31:

89:

157:

household formation groups – namely, overseas students and business migrants who do not continuously stay for 12 months in

Australia." This statistical omission lead to the admission: "The Commission recognises that the ABS resident population estimates have limitations when used for assessing housing demand. Given the significant influx of foreigners coming to work or study in Australia in recent years, it seems highly likely that short-stay visitor movements may have added to the demand for housing. However, the Commissions are unaware of any research that quantifies the effects."

100:, as of March 2010, the Property Market's vacancy rate reached 0.53% signalling that the market is recovering, as these rates had reached 2% in August 2009. As of July 2015, the Property Market in Sydney has surged in the first Q of 2015, up 3.1%. Sydney's eastern and northern suburbs typically attract the highest prices, reflecting their desirability and premium location. The annual capital growth for houses and units in Sydney is 4.2% and 3.8% respectively.

1462:

114:

58:

and reduced interest from foreign investors in residential property, prices have started falling in all the major cities. When compared with the soaring prices of 2017, the housing prices fell by 11.1% in Sydney and 7.2% in

Melbourne in 2018. In 2022 the residential rental market has seen a significant increase in rents, which has been described as a ‘rental crisis’.

1474:

30:

148:

problem. According to

Robertson, Federal Government policies that fuel demand for housing, such as the currently high levels of immigration, as well as capital gains tax discounts and subsidies to boost fertility, have had a greater impact on housing affordability than land release on urban fringes.

71:

In 2011 there were 8.6m households with an average household size of 2.6 persons per household. Freestanding houses have historically comprised most building approvals, but recent data shows a trend towards higher density housing such as townhouses and units. Turnover rates vary across market cycles,

57:

The residential housing market has seen drastic changes in prices in the past few decades. The property prices are soaring in major cities like Sydney, Melbourne, Adelaide, Perth, Brisbane and Hobart. The median house price in Sydney peaked at $ 780,000 in 2016. However, with stricter credit policy

168:

In

December 2008, the federal government introduced legislation relaxing rules for foreign buyers of Australian property. According to FIRB (Foreign Investment Review Board) data released in August 2009, foreign investment in Australian real estate had increased by more than 30% year to date. One

152:

The

Productivity Commission Inquiry Report No. 28 First Home Ownership (2004) also stated, in relation to housing, "that Growth in immigration since the mid-1990s has been an important contributor to underlying demand, particularly in Sydney and Melbourne." This has been exacerbated by Australian

191:

Australian property investors often apply the practice of negative gearing. This occurs when the investor borrows money to fund the purchase of the property, and the income generated by the property is less than the cost of owning and managing the property including interest. The investor is

156:

The RBA in its submission to the same PC Report also stated "rapid growth in overseas visitors such as students may have boosted demand for rental housing". However, in question in the report was the statistical coverage of resident population. The "ABS population growth figures omit certain

88:

210:

In 2022 the

Australian residential rental market saw an annual increase in rents of 12%, the strongest increase in 14 years. Across Australia the vacancy rate was 1%, when a rate below 2% is considered very competitive with affordability constraints impacting

192:

expecting that capital gains will compensate for the shortfall. Negative gearing receives considerable media and political attention due to the perceived distortion it creates on residential property prices. In anticipation of Labor being elected in the

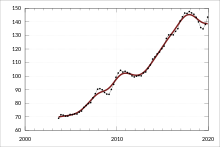

365:

125:, relative to average incomes, were among the highest in the world. As at 2011, house prices were on average six times average household income, compared to four times in 1990. This prompted speculation that the country was experiencing a

72:

but typically average 6% per year. Since 1999-2000 the proportion of households renting from state/territory housing authorities has declined from 6% to 3% while the proportion renting privately increased from 20% to 26% in 2019-20.

