326:

310:

318:

302:

830:

853:

45:

685:- Market capitalization must be greater than or equal to US$ 18.0 billion. These market cap eligibility criteria are for addition to an index, not for continued membership. As a result, an index constituent that appears to violate criteria for addition to that index is not removed unless ongoing conditions warrant an index change.

620:

On Monday, March 4, 1957, the index was expanded to its current extent of 500 companies and was renamed the S&P 500 Stock

Composite Index. In 1962, Ultronic Systems became the compiler of the S&P indices including the S&P 500 Stock Composite Index, the 425 Stock Industrial Index, the 50

613:) began rating mortgage bonds and developed its first stock market index consisting of the stocks of 233 U.S. companies, computed weekly. Three years later, it developed a 90-stock index, computed daily. In 1941, Poor's Publishing merged with Standard Statistics Company to form

660:

introduced the S&P E-mini futures contract. In 2005, the index transitioned to a public float-adjusted capitalization-weighting. Friday, September 17, 2021, was the final trading date for the original SP big contract which began trading in 1982.

677:

which are strictly rule-based, the components of the S&P 500 index are selected by a committee. When considering the eligibility of a new addition, the committee assesses the company's merit using the following primary criteria:

4914:

874:

of the return over the same time period being 20.81%. While the index has declined in several years by over 30%, it has posted annual increases 70% of the time, with 5% of all trading days resulting in record highs.

3063:

451:(ETFs), can replicate, before fees and expenses, the performance of the index by holding the same stocks as the index in the same proportions. ETFs that replicate the performance of the index are issued by

4823:

4907:

3410:"Termination of Trading, Conversion and Delisting of Standard-Size Standard and Poor's 500 Stock Price Index Futures and Options on Standard and Poor's 500 Stock Price Index Futures Contracts"

3462:

4849:

3095:

4900:

5066:

4190:

4816:

3395:

729: – The company must have its primary listing on a U.S. exchange, be subject to U.S. securities laws and derive at least 50% of its revenue in the U.S.

503:), although SPY has a higher annual expense ratio of 0.09% compared to 0.03% for VOO and IVV, and 0.02% for SPLG. Mutual funds that track the index are offered by

3684:

3377:

3045:

5166:

3433:

4809:

4609:

641:

based on the index. Beginning in 1986, the index value was updated every 15 seconds, or 1,559 times per trading day, with price updates disseminated by

5098:

4202:

609:

formed Poor's

Publishing, which published an investor's guide to the railroad industry. In 1923, Standard Statistics Company (founded in 1906 as the

4661:

3546:

408:

226:

3800:

3264:

5161:

3785:

3858:

3084:

3795:

3775:

3510:

3193:

824:

325:

3974:

3677:

3623:

3602:

3525:

3790:

5151:

3355:

5045:

4943:

4178:

4102:

890:

and the reinvestment thereof, and "net total return", which reflects the effects of dividend reinvestment after the deduction of

852:

401:

701: – Minimum monthly trading volume of 250,000 shares in each of the six months leading up to the evaluation date

3571:

634:

590:

5130:

4214:

3670:

2979:

357:

177:

349:

in the United States. It is one of the most commonly followed equity indices and includes approximately 80% of the total

4938:

4844:

4655:

4639:

4056:

2884:

361:

140:

31:

309:

5156:

3744:

3645:

3491:

859:

789:

630:

578:

3628:

3238:

5029:

4162:

3739:

3030:

737:

512:

317:

301:

2927:

815:

to increase their chances of entering the S&P 500 Index—even without meeting the full criteria for inclusion.

4948:

4585:

4107:

3948:

3765:

3409:

3233:

2889:

793:

364:

accounted for 35.8% of the market capitalization of the index and were, in order of highest to lowest weighting:

329:

Logarithmic Chart of S&P 500 Index with and without

Inflation and with Best Fit and other graphs to Feb 2024

4963:

4112:

3396:"Standard & Poor's Announces Changes to U.S. Investable Weight Factors and Final Float Transition Schedule"

653:

476:

3212:

3091:

670:

416:

76:

4790:

4597:

3884:

708:

614:

313:

A logarithmic chart of the S&P 500 index daily closing values from

January 3, 1950, to February 19, 2016

91:

4667:

3853:

695: – Annual dollar value traded to float-adjusted market capitalization is greater than 0.75.

3487:

4685:

4591:

4344:

4006:

3990:

3780:

3259:

682:

393:

350:

157:

150:

610:

4892:

3603:"The S&P 500 has already met its average return for a full year, but don't expect it to stay here"

829:

353:

of U.S. public companies, with an aggregate market cap of more than $ 43 trillion as of

January 2024.

4456:

4277:

4272:

4267:

3749:

3714:

3254:

3124:

3007:

757:

753:

649:

574:

504:

448:

163:

2956:

415:, including ^GSPC, INX, and $ SPX, depending on market or website. The S&P 500 is maintained by

4755:

4645:

4633:

4451:

4262:

733:

101:

3286:

5003:

4998:

4993:

4924:

4876:

4833:

4419:

4282:

4137:

4132:

4081:

3693:

3651:

3361:

871:

745:

674:

622:

597:

on the S&P 500 index as well as on S&P 500 index ETFs, inverse ETFs, and leveraged ETFs.

452:

389:

342:

305:

A linear chart of the S&P 500 daily closing values from

January 3, 1950, to February 19, 2016

3729:

195:

5082:

4389:

4379:

4196:

3905:

3863:

3724:

3336:

777:

606:

400:. The components that have increased their dividends in 25 consecutive years are known as the

3868:

4958:

4861:

4548:

4399:

4318:

4066:

4022:

3953:

3848:

3644:

3463:"S&P Dow Jones Indices Announces Update to S&P Composite 1500 Market Cap Guidelines"

3434:"S&P Dow Jones Indices Announces Update to S&P Composite 1500 Market Cap Guidelines"

3332:

785:

781:

741:

698:

688:

638:

594:

582:

377:

4801:

214:

4615:

4603:

4394:

3340:

3217:

3046:"S&P 500 Index grew over $ 6.7 trillion in one year to January 2024, finds GlobalData"

891:

769:

749:

534:

3120:

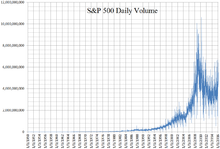

321:

A daily volume chart of the S&P 500 index from

January 3, 1950, to February 19, 2016

4968:

4856:

4739:

4734:

4729:

4691:

4491:

4486:

4481:

4257:

4252:

4247:

4061:

3969:

3932:

3827:

3734:

3160:

3142:

808:

765:

726:

704:

589:

auction, or on CME's Globex platform, and are the exchange's most popular product. The

522:

381:

346:

83:

5145:

5024:

5008:

4881:

4724:

4719:

4627:

4621:

4517:

4476:

4471:

4466:

4157:

4086:

3843:

3313:

3309:

3197:

3070:

2986:

2960:

838:

812:

761:

716:

508:

424:

420:

412:

385:

17:

4679:

4461:

883:

879:

692:

411:, used to forecast the direction of the economy. The index is associated with many

3579:

3174:

723:(Nasdaq Global Select Market, Nasdaq Select Market or the Nasdaq Capital Market).

4785:

4780:

4303:

3770:

3506:

3178:

626:

586:

444:

190:

3156:

4988:

4978:

4973:

4953:

4866:

4538:

4507:

4308:

4127:

4122:

4117:

4071:

3719:

801:

773:

525:

which attempt to produce three times the daily return of either investing in (

440:

373:

200:

3025:

4651:

4522:

4414:

4384:

4339:

4313:

3900:

3530:

867:

712:

657:

558:

550:

546:

538:

526:

496:

488:

480:

468:

456:

365:

3378:"This Day In Market History: S&P 500 Quotes Delivered Every 15 Seconds"

44:

4512:

4409:

4364:

3290:

887:

863:

845:

518:

397:

345:

tracking the stock performance of 500 of the largest companies listed on

882:(excluding returns from dividends). However, they can also be quoted as

811:

reported that a study alleged that some companies purchase ratings from

4673:

4374:

4369:

4323:

3662:

3011:

2932:

642:

562:

542:

530:

492:

464:

3138:

621:

Stock

Utility Index, and the 25 Stock Rail Index. On August 31, 1976,

554:

500:

484:

472:

460:

5114:

5061:

4775:

4569:

4404:

4349:

4298:

4208:

4184:

720:

369:

96:

648:

On

January 22, 1993, the Standard & Poor's Depositary Receipts

629:

to retail investors that tracked the index. On April 21, 1982, the

4564:

4543:

4424:

4242:

3547:"S&P 500 Membership May Be 'For Sale,' NBER Research Suggests"

324:

316:

308:

300:

3607:

4896:

4805:

3666:

4359:

4354:

800:

A stock may rise in value when it is added to the index since

732:

Securities that are ineligible for inclusion in the index are

633:

began trading futures based on the index. On July 1, 1983,

585:

that track the index and trade on the exchange floor in an

3646:"Worried about the stock market? Resist the urge to panic"

229:

of components of the S&P 500 by market capitalization

3194:"Higher Turnover Ahead For S&P 500? Not Necessarily!"

804:

must purchase that stock to continue tracking the index.

360:. As of June 28, 2024, the nine largest companies on the

707: – Must be publicly listed on either the

2974:

2972:

2970:

2928:"Key dates and milestones in the S&P 500's history"

407:

The index is one of the factors in computation of the

495:). The most liquid based on average daily volume is (

3327:

Riggs, Thomas, ed. (2015). "Standard & Poor's".

5123:

5107:

5091:

5075:

5054:

5038:

5017:

4931:

4768:

4748:

4712:

4705:

4578:

4557:

4531:

4500:

4444:

4437:

4332:

4291:

4235:

4228:

4171:

4150:

4095:

4049:

4042:

4035:

4015:

3999:

3983:

3962:

3941:

3925:

3918:

3893:

3877:

3836:

3820:

3813:

3758:

3707:

3700:

209:

183:

173:

156:

146:

136:

110:

82:

72:

54:

3526:"Do stocks soar if they get into the S&P 500?"

3354:

427:, and its components are selected by a committee.

5067:Indice General de la Bolsa de Valores de Colombia

4191:Indice General de la Bolsa de Valores de Colombia

3356:"Vast stock wire network being extended to coast"

3085:S&P Dividend Aristocrats Indices Methodology

833:S&P 500 Buybacks and Dividends (quarterly)

356:The S&P 500 index is a free-float weighted/

4908:

4817:

3678:

3578:. Pie-R-Cube. August 13, 2021. Archived from

3428:

3426:

8:

913:Value of $ 1.00 Invested on January 1, 1970

37:

4915:

4901:

4893:

4824:

4810:

4802:

4709:

4441:

4232:

4046:

4039:

3922:

3817:

3704:

3685:

3671:

3663:

3507:"Stock Price Reactions to Index Inclusion"

3329:Gale Encyclopedia of U.S. Economic History

3304:

3302:

3300:

2921:

2919:

2917:

2915:

2913:

2911:

2909:

2907:

2905:

897:

43:

36:

2853:Total Annual Return, Including Dividends

910:Total Annual Return, Including Dividends

858:Since its inception in 1926, the index's

388:(including both class A & C shares),

30:For a list of S&P 500 companies, see

2951:

2949:

2947:

2945:

2943:

828:

2901:

2890:SPDR S&P 500 Trust ETF (symbol SPY)

2856:Value of $ 1.00 Invested on 1970‑01‑01

866:—has been approximately 9.8% (6% after

409:Conference Board Leading Economic Index

5099:Índice de Precio Selectivo de Acciones

4203:Índice de Precio Selectivo de Acciones

3786:Refinitiv Equal Weight Commodity Index

3101:from the original on November 23, 2023

2926:Valetkevitch, Caroline (May 6, 2013).

898:

3859:FTSEurofirst Euro Supersector Indices

3801:Standard & Poor's Commodity Index

825:Closing milestones of the S&P 500

656:began trading. On September 9, 1997,

7:

3796:Rogers International Commodity Index

3776:Deutsche Bank Liquid Commodity Index

3624:"Why Investors Love the S&P 500"

3511:National Bureau of Economic Research

3213:"How Are S&P 500 Stocks Chosen?"

5167:North American stock market indices

49:S&P 500 Index from 1970 to 2023

3975:Philadelphia Gold and Silver Index

3643:Carlson, Ben (February 27, 2020).

3601:Santoli, Michael (June 18, 2017).

3255:"The Best S&P 500 Index Funds"

3234:"7 S&P Index Funds to Buy Now"

3121:"Global Business Cycle Indicators"

2980:"S&P U.S. Indices Methodology"

277: Information Technology (13%)

253: Consumer Discretionary (10%)

178:Free-float capitalization-weighted

25:

3791:Refinitiv/CoreCommodity CRB Index

3545:Lee, Justina (October 12, 2021).

3267:from the original on June 3, 2023

673:, but unlike indices such as the

283: Communication Services (4%)

5046:Indice de Precios y Cotizaciones

4944:Dow Jones Transportation Average

4179:Indice de Precios y Cotizaciones

4103:Dow Jones Transportation Average

3622:Carlozo, Lou (October 2, 2018).

3572:"S&P 500 Standard Deviation"

3211:Wathen, Jordan (April 9, 2019).

3192:Preston, Hamish (June 9, 2020).

3094:. September 1, 2023. p. 4.

878:Returns are generally quoted as

851:

436:Mutual and exchange-traded funds

402:S&P 500 Dividend Aristocrats

41:

4923:Major North and South American

3376:Duggan, Wayne (June 13, 2019).

5131:S&P/BVL Peru General Index

4215:S&P/BVL Peru General Index

3331:. Vol. 3 (2nd ed.).

3232:Chang, Ellen (June 28, 2019).

3008:"iShares Core S&P 500 ETF"

669:Like other indices managed by

635:Chicago Board Options Exchange

591:Chicago Board Options Exchange

1:

5162:American stock market indices

3524:Krantz, Matt (July 5, 2013).

2885:List of S&P 500 companies

886:, which include returns from

362:list of S&P 500 companies

358:capitalization-weighted index

32:List of S&P 500 companies

4939:Dow Jones Industrial Average

4845:Dow Jones Industrial Average

4057:Dow Jones Industrial Average

3629:U.S. News & World Report

3239:U.S. News & World Report

790:American depositary receipts

431:Investing in the S&P 500

5030:S&P/TSX Composite Index

4163:S&P/TSX Composite Index

3745:FTSE All-World index series

3492:Corporate Finance Institute

2841:

2838:

2835:

2832:

2829:

2826:

2823:

2820:

2812:

2809:

2806:

2803:

2800:

2797:

2794:

2791:

2783:

2780:

2777:

2774:

2771:

2768:

2765:

2762:

2754:

2751:

2748:

2745:

2742:

2739:

2736:

2733:

2725:

2722:

2719:

2716:

2713:

2710:

2707:

2704:

2696:

2693:

2690:

2687:

2684:

2681:

2678:

2675:

2667:

2664:

2661:

2658:

2655:

2652:

2649:

2646:

2638:

2635:

2632:

2629:

2626:

2623:

2620:

2617:

2609:

2606:

2603:

2600:

2597:

2594:

2591:

2588:

2580:

2577:

2574:

2571:

2568:

2565:

2562:

2559:

2551:

2548:

2545:

2542:

2539:

2536:

2533:

2530:

2522:

2519:

2516:

2513:

2510:

2507:

2504:

2501:

2493:

2490:

2487:

2484:

2481:

2478:

2475:

2472:

2464:

2461:

2458:

2455:

2452:

2449:

2446:

2443:

2435:

2432:

2429:

2426:

2423:

2420:

2417:

2414:

2406:

2403:

2400:

2397:

2394:

2391:

2388:

2385:

2377:

2374:

2371:

2368:

2365:

2362:

2359:

2356:

2348:

2345:

2342:

2339:

2336:

2333:

2330:

2327:

2319:

2316:

2313:

2310:

2307:

2304:

2301:

2298:

2290:

2287:

2284:

2281:

2278:

2275:

2272:

2269:

2261:

2258:

2255:

2252:

2249:

2246:

2243:

2240:

2232:

2229:

2226:

2223:

2220:

2217:

2214:

2211:

2203:

2200:

2197:

2194:

2191:

2188:

2185:

2182:

2174:

2171:

2168:

2165:

2162:

2159:

2156:

2153:

2145:

2142:

2139:

2136:

2133:

2130:

2127:

2124:

2116:

2113:

2110:

2107:

2104:

2101:

2098:

2095:

2087:

2084:

2081:

2078:

2075:

2072:

2069:

2066:

2058:

2055:

2052:

2049:

2046:

2043:

2040:

2037:

2029:

2026:

2023:

2020:

2017:

2014:

2011:

2008:

2000:

1997:

1994:

1991:

1988:

1985:

1982:

1979:

1971:

1968:

1965:

1962:

1959:

1956:

1953:

1950:

1942:

1939:

1936:

1933:

1930:

1927:

1924:

1921:

1913:

1910:

1907:

1904:

1901:

1898:

1895:

1892:

1884:

1881:

1878:

1875:

1872:

1869:

1866:

1863:

1855:

1852:

1849:

1846:

1843:

1840:

1837:

1834:

1826:

1823:

1820:

1817:

1814:

1811:

1808:

1805:

1797:

1794:

1791:

1788:

1785:

1782:

1779:

1776:

1768:

1765:

1762:

1759:

1756:

1753:

1750:

1747:

1739:

1736:

1733:

1730:

1727:

1724:

1721:

1718:

1710:

1707:

1704:

1701:

1698:

1695:

1692:

1689:

1681:

1678:

1675:

1672:

1669:

1666:

1663:

1660:

1652:

1649:

1646:

1643:

1640:

1637:

1634:

1631:

1623:

1620:

1617:

1614:

1611:

1608:

1605:

1602:

1594:

1591:

1588:

1585:

1582:

1579:

1576:

1573:

1565:

1562:

1559:

1556:

1553:

1550:

1547:

1544:

1536:

1533:

1530:

1527:

1524:

1521:

1518:

1515:

1507:

1504:

1501:

1498:

1495:

1492:

1489:

1486:

1478:

1475:

1472:

1469:

1466:

1463:

1460:

1457:

1449:

1446:

1443:

1440:

1437:

1434:

1431:

1428:

1420:

1417:

1414:

1411:

1408:

1405:

1402:

1399:

1391:

1388:

1385:

1382:

1379:

1376:

1373:

1370:

1362:

1359:

1356:

1353:

1350:

1347:

1344:

1341:

1333:

1330:

1327:

1324:

1321:

1318:

1315:

1312:

1304:

1301:

1298:

1295:

1292:

1289:

1286:

1283:

1275:

1272:

1269:

1266:

1263:

1260:

1257:

1254:

1246:

1243:

1240:

1237:

1234:

1231:

1228:

1225:

1217:

1214:

1211:

1208:

1205:

1202:

1199:

1196:

1188:

1185:

1182:

1179:

1176:

1173:

1170:

1167:

1159:

1156:

1153:

1150:

1147:

1144:

1141:

1138:

1130:

1127:

1124:

1121:

1118:

1115:

1112:

1109:

1101:

1098:

1095:

1092:

1089:

1086:

1083:

1080:

1072:

1069:

1066:

1063:

1060:

1057:

1054:

1051:

1043:

1040:

1037:

1034:

1031:

1028:

1025:

1022:

1014:

1011:

1008:

1005:

1002:

999:

996:

993:

985:

982:

979:

976:

973:

970:

967:

964:

956:

953:

950:

947:

944:

941:

938:

935:

860:compound annual growth rate

738:master limited partnerships

631:Chicago Mercantile Exchange

579:Chicago Mercantile Exchange

259: Consumer Staples (8%)

27:American stock market index

5183:

3740:Dow Jones Global Titans 50

2871:25-Year Annualized Return

2868:20-Year Annualized Return

2865:15-Year Annualized Return

2862:10-Year Annualized Return

928:25-Year Annualized Return

925:20-Year Annualized Return

922:15-Year Annualized Return

919:10-Year Annualized Return

822:

794:American depositary shares

611:Standard Statistics Bureau

513:Charles Schwab Corporation

29:

5152:S&P Dow Jones Indices

4949:Dow Jones Utility Average

4840:

4108:Dow Jones Utility Average

3949:PHLX Semiconductor Sector

3766:Bloomberg Commodity Index

3175:"S&P 500 Index Quote"

3092:S&P Dow Jones Indices

2859:5-Year Annualized Return

916:5-Year Annualized Return

671:S&P Dow Jones Indices

545:) the S&P 500 index.

417:S&P Dow Jones Indices

169:(as of December 31, 2023)

77:S&P Dow Jones Indices

42:

4964:NYSE Arca Tech 100 Index

4113:NYSE Arca Tech 100 Index

3885:S&P Latin America 40

654:State Street Corporation

549:offers 2x daily return (

477:State Street Corporation

3139:"Yahoo! Finance: ^GSPC"

3031:Encyclopædia Britannica

709:New York Stock Exchange

557:) and 3x daily return (

335:Standard and Poor's 500

247: Industrials (16%)

3854:FTSEurofirst 300 Index

3157:"Google Finance: .INX"

848:

330:

322:

314:

306:

295: Real Estate (6%)

271: Financials (14%)

265: Healthcare (13%)

60:; 67 years ago

4850:historical components

4007:Palisades Water Index

3991:CBV Real Estate Index

3781:NCDEX Commodity Index

832:

758:Exchange-traded notes

754:exchange-traded funds

683:Market capitalization

615:Standard & Poor's

449:exchange-traded funds

394:Eli Lilly and Company

351:market capitalization

328:

320:

312:

304:

18:Standard and Poor 500

4925:stock market indices

4834:stock market indices

4832:Major United States

4756:S&P/NZX 50 Index

4278:FTSE AIM UK 50 Index

4273:FTSE Fledgling Index

4268:FTSE All-Share Index

3750:OTCM QX ADR 30 Index

3694:Stock market indices

3576:Quantamental Finance

3125:The Conference Board

3052:. February 16, 2024.

734:limited partnerships

650:exchange-traded fund

505:Fidelity Investments

289: Utilities (6%)

241: Materials (6%)

4634:Straits Times Index

4263:FTSE SmallCap Index

3730:S&P Global 1200

3582:on January 23, 2022

3488:"S&P 500 Index"

900:

215:spglobal.com/sp-500

196:S&P Global 1200

39:

5157:1957 introductions

5004:Russell 3000 Index

4999:Russell 2000 Index

4994:Russell 1000 Index

4283:FTSE AIM 100 Index

3864:S&P Europe 350

3725:S&P Global 100

3362:The New York Times

899:Show / Hide table

872:standard deviation

849:

746:OTC Bulletin Board

675:Russell 1000 Index

665:Selection criteria

625:offered the first

623:The Vanguard Group

453:The Vanguard Group

423:majority-owned by

390:Berkshire Hathaway

343:stock market index

331:

323:

315:

307:

58:March 4, 1957

5139:

5138:

4890:

4889:

4799:

4798:

4764:

4763:

4701:

4700:

4549:S&P/TOPIX 150

4433:

4432:

4224:

4223:

4146:

4145:

4031:

4030:

3914:

3913:

3809:

3808:

3505:Fitzgerald, Jay.

3468:. January 4, 2022

3419:. August 6, 2021.

2875:

2874:

807:In October 2021,

786:investment trusts

782:convertible bonds

607:Henry Varnum Poor

583:futures contracts

235: Energy (4%)

221:

220:

102:Cboe BZX Exchange

16:(Redirected from

5174:

4959:Nasdaq Composite

4917:

4910:

4903:

4894:

4862:Nasdaq Composite

4826:

4819:

4812:

4803:

4710:

4442:

4319:CAC All-Tradable

4233:

4067:Nasdaq Composite

4047:

4040:

4023:Baltic Dry Index

3923:

3919:Industry indices

3849:STOXX Europe 600

3818:

3715:MSCI ACWI Index

3705:

3687:

3680:

3673:

3664:

3657:

3656:

3648:

3640:

3634:

3633:

3619:

3613:

3612:

3598:

3592:

3591:

3589:

3587:

3568:

3562:

3561:

3559:

3557:

3542:

3536:

3535:

3521:

3515:

3514:

3502:

3496:

3495:

3484:

3478:

3477:

3475:

3473:

3467:

3459:

3453:

3452:

3450:

3448:

3438:

3430:

3421:

3420:

3414:

3406:

3400:

3399:

3398:. March 9, 2005.

3392:

3386:

3385:

3373:

3367:

3366:

3358:

3351:

3345:

3344:

3335:. p. 1256.

3324:

3318:

3317:

3306:

3295:

3294:

3283:

3277:

3276:

3274:

3272:

3250:

3244:

3243:

3229:

3223:

3222:

3208:

3202:

3201:

3189:

3183:

3182:

3171:

3165:

3164:

3153:

3147:

3146:

3135:

3129:

3128:

3117:

3111:

3110:

3108:

3106:

3100:

3089:

3081:

3075:

3074:

3068:

3060:

3054:

3053:

3042:

3036:

3035:

3022:

3016:

3015:

3004:

2998:

2997:

2995:

2993:

2984:

2976:

2965:

2964:

2953:

2938:

2937:

2923:

2850:Change in Index

907:Change in Index

901:

855:

844:

837:

750:closed-end funds

742:investment trust

689:Market liquidity

337:, or simply the

294:

288:

282:

276:

270:

264:

258:

252:

246:

240:

234:

217:

174:Weighting method

167:

68:

66:

61:

47:

40:

21:

5182:

5181:

5177:

5176:

5175:

5173:

5172:

5171:

5142:

5141:

5140:

5135:

5119:

5103:

5087:

5071:

5050:

5034:

5013:

4927:

4921:

4891:

4886:

4836:

4830:

4800:

4795:

4760:

4744:

4735:S&P/ASX 300

4730:S&P/ASX 200

4697:

4616:Moscow Exchange

4610:Taiwan Weighted

4574:

4553:

4527:

4496:

4429:

4328:

4287:

4220:

4167:

4142:

4091:

4027:

4011:

3995:

3979:

3958:

3937:

3910:

3889:

3873:

3832:

3828:S&P Asia 50

3805:

3754:

3696:

3691:

3661:

3660:

3642:

3641:

3637:

3621:

3620:

3616:

3600:

3599:

3595:

3585:

3583:

3570:

3569:

3565:

3555:

3553:

3544:

3543:

3539:

3523:

3522:

3518:

3504:

3503:

3499:

3486:

3485:

3481:

3471:

3469:

3465:

3461:

3460:

3456:

3446:

3444:

3443:. April 1, 2024

3436:

3432:

3431:

3424:

3412:

3408:

3407:

3403:

3394:

3393:

3389:

3375:

3374:

3370:

3365:. June 4, 1962.

3353:

3352:

3348:

3326:

3325:

3321:

3308:

3307:

3298:

3285:

3284:

3280:

3270:

3268:

3252:

3251:

3247:

3231:

3230:

3226:

3218:The Motley Fool

3210:

3209:

3205:

3191:

3190:

3186:

3173:

3172:

3168:

3155:

3154:

3150:

3137:

3136:

3132:

3119:

3118:

3114:

3104:

3102:

3098:

3087:

3083:

3082:

3078:

3066:

3062:

3061:

3057:

3044:

3043:

3039:

3024:

3023:

3019:

3006:

3005:

3001:

2991:

2989:

2982:

2978:

2977:

2968:

2955:

2954:

2941:

2925:

2924:

2903:

2898:

2881:

2876:

892:withholding tax

842:

841:

835:

834:

827:

821:

778:equity warrants

770:preferred stock

766:tracking stocks

667:

603:

571:

438:

433:

347:stock exchanges

299:

298:

297:

296:

292:

290:

286:

284:

280:

278:

274:

272:

268:

266:

262:

260:

256:

254:

250:

248:

244:

242:

238:

236:

232:

213:

205:

184:Related indices

168:

162:

132:

106:

64:

62:

59:

50:

35:

28:

23:

22:

15:

12:

11:

5:

5180:

5178:

5170:

5169:

5164:

5159:

5154:

5144:

5143:

5137:

5136:

5134:

5133:

5127:

5125:

5121:

5120:

5118:

5117:

5111:

5109:

5105:

5104:

5102:

5101:

5095:

5093:

5089:

5088:

5086:

5085:

5083:Índice Bovespa

5079:

5077:

5073:

5072:

5070:

5069:

5064:

5058:

5056:

5052:

5051:

5049:

5048:

5042:

5040:

5036:

5035:

5033:

5032:

5027:

5025:S&P/TSX 60

5021:

5019:

5015:

5014:

5012:

5011:

5006:

5001:

4996:

4991:

4986:

4981:

4976:

4971:

4969:NYSE Composite

4966:

4961:

4956:

4951:

4946:

4941:

4935:

4933:

4929:

4928:

4922:

4920:

4919:

4912:

4905:

4897:

4888:

4887:

4885:

4884:

4879:

4874:

4869:

4864:

4859:

4857:NYSE Composite

4854:

4853:

4852:

4841:

4838:

4837:

4831:

4829:

4828:

4821:

4814:

4806:

4797:

4796:

4794:

4793:

4788:

4783:

4778:

4772:

4770:

4766:

4765:

4762:

4761:

4759:

4758:

4752:

4750:

4746:

4745:

4743:

4742:

4740:All Ordinaries

4737:

4732:

4727:

4725:S&P/ASX 50

4722:

4720:S&P/ASX 20

4716:

4714:

4707:

4703:

4702:

4699:

4698:

4696:

4695:

4689:

4683:

4677:

4676:(Saudi Arabia)

4671:

4665:

4659:

4649:

4643:

4637:

4631:

4625:

4619:

4613:

4607:

4601:

4595:

4589:

4582:

4580:

4576:

4575:

4573:

4572:

4567:

4561:

4559:

4555:

4554:

4552:

4551:

4546:

4541:

4535:

4533:

4529:

4528:

4526:

4525:

4520:

4515:

4510:

4504:

4502:

4498:

4497:

4495:

4494:

4492:SZSE 300 Index

4489:

4487:SZSE 200 Index

4484:

4482:SZSE 100 Index

4479:

4474:

4469:

4464:

4459:

4457:SZSE Component

4454:

4448:

4446:

4439:

4435:

4434:

4431:

4430:

4428:

4427:

4422:

4417:

4412:

4407:

4402:

4397:

4392:

4387:

4382:

4377:

4372:

4367:

4362:

4357:

4352:

4347:

4342:

4336:

4334:

4330:

4329:

4327:

4326:

4321:

4316:

4311:

4306:

4301:

4295:

4293:

4289:

4288:

4286:

4285:

4280:

4275:

4270:

4265:

4260:

4258:FTSE 350 Index

4255:

4253:FTSE 250 Index

4250:

4248:FTSE 100 Index

4245:

4239:

4237:

4230:

4226:

4225:

4222:

4221:

4219:

4218:

4212:

4206:

4200:

4197:Índice Bovespa

4194:

4188:

4182:

4175:

4173:

4169:

4168:

4166:

4165:

4160:

4158:S&P/TSX 60

4154:

4152:

4148:

4147:

4144:

4143:

4141:

4140:

4135:

4130:

4125:

4120:

4115:

4110:

4105:

4099:

4097:

4093:

4092:

4090:

4089:

4084:

4079:

4074:

4069:

4064:

4062:NYSE Composite

4059:

4053:

4051:

4044:

4037:

4033:

4032:

4029:

4028:

4026:

4025:

4019:

4017:

4013:

4012:

4010:

4009:

4003:

4001:

3997:

3996:

3994:

3993:

3987:

3985:

3981:

3980:

3978:

3977:

3972:

3970:HUI Gold Index

3966:

3964:

3960:

3959:

3957:

3956:

3951:

3945:

3943:

3939:

3938:

3936:

3935:

3933:Amex Oil Index

3929:

3927:

3920:

3916:

3915:

3912:

3911:

3909:

3908:

3903:

3897:

3895:

3891:

3890:

3888:

3887:

3881:

3879:

3875:

3874:

3872:

3871:

3866:

3861:

3856:

3851:

3846:

3840:

3838:

3834:

3833:

3831:

3830:

3824:

3822:

3815:

3811:

3810:

3807:

3806:

3804:

3803:

3798:

3793:

3788:

3783:

3778:

3773:

3768:

3762:

3760:

3756:

3755:

3753:

3752:

3747:

3742:

3737:

3735:The Global Dow

3732:

3727:

3722:

3717:

3711:

3709:

3702:

3698:

3697:

3692:

3690:

3689:

3682:

3675:

3667:

3659:

3658:

3635:

3614:

3593:

3563:

3537:

3516:

3497:

3479:

3454:

3441:S&P Global

3422:

3401:

3387:

3368:

3346:

3319:

3314:S&P Global

3296:

3278:

3245:

3224:

3203:

3198:S&P Global

3184:

3166:

3161:Google Finance

3148:

3143:Yahoo! Finance

3130:

3112:

3076:

3071:S&P Global

3064:"S&P 500®"

3055:

3037:

3017:

2999:

2987:S&P Global

2966:

2961:S&P Global

2957:"S&P 500®"

2939:

2900:

2899:

2897:

2894:

2893:

2892:

2887:

2880:

2877:

2873:

2872:

2869:

2866:

2863:

2860:

2857:

2854:

2851:

2848:

2844:

2843:

2840:

2837:

2834:

2831:

2828:

2825:

2822:

2819:

2815:

2814:

2811:

2808:

2805:

2802:

2799:

2796:

2793:

2790:

2786:

2785:

2782:

2779:

2776:

2773:

2770:

2767:

2764:

2761:

2757:

2756:

2753:

2750:

2747:

2744:

2741:

2738:

2735:

2732:

2728:

2727:

2724:

2721:

2718:

2715:

2712:

2709:

2706:

2703:

2699:

2698:

2695:

2692:

2689:

2686:

2683:

2680:

2677:

2674:

2670:

2669:

2666:

2663:

2660:

2657:

2654:

2651:

2648:

2645:

2641:

2640:

2637:

2634:

2631:

2628:

2625:

2622:

2619:

2616:

2612:

2611:

2608:

2605:

2602:

2599:

2596:

2593:

2590:

2587:

2583:

2582:

2579:

2576:

2573:

2570:

2567:

2564:

2561:

2558:

2554:

2553:

2550:

2547:

2544:

2541:

2538:

2535:

2532:

2529:

2525:

2524:

2521:

2518:

2515:

2512:

2509:

2506:

2503:

2500:

2496:

2495:

2492:

2489:

2486:

2483:

2480:

2477:

2474:

2471:

2467:

2466:

2463:

2460:

2457:

2454:

2451:

2448:

2445:

2442:

2438:

2437:

2434:

2431:

2428:

2425:

2422:

2419:

2416:

2413:

2409:

2408:

2405:

2402:

2399:

2396:

2393:

2390:

2387:

2384:

2380:

2379:

2376:

2373:

2370:

2367:

2364:

2361:

2358:

2355:

2351:

2350:

2347:

2344:

2341:

2338:

2335:

2332:

2329:

2326:

2322:

2321:

2318:

2315:

2312:

2309:

2306:

2303:

2300:

2297:

2293:

2292:

2289:

2286:

2283:

2280:

2277:

2274:

2271:

2268:

2264:

2263:

2260:

2257:

2254:

2251:

2248:

2245:

2242:

2239:

2235:

2234:

2231:

2228:

2225:

2222:

2219:

2216:

2213:

2210:

2206:

2205:

2202:

2199:

2196:

2193:

2190:

2187:

2184:

2181:

2177:

2176:

2173:

2170:

2167:

2164:

2161:

2158:

2155:

2152:

2148:

2147:

2144:

2141:

2138:

2135:

2132:

2129:

2126:

2123:

2119:

2118:

2115:

2112:

2109:

2106:

2103:

2100:

2097:

2094:

2090:

2089:

2086:

2083:

2080:

2077:

2074:

2071:

2068:

2065:

2061:

2060:

2057:

2054:

2051:

2048:

2045:

2042:

2039:

2036:

2032:

2031:

2028:

2025:

2022:

2019:

2016:

2013:

2010:

2007:

2003:

2002:

1999:

1996:

1993:

1990:

1987:

1984:

1981:

1978:

1974:

1973:

1970:

1967:

1964:

1961:

1958:

1955:

1952:

1949:

1945:

1944:

1941:

1938:

1935:

1932:

1929:

1926:

1923:

1920:

1916:

1915:

1912:

1909:

1906:

1903:

1900:

1897:

1894:

1891:

1887:

1886:

1883:

1880:

1877:

1874:

1871:

1868:

1865:

1862:

1858:

1857:

1854:

1851:

1848:

1845:

1842:

1839:

1836:

1833:

1829:

1828:

1825:

1822:

1819:

1816:

1813:

1810:

1807:

1804:

1800:

1799:

1796:

1793:

1790:

1787:

1784:

1781:

1778:

1775:

1771:

1770:

1767:

1764:

1761:

1758:

1755:

1752:

1749:

1746:

1742:

1741:

1738:

1735:

1732:

1729:

1726:

1723:

1720:

1717:

1713:

1712:

1709:

1706:

1703:

1700:

1697:

1694:

1691:

1688:

1684:

1683:

1680:

1677:

1674:

1671:

1668:

1665:

1662:

1659:

1655:

1654:

1651:

1648:

1645:

1642:

1639:

1636:

1633:

1630:

1626:

1625:

1622:

1619:

1616:

1613:

1610:

1607:

1604:

1601:

1597:

1596:

1593:

1590:

1587:

1584:

1581:

1578:

1575:

1572:

1568:

1567:

1564:

1561:

1558:

1555:

1552:

1549:

1546:

1543:

1539:

1538:

1535:

1532:

1529:

1526:

1523:

1520:

1517:

1514:

1510:

1509:

1506:

1503:

1500:

1497:

1494:

1491:

1488:

1485:

1481:

1480:

1477:

1474:

1471:

1468:

1465:

1462:

1459:

1456:

1452:

1451:

1448:

1445:

1442:

1439:

1436:

1433:

1430:

1427:

1423:

1422:

1419:

1416:

1413:

1410:

1407:

1404:

1401:

1398:

1394:

1393:

1390:

1387:

1384:

1381:

1378:

1375:

1372:

1369:

1365:

1364:

1361:

1358:

1355:

1352:

1349:

1346:

1343:

1340:

1336:

1335:

1332:

1329:

1326:

1323:

1320:

1317:

1314:

1311:

1307:

1306:

1303:

1300:

1297:

1294:

1291:

1288:

1285:

1282:

1278:

1277:

1274:

1271:

1268:

1265:

1262:

1259:

1256:

1253:

1249:

1248:

1245:

1242:

1239:

1236:

1233:

1230:

1227:

1224:

1220:

1219:

1216:

1213:

1210:

1207:

1204:

1201:

1198:

1195:

1191:

1190:

1187:

1184:

1181:

1178:

1175:

1172:

1169:

1166:

1162:

1161:

1158:

1155:

1152:

1149:

1146:

1143:

1140:

1137:

1133:

1132:

1129:

1126:

1123:

1120:

1117:

1114:

1111:

1108:

1104:

1103:

1100:

1097:

1094:

1091:

1088:

1085:

1082:

1079:

1075:

1074:

1071:

1068:

1065:

1062:

1059:

1056:

1053:

1050:

1046:

1045:

1042:

1039:

1036:

1033:

1030:

1027:

1024:

1021:

1017:

1016:

1013:

1010:

1007:

1004:

1001:

998:

995:

992:

988:

987:

984:

981:

978:

975:

972:

969:

966:

963:

959:

958:

955:

952:

949:

946:

943:

940:

937:

934:

930:

929:

926:

923:

920:

917:

914:

911:

908:

905:

896:

820:

817:

813:S&P Global

809:Bloomberg News

798:

797:

762:royalty trusts

730:

724:

705:Stock exchange

702:

696:

686:

666:

663:

637:began trading

602:

599:

593:(CBOE) offers

570:

567:

559:NYSE Arca

551:NYSE Arca

539:NYSE Arca

527:NYSE Arca

523:leveraged ETFs

497:NYSE Arca

489:NYSE Arca

481:NYSE Arca

469:NYSE Arca

457:NYSE Arca

437:

434:

432:

429:

425:S&P Global

413:ticker symbols

382:Meta Platforms

291:

285:

279:

273:

267:

261:

255:

249:

243:

237:

231:

224:

223:

222:

219:

218:

211:

207:

206:

204:

203:

198:

193:

187:

185:

181:

180:

175:

171:

170:

160:

154:

153:

148:

144:

143:

138:

134:

133:

131:

130:

127:

124:

121:

118:

114:

112:

111:Trading symbol

108:

107:

105:

104:

99:

94:

88:

86:

80:

79:

74:

70:

69:

56:

52:

51:

48:

26:

24:

14:

13:

10:

9:

6:

4:

3:

2:

5179:

5168:

5165:

5163:

5160:

5158:

5155:

5153:

5150:

5149:

5147:

5132:

5129:

5128:

5126:

5122:

5116:

5113:

5112:

5110:

5106:

5100:

5097:

5096:

5094:

5090:

5084:

5081:

5080:

5078:

5074:

5068:

5065:

5063:

5060:

5059:

5057:

5053:

5047:

5044:

5043:

5041:

5037:

5031:

5028:

5026:

5023:

5022:

5020:

5016:

5010:

5009:Wilshire 5000

5007:

5005:

5002:

5000:

4997:

4995:

4992:

4990:

4987:

4985:

4982:

4980:

4977:

4975:

4972:

4970:

4967:

4965:

4962:

4960:

4957:

4955:

4952:

4950:

4947:

4945:

4942:

4940:

4937:

4936:

4934:

4932:United States

4930:

4926:

4918:

4913:

4911:

4906:

4904:

4899:

4898:

4895:

4883:

4882:Wilshire 5000

4880:

4878:

4875:

4873:

4870:

4868:

4865:

4863:

4860:

4858:

4855:

4851:

4848:

4847:

4846:

4843:

4842:

4839:

4835:

4827:

4822:

4820:

4815:

4813:

4808:

4807:

4804:

4792:

4789:

4787:

4784:

4782:

4779:

4777:

4774:

4773:

4771:

4767:

4757:

4754:

4753:

4751:

4747:

4741:

4738:

4736:

4733:

4731:

4728:

4726:

4723:

4721:

4718:

4717:

4715:

4711:

4708:

4704:

4693:

4690:

4687:

4684:

4681:

4678:

4675:

4672:

4669:

4666:

4663:

4660:

4657:

4653:

4650:

4648:(Philippines)

4647:

4644:

4641:

4638:

4635:

4632:

4629:

4628:IDX Composite

4626:

4623:

4620:

4617:

4614:

4611:

4608:

4605:

4602:

4599:

4596:

4593:

4590:

4587:

4584:

4583:

4581:

4577:

4571:

4568:

4566:

4563:

4562:

4560:

4556:

4550:

4547:

4545:

4542:

4540:

4537:

4536:

4534:

4530:

4524:

4521:

4519:

4518:NIFTY Next 50

4516:

4514:

4511:

4509:

4506:

4505:

4503:

4499:

4493:

4490:

4488:

4485:

4483:

4480:

4478:

4477:CSI 300 Index

4475:

4473:

4472:CSI 100 Index

4470:

4468:

4467:SSE 180 Index

4465:

4463:

4460:

4458:

4455:

4453:

4452:SSE Composite

4450:

4449:

4447:

4443:

4440:

4436:

4426:

4423:

4421:

4418:

4416:

4413:

4411:

4408:

4406:

4403:

4401:

4398:

4396:

4393:

4391:

4388:

4386:

4383:

4381:

4378:

4376:

4373:

4371:

4368:

4366:

4363:

4361:

4358:

4356:

4353:

4351:

4348:

4346:

4343:

4341:

4338:

4337:

4335:

4331:

4325:

4322:

4320:

4317:

4315:

4312:

4310:

4307:

4305:

4302:

4300:

4297:

4296:

4294:

4290:

4284:

4281:

4279:

4276:

4274:

4271:

4269:

4266:

4264:

4261:

4259:

4256:

4254:

4251:

4249:

4246:

4244:

4241:

4240:

4238:

4234:

4231:

4227:

4216:

4213:

4210:

4207:

4204:

4201:

4198:

4195:

4192:

4189:

4186:

4183:

4180:

4177:

4176:

4174:

4170:

4164:

4161:

4159:

4156:

4155:

4153:

4149:

4139:

4136:

4134:

4131:

4129:

4126:

4124:

4121:

4119:

4116:

4114:

4111:

4109:

4106:

4104:

4101:

4100:

4098:

4094:

4088:

4087:Wilshire 5000

4085:

4083:

4080:

4078:

4075:

4073:

4070:

4068:

4065:

4063:

4060:

4058:

4055:

4054:

4052:

4048:

4045:

4041:

4038:

4034:

4024:

4021:

4020:

4018:

4014:

4008:

4005:

4004:

4002:

3998:

3992:

3989:

3988:

3986:

3982:

3976:

3973:

3971:

3968:

3967:

3965:

3961:

3955:

3952:

3950:

3947:

3946:

3944:

3940:

3934:

3931:

3930:

3928:

3924:

3921:

3917:

3907:

3904:

3902:

3899:

3898:

3896:

3892:

3886:

3883:

3882:

3880:

3878:Latin America

3876:

3870:

3867:

3865:

3862:

3860:

3857:

3855:

3852:

3850:

3847:

3845:

3844:EURO STOXX 50

3842:

3841:

3839:

3835:

3829:

3826:

3825:

3823:

3819:

3816:

3812:

3802:

3799:

3797:

3794:

3792:

3789:

3787:

3784:

3782:

3779:

3777:

3774:

3772:

3769:

3767:

3764:

3763:

3761:

3757:

3751:

3748:

3746:

3743:

3741:

3738:

3736:

3733:

3731:

3728:

3726:

3723:

3721:

3718:

3716:

3713:

3712:

3710:

3706:

3703:

3699:

3695:

3688:

3683:

3681:

3676:

3674:

3669:

3668:

3665:

3654:

3653:

3647:

3639:

3636:

3631:

3630:

3625:

3618:

3615:

3610:

3609:

3604:

3597:

3594:

3581:

3577:

3573:

3567:

3564:

3552:

3548:

3541:

3538:

3533:

3532:

3527:

3520:

3517:

3512:

3508:

3501:

3498:

3493:

3489:

3483:

3480:

3464:

3458:

3455:

3442:

3435:

3429:

3427:

3423:

3418:

3411:

3405:

3402:

3397:

3391:

3388:

3383:

3379:

3372:

3369:

3364:

3363:

3357:

3350:

3347:

3342:

3338:

3334:

3330:

3323:

3320:

3315:

3311:

3310:"Our History"

3305:

3303:

3301:

3297:

3292:

3288:

3282:

3279:

3266:

3262:

3261:

3256:

3253:Thune, Kent.

3249:

3246:

3241:

3240:

3235:

3228:

3225:

3220:

3219:

3214:

3207:

3204:

3199:

3195:

3188:

3185:

3180:

3176:

3170:

3167:

3162:

3158:

3152:

3149:

3144:

3140:

3134:

3131:

3126:

3122:

3116:

3113:

3097:

3093:

3086:

3080:

3077:

3072:

3065:

3059:

3056:

3051:

3047:

3041:

3038:

3033:

3032:

3027:

3026:"S&P 500"

3021:

3018:

3013:

3009:

3003:

3000:

2988:

2981:

2975:

2973:

2971:

2967:

2962:

2958:

2952:

2950:

2948:

2946:

2944:

2940:

2935:

2934:

2929:

2922:

2920:

2918:

2916:

2914:

2912:

2910:

2908:

2906:

2902:

2895:

2891:

2888:

2886:

2883:

2882:

2878:

2870:

2867:

2864:

2861:

2858:

2855:

2852:

2849:

2846:

2845:

2817:

2816:

2788:

2787:

2759:

2758:

2730:

2729:

2701:

2700:

2672:

2671:

2643:

2642:

2614:

2613:

2585:

2584:

2556:

2555:

2527:

2526:

2498:

2497:

2469:

2468:

2440:

2439:

2411:

2410:

2382:

2381:

2353:

2352:

2324:

2323:

2295:

2294:

2266:

2265:

2237:

2236:

2208:

2207:

2179:

2178:

2150:

2149:

2121:

2120:

2092:

2091:

2063:

2062:

2034:

2033:

2005:

2004:

1976:

1975:

1947:

1946:

1918:

1917:

1889:

1888:

1860:

1859:

1831:

1830:

1802:

1801:

1773:

1772:

1744:

1743:

1715:

1714:

1686:

1685:

1657:

1656:

1628:

1627:

1599:

1598:

1570:

1569:

1541:

1540:

1512:

1511:

1483:

1482:

1454:

1453:

1425:

1424:

1396:

1395:

1367:

1366:

1338:

1337:

1309:

1308:

1280:

1279:

1251:

1250:

1222:

1221:

1193:

1192:

1164:

1163:

1135:

1134:

1106:

1105:

1077:

1076:

1048:

1047:

1019:

1018:

990:

989:

961:

960:

932:

931:

927:

924:

921:

918:

915:

912:

909:

906:

903:

902:

895:

893:

889:

885:

881:

880:price returns

876:

873:

869:

865:

861:

856:

854:

847:

840:

839:Stock buyback

831:

826:

818:

816:

814:

810:

805:

803:

795:

791:

787:

783:

779:

775:

771:

767:

763:

759:

755:

751:

747:

743:

739:

735:

731:

728:

725:

722:

718:

717:NYSE American

714:

710:

706:

703:

700:

697:

694:

690:

687:

684:

681:

680:

679:

676:

672:

664:

662:

659:

655:

651:

646:

644:

640:

636:

632:

628:

624:

618:

616:

612:

608:

600:

598:

596:

592:

588:

584:

581:(CME) offers

580:

576:

568:

566:

564:

560:

556:

552:

548:

544:

540:

536:

532:

528:

524:

520:

516:

514:

510:

509:T. Rowe Price

506:

502:

498:

494:

490:

486:

482:

478:

474:

470:

466:

462:

458:

454:

450:

446:

442:

435:

430:

428:

426:

422:

421:joint venture

418:

414:

410:

405:

403:

399:

395:

391:

387:

383:

379:

375:

371:

367:

363:

359:

354:

352:

348:

344:

340:

336:

327:

319:

311:

303:

230:

228:

216:

212:

208:

202:

199:

197:

194:

192:

189:

188:

186:

182:

179:

176:

172:

166:42.0 trillion

165:

161:

159:

155:

152:

149:

145:

142:

139:

135:

128:

125:

122:

119:

116:

115:

113:

109:

103:

100:

98:

95:

93:

90:

89:

87:

85:

81:

78:

75:

71:

57:

53:

46:

33:

19:

4983:

4877:Russell 2000

4871:

4662:ASE Weighted

4658:) (Thailand)

4656:SET50/SET100

4600:(Uzbekistan)

4594:(Kyrgyzstan)

4588:(Kazakhstan)

4462:SSE 50 Index

4138:Russell 3000

4133:Russell 1000

4082:Russell 2000

4076:

3771:S&P GSCI

3650:

3638:

3627:

3617:

3606:

3596:

3584:. Retrieved

3580:the original

3575:

3566:

3554:. Retrieved

3550:

3540:

3529:

3519:

3500:

3482:

3470:. Retrieved

3457:

3445:. Retrieved

3440:

3416:

3404:

3390:

3381:

3371:

3360:

3349:

3341:CX3611000855

3328:

3322:

3281:

3271:November 28,

3269:. Retrieved

3258:

3248:

3237:

3227:

3216:

3206:

3187:

3169:

3151:

3133:

3115:

3105:November 28,

3103:. Retrieved

3079:

3058:

3049:

3040:

3029:

3020:

3002:

2990:. Retrieved

2931:

884:total return

877:

870:), with the

857:

850:

806:

799:

693:public float

668:

647:

619:

604:

577:market, the

572:

517:

445:mutual funds

443:, including

439:

406:

355:

338:

334:

332:

225:

191:S&P 1500

137:Constituents

4989:S&P 600

4984:S&P 500

4979:S&P 400

4974:S&P 100

4872:S&P 500

4749:New Zealand

4636:(Singapore)

4630:(Indonesia)

4606:(Hong Kong)

4558:South Korea

4304:CAC Next 20

4211:(Argentina)

4128:S&P 600

4123:S&P 400

4118:S&P 100

4077:S&P 500

3984:Real estate

3942:Electronics

3759:Commodities

3556:January 21,

3287:"SPXL SPXS"

3260:The Balance

3179:MarketWatch

2992:October 21,

862:—including

819:Performance

802:index funds

774:unit trusts

711:(including

627:mutual fund

587:open outcry

575:derivatives

569:Derivatives

441:Index funds

339:S&P 500

201:S&P 100

38:S&P 500

5146:Categories

4954:Nasdaq-100

4867:Nasdaq-100

4781:JSE Top 40

4642:(Malaysia)

4624:(Pakistan)

4539:Nikkei 225

4508:BSE SENSEX

4309:CAC Mid 60

4193:(Colombia)

4187:(Colombia)

4072:Nasdaq-100

3720:MSCI World

3472:January 5,

3090:(Report).

3050:GlobalData

2896:References

823:See also:

740:and their

652:issued by

378:Amazon.com

158:Market cap

65:1957-03-04

55:Foundation

5108:Argentina

4713:Australia

4668:DFM Index

4652:SET Index

4604:Hang Seng

4523:NIFTY 500

4314:CAC Small

3901:MSCI EAFE

3551:Bloomberg

3531:USA TODAY

3417:CME Group

2740:$ 242.34

2711:$ 191.89

2682:$ 234.33

2653:$ 182.06

2624:$ 153.76

2595:$ 116.94

2566:$ 122.30

2537:$ 100.38

888:dividends

868:inflation

864:dividends

846:Dividends

713:NYSE Arca

658:CME Group

605:In 1860,

547:ProShares

366:Microsoft

151:Large-cap

84:Exchanges

5055:Colombia

4694:(Turkey)

4682:(Israel)

4664:(Jordan)

4618:(Russia)

4612:(Taiwan)

4598:Tashkent

4513:NIFTY 50

4365:FTSE MIB

4199:(Brazil)

4181:(Mexico)

4036:Americas

3906:MSCI GCC

3814:Regional

3708:Equities

3447:April 8,

3382:Benzinga

3291:Direxion

3265:Archived

3096:Archived

2879:See also

2795:−37.00%

2792:−38.49%

2708:−18.11%

2705:−19.44%

2508:$ 89.66

2479:$ 88.44

2450:$ 77.79

2421:$ 58.76

2392:$ 50.65

2363:$ 49.61

2334:$ 43.11

2305:$ 34.09

2302:−37.00%

2299:−38.49%

2276:$ 54.12

2247:$ 51.30

2218:$ 44.30

2189:$ 42.23

2160:$ 38.09

2131:$ 29.60

2128:−22.10%

2125:−23.37%

2102:$ 37.99

2099:−11.89%

2096:−13.04%

2073:$ 43.12

2067:−10.14%

2044:$ 47.44

2015:$ 39.19

1986:$ 30.48

1957:$ 22.86

1928:$ 18.59

1899:$ 13.51

1870:$ 13.33

1841:$ 12.11

1812:$ 11.26

1400:−11.50%

1316:−26.47%

1313:−29.72%

1287:−14.66%

1284:−17.37%

1168:-11.36%

1081:-13.09%

965:-11.81%

748:issues,

727:Domicile

535:shorting

519:Direxion

398:Broadcom

386:Alphabet

73:Operator

4706:Oceania

4670:(Dubai)

4622:KSE 100

4375:ISEQ 20

4370:IBEX 35

4324:SBF 120

4205:(Chile)

3869:CECEEUR

3652:Fortune

3586:May 14,

3012:iShares

2933:Reuters

2842:10.40%

2839:11.34%

2836:10.71%

2833:12.56%

2830:14.02%

2824:15.43%

2821:12.36%

2818:Median

2804:−1.38%

2801:−2.35%

2784:17.25%

2781:17.88%

2778:18.93%

2775:19.21%

2772:28.56%

2766:37.58%

2763:34.11%

2749:13.97%

2746:12.03%

2743:15.69%

2737:26.29%

2734:24.23%

2717:12.56%

2691:10.66%

2688:16.55%

2685:18.48%

2679:28.71%

2676:26.89%

2659:13.89%

2656:15.22%

2650:18.40%

2647:16.26%

2639:10.22%

2630:13.56%

2627:11.70%

2621:31.49%

2618:28.88%

2601:13.12%

2592:−4.38%

2589:−6.24%

2569:15.79%

2563:21.83%

2560:19.42%

2540:14.66%

2534:11.96%

2511:12.57%

2502:−0.73%

2482:15.45%

2476:13.69%

2473:11.39%

2465:10.26%

2453:17.94%

2447:32.39%

2444:29.60%

2418:16.00%

2415:13.41%

2395:−0.25%

2386:-0.00%

2360:15.06%

2357:12.78%

2349:10.54%

2340:−0.95%

2331:26.46%

2328:23.45%

2311:−1.38%

2308:−2.19%

2291:12.73%

2288:11.82%

2285:10.49%

2279:12.83%

2262:13.37%

2259:11.80%

2256:10.64%

2244:15.79%

2241:13.62%

2233:12.48%

2230:11.94%

2227:11.52%

2204:13.54%

2201:13.22%

2198:10.94%

2195:12.07%

2192:−2.30%

2186:10.88%

2175:13.84%

2172:12.98%

2169:12.22%

2166:11.07%

2163:−0.57%

2157:28.68%

2154:26.38%

2146:12.98%

2143:12.71%

2140:11.48%

2134:−0.59%

2117:13.78%

2114:15.24%

2111:13.74%

2108:12.94%

2105:10.70%

2088:15.34%

2085:15.68%

2082:16.02%

2079:17.46%

2076:18.33%

2070:−9.10%

2059:17.25%

2056:17.88%

2053:18.93%

2050:18.21%

2047:28.56%

2041:21.04%

2038:19.53%

2030:14.94%

2027:17.75%

2024:17.90%

2021:19.21%

2018:24.06%

2012:28.58%

2009:26.67%

2001:13.07%

1998:16.65%

1995:17.52%

1992:18.05%

1989:20.27%

1983:33.36%

1980:31.01%

1972:12.55%

1969:14.56%

1966:16.80%

1963:15.29%

1960:15.22%

1954:22.96%

1951:20.26%

1943:12.22%

1940:14.60%

1937:14.81%

1934:14.88%

1931:16.59%

1925:37.58%

1922:34.11%

1914:10.98%

1911:14.58%

1908:14.52%

1905:14.38%

1893:−1.54%

1882:12.76%

1879:15.72%

1876:14.93%

1873:14.55%

1867:10.08%

1853:11.34%

1850:15.47%

1847:16.17%

1844:15.88%

1824:11.90%

1821:14.34%

1818:17.59%

1815:15.36%

1809:30.47%

1806:26.31%

1795:11.16%

1792:13.94%

1789:13.93%

1786:13.20%

1783:$ 8.63

1780:−3.10%

1777:−6.56%

1766:11.55%

1763:16.61%

1760:17.55%

1757:20.37%

1754:$ 8.90

1751:31.69%

1748:27.25%

1734:12.17%

1731:16.31%

1728:15.31%

1725:$ 6.76

1722:16.61%

1719:12.40%

1702:15.27%

1699:16.47%

1696:$ 5.80

1676:10.76%

1673:13.83%

1670:19.87%

1667:$ 5.51

1664:18.67%

1661:14.62%

1647:10.49%

1644:14.32%

1641:14.67%

1638:$ 4.64

1635:31.73%

1632:26.33%

1615:14.78%

1612:14.81%

1609:$ 3.52

1586:10.63%

1583:17.32%

1580:$ 3.32

1577:22.56%

1574:17.27%

1554:14.09%

1551:$ 2.71

1548:21.55%

1545:14.76%

1522:$ 2.23

1519:−4.92%

1516:−9.73%

1496:13.96%

1493:$ 2.34

1490:32.50%

1487:25.77%

1467:14.76%

1464:$ 1.77

1461:18.44%

1458:12.31%

1435:$ 1.49

1409:−0.21%

1406:$ 1.40

1403:−7.18%

1377:$ 1.51

1374:23.84%

1371:19.15%

1348:$ 1.22

1345:37.20%

1342:31.55%

1322:−2.35%

1319:$ 0.89

1290:$ 1.21

1261:$ 1.41

1258:18.98%

1255:15.63%

1232:$ 1.19

1229:14.31%

1226:10.79%

1203:$ 1.04

1110:20.09%

1023:12.97%

994:18.89%

936:23.13%

744:units,

643:Reuters

639:options

601:History

595:options

573:In the

561::

553::

541::

529::

521:offers

499::

491::

483::

475:), and

471::

465:iShares

459::

341:, is a

210:Website

63: (

5115:MERVAL

5076:Brazil

5062:COLCAP

5039:Mexico

5018:Canada

4791:NSE 30

4776:EGX 30

4769:Africa

4688:(Iran)

4680:TA-125

4570:KOSDAQ

4405:PSI-20

4400:OMXS30

4395:OMXH25

4390:OMXC25

4350:BEL 20

4299:CAC 40

4292:France

4229:Europe

4217:(Peru)

4209:MERVAL

4185:COLCAP

4151:Canada

3963:Metals

3954:TecDax

3926:Energy

3837:Europe

3701:Global

3339:

2813:7.56%

2810:5.62%

2807:4.24%

2755:7.56%

2752:9.69%

2726:7.64%

2723:9.80%

2720:8.80%

2714:9.43%

2697:9.76%

2694:9.52%

2668:9.56%

2665:7.47%

2662:9.88%

2636:6.06%

2633:9.00%

2610:9.07%

2607:5.62%

2604:7.77%

2598:8.49%

2581:9.69%

2578:7.19%

2575:9.92%

2572:8.49%

2552:9.15%

2549:7.68%

2546:6.69%

2543:6.94%

2531:9.54%

2523:9.82%

2520:8.19%

2517:5.00%

2514:7.30%

2505:1.38%

2494:9.62%

2491:9.85%

2488:4.24%

2485:7.67%

2462:9.22%

2459:4.68%

2456:7.40%

2436:9.71%

2433:8.22%

2430:4.47%

2427:7.10%

2424:1.66%

2407:9.28%

2404:7.81%

2401:5.45%

2398:2.92%

2389:2.11%

2378:9.94%

2375:9.14%

2372:6.76%

2369:1.41%

2366:2.29%

2346:8.21%

2343:8.04%

2337:0.41%

2320:9.77%

2317:8.43%

2314:6.46%

2282:5.91%

2273:5.49%

2270:3.53%

2253:8.42%

2250:6.19%

2224:9.07%

2221:0.54%

2215:4.91%

2212:3.00%

2183:8.99%

2137:9.34%

1902:8.70%

1896:1.32%

1864:7.06%

1838:7.62%

1835:4.46%

1705:9.86%

1693:5.25%

1690:2.03%

1618:8.76%

1606:6.27%

1603:1.40%

1557:6.70%

1528:6.47%

1525:8.10%

1499:8.45%

1470:5.86%

1438:4.32%

1432:6.56%

1429:1.06%

1380:4.87%

1351:3.21%

1200:4.01%

1197:0.10%

1139:7.66%

1052:9.06%

843:

836:

792:, and

721:Nasdaq

699:Volume

511:, and

396:, and

370:Nvidia

293:

287:

281:

275:

269:

263:

257:

251:

245:

239:

233:

97:Nasdaq

5092:Chile

4786:MADEX

4579:Other

4565:KOSPI

4544:TOPIX

4532:Japan

4501:India

4445:China

4425:WIG20

4333:Other

4243:FT 30

4172:Other

4096:Other

4050:Major

4016:Other

4000:Water

3894:Other

3466:(PDF)

3437:(PDF)

3413:(PDF)

3099:(PDF)

3088:(PDF)

3067:(PDF)

2983:(PDF)

2847:Year

2760:High

2731:2023

2702:2022

2673:2021

2644:2020

2615:2019

2586:2018

2557:2017

2528:2016

2499:2015

2470:2014

2441:2013

2412:2012

2383:2011

2354:2010

2325:2009

2296:2008

2267:2007

2238:2006

2209:2005

2180:2004

2151:2003

2122:2002

2093:2001

2064:2000

2035:1999

2006:1998

1977:1997

1948:1996

1919:1995

1890:1994

1861:1993

1832:1992

1803:1991

1774:1990

1745:1989

1716:1988

1687:1987

1658:1986

1629:1985

1600:1984

1571:1983

1542:1982

1513:1981

1484:1980

1455:1979

1426:1978

1397:1977

1368:1976

1339:1975

1310:1974

1281:1973

1252:1972

1223:1971

1194:1970

1165:1969

1136:1968

1107:1967

1078:1966

1049:1965

1020:1964

991:1963

962:1962

933:1961

904:Year

719:) or

533:) or

374:Apple

120:$ SPX

117:^GSPC

5124:Peru

4692:BIST

4674:TASI

4646:PSEi

4640:KLCI

4586:KASE

4438:Asia

4415:RTSI

4380:MOEX

3821:Asia

3608:CNBC

3588:2023

3558:2022

3474:2022

3449:2024

3337:Gale

3333:Gale

3273:2023

3107:2023

2994:2023

2827:---

2798:---

2789:Low

2769:---

691:and

563:UPRO

543:SPXS

531:SPXL

493:SPLG

487:and

447:and

419:, a

333:The

227:GICS

164:US$

147:Type

129:.INX

126:.SPX

92:NYSE

4686:TSE

4592:KSE

4420:SMI

4385:OBX

4360:DAX

4355:BUX

4345:ATX

4340:AEX

715:or

565:).

555:SSO

501:SPY

485:SPY

473:IVV

463:),

461:VOO

141:503

123:SPX

5148::

4410:PX

4236:UK

4043:US

3649:.