184:. After decades of involvement in the curb exchange, Mendels became the recognized "proctor" of the curb, and he alone would decide on the quotation lists. He also used his influence to throw out fraudulent stocks and dishonest brokers. In 1904, Mendels began to organize the curb, in an effort to cut down on swindling and other problems. Also that year, Mendels published the first annual directory of reliable brokers. In the mining boom of 1905 and 1906, the Curb market attracted some negative publicity for the "wholesale use of the Curb for swindling." Around late 1907, Mendels as Curb agent began devoting most of his time to keeping the Curb market "free of swindling stocks." As of 1907, Mendels gave the brokers rules "by right of seniority," but the curb brokers intentionally avoided organizing. According to the

217:

28:

399:

bedlams could unite their most violent voiced roarings in one vast and deafening howl, they would fail to parallel the absolute maniacrison of the scene. Buyer and seller, speculator and investor, operator and spectator, agent and principal, met face to face, upon the curb and beneath the sweltering sun, opened their mouths wide and screamed all manner of seeming nonsense at each other, while their hats tipped far toward the small of their backs, their eyes strained fiercely and their arms waved wildly above their heads, from which rolled rivers of profuse perspiration."

233:

the Wall Street

Investigating Committee on how the curb brokers did business. He also gave testimony on their restrictions concerning new business, and how swindlers were dealt with. On November 10, 1909, Mendels issued a notice reading that "For the protection of the public, complaints made in writing against any corporation or individual using the New York Curb market, directly or indirectly, will be investigated by the agency and referred to the proper authorities for suitable action." At the time, the Curb market still had no official organization.

140:, stocks in small industrial companies, such as iron and steel, textiles and chemicals were first sold by curbstone brokers. In August 1865, a reporter described the curb market in front of the new exchange building on Broad Street. "There were at least a thousand people on the sidewalk and street... Buyer and seller, speculator and investor, operator and spectator, agent and principal, met face to face, upon the curb and beneath the sweltering sun, opened their mouths wide and screamed all manner of seeming nonsense at each other".

299:. On March 16, 1911, the Curb Association elected its first Board of Representatives. The board corresponded to the Governing Committee of the Stock Exchange and had the "task of keeping the outside market in order." Members included E. S. Mendels, J. L. McCormack, E. M. Williams, C. H. Pforzheimer, E. A. Chartrand, T. J. Newman, W. A. Titus, Franklink Leonard, Jr., H. P. Armstrong, F. T. Ackermann, W. Content, Carl Rawley, R. Godwin, A. B. Sturges, and E. I. Connor. J.L. McCormack became the first Chairman of the Association

121:. The first local rival of the NYSE, the New Board emerged among the rough and tumble conditions of the very speculative curb-side trading during the down-turn in the market in general. The "curb" or "outside" trading exchange used a system in which "brokers and dealers traded directly with each other in the street near the exchange." To compete, the NYSE quickly began offering a second daily opportunity to buy or sell securities. At first, the New Board was very successful. It remained larger than the

386:

459:

445:

275:

307:

curb among mining brokers, after fist fights broke out the week prior. A second fist fight among Broad Street brokers occurred on

October 7, 1916, with the police warning that the next time the two combatants would be arrested. Curb Association chairman Edward Reid McCormick noted that the mining brokers had not been members of the

208:, reporting on the open letter, wrote that brokers informed of the letter "were not inclined to worry." The article described "their present ground on the broad asphalt in front of 40 Broad Street, south of the Exchange Place, is the first haven of which they have had anything like indisputed possession."

249:

decision was made by the "Curb agent and his advisory board," who ruled via their control of the printed lists of transactions. They held a "solemn conclave" and decided that the NYSE stocks would not be added until they had complied with the "Curb list" of requirements. Among the refused stocks were

248:

in 1910, the Big Board had always looked at the curb as "a trading place for 'cats and dogs.'" On April 1, 1910, however, when the NYSE abolished its "unlisted department," the NYSE stocks "made homeless by the abolition" were "refused domicile" by the curb brokers on Broad Street they turned to. The

365:

building by lying on the sidewalk in front of the doors. 12 were hurt and 45 arrested in a battle between police and picketers, although the protests "failed to prevent the two security markets from operating at virtually normal rates." There was no violence on the Curb, although picketers and their

203:

The noise caused by the curb market led to a number of attempts to shut it down. In August 1907, for example, a Wall Street lawyer sent an open letter to the newspapers and the police commissioner, begging for the New York Curb Market on Broad Street to be immediately abolished as a public nuisance.

398:

In August 1865, a reporter described the curb market in front of the new exchange building on Broad Street. "There were at least a thousand people on the sidewalk and street. Every man shouted; each wore his hat on the top of his head; nearly every man had a moustache, and it seemed to us if twenty

340:

between Thames and Rector

Streets, at 86 Trinity Place. The curbstone brokers moved indoors on June 27, 1921. By 1930, the Curb Exchange was the leading international stock market, "listing more foreign issues than all other U.S. securities markets combined." That year, the building's trading floor

265:

wrote the

Metropolitan Street Railway had experienced severe ups and downs on the NYSE, which "rival of worst of the manipulative scandals that the Curb has been trying to live down." In 1910, Mendels again testified before the Wall Street Investigating Committee on behalf of the curb brokers, when

232:

was a leading curbstone broker who organized the Curb Market Agency. As of

February 1909, Mendels remained "Curb agent," meaning he was essentially the only authority figure in the unorganized curb market on Broad Street. On February 26, 1909, he gave a "very complete and satisfactory" testimony to

393:

1902. Wrote a local resident in 1907, each morning at 10 o'clock the "multitude" of "brokers, brokers' clerks, lemonade and provision vendors, messenger boys, 'lambs' awaiting slaughter, and numerous other attaches and camp followers of the noisy and disorderly throng breaks forth with a volley of

159:, Open Board members specializing in unlisted stocks were left without "a roof over their heads and took to meeting casually in the course of the day in convenient lobbies in the district." The brokers were ousted by a number of buildings as their numbers grew, until they ended up in front of the

306:

reported that leaders of the Curb

Association favored a complete reorganization of trading in Broad Street, and were hastening efforts to get the "Curb under a roof" to allow for limited membership and fixed rules. To further its goals, the special curb committee pointed to recent violence on the

323:

stated that the market presented a "motley, agitated mass of struggling, yelling, finger-wriggling humanity." In 1920, journalist Edwin C. Hill wrote that the curb exchange on lower Broad Street was a roaring, swirling whirlpool” that "tears control of a gold-mine from an unlucky operator, then

195:

where cabbies lined up. There they were given a "little domain of asphalt" fenced off by the police on Broad Street between

Exchange Place and Beaver Street, after Police Commissioner McAddo took office. As of 1907, the curb market operated starting at 10'clock in the morning, each day except

357:. Per the agreement behind the formation of the curb market, all members of the Stock and Bond Exchange held memberships in the new curb exchange. The Curb had an authorized 100 charter members, 67 from the Stock and Bond Exchange, and the remaining made available for sale.

382:. Historically, curbstone brokers often traded stocks that were speculative in nature. To get attention and be recognized on the curb in Manhattan, many members dressed in attention-grabbing clothes and used flamboyant hand signals to conduct trades.

735:"Asks Bingham to Oust Curb Brokers; Lawyer Allen Says Open-Air Exchange Is a Public Nuisance and Therefore Illegal. He Cites Many Decisions And Will Press His Contention -- Brokers Forced to Move Many Times Owing to Complaints"

360:

On the second day of a strike by United

Financial Employees, there was violence outside the Curb Exchange and NYSE on March 30, 1948. The incident occurred in the early morning, when picketers attempted to bar entrance to the

1117:"Pickets and Police Battle in Wall St.; 12 Hurt, 45 Seized; Violence Outside the Exchange Laid Mainly to Seamen Aiding Striking Financial Union - Workers Lying on Sidewall Dragged to Patrol Wagons -- Stock Trading Goes On"

204:

He argued the curb exchange served "no legitimate or beneficial purpose" and was a "gambling institution, pure and simple." He further cited laws relating to street use, arguing blocking the thoroughfare was illegal. The

179:

began promoting the idea of the market moving indoors, an idea which was not actively picked up for two more decades. Efforts to organize and standardize the market started early in the 20th century under

Mendels and

286:

Based on a constitution drafted in 1911 to eliminate "irresponsible brokers and valueless stocks from the outside market," in 1911 the New York Curb Market Agency became the New York Curb Market, with offices in the

394:

discordant screams which rend the air for several blocks, and then bedlam reigns until the gong again sounds at 3 o'clock in the afternoon, to the confusion and discomfort of the whole surrounding neighborhood."

200:, until a gong at 3 o'clock. Orders for the purchase and sale of securities were shouted down from the windows of nearby brokerages, with the execution of the sale then shouted back up to the brokerage.

1989:

136:

often traded stocks that were speculative in nature. With the discovery of oil in the latter half of the 19th century, even oil stocks entered into the curb market. By 1865, following the

1033:

324:

pauses to auction a puppy-dog. It is like nothing else under the astonishing sky that is its only roof.” After a group of Curb brokers formed a real estate company to design a building,

1210:

482:

1994:

188:, this came from a general belief that if a curb exchange was organized, the exchange authorities would force members to sell their other exchange memberships.

311:, leaving "no way for the Curb officers to inflict discipline." The fist-fights occurred over the lack of delivery of Emma Copper and Old Emma Leasing stock.

691:

282:

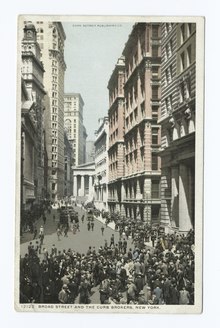

market on Broad Street circa 1916, with brokers and clients signalling from street to offices. Many members used flamboyant hand signals to conduct trades.

1203:

945:

907:

876:

366:

sympathizers later lined outside the exchange that day, numbering around 1,200. At the time, Francis Adams

Truslow was president of the Curb Exchange.

216:

826:

574:

477:

1017:

734:

1196:

354:

1441:

1116:

1083:

1055:

1179:

1160:

1001:

672:

553:

543:

118:

859:

618:

1466:

329:

292:

241:

36:

374:"Curb" or "outside" trading the involves brokers and dealers trading directly with each other in the street, for example near a

266:

an attempt was made to dislodge them from Broad Street. The informal Curb Association formed in 1910 to weed out undesirables.

160:

92:). Efforts to organize and standardize the market started early in the 20th century under notable curb-stone brokers such as

1460:

450:

76:

27:

1943:

1883:

1679:

1585:

83:

that were speculative in nature, as well as stocks in small industrial companies such as iron, textiles and chemicals (

1669:

1637:

1541:

1495:

1478:

1431:

423:

350:

225:

191:

The curb brokers had been kicked out of the Mills Building front by 1907, and had moved to the pavement outside the

1454:

1448:

1018:"Curb Market Opens Its $ 2,250,000 Home; Abandoning Street Trading, Members Dedicate New Quarters in Trinity Place"

856:

172:

765:

279:

254:

1843:

1518:

472:

390:

72:

40:

1084:"New Curb Market for San Francisco; Stock and Bond Exchange Votes for Reorganization and Division of Business"

908:"Curb Bars Stocks Big Board Dropped; Securities Shut Out by Abolition of Unlisted Department Are Homeless Now"

1056:"Stock Sales Jump in San Francisco; President of Exchange Shows Increase of 160 Per Cent in Turnover in Year"

1797:

1658:

1553:

1436:

362:

325:

296:

288:

237:

152:

148:

1685:

927:

413:

1823:

1632:

429:

156:

144:

43:

as "a roaring, swirling whirlpool... like nothing else under the astonishing sky that is its only roof."

1958:

1878:

1643:

1627:

1590:

1472:

1415:

1383:

464:

418:

385:

1888:

1833:

1757:

1617:

1547:

1376:

1349:

258:

181:

1737:

1928:

1903:

1863:

1848:

1767:

1706:

1664:

1408:

1318:

1308:

1121:

1088:

1060:

975:

950:

912:

881:

831:

739:

696:

579:

518:

379:

176:

137:

93:

64:

827:""Curb" Wars on Swindlers; Ready to Investigate Any Stock Brokers of Whom the Public Complains"

575:"Father of the Curb Dead; Emanuel S. Mendels, Jr., Elevated Trade and Routed Dishonest Brokers"

1792:

1777:

1529:

1175:

1156:

1025:

997:

668:

549:

513:

250:

991:

1893:

1813:

1609:

1490:

1366:

1285:

1241:

1219:

333:

308:

151:. Founded in part by former curbstone brokers, the Open Board of Stock Brokers was an early

1968:

1963:

1898:

1873:

1808:

1782:

1762:

1721:

1716:

1711:

1696:

1691:

1579:

1513:

1505:

1393:

1280:

877:"Mendels at the White Inquiry; Hughes Investigators Take Up Conditions in the Curb Market"

863:

337:

155:

established in 1864, which merged with the NYSE in 1869. After the Open Board joined the

1923:

1918:

1818:

1803:

1564:

1559:

1524:

1323:

1290:

1236:

1228:

623:

375:

192:

1983:

1787:

1772:

1747:

1701:

1653:

1356:

1313:

1300:

1251:

1093:

353:

started activities on January 2, 1928, using the unlisted securities formerly on the

229:

126:

114:

1948:

1868:

1838:

1828:

1648:

1622:

1371:

1361:

1344:

1275:

1270:

1246:

1148:

87:

795:

228:

was established, which developed appropriate trading rules for curbstone brokers.

662:

17:

1953:

1933:

1913:

1908:

1853:

1742:

1674:

946:"Men to Run the Curb; Board of Representatives for the Outside Market Nominated"

857:

http://abcnewspapers.com/index.php?option=com_content&task=view&id=11281

67:. Such brokers were prevalent in the 1800s and early 1900s, and the most famous

32:

1938:

1858:

1535:

1398:

440:

1029:

1574:

1569:

1484:

1403:

487:

408:

122:

110:

291:. In 1911, Mendels and his advisers drew up a constitution and formed the

444:

39:. That year, journalist Edwin C. Hill described the curb trading on lower

1752:

1388:

274:

1596:

197:

692:"The Ketchum Forgery; Additional Particulars Yesterday's Developments"

1339:

133:

60:

1188:

1262:

384:

341:

was doubled in size, with the entrance moved to 86 Trinity Place.

215:

80:

1153:

The Curbstone Brokers: The Origins of the American Stock Exchange

545:

The Curbstone Brokers: The Origins of the American Stock Exchange

113:

was an organization of curb-stone brokers established in 1836 in

803:, New York City Landmarks Preservation Commission, June 26, 2012

1192:

295:, which can be considered as the first formal constitution of

125:

until 1845, but the New Board's brokers were "crushed" by the

240:(NYSE), or "Big Board," operating several buildings away at

35:

in 1920, a year before much of the trading was moved into a

129:

and the recession that followed, and it folded in 1848.

885:. New York City, New York. February 27, 1909. p. 13

512:

When Stocks Came in From the Cold (September 30, 2010).

583:. New York City, New York. October 18, 1911. p. 11

954:. New York City, New York. March 17, 1911. p. 11

664:

The Big Board: A History of the New York Stock Market

916:. New York City, New York. April 2, 1901. p. 1.

1730:

1605:

1504:

1424:

1332:

1299:

1260:

1226:

1990:Self-regulatory organizations in the United States

619:"The NYSE's Long History of Mergers and Rivalries"

236:The curb exchange was for years at odds with the

821:

819:

817:

729:

727:

725:

723:

721:

719:

717:

715:

686:

684:

612:

610:

608:

606:

604:

602:

600:

598:

507:

505:

503:

902:

900:

175:in the 1890s. Around 1895, leading curb-broker

63:who conducts trading on the literal curbs of a

1172:AMEX: A History of the American Stock Exchange

483:List of stock exchange mergers in the Americas

1204:

8:

928:"66 Trinity Place - American Stock Exchange"

835:. New York City, New York. November 11, 1909

569:

567:

565:

261:'s Metropolitan Street Railway Company. The

979:. New York City, New York. October 8, 1916.

790:

788:

786:

784:

782:

780:

767:American Stock Exchange Historical Timeline

760:

758:

756:

754:

752:

750:

743:. New York City, New York. August 17, 1907.

171:The curb market moved to Broad Street near

1211:

1197:

1189:

648:, Doubleday: Garden City, New York, p. 22.

220:Broad Street and Curb Brokers, circa 1909.

537:

535:

533:

531:

529:

1125:. New York City, New York, United States

273:

143:The curb market grew further out of the

26:

973:"Brokers Again Use Fists in Broad St".

934:. New York City. March 1977. p. 9.

499:

478:List of stock exchanges in the Americas

1036:from the original on February 21, 2020

852:

850:

270:1911: New York Curb Market Association

617:E. Wright, Robert (January 8, 2013).

355:San Francisco Stock and Bond Exchange

105:1860s-1880s: New Board and Open Board

7:

1995:Stock exchanges in the United States

656:

654:

167:1890s-1907: Broad Street curb market

1115:Adams, Frank S. (March 31, 1948).

212:1908-1910: Increased formalization

25:

119:New York Stock and Exchange Board

79:. Curbstone brokers often traded

1467:Electronic communication network

1174:. Washington, D.C.: BeardBooks.

1155:. Washington, D.C.: BeardBooks.

866:New York Curb Market Association

667:. Beard Books. pp. 49, 51.

457:

443:

293:New York Curb Market Association

993:Financial Trading and Investing

315:Official Curb Exchange building

77:financial district of Manhattan

996:. Academic Press. p. 29.

147:, previously in a building on

1:

1461:Multilateral trading facility

451:Business and economics portal

1884:Returns-based style analysis

1680:Post-modern portfolio theory

1586:Security characteristic line

661:Sobel, Robert (2000-05-01).

1638:Efficient-market hypothesis

1542:Capital asset pricing model

1479:Straight-through processing

424:San Francisco Curb Exchange

351:San Francisco Curb Exchange

255:International Power Company

226:New York Curb Market Agency

37:dedicated exchange building

2011:

1455:Alternative Trading System

522:. New York City, New York.

163:entrance on Broad Street.

280:New York Curb Association

1519:Arbitrage pricing theory

646:The Anatomy of the Floor

473:Economy of New York City

326:Starrett & Van Vleck

1798:Initial public offering

1659:Modern portfolio theory

1554:Dividend discount model

1437:List of stock exchanges

990:Teall, John L. (2012).

644:Sloane, Leonard 1980

297:American Stock Exchange

289:Broad Exchange Building

238:New York Stock Exchange

153:regional stock exchange

1686:Random walk hypothesis

1170:Sobel, Robert (1972).

797:New York Curb Exchange

542:Sobel, Robert (2000).

414:New York Curb Exchange

395:

283:

221:

44:

1824:Market capitalization

1633:Dollar cost averaging

430:Chicago Curb Exchange

388:

330:new exchange building

321:New York Evening Post

278:Stock trading on the

277:

219:

157:Consolidated Exchange

145:Open Board of Brokers

30:

1644:Fundamental analysis

1628:Contrarian investing

1591:Security market line

1496:Liquidity aggregator

1473:Direct market access

1384:Quantitative analyst

465:New York City portal

419:Montreal Curb Market

403:Notable curb markets

302:On October 8, 1916,

117:to compete with the

1889:Reverse stock split

1834:Market manipulation

1758:Dual-listed company

1618:Algorithmic trading

1548:Capital market line

1350:Inter-dealer broker

370:Methods and culture

182:Carl H. Pforzheimer

1929:Stock market index

1768:Efficient frontier

1707:Technical analysis

1665:Momentum investing

1487:(private exchange)

1377:Proprietary trader

1319:Shares outstanding

1309:Authorised capital

1122:The New York Times

1096:. December 9, 1927

1089:The New York Times

1064:. November 4, 1928

1061:The New York Times

1022:The New York Times

976:The New York Times

951:The New York Times

913:The New York Times

882:The New York Times

862:2010-04-14 at the

832:The New York Times

740:The New York Times

697:The New York Times

580:The New York Times

519:The New York Times

514:"Christopher Gray"

396:

380:financial district

345:Later curb markets

304:The New York Times

284:

246:The New York Times

222:

177:Emanuel S. Mendels

138:American Civil War

94:Emanuel S. Mendels

65:financial district

45:

1977:

1976:

1778:Flight-to-quality

1530:Buffett indicator

1220:Financial markets

1092:. New York City,

1024:. June 28, 1921.

700:. August 18, 1865

53:curb-stone broker

18:Curb-side trading

16:(Redirected from

2002:

1894:Share repurchase

1606:Trading theories

1491:Crossing network

1449:Over-the-counter

1286:Restricted stock

1242:Secondary market

1213:

1206:

1199:

1190:

1185:

1166:

1135:

1134:

1132:

1130:

1112:

1106:

1105:

1103:

1101:

1080:

1074:

1073:

1071:

1069:

1052:

1046:

1045:

1043:

1041:

1014:

1008:

1007:

987:

981:

980:

970:

964:

963:

961:

959:

942:

936:

935:

924:

918:

917:

904:

895:

894:

892:

890:

873:

867:

854:

845:

844:

842:

840:

823:

812:

811:

810:

808:

802:

792:

775:

774:

772:

762:

745:

744:

731:

710:

709:

707:

705:

688:

679:

678:

658:

649:

642:

636:

635:

633:

631:

614:

593:

592:

590:

588:

571:

560:

559:

539:

524:

523:

509:

467:

462:

461:

460:

453:

448:

447:

334:Greenwich Street

309:Curb Association

49:curbstone broker

31:Curb brokers in

21:

2010:

2009:

2005:

2004:

2003:

2001:

2000:

1999:

1980:

1979:

1978:

1973:

1964:Voting interest

1874:Public offering

1809:Mandatory offer

1783:Government bond

1763:DuPont analysis

1726:

1722:Value investing

1717:Value averaging

1712:Trend following

1697:Style investing

1692:Sector rotation

1607:

1601:

1580:Net asset value

1506:Stock valuation

1500:

1420:

1328:

1295:

1281:Preferred stock

1256:

1222:

1217:

1182:

1169:

1163:

1147:

1144:

1142:Further reading

1139:

1138:

1128:

1126:

1114:

1113:

1109:

1099:

1097:

1082:

1081:

1077:

1067:

1065:

1054:

1053:

1049:

1039:

1037:

1016:

1015:

1011:

1004:

989:

988:

984:

972:

971:

967:

957:

955:

944:

943:

939:

926:

925:

921:

906:

905:

898:

888:

886:

875:

874:

870:

864:Wayback Machine

855:

848:

838:

836:

825:

824:

815:

806:

804:

800:

794:

793:

778:

770:

764:

763:

748:

733:

732:

713:

703:

701:

690:

689:

682:

675:

660:

659:

652:

643:

639:

629:

627:

616:

615:

596:

586:

584:

573:

572:

563:

556:

548:. Beard Books.

541:

540:

527:

511:

510:

501:

496:

463:

458:

456:

449:

442:

439:

405:

389:Curb market at

372:

347:

338:Lower Manhattan

317:

272:

244:. Explained by

242:18 Broad Street

214:

169:

107:

102:

23:

22:

15:

12:

11:

5:

2008:

2006:

1998:

1997:

1992:

1982:

1981:

1975:

1974:

1972:

1971:

1966:

1961:

1956:

1951:

1946:

1941:

1936:

1931:

1926:

1924:Stock exchange

1921:

1919:Stock dilution

1916:

1911:

1906:

1901:

1896:

1891:

1886:

1881:

1876:

1871:

1866:

1861:

1856:

1851:

1846:

1844:Mean reversion

1841:

1836:

1831:

1826:

1821:

1819:Market anomaly

1816:

1811:

1806:

1801:

1795:

1790:

1785:

1780:

1775:

1770:

1765:

1760:

1755:

1750:

1745:

1740:

1738:Bid–ask spread

1734:

1732:

1728:

1727:

1725:

1724:

1719:

1714:

1709:

1704:

1699:

1694:

1689:

1683:

1677:

1672:

1667:

1662:

1656:

1651:

1646:

1641:

1635:

1630:

1625:

1620:

1614:

1612:

1603:

1602:

1600:

1599:

1594:

1588:

1583:

1577:

1572:

1567:

1565:Earnings yield

1562:

1560:Dividend yield

1557:

1551:

1545:

1539:

1533:

1527:

1522:

1516:

1510:

1508:

1502:

1501:

1499:

1498:

1493:

1488:

1482:

1476:

1470:

1464:

1458:

1452:

1451:(off-exchange)

1446:

1445:

1444:

1439:

1428:

1426:

1425:Trading venues

1422:

1421:

1419:

1418:

1413:

1412:

1411:

1401:

1396:

1391:

1386:

1381:

1380:

1379:

1374:

1364:

1359:

1354:

1353:

1352:

1347:

1336:

1334:

1330:

1329:

1327:

1326:

1324:Treasury stock

1321:

1316:

1311:

1305:

1303:

1297:

1296:

1294:

1293:

1291:Tracking stock

1288:

1283:

1278:

1273:

1267:

1265:

1258:

1257:

1255:

1254:

1249:

1244:

1239:

1237:Primary market

1233:

1231:

1224:

1223:

1218:

1216:

1215:

1208:

1201:

1193:

1187:

1186:

1180:

1167:

1161:

1143:

1140:

1137:

1136:

1107:

1075:

1047:

1009:

1002:

982:

965:

937:

919:

896:

868:

846:

813:

776:

746:

711:

680:

673:

650:

637:

594:

561:

554:

525:

498:

497:

495:

492:

491:

490:

485:

480:

475:

469:

468:

454:

438:

435:

434:

433:

427:

421:

416:

411:

404:

401:

376:stock exchange

371:

368:

346:

343:

316:

313:

271:

268:

213:

210:

206:New York Times

193:Blair Building

173:Exchange Place

168:

165:

161:Mills Building

106:

103:

101:

98:

24:

14:

13:

10:

9:

6:

4:

3:

2:

2007:

1996:

1993:

1991:

1988:

1987:

1985:

1970:

1967:

1965:

1962:

1960:

1957:

1955:

1952:

1950:

1947:

1945:

1942:

1940:

1937:

1935:

1932:

1930:

1927:

1925:

1922:

1920:

1917:

1915:

1912:

1910:

1907:

1905:

1902:

1900:

1899:Short selling

1897:

1895:

1892:

1890:

1887:

1885:

1882:

1880:

1877:

1875:

1872:

1870:

1867:

1865:

1862:

1860:

1857:

1855:

1852:

1850:

1847:

1845:

1842:

1840:

1837:

1835:

1832:

1830:

1827:

1825:

1822:

1820:

1817:

1815:

1812:

1810:

1807:

1805:

1802:

1799:

1796:

1794:

1791:

1789:

1788:Greenspan put

1786:

1784:

1781:

1779:

1776:

1774:

1773:Financial law

1771:

1769:

1766:

1764:

1761:

1759:

1756:

1754:

1751:

1749:

1748:Cross listing

1746:

1744:

1741:

1739:

1736:

1735:

1733:

1731:Related terms

1729:

1723:

1720:

1718:

1715:

1713:

1710:

1708:

1705:

1703:

1702:Swing trading

1700:

1698:

1695:

1693:

1690:

1687:

1684:

1681:

1678:

1676:

1673:

1671:

1670:Mosaic theory

1668:

1666:

1663:

1660:

1657:

1655:

1654:Market timing

1652:

1650:

1647:

1645:

1642:

1639:

1636:

1634:

1631:

1629:

1626:

1624:

1621:

1619:

1616:

1615:

1613:

1611:

1604:

1598:

1595:

1592:

1589:

1587:

1584:

1581:

1578:

1576:

1573:

1571:

1568:

1566:

1563:

1561:

1558:

1555:

1552:

1549:

1546:

1543:

1540:

1537:

1534:

1531:

1528:

1526:

1523:

1520:

1517:

1515:

1512:

1511:

1509:

1507:

1503:

1497:

1494:

1492:

1489:

1486:

1483:

1480:

1477:

1474:

1471:

1468:

1465:

1462:

1459:

1456:

1453:

1450:

1447:

1443:

1442:Trading hours

1440:

1438:

1435:

1434:

1433:

1430:

1429:

1427:

1423:

1417:

1414:

1410:

1407:

1406:

1405:

1402:

1400:

1397:

1395:

1392:

1390:

1387:

1385:

1382:

1378:

1375:

1373:

1370:

1369:

1368:

1365:

1363:

1360:

1358:

1357:Broker-dealer

1355:

1351:

1348:

1346:

1343:

1342:

1341:

1338:

1337:

1335:

1331:

1325:

1322:

1320:

1317:

1315:

1314:Issued shares

1312:

1310:

1307:

1306:

1304:

1302:

1301:Share capital

1298:

1292:

1289:

1287:

1284:

1282:

1279:

1277:

1274:

1272:

1269:

1268:

1266:

1264:

1259:

1253:

1252:Fourth market

1250:

1248:

1245:

1243:

1240:

1238:

1235:

1234:

1232:

1230:

1225:

1221:

1214:

1209:

1207:

1202:

1200:

1195:

1194:

1191:

1183:

1181:1-893122-48-4

1177:

1173:

1168:

1164:

1162:1-893122-65-4

1158:

1154:

1150:

1149:Sobel, Robert

1146:

1145:

1141:

1124:

1123:

1118:

1111:

1108:

1095:

1094:United States

1091:

1090:

1085:

1079:

1076:

1063:

1062:

1057:

1051:

1048:

1035:

1031:

1027:

1023:

1019:

1013:

1010:

1005:

1003:9780123918802

999:

995:

994:

986:

983:

978:

977:

969:

966:

953:

952:

947:

941:

938:

933:

929:

923:

920:

915:

914:

909:

903:

901:

897:

884:

883:

878:

872:

869:

865:

861:

858:

853:

851:

847:

834:

833:

828:

822:

820:

818:

814:

799:

798:

791:

789:

787:

785:

783:

781:

777:

769:

768:

761:

759:

757:

755:

753:

751:

747:

742:

741:

736:

730:

728:

726:

724:

722:

720:

718:

716:

712:

699:

698:

693:

687:

685:

681:

676:

674:9781893122666

670:

666:

665:

657:

655:

651:

647:

641:

638:

626:

625:

620:

613:

611:

609:

607:

605:

603:

601:

599:

595:

582:

581:

576:

570:

568:

566:

562:

557:

555:9781893122659

551:

547:

546:

538:

536:

534:

532:

530:

526:

521:

520:

515:

508:

506:

504:

500:

493:

489:

486:

484:

481:

479:

476:

474:

471:

470:

466:

455:

452:

446:

441:

436:

431:

428:

425:

422:

420:

417:

415:

412:

410:

407:

406:

402:

400:

392:

387:

383:

381:

377:

369:

367:

364:

358:

356:

352:

344:

342:

339:

335:

331:

328:designed the

327:

322:

319:In 1920, the

314:

312:

310:

305:

300:

298:

294:

290:

281:

276:

269:

267:

264:

260:

256:

252:

251:J. H. Hoadley

247:

243:

239:

234:

231:

230:E. S. Mendels

227:

224:In 1908, the

218:

211:

209:

207:

201:

199:

194:

189:

187:

183:

178:

174:

166:

164:

162:

158:

154:

150:

146:

141:

139:

135:

130:

128:

127:Panic of 1837

124:

120:

116:

115:New York City

112:

104:

99:

97:

95:

91:

90:

89:

82:

78:

74:

70:

66:

62:

58:

54:

50:

42:

38:

34:

29:

19:

1949:Tender offer

1869:Public float

1839:Market trend

1829:Market depth

1649:Growth stock

1623:Buy and hold

1532:(Cap-to-GDP)

1372:Floor trader

1362:Market maker

1345:Floor broker

1333:Participants

1276:Golden share

1271:Common stock

1247:Third market

1171:

1152:

1127:. Retrieved

1120:

1110:

1098:. Retrieved

1087:

1078:

1066:. Retrieved

1059:

1050:

1040:February 21,

1038:. Retrieved

1021:

1012:

992:

985:

974:

968:

956:. Retrieved

949:

940:

931:

922:

911:

887:. Retrieved

880:

871:

837:. Retrieved

830:

805:, retrieved

796:

766:

738:

702:. Retrieved

695:

663:

645:

640:

628:. Retrieved

622:

585:. Retrieved

578:

544:

517:

397:

391:Broad Street

373:

359:

348:

320:

318:

303:

301:

285:

262:

245:

235:

223:

205:

202:

190:

185:

170:

142:

131:

108:

88:curb trading

86:

84:

73:Broad Street

68:

59:refers to a

56:

52:

48:

46:

41:Broad Street

1954:Uptick rule

1934:Stock split

1914:Squeeze-out

1909:Speculation

1854:Open outcry

1743:Block trade

1675:Pairs trade

432:(1928-1938)

426:(1928-1938)

71:existed on

69:curb market

57:curb broker

47:The phrase

33:Wall Street

1984:Categories

1959:Volatility

1939:Stock swap

1859:Order book

1610:strategies

1536:Book value

1404:Arbitrager

1399:Speculator

494:References

259:T. F. Ryan

149:New Street

132:Curbstone

1575:Fed model

1570:EV/EBITDA

1485:Dark pool

1416:Regulator

1261:Types of

1227:Types of

1030:0362-4331

958:April 21,

889:April 21,

839:April 21,

704:April 21,

630:April 10,

624:Bloomberg

587:April 21,

488:New Board

409:New Board

123:Big Board

111:New Board

1904:Slippage

1864:Position

1849:Momentum

1753:Dividend

1432:Exchange

1389:Investor

1151:(1970).

1034:Archived

860:Archived

437:See also

349:The new

1793:Haircut

1597:T-model

1409:Scalper

1229:markets

1129:June 1,

1100:June 1,

1068:June 1,

932:nps.gov

807:May 22,

198:Sundays

134:brokers

100:History

75:in the

1814:Margin

1682:(PMPT)

1544:(CAPM)

1394:Hedger

1367:Trader

1340:Broker

1263:stocks

1178:

1159:

1028:

1000:

773:, NYSE

671:

552:

81:stocks

61:broker

1969:Yield

1944:Trade

1879:Rally

1800:(IPO)

1688:(RMH)

1661:(MPT)

1640:(EMH)

1593:(SML)

1582:(NAV)

1556:(DDM)

1550:(CML)

1521:(APT)

1514:Alpha

1481:(STP)

1475:(DMA)

1469:(ECN)

1463:(MTF)

1457:(ATS)

801:(PDF)

771:(PDF)

378:in a

263:Times

186:Times

1804:Long

1608:and

1538:(BV)

1525:Beta

1176:ISBN

1157:ISBN

1131:2017

1102:2017

1070:2017

1042:2020

1026:ISSN

998:ISBN

960:2017

891:2017

841:2017

809:2017

706:2017

669:ISBN

632:2017

589:2017

550:ISBN

363:NYSE

257:and

109:The

85:see

336:in

332:on

253:'s

55:or

1986::

1119:.

1086:.

1058:.

1032:.

1020:.

948:.

930:.

910:.

899:^

879:.

849:^

829:.

816:^

779:^

749:^

737:.

714:^

694:.

683:^

653:^

621:.

597:^

577:.

564:^

528:^

516:.

502:^

96:.

51:,

1212:e

1205:t

1198:v

1184:.

1165:.

1133:.

1104:.

1072:.

1044:.

1006:.

962:.

893:.

843:.

708:.

677:.

634:.

591:.

558:.

20:)

Text is available under the Creative Commons Attribution-ShareAlike License. Additional terms may apply.