127:

209:(SPR) is the world's largest supply of emergency crude oil—727 million barrels— stored in huge underground salt caverns along the coastline of the Gulf of Mexico. An emergency oil stockpile was recommended by several Presidents throughout the twentieth century, in 1944, in 1952, 1956 and in 1970. The SPR is a "deterrent to oil import cutoffs and a key tool of foreign policy" but it has rarely been used.

216:(GAO) recommended reducing the size of the Reserve. According to the report, the amount of oil held in reserve exceeds the amount required to be kept on hand since the need for foreign imports of crude oil have decreased in recent years. The report said the U.S. Department of Energy agreed with the GAO’s recommendation.

193:, combined with the $ 12 million upfront well drilling and construction costs, provide incentives to oil producers to continue to flood the already glutted market with under-priced oil in spite of crude oil storage limitations. Many less efficient and less productive older wells were shut down but these

65:

The strategy works because oil prices for delivery in the future are trading at a premium to those in the spot market - a market structure known in the industry as contango - with investors expecting prices to eventually recover from the near 60 percent slide in oil in the last seven

141:

From June 2014 to

January 2015, as the price of oil dropped 60 percent and the supply of oil remained high, the world's largest traders in crude oil purchased at least 25 million barrels to store in supertankers to try and make a profit in the future should prices rise.

44:

Investors can choose to take profits or losses prior to when the oil delivery date arrives or they can leave the contract in place and physical oil is delivered on the set date to an officially designated delivery point. In the United States, that is usually to

173:

By 5 March 2015, as oil production outpaced oil demand by 1.5 million barrels a day, storage capacity globally dwindled. Crude oil is stored in old salt mines, in tanks and on tankers. In the United States alone, according to data from the

116:"The trend follows a spike in oil futures prices that has created incentives for traders to buy crude oil and oil products at current rates, sell them on futures markets and store them until delivery."

100:

The concept started to be used by oil traders in the market in early 1990. But it was in 2007 through 2009 that the oil storage trade expanded. Many participants—including Wall Street giants, such as

49:, Oklahoma. When delivery dates approach, they close out existing contracts and sell new ones for future delivery of the same oil. The oil never moves out of storage. If the forward market is in "

61:—the strategy is very successful. While new tanks have been added in Cushing for a storage capacity of 6.6 million barrels, by March 2015 all the tanks were fully leased through 2015.

453:

206:

190:

112:—turned sizeable profits simply by sitting on tanks of oil. By May 2007 Cushing's inventory fell by nearly 35% as the oil-storage trade heated up.

41:

in which they agree on a contract basis, to buy or sell oil at a set date in the future. Crude oil is stored in salt mines, tanks and oil tankers.

138:

By the end of

October 2009 one in twelve of the largest oil tankers were being used more for temporary storage of oil than for transportation.

315:"Oil Glut Sparks Latest Dilemma: Where to put it all as storage tanks near capacity, some predict spillover will send crude prices even lower"

76:

In 2015, global capacity for oil storage was out-paced by global oil production and an oil glut occurred. Crude oil storage space became a

29:, is a market strategy in which large, often vertically-integrated oil companies purchase oil for immediate delivery and storage—when the

175:

170:

were reported as booked with storage options, rising from around five vessels the prior week. Each VLCC can hold 2 million barrels.

213:

314:

178:, U.S. crude-oil supplies were at almost 70% of the U.S. storage capacity, the highest supply to capacity ratio since 1935.

402:

480:

367:"Where Has All The Oil Gone? After Sitting on Crude, speculators Unload It. The World's Eyes Fall on Cushing, Oklahoma"

342:

197:

continue to increase production while making a profit in a market where crude oil is priced as low as $ 50 a barrel.

33:

is low— and hold it in storage until the price of oil increases. Investors bet on the future of oil prices through a

428:

225:

92:

contracts in March 2015. Traders and producers can buy and sell the right to store certain types of oil.

89:

77:

485:

34:

385:

182:

278:

159:

46:

163:

151:

166:

began to book oil storage supertankers for up to 12 months. By 13 January 2015 at least 11

194:

155:

101:

474:

131:

105:

54:

366:

126:

30:

38:

167:

58:

454:"U.S. Oil Exports Would Lower Gas Prices, Government Report Says - WSJ - WSJ"

186:

143:

81:

279:"Why speculators are stashing vast quantities of crude oil on tanker ships"

109:

50:

25:

248:

168:

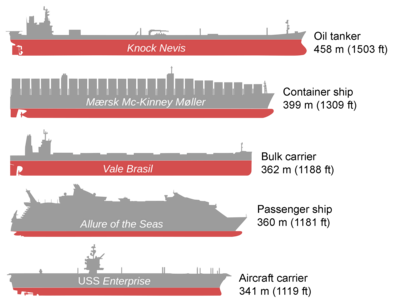

Very Large Crude

Carriers (VLCC) and Ultra Large Crude Carriers (ULCC)

147:

125:

85:

249:"Oil traders to store millions of barrels at sea as prices slump"

134:(1979-2010), a ULCC supertanker and the longest ship ever built.

