500:. Insurance allows people to translate consumption from periods where their consumption is high (having a low marginal utility) to periods when their consumption is low (having a high marginal utility). Due to many possible states of the world, people want to decrease the amount of uncertain outcomes of the future. Basic insurance theory states that individuals will demand full insurance to fully smooth consumption across difference states of the world. This explains why people purchase insurance, whether in healthcare, unemployment, and social security. To help illustrate this, think of a simplified hypothetical scenario with Person A, who can exist in one of two states of the world. Assume Person A who is healthy and can work; this will be State X of the world. One day, an unfortunate accident occurs, person A no longer can work. Therefore, he cannot obtain income from work and is in State Y of the world. In State X, Person A enjoys a good income from his work place and is able to spend money on necessities, such as paying rent and buying groceries, and luxuries, such as traveling to Europe. In State Y, Person A no longer obtains an income, due to injury, and struggles to pay for necessities. In a perfect world, Person A would have known to save for this future accident and would have more savings to compensate for the lack of income post-injury. Rather than spend money on the trip to Europe in State X, Person A could have saved that money to use for necessities in State Y. However, people tend to be poor predictors of the future, especially ones that are myopic. Therefore, insurance can "smooth" between these two states and provide more certainty for the future.

472:

37:

want to maximize their expected utility, as defined as the weighted sum of utilities across states of the world. The weights in this model are the probabilities of each state of the world happening. According to the "more is better" principle, the first order condition will be positive; however, the second order condition will be negative, due to the principle of diminishing

45:

1619:. The data used are US National Income and Product Accounts (NIPA) quarterly from 1948 to 1977. For the analysis the author does not consider the consumption of durable goods. Although Hall argues that he finds some evidence of consumption smoothing, he does so using a modified version. There are also some econometric concerns about his findings.

509:

suffering in extremely low income states of the world want to prepare for the next time they experience an adverse state of the world. This leads to the support of microfinance as a tool to consumption smooth, stating that those in poverty value microloans tremendously due to its extremely high marginal utility.

27:

Since income tends to be hump-shaped across an individual's life, economic theory suggests that individuals should on average have low or negative savings rate at early stages in their life, high in middle age, and negative during retirement. Although many popular books on personal finance advocate

1622:

Wilcox (1989) argue that liquidity constraint is the reason why consumption smoothing does not show up in the data. Zeldes (1989) follows the same argument and finds that a poor household's consumption is correlated with contemporaneous income, while a rich household's consumption is not. A recent

23:

concept for the practice of optimizing a person's standard of living through an appropriate balance between savings and consumption over time. An optimal consumption rate should be relatively similar at each stage of a person's life rather than fluctuate wildly. Luxurious consumption at an old age

36:

The graph below illustrates the expected utility model, in which U(c) is increasing in and concave in c. This shows that there are diminishing marginal returns associated with consumption, as each additional unit of consumption adds less utility. The expected utility model states that individuals

540:

Friedman's theory argues that consumption is linked to the permanent income of agents. Thus, when income is affected by transitory shocks, for example, agents' consumption should not change, since they can use savings or borrowing to adjust. This theory assumes that agents are able to finance

508:

Though there are arguments stating that microcredit does not effectively lift people from poverty, some note that offering a way to consumption smooth during tough periods has shown to be effective. This supports the principle of diminishing marginal utility, where those who have a history of

427:

An actuarially fair premium to pay for insurance would be the insurance premium that is set equal to the insurer's expected payout, so that the insurer will expect to earn zero profit. Some individuals are risk-averse, as shown by the graph above. The blue line,

467:

is curved upwards, revealing that this particular individual is risk-averse. If the blue line was curved downwards, this would reveal the preference for a risk-seeking individual. Additionally, a straight line would reveal a risk-neutral individual.

1217:

553:

formalized

Friedman's idea. By taking into account the diminishing returns to consumption, and therefore, assuming a concave utility function, he showed that agents optimally would choose to keep a stable path of consumption.

241:

The model shows expected utility as the sum of the probability of being in a bad state multiplied by utility of being in a bad state and the probability of being in a good state multiplied by utility of being in a good state.

41:. Due to the concave actual utility, marginal utility decreases as consumption increase; as a result, it is favorable to reduce consumption in states of high income to increase consumption in low income states.

1366:

993:

190:

1093:

354:

700:

1275:

646:

1602:

465:

1434:

831:

879:

770:

585:

1657:

899:

851:

790:

741:

720:

605:

422:

400:

378:

236:

214:

28:

that individuals should at all stages of their life set aside money in savings, economist James Choi states that this deviates from the advice of economists.

1104:

1869:

Modigliani, F.; Brumberg, R. (1954). "Utility analysis and the consumption function: An interpretation of cross-section data". In

Kurihara, K. K. (ed.).

487:: With fixed probabilities of two alternative states 1 and 2, risk averse indifference curves over pairs of state-contingent outcomes are convex.

533:, the idea that agents prefer a stable path of consumption has been widely accepted. This idea came to replace the perception that people had a

48:

The graph shows expected utility, E, after consumption smoothing (e.g. insurance), and actual utility, U(E), without consumption smoothing.

1607:

This expression shows that agents choose to consume a fraction of their present discounted value of their human and financial wealth.

1283:

1616:

911:

534:

57:

1886:

1004:

522:

250:

1884:

Hall, Robert (1978). "Stochastic

Implications of the Life Cycle-Permanent Income Hypothesis: Theory and Evidence".

530:

2000:

653:

1921:

Wilcox, James A. (1989). "Liquidity

Constraints on Consumption: The Real Effects of Real Lending Policies".

550:

1225:

475:

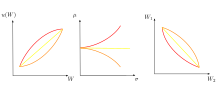

Risk aversion (red) contrasted to risk neutrality (yellow) and risk loving (orange) in different settings.

1972:"Do consumers really follow a rule of thumb? Three thousand estimates from 144 studies say "probably not""

479:: A risk averse utility function is concave (from below), while a risk loving utility function is convex.

1623:

meta-analysis of 3000 estimates reported in 144 studies finds strong evidence for consumption smoothing.

611:

1971:

1693:

1448:

549:

is one of the main reasons why it is difficult to observe consumption smoothing in the data. In 1978,

431:

1995:

546:

1769:

1953:

1903:

1377:

796:

542:

483:: In standard deviation-expected value space, risk averse indifference curves are upward sloped.

1936:

Zeldes, Stephen P. (1989). "Consumption and

Liquidity Constraints: An Empirical Investigation".

541:

consumption with earnings that are not yet generated, and thus assumes perfect capital markets.

1751:

1701:

1665:

1637:

526:

1442:

Hall also showed that for a quadratic utility function, the optimal consumption is equal to:

1945:

1895:

1741:

38:

857:

748:

563:

1632:

518:

517:

Another model to look at for consumption smoothing is Hall's model, which is inspired by

1852:

884:

836:

775:

726:

705:

590:

407:

385:

363:

221:

199:

1212:{\displaystyle \beta E_{t}R_{t+1}{\frac {u^{\prime }(c_{t+1})}{u^{\prime }(c_{t})}}=1}

1989:

1957:

1907:

1658:"Analysis | Shoplifting in Chicago dropped after a change in the food stamp program"

1439:

Thus, rational agents would expect to achieve the same consumption in every period.

24:

does not compensate for an impoverished existence at other stages in one's life.

471:

1615:

Robert Hall (1978) estimated the Euler equation in order to find evidence of a

587:

being the mathematical expectation conditional on all information available in

1755:

1705:

1669:

497:

44:

1746:

1729:

20:

1821:

Collins, D., Jonathan

Morduch, Stuart Rutherford, and Orlanda Ruthven.

1949:

1899:

470:

43:

1823:

Portfolios of the Poor: How the World's Poor Live on $ 2 a Day

1371:

Which, due to the concavity of the utility function, implies:

537:

and therefore current consumption was tied to current income.

1694:"Opinion | In Retirement, You May Not Need to Spend So Much"

1361:{\displaystyle E_{t}u^{\prime }(c_{t+1})=u^{\prime }(c_{t})}

1337:

1302:

1179:

1145:

245:

Similarly, actuarially fair insurance can also be modeled:

1098:

The first order necessary condition in this case will be:

1730:"Popular Personal Financial Advice versus the Professors"

988:{\displaystyle E_{0}\sum _{t=0}^{\infty }\beta ^{t}\left}

380:= probability you will lose all your wealth/consumption

216:= probability you will lose all your wealth/consumption

185:{\displaystyle EU=q*U(W|badstate)+(1-q)*U(W|goodstate)}

743:

being the strictly concave one-period utility function

1923:

Federal

Reserve Bank of San Francisco Economic Review

1451:

1380:

1286:

1228:

1107:

1007:

914:

887:

860:

839:

799:

778:

751:

729:

708:

656:

614:

593:

566:

434:

410:

388:

366:

253:

224:

202:

60:

905:agents choose the consumption path that maximizes:

1851:

1596:

1428:

1360:

1269:

1211:

1088:{\displaystyle A_{t+1}=R_{t+1}(A_{t}+y_{t}-c_{t})}

1087:

987:

893:

873:

845:

825:

784:

764:

735:

714:

694:

640:

599:

579:

459:

416:

394:

372:

348:

230:

208:

184:

1611:Empirical evidence for Hall and Friedman's model

881:being the assets, apart from human capital, in

349:{\displaystyle EU=(1-q)*U(W-p)+q*U(W-p-d+p/q)}

1835:"Does Microcredit Really Help Poor People?".

998:Subject to a sequence of budget constraints:

8:

1858:. Princeton, NJ: Princeton University Press.

1797:. New York, NY: Worth, 2013. Print. 304-305.

1745:

1583:

1564:

1554:

1532:

1521:

1510:

1500:

1469:

1456:

1450:

1420:

1398:

1385:

1379:

1349:

1336:

1314:

1301:

1291:

1285:

1258:

1233:

1227:

1191:

1178:

1157:

1144:

1137:

1125:

1115:

1106:

1076:

1063:

1050:

1031:

1012:

1006:

971:

950:

940:

929:

919:

913:

886:

865:

859:

838:

817:

804:

798:

777:

756:

750:

728:

707:

695:{\displaystyle r_{t}=R_{t}-1\geq \delta }

674:

661:

655:

648:being the agent's rate of time preference

624:

613:

592:

571:

565:

496:One method used to smooth consumption is

450:

433:

409:

387:

365:

335:

252:

223:

201:

147:

85:

59:

1976:Review of Economic Dynamics, forthcoming

1825:. Princeton: Princeton UP, 2015. Print.

1649:

1723:

1721:

1277:we obtain, for the previous equation:

1270:{\displaystyle R_{t+1}=R=\beta ^{-1}}

504:Microcredit and consumption smoothing

7:

1854:A Theory of the Consumption Function

1789:

1787:

1785:

1783:

1687:

1685:

52:Expected utility can be modeled as:

702:being the real rate of interest in

492:Insurance and consumption smoothing

1522:

941:

641:{\displaystyle \delta =1/\beta -1}

14:

1795:Public Finance and Public Policy

1734:Journal of Economic Perspectives

1597:{\displaystyle c_{t}=\left\left}

460:{\displaystyle U(c)={\sqrt {c}}}

1811:. Pearson. pp. Chapter 4.

1410:

1391:

1355:

1342:

1326:

1307:

1197:

1184:

1169:

1150:

1082:

1043:

977:

964:

535:marginal propensity to consume

444:

438:

343:

311:

296:

284:

275:

263:

179:

148:

141:

132:

120:

114:

86:

79:

1:

1770:"On the demonisation of debt"

1938:Journal of Political Economy

1887:Journal of Political Economy

1807:Perloff, Jeffrey M. (2004).

1429:{\displaystyle E_{t}=c_{t}}

826:{\displaystyle y_{t}=w_{t}}

2017:

1617:random walk in consumption

1850:Friedman, Milton (1956).

1692:Coy, Peter (2022-09-28).

772:being the consumption in

513:Hall and Friedman's model

1871:Post-Keynesian Economics

557:With (cf. Hall's paper)

521:. Since Friedman's 1956

1728:Choi, James J. (2022).

523:permanent income theory

1598:

1526:

1430:

1362:

1271:

1213:

1089:

989:

945:

895:

875:

847:

833:being the earnings in

827:

786:

766:

737:

716:

696:

642:

601:

581:

488:

461:

418:

396:

374:

350:

232:

210:

186:

49:

32:Expected utility model

1610:

1599:

1506:

1431:

1363:

1272:

1214:

1090:

990:

925:

896:

876:

874:{\displaystyle A_{t}}

848:

828:

787:

767:

765:{\displaystyle c_{t}}

738:

717:

697:

643:

602:

582:

580:{\displaystyle E_{t}}

512:

474:

462:

419:

397:

375:

351:

233:

211:

187:

47:

17:Consumption smoothing

1747:10.1257/jep.36.4.167

1449:

1378:

1284:

1226:

1105:

1005:

912:

885:

858:

837:

797:

776:

749:

727:

706:

654:

612:

591:

564:

547:liquidity constraint

529:and Brumberg's 1954

432:

408:

386:

364:

251:

222:

200:

58:

1793:Gruber, Jonathan.

1698:The New York Times

1594:

1426:

1358:

1267:

1209:

1085:

985:

891:

871:

843:

823:

782:

762:

733:

712:

692:

638:

597:

577:

543:Empirical evidence

489:

457:

414:

392:

370:

346:

228:

206:

182:

50:

1638:Risk compensation

1548:

1485:

1222:By assuming that

1201:

894:{\displaystyle t}

846:{\displaystyle t}

785:{\displaystyle t}

736:{\displaystyle u}

715:{\displaystyle t}

600:{\displaystyle t}

455:

417:{\displaystyle d}

395:{\displaystyle W}

373:{\displaystyle q}

231:{\displaystyle W}

209:{\displaystyle q}

2008:

1980:

1979:

1968:

1962:

1961:

1933:

1927:

1926:

1918:

1912:

1911:

1881:

1875:

1874:

1866:

1860:

1859:

1857:

1847:

1841:

1840:

1832:

1826:

1819:

1813:

1812:

1804:

1798:

1791:

1778:

1777:

1766:

1760:

1759:

1749:

1725:

1716:

1715:

1713:

1712:

1689:

1680:

1679:

1677:

1676:

1654:

1603:

1601:

1600:

1595:

1593:

1589:

1588:

1587:

1575:

1574:

1559:

1558:

1553:

1549:

1547:

1533:

1525:

1520:

1505:

1504:

1490:

1486:

1484:

1470:

1461:

1460:

1435:

1433:

1432:

1427:

1425:

1424:

1409:

1408:

1390:

1389:

1367:

1365:

1364:

1359:

1354:

1353:

1341:

1340:

1325:

1324:

1306:

1305:

1296:

1295:

1276:

1274:

1273:

1268:

1266:

1265:

1244:

1243:

1218:

1216:

1215:

1210:

1202:

1200:

1196:

1195:

1183:

1182:

1172:

1168:

1167:

1149:

1148:

1138:

1136:

1135:

1120:

1119:

1094:

1092:

1091:

1086:

1081:

1080:

1068:

1067:

1055:

1054:

1042:

1041:

1023:

1022:

994:

992:

991:

986:

984:

980:

976:

975:

955:

954:

944:

939:

924:

923:

900:

898:

897:

892:

880:

878:

877:

872:

870:

869:

852:

850:

849:

844:

832:

830:

829:

824:

822:

821:

809:

808:

791:

789:

788:

783:

771:

769:

768:

763:

761:

760:

742:

740:

739:

734:

721:

719:

718:

713:

701:

699:

698:

693:

679:

678:

666:

665:

647:

645:

644:

639:

628:

606:

604:

603:

598:

586:

584:

583:

578:

576:

575:

531:life-cycle model

466:

464:

463:

458:

456:

451:

423:

421:

420:

415:

401:

399:

398:

393:

379:

377:

376:

371:

355:

353:

352:

347:

339:

237:

235:

234:

229:

215:

213:

212:

207:

191:

189:

188:

183:

151:

89:

39:marginal utility

2016:

2015:

2011:

2010:

2009:

2007:

2006:

2005:

2001:Consumer theory

1986:

1985:

1984:

1983:

1970:

1969:

1965:

1935:

1934:

1930:

1920:

1919:

1915:

1883:

1882:

1878:

1868:

1867:

1863:

1849:

1848:

1844:

1834:

1833:

1829:

1820:

1816:

1806:

1805:

1801:

1792:

1781:

1768:

1767:

1763:

1727:

1726:

1719:

1710:

1708:

1691:

1690:

1683:

1674:

1672:

1662:Washington Post

1656:

1655:

1651:

1646:

1633:Consumer choice

1629:

1613:

1579:

1560:

1537:

1528:

1527:

1496:

1495:

1491:

1474:

1465:

1452:

1447:

1446:

1416:

1394:

1381:

1376:

1375:

1345:

1332:

1310:

1297:

1287:

1282:

1281:

1254:

1229:

1224:

1223:

1187:

1174:

1173:

1153:

1140:

1139:

1121:

1111:

1103:

1102:

1072:

1059:

1046:

1027:

1008:

1003:

1002:

967:

960:

956:

946:

915:

910:

909:

883:

882:

861:

856:

855:

835:

834:

813:

800:

795:

794:

774:

773:

752:

747:

746:

725:

724:

704:

703:

670:

657:

652:

651:

610:

609:

589:

588:

567:

562:

561:

519:Milton Friedman

515:

506:

494:

430:

429:

406:

405:

384:

383:

362:

361:

249:

248:

220:

219:

198:

197:

56:

55:

34:

12:

11:

5:

2014:

2012:

2004:

2003:

1998:

1988:

1987:

1982:

1981:

1963:

1950:10.1086/261605

1928:

1913:

1900:10.1086/260724

1894:(6): 971–988.

1876:

1861:

1842:

1827:

1814:

1809:Microeconomics

1799:

1779:

1761:

1740:(4): 167–192.

1717:

1681:

1648:

1647:

1645:

1642:

1641:

1640:

1635:

1628:

1625:

1612:

1609:

1605:

1604:

1592:

1586:

1582:

1578:

1573:

1570:

1567:

1563:

1557:

1552:

1546:

1543:

1540:

1536:

1531:

1524:

1519:

1516:

1513:

1509:

1503:

1499:

1494:

1489:

1483:

1480:

1477:

1473:

1468:

1464:

1459:

1455:

1437:

1436:

1423:

1419:

1415:

1412:

1407:

1404:

1401:

1397:

1393:

1388:

1384:

1369:

1368:

1357:

1352:

1348:

1344:

1339:

1335:

1331:

1328:

1323:

1320:

1317:

1313:

1309:

1304:

1300:

1294:

1290:

1264:

1261:

1257:

1253:

1250:

1247:

1242:

1239:

1236:

1232:

1220:

1219:

1208:

1205:

1199:

1194:

1190:

1186:

1181:

1177:

1171:

1166:

1163:

1160:

1156:

1152:

1147:

1143:

1134:

1131:

1128:

1124:

1118:

1114:

1110:

1096:

1095:

1084:

1079:

1075:

1071:

1066:

1062:

1058:

1053:

1049:

1045:

1040:

1037:

1034:

1030:

1026:

1021:

1018:

1015:

1011:

996:

995:

983:

979:

974:

970:

966:

963:

959:

953:

949:

943:

938:

935:

932:

928:

922:

918:

903:

902:

890:

868:

864:

853:

842:

820:

816:

812:

807:

803:

792:

781:

759:

755:

744:

732:

722:

711:

691:

688:

685:

682:

677:

673:

669:

664:

660:

649:

637:

634:

631:

627:

623:

620:

617:

607:

596:

574:

570:

514:

511:

505:

502:

493:

490:

454:

449:

446:

443:

440:

437:

413:

391:

369:

345:

342:

338:

334:

331:

328:

325:

322:

319:

316:

313:

310:

307:

304:

301:

298:

295:

292:

289:

286:

283:

280:

277:

274:

271:

268:

265:

262:

259:

256:

227:

205:

181:

178:

175:

172:

169:

166:

163:

160:

157:

154:

150:

146:

143:

140:

137:

134:

131:

128:

125:

122:

119:

116:

113:

110:

107:

104:

101:

98:

95:

92:

88:

84:

81:

78:

75:

72:

69:

66:

63:

33:

30:

13:

10:

9:

6:

4:

3:

2:

2013:

2002:

1999:

1997:

1994:

1993:

1991:

1977:

1973:

1967:

1964:

1959:

1955:

1951:

1947:

1944:(2): 305–46.

1943:

1939:

1932:

1929:

1924:

1917:

1914:

1909:

1905:

1901:

1897:

1893:

1889:

1888:

1880:

1877:

1872:

1865:

1862:

1856:

1855:

1846:

1843:

1839:. 2009-10-05.

1838:

1831:

1828:

1824:

1818:

1815:

1810:

1803:

1800:

1796:

1790:

1788:

1786:

1784:

1780:

1775:

1771:

1765:

1762:

1757:

1753:

1748:

1743:

1739:

1735:

1731:

1724:

1722:

1718:

1707:

1703:

1699:

1695:

1688:

1686:

1682:

1671:

1667:

1663:

1659:

1653:

1650:

1643:

1639:

1636:

1634:

1631:

1630:

1626:

1624:

1620:

1618:

1608:

1590:

1584:

1580:

1576:

1571:

1568:

1565:

1561:

1555:

1550:

1544:

1541:

1538:

1534:

1529:

1517:

1514:

1511:

1507:

1501:

1497:

1492:

1487:

1481:

1478:

1475:

1471:

1466:

1462:

1457:

1453:

1445:

1444:

1443:

1440:

1421:

1417:

1413:

1405:

1402:

1399:

1395:

1386:

1382:

1374:

1373:

1372:

1350:

1346:

1333:

1329:

1321:

1318:

1315:

1311:

1298:

1292:

1288:

1280:

1279:

1278:

1262:

1259:

1255:

1251:

1248:

1245:

1240:

1237:

1234:

1230:

1206:

1203:

1192:

1188:

1175:

1164:

1161:

1158:

1154:

1141:

1132:

1129:

1126:

1122:

1116:

1112:

1108:

1101:

1100:

1099:

1077:

1073:

1069:

1064:

1060:

1056:

1051:

1047:

1038:

1035:

1032:

1028:

1024:

1019:

1016:

1013:

1009:

1001:

1000:

999:

981:

972:

968:

961:

957:

951:

947:

936:

933:

930:

926:

920:

916:

908:

907:

906:

888:

866:

862:

854:

840:

818:

814:

810:

805:

801:

793:

779:

757:

753:

745:

730:

723:

709:

689:

686:

683:

680:

675:

671:

667:

662:

658:

650:

635:

632:

629:

625:

621:

618:

615:

608:

594:

572:

568:

560:

559:

558:

555:

552:

548:

544:

538:

536:

532:

528:

524:

520:

510:

503:

501:

499:

491:

486:

482:

478:

473:

469:

452:

447:

441:

435:

425:

411:

403:

389:

381:

367:

359:

356:

340:

336:

332:

329:

326:

323:

320:

317:

314:

308:

305:

302:

299:

293:

290:

287:

281:

278:

272:

269:

266:

260:

257:

254:

246:

243:

239:

225:

217:

203:

195:

192:

176:

173:

170:

167:

164:

161:

158:

155:

152:

144:

138:

135:

129:

126:

123:

117:

111:

108:

105:

102:

99:

96:

93:

90:

82:

76:

73:

70:

67:

64:

61:

53:

46:

42:

40:

31:

29:

25:

22:

18:

1975:

1966:

1941:

1937:

1931:

1922:

1916:

1891:

1885:

1879:

1870:

1864:

1853:

1845:

1836:

1830:

1822:

1817:

1808:

1802:

1794:

1773:

1764:

1737:

1733:

1709:. Retrieved

1697:

1673:. Retrieved

1661:

1652:

1621:

1614:

1606:

1441:

1438:

1370:

1221:

1097:

997:

904:

556:

539:

516:

507:

495:

484:

481:Middle graph

480:

476:

426:

404:

382:

360:

357:

247:

244:

240:

218:

196:

193:

54:

51:

35:

26:

16:

15:

1996:Consumption

551:Robert Hall

545:shows that

485:Right graph

1990:Categories

1774:www.ft.com

1711:2022-11-07

1675:2022-11-07

1644:References

527:Modigliani

477:Left graph

424:= damages

1958:153924721

1756:0895-3309

1706:0362-4331

1670:0190-8286

1523:∞

1508:∑

1338:′

1303:′

1260:−

1256:β

1180:′

1146:′

1109:β

1070:−

948:β

942:∞

927:∑

690:δ

687:≥

681:−

633:−

630:β

616:δ

498:insurance

402:= wealth

324:−

318:−

306:∗

291:−

279:∗

270:−

238:= wealth

136:∗

127:−

74:∗

1925:: 39–52.

1908:54528038

1627:See also

21:economic

1776:. 2011.

358:where:

194:where:

1956:

1906:

1754:

1704:

1668:

19:is an

1954:S2CID

1904:S2CID

1837:CGAP

1752:ISSN

1702:ISSN

1666:ISSN

525:and

1946:doi

1896:doi

1742:doi

1992::

1974:.

1952:.

1942:97

1940:.

1902:.

1892:86

1890:.

1782:^

1772:.

1750:.

1738:36

1736:.

1732:.

1720:^

1700:.

1696:.

1684:^

1664:.

1660:.

1978:.

1960:.

1948::

1910:.

1898::

1873:.

1758:.

1744::

1714:.

1678:.

1591:]

1585:t

1581:A

1577:+

1572:i

1569:+

1566:t

1562:y

1556:i

1551:)

1545:r

1542:+

1539:1

1535:1

1530:(

1518:0

1515:=

1512:i

1502:t

1498:E

1493:[

1488:]

1482:r

1479:+

1476:1

1472:r

1467:[

1463:=

1458:t

1454:c

1422:t

1418:c

1414:=

1411:]

1406:1

1403:+

1400:t

1396:c

1392:[

1387:t

1383:E

1356:)

1351:t

1347:c

1343:(

1334:u

1330:=

1327:)

1322:1

1319:+

1316:t

1312:c

1308:(

1299:u

1293:t

1289:E

1263:1

1252:=

1249:R

1246:=

1241:1

1238:+

1235:t

1231:R

1207:1

1204:=

1198:)

1193:t

1189:c

1185:(

1176:u

1170:)

1165:1

1162:+

1159:t

1155:c

1151:(

1142:u

1133:1

1130:+

1127:t

1123:R

1117:t

1113:E

1083:)

1078:t

1074:c

1065:t

1061:y

1057:+

1052:t

1048:A

1044:(

1039:1

1036:+

1033:t

1029:R

1025:=

1020:1

1017:+

1014:t

1010:A

982:]

978:)

973:t

969:c

965:(

962:u

958:[

952:t

937:0

934:=

931:t

921:0

917:E

901:.

889:t

867:t

863:A

841:t

819:t

815:w

811:=

806:t

802:y

780:t

758:t

754:c

731:u

710:t

684:1

676:t

672:R

668:=

663:t

659:r

636:1

626:/

622:1

619:=

595:t

573:t

569:E

453:c

448:=

445:)

442:c

439:(

436:U

412:d

390:W

368:q

344:)

341:q

337:/

333:p

330:+

327:d

321:p

315:W

312:(

309:U

303:q

300:+

297:)

294:p

288:W

285:(

282:U

276:)

273:q

267:1

264:(

261:=

258:U

255:E

226:W

204:q

180:)

177:e

174:t

171:a

168:t

165:s

162:d

159:o

156:o

153:g

149:|

145:W

142:(

139:U

133:)

130:q

124:1

121:(

118:+

115:)

112:e

109:t

106:a

103:t

100:s

97:d

94:a

91:b

87:|

83:W

80:(

77:U

71:q

68:=

65:U

62:E

Text is available under the Creative Commons Attribution-ShareAlike License. Additional terms may apply.