31:

3677:. A more recent extension for handling cluster volatility, negative interest rates and different distributions is the so-called "CIR #" by Orlando, Mininni and Bufalo (2018, 2019, 2020, 2021, 2023) and a simpler extension focussing on negative interest rates was proposed by Di Francesco and Kamm (2021, 2022), which are referred to as the CIR- and CIR-- models.

91:

3064:

3661:

for bond prices. Time varying functions replacing coefficients can be introduced in the model in order to make it consistent with a pre-assigned term structure of interest rates and possibly volatilities. The most general approach is in

Maghsoodi (1996). A more tractable approach is in Brigo and

1835:

1542:

2746:

1147:

2000:

2892:

3437:

2909:

672:) also becomes very small, which dampens the effect of the random shock on the rate. Consequently, when the rate gets close to zero, its evolution becomes dominated by the drift factor, which pushes the rate upwards (towards

2174:

3587:

1692:

236:

2530:

2242:

1415:

2557:

878:

3237:

3643:

1207:

1874:

4885:

2290:

928:

799:

2050:

1637:

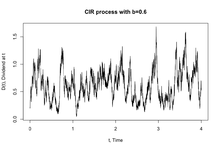

2344:

670:

523:

2094:

1590:

988:

606:

1882:

1347:

4806:

2413:

2773:

3248:

717:

5420:

3095:

1259:

977:

3059:{\displaystyle {\frac {r_{t+\Delta t}-r_{t}}{{\sqrt {r}}_{t}}}={\frac {ab\Delta t}{{\sqrt {r}}_{t}}}-a{\sqrt {r}}_{t}\Delta t+\sigma \,{\sqrt {\Delta t}}\varepsilon _{t},}

1680:

1404:

3738:

Yuliya

Mishura, Andrey Pilipenko & Anton Yurchenko-Tytarenko(10 Jan 2024): Low-dimensional Cox-Ingersoll-Ross process, Stochastics, DOI:10.1080/17442508.2023.2300291

1301:

438:

396:

331:

5244:

4253:

2374:

636:

266:

123:

5847:

4840:

5377:

5357:

2550:

1367:

563:

543:

482:

462:

375:

355:

310:

290:

5761:

4794:

5678:

4339:

Orlando, Giuseppe; Mininni, Rosa Maria; Bufalo, Michele (2020). "Forecasting interest rates through

Vasicek and CIR models: A partitioning approach".

5688:

5362:

4800:

3867:

Orlando, Giuseppe; Mininni, Rosa Maria; Bufalo, Michele (1 January 2019). "A new approach to forecast market interest rates through the CIR model".

5372:

5730:

2102:

1830:{\displaystyle {\partial p \over {\partial t}}+{\partial \over {\partial r}}={1 \over {2}}\sigma ^{2}{\partial ^{2} \over {\partial r^{2}}}(rp)}

5445:

5627:

3715:

3445:

5917:

5907:

5430:

4407:

4291:

3851:

5817:

5781:

139:

5734:

6085:

5822:

4730:

885:

4932:

4833:

4725:

3662:

Mercurio (2001b) where an external time-dependent shift is added to the model for consistency with an input term structure of rates.

1537:{\displaystyle f(r_{\infty };a,b,\sigma )={\frac {\beta ^{\alpha }}{\Gamma (\alpha )}}r_{\infty }^{\alpha -1}e^{-\beta r_{\infty }},}

5887:

5465:

4206:

5738:

5722:

2420:

2185:

5932:

5637:

4857:

130:

2292:, this density describes a gamma distribution. Therefore, the asymptotic distribution of the CIR model is a gamma distribution.

5837:

5802:

5771:

5766:

5405:

5202:

5119:

2741:{\displaystyle \operatorname {Var} =r_{0}{\frac {\sigma ^{2}}{a}}(e^{-at}-e^{-2at})+{\frac {b\sigma ^{2}}{2a}}(1-e^{-at})^{2}.}

5776:

5104:

720:

79:

6116:

5400:

5207:

4720:

4596:

5126:

808:

5862:

5742:

6090:

5867:

5703:

5602:

5587:

4999:

4915:

4826:

5877:

5513:

3910:

Orlando, Giuseppe; Mininni, Rosa Maria; Bufalo, Michele (19 August 2019). "Interest rates calibration with a CIR model".

5872:

5475:

5059:

5004:

4920:

4536:

3654:

5807:

5797:

5440:

5410:

3147:

3834:

Orlando, Giuseppe; Mininni, Rosa Maria; Bufalo, Michele (2018). "A New

Approach to CIR Short-Term Rates Modelling".

3595:

3141:, a bond may be priced using this interest rate process. The bond price is exponential affine in the interest rate:

1158:

6126:

6121:

5812:

4977:

4875:

4576:

5523:

5099:

4880:

6131:

5892:

5693:

5607:

5592:

4982:

4400:

1843:

5726:

5612:

5034:

2250:

891:

5114:

5089:

4735:

2306:

441:

71:

59:

5832:

5415:

4950:

1142:{\displaystyle f(r_{t+T};r_{t},a,b,\sigma )=c\,e^{-u-v}\left({\frac {v}{u}}\right)^{q/2}I_{q}(2{\sqrt {uv}}),}

750:

2008:

1995:{\displaystyle a(b-r)p_{\infty }={1 \over {2}}\sigma ^{2}\left(p_{\infty }+r{dp_{\infty } \over {dr}}\right)}

1595:

6111:

6027:

6017:

5708:

5490:

5229:

5094:

4905:

2315:

641:

494:

5312:

2887:{\displaystyle r_{t+\Delta t}-r_{t}=a(b-r_{t})\,\Delta t+\sigma \,{\sqrt {r_{t}\Delta t}}\varepsilon _{t},}

2055:

1551:

571:

5969:

5897:

5156:

4669:

4571:

3658:

3432:{\displaystyle A(t,T)=\left({\frac {2he^{(a+h)(T-t)/2}}{2h+(a+h)(e^{h(T-t)}-1)}}\right)^{2ab/\sigma ^{2}}}

2757:

1683:

1306:

4053:"Time series forecasting with the CIR# model: from hectic markets sentiments to regular seasonal tourism"

3749:

2379:

5992:

5974:

5954:

5949:

5668:

5500:

5480:

5327:

5270:

5109:

5019:

4715:

4679:

4516:

4475:

4247:

4012:"Interest rates forecasting: Between Hull and White and the CIR#—How to make a single-factor model work"

3666:

3116:

67:

5460:

3686:

682:

3073:

6067:

6022:

6012:

5753:

5698:

5673:

5642:

5622:

5382:

5367:

5234:

4393:

1212:

39:

4216:

Cox, J.C., J.E. Ingersoll and S.A. Ross (1985). "A Theory of the Term

Structure of Interest Rates".

4052:

933:

6062:

5902:

5827:

5632:

5392:

5302:

5192:

4485:

3138:

4303:"A deterministic-shift extension of analytically tractable and time-homogeneous short rate models"

3789:"A deterministic–shift extension of analytically–tractable and time–homogeneous short–rate models"

6032:

5997:

5912:

5882:

5652:

5647:

5470:

5307:

4972:

4910:

4849:

4561:

4374:

4348:

4322:

4235:

4125:

4105:

3992:

3966:

3935:

3892:

3816:

3105:

1658:

1407:

1382:

488:

5713:

1264:

401:

4261:

Maghsoodi, Y. (1996). "Solution of the extended CIR Term

Structure and Bond Option Valuation".

380:

315:

6052:

5857:

5508:

5265:

5182:

5151:

5044:

5024:

5014:

4870:

4865:

4768:

4694:

4546:

4468:

4366:

4287:

4202:

4074:

4033:

3984:

3927:

3884:

3847:

3808:

3769:

5718:

5455:

4302:

6072:

5959:

5842:

5212:

5187:

5136:

5064:

4987:

4940:

4758:

4629:

4601:

4541:

4526:

4358:

4314:

4270:

4227:

4166:

4156:

4115:

4064:

4023:

3976:

3919:

3876:

3839:

3800:

3761:

51:

2352:

614:

244:

101:

6037:

5937:

5922:

5683:

5617:

5295:

5239:

5222:

4967:

4773:

4763:

4566:

4556:

4551:

4480:

3838:. Contributions to Management Science. Springer International Publishing. pp. 35–43.