397:

395:

433:Office of Fossil Energy, U.S. Department of Energy

272:

270:

114:

63:

243:

241:

360:

358:

356:

8:

343:"Tankers store oil as futures prices rocket"

308:

306:

304:

302:

300:

298:

212:On October 20, 2014, a report by the U.S.

191:hydraulic fracturing in the United States

336:

334:

404:Why Cheap Oil Doesn't Stop the Drilling

237:

277:Yglesias, Matthew (25 December 2014),

423:

421:

7:

384:Norris, Michele (17 December 2008).

429:"Strategic Petroleum Reserve (SPR)"

386:"Contango In Oil Markets Explained"

341:Wright, Robert (17 November 2009).

14:

313:Friedman, Nicole (5 March 2015),

201:Strategic Petroleum Reserve (SPR)

176:Energy Information Administration

214:Government Accountability Office

365:Davis, Anne (6 October 2007).

1:

207:Strategic Petroleum Reserve

57:is higher than the current

502:

185:, the efficiency of newer

226:Contingent payment sales

452:Berthelsen, Christian.

135:

124:

74:

23:, also referred to as

129:

35:financial instrument

481:Oil and gas markets

371:Wall Street Journal

319:Wall Street Journal

121:Financial Post 2009

90:oil-storage futures

205:The United States

183:Bloomberg Business

136:

78:tradable commodity

255:. 13 January 2015

21:oil-storage trade

493:

465:

464:

462:

460:

449:

443:

442:

441:

439:

425:

416:

415:

414:

412:

399:

390:

389:

381:

375:

374:

362:

351:

350:

338:

329:

328:

327:

325:

310:

293:

292:

291:

289:

274:

265:

264:

262:

260:

245:

164:energy companies

162:and other major

122:

72:

501:

500:

496:

495:

494:

492:

491:

490:

471:

470:

469:

468:

458:

456:

451:

450:

446:

437:

435:

427:

426:

419:

410:

408:

401:

400:

393:

383:

382:

378:

364:

363:

354:

347:Financial Times

340:

339:

332:

323:

321:

312:

311:

296:

287:

285:

276:

275:

268:

258:

256:

247:

246:

239:

234:

222:

203:

195:shale oil wells

189:wells that use

123:

120:

98:

73:

70:

17:

16:Market strategy

12:

11:

5:

499:

497:

489:

488:

483:

473:

472:

467:

466:

444:

417:

407:, 5 March 2015

391:

376:

352:

330:

294:

266:

236:

235:

233:

230:

229:

228:

221:

218:

202:

199:

118:

102:Morgan Stanley

97:

94:

68:

15:

13:

10:

9:

6:

4:

3:

2:

498:

487:

484:

482:

479:

478:

476:

455:

448:

445:

434:

430:

424:

422:

418:

406:

405:

398:

396:

392:

387:

380:

377:

372:

368:

361:

359:

357:

353:

349:. London, UK.

348:

344:

337:

335:

331:

320:

316:

309:

307:

305:

303:

301:

299:

295:

284:

280:

273:

271:

267:

254:

250:

244:

242:

238:

231:

227:

224:

223:

219:

217:

215:

210:

208:

200:

198:

196:

192:

188:

184:

181:According to

179:

177:

171:

169:

165:

161:

157:

153:

149:

145:

139:

133:

128:

117:

113:

111:

107:

106:Goldman Sachs

103:

95:

93:

91:

87:

84:— which owns

83:

79:

67:

62:

60:

56:

55:forward price

52:

48:

42:

40:

36:

32:

28:

27:

22:

457:. Retrieved

447:

436:, retrieved

432:

409:, retrieved

403:

379:

370:

346:

322:, retrieved

318:

286:, retrieved

282:

257:. Retrieved

252:

211:

204:

180:

172:

140:

137:

115:

99:

75:

71:Reuters 2015

64:

43:

31:price of oil

24:

20:

18:

486:Oil storage

132:Knock Nevis

88:— offering

39:oil futures

475:Categories

459:20 October

438:21 January

288:21 January

259:20 January

232:References

96:Chronology

59:spot price

187:shale oil

144:Trafigura

82:CME Group

220:See also

119:—

110:Citicorp

69:—

51:contango

26:contango

411:6 March

324:6 March

253:Reuters

66:months.

47:Cushing

152:Gunvor

108:, and

53:"—the

160:Shell

148:Vitol

86:NYMEX

80:with

461:2014

440:2015

413:2015

326:2015

290:2015

261:2015

156:Koch

130:The

19:The

283:VOX

477::

431:,

420:^

394:^

369:.

355:^

345:.

333:^

317:,

297:^

281:,

269:^

251:.

240:^

158:,

154:,

150:,

146:,

104:,

37:,

463:.

388:.

373:.

263:.

Text is available under the Creative Commons Attribution-ShareAlike License. Additional terms may apply.