308:

by definition no risk of default – the bond is a form of government obligation which is being discharged through the payment of another form of government obligation (i.e. the domestic currency). In fact, default on government debt does happen, so if in theory this is impossible, then this points out a deficiency of the theory. Another issue with this approach is that with coupon-bearing bonds, the investor does not know ex-ante what his return will be on the reinvested coupons (and hence the return cannot really be considered risk-free).

285:

25:

2316:

127:

347:

One solution that has been proposed for solving the issue of not having a good 'proxy' for the risk-free asset, to provide an 'observable' risk-free rate is to have some form of international guaranteed asset which would provide a guaranteed return over an indefinite time period (possibly even into

323:

The same consideration does not necessarily apply to a foreign holder of a government bond, since a foreign holder also requires compensation for potential foreign exchange movements in addition to the compensation required by a domestic holder. Since the risk-free rate should theoretically exclude

307:

is generally accepted as the risk-free rate of return. However, theoretically this is only correct if there is no perceived risk of default associated with the bond. Government bonds are conventionally considered to be relatively risk-free to a domestic holder of a government bond, because there is

336:

supply the 'monetary authorities' may be private agents as well as the central bank – refer to

Graziani 'The Theory of Monetary Production'.) Again, the same observation applies to banks as a proxy for the risk-free rate – if there is any perceived risk of default implicit in the interbank lending

268:

Given the theoretical 'fog' around this issue, in practice most industry practitioners rely on some form of proxy for the risk-free rate, or use other forms of benchmark rate which are presupposed to incorporate the risk-free rate plus some risk of default. However, there are also issues with this

247:

However, it is commonly observed that for people applying this interpretation, the value of supplying currency is normally perceived as being positive. It is not clear what is the true basis for this perception, but it may be related to the practical necessity of some form of (credit?) currency to

331:

Another possibility used to estimate the risk-free rate is the inter-bank lending rate. This appears to be premised on the basis that these institutions benefit from an implicit guarantee, underpinned by the role of the monetary authorities as 'the lendor of last resort.' (In a system with an

261:

An alternative (less well developed) interpretation is that the risk-free rate represents the time preference of a representative worker for a representative basket of consumption. Again, there are reasons to believe that in this situation the risk-free rate may not be directly observable.

368:. There are numerous issues with this model, the most basic of which is the reduction of the description of utility of stock holding to the expected mean and variance of the returns of the portfolio. In reality, there may be other utility of stock holding, as described by

327:

Since the required return on government bonds for domestic and foreign holders cannot be distinguished in an international market for government debt, this may mean that yields on government debt are not a good proxy for the risk-free rate.

315:

There is also the risk of the government 'printing more money' to meet the obligation, thus paying back in lesser valued currency. This may be perceived as a form of tax, rather than a form of default, a concept similar to that of

230:

The correct interpretation is that the risk-free rate could be either positive or negative and in practice the sign of the expected risk-free rate is an institutional convention – this is analogous to the argument that

243:

creation and where production decisions and outcomes are decentralized and potentially intractable to forecasting, this analysis provides support to the concept that the risk-free rate may not be directly observable.

311:

Some academics support the use of swap rates as a measurement of the risk-free rate. Feldhütter and Lando state that: "the riskless rate is better proxied by the swap rate than the

Treasury rate for all maturities."

258:. However, Smith did not provide an 'upper limit' to the desirable level of the specialization of labour and did not fully address issues of how this should be organised at the national or international level.

265:

A third (also less well developed) interpretation is that instead of maintaining pace with purchasing power, a representative investor may require a risk free investment to keep pace with wages.

643:

182:

Since the risk-free rate can be obtained with no risk, any other investment having some risk will have to have a higher rate of return in order to induce any investors to hold it.

348:

perpetuity). There are some assets in existence which might replicate some of the hypothetical properties of this asset. For example, one potential candidate is the

143:

219:(1930), which is based on the theoretical costs and benefits of holding currency. In Fisher's model, these are described by two potentially offsetting movements:

387:. Note that some finance and economic theories assume that market participants can borrow at the risk-free rate; in practice, very few (if any) borrowers have

324:

any risk, default or otherwise, this implies that the yields on foreign owned government debt cannot be used as the basis for calculating the risk-free rate.

1859:

1434:

636:

320:. But the result to the investor is the same, loss of value according to his measurement, so focusing strictly on default does not include all risk.

2353:

2199:

1889:

2800:

629:

874:

208:, the risk-free rate means different things to different people and there is no consensus on how to go about a direct measurement of it.

2021:

185:

In practice, to infer the risk-free interest rate in a particular currency, market participants often choose the yield to maturity on a

543:

500:

189:

issued by a government of the same currency whose risks of default are so low as to be negligible. For example, the rate of return on

1757:

472:

108:

340:

Similar conclusions can be drawn from other potential benchmark rates, including AAA-rated corporate bonds of institutions deemed '

2259:

1427:

899:

2668:

42:

2947:

2750:

2194:

1839:

89:

46:

61:

893:

2346:

1376:

1316:

1112:

1018:

2633:

2525:

2234:

1772:

1626:

1420:

1102:

1070:

974:

928:

911:

864:

416:

399:

361:

68:

1853:

2697:

2031:

887:

881:

376:

223:

Expected increases in the money supply should result in investors preferring current consumption to future income.

35:

2785:

2366:

2135:

1946:

75:

2643:

2608:

2254:

2249:

1276:

951:

2613:

1904:

1849:

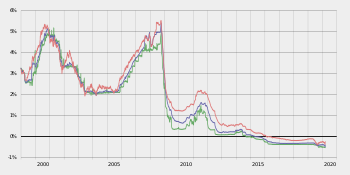

291:

is used as a proxy for the risk-free rate in

European contexts. Euribor-12m (red), 3m (blue), 1w (green) value

226:

Expected increases in productivity should result in investors preferring future income to current consumption.

3021:

3016:

2952:

2673:

2658:

2600:

2339:

2204:

1874:

1864:

1732:

1573:

1505:

1230:

1091:

986:

869:

365:

57:

2648:

2153:

2001:

1986:

1951:

1894:

1118:

2990:

2892:

2865:

2850:

2618:

2473:

2394:

2214:

2065:

1981:

1558:

1256:

1065:

588:

254:

1879:

402:. The cost of capital at risk then is the sum of the risk-free rate of return and certain risk premia.

2995:

2927:

2917:

2872:

2805:

2638:

2389:

2168:

2125:

2115:

2105:

1826:

1767:

1702:

1656:

1651:

1525:

1485:

1452:

1391:

1311:

1076:

1060:

1023:

905:

848:

816:

179:

with scheduled payments over a fixed period of time that is assumed to meet all payment obligations.

1884:

2985:

2942:

2453:

2173:

1961:

1707:

1321:

1266:

1190:

1050:

980:

809:

782:

1170:

2962:

2957:

2937:

2825:

2628:

2586:

2483:

2409:

2224:

2209:

2178:

2163:

2130:

1996:

1787:

1752:

1515:

1480:

1443:

1361:

1336:

1296:

1281:

1200:

1139:

1097:

841:

751:

741:

607:

300:

2331:

360:

The risk-free interest rate is highly significant in the context of the general application of

2840:

2830:

2820:

2775:

2770:

2724:

2720:

2693:

2623:

2540:

2414:

2404:

2229:

2219:

2158:

2145:

2120:

2006:

1792:

1588:

1225:

1210:

962:

584:

539:

496:

468:

388:

369:

304:

2877:

2795:

2745:

2728:

2653:

2517:

2502:

2110:

2100:

2090:

2049:

2044:

2026:

1956:

1722:

1717:

1689:

1641:

1520:

1460:

1326:

1246:

1042:

923:

799:

718:

674:

652:

599:

566:

411:

333:

240:

190:

82:

2912:

2887:

2845:

2835:

2810:

2790:

2780:

2493:

2457:

2399:

2320:

2290:

2285:

2239:

2075:

2070:

2016:

1926:

1834:

1807:

1747:

1742:

1712:

1661:

1646:

1563:

1543:

1401:

1396:

1331:

1306:

1241:

1215:

1195:

1154:

1149:

1144:

1129:

1124:

1012:

946:

938:

826:

713:

395:

341:

441:

2860:

2716:

2712:

2703:

2571:

2550:

2498:

2488:

2478:

2468:

2437:

2419:

2362:

2295:

2280:

2080:

1991:

1941:

1918:

1899:

1727:

1669:

1636:

1631:

1611:

1535:

1356:

1351:

1251:

1236:

997:

992:

957:

756:

723:

669:

661:

421:

296:

248:

support the specialization of labour, the perceived benefits of which were detailed by

186:

172:

3010:

2967:

2855:

2765:

2755:

2708:

2688:

2581:

2530:

2275:

2244:

2085:

2011:

1971:

1966:

1802:

1674:

1621:

1616:

1598:

1495:

1475:

1220:

1205:

1180:

1134:

1086:

789:

746:

733:

684:

349:

212:

272:

Further discussions on the concept of a 'stochastic discount rate' are available in

2922:

2907:

2683:

2545:

2506:

2095:

1869:

1797:

1777:

1737:

1606:

1578:

1568:

1510:

1381:

1301:

1271:

1261:

1081:

1055:

804:

794:

777:

708:

703:

679:

384:

380:

375:

The risk-free rate is also a required input in financial calculations, such as the

284:

2972:

2932:

2678:

2663:

2576:

2463:

2441:

2429:

2381:

1976:

1844:

1815:

1811:

1762:

1553:

1548:

1386:

1366:

1346:

1341:

1286:

1175:

1107:

531:

488:

337:

rate, it is not appropriate to use this rate as a proxy for the risk-free rate.

317:

232:

24:

2555:

2535:

2449:

2445:

2300:

1936:

1931:

1697:

1583:

1371:

1291:

968:

831:

249:

176:

2902:

1490:

1007:

1002:

917:

836:

2315:

2760:

2060:

1782:

1679:

1500:

1185:

821:

570:

2815:

1029:

611:

288:

2882:

1412:

772:

193:

621:

603:

560:

215:'s concept of inflationary expectations, described in his treatise

211:

One interpretation of the theoretical risk-free rate is aligned to

695:

352:

which were issued by the

British government in the 18th century.

299:

is normally perceived as a good proxy for the risk-free rate. In

196:

is sometimes seen as the risk-free rate of return in US dollars.

2897:

2335:

1416:

625:

120:

18:

518:

Market

Consistency: Model Calibration in Imperfect Markets

206:

Market

Consistency: Model Calibration in Imperfect Markets

136:

needs attention from an expert in

Finance & Investment

295:

The return on domestically held short-dated government

204:

As stated by

Malcolm Kemp in chapter five of his book

16:

Hypothetical interest rate on a risk-free investment

2738:

2599:

2564:

2516:

2428:

2380:

2373:

2268:

2187:

2144:

2040:

1917:

1825:

1688:

1597:

1534:

1468:

1459:

1163:

1038:

937:

857:

765:

732:

693:

659:

394:The risk-free rate of return is the key input into

372:in his article 'Stock Prices and Social Dynamics'.

269:approach, which are discussed in the next section.

49:. Unsourced material may be challenged and removed.

463:Bodie, Zvi; Kane, Alex; Marcus, Alan J. (2017).

398:calculations such as those performed using the

559:Feldhütter, Peter; Lando, David (3 May 2007).

2347:

1428:

637:

8:

2377:

2354:

2340:

2332:

1465:

1435:

1421:

1413:

644:

630:

622:

140:The article needs top-to-bottom revision.

109:Learn how and when to remove this message

565:. EFA 2006 Zurich Meetings. p. 31.

283:

2260:Power reverse dual-currency note (PRDC)

2200:Constant proportion portfolio insurance

467:(11 ed.). McGraw Hill. p. 9.

433:

146:may be able to help recruit an expert.

538:. McGraw-Hill Education. p. 16.

495:. McGraw-Hill Education. p. 17.

274:The Econometrics of Financial Markets

7:

2195:Collateralized debt obligation (CDO)

596:Brooking Papers on Economic Activity

144:WikiProject Finance & Investment

47:adding citations to reliable sources

589:"Stock Prices and Social Dynamics"

14:

2629:Conditional Value-at-Risk (CVaR)

2314:

900:Electronic communication network

125:

23:

276:by Campbell, Lo and MacKinley.

34:needs additional citations for

2948:Strategic financial management

2751:Asset and liability management

2022:Year-on-year inflation-indexed

280:Proxies for the risk-free rate

1:

2032:Zero-coupon inflation-indexed

894:Multilateral trading facility

235:makes on page 17 of his book

1317:Returns-based style analysis

1113:Post-modern portfolio theory

1019:Security characteristic line

534:; Golub, Stephen S. (1997).

491:; Golub, Stephen S. (1997).

2526:Operational risk management

2235:Foreign exchange derivative

1627:Callable bull/bear contract

1071:Efficient-market hypothesis

975:Capital asset pricing model

912:Straight-through processing

417:Capital asset pricing model

400:capital asset pricing model

362:capital asset pricing model

303:the long-term yield on the

167:, usually shortened to the

138:. The specific problem is:

3038:

2698:Proportional hazards model

2649:Interest rate immunization

888:Alternative Trading System

442:"Risk-Free Rate of Return"

2981:

2367:financial risk management

2309:

2136:Stock market index future

1450:

536:Money, Credit and Capital

493:Money, Credit and Capital

237:Money, Credit and Capital

2644:First-hitting-time model

2609:Arbitrage pricing theory

2255:Mortgage-backed security

2250:Interest rate derivative

2225:Equity-linked note (ELN)

2210:Credit-linked note (CLN)

952:Arbitrage pricing theory

562:Decomposing Swap Spreads

305:US Treasury coupon bonds

194:Treasury bonds (T-bills)

165:risk-free rate of return

2953:Stress test (financial)

2659:Modern portfolio theory

2205:Contract for difference

1506:Risk-free interest rate

1231:Initial public offering

1092:Modern portfolio theory

987:Dividend discount model

870:List of stock exchanges

391:at the risk free rate.

366:modern portfolio theory

200:Theoretical measurement

1987:Forward Rate Agreement

1119:Random walk hypothesis

364:which is based on the

292:

217:The Theory of Interest

2991:Investment management

2893:Investment management

2619:Replicating portfolio

2395:Sovereign credit risk

2215:Credit default option

1559:Employee stock option

1257:Market capitalization

1066:Dollar cost averaging

377:Black–Scholes formula

287:

255:The Wealth of Nations

2996:Mathematical finance

2928:Risk-return spectrum

2918:Mathematical finance

2873:Fundamental analysis

2806:Exchange traded fund

2390:Consumer credit risk

2169:Inflation derivative

2154:Commodity derivative

2126:Single-stock futures

2116:Normal backwardation

2106:Interest rate future

1947:Conditional variance

1453:Derivative (finance)

1077:Fundamental analysis

1061:Contrarian investing

1024:Security market line

929:Liquidity aggregator

906:Direct market access

817:Quantitative analyst

516:Kemp, Malcolm. "5".

43:improve this article

2986:Financial economics

2943:Statistical finance

2709:Value-at-Risk (VaR)

2614:Black–Scholes model

2454:Holding period risk

2321:Business portal

2174:Property derivative

1322:Reverse stock split

1267:Market manipulation

1191:Dual-listed company

1051:Algorithmic trading

981:Capital market line

783:Inter-dealer broker

571:10.2139/ssrn.687378

239:. In a system with

2963:Structured product

2958:Structured finance

2938:Speculative attack

2624:Cash flow matching

2587:Non-financial risk

2484:Interest rate risk

2410:Concentration risk

2179:Weather derivative

2164:Freight derivative

2146:Exotic derivatives

2066:Commodities future

1753:Intermarket spread

1516:Synthetic position

1444:Derivatives market

1362:Stock market index

1201:Efficient frontier

1140:Technical analysis

1098:Momentum investing

920:(private exchange)

810:Proprietary trader

752:Shares outstanding

742:Authorised capital

585:Shiller, Robert J.

301:business valuation

293:

175:of a hypothetical

3004:

3003:

2776:Corporate finance

2771:Capital structure

2725:Cash flow at risk

2721:Liquidity at risk

2694:Survival analysis

2595:

2594:

2541:Reputational risk

2415:Credit derivative

2329:

2328:

2230:Equity derivative

2220:Credit derivative

2188:Other derivatives

2159:Energy derivative

2121:Perpetual futures

2002:Overnight indexed

1952:Constant maturity

1913:

1912:

1860:Finite difference

1793:Protective option

1410:

1409:

1211:Flight-to-quality

963:Buffett indicator

653:Financial markets

389:access to finance

370:Robert J. Shiller

161:

160:

119:

118:

111:

93:

3029:

2878:Growth investing

2796:Enterprise value

2746:Asset allocation

2729:Earnings at risk

2711:and extensions (

2654:Market portfolio

2518:Operational risk

2503:Refinancing risk

2378:

2356:

2349:

2342:

2333:

2319:

2318:

2091:Forwards pricing

1865:Garman–Kohlhagen

1466:

1437:

1430:

1423:

1414:

1327:Share repurchase

1039:Trading theories

924:Crossing network

882:Over-the-counter

719:Restricted stock

675:Secondary market

646:

639:

632:

623:

616:

615:

593:

581:

575:

574:

556:

550:

549:

528:

522:

521:

513:

507:

506:

485:

479:

478:

460:

454:

453:

451:

449:

438:

412:Short-rate model

334:endogenous money

241:endogenous money

156:

153:

147:

129:

128:

121:

114:

107:

103:

100:

94:

92:

58:"Risk-free rate"

51:

27:

19:

3037:

3036:

3032:

3031:

3030:

3028:

3027:

3026:

3007:

3006:

3005:

3000:

2977:

2913:Systematic risk

2811:Expected return

2791:Economic bubble

2786:Diversification

2781:Cost of capital

2734:

2591:

2560:

2512:

2494:Volatility risk

2458:Price area risk

2424:

2400:Settlement risk

2369:

2360:

2330:

2325:

2313:

2305:

2291:Great Recession

2286:Government debt

2264:

2240:Fund derivative

2183:

2140:

2101:Futures pricing

2076:Dividend future

2071:Currency future

2054:

2036:

1909:

1885:Put–call parity

1821:

1808:Vertical spread

1743:Diagonal spread

1713:Calendar spread

1684:

1593:

1530:

1455:

1446:

1441:

1411:

1406:

1397:Voting interest

1307:Public offering

1242:Mandatory offer

1216:Government bond

1196:DuPont analysis

1159:

1155:Value investing

1150:Value averaging

1145:Trend following

1130:Style investing

1125:Sector rotation

1040:

1034:

1013:Net asset value

939:Stock valuation

933:

853:

761:

728:

714:Preferred stock

689:

655:

650:

620:

619:

604:10.2307/2534436

591:

583:

582:

578:

558:

557:

553:

546:

530:

529:

525:

515:

514:

510:

503:

487:

486:

482:

475:

462:

461:

457:

447:

445:

440:

439:

435:

430:

408:

396:cost of capital

358:

342:too big to fail

282:

202:

157:

151:

148:

142:

130:

126:

115:

104:

98:

95:

52:

50:

40:

28:

17:

12:

11:

5:

3035:

3033:

3025:

3024:

3022:Financial risk

3019:

3017:Interest rates

3009:

3008:

3002:

3001:

2999:

2998:

2993:

2988:

2982:

2979:

2978:

2976:

2975:

2970:

2965:

2960:

2955:

2950:

2945:

2940:

2935:

2930:

2925:

2920:

2915:

2910:

2905:

2900:

2895:

2890:

2885:

2880:

2875:

2870:

2869:

2868:

2863:

2858:

2853:

2848:

2843:

2838:

2833:

2828:

2823:

2813:

2808:

2803:

2798:

2793:

2788:

2783:

2778:

2773:

2768:

2763:

2758:

2753:

2748:

2742:

2740:

2739:Basic concepts

2736:

2735:

2733:

2732:

2717:Margin at risk

2713:Profit at risk

2706:

2704:Tracking error

2701:

2691:

2686:

2681:

2676:

2674:Risk-free rate

2671:

2666:

2661:

2656:

2651:

2646:

2641:

2636:

2631:

2626:

2621:

2616:

2611:

2605:

2603:

2597:

2596:

2593:

2592:

2590:

2589:

2584:

2579:

2574:

2572:Execution risk

2568:

2566:

2562:

2561:

2559:

2558:

2553:

2551:Political risk

2548:

2543:

2538:

2533:

2528:

2522:

2520:

2514:

2513:

2511:

2510:

2499:Liquidity risk

2496:

2491:

2489:Inflation risk

2486:

2481:

2479:Margining risk

2476:

2471:

2469:Valuation risk

2466:

2461:

2438:Commodity risk

2434:

2432:

2426:

2425:

2423:

2422:

2420:Securitization

2417:

2412:

2407:

2402:

2397:

2392:

2386:

2384:

2375:

2371:

2370:

2363:Financial risk

2361:

2359:

2358:

2351:

2344:

2336:

2327:

2326:

2324:

2323:

2310:

2307:

2306:

2304:

2303:

2298:

2296:Municipal debt

2293:

2288:

2283:

2281:Corporate debt

2278:

2272:

2270:

2266:

2265:

2263:

2262:

2257:

2252:

2247:

2242:

2237:

2232:

2227:

2222:

2217:

2212:

2207:

2202:

2197:

2191:

2189:

2185:

2184:

2182:

2181:

2176:

2171:

2166:

2161:

2156:

2150:

2148:

2142:

2141:

2139:

2138:

2133:

2128:

2123:

2118:

2113:

2108:

2103:

2098:

2093:

2088:

2083:

2081:Forward market

2078:

2073:

2068:

2063:

2057:

2055:

2053:

2052:

2047:

2041:

2038:

2037:

2035:

2034:

2029:

2024:

2019:

2014:

2009:

2004:

1999:

1994:

1989:

1984:

1979:

1974:

1969:

1964:

1962:Credit default

1959:

1954:

1949:

1944:

1939:

1934:

1929:

1923:

1921:

1915:

1914:

1911:

1910:

1908:

1907:

1902:

1897:

1892:

1887:

1882:

1877:

1872:

1867:

1862:

1857:

1847:

1842:

1837:

1831:

1829:

1823:

1822:

1820:

1819:

1805:

1800:

1795:

1790:

1785:

1780:

1775:

1770:

1765:

1760:

1758:Iron butterfly

1755:

1750:

1745:

1740:

1735:

1730:

1728:Covered option

1725:

1720:

1715:

1710:

1705:

1700:

1694:

1692:

1686:

1685:

1683:

1682:

1677:

1672:

1667:

1666:Mountain range

1664:

1659:

1654:

1649:

1644:

1639:

1634:

1629:

1624:

1619:

1614:

1609:

1603:

1601:

1595:

1594:

1592:

1591:

1586:

1581:

1576:

1571:

1566:

1561:

1556:

1551:

1546:

1540:

1538:

1532:

1531:

1529:

1528:

1523:

1518:

1513:

1508:

1503:

1498:

1493:

1488:

1483:

1478:

1472:

1470:

1463:

1457:

1456:

1451:

1448:

1447:

1442:

1440:

1439:

1432:

1425:

1417:

1408:

1407:

1405:

1404:

1399:

1394:

1389:

1384:

1379:

1374:

1369:

1364:

1359:

1357:Stock exchange

1354:

1352:Stock dilution

1349:

1344:

1339:

1334:

1329:

1324:

1319:

1314:

1309:

1304:

1299:

1294:

1289:

1284:

1279:

1277:Mean reversion

1274:

1269:

1264:

1259:

1254:

1252:Market anomaly

1249:

1244:

1239:

1234:

1228:

1223:

1218:

1213:

1208:

1203:

1198:

1193:

1188:

1183:

1178:

1173:

1171:Bid–ask spread

1167:

1165:

1161:

1160:

1158:

1157:

1152:

1147:

1142:

1137:

1132:

1127:

1122:

1116:

1110:

1105:

1100:

1095:

1089:

1084:

1079:

1074:

1068:

1063:

1058:

1053:

1047:

1045:

1036:

1035:

1033:

1032:

1027:

1021:

1016:

1010:

1005:

1000:

998:Earnings yield

995:

993:Dividend yield

990:

984:

978:

972:

966:

960:

955:

949:

943:

941:

935:

934:

932:

931:

926:

921:

915:

909:

903:

897:

891:

885:

884:(off-exchange)

879:

878:

877:

872:

861:

859:

858:Trading venues

855:

854:

852:

851:

846:

845:

844:

834:

829:

824:

819:

814:

813:

812:

807:

797:

792:

787:

786:

785:

780:

769:

767:

763:

762:

760:

759:

757:Treasury stock

754:

749:

744:

738:

736:

730:

729:

727:

726:

724:Tracking stock

721:

716:

711:

706:

700:

698:

691:

690:

688:

687:

682:

677:

672:

670:Primary market

666:

664:

657:

656:

651:

649:

648:

641:

634:

626:

618:

617:

576:

551:

545:978-0070653368

544:

523:

508:

502:978-0070653368

501:

480:

473:

455:

444:. Investopedia

432:

431:

429:

426:

425:

424:

422:Beta (finance)

419:

414:

407:

404:

357:

354:

350:'consol' bonds

281:

278:

228:

227:

224:

201:

198:

187:risk-free bond

173:rate of return

169:risk-free rate

159:

158:

133:

131:

124:

117:

116:

31:

29:

22:

15:

13:

10:

9:

6:

4:

3:

2:

3034:

3023:

3020:

3018:

3015:

3014:

3012:

2997:

2994:

2992:

2989:

2987:

2984:

2983:

2980:

2974:

2971:

2969:

2968:Systemic risk

2966:

2964:

2961:

2959:

2956:

2954:

2951:

2949:

2946:

2944:

2941:

2939:

2936:

2934:

2931:

2929:

2926:

2924:

2921:

2919:

2916:

2914:

2911:

2909:

2906:

2904:

2901:

2899:

2896:

2894:

2891:

2889:

2886:

2884:

2881:

2879:

2876:

2874:

2871:

2867:

2864:

2862:

2859:

2857:

2854:

2852:

2849:

2847:

2844:

2842:

2839:

2837:

2834:

2832:

2829:

2827:

2824:

2822:

2819:

2818:

2817:

2814:

2812:

2809:

2807:

2804:

2802:

2799:

2797:

2794:

2792:

2789:

2787:

2784:

2782:

2779:

2777:

2774:

2772:

2769:

2767:

2766:Capital asset

2764:

2762:

2759:

2757:

2756:Asset pricing

2754:

2752:

2749:

2747:

2744:

2743:

2741:

2737:

2730:

2726:

2722:

2718:

2714:

2710:

2707:

2705:

2702:

2699:

2695:

2692:

2690:

2689:Sortino ratio

2687:

2685:

2682:

2680:

2677:

2675:

2672:

2670:

2667:

2665:

2662:

2660:

2657:

2655:

2652:

2650:

2647:

2645:

2642:

2640:

2637:

2635:

2632:

2630:

2627:

2625:

2622:

2620:

2617:

2615:

2612:

2610:

2607:

2606:

2604:

2602:

2598:

2588:

2585:

2583:

2582:Systemic risk

2580:

2578:

2575:

2573:

2570:

2569:

2567:

2563:

2557:

2554:

2552:

2549:

2547:

2544:

2542:

2539:

2537:

2534:

2532:

2531:Business risk

2529:

2527:

2524:

2523:

2521:

2519:

2515:

2508:

2504:

2500:

2497:

2495:

2492:

2490:

2487:

2485:

2482:

2480:

2477:

2475:

2472:

2470:

2467:

2465:

2462:

2459:

2455:

2451:

2447:

2443:

2439:

2436:

2435:

2433:

2431:

2427:

2421:

2418:

2416:

2413:

2411:

2408:

2406:

2403:

2401:

2398:

2396:

2393:

2391:

2388:

2387:

2385:

2383:

2379:

2376:

2372:

2368:

2364:

2357:

2352:

2350:

2345:

2343:

2338:

2337:

2334:

2322:

2317:

2312:

2311:

2308:

2302:

2299:

2297:

2294:

2292:

2289:

2287:

2284:

2282:

2279:

2277:

2276:Consumer debt

2274:

2273:

2271:

2269:Market issues

2267:

2261:

2258:

2256:

2253:

2251:

2248:

2246:

2245:Fund of funds

2243:

2241:

2238:

2236:

2233:

2231:

2228:

2226:

2223:

2221:

2218:

2216:

2213:

2211:

2208:

2206:

2203:

2201:

2198:

2196:

2193:

2192:

2190:

2186:

2180:

2177:

2175:

2172:

2170:

2167:

2165:

2162:

2160:

2157:

2155:

2152:

2151:

2149:

2147:

2143:

2137:

2134:

2132:

2129:

2127:

2124:

2122:

2119:

2117:

2114:

2112:

2109:

2107:

2104:

2102:

2099:

2097:

2094:

2092:

2089:

2087:

2086:Forward price

2084:

2082:

2079:

2077:

2074:

2072:

2069:

2067:

2064:

2062:

2059:

2058:

2056:

2051:

2048:

2046:

2043:

2042:

2039:

2033:

2030:

2028:

2025:

2023:

2020:

2018:

2015:

2013:

2010:

2008:

2005:

2003:

2000:

1998:

1997:Interest rate

1995:

1993:

1990:

1988:

1985:

1983:

1980:

1978:

1975:

1973:

1970:

1968:

1965:

1963:

1960:

1958:

1955:

1953:

1950:

1948:

1945:

1943:

1940:

1938:

1935:

1933:

1930:

1928:

1925:

1924:

1922:

1920:

1916:

1906:

1903:

1901:

1898:

1896:

1893:

1891:

1890:MC Simulation

1888:

1886:

1883:

1881:

1878:

1876:

1873:

1871:

1868:

1866:

1863:

1861:

1858:

1855:

1851:

1850:Black–Scholes

1848:

1846:

1843:

1841:

1838:

1836:

1833:

1832:

1830:

1828:

1824:

1817:

1813:

1809:

1806:

1804:

1803:Risk reversal

1801:

1799:

1796:

1794:

1791:

1789:

1786:

1784:

1781:

1779:

1776:

1774:

1771:

1769:

1766:

1764:

1761:

1759:

1756:

1754:

1751:

1749:

1746:

1744:

1741:

1739:

1736:

1734:

1733:Credit spread

1731:

1729:

1726:

1724:

1721:

1719:

1716:

1714:

1711:

1709:

1706:

1704:

1701:

1699:

1696:

1695:

1693:

1691:

1687:

1681:

1678:

1676:

1673:

1671:

1668:

1665:

1663:

1660:

1658:

1657:Interest rate

1655:

1653:

1652:Forward start

1650:

1648:

1645:

1643:

1640:

1638:

1635:

1633:

1630:

1628:

1625:

1623:

1620:

1618:

1615:

1613:

1610:

1608:

1605:

1604:

1602:

1600:

1596:

1590:

1587:

1585:

1582:

1580:

1579:Option styles

1577:

1575:

1572:

1570:

1567:

1565:

1562:

1560:

1557:

1555:

1552:

1550:

1547:

1545:

1542:

1541:

1539:

1537:

1533:

1527:

1524:

1522:

1519:

1517:

1514:

1512:

1509:

1507:

1504:

1502:

1499:

1497:

1496:Open interest

1494:

1492:

1489:

1487:

1484:

1482:

1479:

1477:

1476:Delta neutral

1474:

1473:

1471:

1467:

1464:

1462:

1458:

1454:

1449:

1445:

1438:

1433:

1431:

1426:

1424:

1419:

1418:

1415:

1403:

1400:

1398:

1395:

1393:

1390:

1388:

1385:

1383:

1380:

1378:

1375:

1373:

1370:

1368:

1365:

1363:

1360:

1358:

1355:

1353:

1350:

1348:

1345:

1343:

1340:

1338:

1335:

1333:

1332:Short selling

1330:

1328:

1325:

1323:

1320:

1318:

1315:

1313:

1310:

1308:

1305:

1303:

1300:

1298:

1295:

1293:

1290:

1288:

1285:

1283:

1280:

1278:

1275:

1273:

1270:

1268:

1265:

1263:

1260:

1258:

1255:

1253:

1250:

1248:

1245:

1243:

1240:

1238:

1235:

1232:

1229:

1227:

1224:

1222:

1221:Greenspan put

1219:

1217:

1214:

1212:

1209:

1207:

1206:Financial law

1204:

1202:

1199:

1197:

1194:

1192:

1189:

1187:

1184:

1182:

1181:Cross listing

1179:

1177:

1174:

1172:

1169:

1168:

1166:

1164:Related terms

1162:

1156:

1153:

1151:

1148:

1146:

1143:

1141:

1138:

1136:

1135:Swing trading

1133:

1131:

1128:

1126:

1123:

1120:

1117:

1114:

1111:

1109:

1106:

1104:

1103:Mosaic theory

1101:

1099:

1096:

1093:

1090:

1088:

1087:Market timing

1085:

1083:

1080:

1078:

1075:

1072:

1069:

1067:

1064:

1062:

1059:

1057:

1054:

1052:

1049:

1048:

1046:

1044:

1037:

1031:

1028:

1025:

1022:

1020:

1017:

1014:

1011:

1009:

1006:

1004:

1001:

999:

996:

994:

991:

988:

985:

982:

979:

976:

973:

970:

967:

964:

961:

959:

956:

953:

950:

948:

945:

944:

942:

940:

936:

930:

927:

925:

922:

919:

916:

913:

910:

907:

904:

901:

898:

895:

892:

889:

886:

883:

880:

876:

875:Trading hours

873:

871:

868:

867:

866:

863:

862:

860:

856:

850:

847:

843:

840:

839:

838:

835:

833:

830:

828:

825:

823:

820:

818:

815:

811:

808:

806:

803:

802:

801:

798:

796:

793:

791:

790:Broker-dealer

788:

784:

781:

779:

776:

775:

774:

771:

770:

768:

764:

758:

755:

753:

750:

748:

747:Issued shares

745:

743:

740:

739:

737:

735:

734:Share capital

731:

725:

722:

720:

717:

715:

712:

710:

707:

705:

702:

701:

699:

697:

692:

686:

685:Fourth market

683:

681:

678:

676:

673:

671:

668:

667:

665:

663:

658:

654:

647:

642:

640:

635:

633:

628:

627:

624:

613:

609:

605:

601:

597:

590:

586:

580:

577:

572:

568:

564:

563:

555:

552:

547:

541:

537:

533:

527:

524:

519:

512:

509:

504:

498:

494:

490:

484:

481:

476:

474:9781259277177

470:

466:

459:

456:

443:

437:

434:

427:

423:

420:

418:

415:

413:

410:

409:

405:

403:

401:

397:

392:

390:

386:

382:

381:stock options

378:

373:

371:

367:

363:

355:

353:

351:

345:

343:

338:

335:

329:

325:

321:

319:

313:

309:

306:

302:

298:

290:

286:

279:

277:

275:

270:

266:

263:

259:

257:

256:

251:

245:

242:

238:

234:

225:

222:

221:

220:

218:

214:

213:Irving Fisher

209:

207:

199:

197:

195:

192:

188:

183:

180:

178:

174:

170:

166:

155:

145:

141:

137:

134:This article

132:

123:

122:

113:

110:

102:

91:

88:

84:

81:

77:

74:

70:

67:

63:

60: –

59:

55:

54:Find sources:

48:

44:

38:

37:

32:This article

30:

26:

21:

20:

2923:Moral hazard

2908:Risk of ruin

2684:Sharpe ratio

2546:Country risk

2507:Deposit risk

2405:Default risk

2096:Forward rate

2007:Total return

1895:Real options

1798:Ratio spread

1778:Naked option

1738:Debit spread

1569:Fixed income

1511:Strike price

1382:Tender offer

1302:Public float

1272:Market trend

1262:Market depth

1082:Growth stock

1056:Buy and hold

965:(Cap-to-GDP)

805:Floor trader

795:Market maker

778:Floor broker

766:Participants

709:Golden share

704:Common stock

680:Third market

595:

579:

561:

554:

535:

532:Tobin, James

526:

517:

511:

492:

489:Tobin, James

483:

464:

458:

446:. Retrieved

436:

393:

385:Sharpe ratio

379:for pricing

374:

359:

346:

339:

330:

326:

322:

314:

310:

294:

273:

271:

267:

264:

260:

253:

246:

236:

229:

216:

210:

205:

203:

184:

181:

168:

164:

162:

149:

139:

135:

105:

96:

86:

79:

72:

65:

53:

41:Please help

36:verification

33:

2973:Toxic asset

2933:Speculation

2866:social work

2851:engineering

2679:Risk parity

2664:Omega ratio

2577:Profit risk

2464:Equity risk

2442:Volume risk

2430:Market risk

2382:Credit risk

2027:Zero Coupon

1957:Correlation

1905:Vanna–Volga

1763:Iron condor

1549:Bond option

1387:Uptick rule

1367:Stock split

1347:Squeeze-out

1342:Speculation

1287:Open outcry

1176:Block trade

1108:Pairs trade

598:: 457–511.

465:Investments

448:7 September

356:Application

318:seigniorage

191:zero-coupon

152:August 2020

3011:Categories

2556:Legal risk

2536:Model risk

2450:Shape risk

2446:Basis risk

2374:Categories

2301:Tax policy

2017:Volatility

1927:Amortising

1768:Jelly roll

1703:Box spread

1698:Backspread

1690:Strategies

1526:Volatility

1521:the Greeks

1486:Expiration

1392:Volatility

1372:Stock swap

1292:Order book

1043:strategies

969:Book value

837:Arbitrager

832:Speculator

428:References

250:Adam Smith

177:investment

69:newspapers

2903:Risk pool

2816:Financial

1992:Inflation

1942:Commodity

1900:Trinomial

1835:Bachelier

1827:Valuation

1708:Butterfly

1642:Commodore

1491:Moneyness

1008:Fed model

1003:EV/EBITDA

918:Dark pool

849:Regulator

694:Types of

660:Types of

171:, is the

99:June 2011

2826:analysis

2761:Bad debt

2639:Drawdown

2601:Modeling

2131:Slippage

2061:Contango

2045:Forwards

2012:Variance

1972:Dividend

1967:Currency

1880:Margrabe

1875:Lattices

1854:equation

1840:Binomial

1788:Strangle

1783:Straddle

1680:Swaption

1662:Lookback

1647:Compound

1589:Warrants

1564:European

1544:American

1536:Vanillas

1501:Pin risk

1481:Exercise

1337:Slippage

1297:Position

1282:Momentum

1186:Dividend

865:Exchange

822:Investor

587:(1984).

406:See also

383:and the

2841:betting

2831:analyst

2821:adviser

2474:FX risk

2050:Futures

1670:Rainbow

1637:Cliquet

1632:Chooser

1612:Barrier

1599:Exotics

1461:Options

1226:Haircut

1030:T-model

842:Scalper

662:markets

612:2534436

289:EURIBOR

83:scholar

2883:Hazard

2634:Copula

2501:(e.g.

2440:(e.g.

2111:Margin

1977:Equity

1870:Heston

1773:Ladder

1723:Condor

1718:Collar

1675:Spread

1622:Binary

1617:Basket

1247:Margin

1115:(PMPT)

977:(CAPM)

827:Hedger

800:Trader

773:Broker

696:stocks

610:

542:

499:

471:

85:

78:

71:

64:

56:

2888:Hedge

2846:crime

2836:asset

2669:RAROC

2565:Other

1982:Forex

1937:Basis

1932:Asset

1919:Swaps

1845:Black

1748:Fence

1607:Asian

1469:Terms

1402:Yield

1377:Trade

1312:Rally

1233:(IPO)

1121:(RMH)

1094:(MPT)

1073:(EMH)

1026:(SML)

1015:(NAV)

989:(DDM)

983:(CML)

954:(APT)

947:Alpha

914:(STP)

908:(DMA)

902:(ECN)

896:(MTF)

890:(ATS)

608:JSTOR

592:(PDF)

297:bonds

233:Tobin

90:JSTOR

76:books

2898:Risk

2861:risk

2365:and

1816:Bull

1812:Bear

1554:Call

1237:Long

1041:and

971:(BV)

958:Beta

540:ISBN

497:ISBN

469:ISBN

450:2010

163:The

62:news

2856:law

2801:ESG

1584:Put

600:doi

567:doi

344:.'

252:in

45:by

3013::

2727:,

2723:,

2719:,

2715:,

2505:,

2456:,

2452:,

2448:,

2444:,

1814:,

1574:FX

606:.

594:.

2731:)

2700:)

2696:(

2509:)

2460:)

2355:e

2348:t

2341:v

1856:)

1852:(

1818:)

1810:(

1436:e

1429:t

1422:v

645:e

638:t

631:v

614:.

602::

573:.

569::

548:.

520:.

505:.

477:.

452:.

154:)

150:(

112:)

106:(

101:)

97:(

87:·

80:·

73:·

66:·

39:.

Text is available under the Creative Commons Attribution-ShareAlike License. Additional terms may apply.