252:, a Baseline is as follows: "An estimate of spending, revenue, the deficit or surplus, and the public debt expected during a fiscal year under current laws and current policy. The baseline is a benchmark for measuring the budgetary effects of proposed changes in revenues and spending. It assumes that receipts and mandatory spending will continue or expire in the future as required by law and that the future funding for discretionary programs will equal the most recently enacted appropriation, adjusted for inflation. Under the Budget Enforcement Act (BEA), to expire at the end of fiscal year 2006, the baseline is defined as the projection of current-year levels of new budget authority, outlays, revenues, and the surplus or deficit into the budget year and out-years based on laws enacted through the applicable date.

314:

168:

66:

25:

293:

however, the

Congress amended the definition of the baseline so that discretionary appropriations would be adjusted to keep pace with inflation. Other technical changes, annual increase of now approximately 3% plus inflation, to the definition of the baseline were enacted in 1990, 1993, and 1997. Presently, the Baseline Budgeting increase is about 7%.

323:

example, if a tax cut is scheduled to expire, the assumption that it will expire as scheduled will appear in the current law baseline. Assuming the tax cuts are extended would appear in the "current policy" baseline. CBO issues forecasts of varying durations, typically 10 years in their "Budget and

Economic Outlook" which is published early each year.

285:

budget) required House and Senate committees to reduce outlays by a total of $ 36 billion below baseline levels, but each committee could determine how those savings were to be achieved. The CBO baseline has been used in every year since 1981 for developing budget resolutions and measuring compliance with reconciliation instructions.

292:

provided the first legal definition of baseline. For the most part, the act defined the baseline in conformity with previous usage. If appropriations had not been enacted for the upcoming fiscal year, the baseline was to assume the previous year's level without any adjustment for inflation. In 1987,

276:

to prepare five-year projections of budget authority, outlays, revenues, and the surplus or deficit. OMB published its initial current-services budget projections in

November 1974, and CBO's five-year projections first appeared in January 1976. Today's baseline budget projections are very much like

284:

CBO's budget projections took on added importance in 1980 and 1981, when they served as the baseline for computing spending reductions to be achieved in the budget reconciliation process. The reconciliation instructions contained in the fiscal year 1982 budget resolution (the so-called Gramm-Latta

317:

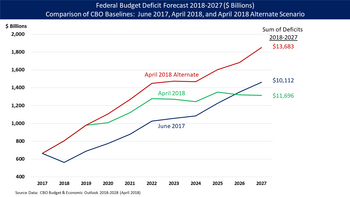

Congressional Budget Office (CBO) baseline scenario comparisons: June 2017 (essentially the deficit trajectory that

President Trump inherited from President Obama), April 2018 (which reflects Trump's tax cuts and spending bills), and April 2018 alternate scenario (which assumes extension of the

239:

growth rate. Twice a year—generally in

January and August—CBO prepares baseline projections of federal revenues, outlays, and the surplus or deficit. Those projections are designed to show what would happen if current budgetary policies were continued as is—that is, they serve as a benchmark for

304:

There have been attempts to eliminate the baseline budget concept and replace it with zero based budgeting, which is the opposite of baseline budgeting. Zero based budgeting requires that all spending must be re-justified each year or it will be eliminated from the budget regardless of previous

322:

CBO prepares a "current law" baseline, which assumes laws currently in place will continue over the forecast period. It also makes particular economic assumptions. CBO sometimes prepares a "current policy" or "alternate" baseline, which assumes policies currently in place continue instead. For

240:

assessing possible changes in policy. They are not forecasts of actual budget outcomes, since the

Congress will undoubtedly enact legislation that will change revenues and outlays. Similarly, they are not intended to represent the appropriate or desirable levels of federal taxes and spending.

300:

debate. Some critics contend that baseline projections create a bias in favor of spending by assuming that federal spending keeps pace with inflation and other factors driving the growth of entitlement programs. Changes that merely slow the growth of federal spending programs have often been

280:

The Budget Act was silent on whether to adjust estimates of discretionary appropriations for anticipated changes in inflation. Until 1980, OMB's projections excluded inflation adjustments for discretionary programs. CBO's projections, however, assumed that appropriations would keep pace with

330:

Comparing a previous current law baseline to the latest current law baseline allows evaluation of major policy changes. For example, there was a significant increase in the deficit and debt forecast between the June 2017 and April 2018 current law baselines, due to

President Trump's

356:

Statement of Paul N. Van de Water, Assistant

Director for Budget Analysis Congressional Budget Office on Budget Projections and Baselines before the Task Force on Budget Process Committee on the Budget U.S. House of Representatives April 1, 1998, see

338:

Comparing the CBO baseline as of

January of a President's first year in office versus what actually happens thereafter is one way of measuring the impact of the President's policies or unforeseen economic events on deficits and

231:

for future years. Baseline budgeting uses current spending levels as the "baseline" for establishing future funding requirements and assumes future budgets will equal the current budget times the

289:

451:

296:

Baseline budget projections increasingly became the subject of political debate and controversy during the late 1980s and early 1990s, and more recently during the 2011

446:

83:

38:

203:

149:

52:

261:

249:

224:

130:

265:

102:

87:

109:

313:

273:

281:

inflation, although CBO has also published projections without these so-called discretionary inflation adjustments.