46:. The average Australian property price grew 0.5% per year from 1890 to 1990 after inflation, however rose from 1990 to 2017 at a faster rate. House prices in Australia receive considerable attention from the media and the

1437:

1442:

369:

280:

Stapledon, Nigel. A History of

Housing Prices in Australia 1780-2030. School of Economics Discussion Paper: 2010/18. Sydney, Australia: The University of New South Wales Australian School of Business.

896:

874:

467:

803:

1432:

1447:

1244:

1422:

389:

132:

Foreign investment has also been identified as a key driver of affordability issues, with recent years seeing particularly high capital inflows from

Chinese investors.

337:

1254:

1234:

727:

544:

936:

825:

351:

690:

1051:

1239:

559:

1515:

144:

analyst Rory

Robertson, assert that high immigration and the propensity of new arrivals to cluster in the capital cities is exacerbating the nation's

1427:

1412:

1407:

851:

594:

650:

630:

285:

755:

205:

401:

780:

666:

1399:

1384:

1152:

929:

1500:

964:

238:

also impacted the rental market with shared households reducing in size and city workers moving to regional areas due to increased

1072:

193:

1107:

432:

1478:

1307:

1208:

575:

261:

1510:

1505:

1466:

1302:

1198:

979:

969:

922:

1036:

629:(submission 12 to the Productivity Commission's position paper on Economic Impacts of Migration and Population Growth).

80:

The

Australian property market is non-uniform, with high variation observed across the major cities and regional areas.

649:(submission 9 to the Productivity Commission's position paper on Economic Impacts of Migration and Population Growth).

34:

The weighted capital city residential property price index, produced by the Australian Bureau of Statistics, since 2003

1343:

1312:

1287:

1102:

1026:

256:

1389:

1358:

1338:

1292:

1167:

1122:

1087:

1041:

1021:

984:

519:

251:

153:

lenders relaxing credit guidelines for temporary residents, allowing them to buy a home with a 10 percent deposit.

51:

514:

1417:

1363:

1264:

1172:

47:

309:

1317:

1297:

1249:

1156:

1067:

533:

1322:

1147:

323:

160:

Some individuals and interest groups have also argued that immigration causes overburdened infrastructure.

1177:

1117:

1082:

989:

1139:

1031:

556:

1353:

1282:

1259:

1193:

1112:

1077:

945:

601:

324:"Median house prices in major cities in Australia as of August 2016 (in thousand Australian dollars)"

17:

646:

626:

1368:

1348:

1274:

1092:

1046:

974:

196:, the banks issued less interest only loans which are used by many investors for negative gearing.

1203:

145:

126:

92:

Sydney established house price index, produced by the Australian Bureau of Statistics, since 2002

1005:

408:

281:

235:

959:

186:

1129:

654:

634:

563:

234:. Other commenators cited a lack of social housing being provided by the government. The

1217:

1212:

1162:

227:

174:

141:

1494:

456:

113:

490:

478:

297:

170:

230:

and some landlords using their properties on the short term rental market such as

728:"'A landlord's market': rents hit record highs across Australia's capital cities"

239:

338:"Australian house prices down in every capital city except Adelaide and Hobart"

223:

122:

43:

457:

6416.0 - Residential Property Price Indexes: Eight Capital Cities, Jun 2015

173:, not to rent them out. The houses just sit vacant because they are after

219:

215:. A number of sources have described the situation as a ‘rental crisis’.

826:"Australia's rents continue to climb, despite affordability constraints"

914:

212:

468:

Property prices in Sydney surge while other capitals underperform: ABS

390:

Apartments, townhouses continue to drive Australian building approvals

42:

comprises the trade of land and its permanent fixtures located within

627:

Submission to the Productivity Commission on Population and Migration

231:

97:

703:"Merchant Channels | Investment Banking & Construction Finance"

112:

87:

29:

852:"How Australia is dealing with Airbnb, Stayz in a housing crisis"

918:

589:

587:

585:

583:

647:

Negative Economic Impacts of Immigration and Population Growth

897:"Sign unpopular rent increases could have reached their peak"

702:

352:"Australian house prices falling at fastest rate in a decade"

310:"Residential Housing Market Australia - Statistics and Facts"

226:

selling their rental properties which are being purchased by

875:"Real cause of Australia's dire rental crisis revealed"

783:. Australian Broadcasting Commission. 21 September 2022

545:

Wall of Chinese capital buying up Australian properties

117:

Melbourne House prices to income ratio, 1965 to 2013.

1398:

1377:

1331:

1273:

1227:

1186:

1138:

1060:

1014:

998:

952:

534:

Is There a Recession Brewing in Our Housing Bubble?

50:and some commentators have argued that there is an

222:due to a variety of reasons, including existing

169:agent said that "overseas investors buy them to

804:"The 'ridiculous' rent hikes in Aussie suburbs"

750:

748:

515:"The facts on Australian housing affordability"

366:"4130.0 - Housing Occupancy and Costs, 2011-12"

218:The primary reason for the rental crisis is a

930:

8:

756:"What's causing the national rental crisis?"

667:"Foreign buyers blow out the housing bubble"

937:

923:

915:

164:Foreign investment in residential property

402:"Housing Prices, Turnover and Borrowing"

273:

27:Overview of Australian property market

691:Negative gearing and positive gearing

121:In the late 2000s, housing prices in

18:Affordability of housing in Australia

7:

1473:

854:. Australian Broadcasting Commission

206:Australian residential rental market

576:PM told he's wrong on house prices

25:

1516:Real estate bubbles of the 2000s

1472:

1461:

1460:

140:A number of economists, such as

873:Rolfe, Brooke (8 August 2022).

850:Nallay, Alicia (24 June 2022).

802:Dudley, Ellie (2 August 2022).

437:Australian Bureau of Statistics

1209:Australian Securities Exchange

595:"Microsoft Word - prelims.doc"

1:

899:. news.com.au. 13 August 2022

726:Taylor, Josh (14 July 2022).

491:"Real Estate Sydney NSW 2000"

433:"Housing Occupancy and Costs"

129:, like many other countries.

1448:Australia–United Kingdom FTA

1052:Australian Capital Territory

574:Wade, M. (9 September 2006)

1423:Australia–United States FTA

1313:National Electricity Market

781:"Australia's runaway rents"

257:Home ownership in Australia

1532:

1168:Minerals Resource Rent Tax

760:National Seniors Australia

252:Australian property bubble

203:

184:

52:Australian property bubble

40:Australian property market

1456:

1438:Trans-Pacific Partnership

1418:Australia–New Zealand FTA

1364:Social class in Australia

1173:Passenger Movement Charge

653:27 September 2007 at the

633:27 September 2007 at the

555:Klan, A. (17 March 2007)

200:Residential rental market

1501:Real estate in Australia

1298:Energy efficiency rating

1153:Goods & Services Tax

136:Immigration to Australia

1443:Indonesia–Australia FTA

990:Snowy Mountains Scheme

965:Banking crisis of 1893

288:. Retrieved 1 May 2011

118:

93:

35:

495:www.microburbs.com.au

194:2019 federal election

146:housing affordability

116:

91:

33:

1511:Housing in Australia

1506:Economy of Australia

1354:Poverty in Australia

946:Economy of Australia

1433:Japan–Australia FTA

1428:China–Australia FTA

1413:Australia–Korea FTA

1408:Australia–Chile FTA

1369:Wealth in Australia

1349:Income in Australia

1332:Economic conditions

1228:Regulatory agencies

1187:Banking and Finance

975:Four pillars policy

707:merchantchannels.co

262:Housing in Victoria

76:Regional variations

1255:Corporations power

1204:Official cash rate

1108:Telecommunications

562:2008-10-22 at the

127:real estate bubble

119:

94:

36:

1488:

1487:

1308:Green electricity

1037:Western Australia

1006:Australian dollar

286:978-0-7334-2956-9

236:COVID-19 pandemic

16:(Redirected from

1523:

1476:

1475:

1464:

1463:

1400:Trade agreements

1303:Geothermal power

1199:Financial system

980:Great Depression

970:Economic history

960:Australian pound

939:

932:

925:

916:

909:

908:

906:

904:

893:

887:

886:

884:

882:

870:

864:

863:

861:

859:

847:

841:

840:

838:

836:

822:

816:

815:

813:

811:

799:

793:

792:

790:

788:

777:

771:

770:

768:

766:

752:

743:

742:

740:

738:

723:

717:

716:

714:

713:

699:

693:

688:

682:

681:

679:

678:

663:

657:

645:Nilsson (2005)

643:

637:

625:Claus, E (2005)

623:

617:

616:

614:

612:

606:

600:. Archived from

599:

591:

578:

572:

566:

553:

547:

542:

536:

531:

525:

524:

520:The Conversation

511:

505:

504:

502:

501:

487:

481:

479:Sydney forecasts

476:

470:

465:

459:

454:

448:

447:

445:

443:

429:

423:

422:

420:

419:

413:

407:. Archived from

406:

398:

392:

387:

381:

380:

378:

377:

368:. Archived from

362:

356:

355:

348:

342:

341:

334:

328:

327:

320:

314:

313:

306:

300:

295:

289:

278:

187:Negative gearing

181:Negative gearing

21:

1531:

1530:

1526:

1525:

1524:

1522:

1521:

1520:

1491:

1490:

1489:

1484:

1452:

1394:

1390:Labour movement

1373:

1359:Property bubble

1339:Government debt

1327:

1269:

1223:

1213:S&P/ASX 200

1182:

1134:

1056:

1042:South Australia

1022:New South Wales

1015:State economies

1010:

994:

948:

943:

913:

912:

902:

900:

895:

894:

890:

880:

878:

872:

871:

867:

857:

855:

849:

848:

844:

834:

832:

824:

823:

819:

809:

807:

801:

800:

796:

786:

784:

779:

778:

774:

764:

762:

754:

753:

746:

736:

734:

725:

724:

720:

711:

709:

701:

700:

696:

689:

685:

676:

674:

665:

664:

660:

655:Wayback Machine

644:

640:

635:Wayback Machine

624:

620:

610:

608:

604:

597:

593:

592:

581:

573:

569:

564:Wayback Machine

554:

550:

543:

539:

532:

528:

513:

512:

508:

499:

497:

489:

488:

484:

477:

473:

466:

462:

455:

451:

441:

439:

431:

430:

426:

417:

415:

411:

404:

400:

399:

395:

388:

384:

375:

373:

364:

363:

359:

350:

349:

345:

336:

335:

331:

322:

321:

317:

308:

307:

303:

298:Monetary Policy

296:

292:

279:

275:

270:

248:

228:owner-occupiers

208:

202:

189:

183:

166:

138:

111:

106:

86:

78:

69:

64:

28:

23:

22:

15:

12:

11:

5:

1529:

1527:

1519:

1518:

1513:

1508:

1503:

1493:

1492:

1486:

1485:

1483:

1482:

1470:

1457:

1454:

1453:

1451:

1450:

1445:

1440:

1435:

1430:

1425:

1420:

1415:

1410:

1404:

1402:

1396:

1395:

1393:

1392:

1387:

1381:

1379:

1375:

1374:

1372:

1371:

1366:

1361:

1356:

1351:

1346:

1344:Home ownership

1341:

1335:

1333:

1329:

1328:

1326:

1325:

1320:

1315:

1310:

1305:

1300:

1295:

1290:

1288:Carbon pricing

1285:

1279:

1277:

1271:

1270:

1268:

1267:

1262:

1257:

1252:

1247:

1242:

1237:

1231:

1229:

1225:

1224:

1222:

1221:

1218:All Ordinaries

1215:

1206:

1201:

1196:

1190:

1188:

1184:

1183:

1181:

1180:

1175:

1170:

1165:

1163:Luxury Car Tax

1160:

1150:

1144:

1142:

1136:

1135:

1133:

1132:

1127:

1126:

1125:

1115:

1110:

1105:

1103:Superannuation

1100:

1095:

1090:

1085:

1080:

1075:

1070:

1064:

1062:

1058:

1057:

1055:

1054:

1049:

1044:

1039:

1034:

1029:

1024:

1018:

1016:

1012:

1011:

1009:

1008:

1002:

1000:

996:

995:

993:

992:

987:

982:

977:

972:

967:

962:

956:

954:

950:

949:

944:

942:

941:

934:

927:

919:

911:

910:

888:

865:

842:

817:

794:

772:

744:

718:

694:

683:

658:

638:

618:

607:on 3 June 2011

579:

567:

548:

537:

526:

506:

482:

471:

460:

449:

424:

393:

382:

357:

343:

329:

315:

301:

290:

272:

271:

269:

266:

265:

264:

259:

254:

247:

244:

220:lack of supply

204:Main article:

201:

198:

185:Main article:

182:

179:

175:capital growth

165:

162:

142:Macquarie Bank

137:

134:

110:

107:

105:

102:

85:

82:

77:

74:

68:

65:

63:

60:

26:

24:

14:

13:

10:

9:

6:

4:

3:

2:

1528:

1517:

1514:

1512:

1509:

1507:

1504:

1502:

1499:

1498:

1496:

1481:

1480:

1471:

1469:

1468:

1459:

1458:

1455:

1449:

1446:

1444:

1441:

1439:

1436:

1434:

1431:

1429:

1426:

1424:

1421:

1419:

1416:

1414:

1411:

1409:

1406:

1405:

1403:

1401:

1397:

1391:

1388:

1386:

1383:

1382:

1380:

1376:

1370:

1367:

1365:

1362:

1360:

1357:

1355:

1352:

1350:

1347:

1345:

1342:

1340:

1337:

1336:

1334:

1330:

1324:

1321:

1319:

1316:

1314:

1311:

1309:

1306:

1304:

1301:

1299:

1296:

1294:

1293:Energy policy

1291:

1289:

1286:

1284:

1281:

1280:

1278:

1276:

1272:

1266:

1263:

1261:

1258:

1256:

1253:

1251:

1250:Corporate law

1248:

1246:

1243:

1241:

1238:

1236:

1233:

1232:

1230:

1226:

1219:

1216:

1214:

1210:

1207:

1205:

1202:

1200:

1197:

1195:

1192:

1191:

1189:

1185:

1179:

1176:

1174:

1171:

1169:

1166:

1164:

1161:

1158:

1154:

1151:

1149:

1146:

1145:

1143:

1141:

1137:

1131:

1128:

1124:

1121:

1120:

1119:

1116:

1114:

1111:

1109:

1106:

1104:

1101:

1099:

1096:

1094:

1091:

1089:

1088:Manufacturing

1086:

1084:

1081:

1079:

1076:

1074:

1071:

1069:

1066:

1065:

1063:

1059:

1053:

1050:

1048:

1045:

1043:

1040:

1038:

1035:

1033:

1030:

1028:

1025:

1023:

1020:

1019:

1017:

1013:

1007:

1004:

1003:

1001:

997:

991:

988:

986:

985:Privatisation

983:

981:

978:

976:

973:

971:

968:

966:

963:

961:

958:

957:

955:

951:

947:

940:

935:

933:

928:

926:

921:

920:

917:

898:

892:

889:

877:. news.com.au

876:

869:

866:

853:

846:

843:

831:

827:

821:

818:

806:. news.com.au

805:

798:

795:

782:

776:

773:

761:

757:

751:

749:

745:

733:

729:

722:

719:

708:

704:

698:

695:

692:

687:

684:

672:

671:Crikey.com.au

668:

662:

659:

656:

652:

648:

642:

639:

636:

632:

628:

622:

619:

603:

596:

590:

588:

586:

584:

580:

577:

571:

568:

565:

561:

558:

552:

549:

546:

541:

538:

535:

530:

527:

522:

521:

516:

510:

507:

496:

492:

486:

483:

480:

475:

472:

469:

464:

461:

458:

453:

450:

438:

434:

428:

425:

414:on 2015-07-07

410:

403:

397:

394:

391:

386:

383:

372:on 2015-09-23

371:

367:

361:

358:

353:

347:

344:

339:

333:

330:

325:

319:

316:

311:

305:

302:

299:

294:

291:

287:

283:

277:

274:

267:

263:

260:

258:

255:

253:

250:

249:

245:

243:

241:

237:

233:

229:

225:

221:

216:

214:

207:

199:

197:

195:

188:

180:

178:

176:

172:

163:

161:

158:

154:

150:

147:

143:

135:

133:

130:

128:

124:

115:

109:Affordability

108:

103:

101:

99:

90:

83:

81:

75:

73:

66:

61:

59:

55:

53:

49:

45:

41:

32:

19:

1477:

1465:

1265:Reserve Bank

1097:

903:22 September

901:. Retrieved

891:

881:22 September

879:. Retrieved

868:

858:22 September

856:. Retrieved

845:

835:22 September

833:. Retrieved

829:

820:

810:22 September

808:. Retrieved

797:

787:22 September

785:. Retrieved

775:

765:22 September

763:. Retrieved

759:

737:22 September

735:. Retrieved

732:The Guardian

731:

721:

710:. Retrieved

706:

697:

686:

675:. Retrieved

673:. 2009-09-21

670:

661:

641:

621:

609:. Retrieved

602:the original

570:

551:

540:

529:

518:

509:

498:. Retrieved

494:

485:

474:

463:

452:

442:19 September

440:. Retrieved

436:

427:

416:. Retrieved

409:the original

396:

385:

374:. Retrieved

370:the original

360:

346:

332:

318:

304:

293:

276:

217:

209:

190:

167:

159:

155:

151:

139:

131:

120:

95:

79:

70:

56:

48:Reserve Bank

39:

37:

1318:Solar power

1098:Real estate

1068:Agriculture

240:remote work

67:Composition

62:Description

1495:Categories

1323:Wind power

1178:Tax return

1148:Fuel taxes

1073:Automotive

1061:Industries

1032:Queensland

712:2018-03-07

677:2016-01-20

557:Locked out

500:2023-06-19

418:2015-10-03

376:2015-09-30

268:References

104:Key issues

1118:Transport

1083:Insurance

830:CoreLogic

224:landlords

171:land bank

123:Australia

44:Australia

1467:Category

1140:Taxation

1047:Tasmania

1027:Victoria

999:Currency

651:Archived

631:Archived

560:Archived

246:See also

1479:Commons

1283:Biofuel

1194:Banking

1157:dispute

1113:Tourism

1078:Fishing

953:History

611:14 July

213:tenants

1378:Unions

1275:Energy

1093:Mining

284:

232:Airbnb

98:Sydney

84:Sydney

1123:Ports

605:(PDF)

598:(PDF)

412:(PDF)

405:(PDF)

1385:ACTU

1245:ASIC

1240:APRA

1235:ACCC

1130:Wine

905:2022

883:2022

860:2022

837:2022

812:2022

789:2022

767:2022

739:2022

613:2011

444:2022

282:ISBN

38:The

1260:FWC

177:."

96:In

54:.

1497::

828:.

758:.

747:^

730:.

705:.

669:.

582:^

517:.

493:.

435:.

242:.

1220:)

1211:(

1159:)

1155:(

938:e

931:t

924:v

907:.

885:.

862:.

839:.

814:.

791:.

769:.

741:.

715:.

680:.

615:.

523:.

503:.

446:.

421:.

379:.

354:.

340:.

326:.

312:.

20:)

Text is available under the Creative Commons Attribution-ShareAlike License. Additional terms may apply.