5852:

5084:

6042:

6007:

5927:

5533:

5280:

5197:

5166:

5161:

5141:

5131:

5074:

5069:

5049:

5029:

4994:

4962:

4945:

4674:

4659:

4624:

4611:

4586:

4490:

4458:

4427:

4274:

4191:

3954:

3765:

3123:

2535:

1352:

548:

528:

467:

447:

360:

340:

295:

275:

269:

126:

6105:

5944:

5485:

5322:

5317:

5275:

5217:

5039:

4955:

4895:

4778:

4753:

4664:

4649:

4639:

4591:

4531:

4521:

4378:

4198:

4145:"On the Deterministic-Shift Extended CIR Model in a Negative Interest Rate Framework"

4129:

3996:

3939:

3896:

3691:

75:

47:

4326:

3955:"Forecasting interest rates through Vasicek and CIR models: A partitioning approach"

3820:

6002:

5964:

5518:

5450:

5339:

5334:

5146:

5079:

5054:

4890:

4689:

4634:

4581:

4511:

4437:

4218:

745:

The distribution of future values of a CIR process can be computed in closed form:

728:

673:

5582:

6047:

5566:

5561:

5556:

5546:

5349:

5290:

5285:

5249:

5009:

4900:

4745:

4684:

4644:

4619:

4495:

4463:

4453:

4416:

3843:

63:

55:

4333:

4120:

4093:

525:, avoids the possibility of negative interest rates for all positive values of

6057:

5597:

5541:

5425:

3696:

3674:

3670:

4370:

4078:

4037:

3988:

3931:

3923:

3888:

3880:

3812:

3773:

5551:

4432:

4069:

3716:"A Theory of the Term Structure of Interest Rates - The Econometric Society"

3665:

A significant extension of the CIR model to the case of stochastic mean and

334:

4284:

Interest Rate Models — Theory and

Practice with Smile, Inflation and Credit

2169:{\displaystyle {\alpha -1 \over {r}}-\beta ={d \over {dr}}\log p_{\infty }}

30:

17:

54:) as it describes interest rate movements as driven by only one source of

4699:

4654:

4161:

4144:

4171:

3582:{\displaystyle B(t,T)={\frac {2(e^{h(T-t)}-1)}{2h+(a+h)(e^{h(T-t)}-1)}}}

90:

5378:

Generalized autoregressive conditional heteroskedasticity (GARCH) model

4818:

4318:

4239:

3804:

3750:"Solution of the Extended Cir Term Structure and Bond Option Valuation"

724:

719:, the Feller square-root process can be obtained from the square of an

464:, with speed of adjustment governed by the strictly positive parameter

4362:

4028:

4011:

3980:

3953:

Orlando, Giuseppe; Mininni, Rosa Maria; Bufalo, Michele (July 2020).

3788:

3097:

is n.i.i.d. (0,1). This equation can be used for a linear regression.

231:{\displaystyle dr_{t}=a(b-r_{t})\,dt+\sigma {\sqrt {r_{t}}}\,dW_{t},}

4231:

4353:

4110:

3971:

1379:

Due to mean reversion, as time becomes large, the distribution of

89:

29:

4822:

4389:

4385:

565:. An interest rate of zero is also precluded if the condition

27:

Stochastic model for the evolution of financial interest rates

2525:{\displaystyle \operatorname {E} =r_{0}e^{-at}+b(1-e^{-at})}

2237:{\displaystyle p_{\infty }\propto r^{\alpha -1}e^{-\beta r}}

727:

and possesses a stationary distribution. It is used in the

5358:

Autoregressive conditional heteroskedasticity (ARCH) model

4334:

Open Source library implementing the CIR process in python

4094:"How to handle negative interest rates in a CIR framework"

440:, is exactly the same as in the Vasicek model. It ensures

1349:

is a modified Bessel function of the first kind of order

4886:

Independent and identically distributed random variables

98:

The CIR model describes the instantaneous interest rate

3119:

of the CIR process can be achieved using two variants:

5363:

Autoregressive integrated moving average (ARIMA) model

873:{\displaystyle c={\frac {2a}{(1-e^{-aT})\sigma ^{2}}}}

4807:

Securities

Industry and Financial Markets Association

3598:

3448:

3251:

3150:

3076:

2912:

2776:

2560:

2538:

2423:

2415:; otherwise it can occasionally touch the zero point,

2382:

2355:

2318:

2253:

2188:

2105:

2058:

2011:

1885:

1846:

1695:

1661:

1598:

1554:

1418:

1385:

1355:

1309:

1267:

1215:

1161:

991:

936:

894:

811:

753:

685:

644:

617:

574:

551:

531:

497:

470:

450:

404:

383:

363:

343:

318:

298:

278:

247:

142:

104:

5985:

5790:

5752:

5661:

5575:

5532:

5499:

5391:

5348:

5258:

5175:

4931:

4856:

4787:

4744:

4708:

4610:

4504:

4446:

4092:Di Francesco, Marco; Kamm, Kevin (4 October 2021).

357:corresponds to the speed of adjustment to the mean

4190:

3637:

3581:

3431:

3231:

3089:

3058:

2886:

2740:

2544:

2524:

2407:

2368:

2338:

2284:

2236:

2168:

2088:

2044:

1994:

1868:

1829:

1674:

1631:

1584:

1536:

1398:

1361:

1341:

1295:

1253:

1201:

1141:

971:

922:

872:

793:

711:

664:

630:

600:

557:

537:

517:

476:

456:

432:

390:

369:

349:

325:

304:

284:

260:

230:

117:

4057:Technological and Economic Development of Economy

4051:Orlando, Giuseppe; Bufalo, Michele (2023-07-14).

4010:Orlando, Giuseppe; Bufalo, Michele (2021-05-26).

3228:

5245:Stochastic chains with memory of variable length

2764:The continuous SDE can be discretized as follows

930:degrees of freedom and non-centrality parameter

444:of the interest rate towards the long run value

3232:{\displaystyle P(t,T)=A(t,T)e^{-B(t,T)r_{t}}\!}

979:. Formally the probability density function is:

3787:Brigo, Damiano; Mercurio, Fabio (2001-07-01).

3638:{\displaystyle h={\sqrt {a^{2}+2\sigma ^{2}}}}

1202:{\displaystyle q={\frac {2ab}{\sigma ^{2}}}-1}

272:(modelling the random market risk factor) and

4834:

4401:

2096:and rearranging terms leads to the equation:

8:

4252:: CS1 maint: multiple names: authors list (

1840:Our interest is in the particular case when

638:) is close to zero, the standard deviation (

58:. The model can be used in the valuation of

1869:{\displaystyle \partial _{t}p\rightarrow 0}

5373:Autoregressive–moving-average (ARMA) model

4841:

4827:

4819:

4795:Commercial Mortgage Securities Association

4408:

4394:

4386:

4286:(2nd ed. 2006 ed.). Springer Verlag.

4149:International Journal of Financial Studies

2285:{\displaystyle p_{\infty }\in (0,\infty ]}

1876:, which leads to the simplified equation:

1643:

923:{\displaystyle {\frac {4ab}{\sigma ^{2}}}}

4352:

4170:

4160:

4143:Di Francesco, Marco; Kamm, Kevin (2022).

4119:

4109:

4068:

4027:

3970:

3627:

3611:

3605:

3597:

3546:

3483:

3470:

3447:

3421:

3412:

3402:

3365:

3322:

3291:

3278:

3250:

3220:

3194:

3149:

3081:

3075:

3047:

3033:

3032:

3014:

3007:

2992:

2985:

2968:

2957:

2950:

2942:

2920:

2913:

2911:

2875:

2857:

2851:

2850:

2837:

2828:

2803:

2781:

2775:

2729:

2713:

2683:

2673:

2652:

2633:

2615:

2609:

2603:

2587:

2574:

2559:

2537:

2507:

2476:

2466:

2450:

2437:

2422:

2399:

2381:

2360:

2354:

2328:

2322:

2317:

2258:

2252:

2222:

2206:

2193:

2187:

2160:

2140:

2135:

2119:

2106:

2104:

2080:

2071:

2057:

2036:

2027:

2010:

1977:

1970:

1960:

1948:

1933:

1922:

1917:

1908:

1884:

1851:

1845:

1806:

1798:

1792:

1786:

1780:

1769:

1764:

1724:

1719:

1706:

1696:

1694:

1666:

1660:

1623:

1614:

1597:

1576:

1567:

1553:

1523:

1512:

1496:

1491:

1465:

1459:

1429:

1417:

1390:

1384:

1354:

1326:

1314:

1308:

1281:

1266:

1239:

1229:

1214:

1185:

1168:

1160:

1123:

1111:

1097:

1093:

1079:

1059:

1054:

1021:

1002:

990:

957:

947:

935:

912:

895:

893:

861:

842:

818:

810:

773:

758:

752:

708:

702:

684:

654:

648:

643:

622:

616:

597:

591:

573:

550:

530:

507:

501:

496:

469:

449:

421:

403:

387:

382:

362:

342:

322:

317:

297:

277:

252:

246:

219:

211:

203:

197:

184:

175:

150:

141:

109:

103:

4801:International Capital Market Association

4301:Brigo, Damiano; Fabio Mercurio (2001b).

794:{\displaystyle r_{t+T}={\frac {Y}{2c}},}

3707:

3653:The CIR model uses a special case of a

2045:{\displaystyle \alpha =2ab/\sigma ^{2}}

1632:{\displaystyle \alpha =2ab/\sigma ^{2}}

611:is met. More generally, when the rate (

5679:Doob's martingale convergence theorems

4282:Damiano Brigo; Fabio Mercurio (2001).

4245:

4193:Options, Futures and Other Derivatives

2376:the process will never touch zero, if

2339:{\displaystyle \sigma {\sqrt {r_{t}}}}

1655:To derive the asymptotic distribution

665:{\displaystyle \sigma {\sqrt {r_{t}}}}

518:{\displaystyle \sigma {\sqrt {r_{t}}}}

50:. It is a type of "one factor model" (

5431:Constant elasticity of variance (CEV)

5421:Chan–Karolyi–Longstaff–Sanders (CKLS)

2089:{\displaystyle \beta =2a/\sigma ^{2}}

1648:Derivation of asymptotic distribution

1585:{\displaystyle \beta =2a/\sigma ^{2}}

601:{\displaystyle 2ab\geq \sigma ^{2}\,}

7:

3836:New Methods in Fixed Income Modeling

1342:{\displaystyle I_{q}(2{\sqrt {uv}})}

886:non-central chi-squared distribution

4731:Commercial mortgage-backed security

2408:{\displaystyle 2ab\geq \sigma ^{2}}

1682:for the CIR model, we must use the

34:Three trajectories of CIR processes

5918:Skorokhod's representation theorem

5699:Law of large numbers (weak/strong)

4726:Collateralized mortgage obligation

4275:10.1111/j.1467-9965.1996.tb00113.x

3766:10.1111/j.1467-9965.1996.tb00113.x

3748:Maghsoodi, Yoosef (January 1996).

3035:

3020:

2977:

2927:

2863:

2838:

2788:

2424:

2276:

2259:

2194:

2161:

1971:

1949:

1909:

1848:

1799:

1789:

1725:

1721:

1707:

1699:

1667:

1524:

1492:

1472:

1430:

1391:

25:

5888:Martingale representation theorem

1410:with the probability density of:

712:{\displaystyle 4ab=\sigma ^{2}\,}

398:to volatility. The drift factor,

5933:Stochastic differential equation

5823:Doob's optional stopping theorem

5818:Doob–Meyer decomposition theorem

3869:Studies in Economics and Finance

3090:{\displaystyle \varepsilon _{t}}

731:to model stochastic volatility.

131:stochastic differential equation

5803:Convergence of random variables

5689:Fisher–Tippett–Gnedenko theorem

1254:{\displaystyle u=cr_{t}e^{-aT}}

62:. It was introduced in 1985 by

5401:Binomial options pricing model

4721:Collateralized debt obligation

4597:Reverse convertible securities

3573:

3562:

3550:

3539:

3536:

3524:

3510:

3499:

3487:

3476:

3464:

3452:

3392:

3381:

3369:

3358:

3355:

3343:

3319:

3307:

3304:

3292:

3267:

3255:

3213:

3201:

3187:

3175:

3166:

3154:

2834:

2815:

2726:

2700:

2667:

2626:

2593:

2567:

2519:

2494:

2456:

2430:

2279:

2267:

1901:

1889:

1860:

1824:

1815:

1758:

1752:

1740:

1734:

1481:

1475:

1453:

1422:

1336:

1320:

1133:

1117:

1045:

995:

972:{\displaystyle 2cr_{t}e^{-aT}}

854:

829:

427:

408:

181:

162:

44:Cox–Ingersoll–Ross (CIR) model

1:

5868:Kolmogorov continuity theorem

5704:Law of the iterated logarithm

5873:Kolmogorov extension theorem

5552:Generalized queueing network

5060:Interacting particle systems

2312:Level dependent volatility (

5005:Continuous-time random walk

4537:Contingent convertible bond

3912:The Journal of Risk Finance

3844:10.1007/978-3-319-95285-7_2

3655:basic affine jump diffusion

2179:Integrating shows us that:

1675:{\displaystyle p_{\infty }}

1399:{\displaystyle r_{\infty }}

129:square-root process, whose

46:describes the evolution of

6148:

6013:Extreme value theory (EVT)

5813:Doob decomposition theorem

5105:Ornstein–Uhlenbeck process

4876:Chinese restaurant process

4577:Inverse floating rate note

4197:. Upper Saddle River, NJ:

4121:10.1007/s40324-021-00267-w

3720:www.econometricsociety.org

1296:{\displaystyle v=cr_{t+T}}

721:Ornstein–Uhlenbeck process

433:{\displaystyle a(b-r_{t})}

80:Ornstein–Uhlenbeck_process

6081:

5893:Optional stopping theorem

5694:Large deviation principle

5446:Heath–Jarrow–Morton (HJM)

5383:Moving-average (MA) model

5368:Autoregressive (AR) model

5193:Hidden Markov model (HMM)

5127:Schramm–Loewner evolution

4423:

4307:Finance & Stochastics

391:{\displaystyle \sigma \,}

326:{\displaystyle \sigma \,}

60:interest rate derivatives

5808:Doléans-Dade exponential

5638:Progressively measurable

5436:Cox–Ingersoll–Ross (CIR)

4736:Mortgage-backed security

4505:Types of bonds by payout

4447:Types of bonds by issuer

3924:10.1108/JRF-05-2019-0080

3881:10.1108/SEF-03-2019-0116

3657:, which still permits a

6028:Mathematical statistics

6018:Large deviations theory

5848:Infinitesimal generator

5709:Maximal ergodic theorem

5628:Piecewise-deterministic

5230:Random dynamical system

5095:Markov additive process

4070:10.3846/tede.2023.19294

3793:Finance and Stochastics

3673:(1996) and is known as

3139:no-arbitrage assumption

2532:, so long term mean is

1374:Asymptotic distribution

74:as an extension of the

5863:Karhunen–Loève theorem

5798:Cameron–Martin formula

5762:Burkholder–Davis–Gundy

5157:Variance gamma process

4670:Option-adjusted spread

4572:Inflation-indexed bond

4341:Journal of Forecasting

4189:Hull, John C. (2003).

4016:Journal of Forecasting

3959:Journal of Forecasting

3659:closed-form expression

3639:

3583:

3433:

3233:

3091:

3060:

2900:which is equivalent to

2888:

2758:Ordinary least squares

2742:

2546:

2526:

2409:

2370:

2340:

2286:

2238:

2170:

2090:

2046:

1996:

1870:

1831:

1684:Fokker-Planck equation

1676:

1633:

1586:

1538:

1400:

1363:

1343:

1297:

1255:

1203:

1143:

973:

924:

874:

795:

713:

666:

632:

602:

559:

539:

519:

478:

458:

434:

392:

371:

351:

327:

306:

286:

262:

232:

119:

95:

35:

6117:Fixed income analysis

5993:Actuarial mathematics

5955:Uniform integrability

5950:Stratonovich integral

5878:Lévy–Prokhorov metric

5782:Marcinkiewicz–Zygmund

5669:Central limit theorem

5271:Gaussian random field

5100:McKean–Vlasov process

5020:Dyson Brownian motion

4881:Galton–Watson process

4716:Asset-backed security

4680:Weighted-average life

4517:Auction rate security

3667:stochastic volatility

3640:

3584:

3434:

3234:

3117:Stochastic simulation

3102:Martingale estimation

3092:

3061:

2889:

2743:

2547:

2527:

2410:

2371:

2369:{\displaystyle r_{0}}

2341:

2287:

2239:

2171:

2091:

2047:

1997:

1871:

1832:

1677:

1634:

1587:

1539:

1401:

1364:

1344:

1298:

1256:

1204:

1144:

974:

925:

875:

796:

714:

667:

633:

631:{\displaystyle r_{t}}

603:

560:

540:

520:

479:

459:

435:

393:

372:

352:

328:

307:

287:

263:

261:{\displaystyle W_{t}}

233:

120:

118:{\displaystyle r_{t}}

93:

68:Jonathan E. Ingersoll

33:

6068:Time series analysis

6023:Mathematical finance

5908:Reflection principle

5235:Regenerative process

5035:Fleming–Viot process

4850:Stochastic processes

4709:Securitized products

4263:Mathematical Finance

4162:10.3390/ijfs10020038

3754:Mathematical Finance

3596:

3446:

3249:

3148:

3074:

2910:

2774:

2558:

2536:

2421:

2380:

2353:

2316:

2251:

2186:

2103:

2056:

2009:

1883:

1844:

1693:

1659:

1596:

1552:

1416:

1383:

1353:

1307:

1265:

1213:

1159:

989:

934:

892:

809:

751:

683:

642:

615:

572:

549:

529:

495:

468:

448:

402:

381:

361:

341:

316:

296:

276:

245:

140:

102:

40:mathematical finance

6063:Stochastic analysis

5903:Quadratic variation

5898:Prokhorov's theorem

5833:Feynman–Kac formula

5303:Markov random field

4951:Birth–death process

4486:Infrastructure bond

2349:For given positive

1507:

740:Future distribution

6033:Probability theory

5913:Skorokhod integral

5883:Malliavin calculus

5466:Korn-Kreer-Lenssen

5350:Time series models

5313:Pitman–Yor process

4562:Floating rate note

4319:10.1007/PL00013541

4183:Further References

3805:10.1007/PL00013541

3635:

3579:

3429:

3229:

3106:Maximum likelihood

3087:

3056:

2884:

2738:

2542:

2522:

2405:

2366:

2336:

2282:

2234:

2166:

2086:

2042:

1992:

1866:

1827:

1672:

1629:

1582:

1534:

1487:

1408:gamma distribution

1396:

1359:

1339:

1293:

1251:

1199:

1139:

969:

920:

870:

791:

709:

662:

628:

598:

555:

535:

515:

489:standard deviation

474:

454:

430:

388:

367:

347:

323:

302:

282:

258:

228:

115:

96:

36:

6127:Short-rate models

6122:Stochastic models

6099:

6098:

6053:Signal processing

5772:Doob's upcrossing

5767:Doob's martingale

5731:Engelbert–Schmidt

5674:Donsker's theorem

5608:Feller-continuous

5476:Rendleman–Bartter

5266:Dirichlet process

5183:Branching process

5152:Telegraph process

5045:Geometric process

5025:Empirical process

5015:Diffusion process

4871:Branching process

4866:Bernoulli process

4816:

4815:

4769:Exchangeable bond

4695:Yield to maturity

4547:Exchangeable bond

4469:Subordinated debt

4293:978-3-540-22149-4

3853:978-3-319-95284-0

3633:

3577:

3396:

3041:

3012:

2998:

2990:

2963:

2955:

2869:

2698:

2624:

2545:{\displaystyle b}

2334:

2297:

2296:

2148:

2124:

1985:

1927:

1813:

1774:

1732:

1714:

1485:

1362:{\displaystyle q}

1334:

1191:

1131:

1087:

918:

868:

786:

660:

558:{\displaystyle b}

538:{\displaystyle a}

513:

477:{\displaystyle a}

457:{\displaystyle b}

370:{\displaystyle b}

350:{\displaystyle a}

305:{\displaystyle b}

285:{\displaystyle a}

209:

16:(Redirected from

6139:

6132:Financial models

6073:Machine learning

5960:Usual hypotheses

5843:Girsanov theorem

5828:Dynkin's formula

5593:Continuous paths

5501:Actuarial models

5441:Garman–Kohlhagen

5411:Black–Karasinski

5406:Black–Derman–Toy

5393:Financial models

5259:Fields and other

5188:Gaussian process

5137:Sigma-martingale

4941:Additive process

4843:

4836:

4829:

4820:

4759:Convertible bond

4602:Zero-coupon bond

4542:Convertible bond

4527:Commercial paper

4410:

4403:

4396:

4387:

4382:

4363:10.1002/for.2642

4356:

4330:

4297:

4278:

4257:

4251:

4243:

4212:

4196:

4177:

4176:

4174:

4164:

4140:

4134:

4133:

4123:

4113:

4089:

4083:

4082:

4072:

4063:(4): 1216–1238.

4048:

4042:

4041:

4031:

4029:10.1002/for.2783

4022:(8): 1566–1580.

4007:

4001:

4000:

3981:10.1002/for.2642

3974:

3950:

3944:

3943:

3907:

3901:

3900:

3864:

3858:

3857:

3831:

3825:

3824:

3784:

3778:

3777:

3745:

3739:

3736:

3730:

3729:

3727:

3726:

3712:

3687:Hull–White model

3644:

3642:

3641:

3636:

3634:

3632:

3631:

3616:

3615:

3606:

3588:

3586:

3585:

3580:

3578:

3576:

3566:

3565:

3513:

3503:

3502:

3471:

3438:

3436:

3435:

3430:

3428:

3427:

3426:

3425:

3416:

3401:

3397:

3395:

3385:

3384:

3332:

3331:

3330:

3326:

3279:

3238:

3236:

3235:

3230:

3227:

3226:

3225:

3224:

3096:

3094:

3093:

3088:

3086:

3085:

3065:

3063:

3062:

3057:

3052:

3051:

3042:

3034:

3019:

3018:

3013:

3008:

2999:

2997:

2996:

2991:

2986:

2983:

2969:

2964:

2962:

2961:

2956:

2951:

2948:

2947:

2946:

2934:

2933:

2914:

2893:

2891:

2890:

2885:

2880:

2879:

2870:

2862:

2861:

2852:

2833:

2832:

2808:

2807:

2795:

2794:

2747:

2745:

2744:

2739:

2734:

2733:

2724:

2723:

2699:

2697:

2689:

2688:

2687:

2674:

2666:

2665:

2644:

2643:

2625:

2620:

2619:

2610:

2608:

2607:

2592:

2591:

2579:

2578:

2551:

2549:

2548:

2543:

2531:

2529:

2528:

2523:

2518:

2517:

2487:

2486:

2471:

2470:

2455:

2454:

2442:

2441:

2414:

2412:

2411:

2406:

2404:

2403:

2375:

2373:

2372:

2367:

2365:

2364:

2345:

2343:

2342:

2337:

2335:

2333:

2332:

2323:

2291:

2289:

2288:

2283:

2263:

2262:

2243:

2241:

2240:

2235:

2233:

2232:

2217:

2216:

2198:

2197:

2175:

2173:

2172:

2167:

2165:

2164:

2149:

2147:

2136:

2125:

2123:

2118:

2107:

2095:

2093:

2092:

2087:

2085:

2084:

2075:

2051:

2049:

2048:

2043:

2041:

2040:

2031:

2001:

1999:

1998:

1993:

1991:

1987:

1986:

1984:

1976:

1975:

1974:

1961:

1953:

1952:

1938:

1937:

1928:

1926:

1918:

1913:

1912:

1875:

1873:

1872:

1867:

1856:

1855:

1836:

1834:

1833:

1828:

1814:

1812:

1811:

1810:

1797:

1796:

1787:

1785:

1784:

1775:

1773:

1765:

1733:

1731:

1720:

1715:

1713:

1705:

1697:

1681:

1679:

1678:

1673:

1671:

1670:

1644:

1638:

1636:

1635:

1630:

1628:

1627:

1618:

1591:

1589:

1588:

1583:

1581:

1580:

1571:

1543:

1541:

1540:

1535:

1530:

1529:

1528:

1527:

1506:

1495:

1486:

1484:

1470:

1469:

1460:

1434:

1433:

1406:will approach a

1405:

1403:

1402:

1397:

1395:

1394:

1368:

1366:

1365:

1360:

1348:

1346:

1345:

1340:

1335:

1327:

1319:

1318:

1302:

1300:

1299:

1294:

1292:

1291:

1260:

1258:

1257:

1252:

1250:

1249:

1234:

1233:

1208:

1206:

1205:

1200:

1192:

1190:

1189:

1180:

1169:

1148:

1146:

1145:

1140:

1132:

1124:

1116:

1115:

1106:

1105:

1101:

1092:

1088:

1080:

1073:

1072:

1026:

1025:

1013:

1012:

978:

976:

975:

970:

968:

967:

952:

951:

929:

927:

926:

921:

919:

917:

916:

907:

896:

879:

877:

876:

871:

869:

867:

866:

865:

853:

852:

827:

819:

800:

798:

797:

792:

787:

785:

774:

769:

768:

718:

716:

715:

710:

707:

706:

671:

669:

668:

663:

661:

659:

658:

649:

637:

635:

634:

629:

627:

626:

607:

605:

604:

599:

596:

595:

564:

562:

561:

556:

544:

542:

541:

536:

524:

522:

521:

516:

514:

512:

511:

502:

483:

481:

480:

475:

463:

461:

460:

455:

439:

437:

436:

431:

426:

425:

397:

395:

394:

389:

376:

374:

373:

368:

356:

354:

353:

348:

337:. The parameter

332:

330:

329:

324:

311:

309:

308:

303:

291:

289:

288:

283:

267:

265:

264:

259:

257:

256:

237:

235:

234:

229:

224:

223:

210:

208:

207:

198:

180:

179:

155:

154:

124:

122:

121:

116:

114:

113:

52:short-rate model

21:

6147:

6146:

6142:

6141:

6140:

6138:

6137:

6136:

6102:

6101:

6100:

6095:

6077:

6038:Queueing theory

5981:

5923:Skorokhod space

5786:

5777:Kunita–Watanabe

5748:

5714:Sanov's theorem

5684:Ergodic theorem

5657:

5653:Time-reversible

5571:

5534:Queueing models

5528:

5524:Sparre–Anderson

5514:Cramér–Lundberg

5495:

5481:SABR volatility

5387:

5344:

5296:Boolean network

5254:

5240:Renewal process

5171:

5120:Non-homogeneous

5110:Poisson process

5000:Contact process

4963:Brownian motion

4933:Continuous time

4927:

4921:Maximal entropy

4852:

4847:

4817:

4812:

4783:

4774:Extendible bond

4764:Embedded option

4740:

4704:

4606:

4567:High-yield debt

4557:Fixed rate bond

4552:Extendible bond

4500:

4481:Government bond

4476:Distressed debt

4442:

4419:

4414:

4338:

4300:

4294:

4281:

4260:

4244:

4232:10.2307/1911242

4215:

4209:

4188:

4185:

4180:

4142:

4141:

4137:

4091:

4090:

4086:

4050:

4049:

4045:

4009:

4008:

4004:

3952:

3951:

3947:

3909:

3908:

3904:

3866:

3865:

3861:

3854:

3833:

3832:

3828:

3786:

3785:

3781:

3747:

3746:

3742:

3737:

3733:

3724:

3722:

3714:

3713:

3709:

3705:

3683:

3651:

3623:

3607:

3594:

3593:

3542:

3514:

3479:

3472:

3444:

3443:

3417:

3361:

3333:

3287:

3280:

3274:

3273:

3247:

3246:

3216:

3190:

3146:

3145:

3135:

3114:

3077:

3072:

3071:

3043:

3006:

2984:

2970:

2949:

2938:

2916:

2915:

2908:

2907:

2871:

2853:

2824:

2799:

2777:

2772:

2771:

2754:

2725:

2709:

2690:

2679:

2675:

2648:

2629:

2611:

2599:

2583:

2570:

2556:

2555:

2534:

2533:

2503:

2472:

2462:

2446:

2433:

2419:

2418:

2395:

2378:

2377:

2356:

2351:

2350:

2324:

2314:

2313:

2303:

2298:

2254:

2249:

2248:

2247:Over the range

2218:

2202:

2189:

2184:

2183:

2156:

2108:

2101:

2100:

2076:

2054:

2053:

2032:

2007:

2006:

1966:

1962:

1944:

1943:

1939:

1929:

1904:

1881:

1880:

1847:

1842:

1841:

1802:

1788:

1776:

1698:

1691:

1690:

1662:

1657:

1656:

1649:

1619:

1594:

1593:

1572:

1550:

1549:

1519:

1508:

1471:

1461:

1425:

1414:

1413:

1386:

1381:

1380:

1351:

1350:

1310:

1305:

1304:

1277:

1263:

1262:

1235:

1225:

1211:

1210:

1181:

1170:

1157:

1156:

1107:

1075:

1074:

1055:

1017:

998:

987:

986:

953:

943:

932:

931:

908:

897:

890:

889:

857:

838:

828:

820:

807:

806:

778:

754:

749:

748:

737:

698:

681:

680:

650:

640:

639:

618:

613:

612:

587:

570:

569:

547:

546:

527:

526:

503:

493:

492:

466:

465:

446:

445:

417:

400:

399:

379:

378:

359:

358:

339:

338:

314:

313:

294:

293:

274:

273:

248:

243:

242:

215:

199:

171:

146:

138:

137:

105:

100:

99:

88:

72:Stephen A. Ross

28:

23:

22:

15:

12:

11:

5:

6145:

6143:

6135:

6134:

6129:

6124:

6119:

6114:

6112:Interest rates

6104:

6103:

6097:

6096:

6094:

6093:

6088:

6086:List of topics

6082:

6079:

6078:

6076:

6075:

6070:

6065:

6060:

6055:

6050:

6045:

6043:Renewal theory

6040:

6035:

6030:

6025:

6020:

6015:

6010:

6008:Ergodic theory

6005:

6000:

5998:Control theory

5995:

5989:

5987:

5983:

5982:

5980:

5979:

5978:

5977:

5972:

5962:

5957:

5952:

5947:

5942:

5941:

5940:

5930:

5928:Snell envelope

5925:

5920:

5915:

5910:

5905:

5900:

5895:

5890:

5885:

5880:

5875:

5870:

5865:

5860:

5855:

5850:

5845:

5840:

5835:

5830:

5825:

5820:

5815:

5810:

5805:

5800:

5794:

5792:

5788:

5787:

5785:

5784:

5779:

5774:

5769:

5764:

5758:

5756:

5750:

5749:

5747:

5746:

5727:Borel–Cantelli

5716:

5711:

5706:

5701:

5696:

5691:

5686:

5681:

5676:

5671:

5665:

5663:

5662:Limit theorems

5659:

5658:

5656:

5655:

5650:

5645:

5640:

5635:

5630:

5625:

5620:

5615:

5610:

5605:

5600:

5595:

5590:

5585:

5579:

5577:

5573:

5572:

5570:

5569:

5564:

5559:

5554:

5549:

5544:

5538:

5536:

5530:

5529:

5527:

5526:

5521:

5516:

5511:

5505:

5503:

5497:

5496:

5494:

5493:

5488:

5483:

5478:

5473:

5468:

5463:

5458:

5453:

5448:

5443:

5438:

5433:

5428:

5423:

5418:

5413:

5408:

5403:

5397:

5395:

5389:

5388:

5386:

5385:

5380:

5375:

5370:

5365:

5360:

5354:

5352:

5346:

5345:

5343:

5342:

5337:

5332:

5331:

5330:

5325:

5315:

5310:

5305:

5300:

5299:

5298:

5293:

5283:

5281:Hopfield model

5278:

5273:

5268:

5262:

5260:

5256:

5255:

5253:

5252:

5247:

5242:

5237:

5232:

5227:

5226:

5225:

5220:

5215:

5210:

5200:

5198:Markov process

5195:

5190:

5185:

5179:

5177:

5173:

5172:

5170:

5169:

5167:Wiener sausage

5164:

5162:Wiener process

5159:

5154:

5149:

5144:

5142:Stable process

5139:

5134:

5132:Semimartingale

5129:

5124:

5123:

5122:

5117:

5107:

5102:

5097:

5092:

5087:

5082:

5077:

5075:Jump diffusion

5072:

5067:

5062:

5057:

5052:

5050:Hawkes process

5047:

5042:

5037:

5032:

5030:Feller process

5027:

5022:

5017:

5012:

5007:

5002:

4997:

4995:Cauchy process

4992:

4991:

4990:

4985:

4980:

4975:

4970:

4960:

4959:

4958:

4948:

4946:Bessel process

4943:

4937:

4935:

4929:

4928:

4926:

4925:

4924:

4923:

4918:

4913:

4908:

4898:

4893:

4888:

4883:

4878:

4873:

4868:

4862:

4860:

4854:

4853:

4848:

4846:

4845:

4838:

4831:

4823:

4814:

4813:

4811:

4810:

4804:

4798:

4791:

4789:

4785:

4784:

4782:

4781:

4776:

4771:

4766:

4761:

4756:

4750:

4748:

4742:

4741:

4739:

4738:

4733:

4728:

4723:

4718:

4712:

4710:

4706:

4705:

4703:

4702:

4697:

4692:

4687:

4682:

4677:

4675:Risk-free bond

4672:

4667:

4662:

4660:Mortgage yield

4657:

4652:

4647:

4642:

4637:

4632:

4627:

4622:

4616:

4614:

4612:Bond valuation

4608:

4607:

4605:

4604:

4599:

4594:

4589:

4587:Perpetual bond

4584:

4579:

4574:

4569:

4564:

4559:

4554:

4549:

4544:

4539:

4534:

4529:

4524:

4519:

4514:

4508:

4506:

4502:

4501:

4499:

4498:

4493:

4491:Municipal bond

4488:

4483:

4478:

4473:

4472:

4471:

4466:

4459:Corporate bond

4456:

4450:

4448:

4444:

4443:

4441:

4440:

4435:

4430:

4424:

4421:

4420:

4415:

4413:

4412:

4405:

4398:

4390:

4384:

4383:

4347:(4): 569–579.

4336:

4331:

4313:(3): 369–388.

4298:

4292:

4279:

4258:

4226:(2): 385–407.

4213:

4207:

4184:

4181:

4179:

4178:

4135:

4104:(4): 593–618.

4084:

4043:

4002:

3965:(4): 569–579.

3945:

3918:(4): 370–387.

3902:

3875:(2): 267–292.

3859:

3852:

3826:

3799:(3): 369–387.

3779:

3740:

3731:

3706:

3704:

3701:

3700:

3699:

3694:

3689:

3682:

3679:

3650:

3647:

3646:

3645:

3630:

3626:

3622:

3619:

3614:

3610:

3604:

3601:

3590:

3589:

3575:

3572:

3569:

3564:

3561:

3558:

3555:

3552:

3549:

3545:

3541:

3538:

3535:

3532:

3529:

3526:

3523:

3520:

3517:

3512:

3509:

3506:

3501:

3498:

3495:

3492:

3489:

3486:

3482:

3478:

3475:

3469:

3466:

3463:

3460:

3457:

3454:

3451:

3440:

3439:

3424:

3420:

3415:

3411:

3408:

3405:

3400:

3394:

3391:

3388:

3383:

3380:

3377:

3374:

3371:

3368:

3364:

3360:

3357:

3354:

3351:

3348:

3345:

3342:

3339:

3336:

3329:

3325:

3321:

3318:

3315:

3312:

3309:

3306:

3303:

3300:

3297:

3294:

3290:

3286:

3283:

3277:

3272:

3269:

3266:

3263:

3260:

3257:

3254:

3240:

3239:

3223:

3219:

3215:

3212:

3209:

3206:

3203:

3200:

3197:

3193:

3189:

3186:

3183:

3180:

3177:

3174:

3171:

3168:

3165:

3162:

3159:

3156:

3153:

3134:

3131:

3130:

3129:

3126:

3124:Discretization

3113:

3110:

3109:

3108:

3103:

3099:

3098:

3084:

3080:

3068:

3067:

3066:

3055:

3050:

3046:

3040:

3037:

3031:

3028:

3025:

3022:

3017:

3011:

3005:

3002:

2995:

2989:

2982:

2979:

2976:

2973:

2967:

2960:

2954:

2945:

2941:

2937:

2932:

2929:

2926:

2923:

2919:

2902:

2901:

2897:

2896:

2895:

2894:

2883:

2878:

2874:

2868:

2865:

2860:

2856:

2849:

2846:

2843:

2840:

2836:

2831:

2827:

2823:

2820:

2817:

2814:

2811:

2806:

2802:

2798:

2793:

2790:

2787:

2784:

2780:

2766:

2765:

2761:

2760:

2753:

2750:

2749:

2748:

2737:

2732:

2728:

2722:

2719:

2716:

2712:

2708:

2705:

2702:

2696:

2693:

2686:

2682:

2678:

2672:

2669:

2664:

2661:

2658:

2655:

2651:

2647:

2642:

2639:

2636:

2632:

2628:

2623:

2618:

2614:

2606:

2602:

2598:

2595:

2590:

2586:

2582:

2577:

2573:

2569:

2566:

2563:

2553:

2541:

2521:

2516:

2513:

2510:

2506:

2502:

2499:

2496:

2493:

2490:

2485:

2482:

2479:

2475:

2469:

2465:

2461:

2458:

2453:

2449:

2445:

2440:

2436:

2432:

2429:

2426:

2416:

2402:

2398:

2394:

2391:

2388:

2385:

2363:

2359:

2347:

2331:

2327:

2321:

2310:

2307:Mean reversion

2302:

2299:

2295:

2294:

2281:

2278:

2275:

2272:

2269:

2266:

2261:

2257:

2245:

2244:

2231:

2228:

2225:

2221:

2215:

2212:

2209:

2205:

2201:

2196:

2192:

2177:

2176:

2163:

2159:

2155:

2152:

2146:

2143:

2139:

2134:

2131:

2128:

2122:

2117:

2114:

2111:

2083:

2079:

2074:

2070:

2067:

2064:

2061:

2039:

2035:

2030:

2026:

2023:

2020:

2017:

2014:

2003:

2002:

1990:

1983:

1980:

1973:

1969:

1965:

1959:

1956:

1951:

1947:

1942:

1936:

1932:

1925:

1921:

1916:

1911:

1907:

1903:

1900:

1897:

1894:

1891:

1888:

1865:

1862:

1859:

1854:

1850:

1838:

1837:

1826:

1823:

1820:

1817:

1809:

1805:

1801:

1795:

1791:

1783:

1779:

1772:

1768:

1763:

1760:

1757:

1754:

1751:

1748:

1745:

1742:

1739:

1736:

1730:

1727:

1723:

1718:

1712:

1709:

1704:

1701:

1669:

1665:

1651:

1650:

1647:

1642:

1641:

1640:

1626:

1622:

1617:

1613:

1610:

1607:

1604:

1601:

1579:

1575:

1570:

1566:

1563:

1560:

1557:

1546:

1545:

1544:

1533:

1526:

1522:

1518:

1515:

1511:

1505:

1502:

1499:

1494:

1490:

1483:

1480:

1477:

1474:

1468:

1464:

1458:

1455:

1452:

1449:

1446:

1443:

1440:

1437:

1432:

1428:

1424:

1421:

1393:

1389:

1376:

1375:

1371:

1370:

1358:

1338:

1333:

1330:

1325:

1322:

1317:

1313:

1290:

1287:

1284:

1280:

1276:

1273:

1270:

1248:

1245:

1242:

1238:

1232:

1228:

1224:

1221:

1218:

1198:

1195:

1188:

1184:

1179:

1176:

1173:

1167:

1164:

1152:

1151:

1150:

1149:

1138:

1135:

1130:

1127:

1122:

1119:

1114:

1110:

1104:

1100:

1096:

1091:

1086:

1083:

1078:

1071:

1068:

1065:

1062:

1058:

1053:

1050:

1047:

1044:

1041:

1038:

1035:

1032:

1029:

1024:

1020:

1016:

1011:

1008:

1005:

1001:

997:

994:

981:

980:

966:

963:

960:

956:

950:

946:

942:

939:

915:

911:

906:

903:

900:

864:

860:

856:

851:

848:

845:

841:

837:

834:

831:

826:

823:

817:

814:

803:

802:

801:

790:

784:

781:

777:

772:

767:

764:

761:

757:

742:

741:

736:

733:

705:

701:

697:

694:

691:

688:

657:

653:

647:

625:

621:

609:

608:

594:

590:

586:

583:

580:

577:

554:

534:

510:

506:

500:

473:

453:

442:mean reversion

429:

424:

420:

416:

413:

410:

407:

386:

366:

346:

321:

301:

281:

270:Wiener process

255:

251:

239:

238:

227:

222:

218:

214:

206:

202:

196:

193:

190:

187:

183:

178:

174:

170:

167:

164:

161:

158:

153:

149:

145:

112:

108:

87:

84:

48:interest rates

26:

24:

14:

13:

10:

9:

6:

4:

3:

2:

6144:

6133:

6130:

6128:

6125:

6123:

6120:

6118:

6115:

6113:

6110:

6109:

6107:

6092:

6089:

6087:

6084:

6083:

6080:

6074:

6071:

6069:

6066:

6064:

6061:

6059:

6056:

6054:

6051:

6049:

6046:

6044:

6041:

6039:

6036:

6034:

6031:

6029:

6026:

6024:

6021:

6019:

6016:

6014:

6011:

6009:

6006:

6004:

6001:

5999:

5996:

5994:

5991:

5990:

5988:

5984:

5976:

5973:

5971:

5968:

5967:

5966:

5963:

5961:

5958:

5956:

5953:

5951:

5948:

5946:

5945:Stopping time

5943:

5939:

5936:

5935:

5934:

5931:

5929:

5926:

5924:

5921:

5919:

5916:

5914:

5911:

5909:

5906:

5904:

5901:

5899:

5896:

5894:

5891:

5889:

5886:

5884:

5881:

5879:

5876:

5874:

5871:

5869:

5866:

5864:

5861:

5859:

5856:

5854:

5851:

5849:

5846:

5844:

5841:

5839:

5836:

5834:

5831:

5829:

5826:

5824:

5821:

5819:

5816:

5814:

5811:

5809:

5806:

5804:

5801:

5799:

5796:

5795:

5793:

5789:

5783:

5780:

5778:

5775:

5773:

5770:

5768:

5765:

5763:

5760:

5759:

5757:

5755:

5751:

5744:

5740:

5736:

5735:Hewitt–Savage

5732:

5728:

5724:

5720:

5719:Zero–one laws

5717:

5715:

5712:

5710:

5707:

5705:

5702:

5700:

5697:

5695:

5692:

5690:

5687:

5685:

5682:

5680:

5677:

5675:

5672:

5670:

5667:

5666:

5664:

5660:

5654:

5651:

5649:

5646:

5644:

5641:

5639:

5636:

5634:

5631:

5629:

5626:

5624:

5621:

5619:

5616:

5614:

5611:

5609:

5606:

5604:

5601:

5599:

5596:

5594:

5591:

5589:

5586:

5584:

5581:

5580:

5578:

5574:

5568:

5565:

5563:

5560:

5558:

5555:

5553:

5550:

5548:

5545:

5543:

5540:

5539:

5537:

5535:

5531:

5525:

5522:

5520:

5517:

5515:

5512:

5510:

5507:

5506:

5504:

5502:

5498:

5492:

5489:

5487:

5484:

5482:

5479:

5477:

5474:

5472:

5469:

5467:

5464:

5462:

5459:

5457:

5454:

5452:

5449:

5447:

5444:

5442:

5439:

5437:

5434:

5432:

5429:

5427:

5424:

5422:

5419:

5417:

5416:Black–Scholes

5414:

5412:

5409:

5407:

5404:

5402:

5399:

5398:

5396:

5394:

5390:

5384:

5381:

5379:

5376:

5374:

5371:

5369:

5366:

5364:

5361:

5359:

5356:

5355:

5353:

5351:

5347:

5341:

5338:

5336:

5333:

5329:

5326:

5324:

5321:

5320:

5319:

5318:Point process

5316:

5314:

5311:

5309:

5306:

5304:

5301:

5297:

5294:

5292:

5289:

5288:

5287:

5284:

5282:

5279:

5277:

5276:Gibbs measure

5274:

5272:

5269:

5267:

5264:

5263:

5261:

5257:

5251:

5248:

5246:

5243:

5241:

5238:

5236:

5233:

5231:

5228:

5224:

5221:

5219:

5216:

5214:

5211:

5209:

5206:

5205:

5204:

5201:

5199:

5196:

5194:

5191:

5189:

5186:

5184:

5181:

5180:

5178:

5174:

5168:

5165:

5163:

5160:

5158:

5155:

5153:

5150:

5148:

5145:

5143:

5140:

5138:

5135:

5133:

5130:

5128:

5125:

5121:

5118:

5116:

5113:

5112:

5111:

5108:

5106:

5103:

5101:

5098:

5096:

5093:

5091:

5088:

5086:

5083:

5081:

5078:

5076:

5073:

5071:

5068:

5066:

5065:Itô diffusion

5063:

5061:

5058:

5056:

5053:

5051:

5048:

5046:

5043:

5041:

5040:Gamma process

5038:

5036:

5033:

5031:

5028:

5026:

5023:

5021:

5018:

5016:

5013:

5011:

5008:

5006:

5003:

5001:

4998:

4996:

4993:

4989:

4986:

4984:

4981:

4979:

4976:

4974:

4971:

4969:

4966:

4965:

4964:

4961:

4957:

4954:

4953:

4952:

4949:

4947:

4944:

4942:

4939:

4938:

4936:

4934:

4930:

4922:

4919:

4917:

4914:

4912:

4911:Self-avoiding

4909:

4907:

4904:

4903:

4902:

4899:

4897:

4896:Moran process

4894:

4892:

4889:

4887:

4884:

4882:

4879:

4877:

4874:

4872:

4869:

4867:

4864:

4863:

4861:

4859:

4858:Discrete time

4855:

4851:

4844:

4839:

4837:

4832:

4830:

4825:

4824:

4821:

4808:

4805:

4802:

4799:

4796:

4793:

4792:

4790:

4786:

4780:

4779:Puttable bond

4777:

4775:

4772:

4770:

4767:

4765:

4762:

4760:

4757:

4755:

4754:Callable bond

4752:

4751:

4749:

4747:

4743:

4737:

4734:

4732:

4729:

4727:

4724:

4722:

4719:

4717:

4714:

4713:

4711:

4707:

4701:

4698:

4696:

4693:

4691:

4688:

4686:

4683:

4681:

4678:

4676:

4673:

4671:

4668:

4666:

4665:Nominal yield

4663:

4661:

4658:

4656:

4653:

4651:

4648:

4646:

4643:

4641:

4640:Current yield

4638:

4636:

4635:Credit spread

4633:

4631:

4628:

4626:

4623:

4621:

4618:

4617:

4615:

4613:

4609:

4603:

4600:

4598:

4595:

4593:

4592:Puttable bond

4590:

4588:

4585:

4583:

4580:

4578:

4575:

4573:

4570:

4568:

4565:

4563:

4560:

4558:

4555:

4553:

4550:

4548:

4545:

4543:

4540:

4538:

4535:

4533:

4530:

4528:

4525:

4523:

4522:Callable bond

4520:

4518:

4515:

4513:

4510:

4509:

4507:

4503:

4497:

4494:

4492:

4489:

4487:

4484:

4482:

4479:

4477:

4474:

4470:

4467:

4465:

4462:

4461:

4460:

4457:

4455:

4452:

4451:

4449:

4445:

4439:

4436:

4434:

4431:

4429:

4426:

4425:

4422:

4418:

4411:

4406:

4404:

4399:

4397:

4392:

4391:

4388:

4380:

4376:

4372:

4368:

4364:

4360:

4355:

4350:

4346:

4342:

4337:

4335:

4332:

4328:

4324:

4320:

4316:

4312:

4308:

4304:

4299:

4295:

4289:

4285:

4280:

4276:

4272:

4269:(6): 89–109.

4268:

4264:

4259:

4255:

4249:

4241:

4237:

4233:

4229:

4225:

4221:

4220:

4214:

4210:

4208:0-13-009056-5

4204:

4200:

4199:Prentice Hall

4195:

4194:

4187:

4186:

4182:

4173:

4168:

4163:

4158:

4154:

4150:

4146:

4139:

4136:

4131:

4127:

4122:

4117:

4112:

4107:

4103:

4099:

4095:

4088:

4085:

4080:

4076:

4071:

4066:

4062:

4058:

4054:

4047:

4044:

4039:

4035:

4030:

4025:

4021:

4017:

4013:

4006:

4003:

3998:

3994:

3990:

3986:

3982:

3978:

3973:

3968:

3964:

3960:

3956:

3949:

3946:

3941:

3937:

3933:

3929:

3925:

3921:

3917:

3913:

3906:

3903:

3898:

3894:

3890:

3886:

3882:

3878:

3874:

3870:

3863:

3860:

3855:

3849:

3845:

3841:

3837:

3830:

3827:

3822:

3818:

3814:

3810:

3806:

3802:

3798:

3794:

3790:

3783:

3780:

3775:

3771:

3767:

3763:

3760:(1): 89–109.

3759:

3755:

3751:

3744:

3741:

3735:

3732:

3721:

3717:

3711:

3708:

3702:

3698:

3695:

3693:

3692:Vasicek model

3690:

3688:

3685:

3684:

3680:

3678:

3676:

3672:

3668:

3663:

3660:

3656:

3648:

3628:

3624:

3620:

3617:

3612:

3608:

3602:

3599:

3592:

3591:

3570:

3567:

3559:

3556:

3553:

3547:

3543:

3533:

3530:

3527:

3521:

3518:

3515:

3507:

3504:

3496:

3493:

3490:

3484:

3480:

3473:

3467:

3461:

3458:

3455:

3449:

3442:

3441:

3422:

3418:

3413:

3409:

3406:

3403:

3398:

3389:

3386:

3378:

3375:

3372:

3366:

3362:

3352:

3349:

3346:

3340:

3337:

3334:

3327:

3323:

3316:

3313:

3310:

3301:

3298:

3295:

3288:

3284:

3281:

3275:

3270:

3264:

3261:

3258:

3252:

3245:

3244:

3243:

3221:

3217:

3210:

3207:

3204:

3198:

3195:

3191:

3184:

3181:

3178:

3172:

3169:

3163:

3160:

3157:

3151:

3144:

3143:

3142:

3140:

3132:

3127:

3125:

3122:

3121:

3120:

3118:

3111:

3107:

3104:

3101:

3100:

3082:

3078:

3069:

3053:

3048:

3044:

3038:

3029:

3026:

3023:

3015:

3009:

3003:

3000:

2993:

2987:

2980:

2974:

2971:

2965:

2958:

2952:

2943:

2939:

2935:

2930:

2924:

2921:

2917:

2906:

2905:

2904:

2903:

2899:

2898:

2881:

2876:

2872:

2866:

2858:

2854:

2847:

2844:

2841:

2829:

2825:

2821:

2818:

2812:

2809:

2804:

2800:

2796:

2791:

2785:

2782:

2778:

2770:

2769:

2768:

2767:

2763:

2762:

2759:

2756:

2755:

2751:

2735:

2730:

2720:

2717:

2714:

2710:

2706:

2703:

2694:

2691:

2684:

2680:

2676:

2670:

2662:

2659:

2656:

2653:

2649:

2645:

2640:

2637:

2634:

2630:

2621:

2616:

2612:

2604:

2600:

2596:

2588:

2584:

2580:

2575:

2571:

2564:

2561:

2554:

2539:

2514:

2511:

2508:

2504:

2500:

2497:

2491:

2488:

2483:

2480:

2477:

2473:

2467:

2463:

2459:

2451:

2447:

2443:

2438:

2434:

2427:

2417:

2400:

2396:

2392:

2389:

2386:

2383:

2361:

2357:

2348:

2329:

2325:

2319:

2311:

2308:

2305:

2304:

2300:

2293:

2273:

2270:

2264:

2255:

2229:

2226:

2223:

2219:

2213:

2210:

2207:

2203:

2199:

2190:

2182:

2181:

2180:

2157:

2153:

2150:

2144:

2141:

2137:

2132:

2129:

2126:

2120:

2115:

2112:

2109:

2099:

2098:

2097:

2081:

2077:

2072:

2068:

2065:

2062:

2059:

2037:

2033:

2028:

2024:

2021:

2018:

2015:

2012:

1988:

1981:

1978:

1967:

1963:

1957:

1954:

1945:

1940:

1934:

1930:

1923:

1919:

1914:

1905:

1898:

1895:

1892:

1886:

1879:

1878:

1877:

1863:

1857:

1852:

1821:

1818:

1807:

1803:

1793:

1781:

1777:

1770:

1766:

1761:

1755:

1749:

1746:

1743:

1737:

1728:

1716:

1710:

1702:

1689:

1688:

1687:

1685:

1663:

1653:

1652:

1646:

1645:

1624:

1620:

1615:

1611:

1608:

1605:

1602:

1599:

1577:

1573:

1568:

1564:

1561:

1558:

1555:

1547:

1531:

1520:

1516:

1513:

1509:

1503:

1500:

1497:

1488:

1478:

1466:

1462:

1456:

1450:

1447:

1444:

1441:

1438:

1435:

1426:

1419:

1412:

1411:

1409:

1387:

1378:

1377:

1373:

1372:

1356:

1331:

1328:

1323:

1315:

1311:

1288:

1285:

1282:

1278:

1274:

1271:

1268:

1246:

1243:

1240:

1236:

1230:

1226:

1222:

1219:

1216:

1196:

1193:

1186:

1182:

1177:

1174:

1171:

1165:

1162:

1154:

1153:

1136:

1128:

1125:

1120:

1112:

1108:

1102:

1098:

1094:

1089:

1084:

1081:

1076:

1069:

1066:

1063:

1060:

1056:

1051:

1048:

1042:

1039:

1036:

1033:

1030:

1027:

1022:

1018:

1014:

1009:

1006:

1003:

999:

992:

985:

984:

983:

982:

964:

961:

958:

954:

948:

944:

940:

937:

913:

909:

904:

901:

898:

887:

883:

862:

858:

849:

846:

843:

839:

835:

832:

824:

821:

815:

812:

804:

788:

782:

779:

775:

770:

765:

762:

759:

755:

747:

746:

744:

743:

739:

738:

734:

732:

730:

726:

722:

703:

699:

695:

692:

689:

686:

677:

675:

655:

651:

645:

623:

619:

592:

588:

584:

581:

578:

575:

568:

567:

566:

552:

532:

508:

504:

498:

490:

485:

471:

451:

443:

422:

418:

414:

411:

405:

384:

364:

344:

336:

319:

299:

279:

271:

253:

249:

225:

220:

216:

212:

204:

200:

194:

191:

188:

185:

176:

172:

168:

165:

159:

156:

151:

147:

143:

136:

135:

134:

132:

128:

110:

106:

92:

85:

83:

81:

77:

76:Vasicek model

73:

69:

65:

61:

57:

53:

49:

45:

41:

32:

19:

6003:Econometrics

5965:Wiener space

5853:Itô integral

5754:Inequalities

5643:Self-similar

5613:Gauss–Markov

5603:Exchangeable

5583:Càdlàg paths

5519:Risk process

5471:LIBOR market

5435:

5340:Random graph

5335:Random field

5147:Superprocess

5085:Lévy process

5080:Jump process

5055:Hunt process

4891:Markov chain

4788:Institutions

4746:Bond options

4690:Yield spread