116:

431:

426:

76:

44:

358:

272:

based on a continuation of the existing level of governmental services. It also required the newly established

98:

301:

described as cuts in spending, when in reality they are actually reductions in the rate of spending growth.

332:

123:

277:

those prepared more than two decades ago, although they now span 10 years instead of five.

181:

Please help update this article to reflect recent events or newly available information.

232:

440:

175:

Parts of this article (those related to laws & government agencies) need to be

269:

65:

326:

Comparing different baselines across time has several analytical implications:

297:

236:

220:

359:

http://www.cbo.gov/sites/default/files/cbofiles/ftpdocs/3xx/doc393/040198.pdf

416:

386:

362:

228:

406:

312:

268:(OMB) to prepare projections of federal spending for the upcoming

260:

The genesis of baseline budget projections can be found in the

161:

59:

18:

421:

290:

Balanced Budget and

Emergency Deficit Control Act of 1985

387:

CBO Budget and Economic Outlook 2018-2028-April 9, 2018

318:

Trump tax cuts, among other current policy extensions).

411:

401:

90:. Unsourced material may be challenged and removed.

374:See Statement of Paul N. Van de Water cited above

452:United States Office of Management and Budget

382:

380:

8:

53:Learn how and when to remove these messages

432:Senate Budget Committee (Democratic Site)

427:Senate Budget Committee (Republican Site)

204:Learn how and when to remove this message

150:Learn how and when to remove this message

422:House Budget Committee (Democratic Site)

417:House Budget Committee (Republican Site)

349:

7:

363:http://www.cbo.gov/publication/10679

88:adding citations to reliable sources

14:

34:This article has multiple issues.

412:Government Accountability Office

262:Congressional Budget Act of 1974

250:Government Accountability Office

225:United States Federal Government

166:

64:

23:

407:Office of Management and Budget

266:Office of Management and Budget

75:needs additional citations for

42:or discuss these issues on the

1:

447:United States federal budgets

274:Congressional Budget Office

468:

335:and other spending bills.

99:"Baseline" budgeting

402:Congressional Budget Act

264:. That act required the

319:

333:Tax Cuts and Jobs Act

316:

84:improve this article

320:

227:uses to develop a

217:Baseline budgeting

305:spending levels.

248:According to the

214:

213:

206:

196:

195:

160:

159:

152:

134:

57:

16:Accounting method

459:

389:

384:

375:

372:

366:

354:

209:

202:

191:

188:

182:

170:

169:

162:

155:

148:

144:

141:

135:

133:

92:

68:

60:

49:

27:

26:

19:

467:

466:

462:

461:

460:

458:

457:

456:

437:

436:

398:

393:

392:

385:

378:

373:

369:

355:

351:

346:

311:

258:

246:

210:

199:

198:

197:

192:

186:

183:

180:

171:

167:

156:

145:

139:

136:

93:

91:

81:

69:

28:

24:

17:

12:

11:

5:

465:

463:

455:

454:

449:

439:

438:

435:

434:

429:

424:

419:

414:

409:

404:

397:

396:External links

394:

391:

390:

376:

367:

348:

347:

345:

342:

341:

340:

336:

310:

307:

257:

254:

245:

242:

233:inflation rate

212:

211:

194:

193:

174:

172:

165:

158:

157:

72:

70:

63:

58:

32:

31:

29:

22:

15:

13:

10:

9:

6:

4:

3:

2:

464:

453:

450:

448:

445:

444:

442:

433:

430:

428:

425:

423:

420:

418:

415:

413:

410:

408:

405:

403:

400:

399:

395:

388:

383:

381:

377:

371:

368:

364:

360:

353:

350:

343:

337:

334:

329:

328:

327:

324:

315:

308:

306:

302:

299:

294:

291:

286:

282:

278:

275:

271:

267:

263:

255:

253:

251:

243:

241:

238:

234:

230:

226:

222:

218:

208:

205:

190:

178:

173:

164:

163:

154:

151:

143:

132:

129:

125:

122:

118:

115:

111:

108:

104:

101: –

100:

96:

95:Find sources:

89:

85:

79:

78:

73:This article

71:

67:

62:

61:

56:

54:

47:

46:

41:

40:

35:

30:

21:

20:

370:

352:

325:

321:

309:CBO Baseline

303:

295:

287:

283:

279:

259:

247:

216:

215:

200:

187:January 2020

184:

176:

146:

137:

127:

120:

113:

106:

94:

82:Please help

77:verification

74:

50:

43:

37:

36:Please help

33:

270:fiscal year

223:method the

441:Categories

365:see page 5

298:debt limit

237:population

235:times the

221:accounting

140:March 2009

110:newspapers

39:improve it

45:talk page

244:Baseline

256:History

177:updated

124:scholar

229:budget

219:is an

126:

119:

112:

105:

97:

361:" at

344:Notes

339:debt.

131:JSTOR

117:books

288:The

103:news

86:by

443::

379:^

48:.

357:"

207:)

201:(

189:)

185:(

179:.

153:)

147:(

142:)

138:(

128:·

121:·

114:·

107:·

80:.

55:)

51:(

Text is available under the Creative Commons Attribution-ShareAlike License. Additional terms may apply.