79:

17:

70:

465:

theory, cumulative probabilities are transformed, rather than the probabilities themselves. This leads to the aforementioned overweighting of extreme events which occur with small probability, rather than to an overweighting of all small probability events. The modification helps to avoid a violation

332:

106:

with a value function that depends on relative payoff, and replacing cumulative probabilities with weighted cumulative probabilities. In the general case, this leads to the following formula for subjective utility of a risky outcome described by probability measure

86:

The main observation of CPT (and its predecessor prospect theory) is that people tend to think of possible outcomes usually relative to a certain reference point (often the status quo) rather than to the final status, a phenomenon which is called

73:

A typical value function in

Prospect Theory and Cumulative Prospect Theory. It assigns values to possible outcomes of a lottery. The value function is asymmetric and steeper for losses than gains indicating that losses outweigh gains.

95:). Finally, people tend to overweight extreme events, but underweight "average" events. The last point is in contrast to Prospect Theory which assumes that people overweight unlikely events, independently of their relative outcomes.

91:. Moreover, they have different risk attitudes towards gains (i.e. outcomes above the reference point) and losses (i.e. outcomes below the reference point) and care generally more about potential losses than potential gains (

54:

132:

431:

453:, is the cumulative probability. This generalizes the original formulation by Tversky and Kahneman from finitely many distinct outcomes to infinite (i.e., continuous) outcomes.

451:

374:

354:

125:

517:

Rieger, M., Wang, M. & Hens, T. (2017). Estimating

Cumulative Prospect Theory Parameters from an International Survey. Theory and Decision, 82, 4, 567-596.

478:

Cumulative prospect theory has been applied to a diverse range of situations which appear inconsistent with standard economic rationality, in particular the

470:

and makes the generalization to arbitrary outcome distributions easier. CPT is, therefore, an improvement over

Prospect Theory on theoretical grounds.

82:

A typical weighting function in

Cumulative Prospect Theory. It transforms objective cumulative probabilities into subjective cumulative probabilities.

501:

Parameters for cumulative prospect theory have been estimated for a large number of countries, demonstrating the broad validity of the theory.

327:{\displaystyle U(p):=\int _{-\infty }^{0}v(x){\frac {d}{dx}}(w(F(x)))\,dx+\int _{0}^{+\infty }v(x){\frac {d}{dx}}(-w(1-F(x)))\,dx,}

462:

50:

579:

99:

78:

379:

569:

526:

Tversky, Amos; Kahneman, Daniel (1992). "Advances in prospect theory: Cumulative representation of uncertainty".

491:

88:

574:

564:

483:

16:

53:

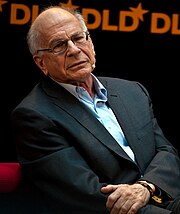

theory but not applied to the probabilities of individual outcomes. In 2002, Daniel

Kahneman received the

479:

467:

58:

543:

535:

495:

103:

487:

46:

42:

38:

33:) is a model for descriptive decisions under risk and uncertainty which was introduced by

20:

49:

is that weighting is applied to the cumulative probability distribution function, as in

436:

359:

339:

110:

102:

by replacing final wealth with payoffs relative to the reference point, replacing the

69:

558:

92:

547:

34:

41:

in 1992 (Tversky, Kahneman, 1992). It is a further development and variant of

539:

433:, i.e. the integral of the probability measure over all values up to

61:, in particular the development of Cumulative Prospect Theory (CPT).

55:

Bank of Sweden Prize in

Economic Sciences in Memory of Alfred Nobel

45:. The difference between this version and the original version of

77:

68:

356:

is the value function (typical form shown in Figure 1),

98:

CPT incorporates these observations in a modification of

461:

The main modification to prospect theory is that, as in

376:

is the weighting function (as sketched in Figure 2) and

439:

382:

362:

342:

135:

113:

445:

425:

368:

348:

326:

119:

426:{\displaystyle F(x):=\int _{-\infty }^{x}\,dp}

8:

438:

416:

410:

402:

381:

361:

341:

314:

263:

242:

237:

223:

181:

163:

155:

134:

112:

490:, various gambling and betting puzzles,

15:

510:

7:

406:

246:

159:

14:

457:Differences from prospect theory

528:Journal of Risk and Uncertainty

463:rank-dependent expected utility

51:rank-dependent expected utility

392:

386:

311:

308:

305:

299:

287:

278:

260:

254:

220:

217:

214:

208:

202:

196:

178:

172:

145:

139:

1:

596:

27:Cumulative prospect theory

492:intertemporal consumption

57:for his contributions to

484:asset allocation puzzle

100:expected utility theory

447:

427:

370:

350:

328:

121:

83:

75:

23:

480:equity premium puzzle

448:

428:

371:

351:

329:

122:

81:

72:

19:

468:stochastic dominance

437:

380:

360:

340:

133:

111:

65:Outline of the model

59:behavioral economics

415:

250:

168:

580:1992 introductions

540:10.1007/BF00122574

443:

423:

398:

366:

346:

324:

233:

151:

117:

84:

76:

24:

446:{\displaystyle x}

369:{\displaystyle w}

349:{\displaystyle v}

276:

194:

120:{\displaystyle p}

587:

570:Finance theories

551:

518:

515:

496:endowment effect

452:

450:

449:

444:

432:

430:

429:

424:

414:

409:

375:

373:

372:

367:

355:

353:

352:

347:

333:

331:

330:

325:

277:

275:

264:

249:

241:

195:

193:

182:

167:

162:

126:

124:

123:

118:

104:utility function

595:

594:

590:

589:

588:

586:

585:

584:

575:Prospect theory

565:Decision theory

555:

554:

525:

522:

521:

516:

512:

507:

488:status quo bias

476:

466:of first order

459:

435:

434:

378:

377:

358:

357:

338:

337:

268:

186:

131:

130:

109:

108:

67:

47:prospect theory

43:prospect theory

39:Daniel Kahneman

21:Daniel Kahneman

12:

11:

5:

593:

591:

583:

582:

577:

572:

567:

557:

556:

553:

552:

534:(4): 297–323.

520:

519:

509:

508:

506:

503:

475:

472:

458:

455:

442:

422:

419:

413:

408:

405:

401:

397:

394:

391:

388:

385:

365:

345:

323:

320:

317:

313:

310:

307:

304:

301:

298:

295:

292:

289:

286:

283:

280:

274:

271:

267:

262:

259:

256:

253:

248:

245:

240:

236:

232:

229:

226:

222:

219:

216:

213:

210:

207:

204:

201:

198:

192:

189:

185:

180:

177:

174:

171:

166:

161:

158:

154:

150:

147:

144:

141:

138:

116:

89:framing effect

66:

63:

13:

10:

9:

6:

4:

3:

2:

592:

581:

578:

576:

573:

571:

568:

566:

563:

562:

560:

549:

545:

541:

537:

533:

529:

524:

523:

514:

511:

504:

502:

499:

497:

493:

489:

485:

481:

473:

471:

469:

464:

456:

454:

440:

420:

417:

411:

403:

399:

395:

389:

383:

363:

343:

334:

321:

318:

315:

302:

296:

293:

290:

284:

281:

272:

269:

265:

257:

251:

243:

238:

234:

230:

227:

224:

211:

205:

199:

190:

187:

183:

175:

169:

164:

156:

152:

148:

142:

136:

128:

114:

105:

101:

96:

94:

93:loss aversion

90:

80:

71:

64:

62:

60:

56:

52:

48:

44:

40:

36:

32:

28:

22:

18:

531:

527:

513:

500:

477:

474:Applications

460:

335:

129:

97:

85:

35:Amos Tversky

30:

26:

25:

559:Categories

505:References

407:∞

404:−

400:∫

294:−

282:−

247:∞

235:∫

160:∞

157:−

153:∫

494:and the

548:8456150

546:

486:, the

482:, the

336:where

544:S2CID

37:and

536:doi

31:CPT

561::

542:.

530:.

498:.

396::=

149::=

127::

550:.

538::

532:5

441:x

421:p

418:d

412:x

393:)

390:x

387:(

384:F

364:w

344:v

322:,

319:x

316:d

312:)

309:)

306:)

303:x

300:(

297:F

291:1

288:(

285:w

279:(

273:x

270:d

266:d

261:)

258:x

255:(

252:v

244:+

239:0

231:+

228:x

225:d

221:)

218:)

215:)

212:x

209:(

206:F

203:(

200:w

197:(

191:x

188:d

184:d

179:)

176:x

173:(

170:v

165:0

146:)

143:p

140:(

137:U

115:p

29:(

Text is available under the Creative Commons Attribution-ShareAlike License. Additional terms may apply.