3646:

the case of direct falls on their heads and do not achieve their main goals. They are expensive, meaning that less resources are available to benefit users in other ways (such as building a playground closer to the child's home, reducing the risk of a road traffic accident on the way to it), and—some argue—children may attempt more dangerous acts, with confidence in the artificial surface. Shiela Sage, an early years school advisor, observes "Children who are only ever kept in very safe places, are not the ones who are able to solve problems for themselves. Children need to have a certain amount of risk taking ... so they'll know how to get out of situations."

3552:) is inconsistent with the expected utility hypothesis. It is assumed that the psychological principle which stands behind this kind of behavior is the overweighting of certainty. Options which are perceived as certain are over-weighted relative to uncertain options. This pattern is an indication of risk-seeking behavior in negative prospects and eliminates other explanations for the certainty effect such as aversion for uncertainty or variability.

3659:

made their choices in a simulated game show environment, which included a live audience, a game show host, and video cameras. In line with this, studies on investor behavior find that investors trade more and more speculatively after switching from phone-based to online trading and that investors tend to keep their core investments with traditional brokers and use a small fraction of their wealth to speculate online.

5819:

45:

5808:

2899:, risk aversion is measured as the additional expected reward an investor requires to accept additional risk. If an investor is risk-averse, they will invest in multiple uncertain assets, but only when the predicted return on a portfolio that is uncertain is greater than the predicted return on one that is not uncertain will the investor will prefer the former. Here, the

1319:(HARA) is the most general class of utility functions that are usually used in practice (specifically, CRRA (constant relative risk aversion, see below), CARA (constant absolute risk aversion), and quadratic utility all exhibit HARA and are often used because of their mathematical tractability). A utility function exhibits HARA if its absolute risk aversion is a

3596:. A 2009 study by Christopoulos et al. suggested that the activity of a specific brain area (right inferior frontal gyrus) correlates with risk aversion, with more risk averse participants (i.e. those having higher risk premia) also having higher responses to safer options. This result coincides with other studies, that show that

576:). This risk premium means that the person would be willing to sacrifice as much as $ 10 in expected value in order to achieve perfect certainty about how much money will be received. In other words, the person would be indifferent between the bet and a guarantee of $ 40, and would prefer anything over $ 40 to the bet.

3692:

The design of experiments, to determine at what increase of wealth or income would an individual change their employment status from a position of security to more risky ventures, must include flexible utility specifications with salient incentives integrated with risk preferences. The application of

3667:

The basis of the theory, on the connection between employment status and risk aversion, is the varying income level of individuals. On average higher income earners are less risk averse than lower income earners. In terms of employment the greater the wealth of an individual the less risk averse they

3658:

finds that people are more risk averse in the limelight than in the anonymity of a typical behavioral laboratory. In the laboratory treatments, subjects made decisions in a standard, computerized laboratory setting as typically employed in behavioral experiments. In the limelight treatments, subjects

3573:

model, a risk-averse person will happily receive a smaller commodity share of the bargain. This is because their utility function concaves hence their utility increases at a decreasing rate while their non-risk averse opponents may increase at a constant or increasing rate. Intuitively, a risk-averse

3544:

domain. The reflection effect is an identified pattern of opposite preferences between negative as opposed to positive prospects: people tend to avoid risk when the gamble is between gains, and to seek risks when the gamble is between losses. For example, most people prefer a certain gain of 3,000 to

2855:

The most straightforward implications of increasing or decreasing absolute or relative risk aversion, and the ones that motivate a focus on these concepts, occur in the context of forming a portfolio with one risky asset and one risk-free asset. If the person experiences an increase in wealth, he/she

3555:

The initial findings regarding the reflection effect faced criticism regarding its validity, as it was claimed that there are insufficient evidence to support the effect on the individual level. Subsequently, an extensive investigation revealed its possible limitations, suggesting that the effect is

3516:

Rabin criticizes this implication of expected utility theory on grounds of implausibility—individuals who are risk averse for small gambles due to diminishing marginal utility would exhibit extreme forms of risk aversion in risky decisions under larger stakes. One solution to the problem observed by

3645:

have become the focus of much risk-averse planning, meaning that children are often prevented from benefiting from activities that they would otherwise have had. Many playgrounds have been fitted with impact-absorbing matting surfaces. However, these are only designed to save children from death in

223:

A person is given the choice between two scenarios: one with a guaranteed payoff, and one with a risky payoff with same average value. In the former scenario, the person receives $ 50. In the uncertain scenario, a coin is flipped to decide whether the person receives $ 100 or nothing. The expected

3688:

Incentive effects are a factor in the behavioural approach an individual takes in deciding to move from a secure job to entrepreneurship. Non-financial incentives provided by an employer can change the decision to transition into entrepreneurship as the intangible benefits helps to strengthen how

3616:

when mitigating a risk; the cost of not taking the risky action. Writing laws focused on the risk without the balance of the utility may misrepresent society's goals. The public understanding of risk, which influences political decisions, is an area which has recently been recognised as deserving

3097:

In applying this model to risk aversion, the function can be used to show how an individual’s preferences of wins and losses will influence their expected utility function. For example, if a risk-averse individual with $ 20,000 in savings is given the option to gamble it for $ 100,000 with a 30%

588:

over an alternative bet (that is, if the probability mass of the second bet is pushed to the right to form the first bet, then the first bet is preferred). (ii) The concavity of the utility function implies that the person is risk averse: a sure amount would always be preferred over a risky bet

3093:

Essentially, von

Neumann and Morgenstern hypothesised that individuals seek to maximise their expected utility rather than the expected monetary value of assets. In defining expected utility in this sense, the pair developed a function based on preference relations. As such, if an individual’s

3672:. The literature assumes a small increase in income or wealth initiates the transition from employment to entrepreneurship-based decreasing absolute risk aversion (DARA), constant absolute risk aversion (CARA), and increasing absolute risk aversion (IARA) preferences as properties in their

83:

Risk aversion explains the inclination to agree to a situation with a more predictable, but possibly lower payoff, rather than another situation with a highly unpredictable, but possibly higher payoff. For example, a risk-averse investor might choose to put their money into a

583:

The utility function for perceived gains has two key properties: an upward slope, and concavity. (i) The upward slope implies that the person feels that more is better: a larger amount received yields greater utility, and for risky bets the person would prefer a bet which is

579:

In the case of a wealthier individual, the risk of losing $ 100 would be less significant, and for such small amounts his utility function would be likely to be almost linear. For instance, if u(0) = 0 and u(100) = 10, then u(40) might be 4.02 and u(50) might be 5.01.

1977:

134:

120:

106:

3612:, are fundamentally risk-averse in their mandate. This often means that they demand (with the power of legal enforcement) that risks be minimized, even at the cost of losing the utility of the risky activity. It is important to consider the

3689:

risk averse an individual is relative to the strength of downside risk aversion. Utility functions do not equate for such effects and can often screw the estimated behavioural path that an individual takes towards their employment status.

2864:

risk aversion is decreasing (or constant, or increasing). Thus economists avoid using utility functions such as the quadratic, which exhibit increasing absolute risk aversion, because they have an unrealistic behavioral implication.

2887:, an increase in relative risk aversion increases the impact of households' money holdings on the overall economy. In other words, the more the relative risk aversion increases, the more money demand shocks will impact the economy.

282:

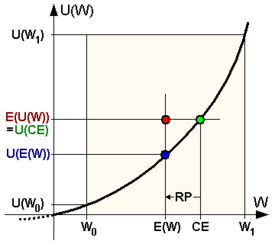

is the difference between the expected value and the certainty equivalent. For risk-averse individuals, risk premium is positive, for risk-neutral persons it is zero, and for risk-loving individuals their risk premium is negative.

3396: would equal a value that means that the individual would rather keep their $ 20,000 in savings than gamble it all to potentially increase their wealth to $ 100,000. Hence a risk averse individuals’ function would show that;

3684:

exceeds the strength of risk aversion. If using the behavioural approach to model an individual’s decision on their employment status there must be more variables than risk aversion and any absolute risk aversion preferences.

1426:

2535:

3564:

Numerous studies have shown that in riskless bargaining scenarios, being risk-averse is disadvantageous. Moreover, opponents will always prefer to play against the most risk-averse person. Based on both the

2417:

769:

2419:

is monotonic in wealth under either DARA or IARA and constant in wealth under CARA, tests of contractual risk sharing relying on wealth as a proxy for absolute risk aversion are usually not identified.

224:

payoff for both scenarios is $ 50, meaning that an individual who was insensitive to risk would not care whether they took the guaranteed payment or the gamble. However, individuals may have different

3058:

2695:

3491:

1516:

574:

3372:

3172:

1057:

3512:

from any initial wealth level turns down gambles where she loses $ 100 or gains $ 110, each with 50% probability will turn down 50–50 bets of losing $ 1,000 or gaining any sum of money.

2980:

2783:

2333:

2100:

2060:

2020:

3622:

948:

601:

There are various measures of the risk aversion expressed by those given utility function. Several functional forms often used for utility functions are represented by these measures.

2244:

1268:

593:

of an alternative bet (that is, if some of the probability mass of the first bet is spread out without altering the mean to form the second bet, then the first bet is preferred).

450:

996:

521:

3268:

2549:(DRRA/IRRA) are used. This measure has the advantage that it is still a valid measure of risk aversion, even if the utility function changes from risk averse to risk loving as

840:

3600:

of the same area results in participants making more or less risk averse choices, depending on whether the modulation increases or decreases the activity of the target area.

3220:

1774:

274:, is $ 50. The smallest guaranteed dollar amount that an individual would be indifferent to compared to an uncertain gain of a specific average predicted value is called the

1684:

278:, which is also used as a measure of risk aversion. An individual that is risk averse has a certainty equivalent that is smaller than the prediction of uncertain gains. The

2602:

2269:

2147:

1307:

2733:

1597:

806:

4912:

Konana, Prabhudev; Balasubramanian, Sridhar (May 2005). "The Social–Economic–Psychological model of technology adoption and usage: an application to online investing".

2342:

Contrary to what several empirical studies have assumed, wealth is not a good proxy for risk aversion when studying risk sharing in a principal-agent setting. Although

1103:

2812:

2541:

Unlike ARA whose units are in $ , RRA is a dimensionless quantity, which allows it to be applied universally. Like for absolute risk aversion, the corresponding terms

2190:

1431:

The solution to this differential equation (omitting additive and multiplicative constant terms, which do not affect the behavior implied by the utility function) is:

3098:

chance of winning, they may still not take the gamble in fear of losing their savings. This does not make sense using the traditional expected utility model however;

1175:

1152:

1553:

1810:

1204:

1132:

889:

669:

636:

1710:

1623:

1819:

3394:

3290:

860:

3545:

an 80% chance of a gain of 4,000. When posed the same problem, but for losses, most people prefer an 80% chance of a loss of 4,000 to a certain loss of 3,000.

2557:. A constant RRA implies a decreasing ARA, but the reverse is not always true. As a specific example of constant relative risk aversion, the utility function

4429:

Battalio, RaymondC.; Kagel, JohnH.; Jiranyakul, Komain (March 1990). "Testing between alternative models of choice under uncertainty: Some initial results".

3566:

3069:

6916:

6872:

80:

to those outcomes with high uncertainty, even if the average outcome of the latter is equal to or higher in monetary value than the more certain outcome.

2062:. Analogously, IARA can be derived with the opposite directions of inequalities, which permits but does not require a negatively skewed utility function (

4740:

3693:

relevant experiments can avoid the generalisation of varying individual preferences through the use of this model and its specified utility functions.

468:(100)=10 then the expected utility of the bet equals 5, which is the same as the known utility of the amount 40. Hence the certainty equivalent is 40.

5689:

5188:

2616:

60:: With fixed probabilities of two alternative states 1 and 2, risk averse indifference curves over pairs of state-contingent outcomes are convex.

4608:

Knoch, Daria; Gianotti, Lorena R. R.; Pascual-Leone, Alvaro; Treyer, Valerie; Regard, Marianne; Hohmann, Martin; Brugger, Peter (14 June 2006).

5065:

4199:

4099:

3996:

3863:

3836:

3809:

3088:

5855:

4657:

Fecteau, Shirley; Pascual-Leone, Alvaro; Zald, David H.; Liguori, Paola; Théoret, Hugo; Boggio, Paulo S.; Fregni, Felipe (6 June 2007).

4659:"Activation of Prefrontal Cortex by Transcranial Direct Current Stimulation Reduces Appetite for Risk during Ambiguous Decision Making"

3525:, where outcomes are considered relative to a reference point (usually the status quo), rather than considering only the final wealth.

4707:

1330:

4753:

1316:

5128:

Blackburn, Douglas W.; Ukhov, Andrey (1 May 2008). "Individual vs. Aggregate

Preferences: The Case of a Small Fish in a Big Pond".

3528:

Another limitation is the reflection effect, which demonstrates the reversing of risk aversion. This effect was first presented by

4610:"Disruption of Right Prefrontal Cortex by Low-Frequency Repetitive Transcranial Magnetic Stimulation Induces Risk-Taking Behavior"

6951:

4150:

Benchimol, Jonathan; Fourçans, André (March 2012). "Money and risk in a DSGE framework: A Bayesian application to the

Eurozone".

2868:

Similarly, if the person experiences an increase in wealth, he/she will choose to increase (or keep unchanged, or decrease) the

2988:

6354:

2629:

642:), a measure that stays constant with respect to these transformations is needed rather than just the second derivative of

638:, the higher the risk aversion. However, since expected utility functions are not uniquely defined (are defined only up to

6535:

6324:

6314:

6007:

5161:

3401:

2442:

5380:

1437:

529:

6474:

6447:

5181:

4402:

Hershey, John C.; Schoemaker, Paul J.H. (June 1980). "Prospect theory's reflection hypothesis: A critical examination".

3094:

preferences satisfy four key axioms, then a utility function based on how they weigh different outcomes can be deduced.

3076:

function, the von

Neumann-Morgenstern model includes risk aversion axiomatically rather than as an additional variable.

3297:

6946:

6901:

6882:

6459:

6304:

6270:

6255:

6234:

6229:

5674:

5626:

5314:

4875:

3609:

3073:

292:

3574:

person will hence settle for a smaller share of the bargain as opposed to a risk-neutral or risk-seeking individual.

3103:

5075:

6941:

6876:

6452:

6142:

6132:

5336:

5324:

5319:

5309:

3597:

3583:

3522:

2345:

697:

31:

5279:

6022:

5754:

5230:

3680:

risk perspective can also be used to as a factor in the transition of employment status, only if the strength of

2933:

2738:

2274:

4759:

4045:

Bellemare, Marc F.; Brown, Zachary S. (January 2010). "On the (Mis)Use of Wealth as a Proxy for Risk

Aversion".

2900:

2815:

6906:

6852:

6595:

6550:

6389:

6260:

6137:

5420:

5289:

4018:

3272:

The von

Neumann-Morgenstern model can explain this scenario. Based on preference relations, a specific utility

2915:. In advanced portfolio theory, different kinds of risk are taken into consideration. They are measured as the

894:

38:

6610:

3072:

is another model used to denote how risk aversion influences an actor’s utility function. An extension of the

376:

The expected utility of the above bet (with a 50% chance of receiving 100 and a 50% chance of receiving 0) is

6560:

6394:

6384:

6374:

6364:

6102:

6092:

6052:

6042:

5922:

5848:

5822:

5719:

5714:

5664:

5537:

5415:

5174:

4283:

2896:

1001:

48:

Risk aversion (red) contrasted to risk neutrality (yellow) and risk loving (orange) in different settings.

6730:

6575:

6435:

6378:

6334:

6297:

6047:

5987:

5962:

5932:

5917:

5739:

5699:

5694:

5476:

5447:

5304:

5226:

4942:

Bonilla, Claudio (2021). "Risk aversion, downside risk aversion, and the transition to entrepreneurship".

4884:

4366:

4318:

3753:

2195:

1219:

639:

590:

382:

52:: A risk averse utility function is concave (from below), while a risk loving utility function is convex.

6545:

3879:

Adhikari, Binay Kumar; Agrawal, Anup (June 2016). "Does local religiosity matter for bank risk-taking?".

477:

6862:

6520:

6505:

6479:

6418:

6097:

6037:

6017:

6012:

5684:

5669:

5385:

5141:

5031:

3763:

3707:

3226:

327:

266:) – if they would accept the bet even when the guaranteed payment is more than $ 50 (for example, $ 60).

3973:

246:) of less than $ 50 (for example, $ 40), rather than taking the gamble and possibly receiving nothing.

6911:

6615:

6359:

6329:

6282:

6245:

6171:

6122:

6087:

6027:

5992:

5927:

5734:

5654:

5586:

5501:

5395:

5331:

4357:

Kahneman, Daniel; Tversky, Amos (March 1979). "Prospect Theory: An

Analysis of Decision under Risk".

3618:

3593:

3541:

3178:

2612:

1812:

is decreasing/increasing. Using the above definition of ARA, the following inequality holds for DARA:

1715:

585:

275:

243:

149:

5086:

4371:

4323:

1628:

953:

6841:

6650:

6510:

6469:

6369:

6349:

6309:

6265:

6250:

6206:

6147:

6072:

6062:

6032:

5955:

5749:

5576:

5425:

5368:

5211:

4889:

3626:

2841:

1213:

2560:

2248:

2105:

2065:

2025:

1985:

1277:

589:

having the same expected value; moreover, for risky bets the person would prefer a bet which is a

6896:

6867:

6825:

6630:

6339:

6319:

6287:

6201:

6196:

6176:

6127:

6067:

6057:

6002:

5997:

5841:

5659:

5605:

5532:

5442:

5400:

5390:

5358:

5353:

5299:

5294:

5116:

4959:

4814:

4548:

4540:

4493:

4446:

4384:

4336:

4264:

4205:

4167:

4132:

4072:

4027:

3955:

3702:

2904:

2903:

is relevant, as it results largely from this type of risk aversion. Here risk is measured as the

2884:

2620:

56:: In standard deviation-expected value space, risk averse indifference curves are upward sloped.

2703:

2339:

Experimental and empirical evidence is mostly consistent with decreasing absolute risk aversion.

1558:

5008:

U.Sankar (1971), A Utility

Function for Wealth for a Risk Averter, Journal of Economic Theory.

1062:

6760:

6735:

6685:

6645:

6525:

6413:

6216:

6152:

6117:

6107:

5977:

5792:

5780:

5759:

5729:

5591:

5515:

5471:

5129:

5061:

5053:

5023:

5019:

4981:

4826:

4822:

4749:

4688:

4639:

4587:

4532:

4485:

4256:

4195:

4095:

4013:

3992:

3859:

3832:

3805:

3083:

2788:

2152:

5133:

1157:

1137:

37:"Risk attitude" redirects here. For the concept in security studies and risk management, see

6956:

6810:

6755:

6740:

6725:

6710:

6690:

6640:

6620:

6600:

6555:

6162:

6112:

6082:

6077:

5967:

5905:

5744:

5724:

5631:

5581:

5552:

5410:

5375:

5272:

5250:

5108:

4993:

4951:

4921:

4894:

4853:

4806:

4678:

4670:

4629:

4621:

4579:

4524:

4477:

4438:

4411:

4376:

4328:

4246:

4236:

4159:

4124:

4062:

4054:

3947:

3888:

3797:

3758:

3737:

3722:

3712:

3669:

3613:

3570:

3549:

3079:

811:

354:

4722:

4307:

Rabin, Matthew (2000). "Risk

Aversion and Expected-Utility Theory: A Calibration Theorem".

1972:{\displaystyle {\frac {\partial A(c)}{\partial c}}=-{\frac {u'(c)u'''(c)-^{2}}{^{2}}}<0}

1524:

777:

6921:

6815:

6780:

6745:

6680:

6605:

6590:

6484:

6440:

6277:

6211:

6186:

6181:

6157:

5900:

5885:

5812:

5284:

5221:

5154:

5044:

3655:

3556:

most prevalent when either small or large amounts and extreme probabilities are involved.

3537:

3518:

1786:

1180:

1108:

865:

645:

612:

1689:

1602:

5162:

The benefit of utilities: a plausible explanation for small risky parts in the portfolio

3625:, a role described as outreach rather than traditional academic research by the holder,

350:) could be multiplied by a positive constant factor, without affecting the conclusions.

6835:

6820:

6785:

6770:

6750:

6720:

6570:

6540:

6191:

5912:

5880:

5787:

5527:

5486:

5405:

5197:

4683:

4658:

4634:

4609:

3727:

3589:

3379:

3275:

2920:

2880:

845:

271:

157:

4567:

3668:

can afford to be, and they are more inclined to make the move from a secure job to an

6935:

6800:

6790:

6765:

6705:

6700:

6695:

6675:

6665:

6635:

6625:

6530:

6430:

6403:

6167:

5709:

5609:

5600:

5571:

5547:

5491:

5255:

5245:

5235:

5120:

4963:

4583:

4552:

4450:

4415:

4268:

4225:"The Nash Solution as a von Neumann–Morgenstern Utility Function on Bargaining Games"

4171:

4136:

3801:

3732:

3717:

3681:

3677:

3505:

2837:

684:

680:

89:

4818:

4340:

4076:

6830:

6775:

6670:

6660:

6655:

6580:

6425:

5950:

5890:

5679:

5511:

5506:

5240:

4674:

4625:

4309:

3892:

3748:

3533:

2022:. Therefore, DARA implies that the utility function is positively skewed; that is,

307:

represents the value that he might receive in money or goods (in the above example

279:

250:

215:

5093:

4873:

Barber, Brad; Odean, Terrance (2002). "Online

Investors: Do the Slow Die First?".

4163:

3920:

3910:

3853:

3826:

2619:

often cannot be disentangled from the coefficient of relative risk aversion. The

92:

that may have high expected returns, but also involves a chance of losing value.

6805:

6795:

6585:

6464:

6408:

5895:

5704:

5616:

5496:

5348:

5262:

4284:"Von Neumann–Morgenstern utility function | Definition & Facts | Britannica"

2908:

258:

77:

44:

5112:

4955:

4241:

4224:

6715:

6515:

6292:

5464:

5216:

4925:

4128:

3938:

Pratt, John W. (January 1964). "Risk Aversion in the Small and in the Large".

3642:

4997:

4591:

4536:

4489:

4260:

6565:

6495:

5942:

5872:

5864:

5775:

5542:

5459:

5454:

5267:

5018:

Zevelev, Albert A. (3 February 2014). "Closed Form Solutions in Economics".

4793:

Baltussen, Guido; van den Assem, Martijn J.; van Dolder, Dennie (May 2016).

4466:"Risk Aversion and Nash's Solution for Bargaining Games with Risky Outcomes"

4332:

3654:

One experimental study with student-subject playing the game of the TV show

2916:

1320:

65:

4898:

4692:

4643:

4209:

4189:

3508:

has showed that a risk-averse, expected-utility-maximizing individual who,

17:

5807:

4058:

133:

119:

105:

6344:

5567:

5562:

5437:

4810:

4794:

3743:

3529:

2912:

2851:

Implications of increasing/decreasing absolute and relative risk aversion

4858:

4841:

4544:

4512:

4251:

5621:

5520:

5432:

4528:

4497:

4465:

4442:

4388:

4194:(60th Anniversary Commemorative ed.). Princeton University Press.

4031:

3959:

3769:

3673:

173:

69:

4067:

5596:

5054:"Diminishing Marginal Utility of Wealth Cannot Explain Risk Aversion"

3638:

3500:

Using expected utility theory's approach to risk aversion to analyze

471:

The risk premium is ($ 50 minus $ 40)=$ 10, or in proportional terms

254:– if they are indifferent between the bet and a certain $ 50 payment.

4481:

4380:

3951:

88:

account with a low but guaranteed interest rate, rather than into a

4777:

4721:. The University of Cambridge Development Office: 3. Archived from

4511:

Murnighan, J. Keith; Roth, Alvin E.; Schoumaker, Francoise (1988).

4115:

Benchimol, Jonathan (March 2014). "Risk aversion in the Eurozone".

3588:

Attitudes towards risk have attracted the interest of the field of

5481:

5363:

5343:

3989:

Stochastic Dominance: Investment Decision Making under Uncertainty

323:

5166:

4568:"Concavifiability and constructions of concave utility functions"

4188:

von Neumann, John; Morgenstern, Oskar; Rubinstein, Ariel (1944).

5638:

85:

5837:

5170:

1421:{\displaystyle A(c)=-{\frac {u''(c)}{u'(c)}}={\frac {1}{ac+b}}}

353:

An agent is risk-averse if and only if the utility function is

2335:

would represent a quadratic utility function exhibiting IARA.

2856:

will choose to increase (or keep unchanged, or decrease) the

2553:

varies, i.e. utility is not strictly convex/concave over all

5833:

3766:, which is different, as uncertainty is not the same as risk

3292:

can be assigned to both outcomes. Now the function becomes;

526:

or 25% (where $ 50 is the expected value of the risky bet: (

330:– in other words, a constant could be added to the value of

111:

Utility function of a risk-averse (risk-avoiding) individual

160:

of the utility (expected utility) of the uncertain payment

139:

Utility function of a risk-loving (risk-seeking) individual

3496:

Limitations of expected utility treatment of risk aversion

2876:

risk aversion is decreasing (or constant, or increasing).

180:– Utility of the expected value of the uncertain payment;

3828:

ProjectThink: Why Good Managers Make Poor Project Choices

3053:{\displaystyle A_{n}={\frac {dE(c)}{d{\sqrt{\mu _{n}}}}}}

2847:

A time-varying relative risk aversion can be considered.

3623:

Winton Professorship of the Public Understanding of Risk

842:

denote the first and second derivatives with respect to

597:

Measures of risk aversion under expected utility theory

552:

534:

76:

is the tendency of people to prefer outcomes with low

3825:

Mr Lev Virine; Mr Michael Trumper (28 October 2013).

3404:

3382:

3300:

3278:

3229:

3181:

3106:

2991:

2936:

2791:

2741:

2706:

2690:{\displaystyle u(c)={\frac {c^{1-\rho }-1}{1-\rho }}}

2632:

2563:

2445:

2348:

2277:

2251:

2198:

2155:

2108:

2068:

2028:

1988:

1822:

1789:

1718:

1692:

1631:

1605:

1561:

1527:

1440:

1333:

1280:

1222:

1183:

1160:

1140:

1111:

1065:

1004:

956:

897:

868:

848:

814:

780:

700:

648:

615:

532:

480:

385:

4513:"Risk Aversion in Bargaining: An Experimental Study"

3486:{\displaystyle EU(A)\prec \$ 20,000(keepingsavings)}

2530:{\displaystyle R(c)=cA(c)={\frac {-cu''(c)}{u'(c)}}}

6851:

6493:

6227:

5976:

5941:

5871:

5768:

5647:

5204:

4840:Barber, Brad M; Odean, Terrance (1 February 2001).

4183:

4181:

1511:{\displaystyle u(c)={\frac {(c-c_{s})^{1-R}}{1-R}}}

569:{\displaystyle {\tfrac {1}{2}}0+{\tfrac {1}{2}}100}

3608:In the real world, many government agencies, e.g.

3604:Public understanding and risk in social activities

3485:

3388:

3366:

3284:

3262:

3214:

3166:

3052:

2974:

2806:

2777:

2727:

2689:

2596:

2529:

2411:

2327:

2263:

2238:

2184:

2141:

2094:

2054:

2014:

1971:

1804:

1768:

1704:

1678:

1617:

1591:

1547:

1510:

1420:

1301:

1262:

1198:

1169:

1146:

1126:

1097:

1051:

990:

942:

883:

854:

834:

800:

763:

663:

630:

568:

515:

444:

3367:{\displaystyle EU(A)=0.3u(\$ 100,000)+0.7u(\$ 0)}

2735:and the elasticity of intertemporal substitution

5060:. Cambridge University Press. pp. 202–208.

456:and if the person has the utility function with

4603:

4601:

3167:{\displaystyle EU(A)=0.3(\$ 100,000)+0.7(\$ 0)}

1209:The following expressions relate to this term:

270:The average payoff of the gamble, known as its

4982:"Risk Aversion and Incentive Effects: Comment"

4748:. Calouste Gulbenkian Foundation. p. 81.

4094:(Student ed.). Viva Norton. p. 363.

2700:exhibits constant relative risk aversion with

5849:

5182:

5056:. In Kahneman, Daniel; Tversky, Amos (eds.).

4404:Organizational Behavior and Human Performance

3663:The behavioural approach to employment status

2923:. The symbol used for risk aversion is A or A

2430:Arrow–Pratt measure of relative risk aversion

2412:{\displaystyle A(c)=-{\frac {u''(c)}{u'(c)}}}

764:{\displaystyle A(c)=-{\frac {u''(c)}{u'(c)}}}

673:Arrow–Pratt measure of absolute risk aversion

125:Utility function of a risk-neutral individual

8:

4742:No fear: Growing up in a Risk Averse society

2872:of the portfolio held in the risky asset if

2860:of the risky asset held in the portfolio if

2547:decreasing/increasing relative risk aversion

2102:). An example of a DARA utility function is

1781:Decreasing/increasing absolute risk aversion

242:) - if they would accept a certain payment (

4776:Sue Durant, Sheila Sage (10 January 2006).

4464:Roth, Alvin E.; Rothblum, Uriel G. (1982).

4352:

4350:

3925:, Markham Publ. Co., Chicago, 1971, 90–109.

3852:David Hillson; Ruth Murray-Webster (2007).

2975:{\displaystyle A={\frac {dE(c)}{d\sigma }}}

2778:{\displaystyle \varepsilon _{u(c)}=1/\rho }

2328:{\displaystyle A(c)=2\alpha /(1-2\alpha c)}

168:– Expected value of the uncertain payment;

30:For the related psychological concept, see

5856:

5842:

5834:

5189:

5175:

5167:

5087:Arrow-Pratt Measure on About.com:Economics

4047:American Journal of Agricultural Economics

2818:shows that this simplifies to the case of

5000:– via The University of Queensland.

4888:

4857:

4682:

4633:

4370:

4322:

4250:

4240:

4066:

3403:

3381:

3299:

3277:

3228:

3180:

3105:

3040:

3034:

3028:

3005:

2996:

2990:

2943:

2935:

2790:

2767:

2746:

2740:

2705:

2655:

2648:

2631:

2562:

2479:

2444:

2367:

2347:

2299:

2276:

2250:

2227:

2197:

2174:

2154:

2107:

2067:

2027:

1987:

1954:

1922:

1858:

1823:

1821:

1788:

1740:

1717:

1691:

1650:

1630:

1604:

1581:

1566:

1560:

1537:

1526:

1482:

1472:

1456:

1439:

1397:

1352:

1332:

1279:

1248:

1221:

1182:

1159:

1139:

1110:

1084:

1064:

1040:

1031:

1003:

980:

955:

943:{\displaystyle u(c)=\alpha +\beta ln(c),}

896:

867:

847:

813:

779:

719:

699:

647:

614:

551:

533:

531:

502:

479:

434:

384:

3855:Understanding and Managing Risk Attitude

3794:The New Palgrave Dictionary of Economics

3086:first developed the model in their book

2617:elasticity of intertemporal substitution

295:theory, an agent has a utility function

43:

4090:Simon, Carl and Lawrence Blume (2006).

4016:(1975). "The Demand for Risky Assets".

3933:

3931:

3911:"Aspects of the Theory of Risk Bearing"

3904:

3902:

3781:

3070:von Neumann-Morgenstern utility theorem

3064:Von Neumann-Morgenstern utility theorem

5150:

5139:

5040:

5029:

3548:The reflection effect (as well as the

3089:Theory of Games and Economic Behaviour

2907:of the return on investment, i.e. the

4975:

4973:

4937:

4935:

4779:Early Years – The Outdoor Environment

4191:Theory of Games and Economic Behavior

3792:Werner, Jan (2008). "Risk Aversion".

2434:coefficient of relative risk aversion

1052:{\displaystyle u''(c)=-\beta /c^{2},}

689:coefficient of absolute risk aversion

7:

3991:(2nd ed.). New York: Springer.

3922:Essays in the Theory of Risk Bearing

3787:

3785:

2239:{\displaystyle u(c)=c-\alpha c^{2},}

1263:{\displaystyle u(c)=1-e^{-\alpha c}}

445:{\displaystyle E(u)=(u(0)+u(100))/2}

369:(40) might be 5, and for comparison

4715:CAM – the Cambridge Alumni Magazine

3917:. Helsinki: Yrjo Jahnssonin Saatio.

586:first-order stochastically dominant

516:{\displaystyle (\$ 50-\$ 40)/\$ 40}

5745:Microfoundations of macroeconomics

4799:Review of Economics and Statistics

3423:

3355:

3328:

3263:{\displaystyle EU(A)>\$ 20,000}

3248:

3200:

3155:

3131:

1843:

1826:

507:

493:

484:

196:– Utility of the maximal payment;

188:– Utility of the minimal payment;

25:

4572:Journal of Mathematical Economics

3744:Prudence in economics and finance

1317:Hyperbolic absolute risk aversion

6379:neoclassical–Keynesian synthesis

5818:

5817:

5806:

4846:Journal of Economic Perspectives

3802:10.1057/978-1-349-95121-5_2741-1

311:could be $ 0 or $ 40 or $ 100).

132:

118:

104:

4842:"The Internet and the Investor"

4795:"Risky Choice in the Limelight"

4517:Journal of Risk and Uncertainty

4431:Journal of Risk and Uncertainty

3215:{\displaystyle EU(A)=\$ 30,000}

2543:constant relative risk aversion

1769:{\displaystyle cA(c)=1/a=const}

1712:, this is CRRA (see below), as

1272:constant absolute risk aversion

5094:"Risk-taking and Tie-breaking"

4675:10.1523/JNEUROSCI.0314-07.2007

4626:10.1523/JNEUROSCI.0804-06.2006

3893:10.1016/j.jcorpfin.2016.01.009

3480:

3435:

3417:

3411:

3361:

3352:

3340:

3325:

3313:

3307:

3242:

3236:

3194:

3188:

3161:

3152:

3143:

3128:

3119:

3113:

3020:

3014:

2958:

2952:

2756:

2750:

2716:

2710:

2642:

2636:

2591:

2585:

2573:

2567:

2521:

2515:

2502:

2496:

2473:

2467:

2455:

2449:

2403:

2397:

2384:

2378:

2358:

2352:

2322:

2304:

2287:

2281:

2208:

2202:

2165:

2159:

2136:

2130:

2118:

2112:

2083:

2077:

2043:

2037:

2003:

1997:

1951:

1947:

1941:

1930:

1919:

1915:

1909:

1898:

1892:

1886:

1875:

1869:

1838:

1832:

1799:

1793:

1731:

1725:

1679:{\displaystyle A(c)=1/b=const}

1641:

1635:

1479:

1459:

1450:

1444:

1388:

1382:

1369:

1363:

1343:

1337:

1290:

1284:

1232:

1226:

1193:

1187:

1121:

1115:

1075:

1069:

1019:

1013:

991:{\displaystyle u'(c)=\beta /c}

971:

965:

934:

928:

907:

901:

878:

872:

829:

823:

795:

789:

755:

749:

736:

730:

710:

704:

658:

652:

625:

619:

499:

481:

431:

428:

422:

413:

407:

401:

395:

389:

1:

6315:Critique of political economy

4706:Spiegelhalter, David (2009).

1177:so affine transformations of

176:of the certainty equivalent;

4986:The American Economic Review

4584:10.1016/0304-4068(77)90015-5

4566:Kannai, Yakar (1977-03-01).

4416:10.1016/0030-5073(80)90037-9

4164:10.1016/j.jmacro.2011.10.003

3881:Journal of Corporate Finance

3637:Children's services such as

3560:Bargaining and risk aversion

2597:{\displaystyle u(c)=\log(c)}

2264:{\displaystyle \alpha >0}

2142:{\displaystyle u(c)=\log(c)}

2095:{\displaystyle u'''(c)<0}

2055:{\displaystyle u'''(c)>0}

2015:{\displaystyle u'''(c)>0}

1309:is constant with respect to

1302:{\displaystyle A(c)=\alpha }

609:The higher the curvature of

5690:Civil engineering economics

5675:Statistical decision theory

5315:Income elasticity of demand

5058:Choices, Values, and Frames

4876:Review of Financial Studies

4663:The Journal of Neuroscience

4614:The Journal of Neuroscience

3915:The Theory of Risk Aversion

3610:Health and Safety Executive

591:mean-preserving contraction

6973:

6453:Real business-cycle theory

5325:Price elasticity of supply

5320:Price elasticity of demand

5310:Cross elasticity of demand

5113:10.1007/s11098-023-01947-1

4956:10.1007/s11238-020-09786-w

4242:10.1007/s41412-020-00095-9

4092:Mathematics for Economists

3650:Game shows and investments

3584:Risk aversion (psychology)

3581:

3523:cumulative prospect theory

3517:Rabin is that proposed by

3504:has come under criticism.

3376:For a risk averse person,

2844:on saving exactly offset.

2728:{\displaystyle R(c)=\rho }

1982:and this can hold only if

1783:(DARA/IARA) is present if

1592:{\displaystyle c_{s}=-b/a}

671:. One such measure is the

36:

32:Risk aversion (psychology)

29:

6893:

5801:

4926:10.1016/j.dss.2003.12.003

4152:Journal of Macroeconomics

4129:10.1016/j.rie.2013.11.005

3858:. Gower Publishing, Ltd.

3831:. Gower Publishing, Ltd.

1098:{\displaystyle A(c)=1/c.}

5381:Income–consumption curve

4998:10.1257/0002828054201378

4980:Harrison, Glenn (2006).

4914:Decision Support Systems

4019:American Economic Review

3974:"Zender's lecture notes"

2807:{\displaystyle \rho =1,}

2185:{\displaystyle A(c)=1/c}

1270:is unique in exhibiting

679:), after the economists

231:A person is said to be:

39:Risk attitude (security)

6952:Financial risk modeling

6093:Industrial organization

5923:Computational economics

5715:Industrial organization

5076:"Monkey business-sense"

5052:Rabin, Matthew (2000).

4333:10.1111/1468-0262.00158

4282:Prokop, Darren (2023).

3670:entrepreneurial venture

3567:von Neumann-Morgenstern

2897:modern portfolio theory

1170:{\displaystyle \beta ,}

1147:{\displaystyle \alpha }

6298:Modern monetary theory

5963:Experimental economics

5933:Pluralism in economics

5918:Mathematical economics

5149:Cite journal requires

5039:Cite journal requires

3754:St. Petersburg paradox

3682:downside risk aversion

3502:small stakes decisions

3487:

3390:

3368:

3286:

3264:

3216:

3168:

3054:

2976:

2808:

2779:

2729:

2691:

2598:

2531:

2424:Relative risk aversion

2413:

2329:

2265:

2240:

2186:

2143:

2096:

2056:

2016:

1973:

1806:

1770:

1706:

1680:

1619:

1593:

1549:

1512:

1422:

1303:

1264:

1200:

1171:

1148:

1128:

1099:

1053:

992:

944:

885:

856:

836:

835:{\displaystyle u''(c)}

802:

765:

665:

640:affine transformations

632:

605:Absolute risk aversion

570:

517:

446:

61:

5685:Engineering economics

5280:Cost–benefit analysis

5101:Philosophical Studies

4223:Gerber, Anke (2020).

4117:Research in Economics

3909:Arrow, K. J. (1965).

3764:Uncertainty avoidance

3740:, a contrary behavior

3708:Equity premium puzzle

3488:

3391:

3369:

3287:

3265:

3217:

3169:

3055:

2977:

2809:

2780:

2730:

2692:

2599:

2532:

2414:

2330:

2266:

2241:

2187:

2144:

2097:

2057:

2017:

1974:

1807:

1771:

1707:

1681:

1620:

1594:

1550:

1548:{\displaystyle R=1/a}

1513:

1423:

1304:

1265:

1201:

1172:

1149:

1129:

1100:

1054:

993:

945:

886:

857:

837:

803:

801:{\displaystyle u'(c)}

766:

666:

633:

571:

518:

447:

328:affine transformation

314:The utility function

47:

6172:Social choice theory

5928:Behavioral economics

5502:Price discrimination

5396:Intertemporal choice

5092:Doody, Ryan (2023).

4899:10.1093/rfs/15.2.455

4811:10.1162/REST_a_00505

3619:Cambridge University

3594:behavioral economics

3542:behavioral economics

3402:

3380:

3298:

3276:

3227:

3179:

3104:

2989:

2934:

2901:risk-return spectrum

2789:

2739:

2704:

2630:

2613:intertemporal choice

2561:

2443:

2346:

2275:

2249:

2196:

2153:

2106:

2066:

2026:

1986:

1820:

1805:{\displaystyle A(c)}

1787:

1716:

1690:

1629:

1603:

1559:

1525:

1438:

1331:

1278:

1220:

1199:{\displaystyle u(c)}

1181:

1158:

1138:

1127:{\displaystyle A(c)}

1109:

1063:

1002:

954:

895:

884:{\displaystyle u(c)}

866:

846:

812:

778:

698:

687:, also known as the

664:{\displaystyle u(c)}

646:

631:{\displaystyle u(c)}

613:

530:

478:

383:

276:certainty equivalent

244:certainty equivalent

150:Certainty equivalent

6256:American (National)

5956:Economic statistics

5813:Business portal

5750:Operations research

5577:Substitution effect

4944:Theory and Decision

4859:10.1257/jep.15.1.41

4059:10.1093/ajae/aap006

3987:Levy, Haim (2006).

3627:David Spiegelhalter

2842:substitution effect

1705:{\displaystyle b=0}

1625:, this is CARA, as

1618:{\displaystyle a=0}

1214:Exponential utility

1134:does not depend on

365:(100) might be 10,

210:– Maximal payment;

203:– Minimal payment;

6947:Behavioral finance

5391:Indifference curve

5359:Goods and services

5300:Economies of scope

5295:Economies of scale

4739:Gill, Tim (2007).

4529:10.1007/BF00055566

4443:10.1007/BF00213259

4288:www.britannica.com

3703:Ambiguity aversion

3483:

3386:

3364:

3282:

3260:

3212:

3164:

3050:

2972:

2905:standard deviation

2885:monetary economics

2804:

2775:

2725:

2687:

2621:isoelastic utility

2594:

2527:

2409:

2325:

2261:

2236:

2182:

2139:

2092:

2052:

2012:

1969:

1802:

1766:

1702:

1676:

1615:

1589:

1545:

1508:

1418:

1299:

1260:

1206:do not change it.

1196:

1167:

1144:

1124:

1095:

1049:

988:

940:

891:. For example, if

881:

852:

832:

798:

761:

661:

628:

566:

561:

543:

513:

442:

322:) is defined only

62:

6942:Actuarial science

6929:

6928:

6460:New institutional

5831:

5830:

5793:Political economy

5592:Supply and demand

5472:Pareto efficiency

5067:978-0-521-62749-8

4728:on March 9, 2013.

4669:(23): 6212–6218.

4620:(24): 6469–6472.

4201:978-0-691-13061-3

4101:978-81-309-1600-2

3998:978-0-387-29302-8

3865:978-0-566-08798-1

3838:978-1-4724-0403-9

3811:978-1-349-95121-5

3536:as a part of the

3389:{\displaystyle u}

3285:{\displaystyle u}

3084:Oskar Morgenstern

3048:

3045:

2970:

2858:number of dollars

2685:

2525:

2407:

1961:

1850:

1599:. Note that when

1506:

1416:

1392:

855:{\displaystyle c}

759:

560:

542:

373:(50) might be 6.

16:(Redirected from

6964:

6133:Natural resource

5968:Economic history

5906:Mechanism design

5858:

5851:

5844:

5835:

5821:

5820:

5811:

5810:

5553:Returns to scale

5411:Market structure

5191:

5184:

5177:

5168:

5158:

5152:

5147:

5145:

5137:

5124:

5107:(7): 2079–2104.

5098:

5083:

5071:

5048:

5042:

5037:

5035:

5027:

5002:

5001:

4977:

4968:

4967:

4939:

4930:

4929:

4909:

4903:

4902:

4892:

4870:

4864:

4863:

4861:

4837:

4831:

4830:

4790:

4784:

4783:

4773:

4767:

4766:

4764:

4758:. Archived from

4747:

4736:

4730:

4729:

4727:

4712:

4703:

4697:

4696:

4686:

4654:

4648:

4647:

4637:

4605:

4596:

4595:

4563:

4557:

4556:

4508:

4502:

4501:

4461:

4455:

4454:

4426:

4420:

4419:

4399:

4393:

4392:

4374:

4354:

4345:

4344:

4326:

4317:(5): 1281–1292.

4304:

4298:

4297:

4295:

4294:

4279:

4273:

4272:

4254:

4244:

4229:Homo Oeconomicus

4220:

4214:

4213:

4185:

4176:

4175:

4147:

4141:

4140:

4112:

4106:

4105:

4087:

4081:

4080:

4070:

4042:

4036:

4035:

4009:

4003:

4002:

3984:

3978:

3977:

3970:

3964:

3963:

3946:(1/2): 122–136.

3935:

3926:

3918:

3906:

3897:

3896:

3876:

3870:

3869:

3849:

3843:

3842:

3822:

3816:

3815:

3796:. pp. 1–6.

3789:

3759:Statistical risk

3738:Problem gambling

3723:Marginal utility

3713:Investor profile

3674:utility function

3614:opportunity cost

3571:Nash Game Theory

3550:certainty effect

3492:

3490:

3489:

3484:

3395:

3393:

3392:

3387:

3373:

3371:

3370:

3365:

3291:

3289:

3288:

3283:

3269:

3267:

3266:

3261:

3221:

3219:

3218:

3213:

3173:

3171:

3170:

3165:

3080:John von Neumann

3074:expected utility

3059:

3057:

3056:

3051:

3049:

3047:

3046:

3044:

3039:

3038:

3029:

3023:

3006:

3001:

3000:

2981:

2979:

2978:

2973:

2971:

2969:

2961:

2944:

2891:Portfolio theory

2835:

2816:l'Hôpital's rule

2813:

2811:

2810:

2805:

2784:

2782:

2781:

2776:

2771:

2760:

2759:

2734:

2732:

2731:

2726:

2696:

2694:

2693:

2688:

2686:

2684:

2673:

2666:

2665:

2649:

2607:

2603:

2601:

2600:

2595:

2536:

2534:

2533:

2528:

2526:

2524:

2514:

2505:

2495:

2480:

2418:

2416:

2415:

2410:

2408:

2406:

2396:

2387:

2377:

2368:

2334:

2332:

2331:

2326:

2303:

2270:

2268:

2267:

2262:

2245:

2243:

2242:

2237:

2232:

2231:

2191:

2189:

2188:

2183:

2178:

2148:

2146:

2145:

2140:

2101:

2099:

2098:

2093:

2076:

2061:

2059:

2058:

2053:

2036:

2021:

2019:

2018:

2013:

1996:

1978:

1976:

1975:

1970:

1962:

1960:

1959:

1958:

1940:

1928:

1927:

1926:

1908:

1885:

1868:

1859:

1851:

1849:

1841:

1824:

1811:

1809:

1808:

1803:

1775:

1773:

1772:

1767:

1744:

1711:

1709:

1708:

1703:

1685:

1683:

1682:

1677:

1654:

1624:

1622:

1621:

1616:

1598:

1596:

1595:

1590:

1585:

1571:

1570:

1554:

1552:

1551:

1546:

1541:

1517:

1515:

1514:

1509:

1507:

1505:

1494:

1493:

1492:

1477:

1476:

1457:

1427:

1425:

1424:

1419:

1417:

1415:

1398:

1393:

1391:

1381:

1372:

1362:

1353:

1308:

1306:

1305:

1300:

1269:

1267:

1266:

1261:

1259:

1258:

1205:

1203:

1202:

1197:

1176:

1174:

1173:

1168:

1153:

1151:

1150:

1145:

1133:

1131:

1130:

1125:

1104:

1102:

1101:

1096:

1088:

1058:

1056:

1055:

1050:

1045:

1044:

1035:

1012:

997:

995:

994:

989:

984:

964:

949:

947:

946:

941:

890:

888:

887:

882:

861:

859:

858:

853:

841:

839:

838:

833:

822:

807:

805:

804:

799:

788:

770:

768:

767:

762:

760:

758:

748:

739:

729:

720:

670:

668:

667:

662:

637:

635:

634:

629:

575:

573:

572:

567:

562:

553:

544:

535:

522:

520:

519:

514:

506:

451:

449:

448:

443:

438:

361:(0) could be 0,

293:expected utility

287:Utility of money

136:

122:

108:

27:Economics theory

21:

6972:

6971:

6967:

6966:

6965:

6963:

6962:

6961:

6932:

6931:

6930:

6925:

6922:Business portal

6889:

6888:

6887:

6847:

6611:von Böhm-Bawerk

6499:

6498:

6489:

6261:Ancient thought

6239:

6238:

6232:

6223:

6222:

6221:

5972:

5937:

5901:Contract theory

5886:Decision theory

5867:

5862:

5832:

5827:

5805:

5797:

5764:

5643:

5285:Deadweight loss

5222:Consumer choice

5200:

5195:

5148:

5138:

5127:

5096:

5091:

5082:. 23 June 2005.

5074:

5068:

5051:

5038:

5028:

5017:

5014:

5006:

5005:

4979:

4978:

4971:

4941:

4940:

4933:

4911:

4910:

4906:

4872:

4871:

4867:

4839:

4838:

4834:

4792:

4791:

4787:

4775:

4774:

4770:

4762:

4756:

4745:

4738:

4737:

4733:

4725:

4710:

4705:

4704:

4700:

4656:

4655:

4651:

4607:

4606:

4599:

4565:

4564:

4560:

4510:

4509:

4505:

4482:10.2307/1912605

4463:

4462:

4458:

4428:

4427:

4423:

4401:

4400:

4396:

4381:10.2307/1914185

4372:10.1.1.407.1910

4356:

4355:

4348:

4324:10.1.1.295.4269

4306:

4305:

4301:

4292:

4290:

4281:

4280:

4276:

4235:(1–2): 87–104.

4222:

4221:

4217:

4202:

4187:

4186:

4179:

4149:

4148:

4144:

4114:

4113:

4109:

4102:

4089:

4088:

4084:

4044:

4043:

4039:

4014:Blume, Marshall

4012:Friend, Irwin;

4011:

4010:

4006:

3999:

3986:

3985:

3981:

3972:

3971:

3967:

3952:10.2307/1913738

3937:

3936:

3929:

3908:

3907:

3900:

3878:

3877:

3873:

3866:

3851:

3850:

3846:

3839:

3824:

3823:

3819:

3812:

3791:

3790:

3783:

3778:

3699:

3665:

3656:Deal or No Deal

3652:

3635:

3617:focus. In 2007

3606:

3598:neuromodulation

3586:

3580:

3562:

3538:prospect theory

3519:prospect theory

3498:

3400:

3399:

3378:

3377:

3296:

3295:

3274:

3273:

3225:

3224:

3177:

3176:

3102:

3101:

3066:

3030:

3024:

3007:

2992:

2987:

2986:

2962:

2945:

2932:

2931:

2926:

2893:

2853:

2823:

2787:

2786:

2742:

2737:

2736:

2702:

2701:

2674:

2651:

2650:

2628:

2627:

2605:

2559:

2558:

2507:

2506:

2488:

2481:

2441:

2440:

2426:

2389:

2388:

2370:

2369:

2344:

2343:

2273:

2272:

2247:

2246:

2223:

2194:

2193:

2151:

2150:

2104:

2103:

2069:

2064:

2063:

2029:

2024:

2023:

1989:

1984:

1983:

1950:

1933:

1929:

1918:

1901:

1878:

1861:

1860:

1842:

1825:

1818:

1817:

1785:

1784:

1714:

1713:

1688:

1687:

1627:

1626:

1601:

1600:

1562:

1557:

1556:

1523:

1522:

1495:

1478:

1468:

1458:

1436:

1435:

1402:

1374:

1373:

1355:

1354:

1329:

1328:

1276:

1275:

1244:

1218:

1217:

1179:

1178:

1156:

1155:

1136:

1135:

1107:

1106:

1061:

1060:

1036:

1005:

1000:

999:

957:

952:

951:

893:

892:

864:

863:

844:

843:

815:

810:

809:

781:

776:

775:

741:

740:

722:

721:

696:

695:

644:

643:

611:

610:

607:

599:

528:

527:

476:

475:

381:

380:

357:. For instance

289:

221:

220:

219:

218:

208:

201:

193:

185:

142:

141:

140:

137:

128:

127:

126:

123:

114:

113:

112:

109:

98:

42:

35:

28:

23:

22:

15:

12:

11:

5:

6970:

6968:

6960:

6959:

6954:

6949:

6944:

6934:

6933:

6927:

6926:

6924:

6919:

6914:

6909:

6904:

6899:

6894:

6891:

6890:

6886:

6885:

6880:

6870:

6865:

6859:

6858:

6857:

6855:

6849:

6848:

6846:

6845:

6838:

6833:

6828:

6823:

6818:

6813:

6808:

6803:

6798:

6793:

6788:

6783:

6778:

6773:

6768:

6763:

6758:

6753:

6748:

6743:

6738:

6733:

6728:

6723:

6718:

6713:

6708:

6703:

6698:

6693:

6688:

6683:

6678:

6673:

6668:

6663:

6658:

6653:

6648:

6643:

6638:

6633:

6628:

6623:

6618:

6613:

6608:

6603:

6598:

6593:

6588:

6583:

6578:

6573:

6568:

6563:

6558:

6553:

6548:

6543:

6538:

6533:

6528:

6523:

6518:

6513:

6508:

6502:

6500:

6494:

6491:

6490:

6488:

6487:

6482:

6477:

6472:

6467:

6462:

6457:

6456:

6455:

6445:

6444:

6443:

6433:

6428:

6423:

6422:

6421:

6411:

6406:

6401:

6400:

6399:

6398:

6397:

6387:

6382:

6367:

6362:

6357:

6352:

6347:

6342:

6337:

6332:

6327:

6325:Disequilibrium

6322:

6317:

6312:

6307:

6302:

6301:

6300:

6290:

6285:

6280:

6275:

6274:

6273:

6263:

6258:

6253:

6248:

6242:

6240:

6228:

6225:

6224:

6220:

6219:

6214:

6209:

6204:

6199:

6194:

6189:

6184:

6179:

6174:

6165:

6160:

6155:

6150:

6145:

6140:

6138:Organizational

6135:

6130:

6125:

6120:

6115:

6110:

6105:

6100:

6095:

6090:

6085:

6080:

6075:

6070:

6065:

6060:

6055:

6050:

6045:

6040:

6035:

6030:

6025:

6020:

6015:

6010:

6005:

6000:

5995:

5990:

5984:

5983:

5982:

5980:

5974:

5973:

5971:

5970:

5965:

5960:

5959:

5958:

5947:

5945:

5939:

5938:

5936:

5935:

5930:

5925:

5920:

5915:

5913:Macroeconomics

5910:

5909:

5908:

5903:

5898:

5893:

5888:

5881:Microeconomics

5877:

5875:

5869:

5868:

5863:

5861:

5860:

5853:

5846:

5838:

5829:

5828:

5826:

5825:

5815:

5802:

5799:

5798:

5796:

5795:

5790:

5788:Macroeconomics

5785:

5784:

5783:

5772:

5770:

5766:

5765:

5763:

5762:

5757:

5752:

5747:

5742:

5737:

5732:

5727:

5722:

5717:

5712:

5707:

5702:

5697:

5692:

5687:

5682:

5677:

5672:

5667:

5662:

5657:

5651:

5649:

5645:

5644:

5642:

5641:

5636:

5635:

5634:

5629:

5619:

5614:

5613:

5612:

5603:

5589:

5584:

5579:

5574:

5565:

5560:

5555:

5550:

5545:

5540:

5535:

5530:

5525:

5524:

5523:

5518:

5509:

5504:

5499:

5494:

5489:

5487:Price controls

5479:

5474:

5469:

5468:

5467:

5462:

5457:

5452:

5451:

5450:

5445:

5435:

5430:

5429:

5428:

5423:

5408:

5406:Market failure

5403:

5398:

5393:

5388:

5383:

5378:

5373:

5372:

5371:

5366:

5356:

5351:

5346:

5341:

5340:

5339:

5329:

5328:

5327:

5322:

5317:

5312:

5302:

5297:

5292:

5287:

5282:

5277:

5276:

5275:

5270:

5265:

5260:

5259:

5258:

5248:

5243:

5233:

5224:

5219:

5214:

5208:

5206:

5202:

5201:

5198:Microeconomics

5196:

5194:

5193:

5186:

5179:

5171:

5165:

5164:

5159:

5151:|journal=

5125:

5089:

5084:

5072:

5066:

5049:

5041:|journal=

5013:

5012:External links

5010:

5004:

5003:

4992:(3): 897–901.

4969:

4931:

4920:(3): 505–524.

4904:

4890:10.1.1.46.6569

4883:(2): 455–488.

4865:

4832:

4805:(2): 318–332.

4785:

4782:. Teachers TV.

4768:

4765:on 2009-03-06.

4754:

4731:

4698:

4649:

4597:

4558:

4523:(1): 101–124.

4503:

4476:(3): 639–647.

4456:

4421:

4410:(3): 395–418.

4394:

4346:

4299:

4274:

4215:

4200:

4177:

4142:

4107:

4100:

4082:

4053:(1): 273–282.

4037:

4026:(5): 900–922.

4004:

3997:

3979:

3965:

3927:

3919:Reprinted in:

3898:

3871:

3864:

3844:

3837:

3817:

3810:

3780:

3779:

3777:

3774:

3773:

3772:

3767:

3761:

3756:

3751:

3746:

3741:

3735:

3730:

3728:Neuroeconomics

3725:

3720:

3715:

3710:

3705:

3698:

3695:

3664:

3661:

3651:

3648:

3634:

3631:

3621:initiated the

3605:

3602:

3590:neuroeconomics

3582:Main article:

3579:

3576:

3561:

3558:

3497:

3494:

3482:

3479:

3476:

3473:

3470:

3467:

3464:

3461:

3458:

3455:

3452:

3449:

3446:

3443:

3440:

3437:

3434:

3431:

3428:

3425:

3422:

3419:

3416:

3413:

3410:

3407:

3385:

3363:

3360:

3357:

3354:

3351:

3348:

3345:

3342:

3339:

3336:

3333:

3330:

3327:

3324:

3321:

3318:

3315:

3312:

3309:

3306:

3303:

3281:

3259:

3256:

3253:

3250:

3247:

3244:

3241:

3238:

3235:

3232:

3211:

3208:

3205:

3202:

3199:

3196:

3193:

3190:

3187:

3184:

3163:

3160:

3157:

3154:

3151:

3148:

3145:

3142:

3139:

3136:

3133:

3130:

3127:

3124:

3121:

3118:

3115:

3112:

3109:

3065:

3062:

3061:

3060:

3043:

3037:

3033:

3027:

3022:

3019:

3016:

3013:

3010:

3004:

2999:

2995:

2983:

2982:

2968:

2965:

2960:

2957:

2954:

2951:

2948:

2942:

2939:

2924:

2921:central moment

2892:

2889:

2852:

2849:

2803:

2800:

2797:

2794:

2774:

2770:

2766:

2763:

2758:

2755:

2752:

2749:

2745:

2724:

2721:

2718:

2715:

2712:

2709:

2698:

2697:

2683:

2680:

2677:

2672:

2669:

2664:

2661:

2658:

2654:

2647:

2644:

2641:

2638:

2635:

2615:problems, the

2593:

2590:

2587:

2584:

2581:

2578:

2575:

2572:

2569:

2566:

2539:

2538:

2523:

2520:

2517:

2513:

2510:

2504:

2501:

2498:

2494:

2491:

2487:

2484:

2478:

2475:

2472:

2469:

2466:

2463:

2460:

2457:

2454:

2451:

2448:

2436:is defined as

2425:

2422:

2421:

2420:

2405:

2402:

2399:

2395:

2392:

2386:

2383:

2380:

2376:

2373:

2366:

2363:

2360:

2357:

2354:

2351:

2340:

2324:

2321:

2318:

2315:

2312:

2309:

2306:

2302:

2298:

2295:

2292:

2289:

2286:

2283:

2280:

2260:

2257:

2254:

2235:

2230:

2226:

2222:

2219:

2216:

2213:

2210:

2207:

2204:

2201:

2181:

2177:

2173:

2170:

2167:

2164:

2161:

2158:

2138:

2135:

2132:

2129:

2126:

2123:

2120:

2117:

2114:

2111:

2091:

2088:

2085:

2082:

2079:

2075:

2072:

2051:

2048:

2045:

2042:

2039:

2035:

2032:

2011:

2008:

2005:

2002:

1999:

1995:

1992:

1980:

1979:

1968:

1965:

1957:

1953:

1949:

1946:

1943:

1939:

1936:

1932:

1925:

1921:

1917:

1914:

1911:

1907:

1904:

1900:

1897:

1894:

1891:

1888:

1884:

1881:

1877:

1874:

1871:

1867:

1864:

1857:

1854:

1848:

1845:

1840:

1837:

1834:

1831:

1828:

1814:

1813:

1801:

1798:

1795:

1792:

1765:

1762:

1759:

1756:

1753:

1750:

1747:

1743:

1739:

1736:

1733:

1730:

1727:

1724:

1721:

1701:

1698:

1695:

1675:

1672:

1669:

1666:

1663:

1660:

1657:

1653:

1649:

1646:

1643:

1640:

1637:

1634:

1614:

1611:

1608:

1588:

1584:

1580:

1577:

1574:

1569:

1565:

1544:

1540:

1536:

1533:

1530:

1519:

1518:

1504:

1501:

1498:

1491:

1488:

1485:

1481:

1475:

1471:

1467:

1464:

1461:

1455:

1452:

1449:

1446:

1443:

1429:

1428:

1414:

1411:

1408:

1405:

1401:

1396:

1390:

1387:

1384:

1380:

1377:

1371:

1368:

1365:

1361:

1358:

1351:

1348:

1345:

1342:

1339:

1336:

1325:

1324:

1314:

1298:

1295:

1292:

1289:

1286:

1283:

1257:

1254:

1251:

1247:

1243:

1240:

1237:

1234:

1231:

1228:

1225:

1195:

1192:

1189:

1186:

1166:

1163:

1143:

1123:

1120:

1117:

1114:

1094:

1091:

1087:

1083:

1080:

1077:

1074:

1071:

1068:

1048:

1043:

1039:

1034:

1030:

1027:

1024:

1021:

1018:

1015:

1011:

1008:

987:

983:

979:

976:

973:

970:

967:

963:

960:

939:

936:

933:

930:

927:

924:

921:

918:

915:

912:

909:

906:

903:

900:

880:

877:

874:

871:

851:

831:

828:

825:

821:

818:

797:

794:

791:

787:

784:

772:

771:

757:

754:

751:

747:

744:

738:

735:

732:

728:

725:

718:

715:

712:

709:

706:

703:

660:

657:

654:

651:

627:

624:

621:

618:

606:

603:

598:

595:

565:

559:

556:

550:

547:

541:

538:

524:

523:

512:

509:

505:

501:

498:

495:

492:

489:

486:

483:

454:

453:

441:

437:

433:

430:

427:

424:

421:

418:

415:

412:

409:

406:

403:

400:

397:

394:

391:

388:

288:

285:

272:expected value

268:

267:

255:

247:

226:risk attitudes

206:

199:

191:

183:

158:Expected value

144:

143:

138:

131:

130:

129:

124:

117:

116:

115:

110:

103: