148:

253:

87:

2121:

189:

To properly understand slippage, let's use the following example: Say, you (as a trader) wanted to purchase 20,000 shares of SPY right now. The problem here is that the current ASK price of $ 151.08 only contains 3900 shares being offered for sale, but you want to purchase 20,000 shares. If you

238:

of the above execution is $ 151.11585. The difference between the current ASK price ($ 151.08) and the average purchase price ($ 151.11585) represents the slippage. In this case, the cost of slippage would be calculated as follows: 20,000 X $ 151.08 - 20,000 X $ 151.11585 = $ -717.00

72:

Knight and

Satchell mention a flow trader needs to consider the effect of executing a large order on the market and to adjust the bid-ask spread accordingly. They calculate the liquidity cost as the difference between the execution price and the initial execution price.

190:

need to purchase those shares now, then you must use a market order and you will incur slippage by doing so. Using a market order to purchase your 20,000 shares would yield the following executions (assuming no hidden orders in the market depth):

317:

value of the position increases. The danger occurs when the trader attempts to exit their position. If the trader manages to create a squeeze large enough then this phenomenon can be profitable. This can also be considered a type of

173:

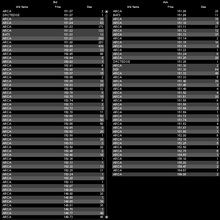

The top left of the image represents the current BID price ($ 151.07) and the top right of the image represents the current ASK price ($ 151.08). At the $ 151.07 bid price point, there are 300 shares available (200 by the

158:

The left hand side of the image contains the market depth for the current BID prices and the right hand side of the image contains the market depth for the current ASK prices. Each side of the image contains three columns:

34:

is the difference between where the computer signaled the entry and exit for a trade and where actual clients, with actual money, entered and exited the market using the computer's signals.

448:

64:(1997) defines slippage as the difference between the average execution price and the initial midpoint of the bid and the offer for a given quantity to be executed.

230:

Buy 500 @ $ 151.25 (only 500 shares out of the 2000 being offered at this price point are executed, because this will represent our entire 20,000 share order)

1664:

1239:

441:

48:

is often used to reduce slippage, and algorithms can be backtested on past data to see the effects of slippage, but it is impossible to eliminate.

2004:

1694:

434:

368:

345:

679:

1826:

274:

108:

1562:

300:

134:

155:

The associated image depicts the Level II (Market Depth) quotes of the SPY ETF (Exchange-Traded Fund) at a given instant in time.

2064:

1232:

704:

313:

Reverse slippage, as described by Taleb, occurs when the purchase of a large position is done at increasing prices, so that the

1999:

1644:

278:

112:

698:

235:

1181:

1121:

917:

823:

2039:

1577:

1431:

1225:

907:

875:

779:

733:

716:

669:

1658:

263:

97:

182:). At the $ 151.08 ask price point, there are 3900 shares available (2800 by the ARCA Market Maker and 1100 by the

1836:

692:

686:

403:

282:

267:

116:

101:

1940:

1751:

20:

2151:

2059:

2054:

1081:

756:

384:

1709:

1654:

2009:

1679:

1669:

1537:

1378:

1310:

1035:

896:

791:

674:

169:

Size: the number of shares at this price level (represented in hundreds). So, 2 actually means 200 shares.

1958:

1806:

1791:

1756:

1699:

923:

2146:

2019:

1870:

1786:

1363:

1061:

870:

360:

61:

1684:

1973:

1930:

1920:

1910:

1631:

1572:

1507:

1461:

1456:

1330:

1290:

1257:

1196:

1116:

881:

865:

828:

710:

653:

621:

337:

186:

Market Maker). This is typically represented in quote form as: $ 151.07 X 300 by $ 151.08 X 3900).

1689:

1978:

1766:

1512:

1126:

1071:

995:

855:

785:

614:

587:

183:

147:

45:

975:

2029:

2014:

1983:

1968:

1801:

1592:

1557:

1320:

1285:

1248:

1166:

1101:

1086:

1005:

944:

902:

646:

556:

546:

2034:

2024:

1963:

1950:

1925:

1811:

1597:

1393:

1030:

1015:

767:

364:

341:

1915:

1905:

1895:

1854:

1849:

1831:

1761:

1527:

1522:

1494:

1446:

1325:

1265:

1131:

1051:

847:

728:

604:

523:

479:

457:

27:

2125:

2095:

2090:

2044:

1880:

1875:

1821:

1731:

1639:

1612:

1552:

1547:

1517:

1466:

1451:

1368:

1348:

1206:

1201:

1136:

1111:

1046:

1020:

1000:

959:

954:

949:

934:

929:

817:

751:

743:

631:

518:

2100:

2085:

1885:

1796:

1746:

1723:

1704:

1532:

1474:

1441:

1436:

1416:

1340:

1161:

1156:

1056:

1041:

802:

797:

762:

561:

528:

474:

466:

314:

2140:

2080:

2049:

1890:

1816:

1776:

1771:

1607:

1479:

1426:

1421:

1403:

1300:

1280:

1025:

1010:

985:

939:

891:

594:

551:

538:

489:

35:

417:

1900:

1674:

1602:

1582:

1542:

1411:

1383:

1373:

1315:

1186:

1106:

1076:

1066:

886:

860:

609:

599:

582:

513:

508:

484:

319:

1781:

1649:

1620:

1616:

1567:

1358:

1353:

1191:

1171:

1151:

1146:

1091:

980:

912:

252:

179:

86:

2105:

1741:

1736:

1502:

1388:

1176:

1096:

773:

636:

1295:

812:

807:

722:

641:

175:

39:

16:

Difference between estimated transaction costs and the amount actually paid

2120:

1865:

1587:

1484:

1305:

990:

626:

834:

1217:

577:

426:

500:

146:

404:"Measuring Slippage: Make it a Top Priority! – Automated Trading"

19:

This article is about the financial concept. For other uses, see

1221:

430:

246:

80:

334:

Dynamic

Hedging: Managing Vanilla and Exotic Options

2073:

1992:

1949:

1845:

1722:

1630:

1493:

1402:

1339:

1273:

1264:

968:

843:

742:

662:

570:

537:

498:

464:

357:Forecasting Volatility in the Financial Markets

1233:

442:

8:

42:, and frictional costs may also contribute.

281:. Unsourced material may be challenged and

115:. Unsourced material may be challenged and

1270:

1240:

1226:

1218:

449:

435:

427:

355:John L. Knight, Stephen Satchell (2003).

301:Learn how and when to remove this message

135:Learn how and when to remove this message

30:as well as other financial instruments,

2065:Power reverse dual-currency note (PRDC)

2005:Constant proportion portfolio insurance

395:

163:MM Name: the Market Maker name column

7:

2000:Collateralized debt obligation (CDO)

279:adding citations to reliable sources

113:adding citations to reliable sources

14:

2119:

705:Electronic communication network

251:

85:

166:Price: the "market depth" price

151:Slippage Example on the SPY ETF

1827:Year-on-year inflation-indexed

332:Taleb, Nassim Nicolas (1997).

1:

1837:Zero-coupon inflation-indexed

699:Multilateral trading facility

68:Using initial execution price

1122:Returns-based style analysis

918:Post-modern portfolio theory

824:Security characteristic line

178:Market Maker and 100 by the

2040:Foreign exchange derivative

1432:Callable bull/bear contract

876:Efficient-market hypothesis

780:Capital asset pricing model

717:Straight-through processing

2168:

693:Alternative Trading System

18:

2114:

1941:Stock market index future

1255:

2060:Mortgage-backed security

2055:Interest rate derivative

2030:Equity-linked note (ELN)

2015:Credit-linked note (CLN)

757:Arbitrage pricing theory

385:Implementation shortfall

2010:Contract for difference

1311:Risk-free interest rate

1036:Initial public offering

897:Modern portfolio theory

792:Dividend discount model

675:List of stock exchanges

57:Using initial mid price

1792:Forward Rate Agreement

924:Random walk hypothesis

236:average purchase price

152:

2020:Credit default option

1364:Employee stock option

1062:Market capitalization

871:Dollar cost averaging

418:"Slippage Definition"

361:Butterworth-Heinemann

338:John Wiley & Sons

150:

62:Nassim Nicholas Taleb

1974:Inflation derivative

1959:Commodity derivative

1931:Single-stock futures

1921:Normal backwardation

1911:Interest rate future

1752:Conditional variance

1258:Derivative (finance)

882:Fundamental analysis

866:Contrarian investing

829:Security market line

734:Liquidity aggregator

711:Direct market access

622:Quantitative analyst

275:improve this section

109:improve this section

2126:Business portal

1979:Property derivative

1127:Reverse stock split

1072:Market manipulation

996:Dual-listed company

856:Algorithmic trading

786:Capital market line

588:Inter-dealer broker

218:Buy 1000 @ $ 151.15

212:Buy 3700 @ $ 151.13

209:Buy 1200 @ $ 151.12

206:Buy 3700 @ $ 151.11

200:Buy 3800 @ $ 151.09

197:Buy 1100 @ $ 151.08

194:Buy 2800 @ $ 151.08

46:Algorithmic trading

1984:Weather derivative

1969:Freight derivative

1951:Exotic derivatives

1871:Commodities future

1558:Intermarket spread

1321:Synthetic position

1249:Derivatives market

1167:Stock market index

1006:Efficient frontier

945:Technical analysis

903:Momentum investing

725:(private exchange)

615:Proprietary trader

557:Shares outstanding

547:Authorised capital

227:Buy 600 @ $ 151.24

224:Buy 100 @ $ 151.22

221:Buy 400 @ $ 151.18

215:Buy 200 @ $ 151.14

203:Buy 900 @ $ 151.10

153:

2134:

2133:

2035:Equity derivative

2025:Credit derivative

1993:Other derivatives

1964:Energy derivative

1926:Perpetual futures

1807:Overnight indexed

1757:Constant maturity

1718:

1717:

1665:Finite difference

1598:Protective option

1215:

1214:

1016:Flight-to-quality

768:Buffett indicator

458:Financial markets

370:978-0-7506-5515-6

347:978-0-471-15280-4

311:

310:

303:

145:

144:

137:

28:futures contracts

2159:

2124:

2123:

1896:Forwards pricing

1670:Garman–Kohlhagen

1271:

1242:

1235:

1228:

1219:

1132:Share repurchase

844:Trading theories

729:Crossing network

687:Over-the-counter

524:Restricted stock

480:Secondary market

451:

444:

437:

428:

422:

421:

414:

408:

407:

406:. 30 April 2014.

400:

374:

351:

306:

299:

295:

292:

286:

255:

247:

243:Reverse slippage

140:

133:

129:

126:

120:

89:

81:

2167:

2166:

2162:

2161:

2160:

2158:

2157:

2156:

2152:Futures markets

2137:

2136:

2135:

2130:

2118:

2110:

2096:Great Recession

2091:Government debt

2069:

2045:Fund derivative

1988:

1945:

1906:Futures pricing

1881:Dividend future

1876:Currency future

1859:

1841:

1714:

1690:Put–call parity

1626:

1613:Vertical spread

1548:Diagonal spread

1518:Calendar spread

1489:

1398:

1335:

1260:

1251:

1246:

1216:

1211:

1202:Voting interest

1112:Public offering

1047:Mandatory offer

1021:Government bond

1001:DuPont analysis

964:

960:Value investing

955:Value averaging

950:Trend following

935:Style investing

930:Sector rotation

845:

839:

818:Net asset value

744:Stock valuation

738:

658:

566:

533:

519:Preferred stock

494:

460:

455:

425:

416:

415:

411:

402:

401:

397:

393:

381:

371:

354:

348:

331:

328:

326:Further reading

307:

296:

290:

287:

272:

256:

245:

141:

130:

124:

121:

106:

90:

79:

70:

59:

54:

26:With regard to

24:

17:

12:

11:

5:

2165:

2163:

2155:

2154:

2149:

2139:

2138:

2132:

2131:

2129:

2128:

2115:

2112:

2111:

2109:

2108:

2103:

2101:Municipal debt

2098:

2093:

2088:

2086:Corporate debt

2083:

2077:

2075:

2071:

2070:

2068:

2067:

2062:

2057:

2052:

2047:

2042:

2037:

2032:

2027:

2022:

2017:

2012:

2007:

2002:

1996:

1994:

1990:

1989:

1987:

1986:

1981:

1976:

1971:

1966:

1961:

1955:

1953:

1947:

1946:

1944:

1943:

1938:

1933:

1928:

1923:

1918:

1913:

1908:

1903:

1898:

1893:

1888:

1886:Forward market

1883:

1878:

1873:

1868:

1862:

1860:

1858:

1857:

1852:

1846:

1843:

1842:

1840:

1839:

1834:

1829:

1824:

1819:

1814:

1809:

1804:

1799:

1794:

1789:

1784:

1779:

1774:

1769:

1767:Credit default

1764:

1759:

1754:

1749:

1744:

1739:

1734:

1728:

1726:

1720:

1719:

1716:

1715:

1713:

1712:

1707:

1702:

1697:

1692:

1687:

1682:

1677:

1672:

1667:

1662:

1652:

1647:

1642:

1636:

1634:

1628:

1627:

1625:

1624:

1610:

1605:

1600:

1595:

1590:

1585:

1580:

1575:

1570:

1565:

1563:Iron butterfly

1560:

1555:

1550:

1545:

1540:

1535:

1533:Covered option

1530:

1525:

1520:

1515:

1510:

1505:

1499:

1497:

1491:

1490:

1488:

1487:

1482:

1477:

1472:

1471:Mountain range

1469:

1464:

1459:

1454:

1449:

1444:

1439:

1434:

1429:

1424:

1419:

1414:

1408:

1406:

1400:

1399:

1397:

1396:

1391:

1386:

1381:

1376:

1371:

1366:

1361:

1356:

1351:

1345:

1343:

1337:

1336:

1334:

1333:

1328:

1323:

1318:

1313:

1308:

1303:

1298:

1293:

1288:

1283:

1277:

1275:

1268:

1262:

1261:

1256:

1253:

1252:

1247:

1245:

1244:

1237:

1230:

1222:

1213:

1212:

1210:

1209:

1204:

1199:

1194:

1189:

1184:

1179:

1174:

1169:

1164:

1162:Stock exchange

1159:

1157:Stock dilution

1154:

1149:

1144:

1139:

1134:

1129:

1124:

1119:

1114:

1109:

1104:

1099:

1094:

1089:

1084:

1082:Mean reversion

1079:

1074:

1069:

1064:

1059:

1057:Market anomaly

1054:

1049:

1044:

1039:

1033:

1028:

1023:

1018:

1013:

1008:

1003:

998:

993:

988:

983:

978:

976:Bid–ask spread

972:

970:

966:

965:

963:

962:

957:

952:

947:

942:

937:

932:

927:

921:

915:

910:

905:

900:

894:

889:

884:

879:

873:

868:

863:

858:

852:

850:

841:

840:

838:

837:

832:

826:

821:

815:

810:

805:

803:Earnings yield

800:

798:Dividend yield

795:

789:

783:

777:

771:

765:

760:

754:

748:

746:

740:

739:

737:

736:

731:

726:

720:

714:

708:

702:

696:

690:

689:(off-exchange)

684:

683:

682:

677:

666:

664:

663:Trading venues

660:

659:

657:

656:

651:

650:

649:

639:

634:

629:

624:

619:

618:

617:

612:

602:

597:

592:

591:

590:

585:

574:

572:

568:

567:

565:

564:

562:Treasury stock

559:

554:

549:

543:

541:

535:

534:

532:

531:

529:Tracking stock

526:

521:

516:

511:

505:

503:

496:

495:

493:

492:

487:

482:

477:

475:Primary market

471:

469:

462:

461:

456:

454:

453:

446:

439:

431:

424:

423:

409:

394:

392:

389:

388:

387:

380:

377:

376:

375:

369:

352:

346:

327:

324:

315:mark to market

309:

308:

259:

257:

250:

244:

241:

232:

231:

228:

225:

222:

219:

216:

213:

210:

207:

204:

201:

198:

195:

171:

170:

167:

164:

143:

142:

93:

91:

84:

78:

75:

69:

66:

58:

55:

53:

50:

15:

13:

10:

9:

6:

4:

3:

2:

2164:

2153:

2150:

2148:

2145:

2144:

2142:

2127:

2122:

2117:

2116:

2113:

2107:

2104:

2102:

2099:

2097:

2094:

2092:

2089:

2087:

2084:

2082:

2081:Consumer debt

2079:

2078:

2076:

2074:Market issues

2072:

2066:

2063:

2061:

2058:

2056:

2053:

2051:

2050:Fund of funds

2048:

2046:

2043:

2041:

2038:

2036:

2033:

2031:

2028:

2026:

2023:

2021:

2018:

2016:

2013:

2011:

2008:

2006:

2003:

2001:

1998:

1997:

1995:

1991:

1985:

1982:

1980:

1977:

1975:

1972:

1970:

1967:

1965:

1962:

1960:

1957:

1956:

1954:

1952:

1948:

1942:

1939:

1937:

1934:

1932:

1929:

1927:

1924:

1922:

1919:

1917:

1914:

1912:

1909:

1907:

1904:

1902:

1899:

1897:

1894:

1892:

1891:Forward price

1889:

1887:

1884:

1882:

1879:

1877:

1874:

1872:

1869:

1867:

1864:

1863:

1861:

1856:

1853:

1851:

1848:

1847:

1844:

1838:

1835:

1833:

1830:

1828:

1825:

1823:

1820:

1818:

1815:

1813:

1810:

1808:

1805:

1803:

1802:Interest rate

1800:

1798:

1795:

1793:

1790:

1788:

1785:

1783:

1780:

1778:

1775:

1773:

1770:

1768:

1765:

1763:

1760:

1758:

1755:

1753:

1750:

1748:

1745:

1743:

1740:

1738:

1735:

1733:

1730:

1729:

1727:

1725:

1721:

1711:

1708:

1706:

1703:

1701:

1698:

1696:

1695:MC Simulation

1693:

1691:

1688:

1686:

1683:

1681:

1678:

1676:

1673:

1671:

1668:

1666:

1663:

1660:

1656:

1655:Black–Scholes

1653:

1651:

1648:

1646:

1643:

1641:

1638:

1637:

1635:

1633:

1629:

1622:

1618:

1614:

1611:

1609:

1608:Risk reversal

1606:

1604:

1601:

1599:

1596:

1594:

1591:

1589:

1586:

1584:

1581:

1579:

1576:

1574:

1571:

1569:

1566:

1564:

1561:

1559:

1556:

1554:

1551:

1549:

1546:

1544:

1541:

1539:

1538:Credit spread

1536:

1534:

1531:

1529:

1526:

1524:

1521:

1519:

1516:

1514:

1511:

1509:

1506:

1504:

1501:

1500:

1498:

1496:

1492:

1486:

1483:

1481:

1478:

1476:

1473:

1470:

1468:

1465:

1463:

1462:Interest rate

1460:

1458:

1457:Forward start

1455:

1453:

1450:

1448:

1445:

1443:

1440:

1438:

1435:

1433:

1430:

1428:

1425:

1423:

1420:

1418:

1415:

1413:

1410:

1409:

1407:

1405:

1401:

1395:

1392:

1390:

1387:

1385:

1384:Option styles

1382:

1380:

1377:

1375:

1372:

1370:

1367:

1365:

1362:

1360:

1357:

1355:

1352:

1350:

1347:

1346:

1344:

1342:

1338:

1332:

1329:

1327:

1324:

1322:

1319:

1317:

1314:

1312:

1309:

1307:

1304:

1302:

1301:Open interest

1299:

1297:

1294:

1292:

1289:

1287:

1284:

1282:

1281:Delta neutral

1279:

1278:

1276:

1272:

1269:

1267:

1263:

1259:

1254:

1250:

1243:

1238:

1236:

1231:

1229:

1224:

1223:

1220:

1208:

1205:

1203:

1200:

1198:

1195:

1193:

1190:

1188:

1185:

1183:

1180:

1178:

1175:

1173:

1170:

1168:

1165:

1163:

1160:

1158:

1155:

1153:

1150:

1148:

1145:

1143:

1140:

1138:

1137:Short selling

1135:

1133:

1130:

1128:

1125:

1123:

1120:

1118:

1115:

1113:

1110:

1108:

1105:

1103:

1100:

1098:

1095:

1093:

1090:

1088:

1085:

1083:

1080:

1078:

1075:

1073:

1070:

1068:

1065:

1063:

1060:

1058:

1055:

1053:

1050:

1048:

1045:

1043:

1040:

1037:

1034:

1032:

1029:

1027:

1026:Greenspan put

1024:

1022:

1019:

1017:

1014:

1012:

1011:Financial law

1009:

1007:

1004:

1002:

999:

997:

994:

992:

989:

987:

986:Cross listing

984:

982:

979:

977:

974:

973:

971:

969:Related terms

967:

961:

958:

956:

953:

951:

948:

946:

943:

941:

940:Swing trading

938:

936:

933:

931:

928:

925:

922:

919:

916:

914:

911:

909:

908:Mosaic theory

906:

904:

901:

898:

895:

893:

892:Market timing

890:

888:

885:

883:

880:

877:

874:

872:

869:

867:

864:

862:

859:

857:

854:

853:

851:

849:

842:

836:

833:

830:

827:

825:

822:

819:

816:

814:

811:

809:

806:

804:

801:

799:

796:

793:

790:

787:

784:

781:

778:

775:

772:

769:

766:

764:

761:

758:

755:

753:

750:

749:

747:

745:

741:

735:

732:

730:

727:

724:

721:

718:

715:

712:

709:

706:

703:

700:

697:

694:

691:

688:

685:

681:

680:Trading hours

678:

676:

673:

672:

671:

668:

667:

665:

661:

655:

652:

648:

645:

644:

643:

640:

638:

635:

633:

630:

628:

625:

623:

620:

616:

613:

611:

608:

607:

606:

603:

601:

598:

596:

595:Broker-dealer

593:

589:

586:

584:

581:

580:

579:

576:

575:

573:

569:

563:

560:

558:

555:

553:

552:Issued shares

550:

548:

545:

544:

542:

540:

539:Share capital

536:

530:

527:

525:

522:

520:

517:

515:

512:

510:

507:

506:

504:

502:

497:

491:

490:Fourth market

488:

486:

483:

481:

478:

476:

473:

472:

470:

468:

463:

459:

452:

447:

445:

440:

438:

433:

432:

429:

419:

413:

410:

405:

399:

396:

390:

386:

383:

382:

378:

372:

366:

362:

358:

353:

349:

343:

339:

335:

330:

329:

325:

323:

321:

320:market making

316:

305:

302:

294:

284:

280:

276:

270:

269:

265:

260:This section

258:

254:

249:

248:

242:

240:

237:

229:

226:

223:

220:

217:

214:

211:

208:

205:

202:

199:

196:

193:

192:

191:

187:

185:

181:

177:

168:

165:

162:

161:

160:

156:

149:

139:

136:

128:

118:

114:

110:

104:

103:

99:

94:This section

92:

88:

83:

82:

76:

74:

67:

65:

63:

56:

51:

49:

47:

43:

41:

37:

36:Market impact

33:

29:

22:

2147:Stock market

1935:

1901:Forward rate

1812:Total return

1700:Real options

1603:Ratio spread

1583:Naked option

1543:Debit spread

1374:Fixed income

1316:Strike price

1187:Tender offer

1141:

1107:Public float

1077:Market trend

1067:Market depth

887:Growth stock

861:Buy and hold

770:(Cap-to-GDP)

610:Floor trader

600:Market maker

583:Floor broker

571:Participants

514:Golden share

509:Common stock

485:Third market

412:

398:

356:

336:. New York:

333:

312:

297:

288:

273:Please help

261:

233:

188:

172:

157:

154:

131:

122:

107:Please help

95:

71:

60:

44:

31:

25:

1832:Zero Coupon

1762:Correlation

1710:Vanna–Volga

1568:Iron condor

1354:Bond option

1192:Uptick rule

1172:Stock split

1152:Squeeze-out

1147:Speculation

1092:Open outcry

981:Block trade

913:Pairs trade

52:Measurement

2141:Categories

2106:Tax policy

1822:Volatility

1732:Amortising

1573:Jelly roll

1508:Box spread

1503:Backspread

1495:Strategies

1331:Volatility

1326:the Greeks

1291:Expiration

1197:Volatility

1177:Stock swap

1097:Order book

848:strategies

774:Book value

642:Arbitrager

637:Speculator

391:References

1797:Inflation

1747:Commodity

1705:Trinomial

1640:Bachelier

1632:Valuation

1513:Butterfly

1447:Commodore

1296:Moneyness

813:Fed model

808:EV/EBITDA

723:Dark pool

654:Regulator

499:Types of

465:Types of

262:does not

96:does not

40:liquidity

1936:Slippage

1866:Contango

1850:Forwards

1817:Variance

1777:Dividend

1772:Currency

1685:Margrabe

1680:Lattices

1659:equation

1645:Binomial

1593:Strangle

1588:Straddle

1485:Swaption

1467:Lookback

1452:Compound

1394:Warrants

1369:European

1349:American

1341:Vanillas

1306:Pin risk

1286:Exercise

1142:Slippage

1102:Position

1087:Momentum

991:Dividend

670:Exchange

627:Investor

379:See also

291:May 2021

180:DRCTEDGE

125:May 2021

32:slippage

21:Slippage

1855:Futures

1475:Rainbow

1442:Cliquet

1437:Chooser

1417:Barrier

1404:Exotics

1266:Options

1031:Haircut

835:T-model

647:Scalper

467:markets

283:removed

268:sources

117:removed

102:sources

77:Example

1916:Margin

1782:Equity

1675:Heston

1578:Ladder

1528:Condor

1523:Collar

1480:Spread

1427:Binary

1422:Basket

1052:Margin

920:(PMPT)

782:(CAPM)

632:Hedger

605:Trader

578:Broker

501:stocks

367:

344:

1787:Forex

1742:Basis

1737:Asset

1724:Swaps

1650:Black

1553:Fence

1412:Asian

1274:Terms

1207:Yield

1182:Trade

1117:Rally

1038:(IPO)

926:(RMH)

899:(MPT)

878:(EMH)

831:(SML)

820:(NAV)

794:(DDM)

788:(CML)

759:(APT)

752:Alpha

719:(STP)

713:(DMA)

707:(ECN)

701:(MTF)

695:(ATS)

1621:Bull

1617:Bear

1359:Call

1042:Long

846:and

776:(BV)

763:Beta

365:ISBN

342:ISBN

266:any

264:cite

234:The

184:BATS

176:ARCA

100:any

98:cite

1389:Put

277:by

111:by

2143::

1619:,

1379:FX

363:.

359:.

340:.

322:.

38:,

1661:)

1657:(

1623:)

1615:(

1241:e

1234:t

1227:v

450:e

443:t

436:v

420:.

373:.

350:.

304:)

298:(

293:)

289:(

285:.

271:.

138:)

132:(

127:)

123:(

119:.

105:.

23:.

Text is available under the Creative Commons Attribution-ShareAlike License. Additional terms may apply.