503:, the former CEO of the financial firm Lehman Brothers, during hearings on the bankruptcy filing by Lehman Brothers and bailout of AIG before the House Committee on Oversight and Government Reform alleged that a host of factors including a crisis of confidence and naked short selling attacks followed by false rumors contributed to the collapse of both Bear Stearns and Lehman Brothers. Fuld had been obsessed with short sellers and had even demoted those Lehman executives that dealt with them; he claimed that the short sellers and the rumour mongers had brought down Lehman, although he had no evidence of it. Upon the examination of the issue of whether "naked short selling" was in any way a cause of the collapse of Bear Stearns or Lehman, securities experts reached the conclusion that the alleged "naked short sales" occurred after the collapse and therefore played no role in it. House committee Chairman Henry Waxman said the committee received thousands of pages of internal documents from Lehman and these documents portray a company in which there was "no accountability for failure". In July 2008, U.S. Securities and Exchange Commission chairman Christopher Cox said there was no "unbridled naked short selling in financial issues".

464:

price signals in response to negative information or prospects for a company. Short selling helps prevent "irrational exuberance" and bubbles. But when someone fails to borrow and deliver the securities needed to make good on a short position, after failing even to determine that they can be borrowed, that is not contributing to an orderly market – it is undermining it. And in the context of a potential "distort and short" campaign aimed at an otherwise sound financial institution, this kind of manipulative activity can have drastic consequences.

727:, in an effort to limit market volatility of financial stocks. But even with respect to those stocks the SEC soon thereafter announced there would be an exception with regard to market makers. SEC Chairman Cox noted that the emergency order was "not a response to unbridled naked short selling in financial issues", saying that "that has not occurred". Cox said, "rather it is intended as a preventative step to help restore market confidence at a time when it is sorely needed." Analysts warned of the potential for the creation of price bubbles.

547:

on March 31, 2011. On May 28, German financial market regulator BaFin announced that this ban would be permanent. The ban became effective July 27, 2010. The

International Monetary Fund issued a report in August 2010 saying that the measure succeeded only in impeding the markets. It said the ban "did relatively little to support the targeted institutions’ underlying stock prices, while liquidity dropped and volatility rose substantially." The IMF said there was no strong evidence that stock prices fell because of shorting.

858:. There is no dispute that illegal naked shorting happens; what is in dispute is how much it happens, and to what extent is DTCC to blame. Some companies with falling stocks blame DTCC as the keeper of the system where it happens, and say DTCC turns a blind eye to the problem. Referring to trades that remain unsettled, DTCC's chief spokesman Stuart Goldstein said, "We're not saying there is no problem, but to suggest the sky is falling might be a bit overdone." In July 2007, Senator Bennett suggested on the

77:

113:

913:

Evans, Chris Geczy, David Musto and Adam Reed, and found its review to provide evidence consistent with their hypothesis that "market makers strategically fail to deliver shares when borrowing costs are high." A study by Autore, Boulton, and Braga-Alves examined stock returns around delivery failures between 2005 and 2008 and found evidence consistent with a positive link between delivery failures and borrowing costs.

397:

eventually delivered to the buyer. However, if the covers are impossible to find, the trades fail. Fail reports are published regularly by the SEC, and a sudden rise in the number of fails-to-deliver will alert the SEC to the possibility of naked short selling. In some recent cases, it was claimed that the daily activity was larger than all of the available shares, which would normally be unlikely.

176:

36:

241:

438:

business days and 90% within 20. That means that about 1% of shares that change hands daily, or about $ 1 billion per day, are subject to delivery failures, although the SEC has stated that "fails-to-deliver can occur for a number of reasons on both long and short sales", and accordingly that they do not necessarily indicate naked short selling.

712:. Even with the regulation in place, the SEC received hundreds of complaints in 2007 about alleged abuses involving short sales. The SEC estimated that about 1% of shares that changed hands daily, about $ 1 billion, were subject to delivery failures. SEC Commissioners Paul Atkins and Kathleen Casey expressed support for the crackdown.

791:(NYSE). Piper violated securities trading rules from January through May 2005, selling shares without borrowing them, and also failing to "cover short sales in a timely manner", according to the NYSE. At the time of this fine, the NYSE had levied over $ 1.9 million in fines for naked short sales over seven regulatory actions.

671:, an investment website, observes that "when a stock appears on this list, it is like a red flag waving, stating 'something is wrong here!'" However, the SEC clarified that appearance on the threshold list "does not necessarily mean that there has been abusive naked short selling or any impermissible trading in the stock".

1006:

nonproblem, but the SEC doesn't claim to be solving a problem. The

Commission's move is intended to prevent even the possibility that an unscrupulous short seller could drive down the shares of a financial firm with a flood of sell orders that aren't backed by an actual ability to deliver the shares to buyers."

599:

starting at $ 1,000 per day. There would also be fines for brokerages who fail to use the exchange's buying-in market to cover their positions, starting at $ 5,000 per day. The

Singapore exchange had stated that the failure to deliver shares inherent in naked short sales threatened market orderliness.

931:

A study of fails to deliver, published in the

Journal of Financial Economics in 2014, found no evidence that FTDs "caused price distortions or the failure of financial firms during the 2008 financial crisis". Researchers studied 1,492 New York Stock Exchange stocks over a 42-month period from 2005 to

908:

A study of trading in initial public offerings by two SEC staff economists, published in April 2007, found that excessive numbers of fails to deliver were not correlated with naked short selling. The authors of the study said that while the findings in the paper specifically concern IPO trading, "The

759:

of intent to file an enforcement action against the securities unit of Refco for securities trading violations concerning the shorting of Sedona stock. The SEC sought information related to two former Refco brokers who handled the account of a client, Amro

International, which shorted Sedona's stock.

734:

On

November 4, 2008, voters in South Dakota considered a ballot initiative, "The South Dakota Small Investor Protection Act", to end naked short selling in that state. The Securities Industry and Financial Markets Association of Washington and New York said they would take legal action if the measure

730:

The emergency actions rule expired August 12, 2008. However, on

September 17, 2008, the SEC issued new, more extensive rules against naked shorting, making "it crystal clear that the SEC has zero tolerance for abusive naked short selling". Among the new rules is that market makers are no longer given

477:

As with the prevalence of naked shorting, the effects are contested. The SEC has stated that the practice can be beneficial in enhancing liquidity in difficult-to-borrow shares, while others have suggested that it adds efficiency to the securities lending market. Critics of the practice argue that it

302:

In August 2008, the SEC issued a temporary order restricting short-selling in the shares of 19 financial firms deemed systemically important, by reinforcing the penalties for failing to deliver the shares in time. Effective

September 18, amid claims that aggressive short selling had played a role in

244:

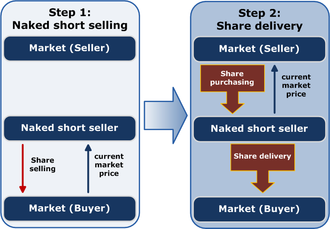

Schematic representation of naked short selling of stock shares in two steps. The short seller sells shares without owning them. They later purchase and deliver the shares for a different market price. If the short seller cannot afford the shares in the second step, or the shares are not available, a

940:

Some journalists have expressed concern about naked short selling, while others contend that naked short selling is not harmful and that its prevalence has been exaggerated by corporate officials seeking to blame external forces for internal problems with their companies. Others have discussed naked

892:

and contributed to the illegal short selling of the company's shares. The court ruled: "In short, all the damages that Pet

Quarters claims to have suffered stem from activities performed or statements made by the defendants in conformity with the program's Commission approved rules. We conclude that

817:

In April 2010 Goldman Sachs paid $ 450,000 to settle the SEC's allegations that it had failed to deliver "approximatedly" (sic) 86 short sells between early

December 2008 and mid-January 2009, and that it had failed to institute adequate controls to prevent the failures. The company neither admitted

463:

The SEC is committed to maintaining orderly securities markets. The abusive practice of naked short selling is far different from ordinary short selling, which is a healthy and necessary part of a free market. Our agency’s rules are highly supportive of short selling, which can help quickly transmit

375:

The trader's profit is the difference between the sale price and the purchase price of the shares. In contrast to "going long" where sale succeeds the purchase, short sale precedes the purchase. Because the seller/borrower is generally required to make a cash deposit equivalent to the sale proceeds,

1009:

In an article in March 2009 Bloomberg News Service said that the Lehman Brothers bankruptcy may have been prevented by curbs on naked shorting. " many as 32.8 million shares in the company were sold and not delivered to buyers on time as of Sept. 11, according to data compiled by the Securities and

893:

the district court did not err in dismissing the complaint on the basis of preemption." Pet Quarters' complaint was almost identical to suits against DTCC brought by Whistler Investments Inc. and Nanopierce Technologies Inc. The suits also challenged DTCC's stock-borrow program, and were dismissed.

