32:

92:

295:. Instead they are drawn against "available funds" that are not in a bank account so the issuer can delay redemption. In the U.S., warrants are issued by government entities such as the military and state and county governments for payroll to individuals and for accounts payable to vendors. Deposited warrants are routed to a collecting bank which processes them as

174:, is a document received by an employee that either includes a notice that the direct deposit transaction has gone through or that is attached to the paycheck. Each country has laws as to what must be included on a payslip, but this typically includes details of the gross wages for the pay period and the

211:"pay cheque" persists in some languages, but this commonly refers to a payslip or stub rather than an actual cheque. Some company payrolls have eliminated both the paper cheque and stub, in which case an electronic image of the stub is available on a website. Most of the provinces and territories in

239:

to withdraw cash (which usually requires the employee to pay a hefty fee to access their own money and always have daily limits for how much of their own money an employee can access daily) or in stores to make purchases. Most payroll cards will charge a fee if used at an ATM more than once per pay

243:

The payroll card account may be held as a single bank account in the employer's name. In that case, the bank account holds the payroll funds for all employees of that company using the payroll card system, and an intermediary limits each employee's draw to an amount specified by the company for a

206:

system, payment of wages and salaries is increasingly being effected by electronic means, rather than by the use of a physical cheque. This saves the company money on printing and processing cheques and reduce the problem of fraud. However, vocabulary referring to the

235:. A payroll card functions like a debit card and allows an employee to access their pay. A payroll card is typically less convenient than cashing a paper paycheck, because the card can be used at participating

291:

and clear through the banking system like checks and are therefore often called paychecks by their recipients. But they are not checks because they are not drawn against a

251:

Before a company can give a payroll card to a worker, the business must first contract with a payroll card program manager. The payroll card company performs required "

194:, or charitable contributions taken out of the gross amount to arrive at the final net amount of the pay, also including the year to date totals in some circumstances.

143:

to the employee's designated bank account or loaded onto a payroll card. Employees may still receive a pay slip to detail the calculations of the final payment amount.

244:

specified pay period. Some payroll card programs establish a separate account for each employee. Most payroll card accounts in the United States are insured by the

42:

422:

245:

331:

299:

like maturing treasury bills and presents the warrants to the government entity's treasury department for payment each business day.

263:

76:

307:

384:

258:

In the United States, payroll cards are regulated by state wage-and-hour-laws and by a variety of federal laws including the

259:

392:

354:

215:

allow employers to issue electronic payslips if the employees have confidential access to it and are able to print it.

459:

464:

20:

236:

58:

273:, it costs an employer about 35 cents to issue pay electronically but two dollars to write a paper paycheck.

139:

for services rendered. In recent times, the physical paycheck has been increasingly replaced by electronic

224:

96:

182:

the employer is required to make by law as well as other personal deductions such as retirement plan or

269:

Businesses may elect to use a payroll card program in order to reduce payroll expense. According to

208:

426:

282:

252:

179:

100:

454:

296:

292:

175:

338:

227:

can arrange for the net pay of an employee to be loaded onto a payroll card, which is a

303:

140:

448:

366:

203:

54:

397:

311:

228:

91:

191:

232:

136:

128:

223:

For employees that do not have access to a personal bank account, most major

270:

187:

183:

385:"Pinched by Plastic: The Impact of Payroll Cards on Low-Wage Workers"

288:

212:

132:

124:

90:

367:"Dodd-Frank: Title X - Bureau of Consumer Financial Protection"

25:

255:" due diligence as a condition of accepting the application.

50:

103:

paid and yearly bonus entitlement, among other things

39:The examples and perspective in this article

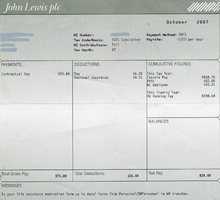

8:

77:Learn how and when to remove this message

323:

123:, is traditionally a paper document (a

246:Federal Deposit Insurance Corporation

7:

306:, warrants are issued as payment by

332:"Understanding Payroll Debit Cards"

202:In most countries with a developed

16:Payment document for employee wages

14:

371:LII / Legal Information Institute

264:Consumer Financial Protection Act

95:An example of a payslip from the

308:National Savings and Investments

99:, showing gross salary, tax and

30:

396:. June 12, 2014. Archived from

423:"Glossary of Accounting Terms"

1:

260:Electronic Funds Transfer Act

393:Attorney General of New York

355:Electronic Fund Transfer Act

287:Payroll warrants look like

53:, discuss the issue on the

481:

280:

18:

237:automatic teller machines

225:payroll service providers

21:Paycheck (disambiguation)

104:

97:John Lewis Partnership

150:, commonly called a

94:

344:on January 24, 2009.

198:Electronic paychecks

59:create a new article

51:improve this article

41:may not represent a

19:For other uses, see

460:Wages and salaries

283:Warrant of payment

253:know-your-customer

105:

101:National Insurance

403:on August 1, 2016

87:

86:

79:

61:, as appropriate.

472:

465:Household income

439:

438:

436:

434:

429:on March 7, 2009

425:. Archived from

419:

413:

412:

410:

408:

402:

389:

381:

375:

374:

363:

357:

352:

346:

345:

343:

337:. Archived from

336:

328:

297:collection items

293:checking account

277:Payroll warrants

148:salary statement

82:

75:

71:

68:

62:

34:

33:

26:

480:

479:

475:

474:

473:

471:

470:

469:

445:

444:

443:

442:

432:

430:

421:

420:

416:

406:

404:

400:

387:

383:

382:

378:

365:

364:

360:

353:

349:

341:

334:

330:

329:

325:

320:

285:

279:

221:

200:

186:contributions,

166:, or sometimes

141:direct deposits

127:) issued by an

111:, also spelled

83:

72:

66:

63:

48:

35:

31:

24:

17:

12:

11:

5:

478:

476:

468:

467:

462:

457:

447:

446:

441:

440:

414:

376:

358:

347:

322:

321:

319:

316:

281:Main article:

278:

275:

220:

217:

199:

196:

178:and any other

85:

84:

45:of the subject

43:worldwide view

38:

36:

29:

15:

13:

10:

9:

6:

4:

3:

2:

477:

466:

463:

461:

458:

456:

453:

452:

450:

428:

424:

418:

415:

399:

395:

394:

386:

380:

377:

372:

368:

362:

359:

356:

351:

348:

340:

333:

327:

324:

317:

315:

313:

309:

305:

300:

298:

294:

290:

284:

276:

274:

272:

267:

265:

261:

256:

254:

249:

247:

241:

238:

234:

231:similar to a

230:

226:

218:

216:

214:

210:

205:

204:wire transfer

197:

195:

193:

189:

185:

181:

177:

173:

169:

168:paycheck stub

165:

161:

157:

153:

149:

144:

142:

138:

134:

130:

126:

122:

118:

114:

110:

102:

98:

93:

89:

81:

78:

70:

60:

56:

52:

46:

44:

37:

28:

27:

22:

431:. Retrieved

427:the original

417:

405:. Retrieved

398:the original

391:

379:

370:

361:

350:

339:the original

326:

312:premium bond

301:

286:

268:

257:

250:

242:

229:plastic card

222:

219:Payroll card

201:

192:garnishments

171:

167:

163:

159:

155:

151:

147:

145:

120:

116:

112:

108:

106:

88:

73:

64:

40:

407:February 1,

314:is chosen.

67:August 2012

449:Categories

318:References

233:debit card

209:figurative

188:insurances

180:deductions

164:pay advice

121:pay cheque

433:March 19,

172:wage slip

117:pay check

113:paycheque

55:talk page

455:Payments

262:and the

240:period.

156:pay stub

137:employee

129:employer

109:paycheck

49:You may

310:when a

302:In the

289:cheques

184:pension

160:paystub

152:payslip

213:Canada

125:cheque

401:(PDF)

388:(PDF)

342:(PDF)

335:(PDF)

176:taxes

57:, or

435:2011

409:2024

271:Visa

170:or

135:an

133:pay

131:to

119:or

451::

390:.

369:.

304:UK

266:.

248:.

190:,

162:,

158:,

154:,

146:A

115:,

107:A

437:.

411:.

373:.

80:)

74:(

69:)

65:(

47:.

23:.

Text is available under the Creative Commons Attribution-ShareAlike License. Additional terms may apply.