149:, William, was a successful stock market investor. Beckman explained "The dog is called William of Arethyn, which means son of the bear, it makes most of its money in bear markets." Beckman claimed to read out the names of companies and to buy or sell according to signals given by William. On one occasion, according to Beckman, William snatched the chart for

254:, he said "The market is rising because of the 'Greater Fool Theory'. You buy a share in the hope that a greater fool will eventually pay more for it. In the end it is bought by 'The Greatest Fool of All', just before the end. The market is like a balloon, the more air you put in, the nearer you are to bursting point."

289:

In 1995, Beckman explained that he had chosen to live in Monaco due to the sophistication of the financial services available there and the tax efficiency of the arrangements possible in the territory, saying: "A long time ago, I was told that the most efficient way for an individual to handle his

134:

Beckman had an early career as a banker and stockbroker on Wall Street in the 1950s. He later claimed to have made a million dollars by the age of 26, and to have lost it all by the age of 27. The experience permanently disillusioned him with the stock market and he thereafter adopted a cautious

157:

the stock to his profit. It later transpired that the dog was actually owned by

Beckman's former assistant, who with Beckman claimed that the share trading profits that had been made belonged exclusively to William and therefore there could be no tax on them. A commentator in

114:(1988). As a young man he made, and quickly lost, a fortune on the stock market. The experience permanently disillusioned him with equity investment and he became known for his forecasts of doom for the stock market and British house prices which were largely proved wrong.

164:

magazine agreed that as

William was neither a "legal entity" or a "person" in law, he probably didn't owe any tax but neither could he own money, and therefore his whole capital of around £100,000 belonged to the British crown.

249:

in April 1987 that he was simply a realist who believed that wealth could not come against a background of high unemployment and global economic stagnation. Of the stockmarket, which subsequently crashed in

October 1987 on

198:

complained to them about an article in his newsletter titled "The

Zionist Factor", which claimed that the two World Wars and the first Gulf War were caused by a Jewish conspiracy of American and German bankers.

207:

Beckman was consistently pessimistic about the outlook for the stock market and

British house prices. In 1979 he predicted that property prices would fall by 50% within three years; they did not. In 1983, in

183:. In 1982, he founded the Beckman International Capital Accumulator Unit Trust, aiming for a steady return from fixed interest bonds and gilts. In 1983, Beckman appeared in the television film

290:

affairs was to work one place, keep his money in a second place and live in a third place. I live in Monaco. I don't work here, my money is placed elsewhere, but managed from here".

228:, a wide-ranging work of over 600 dense pages, in which he continued to forecast a house price collapse but also explained how to prosper in the long term from new trends. In

662:

672:

652:

216:. He followed this up with recommendations for how to beat the coming depression and a history of financial crashes. In 1987 the stock market did crash on

647:

667:

657:

498:

Shakespeare and the twentieth century: The selected proceedings of the

International Shakespeare Association world congress, Los Angeles, 1996

506:

232:(1996), Beckman again predicted a property price collapse, saying "There will not be a property boom during the 1990s of any sort."

195:

642:

521:

588:

31:

571:

376:

363:

350:

337:

102:(August 25, 1934 – December 6, 2007) was an American investment adviser, commentator, and author, who achieved fame in the

608:

135:

approach to investment that was slow but certain, saying that it took him more than 13 years to make his next million.

224:

noted that share prices after the crash were still about twice as high as they had been in 1983. In 1988, he produced

286:. I enjoy the finest of foods, wines, clothes, cars and boats, while being surrounded by beautiful women".

238:

in their 2007 obituary of

Beckman, noted that house prices had more than tripled since that prediction.

172:

tower for £25,000 per annum. In the late 1980s, he moved to The Water

Gardens, on Edgware Road, London.

637:

632:

146:

478:

388:

251:

217:

160:

138:

In 1963, Beckman moved to the United

Kingdom where he began advising on investments and bought the

393:

567:

502:

496:

372:

359:

346:

333:

312:

Supertiming the unique

Elliott Wave System: Keys to anticipating impending stock market action

213:

55:

613:

592:

169:

154:

153:

from his hand and tore it to pieces which Beckman took as a sell signal. He subsequently

283:

126:

on August 25, 1934. His family were poor but he managed to earn a degree in economics.

103:

626:

267:

150:

123:

585:

279:

430:, 29 December 2007, p. 76. ProQuest, UK Newsstand. Retrieved 28 March 2016.

345:. R. Finigan Ed. Milestone Publications, Portsmouth, 1988. (three editions)

242:

234:

142:

newsletter in 1968 when it had just 12 subscribers. He sold it in 1996.

30:

299:

271:

263:

191:

168:

In the 1980s Beckman rented a three-floor penthouse at the top of a

482:, 12 January 1981, p. 14. Gale NewsVault. Retrieved 29 March 2016.

275:

180:

270:. In 1992, he wrote of his "opulent lifestyle, shuttling between

145:

In the 1970s, Beckman achieved publicity after claiming that his

262:

Beckman married Arlette. From 1987 he was based permanently in

176:

314:. Library of Investment Study, Los Angeles, Calif., c.1979.

190:

In 1991, Beckman was warned by his professional regulator,

463:"Investor with a nose for tax avoidance" Francis Kinsman,

106:

in the 1980s through his media appearances and his books

179:

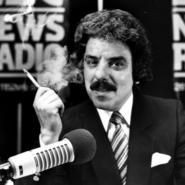

radio, which he held for 12 years, and also appeared on

175:

Beckman began a regular morning investment segment on

358:. Milestone Publications, Horndean, Hampshire, 1992.

326:. Milestone Publications, Horndean, Hampshire, 1984.

566:. 3rd edition. Portsmouth: Milestone Publications.

318:

The Downwave: Surviving the second Great Depression

212:, which sold 500,000 copies, he predicted a second

82:

74:

62:

37:

21:

564:Into the Upwave: How to prosper from slump to boom

549:"Still going up on the downwave", Lawrence Lever,

369:Housequake: Is this the right time to buy a house?

343:Into the Upwave: How to prosper from slump to boom

501:. University of Delaware Press. p. 306.

8:

617:, 24 October 1992. Retrieved 28 March 2016.

320:. Milestone Publications, Portsmouth, 1983.

663:American expatriates in the United Kingdom

495:Bate, Jonathan; et al., eds. (1998).

29:

18:

673:20th-century American non-fiction writers

599:, November 1995. Retrieved 28 March 2016.

533:"Jews attack 'smear' by shares adviser",

447:"The sound of money", Pearson Phillips,

371:Rushmere Wynne, Leighton Buzzard, 1996.

332:. Sidgwick & Jackson, London, 1988.

653:Deaths from cancer in the United States

586:Robert C. Beckman An American in Monaco

562:Beckman, Robert. R. Finigan Ed. (1988)

545:

543:

443:

441:

439:

422:

420:

418:

416:

414:

412:

410:

408:

404:

581:

579:

459:

457:

7:

330:Crashes: Why they happen: What to do

245:for prophesying doom, but he told

14:

196:Board of Deputies of British Jews

609:My Biggest Mistake: Bob Beckman.

648:American financial commentators

241:Beckman was often said to be a

668:Journalists from New York City

658:American expatriates in Monaco

1:

524:BFI. Retrieved 29 March 2016.

476:"Beckman's Bark. Observer.",

282:and various enclaves on the

122:Robert Beckman was born in

16:American investment adviser

689:

130:Financial and media career

467:, 21 October 1972, p. 22.

28:

643:American money managers

484:(subscription required)

451:, 29 April 1987, p. 14.

432:(subscription required)

553:, 25 July 1987, p. 25.

537:, 29 April 1991, p. 2.

78:Investment commentator

306:Selected publications

302:on December 6, 2007.

266:where he appeared on

203:Forecasts and writing

147:Old English sheepdog

479:The Financial Times

389:Greater fool theory

140:Investors' Bulletin

591:2016-03-26 at the

394:Three flags theory

508:978-0-87413-652-4

324:Beat the Downwave

100:Robert C. Beckman

97:

96:

42:Robert C. Beckman

680:

618:

606:

600:

597:Monaco Actualité

583:

574:

560:

554:

547:

538:

531:

525:

519:

513:

512:

492:

486:

485:

474:

468:

461:

452:

445:

434:

433:

424:

298:Beckman died of

214:Great Depression

69:

66:December 6, 2007

51:

49:

33:

19:

688:

687:

683:

682:

681:

679:

678:

677:

623:

622:

621:

614:The Independent

607:

603:

593:Wayback Machine

584:

577:

561:

557:

548:

541:

532:

528:

520:

516:

509:

494:

493:

489:

483:

475:

471:

462:

455:

446:

437:

431:

426:"Bob Beckman",

425:

406:

402:

385:

308:

296:

260:

226:Into the Upwave

222:Financial Times

205:

185:Prophet of Doom

132:

120:

112:Into the Upwave

91:Into the Upwave

67:

58:

53:

52:August 25, 1934

47:

45:

44:

43:

24:

17:

12:

11:

5:

686:

684:

676:

675:

670:

665:

660:

655:

650:

645:

640:

635:

625:

624:

620:

619:

601:

575:

555:

539:

526:

514:

507:

487:

469:

453:

435:

403:

401:

398:

397:

396:

391:

384:

381:

380:

379:

366:

353:

340:

327:

321:

315:

307:

304:

295:

292:

284:French Riviera

259:

256:

204:

201:

131:

128:

119:

116:

104:United Kingdom

95:

94:

84:

83:Known for

80:

79:

76:

72:

71:

70:(aged 73)

64:

60:

59:

54:

41:

39:

35:

34:

26:

25:

22:

15:

13:

10:

9:

6:

4:

3:

2:

685:

674:

671:

669:

666:

664:

661:

659:

656:

654:

651:

649:

646:

644:

641:

639:

636:

634:

631:

630:

628:

616:

615:

611:Bob Beckman,

610:

605:

602:

598:

594:

590:

587:

582:

580:

576:

573:

569:

565:

559:

556:

552:

546:

544:

540:

536:

530:

527:

523:

518:

515:

510:

504:

500:

499:

491:

488:

481:

480:

473:

470:

466:

460:

458:

454:

450:

444:

442:

440:

436:

429:

423:

421:

419:

417:

415:

413:

411:

409:

405:

399:

395:

392:

390:

387:

386:

382:

378:

374:

370:

367:

365:

361:

357:

354:

352:

348:

344:

341:

339:

335:

331:

328:

325:

322:

319:

316:

313:

310:

309:

305:

303:

301:

293:

291:

287:

285:

281:

277:

273:

269:

268:Riviera Radio

265:

258:Personal life

257:

255:

253:

248:

244:

239:

237:

236:

231:

227:

223:

219:

215:

211:

202:

200:

197:

193:

188:

186:

182:

178:

173:

171:

166:

163:

162:

156:

152:

148:

143:

141:

136:

129:

127:

125:

117:

115:

113:

109:

105:

101:

92:

88:

85:

81:

77:

73:

65:

61:

57:

40:

36:

32:

27:

20:

612:

604:

596:

563:

558:

550:

534:

529:

522:Bob Beckman.

517:

497:

490:

477:

472:

464:

448:

427:

368:

355:

342:

329:

323:

317:

311:

297:

288:

261:

252:Black Monday

246:

240:

233:

229:

225:

221:

218:Black Monday

210:The Downwave

209:

206:

194:, after the

189:

184:

174:

167:

159:

144:

139:

137:

133:

121:

111:

108:The Downwave

107:

99:

98:

90:

87:The Downwave

86:

68:(2007-12-06)

56:New York, US

638:1934 births

633:2007 deaths

356:Powertiming

280:Monte Carlo

110:(1983) and

23:Bob Beckman

627:Categories

572:1852651105

400:References

377:0948035463

364:1852651245

351:1852651105

338:0283996730

230:Housequake

118:Early life

75:Occupation

48:1934-08-25

551:The Times

535:The Times

465:The Times

449:The Times

428:The Times

247:The Times

243:Cassandra

235:The Times

151:Hammerson

589:Archived

383:See also

220:but the

170:Barbican

161:Taxation

124:New York

89:(1983),

155:shorted

570:

505:

375:

362:

349:

336:

300:cancer

272:London

264:Monaco

192:FIMBRA

93:(1988)

294:Death

276:Paris

181:TV-am

568:ISBN

503:ISBN

373:ISBN

360:ISBN

347:ISBN

334:ISBN

63:Died

38:Born

177:LBC

629::

595:.

578:^

542:^

456:^

438:^

407:^

278:,

274:,

187:.

511:.

50:)

46:(

Text is available under the Creative Commons Attribution-ShareAlike License. Additional terms may apply.