798:

fined two options market makers for violations of Regulation SHO. SBA Trading was sanctioned for $ 5 million, and ALA Trading was fined $ 3 million, which included disgorgement of profits. Both firms and their principals were suspended from association with the exchange for five years. The exchange

650:

To reduce the duration for which fails to deliver are permitted to sit open, the regulation requires broker-dealers to close out open fail-to-deliver positions in threshold securities that have persisted for 13 consecutive settlement days. The SEC, in describing Regulation SHO, stated that failures

546:

On May 18, 2010, the German Minister of Finance announced that naked short sales of euro-denominated government bonds, credit default swaps based on those bonds, and shares in Germany's ten leading financial institutions will be prohibited. This ban went into effect that night and was set to expire

806:

In October 2007, the SEC settled charges against New York hedge fund adviser Sandell Asset Management Corp. and three executives of the firm for, among other things, shorting stock without locating shares to borrow. Fines totalling $ 8 million were imposed, and the firm neither admitted nor denied

779:

was fined $ 2 million by the SEC for allowing customers to illegally sell shares short prior to secondary public offerings. Naked short-selling was allegedly used by the Goldman clients. The SEC charged Goldman with failing to ensure those clients had ownership of the shares. SEC Chairman Cox said

707:

gave a speech entitled the "'Naked' Short Selling Anti-Fraud Rule", in which he announced new SEC efforts to combat naked short selling. Under the proposal, the SEC would create an antifraud rule targeting those who knowingly deceive brokers about having located securities before engaging in short

384:

Naked short selling is a case of short selling without first arranging a borrow. If the stock is in short supply, finding shares to borrow can be difficult. The seller may also decide not to borrow the shares, in some cases because lenders are not available, or because the costs of lending are too

371:

under the condition that they will return it on demand. Next, the trader sells the borrowed shares and delivers them to the buyer who becomes their new owner. The buyer is typically unaware that the shares have been sold short: their transaction with the trader proceeds just as if the trader owned

323:

Some commentators have contended that despite regulations, naked shorting is widespread and that the SEC regulations are poorly enforced. Its critics have contended that the practice is susceptible to abuse, can be damaging to targeted companies struggling to raise capital, and has led to numerous

3492:

But the most damning thing the attack on Bear had in common with these earlier manipulations was the employment of a type of counterfeiting scheme called naked short-selling. From the moment the confidential meeting at the Fed ended on March 11th, Bear became the target of this ostensibly illegal

958:

said: "In Altomare's view, the issues that bothered the judge are irrelevant. Long and short of it, this is a naked short hallmark case in the making. Or it is proof that it can take a long time for the SEC to stop a fraud." Universal Express claimed that 6,000 small companies had been put out of

912:

In contrast, a study by Leslie Boni in 2004 found correlation between "strategic delivery failures" and the cost of borrowing shares. The paper, which looked at a "unique dataset of the entire cross-section of U.S. equities", credited the initial recognition of strategic delivery fails to Richard

598:

started to penalize naked short sales with an interim measure in September, 2008. These initial penalties started at $ 100 per day. In November, they announced plans to increase the fines for failing to complete trades. The new penalties would penalize traders who fail to cover their positions,

485:

One complaint about naked shorting from targeted companies is that the practice dilutes a company's shares for as long as unsettled short sales sit open on the books. This has been alleged to create "phantom" or "counterfeit" shares, sometimes going from trade to trade without connection to any

1042:

were flooded with "counterfeit stock" that helped kill both companies. Taibbi said that the two firms got a "push" into extinction from "a flat-out counterfeiting scheme called naked short-selling". During a May 2010 discussion on the inclusion of "counterfeiting" in the charges filed against

916:

An April 2007 study conducted for Canadian market regulators by Market Regulation Services Inc. found that fails to deliver securities were not a significant problem on the Canadian market, that "less than 6% of fails resulting from the sale of a security involved short sales" and that "fails

437:

stated that NYSE had not found evidence of widespread naked short selling. In 2006, an official of the SEC said that "While there may be instances of abusive short selling, 99% of all trades in dollar value settle on time without incident." Of all those that do not, 85% are resolved within 10

1005:

said in an editorial in July 2008 that "the Beltway is shooting the messenger by questioning the price-setting mechanisms for barrels of oil and shares of stock." But it said the emergency order to bar naked short selling "won't do much harm", and said "Critics might say it's a solution to a

396:

It is difficult to measure how often naked short selling occurs. Fails to deliver are not necessarily indicative of naked shorting, and can result from both "long" transactions (stock purchases) and short sales. Naked shorting can be invisible in a liquid market, as long as the short sale is

742:

described as "intense political pressure", made permanent an interim rule that obliges brokerages to promptly buy or borrow securities when executing a short sale. The SEC said that since the fall of 2008, abusive naked short selling had been reduced by 50%, and the number of threshold list

691:

that allowed fails-to-deliver that existed before Reg SHO to be exempt from Reg SHO. SEC Chairman Christopher Cox called naked short selling "a fraud that the commission is bound to prevent and to punish". The SEC also said it was considering removing an exemption from the rule for options

320:, found no evidence that failure to deliver stock "caused price distortions or the failure of financial firms during the 2008 financial crisis" and that "greater FTDs lead to higher liquidity and pricing efficiency, and their impact is similar to our estimate of delivered short sales".

678:

referred to "the serious problem of abusive naked short sales, which can be used as a tool to drive down a company's stock price" and that the SEC is "concerned about the persistent failures to deliver in the market for some securities that may be due to loopholes in Regulation SHO".

632:

securities, and by limiting the time in which a broker can permit failures to deliver. In addressing the first, it stated that a broker or dealer may not accept a short sale order without having first borrowed or identified the stock being sold. The rule had the following exemptions:

887:

A suit against DTCC by Pet Quarters Inc. was dismissed by a federal court in Arkansas, and upheld by the Eighth Circuit Court of Appeals in March 2009. Pet Quarters alleged the Depository Trust & Clearing Corp.'s stock-borrow program resulted in the creation of nonexistent or

968:

said in an editorial: "Rather than fixing any of the real problems with the agency and its mission, Cox and his fellow commissioners waved a newspaper and swatted the imaginary fly of naked short-selling. It made a big noise, but there's no dead bug." Holman Jenkins of

771:

and naked short-selling involving PIPEs in the unregistered stock of 35 companies. PIPEs are "private investments in public equities", used by companies to raise cash. The naked shorting took place in Canada, where it was legal at the time. Gryphon denied the charges.

900:, noted that "until a court declares naked short selling as market manipulation as a matter of law and clarifies the issuer's and investor's burdens in proving the occurrence of naked short selling, the practice will continue without a check from the judiciary."

993:

expressed approval of the SEC's decision to address a "frenetic shadow world of postponed promises, borrowed time, obscured paperwork and nail-biting price-watching, usually compressed into a few high-tension days swirling around the decline of a company". The

425:

The SEC has stated that naked shorting is sometimes falsely asserted as a reason for a share price decline, when, often, "the price decrease is a result of the company's poor financial situation rather than the reasons provided by the insiders or promoters."

2760:

746:

In January 2010, Mary Schapiro, chairperson of the SEC, testified before the U.S. Financial Crisis Inquiry Commission that fails to deliver in equity securities had declined 63.4 percent, while persistent and large fails had declined 80.5 percent.

294:

banned what it called "abusive naked short selling" in the United States, as well as some other jurisdictions, as a method of driving down share prices. Failing to deliver shares is legal under certain circumstances, and naked short selling is not

654:

Regulation SHO also created the "Threshold Security List", which reported any stock where more than 0.5% of a company's total outstanding shares failed delivery for five consecutive days. A number of companies have appeared on the list, including

490:

contended that failure to deliver securities "can be done for manipulative purposes to create the impression that the stock is a tight borrow", although he said that this should be seen as a failure to deliver "longs" rather than "shorts".

497:, former undersecretary of commerce for economic affairs, and a consultant to a law firm suing over naked shorting, has claimed that naked short selling has cost investors $ 100 billion and driven 1,000 companies into the ground.

486:

physical shares, and artificially depressing the share price. However, the SEC has disclaimed the existence of counterfeit shares and stated that naked short selling would not increase a company's outstanding shares. Short seller

1047:

speculated that the charge might refer to naked short selling because "naked short-selling is the same as counterfeiting, in that it is selling something that doesn't exist." A 2014 study of fails to deliver, published in the

920:

A Government Accountability Office study, released in June 2009, found that recent SEC rules had apparently reduced abusive short selling, but that the SEC needed to give clearer guidance to the brokerage industry.

869:

Critics also contend DTCC has been too secretive with information about where naked shorting is taking place. Ten suits concerning naked short-selling filed against the DTCC were withdrawn or dismissed by May 2005.

821:

In May 2012, lawyers acting for Goldman accidentally released an unredacted document revealing compromising internal discussions regarding naked short selling. "Fuck the compliance area – procedures, schmecedures",

453:

amidst speculation that naked short selling had played a contributory role. Cox said that "the rule would be designed to ensure transparency in short-selling in general, beyond the practice of naked short-selling."

290:" was enacted, requiring that broker-dealers have grounds to believe that shares will be available for a given stock transaction, and requiring that delivery take place within a limited time period. In 2008, the

2770:

884:, named as defendants ten Wall Street prime brokers. They claimed a scheme to manipulate the companies' stock by allowing naked short selling. A motion to dismiss the Overstock suit was denied in July 2007.

842:

for its approach to naked short selling. DTCC has been sued with regard to its alleged participation in naked short selling, and the issue of DTCC's possible involvement has been taken up by Senator

445:

said that the SEC "has zero tolerance for abusive naked short-selling" while implementing new regulations to prohibit the practice, culminating in the September 2008 action following the failures of

814:(FINRA) for failing to properly document the ownership of short sales as they occurred, and for failing to annotate an affirmative declaration that shares would be available by the settlement date.

538:

In August 2011, France, Italy, Spain, Belgium and South Korea temporally banned all short selling in their financial stocks, while Germany pushed for a eurozone-wide ban on naked short selling.

405:

The reasons for naked shorting, and the extent of it, had been disputed for several years before the SEC's 2008 action to prohibit the practice. What is generally recognized is that naked

578:

stated, "We decided (to move up the short-selling ban) as we thought it could be dangerous for the Tokyo stock market if we do not take action immediately." Nakagawa added that Japan's

272:

from someone else or ensuring that it can be borrowed. When the seller does not obtain the asset and deliver it to the buyer within the required time frame, the result is known as a "

3036:

948:, which had claimed naked shorting of its stock, were sanctioned by a federal court judge for violation of securities laws. Referring to a court ruling against CEO Richard Altomare,

559:

affair, reintroduced short selling under regulations similar to those developed in the United States. In conjunction with this rule change, SEBI outlawed all naked short selling.

372:

rather than borrowed the shares. Some time later, the trader closes their short position by purchasing the same number of shares in the market and returning them to the lender.

430:

731:

an exception. As a result, options market makers will be treated in the same way as all other market participants, and effectively will be banned from naked short selling.

708:

sales, and who fail to deliver the securities by the delivery date. Cox said the proposal would address concerns about short-selling abuses, particularly in the market for

1475:

986:

123:

1772:

1543:"The SEC finally steps in; As other regulators hustle to address the economy, the Securities and Exchange Commission needs to better enforce laws already on its books"

3165:

1812:

646:

Broker-dealer effecting a sale on behalf of a customer that is deemed to own the security pursuant to Rule 200 through no fault of the customer or the broker-dealer.

2112:

583:

567:

Japan's naked shorting ban started on November 4, 2008, and was originally scheduled to run until July 2009, but was extended through October of that year. Japan's

276:" (FTD). The transaction generally remains open until the asset is acquired and delivered by the seller, or the seller's broker settles the trade on their behalf.

1643:

928:, appointed by Congress to investigate the 2008 financial crisis, makes no reference to naked shorting, or short-selling of financial stocks, in its conclusions.

422:

editorial in July 2008 said that naked short selling "enables speculators to drive down a company's stock by offering an overwhelming number of shares for sale".

2963:

975:

said the order was "an exercise in symbolic confidence-building" and that naked shorting involved technical concerns except for subscribers to a "devil theory".

1322:

586:

and Tokyo Stock Exchange to investigate past violations of Japanese regulations on stock short-selling. The ban was subsequently extended through October 2010.

385:

high. When shares are not borrowed within the clearing time period and the short-seller does not tender shares to the buyer, the trade is considered to have "

3532:

3472:

2786:

932:

2008, and found that "greater FTDs lead to higher liquidity and pricing efficiency, and their impact is similar to our estimate of delivered short sales."

532:

202:

186:

862:

floor that the allegations involving DTCC and naked short selling are "serious enough" that there should be a hearing on them with DTCC officials by the

2827:

In some cases, may be perfectly legal, but usually it's not. (...) efforts to take more serious actions against short selling continued yesterday (...)

390:

2008:

998:

called the practice of naked short selling "hard to defend", and stated that it was past time the SEC became active in addressing market manipulation.

835:

2333:

811:

511:

Several international exchanges have either partially or fully restricted the practice of naked short selling of shares. They include Australia's

291:

1189:

1406:

516:

2802:

3057:

3044:

909:

results presented in this paper also inform a public debate surrounding the role of short selling and fails to deliver in price formation."

49:

2937:

2725:

925:

651:

to deliver shares that persist for an extended period of time "may result in large delivery obligations where stock settlement occurs".

2993:

1690:

1052:, found no evidence that fails contributed to "price distortions or the failure of financial firms during the 2008 financial crisis".

1670:

555:

In March 2007, the Securities and Exchange Board of India (SEBI), which disallowed short sales altogether in 2001 as a result of the

190:

3210:

3095:

Edwards, Amy K. & Weiss Hanley, Kathleen (April 18, 2007). "Short Selling and Failures to Deliver in Initial Public Offerings".

2351:

227:

157:

63:

2920:

2453:

2742:

873:

A suit by Electronic Trading Group, naming major Wall Street brokerages, was filed in April 2006 and dismissed in December 2007.

2590:"More woes for Refco, execs: Newspapers say creditors eye over $ 1B insiders made from stock, while SEC probes 'naked shorting'"

1479:

3194:

1644:"'Naked' short selling is center of looming legal battle; Companies on the defensive seize upon an aggressive form of shorting"

716:

613:

2657:

2540:

2157:

512:

316:

2893:

1780:

3378:

1542:

3572:

1816:

1659:

3404:

2868:

2120:

1708:

3352:

3010:

1302:

1021:

reported that naked shorting is "almost gone". He said that delivery failures, where they occur, are quickly corrected.

629:

2973:

2063:

674:

In July 2006, the SEC proposed to amend Regulation SHO, to further reduce failures to deliver securities. SEC Chairman

616:

stipulates a settlement period up to two business days before a stock needs to be delivered, generally referred to as "

571:

568:

299:

illegal. In the United States, naked short selling is covered by various SEC regulations which prohibit the practice.

1450:

139:

3085:"Court Rules Against Company Claiming Illegal Short Selling" by Carol Remond, Dow Jones News Service, March 11, 2009

743:

securities (equity securities with too many "fails to deliver") declined from 582 in July 2008 to 63 in March 2009.

2713:"SEC Charges New York Hedge Fund Adviser With Short Sale Violations in Connection With Hibernia-Capital One Merger"

2192:"Proposed SEC 17 CFR PART 242 (Release No. 34-54154; File No. S7-12-06) RIN 3235-AJ57 Amendments to Regulation SHO"

3480:

2629:

2471:

194:

3582:

3321:

2783:

579:

2816:

2389:

826:

quoted Peter Melz, the former president of Merrill Lynch Professional Clearing Corp. as saying in the document.

2404:

1617:

1092:

877:

863:

697:

660:

135:

55:

3266:

2026:

1794:

1254:

324:

bankruptcies. However, other commentators have said that the naked shorting issue is a "devil theory", not a

3505:

2423:

1235:

971:

848:

795:

788:

434:

286:

Critics have advocated for stricter regulations against naked short selling. In 2005 in the United States, "

3422:

2840:

2678:

866:, and that banking committee chairman Christopher Dodd has expressed a willingness to hold such a hearing.

696:. Removal of the grandfather provision and naked shorting restrictions generally have been endorsed by the

3577:

3567:

2765:

1923:

1277:

3114:

Evans, Richard; Geczy, Christopher; Musto, David; Reed, Adam (7 December 2005). "Failure is an Option".

2309:

2081:

1375:

843:

709:

2276:

1838:

1752:"Public Statement by SEC Chairman: Naked Short Selling Is One Problem a Slumping Market Shouldn't Have"

1093:"Future-Priced Convertible Securities & The Outlook For "Death-Spiral" Securities-Fraud Litigation"

3334:

2224:

2044:

1906:

1414:

964:

524:

307:, the SEC extended and expanded the rules to remove exceptions and to cover all companies, including

265:

3444:

389:". Nevertheless, the trade will continue to sit open or the buyer may be credited the shares by the

2370:

575:

479:

3134:

1147:"Division of Market Regulation: Responses to Frequently Asked Questions Concerning Regulation SHO"

2563:

1885:

1071:

982:

688:

628:

The SEC enacted Regulation SHO in January 2005 to target abusive naked short selling by reducing

595:

528:

520:

386:

360:

356:

283:

opportunities or to anticipate a price fall, but exposes the seller to the risk of a price rise.

273:

269:

2589:

2292:

2259:

2611:

3552:

3522:

3115:

3096:

2941:

1733:

1367:

1363:

1146:

945:

494:

429:

Before 2008, regulators had generally downplayed the extent of naked shorting in the US. At a

418:

3119:

3100:

3305:

3146:

1871:

1337:

1061:

352:

1856:

2924:

2790:

2661:

2575:

2263:

1674:

1667:

1663:

1388:

1039:

768:

715:

In mid-July 2008, the SEC announced emergency actions to limit the naked short selling of

704:

675:

664:

470:

450:

442:

342:

304:

261:

246:

3280:

2209:

3223:

2098:

1977:

1944:

1751:

1596:

90:

Please help update this article to reflect recent events or newly available information.

3493:

practice – and the companies widely rumored to be behind the assault were in that room.

2917:

2191:

1563:

959:

business by naked shorting, which the company said "the SEC has ignored and condoned."

950:

287:

3183:

Gordon, Marcy (2009-06-03). "Guidance on short-selling needed: GAO". Associated Press.

637:

Broker or dealer accepting a short sale order from another registered broker or dealer

3561:

2821:

1282:

1026:

977:

889:

881:

800:

784:

776:

410:

3242:

2654:

2490:

1230:

1122:

917:

involving short sales are projected to account for only 0.07% of total short sales.

3440:

2712:

2548:

2514:

2440:

1959:

1889:

1583:

1170:

1066:

1035:

1018:

955:

693:

656:

641:

556:

500:

487:

446:

409:

tends to happen when shares are difficult to borrow. Studies have shown that naked

368:

308:

2161:

1341:

2897:

2515:"SEC Takes Steps to Curtail Abusive Short Sales and Increase Market Transparency"

2454:"SIFMA to sue if short-sale vote wins; Naked short selling on South Dakota ballot

3468:

2176:

1928:

1524:

1031:

859:

724:

668:

348:

3537:

2938:"Nevada Court Dismisses Nanopierce Lawsuit Against DTCC On Naked Short Selling"

2140:

1656:

1172:

SEC Takes Steps to Curtail Abusive Short Sales and Increase Market Transparency

482:, that it can damage companies and even that it threatens the broader markets.

433:(NASAA) conference on naked short selling in November 2005, an official of the

2872:

2441:"SEC Issues New Rules to Protect Investors Against Naked Short Selling Abuses"

2210:"Opening Statements at the US Securities and Exchange Commission Open Meeting"

1584:"SEC Issues New Rules to Protect Investors Against Naked Short Selling Abuses"

1503:

1044:

764:

720:

17:

3527:

2695:

989:

who found that trading in the 19 financial stocks became less efficient. The

393:

until the short-seller either closes out the position or borrows the shares.

854:

280:

1359:

314:

A 2014 study by researchers at the University at Buffalo, published in the

2009:"Merkel's 'Distortive' Short-Selling Ban Failed to Achieve Aims, IMF Says"

3150:

406:

3166:"No evidence of excessive failed trades on Canadian marketplaces: study"

240:

3135:"Failure is an Option: Impediments to Short Selling and Options Prices"

1586:, Press release, Securities and Exchange Commission, September 17, 2008

780:"That is an important case and it reflects our interest in this area."

2803:"Naked shorting: The curious incident of the shares that didn't exist"

1431:

Jenkins, Holman (July 23, 2008). "Washington (heart) Bank Investors".

3133:

Evans, Richard; Geczy, Christopher; Musto, David; Reed, Adam (2009).

2968:

1597:"Naked Short Selling Is One Problem a Slumping Market Shouldn't Have"

1566:. Depository Trust and Clearing Corporation (DTCC). January 24, 2006

363:

shares of that stock from their owner (the lender), typically via a

3224:"Short sellers not to blame for 2008 financial crisis, study finds"

2918:"Senator Bennett Discusses Naked Short Selling on the Senate Floor"

1994:

1657:"Committee to Hold Hearings on Collapse of Lehman Brothers and AIG"

2839:

James W. Christian, Robert Shapiro & John-Paul Whalen (2006).

981:

said the SEC had "picked the wrong target", mentioning a study by

756:

239:

2940:. Depository Trust Clearing Corporation. May 2005. Archived from

2696:"NYSE American | The New Choice for Institutional Investing"

1190:"Testimony of Mary Schapiro, Financial Crisis Inquiry Commission"

3423:"Naked Short Sales Hint Fraud in Bringing Down Lehman (Update1)"

2927:, website of Senator Bennett, July 20, 2007, accessed 2009-02-21

810:

In October 2008 Lehman Brothers Inc. was fined $ 250,000 by the

617:

364:

2869:"Naked Short Sellers Hurt Companies With Stock They Don't Have"

2334:"SEC Short Sale Rule Could Create a Bubble in Financial Stocks"

2243:"Daily Stock Market Overview, Data Updates, Reports & News"

1195:. Financial Crisis Inquiry Commission. Jan 14, 2010. p. 22

2242:

2082:"Japan Extends Curbs on Short-Selling Until Oct. 31 (Correct)"

1891:

Short selling restrictions and disclosure obligations in Spain

1691:"Dick Fuld's Vendetta Against Short-Sellers—and Goldman Sachs"

169:

106:

70:

29:

1907:"WRAPUP 7-Europe curbs short-selling as credit markets swoon"

122:

deal primarily with the United States and do not represent a

3542:

3528:

Naked Short Selling FAQ: Depository Trust and Clearing Corp.

3506:"Max Keiser Radio - The Truth About Markets - 15 May 2010"

3074:

Pet Quarters, Inc. v. Depository Trust and Clearing Corp.

2994:"US Judge Dismisses Naked Short Selling Suit Vs. Brokers"

1229:

Emshwiller, John R. & Scannell, Kara (July 5, 2007).

941:

short selling as a confusing or bizarre form of trading.

799:

said the firms used an exemption to Reg. SHO for options

2726:"We See Dead People: $ 250K Fine for Lehman Short-Sales"

2443:, Securities and Exchange Commission, September 17, 2008

2064:"TCI Cuts $ 1 Billion of Japanese Short Stock Positions"

1400:

1398:

2225:"S.E.C. Ends Decades-Old Price Limits on Short Selling"

1978:"Germany to permanently ban some short selling: Bafin'"

1943:

Kirschbaum, Erik & Torchia, Andrew (May 18, 2010).

1837:

Nakamichi, Takashi; Tomisawa, Ayai (October 28, 2008).

1321:

Fotak, Veljko; Raman, Vikas; Yadav, Pradeep K. (2014).

131:

3553:

New York University Journal of Law and Business (2009)

3058:"Overstock Shares Rise on Court Ruling in Broker Suit"

2310:"SEC to Limit Short Sales of Fannie, Freddie, Brokers"

2158:"17 CFR 242.203 - Borrowing and delivery requirements"

3523:

Short Selling FAQ: Securities and Exchange Commission

2894:"DTCC Chief Spokesperson Denies Existence of Lawsuit"

2113:"SGX to build up penalties for 'naked' short-selling"

1323:"Fails-to-deliver, short selling, and market quality"

279:

Short selling is used to take advantage of perceived

2679:"Piper Fined by the NYSE Over Short-Sale Violations"

1995:

Naked Short-Selling Ban Coming into Force in Germany

1316:

1314:

1312:

1184:

1182:

1125:. Securities and Exchange Commission. April 11, 2005

431:

North American Securities Administrators Association

1960:"Euro drops to new four-year low against US dollar"

1175:, Securities and Exchange Commission, July 27, 2009

763:In December 2006, the SEC sued Gryphon Partners, a

2293:"SEC proposes tougher 'naked' short selling rules"

2190:United States Securities and Exchange Commission.

987:International Institute for Management Development

803:to "impermissibly engage in naked short selling".

328:market issue and a waste of regulatory resources.

2896:. financialwire.net. May 11, 2004. Archived from

2841:"Naked Short Selling: How Exposed Are Investors?"

2390:"SEC's ban on short-selling Fannie, Freddie ends"

2099:"Japan to extend naked short selling ban to Oct."

1745:

1743:

876:Two separate lawsuits, filed in 2006 and 2007 by

3353:"'Naked Shorting': Far More Dangerous Than Sexy"

3281:"S.E.C. Requests Receiver for Universal Express"

3076:--- F.3d ----, 2009 WL 579270 C.A.8 (Ark.),2009.

1426:

1424:

3538:NASDAQ's Regulation SHO threshold security list

2743:"Goldman Sachs settles short-sales allegations"

2424:"Financial stocks suffer after protection ends"

962:Reviewing the SEC's July 2008 emergency order,

898:New York University Journal of Law and Business

584:Securities and Exchange Surveillance Commission

461:

359:" in a stock of a company. Such a trader first

3267:"Catch It This Weekend: 'Naked Short Selling'"

2784:"DTCC response to Wall Street Journal Article"

1905:de Clercq, Geert; Day, Paul (11 August 2011),

1558:

1556:

1224:

1222:

1220:

1218:

1216:

1214:

1212:

1210:

846:and discussed by the NASAA and in articles in

3533:NYSE's Regulation SHO threshold security list

2630:"Goldman Sachs fined $ 2m over short-selling"

2151:

2149:

120:The examples and perspective in this article

8:

2472:"Naked short-selling ban nixed in S. Dakota"

2277:"SEC Proposes Teeth for Short-Selling Rules"

2136:

2134:

2132:

2130:

1872:"More regulators move to curb short-selling"

1303:"New SEC Rules Target 'Naked' Short-Selling"

896:One scholar, in an article published in the

735:passed. The voters defeated the initiative.

2761:"Taibbi: Goldman and 'Naked Short Selling'"

2655:"Monthly Disciplinary Actions – July 2007 "

2156:Legal Information Institute - Cornell Law.

1895:(restrictions adopted on 22 September 2008)

1684:

1682:

1498:

1496:

1117:

1115:

1113:

1111:

1109:

413:also increases with the cost of borrowing.

64:Learn how and when to remove these messages

1857:"More countries put bans on short selling"

1839:"Japan Cracks Down on Naked Short Selling"

1255:"SEC puts 'naked' short sellers on notice"

1165:

1163:

687:In June 2007, the SEC voted to remove the

2175:University of Cincinnati College of Law.

1870:Saltmarsh, Matthew (September 21, 2008).

1444:

1442:

1024:In an article published in October 2009,

836:Depository Trust and Clearing Corporation

228:Learn how and when to remove this message

158:Learn how and when to remove this message

2612:"SEC Complaint against Gryphon Partners"

2177:"Securities Lawyer's Deskbook, Rule 200"

1773:"ASX ban on short selling is indefinite"

1695:Deal Journal (Wall Street Journal Blogs)

1141:

1139:

1102:. Berkeley Electronic Press. p. 15.

189:: vague phrasing that often accompanies

2405:"Short sellers pare bets on financials"

1470:

1468:

1466:

1464:

1353:

1351:

1248:

1246:

1083:

812:Financial Industry Regulatory Authority

2571:

2561:

2328:

2326:

1813:"Dutch invented short selling in 1609"

1525:"SEC.gov | Fails-to-Deliver Data"

1384:

1373:

1296:

1294:

1292:

738:In July 2009, the SEC, under what the

3306:"A Sad Tale of Fictional SEC Filings"

2715:, SEC Press Release, October 10, 2007

2352:"Short Sellers in Stock Cop's Sights"

1476:"The Naked Truth on Illegal Shorting"

7:

3543:SEC stock delivery failures charted.

3037:"Naked Shorting Case Gains Traction"

2491:"SEC to Limit 'Naked' Short-Selling"

1754:. Securities and Exchange Commission

1709:"Fuld blames 'crisis of confidence'"

1358:Stokes, Alexis Brown (Spring 2009).

1301:Gordon, Marcy (September 18, 2008).

1149:. Securities and Exchange Commission

531:. Also Spain's securities regulator

376:it offers the lender some security.

3322:"Universal Express statement" (pdf)

2541:"US rules on abusive short selling"

2007:Buergin, Rainer (August 17, 2010).

1564:"Regulators Say REG SHO is Working"

1253:Ellis, David (September 17, 2008).

926:Financial Crisis Inquiry Commission

760:No charges had been filed by 2007.

3241:Holman, Jenkins (April 12, 2006).

2519:Securities and Exchange Commission

2371:"Did It Help to Curb Short Sales?"

2308:Westbrook, Jesse (July 15, 2008).

2208:Cox, Christopher (July 12, 2006).

2143:, Security and Exchange Commission

2111:Goh Eng Yeow (November 16, 2008).

1945:"Germany bans naked short-selling"

1795:"Sebi bans overseas short-selling"

1449:Thomas G. Donlan (July 28, 2008).

1405:Kadlec, Daniel (9 November 2005).

838:(DTCC) has been criticized by the

25:

3211:What Caused 2008 Financial Crisis

3164:Langton, James (April 15, 2007).

3011:"Naked Short Victim Strikes Back"

2470:Aaron Siegel (November 5, 2008).

2388:Gordon, Marcy (August 13, 2008).

2369:Norris, Floyd (August 12, 2008).

2350:Antilla, Susan (August 1, 2008).

2141:"Key Points About Regulation SHO"

1924:"Markets up on short-selling ban"

1888:Madrid (September–October 2008),

1779:. October 3, 2008. Archived from

1123:"Key Points About Regulation SHO"

458:Claimed effects of naked shorting

380:Naked shorts in the United States

45:This article has multiple issues.

2867:Drummond, Bob (August 4, 2006).

2422:Krantz, Matt (August 13, 2008).

2403:Petruno, Tom (August 13, 2008).

2062:Tomoko Yamazaki (May 18, 2009).

1707:Smith, Aaron (October 6, 2008).

1642:Barr, Alistair (June 14, 2006).

717:government sponsored enterprises

174:

111:

75:

34:

3324:, June 28, 2007 (archived 2009)

3279:Norris, Floyd (June 23, 2007).

2871:. Bloomberg.com. Archived from

2815:Whitehouse, Kaja (2008-11-05).

2628:Webster, Ben (March 15, 2007).

2223:Norris, Floyd (June 14, 2007).

2045:"Sebi allows all to sell short"

1750:Cox, Christopher (2008-07-18).

1618:"Naked Truth Dressed to Baffle"

1360:"In Pursuit of the Naked Short"

1278:"Searching for the naked truth"

614:Securities Exchange Act of 1934

608:Securities Exchange Act of 1934

303:the failure of financial giant

53:or discuss these issues on the

2489:Lynch, Sarah N. (2009-07-27).

1859:. Reuters. September 19, 2008.

1689:Moore, Heidi N. (2008-10-07),

1330:Journal of Financial Economics

1050:Journal of Financial Economics

1017:chief financial correspondent

751:Regulatory enforcement actions

513:Australian Securities Exchange

317:Journal of Financial Economics

1:

3549:In Pursuit of the Naked Short

3508:– via Internet Archive.

3473:"Wall Street's Naked Swindle"

3243:"Do Nudists Run Wall Street?"

2793:, Press release, July 6, 2007

2592:. CNN/Money. October 20, 2005

1342:10.1016/j.jfineco.2014.07.012

517:Securities and Exchange Board

3479:. p. 53. Archived from

3153:– via Oxford Academic.

3035:Moyer, Liz (July 18, 2007).

2759:Taibbi, Matt (15 May 2012).

2338:Wall Street & Technology

1815:. 2008-09-22. Archived from

1091:Knepper, Zachary T. (2004).

1043:Icelandic bankers, the host

944:In June 2007, executives of

703:In March 2008, SEC Chairman

3445:"Goodbye to Naked Shorting"

3139:Review of Financial Studies

1451:"Swatting an Imaginary Fly"

818:nor denied any wrongdoing.

787:was fined $ 150,000 by the

347:Short selling is a form of

134:, discuss the issue on the

3599:

1997:, July 26, 2010. CNBC.com.

1478:. fool.com. Archived from

1231:"Blame the 'Stock Vault'?"

755:In 2005, the SEC notified

582:would be teaming with the

340:

266:tradable asset of any kind

201:Such statements should be

3269:, NPR, September 12, 2006

2962:Moyer, Liz (2006-04-13).

1958:BBC News (May 18, 2010).

1668:testimony of Richard Fuld

580:Financial Services Agency

84:This article needs to be

2027:"What is short selling?"

1100:Bepress Legal Repository

878:NovaStar Financial, Inc.

864:Senate Banking Committee

698:U.S. Chamber of Commerce

661:Martha Stewart Omnimedia

401:Extent of naked shorting

3409:The Wall Street Journal

3405:"Who's Partying Naked?"

3265:Alex Blumberg (editor),

2495:The Wall Street Journal

2101:July 26, 2010. Reuters.

2031:The Hindu Business Line

1799:The Wall Street Journal

1504:"Fails-to-Deliver Data"

1433:The Wall Street Journal

1407:"Watch Out, They Bite!"

1236:The Wall Street Journal

972:The Wall Street Journal

849:The Wall Street Journal

796:American Stock Exchange

794:Also in July 2007, the

789:New York Stock Exchange

469:Speech by SEC Chairman

435:New York Stock Exchange

2998:Dow Jones News Service

2817:"Drop in naked shorts"

2766:Rolling Stone Magazine

1734:"HITC Business - News"

1383:Cite journal requires

1010:Exchange Commission".

824:Rolling Stone Magazine

683:Developments 2007–2010

475:

441:In 2008, SEC chairman

250:

27:Short-selling practice

3379:"SEC muscle, finally"

2123:on February 12, 2010.

2049:The Financial Express

1777:Sydney Morning Herald

689:grandfather provision

507:Regulations by market

260:, is the practice of

243:

3573:Financial regulation

3170:Investment Executive

2617:. December 12, 2006.

2033:. December 23, 2007.

527:, and Switzerland's

525:Tokyo Stock Exchange

519:, the Netherlands's

203:clarified or removed

140:create a new article

132:improve this article

3547:Stokes, Alexis B.,

3483:on October 18, 2009

3357:The Washington Post

3247:Wall Street Journal

3047:on August 21, 2007.

2944:on December 7, 2006

2900:on November 5, 2007

2741:Marcy Gordon (AP),

2732:, October 22, 2008.

2730:Wall Street Journal

2392:. Associated Press.

2281:Wall Street Journal

1843:Wall Street Journal

1801:. October 28, 2008.

1783:on October 5, 2008.

1305:. Associated Press.

1003:Wall Street Journal

840:Wall Street Journal

830:Litigation and DTCC

740:Wall Street Journal

480:market manipulation

270:borrowing the asset

254:Naked short selling

3449:The New York Times

3341:. August 14, 2008.

3310:The New York Times

3285:The New York Times

3151:10.1093/rfs/hhm083

3017:. February 2, 2007

2923:2008-02-27 at the

2875:on January 6, 2008

2848:Houston Law Review

2789:2009-03-02 at the

2660:2013-03-25 at the

2574:has generic name (

2460:, November 2, 2008

2229:The New York Times

1673:2009-08-26 at the

1666:, October 3, 2008

1662:2008-10-14 at the

1417:on April 24, 2008.

1072:Securities lending

630:failure to deliver

596:Singapore Exchange

529:SWX Swiss Exchange

521:Euronext Amsterdam

478:is often used for

274:failure to deliver

251:

3429:. March 19, 2009.

3383:Los Angeles Times

2409:Los Angeles Times

2295:, March 4, 2008,

2275:Judith A. Burns,

2117:The Straits Times

2051:. March 22, 2007.

1624:. August 29, 2005

1547:Los Angeles Times

1455:Barron's Magazine

1362:. Rochester, NY.

1286:, August 17, 2008

1013:In May 2009, the

996:Los Angeles Times

946:Universal Express

880:shareholders and

495:Robert J. Shapiro

419:Los Angeles Times

387:failed to deliver

357:negative position

337:"Normal" shorting

238:

237:

230:

220:

219:

168:

167:

160:

142:, as appropriate.

105:

104:

68:

16:(Redirected from

3590:

3583:Dutch inventions

3510:

3509:

3502:

3496:

3495:

3489:

3488:

3471:(October 2009).

3465:

3459:

3458:

3456:

3455:

3437:

3431:

3430:

3419:

3413:

3412:

3411:. July 18, 2008.

3401:

3395:

3394:

3392:

3390:

3375:

3369:

3368:

3366:

3364:

3349:

3343:

3342:

3335:"Phantom menace"

3331:

3325:

3319:

3313:

3302:

3296:

3295:

3293:

3291:

3276:

3270:

3263:

3257:

3256:

3254:

3253:

3238:

3232:

3231:

3220:

3214:

3208:

3202:

3201:

3199:

3191:

3185:

3184:

3180:

3174:

3173:

3161:

3155:

3154:

3145:(5): 1955–1980.

3130:

3124:

3123:

3111:

3105:

3104:

3092:

3086:

3083:

3077:

3071:

3065:

3055:

3049:

3048:

3043:. Archived from

3032:

3026:

3025:

3023:

3022:

3007:

3001:

2991:

2985:

2984:

2982:

2981:

2972:. Archived from

2959:

2953:

2952:

2950:

2949:

2934:

2928:

2915:

2909:

2908:

2906:

2905:

2890:

2884:

2883:

2881:

2880:

2864:

2858:

2857:

2855:

2854:

2845:

2836:

2830:

2829:

2812:

2806:

2800:

2794:

2781:

2775:

2774:

2773:on 26 June 2014.

2769:. Archived from

2756:

2750:

2739:

2733:

2724:Heidi N. Moore,

2722:

2716:

2710:

2704:

2703:

2692:

2686:

2675:

2669:

2652:

2646:

2645:

2643:

2641:

2625:

2619:

2618:

2616:

2608:

2602:

2601:

2599:

2597:

2586:

2580:

2579:

2573:

2569:

2567:

2559:

2557:

2556:

2551:on July 31, 2009

2547:. Archived from

2536:

2530:

2529:

2527:

2526:

2511:

2505:

2504:

2502:

2501:

2486:

2480:

2479:

2467:

2461:

2450:

2444:

2438:

2432:

2431:

2419:

2413:

2412:

2400:

2394:

2393:

2385:

2379:

2378:

2366:

2360:

2359:

2347:

2341:

2330:

2321:

2320:

2318:

2317:

2305:

2299:

2290:

2284:

2273:

2267:

2257:

2251:

2250:

2239:

2233:

2232:

2220:

2214:

2213:

2205:

2199:

2198:

2196:

2187:

2181:

2180:

2172:

2166:

2165:

2160:. Archived from

2153:

2144:

2138:

2125:

2124:

2119:. Archived from

2108:

2102:

2096:

2090:

2089:

2088:. July 24, 2009.

2078:

2072:

2071:

2059:

2053:

2052:

2041:

2035:

2034:

2023:

2017:

2016:

2004:

1998:

1992:

1986:

1985:

1974:

1968:

1967:

1955:

1949:

1948:

1940:

1934:

1933:

1932:, 12 August 2012

1920:

1914:

1913:

1902:

1896:

1894:

1882:

1876:

1875:

1867:

1861:

1860:

1853:

1847:

1846:

1834:

1828:

1827:

1825:

1824:

1809:

1803:

1802:

1791:

1785:

1784:

1769:

1763:

1762:

1760:

1759:

1747:

1738:

1737:

1730:

1724:

1723:

1721:

1719:

1704:

1698:

1697:

1686:

1677:

1654:

1648:

1647:

1639:

1633:

1632:

1630:

1629:

1614:

1608:

1607:

1605:

1603:

1593:

1587:

1581:

1575:

1574:

1572:

1571:

1560:

1551:

1550:

1549:. July 17, 2008.

1539:

1533:

1532:

1521:

1515:

1514:

1512:

1511:

1500:

1491:

1490:

1488:

1487:

1472:

1459:

1458:

1446:

1437:

1436:

1428:

1419:

1418:

1413:. Archived from

1402:

1393:

1392:

1386:

1381:

1379:

1371:

1355:

1346:

1345:

1327:

1318:

1307:

1306:

1298:

1287:

1275:

1269:

1268:

1266:

1265:

1250:

1241:

1240:

1226:

1205:

1204:

1202:

1200:

1194:

1186:

1177:

1176:

1167:

1158:

1157:

1155:

1154:

1143:

1134:

1133:

1131:

1130:

1119:

1104:

1103:

1097:

1088:

1062:Locate (finance)

719:(GSEs), such as

710:small-cap stocks

576:Shōichi Nakagawa

473:

233:

226:

215:

212:

206:

178:

177:

170:

163:

156:

152:

149:

143:

115:

114:

107:

100:

97:

91:

79:

78:

71:

60:

38:

37:

30:

21:

3598:

3597:

3593:

3592:

3591:

3589:

3588:

3587:

3558:

3557:

3519:

3514:

3513:

3504:

3503:

3499:

3486:

3484:

3467:

3466:

3462:

3453:

3451:

3439:

3438:

3434:

3421:

3420:

3416:

3403:

3402:

3398:

3388:

3386:

3385:. July 17, 2008

3377:

3376:

3372:

3362:

3360:

3359:. July 16, 2008

3351:

3350:

3346:

3333:

3332:

3328:

3320:

3316:

3312:, June 22, 2007

3303:

3299:

3289:

3287:

3278:

3277:

3273:

3264:

3260:

3251:

3249:

3240:

3239:

3235:

3228:www.buffalo.edu

3222:

3221:

3217:

3209:

3205:

3197:

3193:

3192:

3188:

3182:

3181:

3177:

3163:

3162:

3158:

3132:

3131:

3127:

3113:

3112:

3108:

3094:

3093:

3089:

3084:

3080:

3072:

3068:

3064:, July 18, 2007

3056:

3052:

3034:

3033:

3029:

3020:

3018:

3009:

3008:

3004:

3000:, Dec. 20, 2007

2992:

2988:

2979:

2977:

2961:

2960:

2956:

2947:

2945:

2936:

2935:

2931:

2925:Wayback Machine

2916:

2912:

2903:

2901:

2892:

2891:

2887:

2878:

2876:

2866:

2865:

2861:

2852:

2850:

2843:

2838:

2837:

2833:

2814:

2813:

2809:

2801:

2797:

2791:Wayback Machine

2782:

2778:

2758:

2757:

2753:

2749:, 5 April 2010.

2740:

2736:

2723:

2719:

2711:

2707:

2694:

2693:

2689:

2685:, July 11, 2007

2676:

2672:

2668:, July 11, 2007

2666:NYSE Regulation

2662:Wayback Machine

2653:

2649:

2639:

2637:

2627:

2626:

2622:

2614:

2610:

2609:

2605:

2595:

2593:

2588:

2587:

2583:

2570:

2560:

2554:

2552:

2538:

2537:

2533:

2524:

2522:

2513:

2512:

2508:

2499:

2497:

2488:

2487:

2483:

2469:

2468:

2464:

2451:

2447:

2439:

2435:

2421:

2420:

2416:

2402:

2401:

2397:

2387:

2386:

2382:

2368:

2367:

2363:

2349:

2348:

2344:

2340:, July 20, 2008

2332:Ivy Schmerken,

2331:

2324:

2315:

2313:

2312:. Bloomberg.com

2307:

2306:

2302:

2291:

2287:

2283:, March 5, 2008

2274:

2270:

2264:Christopher Cox

2258:

2254:

2241:

2240:

2236:

2222:

2221:

2217:

2207:

2206:

2202:

2194:

2189:

2188:

2184:

2174:

2173:

2169:

2155:

2154:

2147:

2139:

2128:

2110:

2109:

2105:

2097:

2093:

2080:

2079:

2075:

2061:

2060:

2056:

2043:

2042:

2038:

2025:

2024:

2020:

2006:

2005:

2001:

1993:

1989:

1984:. May 28, 2010.

1976:

1975:

1971:

1957:

1956:

1952:

1942:

1941:

1937:

1922:

1921:

1917:

1904:

1903:

1899:

1884:

1883:

1879:

1869:

1868:

1864:

1855:

1854:

1850:

1836:

1835:

1831:

1822:

1820:

1811:

1810:

1806:

1793:

1792:

1788:

1771:

1770:

1766:

1757:

1755:

1749:

1748:

1741:

1732:

1731:

1727:

1717:

1715:

1706:

1705:

1701:

1688:

1687:

1680:

1675:Wayback Machine

1664:Wayback Machine

1655:

1651:

1641:

1640:

1636:

1627:

1625:

1616:

1615:

1611:

1601:

1599:

1595:

1594:

1590:

1582:

1578:

1569:

1567:

1562:

1561:

1554:

1541:

1540:

1536:

1523:

1522:

1518:

1509:

1507:

1502:

1501:

1494:

1485:

1483:

1474:

1473:

1462:

1448:

1447:

1440:

1430:

1429:

1422:

1404:

1403:

1396:

1382:

1372:

1357:

1356:

1349:

1325:

1320:

1319:

1310:

1300:

1299:

1290:

1276:

1272:

1263:

1261:

1252:

1251:

1244:

1228:

1227:

1208:

1198:

1196:

1192:

1188:

1187:

1180:

1169:

1168:

1161:

1152:

1150:

1145:

1144:

1137:

1128:

1126:

1121:

1120:

1107:

1095:

1090:

1089:

1085:

1080:

1058:

1040:Lehman Brothers

1034:contended that

991:Washington Post

938:

906:

832:

775:In March 2007,

769:insider trading

753:

705:Christopher Cox

685:

676:Christopher Cox

665:Delta Air Lines

626:

610:

605:

592:

565:

553:

544:

509:

474:

471:Christopher Cox

468:

460:

451:Lehman Brothers

443:Christopher Cox

403:

382:

345:

343:Short (finance)

339:

334:

305:Lehman Brothers

247:fail to deliver

234:

223:

222:

221:

216:

210:

207:

200:

179:

175:

164:

153:

147:

144:

129:

116:

112:

101:

95:

92:

89:

80:

76:

39:

35:

28:

23:

22:

15:

12:

11:

5:

3596:

3594:

3586:

3585:

3580:

3575:

3570:

3560:

3559:

3556:

3555:

3545:

3540:

3535:

3530:

3525:

3518:

3517:External links

3515:

3512:

3511:

3497:

3460:

3443:(2009-05-01).

3432:

3414:

3396:

3370:

3344:

3326:

3314:

3304:Floyd Norris,

3297:

3271:

3258:

3233:

3215:

3203:

3195:"FCIC Reports"

3186:

3175:

3156:

3125:

3106:

3087:

3078:

3066:

3062:Bloomberg News

3050:

3027:

3002:

2986:

2976:on May 9, 2006

2964:"Naked Shorts"

2954:

2929:

2910:

2885:

2859:

2831:

2807:

2795:

2776:

2751:

2734:

2717:

2705:

2687:

2683:Bloomberg News

2677:Edgar Ortega,

2670:

2647:

2620:

2603:

2581:

2531:

2506:

2481:

2476:InvestmentNews

2462:

2458:InvestmentNews

2452:Sara Hansard,

2445:

2433:

2414:

2395:

2380:

2375:New York Times

2361:

2342:

2322:

2300:

2285:

2268:

2252:

2247:www.nasdaq.com

2234:

2215:

2200:

2182:

2167:

2164:on 2019-01-25.

2145:

2126:

2103:

2091:

2073:

2054:

2036:

2018:

1999:

1987:

1969:

1950:

1935:

1915:

1897:

1877:

1862:

1848:

1829:

1804:

1786:

1764:

1739:

1725:

1699:

1678:

1649:

1646:. MarketWatch.

1634:

1609:

1588:

1576:

1552:

1534:

1516:

1492:

1460:

1438:

1420:

1394:

1385:|journal=

1347:

1336:(3): 493–516.

1308:

1288:

1270:

1242:

1206:

1178:

1159:

1135:

1105:

1082:

1081:

1079:

1076:

1075:

1074:

1069:

1064:

1057:

1054:

1015:New York Times

951:New York Times

937:

936:Media coverage

934:

905:

902:

844:Robert Bennett

831:

828:

783:In July 2007,

752:

749:

684:

681:

648:

647:

644:

638:

625:

624:Regulation SHO

622:

609:

606:

604:

601:

591:

588:

564:

561:

552:

549:

543:

540:

508:

505:

466:

459:

456:

402:

399:

381:

378:

351:that allows a

341:Main article:

338:

335:

333:

330:

288:Regulation SHO

268:without first

258:naked shorting

236:

235:

218:

217:

182:

180:

173:

166:

165:

148:September 2010

126:of the subject

124:worldwide view

119:

117:

110:

103:

102:

83:

81:

74:

69:

43:

42:

40:

33:

26:

24:

18:Regulation SHO

14:

13:

10:

9:

6:

4:

3:

2:

3595:

3584:

3581:

3579:

3578:Finance fraud

3576:

3574:

3571:

3569:

3568:Short selling

3566:

3565:

3563:

3554:

3550:

3546:

3544:

3541:

3539:

3536:

3534:

3531:

3529:

3526:

3524:

3521:

3520:

3516:

3507:

3501:

3498:

3494:

3482:

3478:

3477:Rolling Stone

3474:

3470:

3464:

3461:

3450:

3446:

3442:

3441:Norris, Floyd

3436:

3433:

3428:

3424:

3418:

3415:

3410:

3406:

3400:

3397:

3384:

3380:

3374:

3371:

3358:

3354:

3348:

3345:

3340:

3339:The Economist

3336:

3330:

3327:

3323:

3318:

3315:

3311:

3307:

3301:

3298:

3286:

3282:

3275:

3272:

3268:

3262:

3259:

3248:

3244:

3237:

3234:

3229:

3225:

3219:

3216:

3212:

3207:

3204:

3196:

3190:

3187:

3179:

3176:

3171:

3167:

3160:

3157:

3152:

3148:

3144:

3140:

3136:

3129:

3126:

3121:

3117:

3110:

3107:

3102:

3098:

3091:

3088:

3082:

3079:

3075:

3070:

3067:

3063:

3059:

3054:

3051:

3046:

3042:

3038:

3031:

3028:

3016:

3012:

3006:

3003:

2999:

2995:

2990:

2987:

2975:

2971:

2970:

2965:

2958:

2955:

2943:

2939:

2933:

2930:

2926:

2922:

2919:

2914:

2911:

2899:

2895:

2889:

2886:

2874:

2870:

2863:

2860:

2849:

2842:

2835:

2832:

2828:

2824:

2823:

2822:New York Post

2818:

2811:

2808:

2804:

2799:

2796:

2792:

2788:

2785:

2780:

2777:

2772:

2768:

2767:

2762:

2755:

2752:

2748:

2744:

2738:

2735:

2731:

2727:

2721:

2718:

2714:

2709:

2706:

2701:

2697:

2691:

2688:

2684:

2680:

2674:

2671:

2667:

2663:

2659:

2656:

2651:

2648:

2635:

2631:

2624:

2621:

2613:

2607:

2604:

2591:

2585:

2582:

2577:

2565:

2550:

2546:

2542:

2535:

2532:

2520:

2516:

2510:

2507:

2496:

2492:

2485:

2482:

2477:

2473:

2466:

2463:

2459:

2455:

2449:

2446:

2442:

2437:

2434:

2429:

2425:

2418:

2415:

2410:

2406:

2399:

2396:

2391:

2384:

2381:

2376:

2372:

2365:

2362:

2357:

2353:

2346:

2343:

2339:

2335:

2329:

2327:

2323:

2311:

2304:

2301:

2298:

2294:

2289:

2286:

2282:

2278:

2272:

2269:

2265:

2261:

2256:

2253:

2248:

2244:

2238:

2235:

2230:

2226:

2219:

2216:

2211:

2204:

2201:

2193:

2186:

2183:

2178:

2171:

2168:

2163:

2159:

2152:

2150:

2146:

2142:

2137:

2135:

2133:

2131:

2127:

2122:

2118:

2114:

2107:

2104:

2100:

2095:

2092:

2087:

2083:

2077:

2074:

2069:

2065:

2058:

2055:

2050:

2046:

2040:

2037:

2032:

2028:

2022:

2019:

2014:

2010:

2003:

2000:

1996:

1991:

1988:

1983:

1979:

1973:

1970:

1965:

1961:

1954:

1951:

1946:

1939:

1936:

1931:

1930:

1925:

1919:

1916:

1912:

1908:

1901:

1898:

1893:

1892:

1887:

1881:

1878:

1873:

1866:

1863:

1858:

1852:

1849:

1844:

1840:

1833:

1830:

1819:on 2010-12-02

1818:

1814:

1808:

1805:

1800:

1796:

1790:

1787:

1782:

1778:

1774:

1768:

1765:

1753:

1746:

1744:

1740:

1735:

1729:

1726:

1714:

1710:

1703:

1700:

1696:

1692:

1685:

1683:

1679:

1676:

1672:

1669:

1665:

1661:

1658:

1653:

1650:

1645:

1638:

1635:

1623:

1622:thestreet.com

1619:

1613:

1610:

1598:

1592:

1589:

1585:

1580:

1577:

1565:

1559:

1557:

1553:

1548:

1544:

1538:

1535:

1530:

1526:

1520:

1517:

1505:

1499:

1497:

1493:

1482:on 2008-03-07

1481:

1477:

1471:

1469:

1467:

1465:

1461:

1456:

1452:

1445:

1443:

1439:

1434:

1427:

1425:

1421:

1416:

1412:

1408:

1401:

1399:

1395:

1390:

1377:

1369:

1365:

1361:

1354:

1352:

1348:

1343:

1339:

1335:

1331:

1324:

1317:

1315:

1313:

1309:

1304:

1297:

1295:

1293:

1289:

1285:

1284:

1283:The Economist

1279:

1274:

1271:

1260:

1256:

1249:

1247:

1243:

1238:

1237:

1232:

1225:

1223:

1221:

1219:

1217:

1215:

1213:

1211:

1207:

1191:

1185:

1183:

1179:

1174:

1173:

1166:

1164:

1160:

1148:

1142:

1140:

1136:

1124:

1118:

1116:

1114:

1112:

1110:

1106:

1101:

1094:

1087:

1084:

1077:

1073:

1070:

1068:

1065:

1063:

1060:

1059:

1055:

1053:

1051:

1046:

1041:

1037:

1033:

1029:

1028:

1027:Rolling Stone

1022:

1020:

1016:

1011:

1007:

1004:

999:

997:

992:

988:

985:of the Swiss

984:

980:

979:

978:The Economist

974:

973:

967:

966:

960:

957:

953:

952:

947:

942:

935:

933:

929:

927:

922:

918:

914:

910:

903:

901:

899:

894:

891:

890:phantom stock

885:

883:

882:Overstock.com

879:

874:

871:

867:

865:

861:

857:

856:

851:

850:

845:

841:

837:

829:

827:

825:

819: