8.3 million. In stark contrast, in the same piece, black households were shown as a mere 1.4 percent of the top one percent by income, that's only 16,800 homes. In addition, their median net asset worth was just $ 1.2 million. Using this data as an indicator only several thousand of the over 14 million African American households have more than $ 1.2 million in net assets ...

1373:, the median wealth of non-Hispanic black households fell nearly 38% from 2010 to 2013. During that time, the median wealth of those households fell from $ 16,600 to $ 13,700. The median wealth of Hispanic families fell 14.3% as well, from $ 16,000 to $ 14,000. Despite the median net worth of all households in the United States decreasing with time, as of 2013, white households had a median net worth of $ 141,900 while black house households had a median net worth of just $ 11,000. Hispanic households had a median net worth of just $ 13,700 over that time as well.

401:

170:

1464:

1019:

941:

reporting certain non-taxable income in their AGI at all, such as municipal bond income. In addition, IRS studies consistently show that a majority of households in the top income quintile have moved to a lower quintile within one decade. There are even more changes to households in the top 1%. Without including those data here, a reader is likely to assume households in the top 1% are almost the same from year to year.) In 2009, people in the top 1% of taxpayers made $ 343,927 or more. According to US economist

4150:"Productivity growth closely matched that of median family income until the late 1970s when median American family income stagnated while productivity continued to climb. Chart comparing productivity growth and real median family income growth in the United States from 1947–2009. Source: EPI Authors' analysis of Current Population Survey Annual Social and Economic Supplement Historical Income Tables, (Table F–5) and Bureau of Labor Statistics Productivity – Major Sector Productivity and Costs Database (2012)"

1520:'s proposed budget for 2023 there are two proposed tax changes for households with wealth above $ 100 million. First, is a new "minimum tax" at death for unrealized capital gains above $ 1 million. Second is to realized capital gains as ordinary income; which is expected to effectively raise the percent of capital taxed from 23.8% to 43.4%. Combined it is estimated that these tax changes will place these households at an effective tax rate of 61.1%, which is nearly double the effective tax rate in 2022.

1350:

white families create even more wealth over those same two hundred years. In fact, this is a gap that will never close if

America stays on its current economic path. According to the Institute on Assets and Social Policy, for each dollar of increase in average income an African American household saw from 1984 to 2009 just $ 0.69 in additional wealth was generated, compared with the same dollar in increased income creating an additional $ 5.19 in wealth for a similarly situated white household.

1377:

44,900. Although black families had the lowest median net worth of all racial groups, they experienced the greatest percent increase in net worth from 2019 to 2022, at 60 percent. For the first time, the survey calculated net worth for Asian families separately (Asian families had previously been grouped into an "other" category along with Native

American, Pacific Islander, and multiracial families). Asian families had the highest median net worth, at $ 536,000.

1146:. Earnings from the stock market or mutual funds are reinvested to produce a larger return. Over time, the sum that is invested becomes progressively more substantial. Those who are not wealthy, however, do not have the resources to enhance their opportunities and improve their economic position. Rather, "after debt payments, poor families are constrained to spend the remaining income on items that will not produce wealth and will depreciate over time." Scholar

929:

equality. From this data, it is evident that in 1989 there was a discrepancy in the level of economic disparity; the extent of wealth inequality was significantly higher than income inequality. Recent research shows that many households, in particular, those headed by young parents (younger than 35), minorities, and individuals with low educational attainment, display very little accumulation. Many have no financial assets and their total net worth is also low.

1127:

1400:

19:

1202:

are not wealthy are more likely to have their money in savings accounts and home ownership. This difference comprises the largest reason for the continuation of wealth inequality in

America: the rich are accumulating more assets while the middle and working classes are just getting by. As of 2007, the richest 1% held about 38% of all privately held wealth in the United States. While the bottom 90% held 73.2% of all debt. According to

1135:

431:, also known as NPR, reported in 2017 that the bottom 50% of U.S. households (by net worth) have little stock market exposure (neither directly nor indirectly through 401k plans), writing: "That means the stock market rally can only directly benefit around half of all Americans — and substantially fewer than it would have a decade ago when nearly two-thirds of families owned stock."

1302:

disadvantaged economic position and prospects of today's blacks to the disadvantaged positions of their parents' and grandparents' generations, according to a report done by Robert B. Avery and

Michael S. Rendall that pointed out "one in three white households will receive a substantial inheritance during their lifetime compared to only one in ten black households." In the journal

424:

by contrast, wasn't just rich — it was specifically rich in terms of owning companies, both stock in publicly traded ones ("corporate equities") and shares of closely held ones ("private businesses")...So the value of those specific assets — assets that people in the bottom half of the distribution never had a chance to own in the first place — soared."

920:

value of their assets may be enough money to support their lifestyle. Dividends from trusts or gains in the stock market do not fall under the aforementioned definition of income, but are commonly the primary source of capital for the ultra-wealthy. Retired people also have little income, but may have a high net worth, because of money saved over time.

147:, which began in 2007, the share of total wealth owned by the top 1% of the population grew from 35% to 37%, and that owned by the top 20% of Americans grew from 86% to 88%. The Great Recession also caused a drop of 36% in median household wealth, but a drop of only 11% for the top 1%, further widening the gap between the top 1% and the bottom 99%.

1340:

According to

Inequality.org, the median black family is only worth $ 1,700 when durables are deducted. In contrast, the median white family holds $ 116,800 of wealth using the same accounting methods. Today, using Wolff's analysis, the median African American family holds a mere 1.5 percent of median

1335:

If you're white and have a net worth of about $ 356,000, that's good enough to put you in the 72nd percentile of white families. If you're black, it's good enough to catapult you into the 95th percentile." This means 28 percent of the total 83 million white homes, or over 23 million white households,

1271:

found that greater economic inequality in the United States than in Europe was not because of the nature of tax and transfer systems in the United States. The study found that the U.S. redistributes a greater share of its wealth to the bottom half of the income distribution than any

European country.

1083:

that derive their value from financial assets like stocks and bonds. The NYT reported that the percentage of workers covered by generous defined-benefit pension plans has declined from 62% in 1983 to 17% by 2016. While some economists consider an increase in the stock market to have a "wealth effect"

923:

Additionally, income does not capture the extent of wealth inequality. Wealth is most commonly obtained over time, through the steady investing of income, and the growth of assets. The income of one year does not typically encompass the accumulation over a lifetime. Income statistics cover too narrow

257:

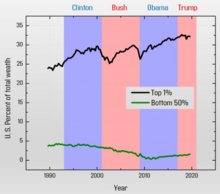

reported in August 2019 that: "Looking at the cumulative growth of wealth disaggregated by group, we see that the bottom 50 percent of wealth owners experienced no net wealth growth since 1989. At the other end of the spectrum, the top 1 percent have seen their wealth grow by almost 300 percent since

1435:

about the study at a congressional hearing in May 2014, she responded "There's no question that we've had a trend toward growing inequality" and that this trend "can shape determine the ability of different groups to participate equally in a democracy and have grave effects on social stability over

1419:

concludes that government policies reflect the desires of the wealthy, and that the vast majority of

American citizens have "minuscule, near-zero, statistically non-significant impact upon public policy. When a majority of citizens disagrees with economic elites and/or with organized interests, they

423:

explained in June 2019 how the ownership of stock has driven wealth inequality, as the bottom 50% has minimal stock ownership: "...he bottom half of the income distribution had a huge share of its wealth tied up in real estate while owning essentially no shares of corporate stock. The top 1 percent,

1211:

However, other studies argue that higher average savings rate will contribute to the reduction of the share of wealth owned by the rich. The reason is that the rich in wealth are not necessarily the individuals with the highest income. Therefore, the relative wealth share of poorer quintiles of the

1201:

Corresponding to financial resources, the wealthy strategically organize their money so that it will produce profit. Affluent people are more likely to allocate their money to financial assets such as stocks, bonds, and other investments which hold the possibility of capital appreciation. Those who

948:

A study by

Emmanuel Saez and Piketty showed that the top 10 percent of earners earned more than half of the country's total income in 2012, the highest level recorded since the government began collecting the relevant data a century ago. People in the top one percent were three times more likely to

1376:

In 2023, the

Federal Reserve Board published median and mean family wealth statistics for 2022, based on a nationwide survey of 4,602 families. The average white family's median net worth was $ 285,000. Hispanic families had a median net worth of $ 61,600, and for black families, this figure was $

1301:

A Brandeis

University Institute on Assets and Social Policy paper cites the number of years of homeownership, household income, unemployment, education, and inheritance as leading causes for the growth of the gap, concluding homeownership to be the most important. Inheritance can directly link the

1564:

analyzed the Warren's proposal and estimated that about 75,000 households (less than 0.1%) would pay the tax. The tax was expected to raise around $ 2.75 trillion over 10 years, roughly 1% GDP on average per year. This was expected to raise the total tax burden for those subject to the wealth tax

972:

A 2022 study in PNAS found that earnings inequality in the United States did not increase over the preceding decade, marking the first reversal of rising earnings inequality since 1980. The reversal was due to a shrinking wage gap between low-wage workers and median-wage earners, which was due to

67:

data indicates that as of Q4 2021, the top 1% of households in the United States held 30.9% of the country's wealth, while the bottom 50% held 2.6%. From 1989 to 2019, wealth became increasingly concentrated in the top 1% and top 10% due in large part to corporate stock ownership concentration in

1572:

found that Warren's proposal would reduce long-term GDP by 0.37% and raise $ 2.2 trillion over a period of ten years, after factoring in macroeconomic feedback effects. It expected the tax to "face serious administrative and compliance challenges due to valuation difficulties and tax evasion and

1349:

Going even further into the data, a recent study by the Institute for Policy Studies (IPS) and the Corporation For Economic Development (CFED) found that it would take 228 years for the average black family to amass the same level of wealth the average white family holds today in 2016. All while

1171:

is a separate social issue, it plays a role in economic inequality. According to the U.S. Census Report, in America the median full-time salary for women is 77 percent of that for men. Also contributing to the wealth inequality in the U.S, both unskilled and skilled workers are being replaced by

940:

pre-1987 and post-1987 are complicated by large changes in the definition of AGI, which led to households within the top income quintile reporting more of their income on their individual income tax form's AGI, rather than reporting their business income in separate corporate tax returns, or not

928:

for wealth inequality increased from 0.80 in 1983 to 0.84 in 1989. In the same year, 1989, the Gini coefficient for income was only 0.52. The Gini coefficient is an economic tool on a scale from 0 to 1 that measures the level of inequality. 1 signifies perfect inequality and 0 represents perfect

919:

formally defines income as money received on a regular basis (exclusive of certain money receipts such as capital gains) before payments on personal income taxes, social security, union dues, Medicare deductions, etc. By this official measure, the wealthiest families may have low income, but the

1189:

perpetuates and increases wealth inequality. Wealthy families pass down their assets allowing future generations to develop even more wealth. The poor, on the other hand, are less able to leave inheritances to their children leaving the latter with little or no wealth on which to build. Wealthy

1540:

proposed an annual tax on wealth in January 2019, specifically a 2% tax for wealth over $ 50 million and another 1% surcharge on wealth over $ 1 billion. Wealth is defined as including all asset classes, including financial assets and real estate. In 2021, officials in the state of Washington

1166:

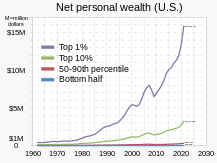

demand and supply, gender differences, growth in technology, and personal abilities. The quality and level of education that a person has often corresponds to their skill level, which is justified by their income. Wages are also determined by the "market price of a skill" at that current time.

142:

In 2007, the top 20% of the wealthiest Americans possessed 80% of all financial assets. In 2007 the richest 1% of the American population owned 35% of the country's total wealth, and the next 19% owned 51%. The top 20% of Americans owned 86% of the country's wealth and the bottom 80% of the

315:

land, which was abundant at the time, and an overall scarcity of labor in non-slaveholding areas, which forced landowners to pay higher wages. There were also relatively few poor people in America at the time, since only those with at least some money could afford to come to America.

306:

In the late 18th century, “incomes were more equally distributed in colonial America than in any other place that can be measured,” according to Peter Lindert and Jeffrey Williamson. The richest 1 percent of households held only 8.5% of total income in the late 18th century. The

418:

The Federal Reserve publishes information on the distribution of household assets, debt, and equity (net worth) by quarter going back to 1989. The tables below summarize the net worth data, in real terms (adjusted for inflation), for 1989 to 2022, and 2016 to 2022. Journalist

1078:

NPR reported that when politicians reference the stock market as a measure of economic success, that success is not relevant to nearly half of Americans. Further, more than one-third of Americans who work full-time have no access to pensions or retirement accounts such as

173:

Distribution of household wealth for the Top 1% and Bottom 50% in the U.S. since 1989, from the Federal Reserve (Wealth by wealth percentile group (Shares (%))). Colored regions indicate the presidencies of Bill Clinton, George W. Bush, Barack Obama, and Donald Trump,

949:

work more than 50 hours a week, were more likely to be self-employed, and earned a fifth of their income as capital income. The top one percent was composed of many professions and had an annual turnover rate of more than 25%. The five most common professions were

1565:

from 3.2% relative to their wealth under current law to about 4.3% on average, versus the 7.2% for the bottom 99% families. For scale, the federal budget deficit in 2018 was 3.9% GDP and was expected to rise towards 5% GDP over the next decade. An analysis by the

343:, using income tax records and his research-based estimates, showed a reduction of about 10% in the movement of national income toward the top 10% of wealth-owners, a reduction from about 45–50% in 1913 to about 30–35% in 1948. This period spans both The

245:

found that the bottom 20 percent of earners pay an average 2.9 percent effective income tax rate federally, while the richest 1 percent paid an effective 29.6 percent tax rate and the top 0.01 percent paid an effective 30.6 percent tax rate. In 2019, the

1227:

to perpetuate economic inequality in America by steering large sums of wealth into the hands of the wealthiest Americans. The mechanism for this is that when the wealthy avoid paying taxes, wealth concentrates to their coffers and the poor go into debt.

311:, which measures inequality on a scale from 0 to 1(with 1 being very high inequality) was 0.367 in New England and the Middle Atlantic, as compared to 0.57 in Europe. Some reasons for this include the ease that the average American had in buying

1479:

taxes: federal+state income tax, sales tax, property tax, etc) for the richest Americans declined by 2018 to a level beneath that of the bottom 50% of earners, contributing to wealth inequality. Analysis by economists Emmanuel Saez and Gabriel

1150:

notes that "62 percent of households headed by single parents are without savings or other financial assets." Net indebtedness generally prevents the poor from having any opportunity to accumulate wealth and thereby better their conditions.

328:, as compared to 13.7% in 1774. There was a great deal of competition for land in the cities and non-frontier areas during this time period, with those who had already acquired land becoming richer than everyone else. The newly burgeoning

201:

are the most important sources of income during retirement, and the promised benefit stream constitutes a sizable fraction of household wealth" and "including pensions and Social Security in net worth makes the distribution more even."

1247:

should be abolished because it provides more tax relief for people in higher tax brackets and with more expensive homes, and that poorer people are more often renters and therefore less likely to be able to use this deduction at all.

1364:

Black programming features TV shows that collectively create false perceptions of wealth for African-American families. The images displayed are in stark contrast to the economic conditions the average black family is battling each

143:

population owned 14%. In 2011, financial inequality was greater than inequality in total wealth, with the top 1% of the population owning 43%, the next 19% of Americans owning 50%, and the bottom 80% owning 7%. However, after the

3226:

Now, those policies and their progeny have helped put 63 percent of America's private wealth in the hands of U.S. millionaires and billionaires, BCG said. By 2021, their share of the nation's wealth will rise to an estimated 70

1344:

A recent piece on Eurweb/Electronic Urban Report, "Black Wealth Hardly Exists, Even When You Include NBA, NFL and Rap Stars", stated this about the difference between black middle-class families and white middle-class families:

215:, in which he argues that income inequality is the defining issue of the United States—Reich states that 95% of economic gains following the economic recovery which began in 2009 went to the top 1% of Americans (by net worth) (

61:, and can be leveraged to obtain more wealth. Hence, wealth provides mobility and agency—the ability to act. The accumulation of wealth enables a variety of freedoms, and removes limits on life that one might otherwise face.

4709:

1306:, Lisa Keister reports that family size and structure during childhood "are related to racial differences in adult wealth accumulation trajectories, allowing whites to begin accumulating high-yield assets earlier in life."

4748:

1450:

argues that "extremely high levels" of wealth inequality are "incompatible with the meritocratic values and principles of social justice fundamental to modern democratic societies" and that "the risk of a drift towards

240:

found that the average effective tax rate paid by the richest 400 families (0.003%) in the US was 23 percent, more than a percentage point lower than the 24.2 percent paid by the bottom half of American households. The

877:. Income refers to a flow of money over time, commonly in the form of a wage or salary; wealth is a collection of assets owned, minus liabilities. In essence, income is what people receive through work, retirement, or

3541:(that is, the top 10 percent of US earners) claimed 45–50 percent of annual national income. By the late 1940s, the share of the top decile had decreased to roughly 30–35 percent of national income." Piketty, Thomas.

1114:, the widening disparity between wages and productivity is evidence that there has been a significant shift of GDP share going from labor to capital, and this trend is playing a significant role in growing inequality.

1235:

argues that "Strong unions have helped to reduce inequality, whereas weaker unions have made it easier for CEOs, sometimes working with market forces that they have helped shape, to increase it." The long fall in

49:, the two are related. Wealth is usually not used for daily expenditures or factored into household budgets, but combined with income, it represents a family's total opportunity to secure stature and a meaningful

1190:

parents often use their economic or political power to advantage their own children, such as by providing extra funding for education, excluding poor families from the local community or schools (usually through

1272:

The study found instead that Europe had less economic inequality because it had been more successful at ensuring that the bottom half of the income distribution are able to get relatively well-paying jobs.

1497:

doubled the exemption of estates by increasing the exemption from $ 5.49 million in 2017 to $ 11.18 million in 2018. This increase in estate exemption was estimated to affect about 3,200 estates in 2018.

186:. In the United States, the use of offshore holdings is exceptionally small compared to Europe, where much of the wealth of the top percentiles is kept in offshore holdings. According to a 2014

22:

CBO Chart, U.S. Holdings of Family Wealth 1989 to 2013. The top 10% of families held 76% of the wealth in 2013, while the bottom 50% of families held 1%. Inequality increased from 1989 to 2013.

2419:

2039:

1183:

wrote in June 2016 that the top 1% of families captured 52% of the total real income (GDP) growth per family from 2009 to 2015. From 2009 to 2012, the top 1% captured 91% of the income gains.

250:

found that when state and federal taxes are taken into account, however, the poorest 20 percent pay an effective 20.2 percent rate while the top 1 percent pay an effective 33.7 percent rate.

298:, 735 billionaires collectively possessed more wealth than the bottom half of U.S. households ($ 4.5 trillion and $ 4.1 trillion respectively). The top 1% held a total of $ 43.45 trillion.

3356:

2613:

2338:

2413:

2004:

4881:

3241:"American billionaires paid less in taxes in 2018 than the working class, analysis shows — and it's another sign that one of the biggest problems in the US is only getting worse"

2044:

1999:

912:

of the working and middle classes is dependent primarily upon income and wages, while the rich tend to rely on wealth, distinguishing them from the vast majority of Americans.

2206:

2009:

3537:" He noted a sharp reduction in income inequality in the United States between 1913 and 1948. More specifically, at the beginning of this period, the upper decile of the

3268:

5232:

258:

1989. Although cumulative wealth growth was relatively similar among all wealth groups through the 1990s, the top 1 percent and bottom 50 percent diverged around 2000."

2695:

3342:

1093:

829:

121:

1130:

The image contains several charts related to U.S. wealth inequality. While U.S. net worth roughly doubled from 2000 to 2016, the gains went primarily to the wealthy.

34:) has substantially increased in the United States in recent decades. Wealth commonly includes the values of any homes, automobiles, personal valuables, businesses,

3613:

3588:

3563:

2067:

2019:

324:

Inequality grew in the 19th century; between 1774 and 1860, the Gini coefficient grew from 0.441 to 0.529. In 1860, the top 1 percent collected almost one-third of

4925:

4447:

Stiglitz, Joseph E. (June 4, 2012). The Price of Inequality: How Today's Divided Society Endangers Our Future (Kindle Locations 1148–1149). Norton. Kindle Edition.

2332:

2641:

4943:

2077:

2919:

109:

1994:

2201:

1118:

3081:

2703:

1102:

3727:

3452:

3424:

2092:

2024:

247:

134:

2699:

2062:

388:

91:, the wealth held by billionaires in the U.S. increased by 70%, with 2020 marking the steepest increase in billionaires' share of wealth on record.

3513:

5157:

2097:

909:

329:

3155:

4667:

3923:

3379:

2721:

3985:

2353:

2087:

2014:

1394:

1295:

1281:

1110:

until some time in the 1970s. While it began to stagnate, productivity has continued to climb. According to the 2014 Global Wage Report by the

1084:

that increases economic growth, economists like Former Dallas Federal Reserve Bank President Richard Fisher believe those effects are limited.

821:

46:

4316:

3240:

3110:

2710:. See Table 3.1 (page 114) of databook for mean and median wealth by country. See page 106 (end of Table 2.4) for total wealth of continents.

2541:

69:

5027:

5012:

3122:

57:

down to their children. Moreover, wealth provides for both short- and long-term financial security, bestows social prestige, contributes to

5227:

5160:

The report summarizes the problem (gross inequality) and its cause ("special tax treatment for the "), and specific "ways to rebalance the

4414:

Berman Y, Ben-Jacob E, Shapira Y (2016) The Dynamics of Wealth Inequality and the Effect of Income Distribution. PLoS ONE 11(4): e0154196,

1989:

1966:

1212:

population would increase if the savings rate of income is very large, although the absolute difference from the wealthiest will increase.

2979:

2878:

2707:

4877:

3775:

3751:

4836:

1441:

4149:

5191:

3956:

406:

Median wealth of married couples is almost three times that of single individuals, regardless of gender and across all age categories.

1336:

have more than $ 356,000 in net assets. While only 700,000 of the 14 million black homes have more than $ 356,000 in total net worth.

2592:

2072:

1716:

1471:

1237:

1111:

158:

may help explain why many Americans who have become rich may have had a substantial head start. In September 2012, according to the

54:

2685:

936:, between 1979 and 2007, incomes of the top 1% of Americans grew by an average of 275%. (Note: The IRS insists that comparisons of

1138:

U.S. median family net worth peaked in 2007, declined due to the Great Recession until 2013, and only partially recovered by 2016.

2326:

1981:

1617:

1244:

382:

Though the 10th percentile of American households have zero net worth, the 90th percentile has $ 1.6 million of household wealth.

856:

5237:

3969:

3357:"The Federal Reserve's new distributional financial accounts provide telling data on growing U.S. wealth and income inequality"

3210:

2263:

1800:

1490:

198:

1162:

is also a result of difference in income. Factors that contribute to this gap in wages are things such as level of education,

1051:

As of 2013, the top 10% own 81% of the stock wealth, the next 10% (80th to 90th percentile) own 11% and the bottom 80% own 8%.

376:

4849:

2445:

2321:

1677:

1502:

3951:

The Price of Inequality: How Today's Divided Society Endangers Our Future, Stiglitz, J.E.,(2012) W.W. Norton & Company,

844:

973:

broadly rising pay in low-wage professions. At the same time, the gap between median-wage workers and top earners widened.

4812:

3852:

1494:

3606:

3581:

3556:

5222:

5153:

3040:

1961:

1935:

1846:

1428:

905:

159:

4961:

4170:

278:

reported that three people (less than the 400 reported in 2011) had more wealth than the bottom half of all Americans.

68:

those segments of the population; the bottom 50% own little if any corporate stock. From an international perspective,

4568:

4103:

3105:

Peter Baldwin (2009). The narcissism of minor differences: how America and Europe are alike. Oxford University Press.

2470:

2430:

1971:

1956:

1285:

1023:

933:

916:

263:

1943:

3892:

222:

A September 2017 study by the Federal Reserve reported that the top 1% owned 38.5% of the country's wealth in 2016.

169:

3880:

3384:

2300:

2104:

268:

127:

The logarithmic scale shows how wealth has increased for all percentile groups, though moreso for wealthier people.

2894:

Recent Trends in Household Wealth in the United States: Rising Debt and the Middle-Class Squeeze—an Update to 2007

5184:

Toxic Inequality: How America's Wealth Gap Destroys Mobility, Deepens the Racial Divide, and Threatens Our Future

4590:

4508:

3182:

1951:

1795:

1573:

avoidance issues." It also expected foreign investors to replace American billionaires as the owners of capital.

4962:"17 States With Estate or Inheritance Taxes Even if you escape the federal estate tax, these states may hit you"

400:

5128:

4753:

4095:

2408:

1684:

1672:

958:

115:

The average personal wealth of people in the top 1% is more than a thousand times that of people in bottom 50%.

3295:

2779:

1548:

wrote in January 2019 that polls indicate the idea of taxing the rich more is very popular. Two billionaires,

1463:

154:

and other sources, in 2011, the 400 wealthiest Americans had more wealth than half of all Americans combined.

5046:

4102:. Table 1 (on the left) is taken from page 4 of the PDF. Table 2 (on the right) is taken from page 13. See:

3480:

2842:

2029:

1760:

1416:

1327:

1176:

argues that because of this "technological advance", the income gap between workers and owners has widened.

1173:

1018:

286:

226:

4896:

4415:

3676:

3062:

5205:

4427:

Berman, Y; Peters, O; Adamou, A (2016). "Far from equilibrium: Wealth reallocation in the United States".

2146:

1869:

1041:

52% of U.S. adults owned stock in 2016. Ownership peaked at 65% in 2007 and fell significantly due to the

332:

also greatly rewarded the already-wealthy, as they were the only ones financially sound enough to invest.

5064:

4886:(Chart labeled "Effective tax rates by income".) Analysis by economists Emmanuel Saez and Gabriel Zucman.

4686:

3909:"Tax Data Show Richest 1 Percent Took a Hit in 2008, But Income Remained Highly Concentrated at the Top."

3321:

3269:"For the first time in history, U.S. billionaires paid a lower tax rate than the working class last year"

1354:

Author Lilian Singh wrote on why the perceptions about black life created by media are misleading in the

3692:

3649:

2657:

2277:

2128:

937:

356:

2951:

3141:

1501:

A 2021 investigation using leaked IRS documents found more than half of the richest 100 Americans use

4626:

4402:

4356:

4028:

2440:

2425:

2185:

2180:

2170:

1884:

1864:

1645:

1610:

1412:

1142:

Essentially, the wealthy possess greater financial opportunities that allow their money to make more

897:

27:

4287:

4124:

4079:

4649:

3538:

3273:

3127:

2255:

2152:

1909:

1839:

1790:

1765:

1667:

1662:

1657:

1370:

1322:

1198:, and allowing children to take entrepreneurial risks without risking homelessness or destitution.

1191:

1159:

886:

229:, around 70% of the nation's wealth will be in the hands of millionaires and billionaires by 2021.

1022:

U.S. family pre-tax income and net worth distribution for 2013 and 2016, from the Federal Reserve

197:

According to a paper published by the Federal Reserve in 1997, "For most households, pensions and

4798:

4770:

4607:

4486:

4428:

4321:

3409:

3187:

2752:

2373:

1204:

1122:

Selected economic variables related to wealth and income equality, comparing 1979, 2007, and 2015

207:

73:

50:

4862:

4237:

4100:

Changes in U.S. Family Finances from 2013 to 2016: Evidence from the Survey of Consumer Finances

3633:

3144:

by Arthur B. Kennickell and Annika E. Sundén of Board of Governors of the Federal Reserve System

3006:

178:

In 2013, wealth inequality in the U.S. was greater than in most developed countries, other than

4582:

3425:"The wealthiest three families now own more wealth than the bottom half of the country. - TRUE"

1215:

The nature of tax policies in America has been suggested by economists and politicians such as

1126:

5187:

4939:

4845:

4478:

4384:

4099:

4062:

4044:

3952:

3768:

3744:

3336:

3106:

2905:

2744:

2588:

2537:

2514:

2248:

2175:

1894:

1834:

1829:

1549:

1356:

1168:

882:

352:

312:

282:

242:

88:

77:

5099:

4987:

4944:"More Than Half of America's 100 Richest People Exploit Special Trusts to Avoid Estate Taxes"

4583:"Race, Family Structure, and Wealth: The Effect of Childhood Family on Adult Asset Ownership"

3774:. Board of Governors of the Federal Reserve System (US). October 2023. p. 12 (Table 2).

1309:

The article "America's Financial Divide" added context to racial wealth inequality, stating:

1208:, the richest 1 percent in the United States now own more wealth than the bottom 90 percent.

623:

The table below shows changes from Q4 2016 (the end of the Obama Administration) to Q1 2022.

4762:

4599:

4537:

4470:

4374:

4364:

4262:

4052:

4036:

3750:. Board of Governors of the Federal Reserve System (US). October 2023. p. 6 (Table 1).

3245:

2736:

2506:

2393:

1812:

1650:

1556:, criticized the proposal as "unconstitutional" and "ridiculous," respectively. Economists

1537:

1399:

1097:

925:

825:

420:

344:

308:

191:

155:

5172:

3453:"Just 400 Americans -- 400 -- have more wealth than half of all Americans combined. - TRUE"

2557:

1055:

The Federal Reserve reported the median value of stock ownership by income group for 2016:

18:

4458:

3814:

3705:

3662:

3159:

3035:

2984:

2670:

2435:

2388:

2368:

2358:

2295:

2211:

1899:

1874:

1603:

1582:

1243:

Some tax policies subsidize wealthy people more than poor people; critics often argue the

1232:

1147:

1042:

942:

325:

144:

64:

58:

4509:"The Roots of the Widening Racial Wealth Gap: Explaining the Black-White Economic Divide"

3406:

Krystal and Saagar: NEW Data Shows Millionaires, Billionaires Own 79% Of America's Wealth

924:

a time span for it to be an adequate indicator of financial inequality. For example, the

289:, "2020 marked the steepest increase in global billionaires' share of wealth on record."

4360:

4032:

3908:

2924:– Michael Moore says 400 Americans have more wealth than half of all Americans combined"

1033:

summarized the distribution of U.S. stock market ownership (direct and indirect through

5200:

5104:

4831:

4710:"Wealth inequality has widened along racial, ethnic lines since end of Great Recession"

4379:

4344:

4057:

4016:

1586:

1569:

1561:

1553:

1529:

1455:

is real and gives little reason for optimism about where the United States is headed."

1447:

1432:

1390:

1249:

1220:

1134:

878:

237:

4749:"Testing Theories of American Politics: Elites, Interest Groups, and Average Citizens"

4729:

4192:

4107:

285:, the wealth held by billionaires in the U.S. increased by 70%. According to the 2022

5216:

4841:

4744:

4490:

3939:

3011:

2980:"You call this a meritocracy? How rich inheritance is poisoning the American economy"

2689:

2383:

2348:

2269:

2234:

1879:

1730:

1590:

1557:

1318:

1216:

1180:

340:

233:

187:

4627:"America's Financial Divide: The Racial Breakdown of U.S. Wealth in Black and White"

4611:

190:

study, the ratio of wealth to household income is the highest it has been since the

4774:

4668:"Opinion: Black Wealth Hardly Exists, Even When You Include NBA, NFL and Rap Stars"

4171:"Global wage growth stagnates, lags behind pre-crisis rates, ILO, December 5, 2014"

3896:

2756:

2162:

1904:

1750:

1545:

1493:, which reduces inequality by taxing the estate of large quantities of wealth. The

1424:

1224:

1163:

1107:

1034:

348:

212:

1106:

The income growth of the typical American family closely matched that of economic

850:

Annual income of U.S. families is near its highest throughout the 35-64 age group.

4369:

1240:

since WWII has seen a corresponding rise in the inequality of wealth and income.

945:

the richest 1% of Americans gained 93% of the additional income created in 2010.

394:

Higher educational attainment in the US corresponds with higher household wealth.

2893:

2403:

2343:

2228:

1889:

1819:

1785:

1755:

1725:

1253:

179:

81:

4878:"America's richest 400 families now pay a lower tax rate than the middle class"

3728:

While Trump Touts Stock Market, Many Americans Are Left Out of the Conversation

2809:

1508:

On top of the federal estate tax, 17 states have an estate or inheritance tax.

5065:"Saez & Zucman-Scoring of the Warren Wealth Tax Proposal-January 18, 2019"

4947:

4817:

4788:

4766:

4603:

3457:

3429:

3405:

2928:

2762:

2398:

2138:

1914:

1704:

1566:

1533:

1404:

1395:

Income inequality in the United States § Effects on democracy and society

1386:

1331:

in the article "How America's Wealthiest Black Families Invest Money" stated:

1195:

954:

275:

163:

151:

39:

5082:"The Budget and Economic Outlook: 2019 to 2029 - Congressional Budget Office"

4482:

4048:

2740:

2518:

4926:"3,200 wealthy individuals wouldn't pay estate tax next year under GOP plan"

4263:"Emmanuel Saez-Striking it richer: The evolution of top incomes in the U.S."

4083:

4040:

2378:

2363:

2133:

1824:

1739:

1709:

1699:

1694:

1517:

1452:

1289:

1257:

31:

4388:

4066:

2748:

1179:

Income inequality contributes to wealth inequality. For example, economist

1037:) in the U.S., which is highly concentrated among the wealthiest families:

3935:

2614:"The Fed - Table: Distribution of Household Wealth in the U.S. since 1989"

2585:

Social Stratification: Class, Race, and Gender in Sociological Perspective

2510:

1194:), using social connections to provide opportunities for advancement like

1048:

As of 2013, the top 1% of households owned 38% of the stock market wealth.

363:

and efforts towards wealth redistribution also reduced wealth inequality.

5161:

4474:

4345:"Modeling the Origin and Possible Control of the Wealth Inequality Surge"

3815:"U.S. Census Bureau, Housing and Household Economic Statistics Division;

3607:"The Wealth of Households: 2021 / Current Population Reports / P70BR-183"

3582:"The Wealth of Households: 2021 / Current Population Reports / P70BR-183"

3557:"The Wealth of Households: 2021 / Current Population Reports / P70BR-183"

2784:

1261:

1186:

1143:

966:

950:

862:

Accumulated net worth of U.S. families peaks in the 65-74 year age group.

360:

271:, 79% of the country's wealth is owned by millionaires and billionaires.

5081:

4416:

http://journals.plos.org/plosone/article?id=10.1371/journal.pone.0154196

3883:

By Dave Gilson and Carolyn Perot in Mother Jones, March/April 2011 Issue

3481:"Do 728 Billionaires Hold More Wealth Than Half of American Households?"

2896:

by Edward N. Wolff, Levy Economics Institute of Bard College, March 2010

2780:"The new Gilded Age: 2,750 people have more wealth than half the planet"

2465:

5165:

5013:"Sanders Proposes Wealth Tax; Piketty, Reich Applaud-September 6, 2014"

4793:

4291:

2562:

1807:

962:

183:

35:

2494:

3545:(Kindle Locations 298–300). Harvard University Press. Kindle Edition.

3485:

2241:

1856:

1627:

1080:

874:

870:

294:

4401:

Zyga L, Model shows how surge in wealth inequality may be reversed,

351:, events with significant economic consequences. This is called the

4433:

4403:

http://phys.org/news/2015-07-surge-wealth-inequality-reversed.html

2908:

by G. William Domhoff of the UC-Santa Barbara Sociology Department

2495:"Top Wealth in America: New Estimates under Heterogeneous Returns"

1689:

1470:

1462:

1398:

1133:

1125:

1117:

1101:

168:

133:

17:

4017:"Rapid wage growth at the bottom has offset rising US inequality"

3802:

The American Class Structure: In an Age of the Growing Inequality

3063:"Household wealth inequality statistics from the Federal Reserve"

2834:

1595:

1467:

Trends in share of wealth held by various wealth groups 1989-2019

1360:

article "Black Wealth On TV: Realities Don't Match Perceptions":

893:

It does not accurately reflect an individual's economic position.

2684:

Anthony Shorrocks; Jim Davies; Rodrigo Lluberas (October 2018).

2642:"New Federal Reserve data shows how the rich have gotten richer"

1541:

considered proposals to tax wealthy residents within the state.

216:

5129:"Opinion - Schumer and Sanders: Limit Corporate Stock Buybacks"

4565:

Lifetime Inheritances of Three Generations of Whites and Blacks

3380:"Millionaires and Billionaires Own 79% of All Household Wealth"

1599:

3731:

2956:

1030:

881:

whereas wealth is what people own. While the two are related,

428:

5171:

Moritz Kuhn, Moritz Schularick, and Ulrike I. Steins. 2020. "

4863:"FRED Chart - Wealth inequality by wealth group 1989-Present"

4507:

Thomas Shapiro; Tatjana Meschede; Sam Osoro (February 2013).

3156:"Robert Reich: Income inequality the defining issue for U.S."

3123:

Key Inequality Measure The Highest Since The Great Depression

3082:"Yes, U.S. Wealth Inequality Is Terrible by Global Standards"

72:

is over 600%. A 2011 study found that US citizens across the

5100:"Analysis of Sen. Warren and Sen. Sanders' Wealth Tax Plans"

5028:"Mega-Rich and Plans to Tax Them Abound in Washington State"

4813:

Bernie Sanders Asks Fed Chair Whether the US Is an Oligarchy

3605:

Sullivan, Brianna; Hays, Donald; Bennett, Neil (June 2023).

3580:

Sullivan, Brianna; Hays, Donald; Bennett, Neil (June 2023).

3555:

Sullivan, Brianna; Hays, Donald; Bennett, Neil (June 2023).

1544:

Warren's plan received both praise and criticism. Economist

4518:. Brandeis University Institute on Assets and Social Policy

2722:"Building a Better America – One Wealth Quintile at a Time"

2420:

The Divide: American Injustice in the Age of the Wealth Gap

1298:

nearly tripled from $ 85,000 in 1984 to $ 236,500 in 2009.

4732:. Board of Governors of the Federal Reserve System. 2023.

3981:

3979:

3924:

Top Earners Doubled Share of Nation's Income, Study Finds

3142:

Pensions, Social Security, and the Distribution of Wealth

70:

the difference in the US median and mean wealth per adult

4457:

Blanchet, Thomas; Chancel, Lucas; Gethin, Amory (2022).

3514:"The Founding Fathers Weren't Concerned With Inequality"

2556:

Rugaber, Christopher S.; Boak, Josh (January 27, 2014).

2339:

Criticism of credit scoring systems in the United States

1593:

to reduce income and wealth inequality in January 2019.

4687:"Black Wealth On TV: Realities Don't Match Perceptions"

2414:

Tax policy and economic inequality in the United States

4080:

The Richest 10% of Americans Now Own 84% of All Stocks

3911:

3628:

3626:

3612:. United States Census Bureau. p. 5 (Figure 2).

3587:. United States Census Bureau. p. 5 (Figure 2).

1174:

Seven Pillars Institute for Global Finance and Ethics

5127:

Schumer, Chuck; Sanders, Bernie (February 3, 2019).

3562:. United States Census Bureau. p. 2 (Table 1).

3926:

The New York Times By Robert Pear, October 25, 2011

3838:

3836:

3769:"Changes in U.S. Family Finances from 2019 to 2022"

3745:"Changes in U.S. Family Finances from 2019 to 2022"

2829:

2827:

2696:

Global Wealth Report 2018: US and China in the lead

2558:"Wealth gap: A guide to what it is, why it matters"

2220:

2194:

2161:

2117:

2055:

1980:

1934:

1927:

1855:

1778:

1634:

5173:Income and Wealth Inequality in America, 1949–2016

4459:"Why Is Europe More Equal than the United States?"

4193:"Federal Reserve-Survey of Consumer Finances 2017"

2534:Social Inequality: Forms, Causes, and Consequences

2207:Socialism for the rich and capitalism for the poor

5158:Ending Special Tax Treatment for the Very Wealthy

5150:Ending Special Tax Treatment for the Very Wealthy

5047:"Opinion - Elizabeth Warren Does Teddy Roosevelt"

4986:Garrett Watson; Scott A. Hodge (April 12, 2022).

4938:Jeff Ernsthausen; James Bandler; Justin Elliott;

4789:"'Corruption is Legal in America' by RepresentUs"

4644:

4642:

4640:

4213:

4211:

4209:

4125:"Opinion - The Market Isn't Bullish for Everyone"

3036:"The 'Self-Made' Hallucination of America's Rich"

2918:Kertscher, Tom; Borowski, Greg (March 10, 2011).

2862:

2860:

2493:Smith, Matthew; Zidar, Owen; Zwick, Eric (2022).

4538:"Nine Charts about Wealth Inequality in America"

3320:Wamhoff, Steve., Gardner, Matthew (April 2019).

2835:"Evolution of wealth indicators, USA, 1913-2019"

1094:Causes of income inequality in the United States

830:Causes of income inequality in the United States

138:Average and median household income by age group

76:dramatically underestimate the current level of

4021:Proceedings of the National Academy of Sciences

4001:Divided We Stand: Why Inequality Keeps Rising.

2879:Occupy Wall Street And The Rhetoric of Equality

2874:

2872:

2005:Largest financial services companies by revenue

1362:

1347:

1333:

1311:

837:Annual income and accumulated net worth, by age

5209:, vol. 46, no. 3 (February 8, 2024), pp. 7–11.

4563:Avery, Robert B.; Rendall, Michael S. (2002),

4542:Nine Charts about Wealth Inequality in America

4118:

4116:

2333:Citizens United v. Federal Election Commission

1325:'s Institute on Assets and Social Policy, the

3723:

3721:

3719:

3717:

3715:

2000:Largest corporations by market capitalization

1611:

8:

4988:"President Biden's 61 Percent Tax on Wealth"

4463:American Economic Journal: Applied Economics

4343:Berman, Y; Shapira, Y; Ben-Jacob, E (2015).

4098:. September 2017, Vol. 103, No. 3. See PDF:

3341:: CS1 maint: multiple names: authors list (

3211:"The U.S. Is Where the Rich Are the Richest"

1505:to avoid paying estate taxes when they die.

729:Share of Increase (Increase/Total Increase)

537:Share of Increase (Increase/Total Increase)

3986:The Top 1 Percent - What Jobs Do They Have?

2202:The rich get richer and the poor get poorer

1296:wealth gap between white and black families

359:establishment of social programs under the

4502:

4500:

3970:"The Rich Get Richer Through the Recovery"

2804:

2802:

2121:

2010:Largest manufacturing companies by revenue

1931:

1638:

1618:

1604:

1596:

869:There is an important distinction between

102:Net personal wealth in the U.S. since 1962

4432:

4378:

4368:

4056:

3730:. By Danielle Kurtzleben, March 1, 2017.

3329:Institute on Taxation and Economic Policy

3267:Ingraham, Christopher (October 8, 2019).

3239:Rogers, Taylor Nicole (October 9, 2019).

2950:Pepitone, Julianne (September 22, 2010).

2773:

2771:

2636:

2634:

248:Institute on Taxation and Economic Policy

5233:Economic inequality in the United States

5148:Alexandra Thornton and Galen Hendricks,

4685:Singh, Lillian D. (September 26, 2014).

4296:(audio interview with Richard V. Reeves)

1017:

980:

977:U.S. stock market ownership distribution

896:Income does not portray the severity of

885:alone is insufficient for understanding

625:

433:

30:(i.e. inequality in the distribution of

4801:from the original on December 12, 2021.

3781:from the original on December 25, 2023.

3757:from the original on December 25, 2023.

3679:. federalreserve.gov. February 16, 2020

3636:. fred.stlouisfed.org. October 10, 2020

3183:"Wealth Inequality Is Higher Than Ever"

2952:"Forbes 400: The super-rich get richer"

2536:, Pearson Education, Inc., p. 31,

2466:"Trends in Family Wealth, 1989 to 2013"

2457:

2020:Largest technology companies by revenue

225:According to a June 2017 report by the

80:in the US, and would prefer a far more

4015:Aeppli, Clem; Wilmers, Nathan (2022).

3912:Center on Budget and Policy Priorities

3701:

3690:

3658:

3647:

3359:. equitablegrowth.org. August 22, 2019

3334:

2884:November 1, 2011, by Deborah L. Jacobs

2666:

2655:

2354:Income inequality in the United States

2088:Income inequality in the United States

2083:Wealth inequality in the United States

1282:Racial inequality in the United States

822:Income inequality in the United States

255:Washington Center for Equitable Growth

5203:, "In the Shadow of Silicon Valley",

4865:. fred.stlouisfed.org. March 9, 2020.

4724:

4722:

4704:

4702:

4700:

3507:

3505:

3503:

3034:Pizzigati, Sam (September 24, 2012).

2729:Perspectives on Psychological Science

2015:Largest software companies by revenue

1489:There is a political debate over the

1459:Proposals to reduce wealth inequality

1071:80th to 89th percentile own $ 82,000.

1068:60th to 80th percentile own $ 31,700.

1065:40th to 60th percentile own $ 15,500.

7:

4288:"Redefining "Rich": Not Just The 1%"

4123:Rattner, Steven (January 22, 2018).

3968:Lowrey, Annie (September 10, 2013).

3378:Bruenig, Matt (September 28, 2020).

3322:"Who Pays Taxes in America in 2019?"

3080:Weissmann, Jordan (March 11, 2013).

1995:Largest corporate profits and losses

1475:Total effective tax rates (includes

1407:was the richest person in the world.

4837:Capital in the Twenty-First Century

4315:Kristof, Nicholas (July 22, 2014).

4238:"The Causes of Economic Inequality"

3543:Capital in the Twenty-First Century

3479:Jayshi, Damakant (April 13, 2023).

2841:. World Inequality Database. 2022.

2068:Countries by number of billionaires

1442:Capital in the Twenty-First Century

42:, as well as any associated debts.

5045:Krugman, Paul (January 28, 2019).

4884:from the original on May 11, 2024.

4876:Picchi, Aimee (October 17, 2019).

4730:"2022 Survey of Consumer Finances"

4650:"Our Real Racial Wealth Gap Story"

4082:. By Rob Wile, December 19, 2017.

3853:"Federal Reserve Bank of Chicago,

3677:"Distributional National Accounts"

3619:from the original on May 24, 2024.

3594:from the original on May 24, 2024.

3569:from the original on May 24, 2024.

3121:Mark Gongloff (October 14, 2014).

2778:Picchi, Aimee (December 7, 2021).

2499:The Quarterly Journal of Economics

1536:in the US in 2014. Later, Senator

1062:20th-40th percentile own $ 10,000.

166:grew up in substantial privilege.

14:

4625:Moore, Antonio (April 13, 2015).

3512:Semuels, Alana (April 25, 2016).

3451:Kertscher, Tom (March 10, 2011).

3181:Bruenig, Matt (October 1, 2017).

3154:Svaldi, Aldo (January 11, 2014).

2845:from the original on July 5, 2023

2720:Norton, M.I.; Ariely, D. (2011).

1717:Primitive accumulation of capital

1112:International Labour Organization

243:Urban-Brookings Tax Policy Center

211:—a 2013 documentary, narrated by

5026:Mahoney, Laura (March 4, 2021).

4921:Heather Long, November 5, 2017,

4317:"An Idiot's Guide to Inequality"

3296:"Are federal taxes progressive?"

3209:Steverman, Ben (June 16, 2017).

2978:Bruenig, Matt (March 24, 2014).

2327:Distribution of wealth in Europe

2063:Cities by number of billionaires

1245:home mortgage interest deduction

855:

843:

399:

387:

375:

253:Using Federal Reserve data, the

120:

108:

4236:Leung, May (January 22, 2015).

3423:Kertscher, Tom (July 3, 2019).

3413:on YouTube, September 29, 2020.

3007:"Inequality – Inherited wealth"

2587:, p. 637. Westview Press, 2001

2264:The Theory of the Leisure Class

2139:Acquired situational narcissism

1503:grantor retained annuity trusts

1491:estate tax in the United States

1411:A 2014 study by researchers at

1369:According to an article by the

2810:"World Inequality Report 2022"

2446:List of Americans by net worth

2322:Affluence in the United States

2078:Countries by wealth inequality

1678:History of economic inequality

1341:white American family wealth.

292:As of late 2022, according to

1:

5177:Journal of Political Economy.

1495:Tax Cuts and Jobs Act of 2017

5154:Center for American Progress

4811:John Nichols (May 7, 2014).

4370:10.1371/journal.pone.0130181

3041:Institute for Policy Studies

2045:Number of billionaire alumni

1990:Largest companies by revenue

1429:chair of the Federal Reserve

414:Effect of stock market gains

261:According to an analysis of

164:Forbes richest 400 Americans

160:Institute for Policy Studies

5228:Wealth in the United States

4569:University of Chicago Press

4104:Survey of Consumer Finances

3881:It's the Inequality, Stupid

3132:Retrieved October 14, 2014.

2694:October 10, 2018, article:

2471:Congressional Budget Office

2431:Wealth in the United States

1286:Racism in the United States

1088:Causes of wealth inequality

1024:Survey of Consumer Finances

934:Congressional Budget Office

917:United States Census Bureau

774:Share of Net Worth Q1 2022

754:Share of Net Worth Q4 2016

749:(Intentionally left blank)

582:Share of Net Worth Q1 2022

562:Share of Net Worth Q3 1989

557:(Intentionally left blank)

264:Survey of Consumer Finances

232:A 2019 study by economists

5256:

5182:Thomas M. Shapiro (2017).

4928:Retrieved August 30, 2018.

2532:Hurst, Charles E. (2007),

1431:was questioned by Senator

1384:

1279:

1091:

819:

4767:10.1017/S1537592714001595

4604:10.1525/sop.2004.47.2.161

4591:Sociological Perspectives

4581:Keister, Lisa A. (2004).

4516:Research and Policy Brief

3804:. Belmont, CA: Wadsworth.

2920:"The Truth-O-Meter Says:

2906:Wealth, Income, and Power

2291:

2124:

2073:Countries by total wealth

1952:List of centibillionaires

1796:High-net-worth individual

1641:

1304:Sociological Perspectives

1269:American Economic Journal

983:

162:, over 60 percent of the

4754:Perspectives on Politics

4096:Federal Reserve Bulletin

3914:. Accessed October 2011.

3855:Savings of Young Parents

2741:10.1177/1745691610393524

2708:Downloadable data sheets

2409:Redistribution of wealth

1685:International inequality

1673:Consumption distribution

1238:unionization in the U.S.

689:Increase ($ trillions)

497:Increase ($ trillions)

84:distribution of wealth.

45:Although different from

4242:Seven Pillars Institute

4041:10.1073/pnas.2204305119

3385:People's Policy Project

1761:Conspicuous consumption

1577:Limiting stock buybacks

1328:Harvard Business Review

1059:Bottom 20% own $ 5,800.

669:Q1 2022 ($ trillions)

649:Q4 2016 ($ trillions)

477:Q1 2022 ($ trillions)

457:Q3 1989 ($ trillions)

357:Franklin D. Roosevelt's

287:World Inequality Report

269:People's Policy Project

227:Boston Consulting Group

5238:Distribution of wealth

5206:London Review of Books

4942:(September 26, 2021).

4822:Retrieved May 8, 2014.

4747:(September 18, 2014).

3893:Who are the 1 percent?

3700:Cite journal requires

3657:Cite journal requires

2686:"Global Wealth Report"

2665:Cite journal requires

2618:www.federalreserve.gov

2147:Argumentum ad crumenam

1532:pitched the idea of a

1481:

1468:

1408:

1367:

1352:

1338:

1315:

1139:

1131:

1123:

1115:

1074:Top 10% own $ 365,000.

1026:

267:data from 2019 by the

175:

139:

23:

4743:Gilens, Martin &

4691:The American Prospect

4567:, vol. 107, The

2278:The Wealth of Nations

2129:Diseases of affluence

1474:

1466:

1402:

1317:Relying on data from

1137:

1129:

1121:

1105:

1021:

938:adjusted gross income

900:in the United States.

429:National Public Radio

172:

137:

21:

4475:10.1257/app.20200703

3800:Gilbert, D. (1998).

2644:. Vox. June 13, 2019

2441:American upper class

2426:Wealth concentration

2186:Venture philanthropy

2181:Philanthrocapitalism

2093:Most expensive items

1967:Wealthiest Americans

1947:list of billionaires

1646:Capital accumulation

1267:A 2022 study in the

898:financial inequality

629:Household Net Worth

437:Household Net Worth

28:inequality of wealth

5223:Capital (economics)

5168:on a better track."

5088:. January 28, 2019.

4923:The Washington Post

4674:. October 12, 2016.

4361:2015PLoSO..1030181B

4033:2022PNAS..11904305A

4027:(42): e2204305119.

3821:. December 20, 2005

3539:income distribution

3274:The Washington Post

3128:The Huffington Post

2511:10.1093/qje/qjac033

2242:Greek god of wealth

2153:Prosperity theology

1972:Wealthiest families

1957:Female billionaires

1791:Captain of industry

1766:Conspicuous leisure

1668:Income distribution

1663:Wealth distribution

1658:Economic inequality

1589:advocated limiting

1381:Effect on democracy

1371:Pew Research Center

1323:Brandeis University

1192:exclusionary zoning

1160:Economic inequality

1155:Economic inequality

887:economic inequality

53:, or to pass their

5133:The New York Times

5108:. January 28, 2020

5051:The New York Times

4322:The New York Times

4173:. December 5, 2014

4129:The New York Times

3992:January 14, 2012,

3990:The New York Times

3899:, October 29, 2011

2374:Occupy Wall Street

2105:Wealthiest animals

1524:Taxation of wealth

1482:

1469:

1420:generally lose."

1409:

1276:Racial disparities

1205:The New York Times

1140:

1132:

1124:

1116:

1027:

910:standard of living

908:asserted that the

336:Early 20th century

208:Inequality for All

176:

140:

74:political spectrum

51:standard of living

24:

4940:Patricia Callahan

3942:, June 23, 2012,

3634:"Total Net Worth"

3300:Tax Policy Center

3111:978-0-19-539120-6

3069:. March 18, 2020.

2812:. October 9, 2021

2583:Grusky, David B.

2543:978-0-205-69829-5

2474:. August 18, 2016

2311:

2310:

2287:

2286:

2176:The Giving Pledge

2113:

2112:

1923:

1922:

1550:Michael Bloomberg

1446:French economist

1357:American Prospect

1169:gender inequality

1016:

1015:

932:According to the

889:for two reasons:

883:income inequality

816:Wealth and income

813:

812:

621:

620:

353:Great Compression

302:Late 18th century

283:COVID-19 pandemic

89:COVID-19 pandemic

78:wealth inequality

47:income inequality

5245:

5197:

5156:, June 4, 2019.

5137:

5136:

5124:

5118:

5117:

5115:

5113:

5096:

5090:

5089:

5078:

5072:

5071:

5069:

5061:

5055:

5054:

5042:

5036:

5035:

5023:

5017:

5016:

5009:

5003:

5002:

5000:

4998:

4983:

4977:

4976:

4974:

4972:

4958:

4952:

4951:

4935:

4929:

4919:

4913:

4912:

4910:

4908:

4893:

4887:

4885:

4873:

4867:

4866:

4859:

4853:

4829:

4823:

4809:

4803:

4802:

4785:

4779:

4778:

4740:

4734:

4733:

4726:

4717:

4716:

4714:

4706:

4695:

4694:

4682:

4676:

4675:

4664:

4658:

4657:

4646:

4635:

4634:

4622:

4616:

4615:

4587:

4578:

4572:

4571:

4560:

4554:

4553:

4551:

4549:

4534:

4528:

4527:

4525:

4523:

4513:

4504:

4495:

4494:

4454:

4448:

4445:

4439:

4438:

4436:

4424:

4418:

4412:

4406:

4399:

4393:

4392:

4382:

4372:

4340:

4334:

4333:

4331:

4329:

4312:

4306:

4305:Hurst, pp. 34–35

4303:

4297:

4295:

4294:. July 19, 2017.

4284:

4278:

4277:

4275:

4273:

4267:

4259:

4253:

4252:

4250:

4248:

4233:

4227:

4224:

4218:

4215:

4204:

4203:

4201:

4199:

4189:

4183:

4182:

4180:

4178:

4167:

4161:

4160:

4158:

4156:

4146:

4140:

4139:

4137:

4135:

4120:

4111:

4093:

4087:

4077:

4071:

4070:

4060:

4012:

4006:

3999:

3993:

3983:

3974:

3973:

3965:

3959:

3949:

3943:

3933:

3927:

3921:

3915:

3906:

3900:

3890:

3884:

3878:

3872:

3871:

3869:

3867:

3861:

3849:

3843:

3840:

3831:

3830:

3828:

3826:

3811:

3805:

3798:

3792:

3791:Grusky, page 637

3789:

3783:

3782:

3780:

3773:

3765:

3759:

3758:

3756:

3749:

3741:

3735:

3725:

3710:

3709:

3703:

3698:

3696:

3688:

3686:

3684:

3673:

3667:

3666:

3660:

3655:

3653:

3645:

3643:

3641:

3630:

3621:

3620:

3618:

3611:

3602:

3596:

3595:

3593:

3586:

3577:

3571:

3570:

3568:

3561:

3552:

3546:

3535:

3529:

3528:

3526:

3524:

3509:

3498:

3497:

3495:

3493:

3476:

3470:

3469:

3467:

3465:

3448:

3442:

3441:

3439:

3437:

3420:

3414:

3403:

3397:

3396:

3394:

3392:

3375:

3369:

3368:

3366:

3364:

3353:

3347:

3346:

3340:

3332:

3326:

3317:

3311:

3310:

3308:

3306:

3292:

3286:

3285:

3283:

3281:

3264:

3258:

3257:

3255:

3253:

3246:Business Insider

3236:

3230:

3229:

3223:

3221:

3206:

3200:

3199:

3197:

3195:

3178:

3172:

3171:

3169:

3167:

3151:

3145:

3139:

3133:

3119:

3113:

3103:

3097:

3096:

3094:

3092:

3077:

3071:

3070:

3059:

3053:

3052:

3050:

3048:

3031:

3025:

3024:

3022:

3020:

3015:. March 18, 2014

3003:

2997:

2996:

2994:

2992:

2975:

2969:

2968:

2966:

2964:

2947:

2941:

2940:

2938:

2936:

2915:

2909:

2903:

2897:

2891:

2885:

2876:

2867:

2864:

2855:

2854:

2852:

2850:

2831:

2822:

2821:

2819:

2817:

2806:

2797:

2796:

2794:

2792:

2775:

2766:

2760:

2726:

2717:

2711:

2693:

2681:

2675:

2674:

2668:

2663:

2661:

2653:

2651:

2649:

2638:

2629:

2628:

2626:

2624:

2610:

2604:

2601:

2595:

2581:

2575:

2574:

2572:

2570:

2553:

2547:

2546:

2529:

2523:

2522:

2490:

2484:

2483:

2481:

2479:

2462:

2394:Pareto principle

2171:Gospel of Wealth

2122:

1932:

1743:

1734:

1651:Overaccumulation

1639:

1620:

1613:

1606:

1597:

1538:Elizabeth Warren

1250:Regressive taxes

1098:Cycle of poverty

981:

926:Gini coefficient

859:

847:

826:Cycle of poverty

794:Change in Share

626:

602:Change in Share

434:

421:Matthew Yglesias

403:

391:

379:

345:Great Depression

330:financial sector

326:property incomes

309:Gini coefficient

192:Great Depression

156:Inherited wealth

124:

112:

5255:

5254:

5248:

5247:

5246:

5244:

5243:

5242:

5213:

5212:

5194:

5186:. Basic Books.

5181:

5145:

5143:Further reading

5140:

5126:

5125:

5121:

5111:

5109:

5098:

5097:

5093:

5080:

5079:

5075:

5067:

5063:

5062:

5058:

5044:

5043:

5039:

5025:

5024:

5020:

5011:

5010:

5006:

4996:

4994:

4985:

4984:

4980:

4970:

4968:

4960:

4959:

4955:

4937:

4936:

4932:

4920:

4916:

4906:

4904:

4895:

4894:

4890:

4875:

4874:

4870:

4861:

4860:

4856:

4832:Piketty, Thomas

4830:

4826:

4810:

4806:

4787:

4786:

4782:

4742:

4741:

4737:

4728:

4727:

4720:

4712:

4708:

4707:

4698:

4684:

4683:

4679:

4666:

4665:

4661:

4648:

4647:

4638:

4624:

4623:

4619:

4585:

4580:

4579:

4575:

4562:

4561:

4557:

4547:

4545:

4536:

4535:

4531:

4521:

4519:

4511:

4506:

4505:

4498:

4456:

4455:

4451:

4446:

4442:

4426:

4425:

4421:

4413:

4409:

4400:

4396:

4355:(6): e0130181.

4342:

4341:

4337:

4327:

4325:

4314:

4313:

4309:

4304:

4300:

4286:

4285:

4281:

4271:

4269:

4268:. June 30, 2016

4265:

4261:

4260:

4256:

4246:

4244:

4235:

4234:

4230:

4225:

4221:

4216:

4207:

4197:

4195:

4191:

4190:

4186:

4176:

4174:

4169:

4168:

4164:

4154:

4152:

4148:

4147:

4143:

4133:

4131:

4122:

4121:

4114:

4094:

4090:

4078:

4074:

4014:

4013:

4009:

4000:

3996:

3984:

3977:

3967:

3966:

3962:

3950:

3946:

3936:An ordinary Joe

3934:

3930:

3922:

3918:

3907:

3903:

3891:

3887:

3879:

3875:

3865:

3863:

3862:. December 2000

3859:

3851:

3850:

3846:

3841:

3834:

3824:

3822:

3817:Income Overview

3813:

3812:

3808:

3799:

3795:

3790:

3786:

3778:

3771:

3767:

3766:

3762:

3754:

3747:

3743:

3742:

3738:

3726:

3713:

3699:

3689:

3682:

3680:

3675:

3674:

3670:

3656:

3646:

3639:

3637:

3632:

3631:

3624:

3616:

3609:

3604:

3603:

3599:

3591:

3584:

3579:

3578:

3574:

3566:

3559:

3554:

3553:

3549:

3536:

3532:

3522:

3520:

3511:

3510:

3501:

3491:

3489:

3478:

3477:

3473:

3463:

3461:

3450:

3449:

3445:

3435:

3433:

3422:

3421:

3417:

3404:

3400:

3390:

3388:

3377:

3376:

3372:

3362:

3360:

3355:

3354:

3350:

3333:

3324:

3319:

3318:

3314:

3304:

3302:

3294:

3293:

3289:

3279:

3277:

3266:

3265:

3261:

3251:

3249:

3238:

3237:

3233:

3219:

3217:

3208:

3207:

3203:

3193:

3191:

3180:

3179:

3175:

3165:

3163:

3160:The Denver Post

3153:

3152:

3148:

3140:

3136:

3120:

3116:

3104:

3100:

3090:

3088:

3079:

3078:

3074:

3067:Federal Reserve

3061:

3060:

3056:

3046:

3044:

3033:

3032:

3028:

3018:

3016:

3005:

3004:

3000:

2990:

2988:

2977:

2976:

2972:

2962:

2960:

2949:

2948:

2944:

2934:

2932:

2917:

2916:

2912:

2904:

2900:

2892:

2888:

2877:

2870:

2865:

2858:

2848:

2846:

2833:

2832:

2825:

2815:

2813:

2808:

2807:

2800:

2790:

2788:

2777:

2776:

2769:

2724:

2719:

2718:

2714:

2683:

2682:

2678:

2664:

2654:

2647:

2645:

2640:

2639:

2632:

2622:

2620:

2612:

2611:

2607:

2602:

2598:

2582:

2578:

2568:

2566:

2555:

2554:

2550:

2544:

2531:

2530:

2526:

2492:

2491:

2487:

2477:

2475:

2464:

2463:

2459:

2455:

2450:

2389:Paradise Papers

2369:Occupy movement

2359:Monetary policy

2317:

2312:

2307:

2283:

2216:

2212:Too big to fail

2190:

2157:

2109:

2051:

2030:Philanthropists

1976:

1919:

1851:

1774:

1630:

1624:

1583:Charles Schumer

1579:

1526:

1514:

1487:

1461:

1397:

1383:

1292:

1278:

1233:Joseph Stiglitz

1172:machinery. The

1157: