85:

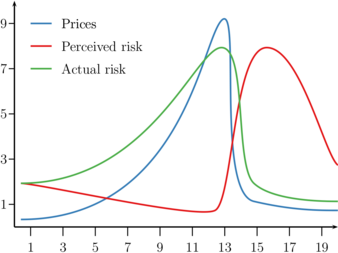

112:. Shown in the figure on the right, as a financial asset enters into a bubble state, followed by a crash, perceived risk reported by typical risk measures, falls as the bubble builds up, sharply increasing after the bubble deflates. By contrast, actual risk increases along with the bubble, falling at the same time the bubble bursts. Perceived risk and actual risk are negatively correlated. The phenomenon is often explained by use of Danielsson's dam metaphor.

20:

65:. Market participants react to these shocks, but have no influence over them. By contrast, endogenous risk is risk stemming from the behaviour of participants within the financial system, such as when positive economic outlooks cause innovation of new financial products, increased leverage, and speculation; these self-reinforcing processes feed on each other to increase risk. Such endogenous factors,

249:

91:

A dam is a good illustration of actual and perceived risk. Before the dam breaks, risk is perceived as low, and we leave the dam as it is. After the dam breaks, risk is perceived as high, and we institute crisis measures. The endogenous or actual risk in the system is the opposite of the perceived

92:

risk: when tensions build up before the dam breaks, actual or endogenous risk in the system is high and growing, amplified by self-reinforcing weaknesses. After the dam has broken, actual or endogenous risk in the system is low.

49:

Risk can be classified into the two categories of exogenous and endogenous. Exogenous risk is risk stemming from factors outside the financial system, such as

286:

96:

As a practical interpretation of endogenous risk when applied to risk measurements, it can be further subdivided into

279:

84:

38:

that is created by the interaction of market participants internal to the financial system. It was proposed by

224:

Danielsson, J.; Shin, H. S.; Zigrand, J. P. (2012). "Endogenous extreme events and the dual role of prices".

305:

70:

310:

272:

50:

142:

121:

109:

180:

162:

256:

154:

74:

62:

54:

19:

43:

39:

35:

158:

299:

105:

78:

210:

66:

166:

31:

58:

248:

141:

Danı́elsson, Jón; Shin, Hyun Song; Zigrand, Jean-Pierre (2004-05-01).

104:

what is reported by common risk measurement techniques, such as

260:

143:"The impact of risk regulation on price dynamics"

280:

8:

207:Global Financial Systems: Stability and Risk

287:

273:

83:

18:

133:

7:

245:

243:

61:, which may have severe effects on

259:. You can help Knowledge (XXG) by

255:This finance-related article is a

122:Supply chain network risk analysis

14:

247:

147:Journal of Banking & Finance

100:the underlying latent risk, and

69:and Shin claim, are behind most

181:"When risk models hallucinate"

81:is a form of endogenous risk.

77:. They further claim that all

1:

159:10.1016/S0378-4266(03)00113-4

327:

242:

89:Danielsson's dam metaphor:

23:Actual and perceived risk

205:Danielsson, Jon (2013).

93:

24:

87:

51:political instability

22:

34:risk, is a type of

110:expected shortfall

94:

25:

268:

267:

213:. pp. 40–60.

55:natural disasters

318:

289:

282:

275:

251:

244:

234:

233:

221:

215:

214:

209:(1st ed.).

202:

196:

195:

193:

192:

177:

171:

170:

153:(5): 1069–1087.

138:

75:financial crises

28:Endogenous risk,

326:

325:

321:

320:

319:

317:

316:

315:

296:

295:

294:

293:

240:

238:

237:

226:Annu. Rev. Econ

223:

222:

218:

204:

203:

199:

190:

188:

179:

178:

174:

140:

139:

135:

130:

118:

102:perceived risk;

17:

12:

11:

5:

324:

322:

314:

313:

308:

306:Financial risk

298:

297:

292:

291:

284:

277:

269:

266:

265:

252:

236:

235:

216:

197:

172:

132:

131:

129:

126:

125:

124:

117:

114:

44:Hyun-Song Shin

40:Jon Danielsson

36:financial risk

30:as opposed to

16:Financial risk

15:

13:

10:

9:

6:

4:

3:

2:

323:

312:

311:Finance stubs

309:

307:

304:

303:

301:

290:

285:

283:

278:

276:

271:

270:

264:

262:

258:

253:

250:

246:

241:

232:(1): 111–129.

231:

227:

220:

217:

212:

208:

201:

198:

186:

182:

176:

173:

168:

164:

160:

156:

152:

148:

144:

137:

134:

127:

123:

120:

119:

115:

113:

111:

107:

106:value at risk

103:

99:

90:

86:

82:

80:

79:systemic risk

76:

72:

68:

64:

60:

56:

52:

47:

45:

41:

37:

33:

29:

21:

261:expanding it

254:

239:

229:

225:

219:

206:

200:

189:. Retrieved

187:. 2024-02-03

184:

175:

150:

146:

136:

101:

98:actual risk;

97:

95:

88:

63:asset prices

48:

27:

26:

73:and severe

71:tail events

300:Categories

191:2024-06-02

128:References

67:Danielsson

167:0378-4266

46:in 2002.

32:exogenous

116:See also

59:pandemic

211:Pearson

57:, or a

165:

257:stub

185:CEPR

163:ISSN

108:and

42:and

155:doi

302::

228:.

183:.

161:.

151:28

149:.

145:.

53:,

288:e

281:t

274:v

263:.

230:4

194:.

169:.

157::

Text is available under the Creative Commons Attribution-ShareAlike License. Additional terms may apply.